Month: February 2022

Lumen Technologies tops Vertical Systems Group’s 2021 U.S. Wavelength Services Leaderboard

- Customer demand for retail wavelength circuits exceeded wholesale deployments in 2021.

- Revenue for U.S. Wavelength Services is projected to grow at a 13% CAGR between 2021 and 2026. This projection incorporates the effects of the COVID pandemic, including installation disruptions and chip shortages.

- Six providers on the U.S. Wavelength Services LEADERBOARD also hold a rank position on the latest U.S. Fiber Lit Buildings LEADERBOARD – Lumen, Zayo, Verizon, AT&T, Crown Castle and Cox. Additionally, Windstream achieved a Challenge Tier citation.

- Five U.S. Wavelength Services LEADERBOARD providers are also top ranked on the Mid-2021 U.S. Ethernet LEADERBOARD– Lumen, Verizon, AT&T, Windstream and Cox. Zayo has a Challenge Tier citation.

………………………………………………………………………………………………………………………………….

References:

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

Strand Consult: MWC 2022 Preview and What to Expect

by John Strand

Tomorrow the Mobile World Congress (MWC) opens physically in Barcelona and also online. Every year for the last 19 years, Strand Consult has published previews of the Mobile World Congress (MWC). After its cancellation in 2020, MWC 2021 was a shadow of its former self, though the hybrid in person/online format brought 30,000 participants. 2022 promises to bring some 50,000, one of the largest gatherings since the pandemic began.

Recall that 2019 MWC had some 110,000 participants and 2400 exhibitors. It’s come a long way from its start 36 years ago in Cannes, cozy enough that attendees to mingle at the Hotel Majestic’s bar following each day’s events.

Like the process for MWC, many people have been returning to normal after Covid. However the world has been gripped by the invasion of Ukraine by Russia, an absurd act against a sovereign, democratic nation which became independent in August 1991. Most democratic countries are united against Russia’s action. GSMA canceled the event’s Russian Pavilion and barred some Russian firms per international sanctions. Consider how Telenor stood up to dictatorship in Myanmar: by selling their assets and leaving the country. Pressure could grow for GSMA to suspend its Russian members.

Covid-19 has had a big impact on how people use mobile telecom services as well as the over-top players like Google, Facebook, Amazon, Apple etc. Historically GSMA kept a low profile on political matters. However that is increasingly difficult in a connected world when people communicate globally and have expectations of their service providers. Mobile operators and trade organizations like GSMA no longer have the luxury to focus solely on short-term profit and remain passive to aggression and autocracy.

MWC Buzzwords: 5G, OpenRAN, AI, Cloud, IoT, Green, and Diversity:

GSMA Director General Mats Granryd will open the conference, and it’s natural that this Swede would look to create consensus among 750 mobile operator members. He has a tough job to tell regulators that the industry needs better conditions while defending his members’ request for subsidies among other industries which have fared far worse than mobile telecommunications. As usual, he will focus on the latest hype and avoid the uncomfortable, which is too bad for journalists who want answers to critical questions.

Granryd will probably make the point that 5G is growing quickly: over 200 5G mobile networks based on 3GPP standards have now been launched around the world. If 4G was about the smartphone app economy, 5G is about disrupting the wireline home broadband market and opportunities for industry to integrate people and machines intelligently. There are hundreds of millions of new 5G customers. It’s an impressive accomplishment, but it’s doubtful that this can be turned into greater revenue for mobile operators’ shareholders. To date, the money has flowed to Big Tech.

Granryd will also tout the greening of the industry, though careful not to point out that the total energy footprint of the industry is growing. More traffic, devices, connections, network sites, and applications means more energy use. Not all of this is green and much is “greenwashing.”

The other hot topic is diversity, which has been moved from the last day of the conference to the first. The new Diversity4Tech replaces what was Women4Tech, an effort ended prematurely without success. Indeed, half of the world’s mobile subscribers are women, but there are still too few female executives in the mobile industry. Only 3 of GSMA’s 26 board members are women. It’s embarrassing that GSMA has not performed better on this metric. The only woman in the mobile leader line up is President & CEO of Telia Allison Kirkby who speaks on the New Tech Order. Tellingly, the session features three Chinese men: Yang Jie, Chairman, China Mobile; Ruiwen Ke, Chairman & CEO, China Telecom; and LieHong Liu, Chairman & CEO, China Unicom. Diversity, equity, and inclusion (DEI) are unlikely to be themes in the remarks of China’s state-owned operators. Moreover, they are unlikely to mention state-sponsored cyberattacks which are growing more frequent, more sophisticated, and more severe.

Oddly enough this MCW features a keynote by FC Barcelona President Joan Laporta. The program text boasts that the European football market is worth over $25 billion dollars and growing. In reality, football (soccer) is not an industry that mobile operators should emulate. Not only is FC Barcelona $1.57 billion in debt, it had to let Lionel Messi go because it couldn’t honor its financial contract. More largely, the salaries for superstars like Messi, Ronaldo and, others are breaking the cable industry. GSMA is probably thanking its lucky stars that it didn’t feature Chelsea FC owner Roman Abramovich, a Russian oligarch and Friend of Putin who invested in the UK’s Truphone in 2006.

In any event, Ukraine is a communication game changer. Look at Germany’s Chancellor Olaf Scholz now committing to pay the full freight of NATO dues, something that former Chancellor Merkel refused do to.

Regulation, the never-ending story:

MWC should be the opportunity for mobile operators take a victory lap. The mobile telecom industry salvaged society from the pandemic, allowing people to work, learn and receive health care from home. Moreover, many operators have commendable plans to be carbon neutral in the near future. Yet GSMA has failed utterly to build on mobile operators’ good citizenship to modernize regulation and kick start much-needed consolidation. Instead many authorities want to double-down on failed regulatory policies like net neutrality and are even-more entrenched against mergers. GSMA lacks a coherent strategy of policy and communication to convince competition authorities and regulators to adopt a modern framework for consolidation, investment, and innovation.

Strand Consult has studied mobile industry consolidation globally for more than 20 years and just published the definitive report on 4 to 3 mobile mergers. It describes why European operators don’t pass the acid test on consolidation and why they fail to succeed.

Strand Consult has published hundreds of research notes, reports, and articles about net neutrality around the world. Notably the leading countries for 5G; Japan, South Korea, China, and USA have no net neutrality rules, or only soft rules. It is no surprise that European countries were late to 5G. Strand Consult has documented how the Body of European Regulators (BEREC) has consistently prioritized the needs of a small cadre of so-called “civil society” advocates over Europeans as whole who want more mobile telecom innovation and investment.

More largely, the measures taken by the European Union to “tame” Big Tech have had the opposite effect. Since Margrethe Vestager became Competition Commissioner in November 2017, Big Tech companies have increased their turnover, market share and earnings.

GSMA promotes Clouds:

Where GSMA fails to communicate the value proposition of mobile operators and demand the needed regulatory update, it does a great job to promote cloud providers. Once again, mobile operators are set up to be the biggest losers while Big Tech firms Google, Apple, Amazon, and Microsoft are poised take the lion’s share of the 5G profits of connectivity, just as they did with 4G.

Few understand what AWS means for Amazon. AWS controls about a third of the global cloud market, substantially more its closest competitors Microsoft Azure and Google Cloud. In Q4 FY 2021 AWS generated net sales of $17.8 billion and operating income of $5.3 billion. Net sales grew 39.5% while operating income rose 48.5% compared to the year ago quarter. The value continues to increase as cloud services are integrated with artificial intelligence (AI) and other services.

Here are some critical questions to help you navigate the “cloudnet” sessions

- Why are clouds, which are fundamental to the running of 5G and 5G services, not subject to regulation, like mobile operators?

- Why do regulators obsess about market power of mobile operators while being oblivious to cloud providers Google, Microsoft, Amazon, and increasingly Huawei?

- What has been governments’ strategic blunder in the focus of restricting Huawei in 5G? (Hint: They forget about Huawei in the cloud. See Strand Consult’s note.

- How easy or difficult is it for customers to migrate from one cloud to another? Is data portable from Amazons AWS to Microsoft´s Azure?

3G, 4G, 5G: Where does the cash flow?

At MWC, there is always discussion about the next generation or G. However there is little discussion of the cash flow. Here are the cold, hard facts to consider.

- Many mobile operators believed in 2000 that 3G would be a gold mine for their revenues. They spent billions of euros on spectrum, but the revenue projections that ARPU will grow from to €36 to €72 per month fell far below expectation, ARPU declined.

- There are very few examples of successful partnerships that mobile operators have realized under 3G and 4G. In general, the revenue has flowed to the OTT or third-party providers, not operators.

- The value created in 4G has flowed to Google’s and Apple’s app stores which take a significant revenue cut of the apps on offer.

