Month: December 2020

MTN Consulting: Network operator capex forecast at $520B in 2025

Executive Summary:

Telco, webscale and carrier-neutral capex will total $520 billion by 2025 according to a report from MTN Consulting.. That’s compared with $420 billion in 2019.

- Telecom operators (telco) will account for 53% of industry Capex by 2025 vs 9% in 2019;

- Webscale operators will grow from 25% to 39%;

- Carrier-neutral [1.] providers will add 8% of total Capex in 2025 from 6% in 2019.

Note 1. A Carrier-neutral data center is a data center (or carrier hotel) which allows interconnection between multiple telecommunication carriers and/or colocation providers. It is not owned and operated by a single ISP, but instead offers a wide variety of connection options to its colocation customers.

Adequate power density, efficient use of server space, physical and digital security, and cooling system are some of the key attributes organizations look for in a colocation center. Some facilities distinguish themselves from others by offering additional benefits like smart monitoring, scalability, and additional on-site security.

……………………………………………………………………………………………………………………………………………………….

The number of telco employees will decrease from 5.1 million in 2019 to 4.5 million in 2025 as telcos deploy automation more widely and spin off parts of their network to the carrier-neutral sector.

By 2025, the webscale sector will dominate with revenues of approximately $2.51 trillion, followed by $1.88 trillion for the telco sector and $108 billion for carrier-neutral operators (CNNOs).

KEY FINDINGS from the report:

Revenue growth for telco, webscale and carrier-neutral sector will average 1, 10, and 7% through 2025

Telecom network operator (TNO, or telco) revenues are on track for a significant decline in 2020, with the industry hit by COVID-19 even as webscale operators (WNOs) experienced yet another growth surge as much of the world was forced to work and study from home. For 2020, telco, webscale, and carrier-neutral revenues are likely to reach $1.75 trillion (T), $1.63T, and $71 billion (B), amounting to YoY growth of -3.7%, +12.2%, and 5.0%, respectively. Telcos will recover and webscale will slow down, but this range of growth rates will persist for several years. By 2025, the webscale sector will dominate with revenues of approximately $2.51 trillion, followed by $1.88 trillion for the telco sector and $108 billion for carrier-neutral operators (CNNOs).

Network operator capex will grow to $520B by 2025

In 2019, telco, webscale and carrier-neutral capex totaled $420 billion, a total which is set to grow to $520 billion by 2025. The composition will change starkly though: telcos will account for 53% of industry capex by 2025, from 9% in 2019; webscale operators will grow from 25% to 39% in the same timeframe; and, carrier-neutral providers will add 8% of total capex in 2025 from their 2019 level of 6%.

By 2025, the webscale sector will employ more than the telecom industry

As telcos deploy automation more widely and cast off parts of their network to the carrier-neutral sector, their employee base should decline from 5.1 million in 2019 to 4.5 million in 2025. The cost of the average telco employee will rise significantly in the same timeframe, as they will require many of the same software and IT skills currently prevalent in the webscale workforce. For their part, webscale operators have already grown from 1.3 million staff in 2011 to 2.8 million in 2019, but continued rapid growth in the sector (especially its ecommerce arms) will spur further growth in employment to reach roughly 4.8 million by 2025. The carrier-neutral sector’s headcount will grow far more modestly, rising from 90 million in 2019 to about 119 million in 2025. Managing physical assets like towers tends to involve a far lighter human touch than managing network equipment and software.

Example of a Carrier Neutral Colo Data Center

RECOMMENDATIONS:

Telcos: embrace collaboration with the webscale sector

Telcos remain constrained at the top line and will remain in the “running to stand still” mode that has characterized their last decade. They will continue to shift towards more software-centric operations and automation of networks and customer touch points. What will become far more important is for telcos to actively collaborate with webscale operators and the carrier-neutral sector in order to operate profitable businesses. The webscale sector is now targeting the telecom sector actively as a vertical market. Successful telcos will embrace the new webscale offerings to lower their network costs, digitally transform their internal operations, and develop new services more rapidly. Using the carrier-neutral sector to minimize the money and time spent on building and operating physical assets not viewed as strategic will be another key to success through 2025.

Vendors: to survive you must improve your partnership and integration capabilities

Collaboration across the telco/webscale/carrier-neutral segments has implications for how vendors serve their customers. Some of the biggest telcos will source much of their physical infrastructure from carrier-neutral providers and lean heavily on webscale partners to manage their clouds and support new enterprise and 5G services. Yet telcos spend next to nothing on R&D, especially when compared to the 10% or more of revenues spent on R&D by their vendors and the webscale sector. Vendors who develop customized offerings for telcos in partnership with either their internal cloud divisions (e.g. Oracle, HPE, IBM) or AWS/GCP/Azure/Alibaba will have a leg up. This is not just good for growing telco business, but also for helping webscale operators pursue 5G-based opportunities. One of the earliest examples of a traditional telco vendor aligning with a cloud player for the telco market is NEC’s 2019 development of a mobile core solution for the cloud that can be operated on the AWS network; there will be many more such partnerships going forward.

All sectors: M&A is often not the answer, despite what the bankers urge

M&A will be an important part of the network infrastructure sector’s evolution over the next 5 years. However, the difficulty of successfully executing and integrating a large transaction is almost always underappreciated. There is incredible pressure from bankers to choose M&A, and the best ones are persuasive in arguing that M&A is the best way to improve your competitiveness, enter a new market, or lower your cost base. Many chief executives love to make the big announcements and take credit for bringing the parties together. But making the deal actually work in practice falls to staff way down the chain of command, and to customers’ willingness to cope with the inevitable hiccups and delays brought about by the transaction. And the bankers are long gone by then, busy spending their bonuses and working on their next deal pitch. Be extremely skeptical about M&A. Few big tech companies have a history of doing it well.

Webscale: stop abusing privacy rights and trampling on rules and norms of fair competition

The big tech companies that make up the webscale sector tracked by MTN Consulting have been rightly abused in the press recently for their disregard for consumer privacy rights, and overly aggressive, anti-competitive practices. After years of avoiding increased regulatory oversight through aggressive lobbying and careful brand management, the chickens are coming home to roost in 2021. Public concerns about abuses of privacy, facilitation of fake news, and monopolistic or (at the least) oligopolistic behavior will make it nearly impossible for these companies to stem the increased oversight likely to come soon from policymakers.

Australia’s pending law, the “News Media and Digital Platforms Bargaining Code,” could foreshadow things to come for the webscale sector, as do recent antitrust lawsuits against Facebook and Alphabet. Given that webscale companies are supposed to be fast moving and innovative, they should get out ahead of these problems. They need to implement wholesale, transparent changes to how they treat consumer privacy and commit to (and actually follow) a code of conduct that is conducive to innovation and competition. The billionaires leading the companies may even consider encouraging fairer tax codes so that some of their excessive wealth can be spread across the countries that actually fostered their growth.

ABOUT THIS REPORT:

This report presents MTN Consulting’s first annual forecast of network operator capex. The scope includes telecommunications, webscale and carrier-neutral network operators. The forecast presents revenue, capex and employee figures for each market, both historical and projected, and discusses the likely evolution of the three sectors through 2025. In the discussion of the individual sectors, some additional data series are projected and analyzed; for example, network operations opex in the telco sector. The forecast report presents a baseline, most likely case of industry growth, taking into account the significant upheaval in communication markets experienced during 2020. Based on our analysis, we project that total network operator capex will grow from $420 billion in 2020 to $520 billion in 2025, driven by substantial gains in the webscale and (much less so) carrier-neutral segments. The primary audience for the report is technology vendors, with telcos and webscale/cloud operators a secondary audience.

