Month: May 2018

IHS Markit: Optical Network Equipment Market off to slow start in 2018

By Heidi Adams, senior research director, IP and optical networks, IHS Markit

Highlights

- Global optical network hardware revenue totaled $3.1 billion in the first quarter of 2018 (Q1 2018), declining 25 percent sequentially and remaining flat on a year-over-year basis.

- The global Q1 2018 optical equipment market net of China was down 2 percent year over year. China itself was up 7 percent year over year, and continues to be a key market for optical transport equipment.

- Huawei remained the overall optical equipment market leader in Q1 2018, with 26 percent market share.

Our analysis

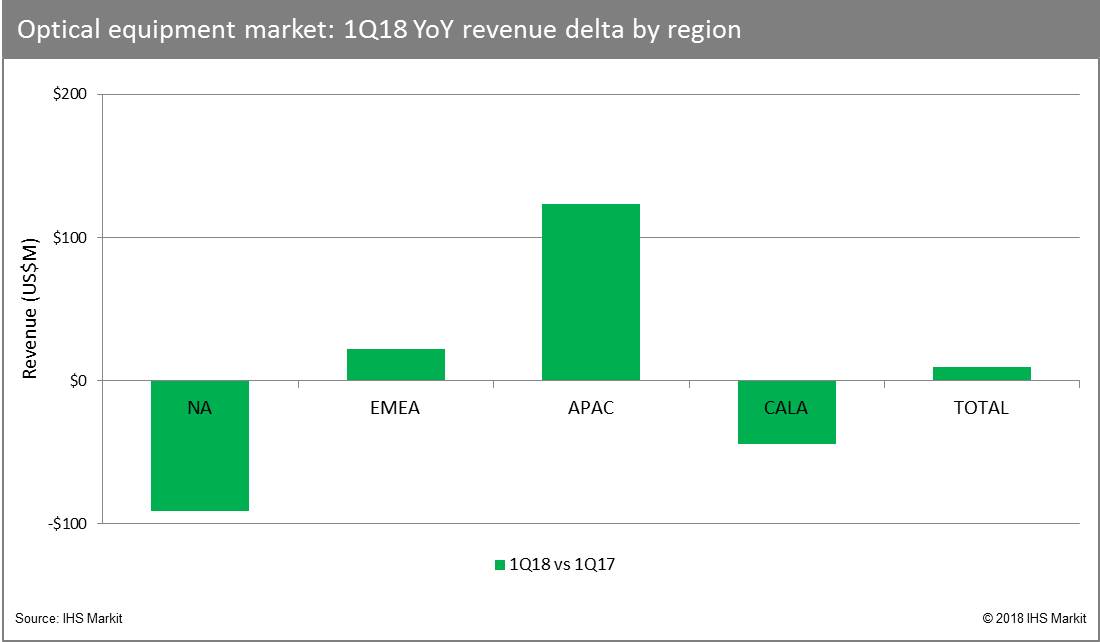

After a strong close to 2017, the optical equipment market got off to a lackluster start in 2018. Modest year-over-year growth in Europe, the Middle East and Africa (EMEA) and Asia Pacific was not sufficient to overcome year-over-year spending declines in North America and the Caribbean and Latin America (CALA) regions in the quarter. Total optical equipment market spending was down 25 percent on a sequential basis, with all regions seeing quarter-over-quarter declines.

Wavelength-division multiplexing (WDM) continues to be the growth engine for the market. In Q1 2018, the WDM segment totaled $2.9 billion, up 3 percent year-over-year, thanks to gains in EMEA and Asia Pacific. Both the metro and long haul segments experienced low single-digit year-over-year growth in Q1 2018.

Synchronous optical networking (SONET)/synchronous digital hierarchy (SDH) continued its overall decline. Global revenue came to $206 million in Q1 2018, down over 25 percent year over year. This segment represented less than 10 percent of the total optical network equipment market in the quarter.

Huawei continued to lead the total optical equipment market by a wide margin in Q1 2018. Nokia secured second place based on continuing strength in EMEA and increasing business in Asia Pacific. Ciena maintained its leadership position in North America and remained number three overall in the global market. ZTE rounded out the top four, but faces a difficult journey ahead with the impact of US sanctions and a subsequent halt in major operations.

Unstoppable bandwidth demand drives long-term growth

IHS Markit anticipates a continuing ramp in network capacity to address growing bandwidth demand. In the metro, the primary driver is burgeoning bandwidth demand—to, from and between data centers.

Not to be ignored is the coming broader introduction and adoption of consumer 4K and higher video content and services on a variety of devices. The shift from data to video to virtual reality (VR)/augmented reality (AR) will add yet another set of bandwidth-intensive and latency-sensitive services to the mix toward 2022.