- Over the years, operators have attempted to launch various application programming interfaces (APIs) that third parties could integrate into their services. Some of these actions have been successful, like premium SMS. From 1998 onwards, mobile operators have been successful to offer premium SMS to pay for various digital services. Strand Consult was the first to publish research on this market and business models. Many of the world’s mobile operators followed our recommendations when it came to how to implement and operate a market with a short code where mobile customers could use to pay for services. See Strand Consult’s old report and research note about premium SMS

- Later around 2009 at MWC, GSMA launched OneAPI, about which we published a lot of research. Unfortunately, the operators did not know how to operate this market and create an ecosystem. Look at the research note ”One API is good news”. While this was a welcome development at the time, it did not develop into a revenue stream.

- Since that time, operators have been transformed into “dumb pipes”, mainly generating revenue from traffic they sell, not by adding value with better or different services. Mobile operators have little to no ability to monetize their own value-added services. In fact WhatsApp has cannibalized mobile operators’ SMS revenue. For example from 2012 to 2013, KPN´s SMS revenue declined by €100 million as customers switched to WhatsApp for messaging.

- There is only limited experience to reference for mobile operators’ 5G partnerships. The current version of 5G is 3GPP release 14 and 15 which do not have a functionality that is more advanced than 4G. Mobile operators have a dream to make money from 5G in the same way they dreamed it for 3G and 4G.

- Moreover, the EU regulatory environment with hard net neutrality rules and BEREC’s draconian over-interpretation of the rules have created an environment which discourages, if not prohibits, partnerships for mobile operators in 5G. It is not surprising that telecom investment has languished for years in EU.

- At MWC there are likely many PowerPoint presentations which describe proposed partnerships between mobile operators and other technology providers. However the business models are not in place, and many mobile operators have an unrealistic view of their ability to monetize value-added services.

- The reality is that to innovate in 5G, firms like Apple and Google, only need to add a new layer on their existing business. They are a proven partner. However mobile operators are required to do the essential retooling of networks. Mobile operators thus have a higher bar for 5G. They have to build an new ecosystem to convince a partner to join, where as Apple, Google and AWS only need, to extend their ecosystem with 5G services.

The role of mobile operators in the value chain has been decimated in the last two decades. It is not a question how mobile operators will react to 5G, but whether they have the skills at all to execute.

OpenRAN and Vendor Diversity – What does that mean?

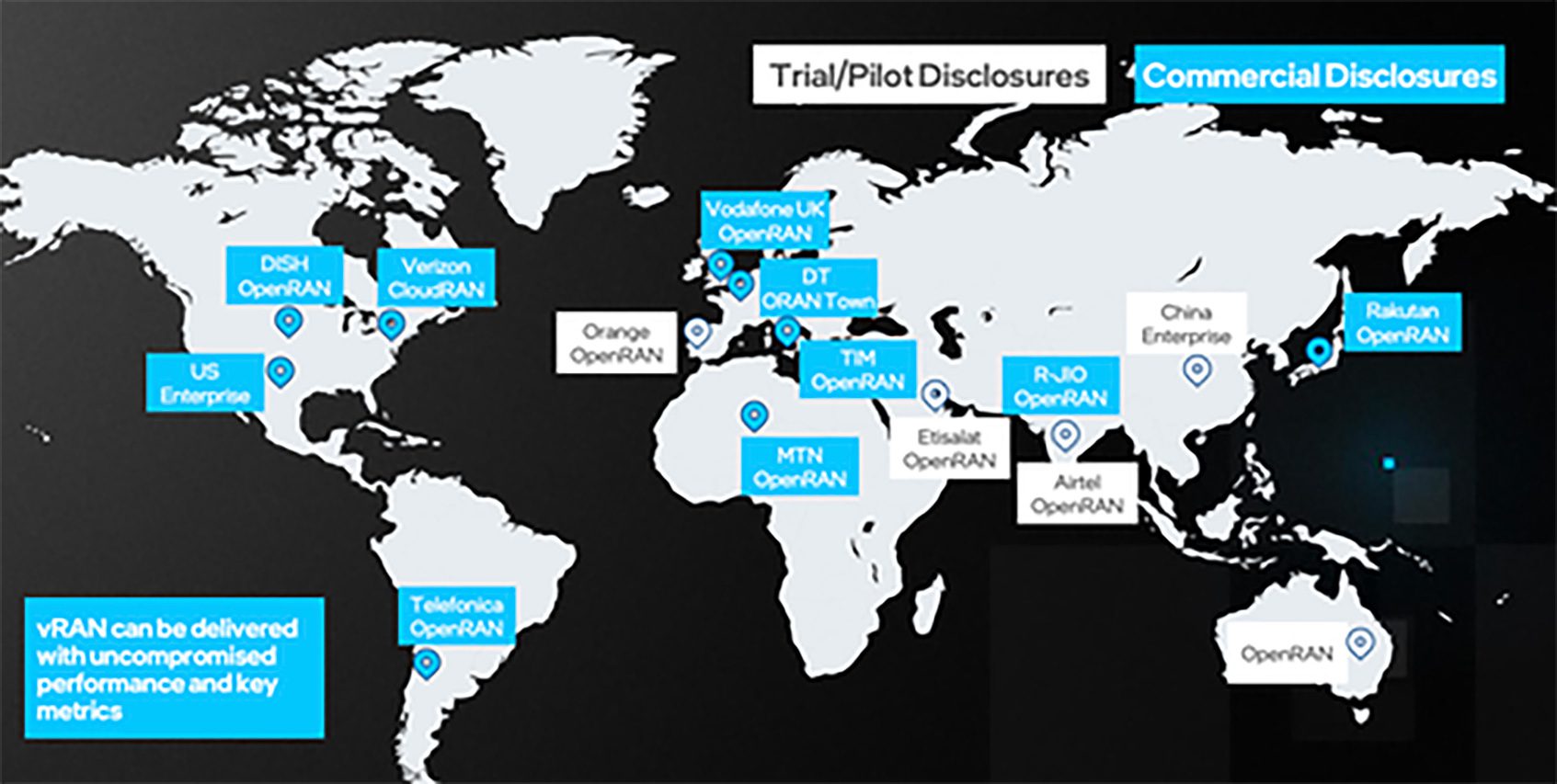

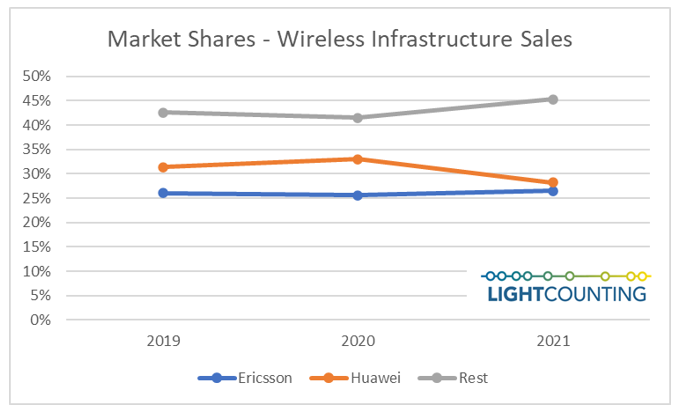

The latest MWC hype is OpenRAN and the invented term “vendor diversity”. Much of the hype is driven by OpenRAN players which claim that the market for mobile infrastructure equipment is controlled by Huawei, Ericsson, Nokia and ZTE. However, MWC features some 2000 exhibitors which supply infrastructure equipment to over 750 mobile operators. Note that the need for “vendor diversity” is not addressed with cloud providers.

Many OpenRAN pronouncements sound too good to be true, for example a technology that can reduce mobile operators infrastructure CAPEX and OPEX by 30-40 percent. Investors and other decision makers want objective information about the latest mobile industry hype. Strand Consult’s free report Debunking 25 Myths of OpenRAN examines the claims made by OpenRAN proponents. Strand Consult, having witnessed the launch of WiMax, OneAPI, and the iPhone among other hyped technologies promised to bring windfall revenues to mobile operators, provides critical questions to evaluate OpenRAN in its latest report.

The main challenge for OpenRAN is whether it can be relevant for operators which have very little room for margin of error. OpenRAN is far from being able to replace classic infrastructure on a 1:1 basis.

OpenRAN testing has been launched in a world in which mobile operators buy and build classic RAN at a high rate. There are two reference cases. One is Rakuten in Japan driven by charismatic CEO Tareq Amin. Rakukten gives away free traffic without getting paying customers into the store. It’s solution is proprietary, not open.