References:

………………………………………………………………………………………………………………………………………………….

January 8, 2021 Update:

Analysys Mason: Cloud technology will pervade the 5G mobile network, from the core to the RAN and edge

“Communications Service Providers (CSPs) spending on multi-cloud network infrastructure software, hardware and professional services will grow from USD4.3 billion in 2019 to USD32 billion by 2025, at a CAGR of 40%.”

5G and edge computing are spurring CSPs to build multi-cloud, cloud-native mobile network infrastructure

Many CSPs acknowledge the need to use cloud-native technology to transform their networks into multi-cloud platforms in order to maximise the benefits of rolling out 5G. Traditional network function virtualisation (NFV) has only partly enabled the software-isation and disaggregation of the network, and as such, limited progress has been made on cloudifying the network to date. Indeed, Analysys Mason estimates that network virtualisation reached only 6% of its total addressable market for mobile networks in 2019.

The telecoms industry is now entering a new phase of network cloudification because 5G calls for ‘true’ clouds that are defined by cloud-native technologies. This will require radical changes to the way in which networks are designed, deployed and operated, and we expect that investments will shift to support this new paradigm. The digital infrastructure used for 5G will be increasingly built as horizontal, open network platforms comprising multiple cloud domains such as mobile core cloud, vRAN cloud and network and enterprise edge clouds. As a result, we have split the spending on network cloud into spending on multiple cloud domains (Figure 1) for the first time in our new network cloud infrastructure report. We forecast that CSP spending on multi-cloud network infrastructure software, hardware and professional services will grow from USD4.3 billion in 2019 to USD32 billion by 2025, at a CAGR of 40%.

https://www.analysysmason.com/research/content/comments/network-cloud-forecast-comment-rma16/

Omdia: Telco AI investment starts to pick up and effect automation of network activities

According to Omdia (owned by Informa), service providers face intense pressure to transform their IT systems, operations, and processes. Telco AI investment is expected to ramp up in 2021, but there is not as much clarity as there should be around best practices and business outcomes.

Omdia’s research indicates that early 80% of service providers see the use of AI and analytics, when it comes to the automation of network activities, as an “important” or “very important” IT project for 2021. Nearly 60% of them are planning to increase investment in AI tools.

Top AI use cases are expected to include network fault prediction and prevention, automation of end-to-end life-cycle management, and the management of network slicing. AI will also support a variety of non-network use cases, including using AI to support new

business models such as contextual offer management as well as automating and personalizing customer engagement and delivering customer insights.

Let’s take automation as an example. As networks become more complex and services more difficult to manage (e.g. 5G core networks, edge computing and network slicing), Omdia emphasized that automation was becoming critical. Automation of service fulfillment and assurance and creating highly prized “closed loops” – where the need for human intervention is minimal – are usually seen as some of the main drivers for AI investment, as a way to improve operational efficiencies.

It is often said that it is crucial to consider the potential ROI (Return On Investment) before initiating an automation project. ROI is certainly a good starting point for sorting out “must have” from the “nice to have” automation project, whether looking at it from the perspective of five-year cost savings, annual operating cost, time to value, or some other indicator. However, measuring automation outcomes is more complex than it may at first seem. It is of course useful to directly compare operations costs before and after adoption of an AI-based solution, but it is not the full story. It is also important to consider the business outcomes that require prioritization. These can include improving the accuracy of a process, increasing consistency and predictability, including ensuring compliance with specific SLAs, delivering greater reliability, boosting productivity, or reducing turnaround times. The list is extensive, but to make a success of an automation project it is important not to lose sight of the end goal, and to identify those KPIs (Key Performance Indicators) which specifically support the business outcomes an organization is seeking to achieve.

An AI-driven automation also needs to be sustainable. It’s not just about having the capabilities in place to address incidents as they occur. A process automation also needs to continue to be relevant even when a network/IT element is upgraded, or a vendor swapped out.

Visibility is also essential, because to improve anything you need to be able to measure it. But how does a service provider know if they are automating more successfully than their peers? There are plenty of sources of AI-linked training and support, as well as best practice guidance and models provided by industry bodies like the TM Forum. But there is not as yet a commonly agreed methodology to assess automation in the telco space. Some vendors have internal measures, such as internal process automation indexes, but this is not the same as having an industry-wide measure.

“Cloud-native and distributed cloud architectures and the growing importance of the network edge are adding to the complexity. AI is increasingly needed because existing operations are too reactive and rely heavily on human operators to execute functions,” said Kris Szaniawski, Omdia’s practice leader of service provider transformation.

“In current stressful circumstances, service providers that provide a fragmented customer experience will be quickly punished,” warned Szaniawski, who noted that progress toward enabling omnichannel customer engagement “has not always been as advanced as it should be.”

The Omdia report concluded by by suggesting service providers should make “targeted use of AI to better orchestrate customer journeys, as well as invest in well integrated central data repositories and robust data management capabilities.”

………………………………………………………………………………………………………………………………………………………………………….

Separately, Liam Churchill writes that forward-thinking CSPs have focused their AI investments on four main areas:

- Network optimization

- Preventive maintenance

- Virtual Assistants

- Robotic process automation (RPA)

In these areas, AI has already begun to deliver tangible business results. AI applications in the telecommunications industry are increasingly helping CSPs manage, optimize and maintain not only infrastructure, but also customer support operations. Network optimization, predictive maintenance, virtual assistants and RPA are all examples of use cases where AI has impacted the telecom industry, delivering enhanced CX and added value for enterprises.

As Big Data tools and applications become more available and sophisticated, AI can be expected to continue to accelerate growth in this highly competitive space.

References:

https://omdia.tech.informa.com/products/service-provider-operations-it-intelligence-service

https://techsee.me/blog/artificial-intelligence-in-telecommunications-industry/

Work from Home Reality Impacts Market for New Networking Technologies

SOURCE: Bigleaf Networks

Introduction:

Hype around next generation wireless standards (e.g. WiFi6/IEEE 802.11ax, 5G: ITU-R IMT 2020.SPECS/3GPP Release 16) has become a distraction, according to Bigleaf Networks founder and CEO, Joel Mulkey. Marketers are promoting these new technologies which sacrifice reliability to push faster speeds that are mostly useless in the new work from home era.

Mulkey and Bigleaf Vice President of Product, Jonathan Petkevich, looked into the reality behind the marketing hype around 5G and WiFi 6, as well as other networking trends such as satellite networks and artificial intelligence, in a wide-ranging panel discussion hosted for the company’s customers, partners, and agents.

As IT leaders look to regain their footing in 2021, many tech conversations that were trending at the beginning of 2020 picked up where they left off, while other trends emerged. Below are selected highlights from Mulkey and Petkevich’s conversation:

The Work From Home Reality:

“If you look at some of the Stay-At-Home mandates that have happened over the course of 2020, we estimate that about 85 million people are working from home, and that’s a big shift towards where we were at the start of 2020,” said Mulkey. “Starting at about the mid-March timeframe, 88% of organizations asked employees or required employees to work from home. About 57% of the US workforce started to work from home on a regular basis. So that was a big shift towards most people working in the office, with a few people working remotely in regional or local areas. And a lot of organizations have been talking about how they’re switching to a more long-term remote work-from-home strategy.”