Finally, a further evolutionary shift in mobile network architectures in preparation for 5G and a range of new fixed and mobile machine-to-machine (M2M) and Internet of Things (IoT) applications will set the stage for an investment cycle at the farthest reaches of the optical access network.

Based on these industry trends, the optical equipment market will grow at a compound annual growth rate (CAGR) of 4.5 percent from 2017 to 2022, according to IHS Markit forecasts.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Editor’s Note:

We believe much of the anticipated fiber optic network growth will come from a variety of factors in the metro, including data center interconnect demands, higher-bandwidth video transmission (with the advent of 4K video) and eventually virtual and augmented reality. We think 5G mobile backhaul support is questionable in the next few years considering all the “5G” hype and lack of standards till IMT 2020 (5G radio aspects ONLY) recommendations are finalized in late 2020.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Optical Network Hardware Market Tracker – Q1 2018

This report tracks the global market for metro and long-haul WDM and SONET/SDH equipment and SONET/SDH and WDM ports. It provides market size, market share, forecasts through 2022, analysis and trends.

PointTopic: Fiber & cable make up 3/4 of global fixed broadband subscriptions

Fiber and cable networks are dominating the global broadband market, with the technologies now servicing 77% of fixed subscriptions, new figures from Point Topic have revealed.

According to the Global Broadband Statistics, which take into account subscriptions up to the end of 2017, more than 50% of people in more than 40 countries, including Singapore (97%), China (89%), United States (87%), and the UK (55%), are connected via full-fiber, fiber-fed copper or cable.

Point Topic Research Director Dr Jolanta Stanke told the Broadband Forum:

“We are finding that customers across most global regions increasingly prefer faster broadband services delivered over fiber and cable platforms, as opposed to ADSL. This trend will continue as more bandwidth-hungry young consumers become paying decision makers, even though superfast 4G LTE and 5G mobile broadband services will compete for their wallets.”

Fiber-fed subscriptions – including Fiber-to-the-Home (FTTH), Fiber-to-the-Building (FTTB), Fiber-to-the-Cabinet (FTTC), Very High Bitrate Digital Subscriber Line (VDSL), VDSL2 and G.fast – accounted for 57% of broadband subscriptions, with more than 530 million connections. Stanke agreed VDSL and Gfast were together largely responsible for the growth that fiber has seen, with more than 30 operators across all continents deploying or trialing G.fast.

“G.fast gives operators a more cost-effective variant of fiber that will be used by operators who want to upgrade their existing networks quicker and more easily,” she added. “This could enable them to serve more customers in less densely populated areas, where direct fiber investment is less economically feasible.”

In total, cable, including hybrid fiber-coaxial, accounted for 20% of all fixed broadband connections. According to the report, the latest standard of this technology is currently deployed across several markets, being especially popular in North America, and can deliver gigabit download speeds.

Broadband Forum CEO Robin Mersh said the figures reflect the fact that new technologies that let operators deploy fiber deep into the network without having to enter buildings themselves are quickly moving from trials to mass deployment.

“If operators want to deliver competitive broadband services, maximizing their investments through the use of technologies like G.fast is vital,” said Mersh. “Expanding the footprint of their existing fiber networks in this way is cost-effective and delivers the gigabit speeds consumers crave. The growing trend towards fiber, whether its fiber-fed copper or full fiber, and cable deployments highlighted by Point Topic’s report confirms that the Forum’s work on interoperability and management of ‘fiber-extending’ technologies is vitally important.”

The voracious demand for connectivity is evident in the increased demand for fiber, cable and coax despite the parallel growth of LTE and MAYBE (?) “5G.”

Though “5G” is in currently proprietary to each wireless network operator, huge investments in fiber, coax and copper are being made because strategic planners expect 5G to be mainstream in the next several years (we think NOT until late 2021 at the earliest when IMT 2020 recommendations are finalized and implemented in base stations and endpoint devices.

Last month, Broadbandtrends’ Global Service Provider G.fast Deployment Strategies surveyed 33 incumbent and competitive broadband operators from across the globe. The market research firm found that four in five service providers have G.fast plans for this year and that 27% are in active deployments. AT&T is a huge supporter of G.fast while Verizon is not.

About the Broadband Forum

Broadband Forum, a non-profit industry organization, is focused on engineering smarter and faster broadband networks. The Forum’s flagship TR-069 CPE WAN Management Protocol has now exceeded 800 million installations worldwide.

Australia’s NBN Abandons Plans for 100Mb/sec Fixed Wireless Access; Telstra testing “5G” vs Verizon’s Plans?