The US-based Dish is the second. It faces many challenges which make it hard to see how it can become a serious alternative to Verizon, AT&T and T-Mobile

The Federal Communication Commission (FCC) proceeding on OpenRAN showed few, if any examples, of US mobile operators and their trade associations (CTIA, Rural Wireless Association, and Competitive Carriers Association) testifying that OpenRAN is a serious alternative to classic RAN installations.

MWC offers an opportunity to meeting mobile operators’ Chief Technology Officers. Ask them what they think of OpenRAN why they have launched 5G using classic RAN based on 3GPP standards.

The history of OpenRAN is reminiscent of WiMax. If you have some of the PowerPoints from the early 2000s, you will see how infrastructure vendors talked about why WiMax was so amazing. These points are almost identical to what is asserted about OpenRAN.

To assess claims about vendor diversity, it’s important to look at facts and history. The infrastructure supplier market has consolidated from 20 top tier providers in the 2G market in 1989 to 12 top tier providers in 1999 to 5 top tier providers in 2019. Many of the first-generation enthusiasts did not make it out of the 1G analogue cellular world into the world of 2G digital cellular. Over time the GSM standards family (GSM, WCDMA, LTE etc.) became the de facto basis for the roadmap, the standard for global economies of scale and the industry benefits such as lower unit costs. Those equipment suppliers which focused on CDMA and analog exited the market.

There is also the practical issue of math. The notion of vendor diversity for its own sake challenges operators to reduce complexity and cost in their networks. Operators frequently reduce the number of vendors to improve security (ability to vet vendors and develop trusted relationships) and to lower cost (ability to secure volume discounts). Indeed operators want concentration in part to get better value for money.

Note how Neil McRae, Managing Director and Chief Architect at British Telecom described when he got the question; “The major operators have been telling their shareholders since 2000 that they should reduce suppliers to save money?”. He replied, I have worked with BT for 10 years. When I arrived, BT had a 21 C fixed network with 50 vendors. I reduced it to 4 vendors and saved BT £1 billion in 3 years. The key was reducing complexity, which is the killer in telecommunications. When I hear about Open architectures with 5- 50 vendors, I run for the hills. Reducing vendors was the right thing to do and we would do it again.” RAN, while important, is just one part of an operator’s infrastructure requirements.

Moreover, the consolidation of European infrastructure is the result of many European operators having opted into Huawei and opted out of European suppliers.

The active customer base of Europe’s 102 mobile operators is 673 million subscribers. Huawei’s and ZTE’s share of 4G RAN mobile networks are 44% and 4% respectively, total 48%.This means that 325 million European mobile customers access Chinese infrastructure, primarily from Huawei. Countries are divided into four categories of share of 4G RAN equipment from Chinese suppliers: 75-100%; 50-75%; 25-50%; and less than 25%.In its RAN report Strand Consult has mapped the market for 4G RAN in Europe.

More than 40% of the CAPEX that European operators have used every year for the last 10 years has been shipped to China and Chinese suppliers like Huawei and ZTE. If you look at the American operators, most of their CAPEX has gone to European suppliers Nokia and Ericsson. We thought that the EU should thank the US operators and the US government for their massive support for European manufacturers and for their fight against the use of Chinese equipment from Huawei and ZTE. The five operators Vodafone, TIM, Telefonica, Orange and Deutsche Telekom have for several years opted for Chinese manufacturers at the expense of European vendors. 62% of Vodafone´s 4G RAN in Europe are from Huawei.

The fact is that RAN Capex makes up less than 3 percent of a mobile operator’s ARPU. The global RAN market is today $29 billion and can be pitted against Verizon’s Capex which amounts to $18 billion.

The bottom line for MWC

Strand Consult has limited expectation for mobile operators’ profitability in 5G. Operators may have ambitions, but the question is whether they have the skills to build an ecosystem that can compete with Apple, Google, and AWS. However, operators can do better on the policy front to modernize regulation and promote consolidation.

Under the current frameworks, there is little to no upside for operators. Mobile operators must consolidate to cut cost and increase profitability. They will probably continue to sell off infrastructure. They continually become dumb pipes. There’s nothing wrong with being a dumb pipe; it’s a business model that works quite fine in water and energy. But don’t expect it to be innovative.

In practice, this development means that many functions from telecom regulators have become irrelevant. The primary task of the telecom regulator of the future will be to deal with spectrum.

Technology companies build services on top of US and Chinese platforms. Many of the smaller technology companies are driven by the construction of a business with the aim of being acquired by these tech companies. A good example is Facebook’s purchase of WhatsApp for $16 billion in February 2014.

There will be many interesting discussions on 5G, OpenRAN, IOT and AI, including the need for more security and transparency. In any event, MWC is always a party because of the cool people who attend giving food for thought to those who want to be stimulated intellectually. Moreover Barcelona’s bars and restaurants rarely disappoint.

Strand Consult provides both pre and post review of the Mobile World Congress. Read reviews from the past years.

Meet Strand Consult at the Mobile World Congress:

If you would like to meet with Strand Consult during the MWC, please email your contact details and the details/purpose of the meeting, and we will get back to you. Journalists are most welcome!

………………………………………………………………………………………………………………………………………………………………………

Biography:

John Strand founded Strand Consult in 1995. Since then, hundreds of companies in the telecom, media and technology industries have attended Strand Consult’s workshops, purchased reports, consulted with the company to develop strategy, launch new products, and conduct a dialogue with policymakers.

John Strand sits on the advisory board of a number of Scandinavian and International companies and is a member of the Arctic Economic Council Telecommunications Working Group. He served on the Advisory Board for the 3GSM World Congress, the event known as the Mobile World Congress in Barcelona.

References:

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

TIP OpenRAN Release 2 Roadmap Published along with Release Schedule

The Telecom Infra Project (TIP) OpenRAN Project Group [1.] has just published its Release 2 Roadmap after conducting a thorough industry review with input from both the supply and the demand sides – including some of the world’s largest network operators. T-Mobile USA, Orange, Bharti Airtel, and Vodafone were authors and contributors.

Note 1. TIP’s OpenRAN Project Group (OpenRAN PG) is focused on scaling up productization of Open RAN technology driven by an ecosystem of technology suppliers, including hardware and software vendors, along with system integrators and service providers. The overarching goal of the OpenRAN PG is to streamline the industry’s efforts on OpenRAN development and to accelerate OpenRAN adoption.

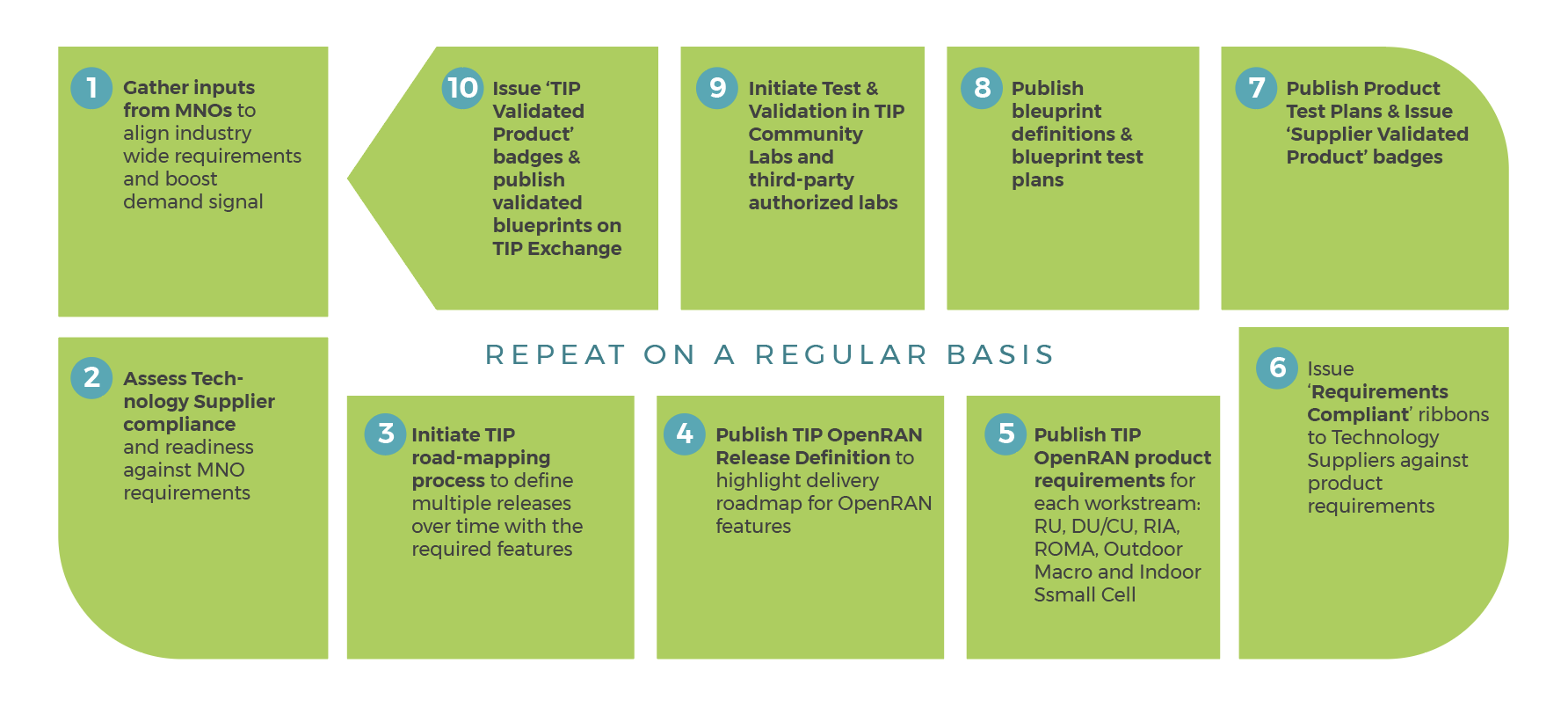

The OpenRAN PG activities include, but are not limited to:

- Gathering and consolidation of prioritized technology requirements for MNOs.