Adapting to this new work from home reality meant frantically moving technology to the cloud. Part of that shift meant IT and network infrastructure teams needed to revamp their networks to support the connection reliability and application performance required in this kind of new normal.

“You need to have a healthy path between the device you’re using and the cloud server, otherwise you’re not going to have a usable experience,” said Mulkey. “One of the things we’re seeing companies running into is a sudden realization that quality of connectivity is really important.”

The Danger of WiFi 6:

According to Gartner, WiFi (IEEE 802.11) is the primary high performance network technology that companies will use through 2024. Today, roughly 96% of organizations use some form of wireless technology with many of those companies looking to move to faster versions of those networking capabilities in the next couple of years. Mulkey and Petkevich say the hype is hurting companies.

“Ensuring that you have technology that’s built on the latest standards makes sense,” said Petkevich. “I don’t know that 5G or WiFi 6 are drastically changing how a business operates day-to-day. There’s a little bit of over-hype around the speed and performance and some of the promise that’s with both of these.”

“WiFi 6 is a bit misplaced in our industry’s priorities and 5G is a marketing mess,” said Mulkey. “WiFi 6 is good for really dense, high bandwidth needs. So if you have an office with 1,000 people in a small area or you’re trying to provide WiFi offload in a stadium, WiFi 6 has technologies that will help you out. But if you’re a normal person and you’ve got a house with a couple of kids and you need to make sure your WiFi doesn’t drop-out when you’re on Zoom calls, I don’t see WiFi 6 moving the needle there. In fact, I think it’s harmful. The WiFi industry has become so focused on a story of faster, faster, faster, that the pace of innovation comes at the sacrifice of reliability. What you really need is stable WiFi connectivity that doesn’t drop out, that deals really well with roaming, that has some more intelligence to the quality of connectivity rather than prioritizing speed.”

5G Hype and Rural America:

“Now, 5G is interesting because there’s some really promising stuff there,” continued Mulkey. “Imagine if you didn’t even need WiFi, you just had always-on connectivity from all your devices at say, 100 megabits a second. That was the vision cast for it. The problem is, it’s almost all hype. What you need for the really high speeds is millimeter wave connectivity, which is really only going to be available in dense urban areas. So the folks that absolutely need good 5G today in rural areas or suburban areas without good landline connectivity, are probably not gonna get that millimeter wave behavior, surely not in rural areas.”

“We really have most of the benefits, if not all of them, with 4G today, so the evolution from a 4G to 5G in these longer distance connections is minimal to nothing,” added Mulkey. “It’s just a marketing term slapped on 4G. Now, 4G has gotten better since your phone first said 4G on it, but you’re not going to magically be able to stream 3D Star Wars style holograms because your phone has a 5G icon on it. That may come some day, but it won’t be 2021.”

Satellites:

Those who have the toughest time with WAN internet connectivity are those in rural areas or suburban areas that have been abandoned by the telecom and cable operators. An area Mulkey and Petkevich see low Earth orbit satellite networks moving beyond hype.

“The issue with traditional satellites is latency,” said Petkevich. “Starlink fixes that. So it’ll be interesting to see that play out in 2021.”

Artificial Intelligence in the Network:

44% of IT decision-makers believe that AI and machine learning can help companies optimize their network performance, and more than 50% identify AI as a priority investment needed to deliver their ideal network and make things work for them.

“There are two main ways that AI is in use today. You have a consumer-facing flavor — Siri on my iPhone, or the way that Google can find me images of apples; and then you have the hidden AI that nobody knows about — the instantaneous response of a Google search, where they’ve built smart technology that would fall under the definitions of AI to make sure that your request for Google gets to the right server from the right path and gets back to you as efficiently and effectively as possible,” said Mulkey. “Those technologies are available today. The challenge is they’re not available to the everyday person. This is an area where we, ourselves, have dedicated people and resources to figure out, ‘How can we make our network behave in an autonomous manner far better than it could if there were just people controlling it?'”

“There’s a kind of a misconception that when we talk about AI, the first thought is all the wonderful movies that have come out over the years,” quipped Petkevich. “Where we are today is there’s a lot of innovation going on to make this more tangible and more practical for businesses to use on the smaller scale, and not reserve it for the large enterprises of the world, and make it more generally available. This is definitely an area where a technology is moving beyond its hype.”

About Bigleaf Networks:

Bigleaf Networks is the intelligent networking service that optimizes Internet and Cloud performance by dynamically choosing the best connection based on real-time usage and diagnostics. Inspired by the natural architecture of leaves, the Bigleaf Cloud-first SD-WAN platform leverages redundant connections for optimal traffic re-routing, failover and load-balancing. The company is dedicated to providing a better Internet experience and ensuring peace of mind with simple implementation, friendly support and powerful technology. Founded in 2012, Bigleaf Networks is investor-backed, with service across North America.

Bigleaf combines a simple on-site installation, intelligent hands-off operations, and redundancy at every level to turn commodity broadband connections into a worry-free, Enterprise-grade connection to your applications.

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

Economic Times: India’s big bet on 5G in 2021 starts with 5G spectrum auction

Earlier this month K. Ramchand, Member (Technology), India’s Department of Telecommunications (DoT) said that it would soon announce 5G spectrum bands for auction. That’s a clear indication that adopting 5G is now a priority for the government. Most Indian telecom service providers currently lack the financial resources to invest and build a 5G ecosystem, but the government has indicated that it is willing to start the process.

Lt. Gen Dr. S.P. Kochhar, Director General of COAI said:

“5G technology is poised to open up a plethora of possibilities in terms of business models, and overall, enhanced lifestyles for one and all. We seek the support of the government in enabling the industry to play its role as an enabler of horizontal growth and a boost to the nation’s economy. The 5G potential is immense and can turn the game for India and be a catalyst for the government’s campaigns such as Make in India, Digital India, Atmanirbhar Bharat.”

Enterprises are at an inflection point in partnering with companies focusing on technical skills and turnkey solutions to drive efficiencies and building efficient and future-ready networks.

According to Karthik Natarajan, President and COO, Cyient, “We are seeing significant investments in the communication network space. The current digital transformation will lead to enhanced user experience, increased operational efficiency and a competitive edge for the enterprise businesses. Our experience in design, delivery, deployment, migration, and support of network infrastructure globally makes us an ideal partner for 5G rollouts.”

Over the past few years, many global technology companies have set up a manufacturing base in India. Samsung got the nod from the Uttar Pradesh government to make OLED at its Noida factory recently. Though such investments are significant but investment in R&D, semiconductors and future technology need a lot of impetus. The big challenge that India faces in electronics manufacturing is the lack of a world-class semiconductor fabricating unit (FAB). It’s time the government either gets global players to invest in a Fab in India or start the work to build a domestic version.

Anku Jain, Managing Director, MediaTek India told Economic Times: “2020 has set the stage for 5G to go mainstream and in 2021 this will also lead to an increase in demand for next-gen 5G smartphones, newer applications and smart devices like smart TVs, tablets, phones integrated with voice interface, etc. 5G will drive innovation across sectors such as remote working, gaming, healthcare, manufacturing, video, and data consumption which will drive the smart devices ecosystem.”

“This will also lead to an increase in demand for next-gen 5G smartphones, newer applications and smart devices like smart TVs, tablets, phones integrated with voice interface etc,” Jain added. Jain also believes that 2021 will tilt towards improved remote working capabilities and 5G chipsets will take “smartphone and smart device experience to the next level.”