In sharp contrast to Verizon’s claim of delivering (fake) “5G” broadband wireless access in the U.S. this year, Australia’s NBN Co.has abandoned plans to provide 100Mbps broadband plans for fixed wireless customers. Last month, we wrote about state owned NBN’s FTTC plans, but there was no mention of fixed broadband wireless access.

“We killed it,” NBN boss Bill Morrow told a Senate Estimates committee. Mr Morrow said consistently achieving 100 Mb/sec would cost “billions and billions of dollars” — an Australia taxpayer spend he described as “outrageous.”

“The economics … [start] to actually break apart to a point where it doesn’t make any sense. It would just never happen” Morrow added. “There is no economic model that would work … [especially when] it’s hard to find applications that warrant the need for 100 Mb/sec.”

Mr Morrow said at peak times of the day — for example, in an evening when people stream video — 100 Mb/sec speeds could not be consistently maintained.

More than 230,000 households are currently NBN fixed wireless customers, the committee heard, with the rollout of nearly 2,000 cell towers costing $AUS 2 billion to date. Australia’s fixed wireless network has struggled with congestion, with speeds in some areas less than what the average Turkish internet user enjoyed in 2012.

Morrow said NBN is trialing “5G” ahead of the commercial launch, but he didn’t provide details of which “5G” technology would be used.

………………………………………………………………………………………………………………….

Telstra is currently trialing 5G on Australia’s Gold Coast using mmWave. It has achieved speeds of roughly 3,000 Mbps. Telstra has committed to making 5G available in all major capital cities and regional areas over the course of that year. But that will be limited to key metro areas.

To put that in context, the fastest speed offered to nearly all Australians by the NBN is 100 M bit/sec. So that means 5G could be 30x faster than the NBN top speed tier – 100 M bit/sec. Approximately 6.3 million Australian homes are able to connect to the NBN network today and that number should rise significantly over the next couple of years.

………………………………………………………………………………………………………………….

Author’s Note:

Neither this author or AT&T is encouraged by Verizon’s plan to deploy “5G” mmWave band, fixed broadband access in the U.S. this year using its propriety V5GTF specification.

AT&T’s CFO John Stephens said on the mega telco’s last quarterly conference call with Wall Street analysts: “We’re not as excited about the (5G fixed wireless) business case—it’s not as compelling yet, for us, as it may be for some.”

AT&T believes it might be more effective to simply deliver very high speed internet services via its growing fiber network via FTTP.

“To get that fixed wireless to the residential, you still have to have backhaul from where the 1,000 feet away to the 1,500 feet away, and you still have to have that backhaul infrastructure. So that could be, depending upon your ability to successfully pick who is going to buy, and how much you’re going to need, it’s going to be a very tricky business case,” Stephens explained. “For us, with this extensive fiber network, we will be able to have that backhaul. With this extensive FirstNet network, we’ll be able to have that backhaul. But quite frankly, if we’ve got FirstNet and we’ve got fiber there, it may be just as effective, and may be a better quality product, to give those customers fiber to the home.

“So, we’re continuing to work at it, I just don’t want to hold it out as a—right now, as you can tell, we are more excited about our FirstNet opportunity, about our fiber opportunities that we’re building and selling into that. And quite frankly, about the overall 5G Evolution and 5G capabilities in our overall mobility network, serving much of the mobile broadband demands that are out there.”

AT&T has promised to launch mobile “standards based (?) 5G” services in a dozen cities by the end of this year. The carrier has said that its so-called “5G Evolution” markets offer advanced LTE technologies that pave the way for its “5G” service(s).

On its 1st quarter 2018 earnings call, Verizon CFO Matt Ellis said that Verizon had shown propagation “over 2,000 feet,” for the 28GHz millimeter wave (mmWave) technology it will use for its 5G fixed wireless service which has been announced for Sacramento and Los Angeles, CA before the end of this year.

In January of this year, Verizon CEO Lowell McAdams stated: “we’re very comfortable with being able to deliver a Gigabit of service to everyone that we’re providing (5G fixed broadband) service to,” when the company launches its 5G fixed wireless service in the U.S. this year.

Opinion:

NBN’s killing of their much lower speed (100Mb/sec) fixed wireless service and AT&T CFO’s comments on the lack of a business case especially considering the need for fiber backhaul, caste a lot of doubt on Verizon’s “5G” fixed broadband access plans.

NFIC Conference at SCU May 30, 2018 3PM-10PM: Accelerating Smart and Connected Communities

The joint IEEE-NATEA conference on an emerging technology is aimed to provide IEEE and NATEA members with an inexpensive solid overview of a technology that may affect their work and careers in the near future.