- Identification and engagement with vendors that will deliver the various hardware and software components for OpenRAN solutions that meet harmonized MNO requirements.

- Publishing an OpenRAN Release Definition document mapping the prioritized features to a roadmap of releases.

- Creation of the resulting harmonized OpenRAN Product Requirements documents and definition of Product Test Plans utilized in the Test & Validation framework within TIP.

- Definition of OpenRAN Product Blueprint documents and Blueprint Test Plans utilizing the Test and Validation framework within TIP.

……………………………………………………………………………………………………………………………………………………………………..

The Roadmap document provides a foundational framework for ecosystem alignment – harmonizing the prioritized network operator requirements, including the five European Open RAN MoU signatories, with vendor’s product readiness. You can read the full document here.

Last June, TIP published the ‘Open RAN Technical Priorities Document’ – a comprehensive list of technical requirements that the signatories of the Open RAN MoU Group (Deutsche Telekom, Orange, Telefónica, TIM and Vodafone) considered priorities for Open RAN architecture. Building on that work, the TIP OpenRAN Project Group invited community participants to provide feedback, resulting in over 40 ecosystem responses.

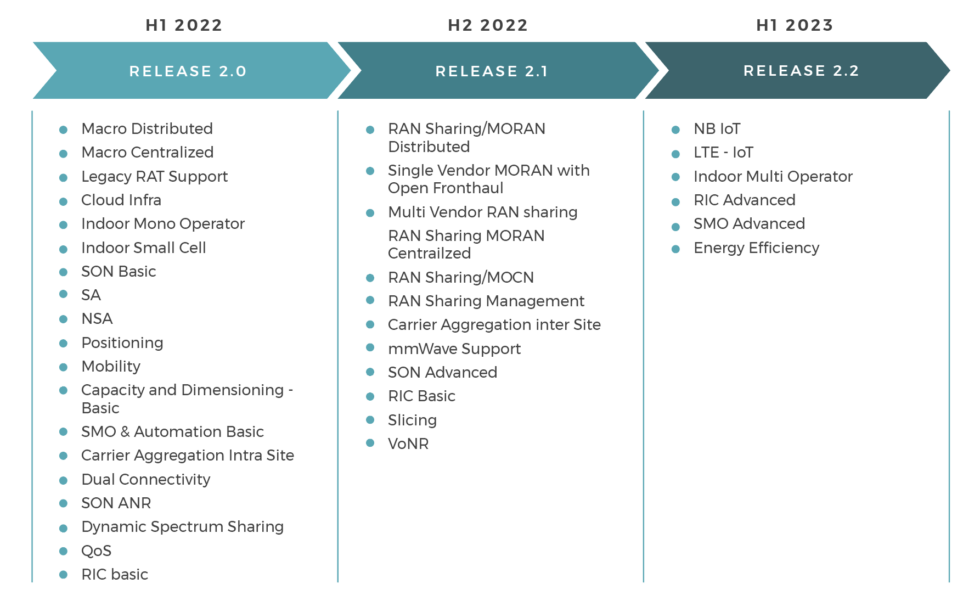

The Roadmap release approach (shown below) enables the execution of the Project Group activities more efficiently, while also providing a path to commercialization via TIP’s Test and Validation framework, delivering on product requirements, blueprint definitions and associated test plans.

TIP Open RAN Roadmap Release Schedule:

The TIP OpenRAN Project Group will continue to advance the requirements gathering and road-mapping process with a regular cadence. As part of the framework, the requirement contribution window will open for MNOs for subsequent minor releases R2.1, R2.2, and so on. The requirements input from MNOs will be harmonized into requirements documents and assessed for compliance and readiness with the technology suppliers.

The TIP OpenRAN Project Group is focused on scaling up productization of OpenRAN technology driven by an ecosystem of technology suppliers, system integrators and service providers. The Project Group aims to streamline the industry’s efforts on OpenRAN development and accelerates OpenRAN adoption.

In addition to publishing the overall roadmap, TIP is also publishing Release 2 roadmaps and Technical Requirements Documents 2.0 for the RU, DU/CU, RIA and ROMA OpenRAN PG subgroups. These will form the basis for issuing ribbons and badges to vendor products – once they have progressed through TIP’s Test and Validation framework – with their subsequent listing on TIP Exchange.

References:

TIP OpenRAN project: New 5G Private Networks and ROMA subgroups

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

Excerpts of ITU-R preliminary draft new Report: FUTURE TECHNOLOGY TRENDS OF TERRESTRIAL IMT SYSTEMS TOWARDS 2030 AND BEYOND

Cautionary Note:

This ITU-R draft report is not complete or agreed upon at this time. Therefore, all of the text below is subject to change. For sure, AI will play a huge role in future IMT

Introduction:

International Mobile Telecommunications (IMT) systems are mobile broadband systems including both IMT-2000 (3G), IMT-Advanced (true 4G) and IMT-2020 (M.2150 5G RIT/SRIT/RAN previously know as IMT-2020.specs).

IMT-2000 provides access by means of one or more radio links to a wide range of telecommunications services supported by the fixed telecommunications networks (e.g. PSTN/Internet) and other services specific to mobile users. Since the year 2000, IMT-2000 has been continuously enhanced, and Recommendation ITU-R M.1457 providing the detailed radio interface specifications of IMT-2000, has been updated accordingly. Some new features and technologies were introduced to IMT-2000 which enhanced its capabilities.

IMT-Advanced is a mobile system that includes the new capabilities of IMT that go far beyond those of IMT-2000 and also has capabilities for high-quality multimedia applications within a wide range of services and platforms providing a significant improvement in performance and quality of the current services. IMT-Advanced systems can work in low to high mobility conditions and a wide range of data rates in accordance with user and service demands in multiple user environments. Such systems provide access to a wide range of telecommunication services including advanced mobile services, supported by mobile and fixed networks, which are generally packet-based. Recommendations ITU-R M.2012 provides the detailed radio interface specifications of IMT‑Advanced.

ITU-R studied the technology trends for the preparation of development of IMT-Advanced and IMT-2020, and the results were documented in Reports ITU-R M.2038 and ITU-R M.2320, respectively.

Since the approval of Report ITU-R M.2320 in 2014, there have been significant advances in IMT technologies and the deployment of IMT systems. The capabilities of IMT systems are being continuously enhanced in line with user trends and technology developments. [813] IMT-2020 systems include new capabilities of IMT that go beyond those of IMT-2000 and IMT-Advanced and make IMT-2020 more efficient, fast, flexible and reliable when providing diverse services in the intended usage scenarios including enhanced Mobile Broadband, ultra-reliable low-latency communication and massive machine-type communication.

This Report provides information on the technology trends of terrestrial IMT systems considering the time-frame 2023-2030 and beyond. Technologies described in this Report are collections of possible technology enablers which may be applied in the future. This Report does not preclude the adoption of any other technologies that exist or appear in the future, and newly emerging technologies are expected in the future.

Scope:

This Report provides a broad view of future technical aspects of terrestrial IMT systems considering the time frame up to 2030 and beyond, characterized with respect to key attributes and alignment with relevant driving factors. It includes information on technical and operational characteristics of terrestrial IMT systems, including the evolution of IMT through advances in technology and spectrally efficient techniques, and their deployment.

New services and application trends:

The development of IMT systems for 2030 and beyond calls for a thorough reconsideration of several types of interactions [3]. The roles of modularity and complementarity of new technological solutions become increasingly important in the development of increasingly complex systems. The use of data and algorithms, such as AI, will play an important role and technological complementarities are required to ensure that the technology innovations complement each other. This is particularly important as the role of IMT for 2030 and beyond can be seen as a pervasive general-purpose system, instead of simply an enabling technology, resulting in complex technical dependencies.