Jain added that pandemic has catalyzed the growth of adoption of transformative technologies such as artificial intelligence (AI), Internet of Things (IoT), robotics, and cloud computing, among others. MediaTek envisions a wide range of applications and devices driven by the Internet of Things (IoT) in the 5G era.

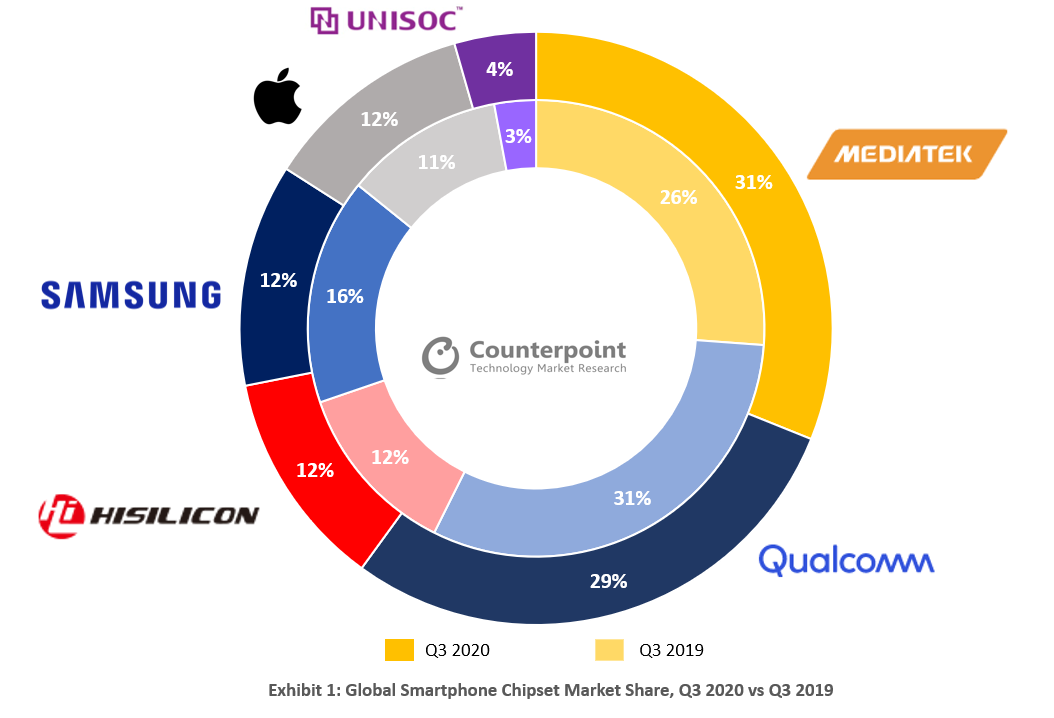

The Taiwanese fabless chip maker became the world’s #1 smartphone chipset vendor with a 31% market share in Q3 2020 helped by its growth in regions like India and China, and a strong performance in the $150-200 price band, as per market research firm Counterpoint Research’s estimates.

Last year, MediaTek launched a new gaming-based G-series, while Dimensity chipsets have helped in bringing 5G to affordable categories, according to Counterpoint Research.

It will be interesting and crucial to see how India can attract investments in future technologies with 5G making a tectonic shift in the TMT industry and presenting a range of economic opportunities in the next three to five years.

……………………………………………………………………………………………………………………………………………………………………

5G technology is expected to launch in the latter half of 2021 and will drive new business models, better education, healthcare, enable smart cities, smart manufacturing, among others, said SP Kochhar, director-general of the Cellular Operators Association of India (COAI) in a statement. That New Delhi-based group represents Jio, Airtel and Vodafone Idea as well as telecom gear makers such as Ericsson, Huawei, Nokia and Cisco.

“The Atmanirbhar Bharat initiative will lead to revenue growth to $26.38 billion by 2020 while the number of internet subscribers in the country is expected to double by 2021 to 829 million, and overall IP traffic is expected to grow four times at a CAGR of 30% by 2021,” he added.

In the first quarter of this fiscal year through June, customer spending on voice and data services increased 16.6% year-on-year, amounting to Rs. 35,642 crore ($4.80 billion), on account of use of OTT platforms for voice communications, chat, online meetings, webinars, among others, Kochhar further said.

India plans to auction 2,251 MHz with a total valuation of Rs 3.92 trillion in March 2021. It will sell spectrum in 700MHz, 800MHz, 900MHz, 1800MHz, 2100MHz, 2300 MHz and 2500 MHz bands which couldfetch Rs 55,000 – 60,000 crore to the exchequer and even at this participation, the industry will have to shelve out around Rs. 20,000-25,000 crore upfront, ICRA had said in a statement.

………………………………………………………………………………………………………………………………………………………………….

References:

https://telecom.economictimes.indiatimes.com/news/india-bets-big-on-5g-in-2021/79989257

https://telecom.economictimes.indiatimes.com/news/5g-launch-likely-in-h2-2021-telco-group/79987664

Counterpoint Research: Mediatek is world’s #1 smartphone chipset vendor

Christmas day surprise! Taiwanese fabless chipmaker Mediatek has overtaken Qualcomm and is now the #1 smartphone chipset vendor with a 31% market share in Q3 2020. Mediatek was helped by its growth in regions like India and China, and a strong performance in the $150-200 price smartphone category, according to estimates from market research firm Counterpoint Technology Market Research.

In terms of market share, MediaTek led the chipset market at the first position, followed by Qualcomm (29%), HiSilicon (12%), Samsung (12%), Apple (12%), and UNISOC (4%) respectively.

Qualcomm was the biggest 5G chipset vendor in Q3 2020. Its silicon powered 39% of the 5G phones sold worldwide. The demand for 5G smartphones doubled in Q3 2020 – 17% of all smartphones sold in Q3 2020 were 5G. This impressive growth trajectory is going to continue, more so with Apple launching its 5G line-up. One-third of all smartphones shipped in Q4 2020 are expected to be 5G enabled. There is still a chance Qualcomm will regain the top position in Q4 2020.

Source: Counterpoint Research

………………………………………………………………………………………………………………………………………………………………………………………………………

MediaTek’s Research Director Dale Gai said:

“MediaTek’s strong market share gain in Q3 2020 happened due to three reasons – strong performance in the mid-end smartphone price segment ($100-$250) and emerging markets like LATAM and MEA, the U.S. ban on Huawei and finally wins in leading OEMs like Samsung, Xiaomi and Honor. The share of MediaTek chipsets in Xiaomi smartphones has increased by more than three times since the same period last year.’

“MediaTek was also able to leverage the gap created due to the U.S. ban on Huawei. Affordable MediaTek chips fabricated by TSMC became the first option for many OEMs to quickly fill the gap left by Huawei’s absence. Huawei had also previously purchased a significant amount of chipsets ahead of the ban.”

“On the other hand, Qualcomm also posted strong share gains (from a year ago) in the high-end segment in Q3 2020, again thanks to HiSilicon’s supply issues. However, Qualcomm faced competition from MediaTek in the mid-end segment. We believe both will continue to compete intensively through aggressive pricing, and mainstream 5G SoC products into 2021.”

Counterpoint Research Analyst Ankit Malhotra said:

“Qualcomm and MediaTek have both reshuffled their portfolios, and consumer focus has played a key role here. Last year, MediaTek launched a new gaming-based G-series, while Dimensity chipsets have helped in bringing 5G to affordable categories. The world’s cheapest 5G device, the realme V3, is powered by MediaTek.”