Co-organized initially by IEEE Computer Society Silicon Valley Chapter and NATEA in 1999, the New Frontiers in Computing Conference aims to provide computer and engineering professionals with enough technical information on a developing field to make informed decisions as to its role in their professional careers. NFIC strives to make all this accessible through an inexpensive one-day conference on emerging technologies such as Cloud Computing, Nanotechnology, Multi Core Processors and RFID.

Innovation in edge cloud and increased automation of technologies drive urban agglomeration to meet our lifestyle demands. Through keynotes, panelists, and presentations, this conference provides a means to enhance your understanding of the problems and solutions that are at trial in communities and the workplace.

The conference will address the innovation in edge cloud and the increased automation of associated technologies that are driving urban agglomeration to meet our lifestyle demands. In addition, we will explore how these technologies are being used in:

-Mobile Edge Computing with Distributed Cloud

-Smart Devices and Gateways

-Location-Based Applications

At the end of this conference, we hope you are equipped with the knowledge and tools to collaborate with your communities. Most importantly, we hope that you will carry forth the vision of bringing cutting-edge technologies and innovations to ensure that all benefit from the improved standards of living that smart and connected communities offer.

More info at:

https://ieee-nfic.org/program/

https://ieee-nfic.org

Dell’Oro: Market for disaggregated WDM systems increased 142% YoY in 1Q-2018

A new report from market research firm Dell’Oro Group states the market for disaggregated WDM platforms increased at a 142% year-over-year (YoY) growth in sales in the first quarter of this year. This high growth was driven by the adoption of disaggregated WDM systems expanding beyond web-scale companies and data center interconnect (DCI).

“Small form factor, disaggregated WDM systems were developed for the hyperscalers,” said Jimmy Yu, Vice President at Dell’Oro Group. “And for a long period of time, they were the only large purchasers. However, now we see a growing number of buyers that include cable operators and wholesale carriers. We think this is just the start of a good thing, and expect demand for these disaggregated systems will continue to grow at a hyper-scale rate,” added Yu.

Disaggregated WDM systems reached an annualized revenue run-rate of $800 million in the first three months of this year and Dell’Oro projects the run rate will exceed $925 million for full-year 2018. Ciena and Infinera currently have enjoyed the most success in this niche, with a combined market share of approximately 60% for the trailing four quarters ending in 1Q-2018.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Author’s Note: The move towards disaggregated network equipment started in the Open Compute Project (OCP) Networking and Telco groups. It’s now being propelled forward by the the Telecom Infra Project (TIP) which aims to create greater innovation and flexibility through disaggregation of traditional (vendor specific/proprietary) network equipment. TIP is also attempting to disaggregate optical line terminal equipment (e.g. OLT) and transmission systems such as those that use mmWave frequencies. We first wrote about this disaggregation mega-trend almost three years ago in this article.

Here’s a schematic of an open line system (OLS), which allow transponders from many different suppliers to share a single line system:

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Dell’Oro Group’s “Optical Transport Quarterly Report” provides tables stating manufacturers’ revenue, average selling prices, and unit shipments (by speed, including 40 Gbps, 100 Gbps, 200 Gbps, and 400 Gbps). The report tracks DWDM long-haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switches, optical packet platforms, and data center interconnect (metro and long haul).

To purchase this report, call Daisy Kwok at +1.650.622.9400 x227 or email [email protected].

About Dell’Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

Ericsson’s Deliverables and Take-aways from IoT World 2018 & Private Briefing

Ericsson is one of the top three wireless network equipment companies in the world (they were #1 until Huawei took that coveted spot). Approximately 40% of the world’s mobile traffic is carried over Ericsson networks. The company has customers in 182 countries and offers comprehensive industry solutions ranging from Cloud services and Mobile Broadband to Network Design and Optimization. Ericcson also has one of the most compelling IoT platforms in their IoT Accelerator, which we described earlier this year.

Image above courtesy of Ericsson

…………………………………………………………………………………………………………………………………………………………………..

Ericsson had a huge presence at IoT World 2018 with an impressive exhibit floor booth, a Wednesday private briefing session at their Santa Clara, CA location and three presentations at IoT World 2018 conference sessions.

I attended the private briefing at Ericsson- Santa Clara, got a tour of some of the exhibits there, heard the talk by Shannon Lucas (VP. Head of Emerging Business Unit in North America) on Tuesday and met with Ericsson’s IoT expert Mats Alendal on Thursday for a one on one conversation about Ericsson’s IoT strategy and associated wireless WANs (e.g. NB-IoT, LTE-M, and “5G”).

Most surprising was that Mats claimed that the transition from 4G LTE to whatever the 5G RAN/RIT is will be ONLY A SOFTWARE UPGRADE OF ERICSSON’S BASE STATION. He also said that if the 5G latency could be reduced to 1 or 2 ms, it would open up many new real time Industrial IoT (IIoT) applications that we haven’t thought of yet. Such a low latency would require a controlled environment, typically in a manufacturing plant or similar, and mm wave radio.