The role of the users of new services and applications is important in the technology development for IMT for 2030 and beyond, and users will need to have access to the services, required devices, and knowledge to use them, including non-users and potential reasons for their exclusion. Users’ opportunities to actively participate as experientials and developers will increase through a deeper understanding of technologies and skills and allows to shape the technologies for personalized needs.

Key new services and application trends for IMT for 2030 and beyond can be summarized as follows:

– Networks support enabling services that help to steer communities and countries towards reaching the UN SDGs

– Customization of user experience will increase with the help of user-centric resource orchestration models

– Localized demand–supply–consumption models will become prominent at a global level

– Community-driven networks and public–private partnerships (PPP) will bring about new models for future service provisioning

– Networks will have a strong role in various vertical and industrial contexts

– Market entry barriers will be lowered by the decoupling of technology platforms, making it possible for multiple entities to contribute to innovations

– Empowering citizens as knowledge producers, users and developers will contribute to a process of human-centred innovation, contributing to pluralism and increased diversity

– Privacy will be strongly influenced by the increased platform data economy or sharing economy, emergence of intelligent assistants (AI), connected living in smart cities, transhumanism, and digital twins

– Monitoring and steering of circular economy will be possible, helping to create better understanding of sustainable data economy

– Sharing- and circular economy-based co-creation will enable promoting sustainable interaction also with existing resources and processes

– Development of products and technologies that innovate to zero are promoted, for example, zero-waste and zero-emission technologies

– Immersive digital realities will facilitate novel ways of learning, understanding, and memorizing in several fields of science.

The role of IMT for 2030 and beyond will be to connect a number of feasible devices, processes as well as humans to a global information grid in a cognitive fashion, offering new opportunities for various verticals [3]. Considering their different development cycles, a full trolley of the potential advances and vertical transformations will continue to be occur in the beyond 2030 era. The trend towards higher data rates will continue going towards 2030 leading to peak data rates approaching Tbit/s regime indoors, which will require large available bandwidths giving rise to (sub-) THz communications. On the other hand, a large portion of the verticals’ data traffic will be measurement based or actuation related small data which in many cases require extreme low latency in rapid control loops necessitating short over the air latencies to allow time for computation and decision making. At the same time, the reliability requirement in many vertical applications will be stringent. Industrial devices and processes, future haptic applications and multi-stream holographic applications require timing synchronization setting tight requirements for transmission jitter. In the future, there will be use cases that require extreme performance as well as new combinations of requirements that do not fall into the three categories of IMT-2020: eMBB, URLLC, and massive machine type communication (mMTC). Some of these use cases will require wide coverage whereas others are confined in small areas.

The three usage scenarios described in IMT-2020 i.e. eMBB, mMTC and URLLC will still be important and new use cases and applications should be all taken into account for the continuing evolution, especially for those driving the technologies development and reflecting the future requirements.

Services and trend opportunities:

– Holographic Communications

Holographic displays are the next evolution in multimedia experience delivering 3D images from one or multiple sources to one or multiple destinations, providing an immersive 3D experience for the end user. Interactive holographic capability in the network will require a combination of very high data rates and ultra-low latency. The former arises because a hologram consists of multiple 3D images, while the latter is rooted in the fact that parallax is added so that the user can interact with the image, which also changes with the viewer’s position.

Holographic communication provides real-time three-dimensional representation of people, things, and their surroundings into a remote scenario. It requires at least an order of magnitude high transmission rate and powerful 3D display capability.

– Tactile and Haptic Internet Applications

Advanced robotics scenarios in manufacturing need a maximum latency target in a communication link of 100 microseconds (µs), and round-trip reaction times of 1 millisecond (ms). Human operators can monitor the remote machines by VR or holographic-type communications, and are aided by tactile sensors, which could also involve actuation and control via kinaesthetic feedback.

Vehicle-to-vehicle (V2V) or vehicle-to-infrastructure communication (V2I) and coordination, autonomous driving can result in a large reduction of road accidents and traffic jams. Latency in the order of a few ms will likely be needed for collision avoidance and remote driving.

Tele-diagnosis, remote surgery and telerehabilitation are just some of the many potential applications in healthcare. Tele-diagnostic tools, medical expertise/consultation could be available anywhere and anytime regardless of the location of the patient and the medical practitioner. Remote and robotic surgery is an application where a surgeon gets real-time audio-visual feeds of the patient that is being operated upon in a remote location. The technical requirements for haptic internet capability cannot be fully provided by current systems.

– Network and Computing Convergence

Mobile edge compute (MEC) will be deployed as part of 5G networks, yet this architecture will continue towards IMT 2030 networks. When a client requests a low latency service, the network may direct this to the nearest edge computing site. For computation-intensive applications, and due to the need for load balancing, a multiplicity of edge computing sites may be involved, but the computing resources must be utilized in a coordinated manner. Augmented reality/virtual reality (AR/VR) rendering, autonomous driving and holographic type communications are all candidates for edge cloud coordination.

– Extremely High Rate Information Access

Access points in metro stations, shopping malls, and other public places may provide information access kiosks. The data rates for these information access kiosks could be up to 1 Tbps. The kiosks will provide fibre-like speeds. They could also act as the backhaul needs of millimeter-wave (mmWave) small cells. Co-existence with contemporaneous cellular services as well as security seems to be the major issue requiring further attention in this direction.

– Connectivity for Everything

Scenarios include real-time monitoring of buildings, cities, environment, cars and transportation, roads, critical infrastructure, water and power etc. The internet of bio-things through smart wearable devices, intra-body communications achieved via implanted sensors will drive the need of connectivity much beyond mMTC.

It is anticipated that Private networks, applications or vertical-specific networks, mini and micro, enterprises, IoT / sensor networks will increase in numbers in the coming years (based on multiple Radio technologies). Interoperability is one of the most significant challenges in such a Ubiquitous connectivity / compute environment (smart environments), where different products, processes, applications, use cases and organizations are connected. Interactions among telecommunications networks, computers, and other peripheral devices have been of interest since the earliest distributed computing systems.

– XR – Interactive immersive experience

The interactive immersive experience use case will have the ability to seamlessly blend virtual and real-world environments and offer new multi-sensory experiences to users. This use case will enable the users to interact with avatars of other remotely located users and flexibly manipulate objects from representations of real and/or virtual environments with high degree of realism. The implications of this use case are expected to be immense, given its wide-ranging applicability to social, entertainment, gaming, industry, and business sectors.

X-Reality, such as virtual reality (VR), augmented reality (AR), and mixed reality (MR) is expected to provide higher resolution, larger FoV, higher FPS, and lower MTP, which all translate into higher demand on the transmission data rate and end-to-end latency.

A key challenge to address when supporting interactive experiences in network include synchronized transport of multi-modality of flows (e.g., visual media, audio, haptics) to and from different devices in a collaborative group serving the same XR application. Another important consideration is supporting real-time adaptations in the network relative to user movements and actions to ensure the interactions with other users and objects appear highly realistic in terms of placement and responsivity. Enabling spatial interactions will also require fast accessibility and ease of integration of content containing up-to-date and accurate representations of real/virtual environments from different content sources.

– Multidimensional sensing

Sensing based on measuring and analysing wireless signals will open opportunities for high-precision positioning, ultra-high-resolution imaging, mapping and environment reconstruction, gesture and motion recognition, which will demand high sensing resolution, accuracy, and detection rate.

– Digital Twin

Digital twin is a digital replica of entities in physical world, which demands real time and high accuracy sensing to ensure the accuracy, and low latency and high data transmission rate to guarantee the real time interaction between virtual and physical worlds.

A digital twin network is a dynamic replica of the physical network for its full life cycle. It should be capable of generating perceptive and cognitive intelligence based on collection of historical and on-line network data. It should be capable of continuously seeking the optimal state of the physical network in advance, and enforcing management operations accordingly. Digital twin enables network self-boosting, self-evolving, self-optimizing by verifying new functionalities, services and optimization features before deployment. Sensing and learning are the two fundamental functions to fuse the physical and cyber world.

Mixed Reality and Virtual Presence

Enabling efficient Machine Type Communication (MTC) continues to be important driver for IMT for 2030 and beyond. It allows machines and devices to communicate with each other without direct human involvement is a major driver behind the Internet of Things (IoT) and the future digitalization of economies and society [11]. MTC encompasses critical MTC (cMTC) and massive MTC (mMTC). The former targets mission-critical connectivity with stringent requirements on key performance indicators (KPI) such as reliability, latency, dependability, and synchronization accuracy. On the other hand, the latter addresses connectivity needs for massive number of potentially low-rate, low-energy simple devices, where the connection density and the energy efficiency are the most important KPIs.