Commenting on the outlook for chipset vendors, Malhotra added, “The immediate focus of chipset vendors will be to bring 5G to the masses, which will then unlock the potential of consumer 5G use cases like cloud gaming, which in turn will lead to higher demand for higher clocked GPUs and more powerful processors. Qualcomm and MediaTek will continue to contend for the top position.”

Source: Counterpoint Research

……………………………………………………………………………………………………………………………………………………………………………………………………..

About Counterpoint Research:

Counterpoint Technology Market Research is a global research firm specializing in Technology products in the TMT industry. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of 13 years in the high-tech industry.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, MediaTek 5G silicon will be used in future notebook PCs with Intel inside.

MediaTek’s T700 5G modem, which will be used to bring 5G connectivity to Intel-powered PCs, completed 5G standalone (SA) calls in real world test scenarios. Additionally, Intel has progressed on system integration, validation and developing platform optimizations for a superior user experience and is readying co-engineering support for its OEM partners. MediaTek and Intel are both committed to delivering a superior user experience.

“Our partnership with Intel is a natural extension of our growing 5G mobile business, and is an incredible market opportunity for MediaTek to move into the PC market,” said MediaTek President Joe Chen. “With Intel’s deep expertise in the PC space and our groundbreaking 5G modem technology, we will redefine the laptop experience and bring consumers the best 5G experiences.”

“A successful partnership is measured by execution, and we’re excited to see the rapid progress we are making with MediaTek on our 5G modem solution with customer sampling starting later this quarter. Building on our 4G/LTE leadership in PCs, 5G is poised to further transform the way we connect, compute and communicate. Intel is committed to enhancing those capabilities on the world’s best PCs,” said Chris Walker, Intel corporate vice president and general manager of Mobile Client Platforms.

References:

MediaTek Becomes Biggest Smartphone Chipset Vendor for First Time in Q3 2020

SK Telecom and AWS launch 5G edge cloud service and collaborate on other projects

South Korea’s #1 wireless network operator SK Telecom (SKT) has launched a 5G edge cloud service in partnership with Amazon Web Services (AWS). ‘SKT 5GX Edge’ uses AWS Wavelength at the edge of SKT’s 5G network. SKT said that SKT 5GX Edge will enable customers to develop mobile applications that require ultra-low latency.

With SKT 5GX Edge, applications are connected to ‘AWS Wavelength Zones’, which are located at the edge of SK Telecom’s 5G network, making it unnecessary for application traffic to hop through regional aggregation sites and the public internet.

SKT 5GX Edge with AWS Wavelength is expected to enable SK Telecom’s enterprise customers and developers to build innovative services in areas including machine learning, IoT, video games and streaming using the AWS services, APIs, and tools they already use.

SK Telecom and AWS started operating the first AWS Wavelength Zone in South Korea in the central city of Daejeon (140 kilometers south of Seoul) earlier this month. They plan to expand the SKT 5GX Edge infrastructure to other parts of the country, including Seoul in 2021.

SK Telecom has been cooperating with AWS since February of this year to deploy AWS Wavelength Zones on SK Telecom’s 5G network and worked with 20 enterprise customers to test the service.

SKT and AWS are actively cooperating in the area of non-face-to-face services as demand grows due to the pandemic. The two companies have been working with video conferencing solution provider Gooroomee to build an environment where two-way video conferencing and remote education services are provided without delay, and have realized a service with a latency of less than 100 milliseconds for multiple simultaneous sessions.

“With AWS Wavelength on SKT’s 5G network, customers in South Korea can develop applications that take advantage of ultra-low latencies to address use cases like machine learning inference at the edge, smart cities and smart factories, and autonomous vehicles – all while using the same familiar AWS services, API, and tools to deploy them to 5G networks worldwide,” said Matt Garman, Vice President of Sales and Marketing, AWS.

“In collaboration with AWS, SK Telecom has successfully integrated private 5G and edge cloud. By leveraging this new technology, we will lead the efforts to create and expand innovative business models in game, media services, logistics, and manufacturing industries,” said Ryu Young-sang, President of MNO at SK Telecom.

………………………………………………………………………………………………………………………………

SK Telecom and AWS also report that they have been working to improve operational stability of autonomous robots and efficiency in remote monitoring and control. Together with Woowa Brothers, the operator of food delivery app ‘Baedal Minjok,’ the two companies have completed tests of applying the 5G MEC service to outdoor food delivery robot Dilly Drive. Meanwhile, work continues with local robotics company Robotis to test run autonomous robots in the 5G cloud environment.

SK Telecom and AWS have also signed an agreement with Shinsegae I&C and Maxst to build an AR navigation and guidance system in the Coex Starfield shopping mall in Seoul. They are also working on potential use of the 5G cloud service with Deep Fine, an AR glass solution developer, and Dabeeo, a spatial recognition service provider. With the National IT Industry Promotion Agency (NIPA), SK Telecom has launched an open lab to develop realistic contents optimized for the 5G network and to support the growth of the related ecosystem.

Collaboration is also ongoing with Looxid Labs, a provider of real-time analysis for eye-gaze tracking and brain wave data, to develop services on the 5G MEC for a senior citizen center in Busan.

SK Telecom and AWS are also cooperating in the area of non-face-to-face services as demand grows due to the COVID-19 pandemic. The two companies have been working with video conferencing services provider Gooroomee to develop an environment where 2-way video conferencing and remote education services are provided without delay, and claim they have achieved a service with a latency of less than 100 milliseconds for multiple simultaneous sessions.

………………………………………………………………………………………………………………………………………………

References:

https://www.sktelecom.com/en/press/press_detail.do?page.page=1&idx=1494&page.type=all&page.keyword=

https://www.telecompaper.com/news/sk-telecom-launches-5gx-edge-cloud-service-with-aws–1366915

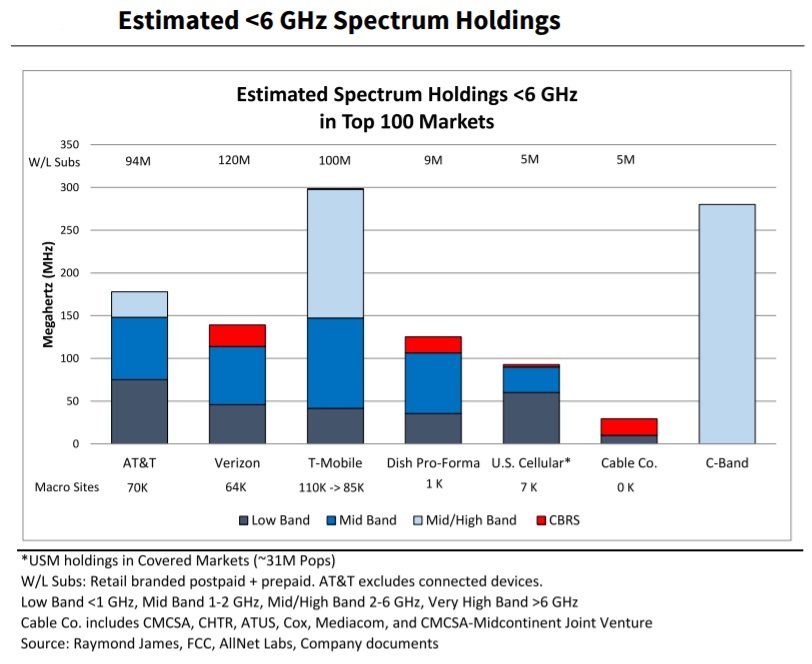

UPDATED: Mid-band Spectrum for 5G: FCC C-Band Auction at $80.9B Shattering Records

The FCC’s latest auction has raised more than $69.8 billion after three weeks of bidding, a record sum that could alter cellphone carriers’ prospects for 5G and the next decade. The C-band auction, offering 280-megahertz of spectrum, started on December 8th. Just within two weeks, it’s by far the biggest U.S. spectrum auction ever. The auction will now pause for the Christmas holidays until Jan. 4th , when total bids could move even higher.