Currently most IIoT applications rely on wired connectivity on a factory floor, manufacturing plant or test facility. In a few cases wireless LANs (e.g. WiFi, Zigbee, proprietary) might be used. Hence, wireless WAN connectivity represents a big shift for many industrial customers. IIoT use cases in manufacturing require a wireless WAN with low latency, guaranteed delivery of messages/packets/frames, and instant control/feedback.

One of the best IIoT wireless WAN solutions is Private LTE. It’s probably more robust than cellular LPWANs (NB-IoT and LTE-M) and provides cost benefits as well. In a Thursday afternoon session, Nokia recommended Private LTE for many of those IIoT applications (more information by emailing this author). Ericsson is delivering Private LTE equipment via its 3GPP compliant, licensed and unlicensed bands for Private LTE.

IIoT use cases powered by Ericsson include connected factory robots, manufacture of highly precise bladed disks (BLISKs) for turbines, and spherical roller bearings for SKF. A case study for 5G trial for BLISKs may be viewed here.

Highlights of Shannon Lucas’ talk – Data Infrastructure: Mobile IoT: LPWAN & 5G:

- 18B connected IoT devices are expected by 2022 (that’s down from earlier forecasts of 20B and more by 2020)

- Edge computing network is needed for ultimate scalability and a great user experience (user might be a machine/device)

- Hardware innovation platform can make LTE-M and NB-IoT easier to implement for network operators. AT&T and Verizon are using Ericsson’s NB-IoT technology for their commercial offerings.

- Ericsson has driven standards for cellular connectivity, and that effort is now naturally extending into setting standards for IoT, and more specifically, cellular IoT. With standardization, the IoT becomes a platform from which collaboration between organizations, both private and public, will benefit us all.

- Ericsson’s standardized approach for connecting devices and sensors allows cities to collaborate and share data, regardless of legacy platforms. This helps engineers improve traffic flow, and allows emergency services to optimize response times.

- A collaboration between Ericsson, Intelight and Teleste is helping to break up traffic and information gridlock. Four cities in the Dallas-Fort Worth metroplex have launched a regional system employing the Ericsson Connected Urban Transport ITS platform.

Wednesday Evening Private Briefing:

Ericsson Ventures (VC arm of Ericsson) is focused on driving innovation in areas that will accelerate Ericsson’s core business and generate strong financial performance. Intent is to combine start-up solution with Ericsson’s technologies. 6 to 7 deals per year with average investment of $1.5M. Ericsson likes to be part of a syndicate of VCs and corporate investors in the targeted start-up. They are start-up stage agnostic.

Areas for Ericsson Ventures investment include: IoT, analytics connected car, security, SDN, AR and VR, mobile advertising, wireless connectivity AI and ML.

Many new IoT applications will be enabled by 5G (so thinks everyone), including the connected car and real time control for IIoT. This author is not so sure. We think that high bandwidth and/or low latency might be needed for at most 5 to 10% of IoT applications.

…………………………………………………………………………………………………………………………………………………………………..

References:

Ericsson IoT accelerator platform: https://www.ericsson.com/en/internet-of-things/solutions/iot-platform

Ericsson Technology Review (our most technical papers): https://www.ericsson.com/en/ericsson-technology-review

Cellular IoT Use Cases: https://www.ericsson.com/en/networks/cases/cellular-iot

Enabling intelligent transport in 5G networks

Industrial automation enabled by robotics, machine intelligence and 5G

Ericsson white papers: https://www.ericsson.com/en/white-papers

- 5G radio access – capabilities and technologies

- Cellular networks for Massive IoT

Cignal AI: Optical Hardware Spending Grows in Europe, Asia Pacific in 1Q2018; flat in North America

According to research firm Cignal AI, first quarter 2018 growth in optical hardware sales in the Asia Pacific region was fueled by additional increases in spending outside of China. Sales in the EMEA region also grew YoY, and larger equipment vendors express optimism about incumbent operators future spending. Cignal AI’s report also illustrates an ongoing a spending decline in the North American market, which has proved weaker than expected.

“The massive spending in China during 2017 has slackened during 1Q18, resulting in flat year-over-year growth. A precise determination of results for the region is complicated by the ongoing ZTE export ban and ZTE’s communication blackout,” said Andrew Schmitt, lead analyst for Cignal AI. “Meanwhile, North America continues to be weaker than expected in an aggressive pricing environment.”