For 2030 and beyond, data markets will become increasingly important technology area connecting data suppliers and customers [11]. The data generated by the widely distributed MTDs will have enormous business and societal value. The value-added services of data marketplaces will be empowered by emerging technologies like artificial intelligence (AI) and distributed ledger technology (DLT), while adding new data-centric KPIs such as the age of information, privacy and localization accuracy.

Proliferation of intelligence

Real-time distributed learning, joint inferring among proliferation of intelligent devices, and collaboration between intelligent robots demand a re-thinking of the communication system and networks design.

– Global Seamless Coverage

In order to connect the unconnected and provide continuously high quality mobile broadband service in various areas, it is expected that the interconnection of terrestrial and non-terrestrial networks will facilitate the provision of such services.

Technology Drivers for future technology trends towards 2030 and beyond:

The continuing evolution of the IMT systems, and the underlying technologies, must be guided by the imperative to satisfy fundamental needs, and contextualized in terms of how they can help the society, the end users, and the value creation and delivery. These necessities and key driving factors are:

– Societal goals – Future technologies should help contribute further to the success of a number of UN SDG goals including environmental sustainability, trust and inclusion, efficient delivery of health care, reduction in poverty and inequality, improvements in public safety and privacy, support for ageing populations, and managing expanding urbanization.

– Market expectations – New technologies should enable significant and novel capabilities, supporting radically new and differentiated services, opening up greater market opportunities

– Operational necessities – The need to manage complexity, drive efficiency, and reduce costs, with end to end automation and visibility, is also an imperative as a motivation and driving factor

Key considerations for IMT Systems for 2030 and beyond include:

– Sustainability/Energy efficiency

Energy efficiency has long been one important design target for both network and terminal. While improving the energy efficiency, the total energy consumption should also be kept as low as possible for the sustainable development.

Energy efficiency has long been one important design target for both network and terminal. While improving the energy efficiency, the total energy consumption should also be kept as low as possible for the sustainable development. Power efficient technology solutions are needed both in backhaul and local access to make use of small-scale renewable energy sources.

– Peak Data Rate/Guaranteed Data Rate

The peak data rate for future system should be largely increased in order to support extremely high bandwidth services such as extremely immersive XR and holographic communication.

Guaranteed data rate usually refers to the achievable data rate at the edge of coverage area. Future system should guarantee users’ experience regardless of users’ location and network traffic conditions.

– Latency

Services with real-time and precise control usually have high demands on the low latency of communications, such as the air interface delay, end-to-end latency, and roundtrip latency.

– Jitter

Usually refers to the degree of latency variation. Some of the future services such as time sensitive industry automation applications may request the jitter close to zero.

– Sensing resolution and accuracy

Sensing based services, including traditional positioning and new functions such as imaging and mapping, will be widely integrated with future smart services, including indoor and outdoor scenarios. Very high accuracy and resolution will be needed to support a better service experience.

– Connection density

Refers to the number of connected or accessible devices per unit space. It is an important indicator to measure the ability of mobile networks to support large-scale terminal devices. With the popularity of the Internet of Things (IoT) and the diversification of terminal accesses in the specific applications, such as industrial automation and personal health care etc., mobile system needs to have the ability to support ultra-large connections.

– Coverage and full connectivity

The future network should be able to provide global coverage and full connectivity by wireless and wired, terrestrial and non-terrestrial coverage with heterogeneous multi-layer architecture. The full connectivity network should support intelligent scheduling of connectivity according to application requirements and network status to improve the resource efficiency and service experience. It will extend the provision of quality guaranteed services, such as MBB, massive IoT, high precision navigation services etc, from outdoor to outdoor from urban to rural areas and from terrestrial to non-terrestrial spaces.

– Mobility

Refers to the maximum speed supported under a specific Quality of Service (QoS) requirement. Future system will not only support terminals on land including high speed train, but it will also provide services to terminals in high-speed airplane, drone and so on.

– Spectrum utilization

With new services and applications towards 2030 and beyond, more spectrum is required to accommodate the explosive mobile data traffic growth. Further study will be introduced on novel usage of low and mid band, and the extension to much higher frequency band with much broader channel bandwidth. The smart utilization of multiple bands and improvement of spectrum efficiency through advanced technologies are essential to achieve high throughput in limited bandwidth.

– Simplified user-centric network

With huge amounts of new services and scenarios towards 2030 and beyond, the network is required to satisfy diversified demand and personalized performance. The soft network should be designed as a fully service-based and native cloud-based radio access network, which can guarantee the QoS and provide consistent user experience. The lite network should be constructed as a globally unified access network with the simple architecture and the powerful capabilities of robust signalling control, accurate network services and efficient transmission through the converged communication protocols and access technologies with plug-and-play, on-demand deployment. A user-centric network is required to enable a fully distributed/decentralized network mitigating single point of failure as well as to enable the user-controlled data ownership which is critical to the next generation network.

– Native AI

The future mobile system will have stronger capabilities and support more diversified services, which will inevitably increase the complexity of the network. Artificial Intelligence (AI) reasoning will be embedded everywhere in the future network including physical layer design, radio resource management, network security, and application enhancement, as well as network architecture, which results in a multi-layer deep integrated intelligent network design. Meanwhile the future network can also support distributed AI as a service for larger scale intelligence.

– Security/Trustworthiness

The future network supports more advanced system resilience for reliable operation and service provision, security to provide confidentiality, integrity and availability, privacy with self-sovereign data, and safety regarding the impact to the human being and environment etc.

The roles of trust, security and privacy are somewhat interconnected, but different facets of the future networks. Inherited and novel security threats in future networks need to be addressed. Diversity and volume of novel IoT and other networked devices and their control systems will continue to pose significant security and privacy risks and additional threat vectors as we move from IMT-2020 to beyond. IMT for 2030 and beyond needs to support embedded end-to-end trust such that the resulting level of information security in the networks to is significantly better than in state-of-the art networks. Trust modelling, trust policies and trust mechanisms need to be defined.

Security algorithms can use machine learning to identify attacks and respond to them. Continuous deep learning is needed on a packet/byte level and applying machine learning to enforce policies, detect, contain, mitigate, and prevent threats or active attacks. While IMT-2020 is still largely device / network specific, future networks envisage far more immersive engagement with the network.

Conventional trust, security and privacy solutions may not be directly applicable to specific machine type communication scenarios owing to their lack of humans in the loop, massive deployment, diverse requirements, and wide range of deployment scenarios. This motivates the design of resource-efficient unsupervised solutions to be exploited by MTD, e.g., based on distributed ledger technology (DLT).

– Dynamically controllable radio environment

To be able to dynamically change the characteristics of radio propagation environment and create favourable channel conditions to support higher data rate communication and improve the coverage.

Emerging Technology trends and enablers:

Technologies to use AI in communications:

The big success of artificial intelligence (AI) in image, video and audio signal processing, data mining and knowledge discovery, etc., has made it possible to shift wireless communication to an intelligent paradigm in a similar manner, i.e., learning from the wireless big data which has yet to be fully exploited to design new and efficient architectures, protocols, schemes and algorithms for the future communication system. In turn, with the wide deployment of base stations, edge servers and intelligent devices, the mobile network will provide a new and powerful platform for ubiquitous data collection, storage, exchange and computing which are needed for future mobile / distributed / collaborative machine learning. For the future communication system, an emerging and transformative move will be providing the access of AI to everyone, every business, every service anywhere anytime. AI is the design tablet of the future communication system, and it will be the cornerstone to create intelligence everywhere. One of the main differences of the future communication system compared to IMT-2020 is that it will use mobile technologies to enable the proliferation of AI and use the radio networks to augment ubiquitous, distributed machine learning. Furthermore, AI ethics issues, existing in all AI-based systems and applications, have been raised and discussed in wireless community from different aspects. Then, future IMT technology would request on fairness, robustness to avoid AI ethics issues in certain level.

AI native new air interface:

Applying tools from Artificial Intelligence (AI), and Machine Learning (ML) and its sub-set Deep Learning (DL), in wireless communications have gained a lot of traction in recent years. This trend in large part has been motivated by the significant increase in the system complexity in the IMT-2020 radio access network (RAN) and its evolution over previous wireless technology generations. Deep neural networks allow the characterization of specific or even unknown channel environment and network environment, i.e., the traffic, the interferences and user behaviours, and then adapt the radio signalling to the channel and network environment. With learning it can optimize user signalling, power consumption as well as its end-to-end connectivity, and smartly coordinate the multi-user access of radio resources, thus optimizing the data and control plane signalling and improving the overall system performances.