The radio frequencies being offered range between 3.7 GHz and 4 GHz, a middle-of-the-road range considered well-suited for 5G service. New 5G smartphones can already connect to those frequencies in other countries that have licensed equivalent mid-band spectrum. The U.S. is also selling big chunks of spectrum all at once, enhancing its value.

The high offers benefit the U.S. Treasury, which will collect a windfall after the winners pay for their licenses. The victors will also need to spend at least $13 billion more to help modify equipment for a group of satellite companies that already use the frequencies. The satellite operators agreed to an FCC plan that shifts their TV transmissions to a narrower portion of the radio spectrum.

The current auction proceeds have already topped the $44.9 billion in provisional bids in a 2015 FCC sale of mid-band spectrum licenses, which U.S. cellphone carriers used at the time to enhance their 4G LTE service. Those telcos are now investing billions of dollars in 5G coverage. Some higher-end estimates for the auction had ranged from $35.2 to $51 billion.

After 45 rounds, the average nationwide price per MHz PoP price for licenses was of $0.81. That rises to $0.96 across categories when factoring in accelerated clearing payments and relocation costs to move satellite operators out of the band band, estimated at $9.7 billion and $3.3 billion respectively.

Editors Notes: The B block consists of 100 megahertz (five 20-megahertz sub-blocks) from 3.8-3.9 GHz) and the C block makes up the final 80 megahertz with four 20-megahertz sub-blocks; there are 406 available Partial Economic Areas (PEAs) across the United States. 406 available Partial Economic Areas across the United States.

…………………………………………………………………………………………………………………………….

Analysts had estimated C-band licenses would be between $0.20-$0.50 per MHz PoP (Point of Presence). The nationwide price for A block licenses per MHz Pop was $1.21 as of Wednesday, while BC prices were $1.11 per MHz PoP according to tracking by BitPath COO Sasha Javid.

Demand for most of the category A blocks (which includes the first 100-megahertz tranche of spectrum in 46 of the top 50 markets that has a clearing schedule of December 2021) has evened out. In the top 20 PEAs at the end of round 43 there were still 12 markets that had competition, mostly for BC blocks, but also a few category A, including PEAs of Miami, Phoenix, and Minneapolis-St.Paul.

PHOTO: ADREES LATIF/REUTERS

……………………………………………………………………………………………………………………………………………………

The recent bids have blown past Wall Street’s highest forecasts, suggesting that several companies are fighting over the most valuable wireless rights.

There are 57 participants in the clock phase of this auction, but each bid is cloaked in secrecy until the auction process ends. Industry analysts expect mega telcos like AT&T and Verizon Communications to obtain a large share of the licenses to match the trove of 2.5 GHz assets that rival T-Mobile US acquired from Sprint.

Wall Street analyst firms like Wells Fargo, believe Verizon will spend the most, previously estimating around $22 billion in gross proceeds to acquire 120 MHz of mid-band spectrum. AT&T could spend anywhere from $4.3 billion to $20 billion for the C-band.

All three major U.S. wireless carriers have rolled out nationwide 5G either using low-band spectrum or dynamic spectrum sharing (DSS) technology, but performance hasn’t proved better than 4G LTE. Verizon has deployed 5G with high-band millimeter wave in parts of 60 cities, and AT&T has a few mmWave markets, but mid-band is seen as the sweet spot in delivering both capacity and coverage.

Meanwhile, T-Mobile says its 2.5 GHz can deliver 300 Mbps and peak speeds up to 1 Gbps.

……………………………………………………………………………………………………………………………………………………………………………………………………..

“Mid-band spectrum will be where 5G lives,” said Walt Piecyk, a telecom analyst for research firm LightShed Partners. He added that T-Mobile’s merger with Sprint “clearly put pressure on Verizon and AT&T” to match their rival’s war chest. “When the numbers get this big, you have to assume that everybody’s getting more aggressive,” Mr. Piecyk said.

“Gross proceeds have been driven by surprisingly robust and persistent demand,” wrote Javid in an analysis Tuesday morning. “In Round 36, I suspect that a large bidder pulled back significantly in the largest markets given that all the top 10 markets experienced a drop in demand.”

Mobile service providers are also bidding against investment firms and new market entrants. Satellite provider Dish Network Corp. won many of the licenses sold in the 2015 auction. The company this month raised more cash through a $2 billion convertible-note offering to help fund more network investments. Dish is building its own 5G network after buying spectrum assets and about 8 million customers from Sprint.

Cable internet providers (MSOs) could also influence the auction’s outcome after years of experimentation with wireless services. Comcast Corp. and Charter Communications Inc. teamed up to bid in the current auction after they spent nearly $1 billion on a smaller license sale earlier this year.

…………………………………………………………………………………………………………………………………

Cellphone carriers can afford to commit to big payments given their low borrowing costs and relatively stable service revenue (AT&T is an exception due to its high debt), said Raymond James analyst Frank Louthan. “Investors see these companies as some of the most secure around,” Mr. Louthan said. “I don’t think a slight change in a debt ratio would make much of a difference. Time to market matters. We generally see prices get high when you can deploy spectrum quickly.”

The FCC won’t reveal the auction’s winners for several days after the auction ends, meaning the broader telecom industry could remain in suspense until February. Federal rules against coordinated bidding also limit what the auction participants can say about the process, restricting their ability to raise capital or discuss major deals involving spectrum.

The auction is a first step in a multiyear process. Wireless customers might not see the full band cleared for cellphone service until late 2023, though there is an early tranche slated to move by late 2021. Auction winners with no time to spare could also pay the incumbent satellite users larger fees to quicken their relocation. That would allow some companies to repurpose spectrum in base stations and related cell-tower equipment that is already transmitting data on other frequencies–just not the bands in question. The change could result in faster and more reliable 5G service.

………………………………………………………………………………………………………………………………………….

This author is astonished there has been no concern expressed regarding C-Band Auction’s Threat to Aviation. Viodi View principal Ken Pyle wrote:

The RTCA is recommending that the mobile wireless and aviation industries work with their respective regulators to take appropriate steps to mitigate the risk associated with the deployment of 5G in the C-Band. The question is what impact will this interference risk have on the rollout of 5G in the C-band?

It will be interesting to see how the potential interference risks raised by RTCA impact the rollout of 5G in the C-Band.

On December 7th, Reuters reported that House Committee on Transportation and Infrastructure Chair Peter DeFazio urged a delay in the FCC auction of C-Band spectrum over concerns it could jeopardize aviation safety. He cited a six-month review of 5G network emissions with safety-critical radio altimeter performance by the Radio Technical Commission for Aeronautics (RTCA) that found serious risks of harmful interference on all types of aircraft.

Caveat Emptor!