Cignal AI’s Optical Hardware Report is issued each quarter and examines optical equipment revenue across all regions and equipment types. Shipment information and guidance from individual equipment companies are included, and forecasts are based on spending trends in each region and the equipment types within those regions.

Key Findings In 1Q18 Optical Hardware Report:

- RoAPAC exceeds forecasts, while Chinese market softens.Optical hardware spending in China was flat year-over-year. Cignal AI estimates ZTE experienced a soft quarter even before the impact of the export ban. Outside of China, the RoAPAC continued to grow, with Huawei, Nokia, and Coriant as primary beneficiaries.

- North American optical hardware spending remains weak. North American spending declined by nearly double digits YoY in the first quarter. Cignal AI expected the region to rebound in 2018 with the return of stabilized pricing. But aggressive pricing continues and may impact total spending levels for the entire year. Infinera was a bright spot in the North American market as sales of its new ICE3-based products helped lead a revenue turnaround for the company.

- Optimism abounds in EMEA. Vendors are optimistic about ongoing spending trends in the EMEA region, particularly among the large incumbents. This bodes well for Nokia and Ciena; two companies well-positioned to take advantage of new market opportunities.

Real-Time Optical Hardware Tracker Now Available from Cignal AI

Cignal AI launched its new and unique Optical Hardware Market Share Tracker. The tracker provides real-time visibility on individual vendors’ ongoing results as soon as they are reported. This insightful tool gives Cignal AI clients the freshest, most up to date market data possible to enable well-informed market analysis.

About the Optical Hardware Report

The Cignal AI Optical Hardware Report includes market share and forecasts for optical transport hardware used in optical networks worldwide. Analysis includes an Excel database and PowerPoint summaries, plus Cignal AI’s real-time news briefs on current market events, Active Insight. The Hardware Report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, Coriant, Cyan, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, MRV, NEC, Nokia, Padtec, TE Conn, Transmode, Xtera and ZTE.

Full report details, as well as articles and presentations, are available to users who register for a free account on the Cignal AI website.

Verizon talks up OTT video over “5G” fixed access; will participate in “5G” trial in South Africa

Verizon will join with an unannounced over-the-top (OTT) video company rather than launch a linear service of its own, CEO Lowell McAdam said during a Yahoo Finance interview yesterday. Verizon intends to bundle the OTTP video service with its “5G” fixed access starting in the fourth quarter. “I think the linear TV model is dead — it’s just going to take a long time to die,” he said.

“Our view is we should partner with those that are in the linear game, let them be very good at what they do. We’ll add digital content to that mix and we’ll position ourselves for where we become more of an over-the-top video culture versus the linear model that we have today.”

What McAdam is previewing is an integrated OTT offer that combines a linear channel line-up and VOD with Verizon’s digital assets. He hopes this approach will provide both some differentiation in the market and additional ways to monetize their Oath digital content.

………………………………………………………………………………………………………………………………………………………..

Separately, Verizon will participate in a trial “5G” network to be deployed in South Africa by local telecommunications company Comsol. South Korea’s Samsung Electronics has also joined Comsol as a partner in the venture. The three firms will deploy a trial “5G” network, which will be operational by the third quarter of 2018, Comsol CEO Iain Stevenson told TechCentral by phone on Tuesday. The objective is to showcase the network at the upcoming ITU Telecom World conference to be hosted by South Africa later this year.

Stevenson said the trial will be converted into a full commercial network with more base stations early next year once the 5G standards have been ratified. Comsol has been working to build a 5G network in South Africa for some time.

The trial, which will take place in Johannesburg, will consist of two “multi-sector” base stations to start, connected to fibre-optic backhaul. Multiple demonstration points will be established where members of the public will be able to experience 5G, which will deliver gigabit-class Internet access. Both Samsung, whose technology will be used in the trial, and Verizon will send engineers to South Africa to assist in the construction of the network.

Though the trial network will be “non-commercial”, customers will be connected to it and will use it in real-world environments, Stevenson said. Other 5G trials in South Africa have not involved live customers.

The “point-to-multipoint” network will utilise Comsol’s extensive spectrum assignment at 28GHz — it owns more than 30% of the high-frequency band. Stevenson declined to comment in detail on Comsol’s strategic plans, including its likely future funding model, but said it intends offering services to both businesses and retail consumers, with the technology serving as a replacement to fiber.

The trial is aimed at delivering a wireless solution that rivals “FTTx” offerings, including fiber to the business and fiber to the home, by early next year. This will be achieved by using the “pre-5G” proprietary standard from Verizon’s 5G Technical Forum for fixed-wireless deployments in the 28GHz and 39GHz bands. The proprietary standard will ultimately be converted into the 3GPP 5G New Radio specification once they have been confirmed by ITU-R WP 5D (not before August 2019!)