The most challenging issue in air interface design is to sense the communication environments, i.e. the estimation and prediction of propagation channels. To this end, traditional air interface pays much effort to pilot design and channel estimation. Now with machine learning and especially the capability of black-box modelling and hyper-parameterization of a deep neural network, the unknowns of the underlying channel could be properly learned providing that sufficient data is available. Thus, we can reconstruct a physical channel rather than just estimate it. With transfer learning, the learned model can be transferred to adjacent nodes. This gives new way to air interface design. Several components in the transceiver chain are expected to be implemented through AI/ML based algorithms. This includes the transmitter side – beamforming and management and the receiver side – channel estimation, symbol detection and/or decoding at a minimum. Therefore, there will be a heavy focus to redesign the physical layer of the communication protocol stack using AI. On the other hand, the implementation issues related to periodic updating of deep learning models that are used in various blocks of the physical layer must be addressed.

In addition, radio resource management or resource allocation can also be implemented via AI/ML based methods. In a multi-user environment, with reinforcement learning, base stations and user equipment could automatically coordinate the channel access and resource allocation based on the signals they respectively received. Each of the nodes calculates its reward for each transmission, and adjusts its power, beam direction and other signalling to accomplish the distributed interference coordination and improve the system capacity. Following are some potential usages:

– For QoE bottleneck of last mile radio link. It is expected for RAN AI to expose radio channel prediction capabilities for upper layer adaptation, for example, available bandwidth and predicted latency, by taking into account multi-users radio channel fluctuation, traffic pattern and cell load variation and etc. This interaction could be based on the subscribed request from upper layer and would be only triggered when the predefined threshold is satisfied.

– The optimization of radio resource allocation to meet the requirements of highly demanding applications such as the cloud based interactive applications which requires low latency and high throughput. The optimization will take into account multi-dimensional metrics, for example, application-level traffic pattern, i.e., video frame level I/B/P frames distribution, transport layer congestion control, low layer buffer status, QoS profiles (e.g. bandwidth, latency)

– For the randomness and uncertainty of traffic distribution in the vehicle network, use the deep reinforcement learning based adaptive exploration approach for the resource allocation, including offline training, online distributed learning method etc.

Machine learning techniques can be used for symbol detection and/or decoding. While de-modulation/decoding in the presence of Gaussian noise or interference by classical means has been studied for many decades, and optimal solutions are available in many cases, ML could be useful in scenarios where either the interference/noise situation does not conform to the assumptions of the optimal theory, or where the optimal solutions are too complex. Meanwhile, IMT for 2030 and beyond will likely utilize even shorter codewords than IMT-2020 with low-resolution hardware (which inherently introduce non-linearity that is difficult to handle with classical methods). ML could play a major role, from symbol detection, to precoding, to beam selection, and antenna selection.

Another promising area for ML is the estimation and prediction of propagation channels. Previous generations, including IMT-2020, have mostly exploited CSI at the receiver, while CSI at the transmitter was mostly based on roughly quantized feedback of received signal quality and/or beam directions. In systems with even larger number of antenna elements, wider bandwidths, and higher degree of time variations, the performance loss of these techniques is non negligible. ML may be a promising approach to overcome such limitations.

MAC layer is a major application area of AI where many of the problems that have legacy solutions can be replaced with AI based methods using supervised learning, data collection and ML model deployment options. Next generation MAC algorithms will need to consider the AI that is used in various layers of the network, especially in physical layer. This is needed because of the need to update the deployed machine learning models, collect data for supervised learning tasks and enable reinforcement learning on different blocks of the network.

AI techniques can be used to target one or more wireless domains, including non-real-time (non-RT) network orchestration and management, such as configuration of antenna parameters and near-real-time (near-RT) network operation, such as load balancing and mobility robustness optimization. Each wireless domain involves different sets of physical and virtual components, family of parameters including key-performance-indicators (KPIs), underlying complexities, and time constraints for updates. Hence, there is a need to consider tailored AI solutions for different classes of the RAN, and their associated problems. There already exists a rich body of research and practical demonstrations of the potential benefits of AI for Wireless, including significant network energy savings.

With the progresses of machine learning and information theory, the ultimate air interface can hopefully perform the automatic semantic communications. There are many open fundamental problems in this direction for the wireless community. For example, learning algorithms usually relies highly on the wireless data which may be hard to obtain or be preserved under privacy constraints. To solve it, we can learn with both the practical wireless data and the statistical models.

Questions related to the most optimal ML algorithms given certain conditions, required amount of training data, transferability of parameters to different environments, and improvement of explainability will be the major topics of research in the foreseeable future. There will be various phases towards development of AI for Wireless, and it is imperative to ensure the increased integration of the technology comes with minimum disruption to the rollout and operation of wireless systems and services. In the short and medium terms, AI models may be targeted for optimisation of specific features within RAN for IMT-2020 and its evolution, such as network operation and management functionalities. In the longer term, AI may be used to enable new features over legacy wireless systems.

AI-Native radio network

Future IMT-systems are required to support extremely reliable and performance-guaranteed services. They will introduce a multi-dimensional network topology, which will make network management and operation more difficult and introduce more challenging problems. To address these problems, it will adopt AI technologies for automated and intelligent networking services. Consequently, to assist computation intensive tasks in AI applications, it will evolve into an AI-native network architecture.

The highest level of AI-native radio network should be designed and implemented by AI to be an intelligent radio network, which can automatically optimize and adjust the network according to specific requirements/objectives/commands, or changes of the environment. The research may include the high-layer protocols, network architecture and networking technologies enabling the above intelligent radio network.

RAN optimization is one of the problems that is rather difficult to solve due to the complexity of the mathematical formulation of the problems. Deep reinforcement learning paradigm in AI can enable zero-touch optimization of the RAN elements with minimum hand-crafted engineering. In addition, Radio networks architecture design is often a challenging task that can be automated with the use of AI. Methods such as graph representation learning could be utilized to enable the network architecture design that can simplify the problem.

Various use cases of AI-empowered network automation are proposed, including fault recovery/root cause analysis, AI-based energy optimization, optimal scheduling, and network planning. Key challenges of training issues have been identified: lack of bounding performance, lack of explainability, uncertainty in generalization, and lack of interoperability to realize full network automation. Four types of analytics can be classified for future AI-native networks, and they are: descriptive analytics, diagnostic analytics, predictive analytics, and prescriptive analytics. The key for successful network automation in AI-native network architecture is how to collect rich and reliable network data that is not typically open to other players other than network operators.

In general, an overall network architecture consists of four tiers of entities: UE, BS, core network, and application server. Application of AI can be categorized into three levels as shown in Figure 1: 1) local AI, 2) joint AI, and 3) E2E AI. This use case family consists in being present and interacting anytime, anywhere, using all senses if so desired. It enables humans to interact with each other without any limitation on physical presence.

The future RAN will be able to perceive and adapt to complex and dynamic environments by monitoring and tracking conditions in the radio network while diagnosing and restoring any RAN issues in an automated fashion. To achieve autonomy for its full life cycle management, at least the following novel networking technologies need to be considered: 1) efficient and intelligent network telemetry technologies that leverage AI to apply management operations based on a collection of historical and live network data, 2) automated network management and orchestration technologies that continuously seek the optimal state of the RAN and enforce management operations accordingly, 3) automatically perform life cycle management operations, adjust configurations on radio network elements, and optimize new services and features during and after deployment, and 4) provide AI based assistance, in particular for aspects such as forecasting, root cause analysis, anomaly detection and intent translation.

More specifically, large quantity of data transportation will bring burdens to each network interface. Besides, data sensed from the radio environment sometimes don’t have the corresponding labels. Intelligent data perception, e.g., utilizing GAN to generate the required data so as to simulate real data, will avoid transferring large amount of data over interfaces, and protect the data privacy to a certain degree. To further this vision of zero-touch network management, an open network data set and open eco-system need to be established.

It is also possible that user feedback is introduced into the decision-making process of the network to improve the decision-making of AI algorithms and help the machine better understand user preferences and make more user-preferred decisions.

In future IMT-systems, more computation nodes will be required to support highly computation-intensive services. Thus, computation nodes will be pervasive from core to edge and from network to device. To cope with this trend, the control and user planes of the network for future IMT-systems need to be redesigned, and emerging technologies such as programmable switches and distributed/federated learning need to be aggressively adopted.

To support services in multiple application scenarios, an intelligent network is needed. In the AI-Native Radio Network, AI is no longer just optimizing the wireless resources of the wireless network, but an intelligent system integrating with radio network, which can realize the supply of on-demand capability.

In order to realize the intelligence of Radio Network, the new functions of Sensing and AI need to be supported. Through the data sensing function, we can realize the end-to-end collection, processing and storage of network data. While the AI function can call and subscribe to these data on demand, and provide capability support according to different application scenarios. In this way, the utilization and support of AI capabilities can be realized more efficiently and globally.