References:

https://www.wsj.com/articles/5g-auction-shatters-record-as-bidding-tops-66-billion-11608731335 (on-line subscription required)

https://www.fiercewireless.com/5g/c-band-nears-70b-rockets-above-prior-us-spectrum-auctions

https://www.rcrwireless.com/20201223/spectrum/fccs-auction-holiday-haul-closing-in-on-70-billion

https://viodi.com/2020/11/30/c-band-5gs-threat-to-aviation/

https://www.wsj.com/articles/everything-you-need-to-know-about-5g-11605024717

……………………………………………………………………………………………………………………………………

January 18, 2021 Update:

The Federal Communications Commission has completed the first round of the auction of the 3.7-3.98 GHz band, raising the most ever in a spectrum auction in the US. All 5,684 blocks on offer were acquired, with total bids of USD 80.9 billion, nearly twice the previous record for a FCC auction.

China tops 200M 5G subs while operators move to 5G SA

According to filings by China’s state owned telcos, China now has more than 200 million “official 5G subscribers.” China Mobile and China Telecom tallied 147.4 million and 74.9 million “5G package subscribers” respectively as of November 30, 2020. China Mobile adding nearly 19 million subs last month.

“Package subscribers” is a unique category that includes subscribers that have migrated to 5G but are still using 4G phones, which greatly overstates the actual 5G user numbers.

- China Mobile is adding 5G subs at a fast pace, with 18.6 million adds last month and 15.2 million in October.

- China Telecom added more than 7 million every month since August.

- The third telco, China Unicom, has suffered a net loss of 11.4 million subs for the year to date. It had 307.1 million mobile customers at November 30, down 1.9 million on the previous month.

Some energetic price-cutting has helped. At launch time in November 2019 the lowest package price was 128 yuan ($19.57). Now many plans are being sold at 100 yuan ($15.29) or less.

………………………………………………………………………………………………………………………………………….

Separately, the three state owned network operators are said to be close to deploying 5G standalone (SA) with a 5G core network. China Unicom and China Telecom are leading the move.

China Telecom says its 5G standalone network is commercially available in more than 300 cities, according to Sohu.

According to THEELEC, China Unicom will expand 5G network slicing technology to the whole country next year, the company said on December 7th at a press conference in Beijing. China’s third largest telco launched 5G SA network in over 300 cities this year, the company said. Last month, it added network slicing technology to its 5G network in Beijing and Guangdong Province.

Miao Shouye, the head of China Unicom’s 5G co-construction project with China Telecom, spoke at the “2020 Communication Industry Conference and the 15th Communication Technology Annual Conference” on December 17th. He said that “China has achieved full leadership in the 5G field.”

Also, that China Unicom launched the world’s first commercial network slicing service in Beijing and Guangdong in November. It will be commercially available nationwide next year, C114 reported.

Data shows that China has more than 700,000 5G base stations , accounting for 80% of the world’s total; 5G users exceed 160 million, accounting for 70% of the world’s total. The rapid development of networks and users has also driven the development of terminals. China’s 5G terminal shipments accounted for more than 60%, and 5G thousand yuan phones began to appear.

In Miao Shouye’s view, mobile internet is about to enter the 5G era. “It is estimated that by 2021, the penetration rate of 5G users in China will cross the 20% mark.”

In 2020, China Unicom has achieved good results in 5G co-construction and sharing. According to reports, as of the end of this year, the two parties have shared 5G base stations with a scale of 380,000 stations, realizing 5G coverage in cities and key counties at prefecture-level and above across the country, and completing the goal of jointly building “one network.” At the same time, co-construction and sharing also saves 5G expenses, CAPEX saves 40% and OPEX saves 35% annually. Based on such a co-built and shared network, the rate has been further improved, and the world’s highest 3.2Gbps peak experience rate of 200MHz full sharing is the first.

As the network is deployed, technology is constantly evolving. Miao Shouye pointed out that China Unicom is the first operator in the world to implement SA commercial networks . In June this year, China Unicom announced the commercialization of its 2B SA network; in September, the commercialization of 2C SA; in November, China Unicom achieved the world’s first commercial slicing in Beijing and Guangdong; it is expected that by 2021, 5G slicing will be commercialized nationwide.

In terms of security, China Unicom is actively building 5G security capabilities. The flexible combination of 5G network, MEC , and slice security capabilities provide multiple levels of protection capabilities to meet customized security requirements.

China Unicom continues to carry out technological innovation to enhance user experience. In October this year, China Unicom joined forces with Huawei to demonstrate the first 5G R17 FDD ultra-large bandwidth prototype device PoC field test. At the same time, China Unicom also cooperated with Huawei to carry out innovative experiments, and the throughput rate reached 4.7Gbps.

Miao Shouye believes that the 5G industry supply chain should work together from the terminal to the network to improve capabilities. At the terminal level, power consumption and heating issues need to be paid attention to; terminal network coordination still needs to be continuously strengthened; industry terminals/modules are lacking, shipments are small, and diversity is poor.

- At the network level, 5G standards (ITU) and specifications (3GPP) continue; 5G equipment has high energy consumption and pressure on network operating costs. Network empowerment needs to be improved, such as network slicing, 5G+TSN (Time Sensitive Networking), etc.

- At the business level, 2C killer applications still need to be explored; 5G products need to be continuously improved in practice; 2B business models need to be explored; business applications still need to be incubated.

Meanwhile, China Mobile hasn’t given a timetable for standalone deployment or services, although executives have promised they are building a “premium” SA network.

References:

https://www.lightreading.com/asia/china-5g-crosses-200m-mark-as-operators-prep-for-sa/d/d-id/766292?

Synergy Research: Hyperscale Operator Capex at New Record in Q3-2020

Hyperscale cloud operator capex topped $37 billion in Q3-2020, which easily set a new quarterly record for spending, according to Synergy Research Group (SRG). Total spending for the first three quarters of 2020 reached $99 billion, which was a 16% increase over the same period last year.

The top-four hyperscale spenders in the first three quarters of this year were Amazon, Google, Microsoft and Facebook. Those four easily exceeded the spending by the rest of the hyperscale operators. The next biggest cloud spenders were Apple, Alibaba, Tencent, IBM, JD.com, Baidu, Oracle, and NTT.

SRG’s data found that capex growth was particularly strong across Amazon, Microsoft, Tencent and Alibaba while Apple’s spend dropped off sharply and Google’s also declined.

Much of the hyperscale capex goes towards building, expanding and equipping huge data centers, which grew in number to 573 at the end of Q3. The hyperscale data is based on analysis of the capex and data center footprint of 20 of the world’s major cloud and internet service firms, including the largest operators in IaaS, PaaS, SaaS, search, social networking and e-commerce. In aggregate these twenty companies generated revenues of over $1.1 trillion in the first three quarters of the year, up 15% from 2019.

“As expected the hyperscale operators are having little difficulty weathering the pandemic storm. Their revenues and capex have both grown by strong double-digit amounts this year and this has flowed down to strong growth in spending on data centers, up 18% from 2019,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “They generate well over 80% of their revenues from cloud, digital services and online activities, all of which have seen COVID-19 related boosts. As these companies go from strength to strength they need an ever-larger footprint of data centers to support their rapidly expanding digital activities. This is good news for companies in the data center ecosystem who can ride along in the slipstream of the hyperscale operators.”