Stevenson said 5G fixed-wireless access has the potential to connect millions of South Africans with high-speed connectivity that would never be possible with fiber solutions, which, he said, require significant investment in physical infrastructure.

“Verizon has made significant investments in spectrum and technology and established a number of strategic collaborations to launch fixed-wireless 5G services in between three and five US cities by the end of this year.”

Sung Yoon, president and CEO of Samsung Electronics Africa, said in a statement about the collaboration between the companies that there is “so much opportunity in the region due to the diversity of markets and services already in place here, and we think South Africa is a prime candidate to show off the benefits that 5G can bring to consumers here.”

“While this agreement initially focuses on 5G fixed-wireless access, over time this will evolve into consumer offerings, similar to the way that we use 4G services today,” Stephenson said.

Reference:

https://www.techcentral.co.za/verizon-samsung-back-new-5g-network-in-sa/81229/

Cable Companies/MSOs Continue to Dominate U.S. Broadband Access with 64% Market Share

by Karl Bode edited by Alan J Weissberger

The nation’s biggest cable companies continue to dominate traditional telcos when it comes to quarterly broadband additions. According to the latest data by Leichtman Research, the nation’s top cable operators added 845,000 subscribers during the first quarter, while the nation’s telcos lost 45,000 broadband subscribers during the quarter. That’s largely thanks to many phone companies (Verizon, Frontier, Windstream, CenturyLink) refusal to upgrade aging DSL users at any real scale, resulting in a slow but steady exodus as users flee to cable to obtain the FCC’s definition of broadband (25 Mbps).

According to Leichtman, that’s eight straight quarters during which the nation’s telcos have lost subscribers.

Leichtman’s findings for the quarter include:

- Overall, broadband additions in 1Q 2018 were 83% of the 965,000 net adds in 1Q 2017

- The top cable companies added about 845,000 subscribers in 1Q 2018 – 84% of the net adds for the top cable companies in 1Q 2017

- The top telephone companies lost about 45,000 subscribers in 1Q 2018 – similar to the net losses in 1Q 2017

- Telcos have had combined net broadband losses in each of the past eight quarters

- At the end 1Q 2018, cable had a 64% market share vs. 36% for Telcos – compared to 61% for cable vs. 39% for Telcos at the end of 1Q 2016

“With the addition of 800,000 subscribers in the quarter, top broadband providers in the U.S. cumulatively now account for about 96.5 million subscribers,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Over the past year, there were about 1,950,000 net broadband adds, compared to about 2,550,000 net adds over the prior year.”

………………………………………………………………………………………………………………………………

At the end of the first quarter, cable had a 64% market share versus 36% for Telcos — compared to 61% for cable versus 39% for Telcos at the end of 2016. This expanding monopoly not only reduces the incentive on cable to to improve historically-terrible customer service, but it also gives them the green light to abuse these captive markets via a bevy of price hikes — especially arbitrary and unnecessary usage caps and overage fees.

Overall, broadband growth continues to slow, which is driving many of these companies into additional markets (like online advertising).

References:

Telcos Refusal to upgrade period.

quote:

That’s largely thanks to many phone companies (Verizon, Frontier, Windstream, CenturyLink) refusal to upgrade aging DSL users at any real scale, resulting in a slow but steady exodus as users flee to cable to obtain the

The mess the US is in goes back to the break up ATT, and possibly further.

The RBOC’s and other ILEC were in the cat bird seat, and BLEW IT! They could have taken their already wired to practically every one position and just blown the MSO’s out of the water in the early days of @Home etc..

INSTEAD they chose to just let the MSO’s develop things, and DO NOTHING In most cases to some DSL, and some fiber. When VZ started to get its act togehter and try to right the ship, Gordon Gecko’s just backed up and ran into the iceberg again!

I honestly believe had ISDN been pushed harder by ATT in the 70’s we would see ubiquitous HSD to everyone via ATT. WHY Well starting with a DIGITAL LINE to the premises in the 70’s… then upgrade from there…128K in the 70’s compared to what most were getting 110 or 300 or even if you were lucky 1200 baud! 2400 baud was not that old into the early 80’s! I had a 2400 baud for QLink..

The ILEC/RBOC’s blew their chance, they had everything there and all they had to do was continue to ugprade. They chose not to! Now we have this mess.

UPS Exec: Data analytics & tracking crucial to effective IoT deployments

Is UPS a package delivery company or a logistics and data/analytics company? Known for its ubiquitous brown trucks, the global package delivery giant has embraced IoT in just about every facet of its business, with even more projects in the works. There are IoT sensors on trucks, handheld devices, even labels that monitor everything from truck engine performance to packages flowing through the network.