AI system in AI-Native Radio Network is distributed on different network functions. AI algorithms running on different functions or AI models trained on different functions are all components of this distributed AI system, and all components are organic unity. Under the control or coordination of the unified AI control center, each component of the distributed AI system independently completes the assigned tasks, interacts with other components, and reports measurements to the control center. Distributed AI system should be end-to-end solution.

Edge AI is to be considered one of the key enablers for future IMT-systems, especially for sensing-communication-computing-control. On the other hand, a distributed deep learning architecture is to be considered for realizing URLLC in future IMT-systems. Thus, its RAN can be flexibly and adaptively optimized with the aid of AI to guarantee QoS and leading to the topics of interest: 1) adaptive RAN slicing architecture and the corresponding distributed intelligence architecture, 2) knowledge-assisted learning architecture and methods, and 3) fast training/federated learning methods.

In addition, Self-Synthesising Networks automate the actual design process, or large parts thereof. Whilst the actual invention of engineering principles may still be done by human researchers or in combination with AI, the system design, prototyping and standards development are now largely executed by machines. Given that the two phases of systems design and standardisation take years, it is hoped that the introduction of self-synthesising networking principles will accelerate feature development in telecoms by 5-8 years.

Radio network for AI:

The radio network will be migrated from over the top towards the AI era. Wireless networks should consider the AI applications and paradigms that require exchange of large amounts of data, machine learning models, and inference data exchange between different entities in the networks. We must find long-term platform technologies to better support AI service, which will greatly impact the design of future radio network, i.e. radio network for AI, The distributed and collaborative machine learning is required to fully leverage the computing/communication load and the efficiency and furthermore to comply with the local governance of data requirement and data privacy. Therefore, the data-split and model‑split approaches will be the major focuses for future research. The impacts of this on the future network design are threefold:

– Shift from downlink-centric radio to uplink-centric radio: Unlike existing downlink-centric radio which usually supports heavier traffic and better QoS for downlinks, AI requires more frequent model and data exchanges between a base station and the different users it serves. The uplinks should be reconsidered in network design to attain a balanced, efficient and robust distributed machine learning.

– Shift from the core network to the deep edge: The locality of data and the computing/communication needed for deep machine learning bring big challenges to the end-to-end delay. To mitigate it, new network as well as the corresponding protocols should be redesigned. One of such research directions is to place the major learning processes and threads close to the edge and thus forms a deep edge which can greatly mitigate the system delay.

– Shift from cloudification to machine learning: Due to the distributive nature of data and computing power, the communication and computing procedures of a machine learning algorithm often take place across the whole network from the cloud to the edge and the devices. Therefore, traditional cloudification should also be reconsidered to be application-centric, i.e., to meet the specific needs of the more general distributed machine learning applications with proper deployment of computing and communication resources.

In addition, Future data-intensive, real-time applications require distributed ML/AI solutions deployed on the edge-cloud continuum, shortly known as EdgeAI or Edge Intelligence. These solutions support augmenting human-decision processes, developing autonomous systems from small devices to complete factories, and optimising the network performance and marshalling the billions of IoT devices expected to be interacting in the 2030s. Distributed ML/AI has become an inseparable part of wireless networks and increasing volumes of heterogeneous streaming data will require more advanced computing paradigms. Since heterogeneous IoT devices are not as reliable as high-performance, centralised servers, distributed and self-organising schemes are mandatory to provide strong robustness in device and link failures. The current open questions in fulfilling the requirements of the true Edge Intelligence include data and resource distribution, distributed and online model training, and inference on those models across multiple heterogeneous devices, locations, and domains of varying context-awareness. The future network architecture is expected to provide native support for radio-based sensing and, through versatile connectivity, accommodate ultra-dense sensor and actuator networks, enabling hyper-local and real-time sensing, communication, and interaction the intelligent edge-cloud continuum.

Explainable AI for RAN:

Automation principles were introduced into the telecommunications architecture as early as in 2008. Despite a swath of algorithmic ML/AI/SON frameworks available, uptake was not as widespread as expected. An important reason for this was that –whilst the developed automation frameworks outperformed any other operational approach– it exhibited occasional and unexplainable outages which operators could not accept. Since the proposal of the concept of wireless AI, there has been a widespread concern on how to harmonize the relationship between existing communication mechanism and the so-called “black-box” AI (machine learning, or even deep learning) models. It has been highly encouraged that existing expert wireless knowledge should be fused in the design of AI models to improve their performance and interpretability, for example, AI based MIMO channel estimation achieving the significant performance gain.

In the context of telecoms, explainable AI (XAI) enables the creation of Trusted Networks which are trusted both by consumers and operators. Individual building blocks in the network are still embodied through machine learning (eg regression) or deep learning (e.g., CNNs, RNNs or GANs), but the overall interaction between these automated components is supervised through XAI. It is typically enabled through a fairly deterministic but “human-influenceable” decision tree which trades the levels of trust with performance through planning optimization approaches. Given the high-level of automation at the radio interface, RAN, Core and Transport networks, XAI will play an instrumental role in 5G and 6G to ensure an end-to-end trusted operation of the networks.

Furthermore, it should be pointed out that the solutions for integrating existing communication mechanism and AI models should go beyond simple “one plus one” splices, for example, AI-based channel state information (CSI) feedback improving the CSI reconstruction accuracy. It could be anticipated that the exploration of expert knowledge will be one of the determinant factors in wireless AI model designs. Even more, we can envision that the ultimate goal of wireless AI will be to develop a kind of models specifically designed based on the distinguishing characteristics of data from wireless networks, just like those models in computer vision and natural language processing.

Technologies for integrated sensing and communication:

Wireless sensing including object detection, ranging, positioning, tracking, as well as imaging, etc, has long been a separated technology developed in parallel with the mobile communication systems. Positioning is the only sensing service that mobile communication systems up to IMT-2020 could offer. Departing from the traditional approach of designing wireless networks solely for communication purposes, IMT for 2030 and beyond will consider an integrated sensing and communication (ISAC) system from its outset. In the future communication system, enabled by the potential use of very high frequency bands (e.g. from mmWave, THz, up to visible light), wider bandwidth, denser deployment of large antenna arrays, reconfigurable intelligent surface(RIS), artificial intelligence(AI) and collaboration between communication nodes/devices, sensing will become a new function integrated with the communication system to enable new services and solutions with higher degree of accuracy in aspects such as ranging, doppler, and angular estimation, as well as positioning.

In the ISAC system, sensing and communication function will mutually benefit within the integrated system. On one hand, the communications system can assist sensing service. It can explore the radio wave transmission, reflection, and scattering to sense and better understand the physical world, also known as “Network as a sensor”. On the other hand, sensing results can be used to assist communication in access or management such as more accurate beamforming, better interference management, faster beam failure recovery, and less overhead to track the channel state information, improving quality-of-service and efficiency of the communication system. This is known as “sensing assisted communication”. Moreover, as a foundational feature for 6G, sensing can be seen as a “new channel” linking the physical world to the digital world. Real-time sensing combined with AI technologies is thus essential to realize the concept of digital twin.

In general, the interaction level between communication and sensing systems can be classified as (a) co-existence, where sensing and communication operate on physically separated hardware, use the same or different spectrum resources and do not share any information, treating each other as interference,(b) cooperation, where the two systems operate on physically separated hardware While information can be shared to each other(e.g. prior knowledge of sensing/communication could be shared to reduce inter-system interference or in some case enhance the other system), and (c) integrated design, where the two systems are designed to behave as a single system with information sharing and joint design in spectrum usage, hardware, wireless resource management, air interface, and signal transmission and processing, etc . The focus of ISAC in future IMT is on (c).

In the integrated design, the technology development of the ISAC can be divided into different stages which can range from loosely coupled to fully integrated. As a starting point, communication and sensing system share the resources such as spectrum, hardware. Communication and sensing can be implemented as one system serving two traffic forms simultaneously. The key research issues in this stage could be efficient scheduling and coordination algorithms between sensing and communication modules to minimize the interference to each other. As a step further, communication and sensing will work together to improve the performance for one single system. The integration of signal processing, such as the time, frequency and spatial domain processing techniques can be jointly designed to serve both sensing and communication. Potential directions in this stage would be air interface design based on joint waveform, unified beamforming scheme, etc., which is essential to improve the efficiency of the ISAC system. Towards the mature stage of the ISAC, communications and sensing will be completely coordinated and collaborated in all possible dimensions including spectrum, hardware, signalling, protocol, networking, etc., achieving mutual promotion and benefits. Further combined with technologies such as AI, network cooperation and multi-nodes cooperative sensing, the ISAC system will have benefits in enhanced mutual performance, overall cost, size and power consumption of the whole system.