Separately, Google Cloud announced it is set to add three new ‘regions,’ which provide faster and more reliable services in targeted locations, to its global footprint. The new regions in Chile, Germany and Saudi Arabia will take the total to 27 for Google Cloud.

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database tool, which enables easy access to complex data sets. Synergy’s CustomView ™ takes this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

Synergy Research Group helps marketing and strategic decision makers around the world via its syndicated market research programs and custom consulting projects. For nearly two decades, Synergy has been a trusted source for quantitative research and market intelligence. Synergy is a strategic partner of TeleGeography.

To speak to an analyst or to find out how to receive a copy of a Synergy report, please contact [email protected] or 775-852-3330 extension 101.

References:

Verizon and Deloitte collaborate on 5G mobile edge computing + 6G nonsense talk

Verizon today announced a deal with Deloitte to collaborate on 5G mobile edge computing services for manufacturing and retail businesses and ultimately expand to other industry verticals. The companies plan to create transformational solutions to serve client-specific needs using Deloitte’s industry and solution engineering expertise combined with Verizon’s advanced mobile and private enterprise wireless networks, 5G Edge MEC platform, IoT, Software Defined-Wide Area Network (SD-WAN), and VNS Application Edge capabilities.

Verizon and Deloitte are collaborating on innovative solutions to transform manufacturers into “real-time enterprises” with real-time intelligence and business agility by integrating next-gen technologies including 5G, MEC, computer vision and AI with cloud and advanced networking. The companies are co-developing a smart factory solution at Verizon’s Customer Technology Center in Richardson, TX that will utilize computer vision and sensor-based detection coupled with MEC to identify and predict quality defects on the assembly line and automatically alert plant engineering and management in near real-time.

The companies will also introduce an integrated network and application edge compute environment for next generation application functionality and performance that reduces the need for manual quality inspection, avoids lost productivity, reduces production waste, and ultimately lowers the cost of raw materials and improves plant efficiency. The combination of SD-WAN and VNS Application Edge will bring together software defined controls, application awareness, and application lifecycle management to deliver on-demand network transformation and edge application deployment and management.

“By bringing together Verizon’s 5G and MEC prowess with Deloitte’s deep industry expertise and track record in system integration with large enterprises on smart factories, we plan to deliver cutting-edge solutions that will close the gap between digital business operations and legacy manufacturing environments and unlock the value of the end-to-end digital enterprise,” said Tami Erwin, CEO of Verizon Business. “This collaboration is part of Verizon’s broader strategy to align with enterprises, startups, universities and government to explore how 5G and MEC can disrupt and transform nearly every industry.”

“In our recently published Deloitte Advanced Wireless Adoption study, over 85% of US executives surveyed indicated that advanced wireless is a force multiplier that will unlock the full potential of edge computing, AI, Cloud, IoT, and data analytics. Our collaboration with Verizon combines Deloitte’s business transformation expertise with advanced wireless and MEC technology to deliver game changing solutions,” said Ajit Prabhu, US Ecosystems & Alliances Strategy Officer and 5G/Edge Computing Commercialization leader, Deloitte Consulting LLP.

The #1 U.S. wireless telco still plans to reach an additional two cities with its mobile edge computing (MEC) network, ending the year with availability in 10 cities.

Verizon is also working with Microsoft Azure on private 5G MEC, Amazon Web Services (AWS) on consumer-oriented 5G MEC, IBM on IoT, Samsung and Corning on in-building 5G radios, Apple, major sporting leagues, and other organizations — all in an effort to explore and develop new use cases for 5G.

The MEC activities follows a flurry of announcements last week when Verizon expanded its low-band 5G network to reach up to 230 million people, said its millimeter-wave 5G network is now live in parts of 61 U.S. cities, revealed an on-premises private 4G LTE service for enterprises, expanded a partnership with SAP, inked a multi-year deal with Walgreens Boot Alliance, and launched an IoT services platform.

…………………………………………………………………………………………………………………………………………….

Separately, Verizon CTO Kyle Malady said that there’s currently no clear reason to move beyond 5G. “I really don’t know what the hell 6G is,” he said. Neither does anyone else- see Opinion below.

“We just put 5G in. And I think there’s a lot of development still to come on that one.”

Verizon, AT&T, Apple, Google and a wide range of other companies have already teamed under ATIS’ “Next G Alliance” that seeks to unite US industry, government and academia around 6G efforts.

………………………………………………………………………………………………………………………………….

Opinion on “6G”:

Talk of “6G” is preposterous at this time, since we don’t even have an approved 5G RAN/ IMT 2020 RIT spec or standard that meets the 5G URLLC performance requirements in ITU M.2410. Despite numerous 3GPP Release 16 specs, we don’t have a standard for 5G core network implementation, 5G security, 5G network management, 5G network slicing, etc.

At its 34th meeting (19-26 February 2020), ITU‑R Working Party (WP) 5D decided to start study on future technology trends for the future evolution of IMT. A preliminary draft new Report ITU-R M.[IMT.FUTURE TECHNOLOGY TRENDS] will be developed and will consider related information from various external organizations and country/regional research programs.

The scope of the new report ITU-R M.[IMT.FUTURE TECHNOLOGY TRENDS] focuses on the following aspects:

“This Report provides a broad view of future technical aspects of terrestrial IMT systems considering the time frame up to 2030 and beyond. It includes information on technical and operational characteristics of terrestrial IMT systems, including the evolution of IMT through advances in technology and spectrally-efficient techniques, and their deployment.”

In a Sept 27, 2020 ITU-R WP5D contribution, China stated:

IMT technology needs to show sustainable vitality in the perspective of technical development. There are emerging services and applications, and their further development towards 2030 and beyond will impose higher requirements on the IMT system. It motivates the introduction of new IMT technical features, e.g., very high spectrum up to Terahertz, native artificial intelligence (AI), integrated sensing and communications, integrated terrestrial and non-terrestrial networks, block chain and quantum computing for multi-lateral trustworthiness architecture, etc., which were not emphasised in Report ITU-R M.2320-0 considering the time-frame for 2015-2020. IMT technology continues to develop and it is necessary for ITU to provide a broad view of future technical aspects of IMT systems considering 2030 and beyond.

And suggested topics to be covered in this new IMT.FUTURE TECHNOLOGY TRENDS Report:

-

IMT technology trends and enablers for the time up to 2030 and beyond:

-

-

Technologies for further enhanced radio interface, including advanced modulation, coding and multiple access schemes, E-MIMO (Extreme -MIMO), Co-frequency Co-time Full Duplex (CCFD) communications, multiple physical dimension transmission

-

Technologies for Tera Hertz communication and optical wireless communication

-

Technologies for native AI based communication

-

Technologies for integrated sensing and communication

-

Technologies for integrated terrestrial and non-terrestrial communications

-

Technologies for integrated access and super sidelink communications

-

Technologies for high energy efficiency and low energy consumption

-

Technologies for native security, privacy, and trust

-

Technologies for efficient spectrum utilization

-

Terminal Technologies

-

Network Technologies

-

Editor’s Note: The next meeting of ITU-R WP5D is March 1-to-12, 2021 (e-meeting)

………………………………………………………………………………………………………………………………………..

References:

https://www.verizon.com/about/news/verizon-business-deloitte-5g-mobile-edge-computing

https://www.lightreading.com/cloud-nativenfv/verizons-cto-i-dont-know-what-hell-6g-is/d/d-id/766270?

ITU-R: Future Technology Trends for the evolution of IMT towards 2030 and beyond (including 6G)