During his May 15th keynote address at IOT World 2018, Juan Perez, chief information officer and chief engineering officer for UPS, said that his company has “truly transformed” the way it does business by leveraging the power of IoT technology to realize efficiencies and avoid downtime. But achieving these benefits is not a product of simply deploying sensor throughout the organization to gather random information, he said.

“I think we all recognize that IoT is data, but, very importantly, data minus analytics is just simply trivia. I get really, really worried when I hear business units … wanting more and more data in the organization without having a solid strategy as to how that data is going to help us make better business decisions.”

“Of course, trivia can cost UPS lots of money—ultimately, without the type of value that we want to generate from it. However, data plus insight helps with decisions.”

IoT has already helped UPS save millions of dollars every year. One of the best-known examples of this is optimizing driver routes. Before drivers leave the facility, they get a manifest on their handheld devices that lays out their route for the day. It’s a route that factors in numerous data signals in order to minimize the miles they drive. Sensors also track location, traffic conditions, and monitor a truck’s performance to avoid breakdowns on the roads or highway.

Juan Perez of UPS shows off the company’s E-Trikes on stage at IoT World in Santa Clara, CA

……………………………………………………………………………………………………………………………………………………………..

Perez has been with UPS for over 25 years, starting as a truck driver in the Beverly Hills, CA area. Juan became UPS’s CIO in 2016 and added engineering to his title in April 2017. His career has covered assignments in Operations, Industrial Engineering, Process Management, and Technology in corporate, US, and international business units.

Juan said the key between data being a trivial pursuit and an engine for driving more effective and efficient operations is analytics.

“All of these connected devices that we have at UPS collect a significant amount of data, but raw data is just useless—it doesn’t mean anything to us,” he said. “What we’ve had to do to truly extract value from our IoT strategy and from our data strategy is to get very, very effective at analytics.

“Analytics … is taking raw data and making that raw data be converted into insight, so we can make better decisions. We live by this day in and day out.”

Perez said there are three types of analytics: descriptive, predictive and prescriptive. Descriptive analytics is focused on past performance, and predictive analytics is focused on the present—both can be helpful in identifying areas of improvement within an organization, but they only help personnel make good future decisions if conditions do not change, he said.

In contrast, prescriptive analytics are focused on the future and can be adaptive to changing environments, Perez said.

“Where we want to be is in the world of prescriptive analytics,” Perez said. “The output is now allowing us to make really effective decisions and take action on the way we do work. The focus is not only on the present but also on the future. The question that needs to be asked—which is really important—is, ‘What should I do next?’

“Quite frankly, there hasn’t been a downside to UPS in focusing on prescriptive analytics.”

This approach is manifested in several areas, from package-tracking capabilities to analytics that use sensor data on vehicles to determine maintenance needs, Perez said. In addition, UPS drivers are given routes each day that have been optimized to deliver packages in the most efficient manner, he said.

Analytics crucial to effective IoT deployments, UPS exec said. Matters like route optimization might seem like a small item on the surface, but in a company with UPS’s scale–more than 454,000 employees, more than 100,000 delivery vehicles and a fleet of more than 500 airplane worldwide delivering up to 34 million packages in the U.S. during its peak period last year—even small efficiency gains can have a very real bottom-line impact, Perez said.

“We are detail-oriented,” Perez said. “Think about these numbers: If we save 1 mile per driver per day—across all of our drivers in the U.S.—in the course of a year, UPS can save $50 million. If we can save one minute in our drivers’ day that is non-value-added for our customer or for us as a company, we can save—across all drivers the course of a year–$14.6 million. If we can reduce one minute of idle time, we can reduce $515,000 in a year.

“Details matter. So, as you develop your data strategy and your IoT strategy, ensure that you remain detail-oriented.”

This mindset has altered the way UPS operates, Perez said.

“UPS has changed significantly in the last several years,” Perez said. “In fact, we’re no longer a small-package delivery company alone. Yes, we’re definitely the largest package-delivery company in the world, but we’re also a logistics company. We’re also an insurance company. We provide all kinds of freight transportation across multiple modes. And we continue to gather data on all aspects of our business and keep generating insights that can help UPS run better. So, today, we’re a very different company than we were many years ago.

“The journey to get here has been difficult. We were a paper-based company only a few years back … Today, I would make the argument that UPS is truly a technology company that happens to be in the logistics business. We deliver packages, but we are a technology company.”

“We’re working on a number of projects to bring sensors to everything. We believe data and IoT will continue to improve our business in ways that we haven’t even dreamed of.”

The exponential growth of data made possible by connected devices and the industrial Internet is creating a society that is always on and always learning. These connections are transforming entire industries as companies leverage new technologies for greater efficiency, improved service and positive environmental impact.