Month: October 2015

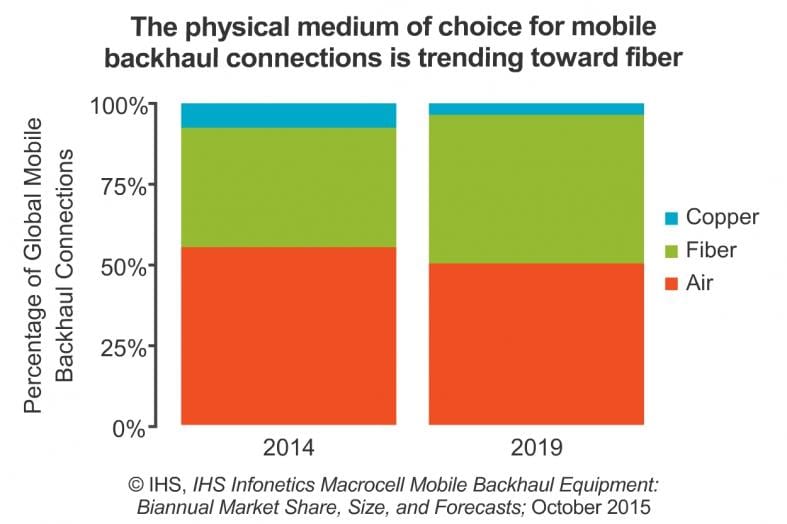

IHS-Infonetics Report: Microwave Radio still dominates Mobile Backhaul but Fiber Increasing

The recently released IHS Infonetics Macrocell Mobile Backhaul Equipment report tracks equipment used to transport mobile traffic. In the report, IHS Technology forecasts a cumulative $45 billion to be spent on macrocell mobile backhaul equipment worldwide over the 5 years from 2015 to 2019.

MOBILE BACKHAUL MARKET HIGHLIGHTS:

· Worldwide macrocell mobile backhaul equipment revenue declined slightly (-0.6 percent) in 2014 from 2013, to $8.5 billion

· Demand remains solid from LTE deployment, 3G network expansion and backhaul capacity enhancement, but increasing pressure on equipment pricing is inhibiting revenue growth

· IP/Ethernet clearly remains the driver of the mobile backhaul equipment market, required to do the heavy lifting for ever-growing mobile bandwidth usage

· Microwave radio was the largest spending category in 2014, at 47 percent of global mobile backhaul gear revenue, though this segment is projected to decline as more fiber and wireline Ethernet come into play

· Toward 2019, 5G backhaul demand starts to drive the market, pushing the microwave segment back to modest year-over-year revenue growth

Analyst Quote:

“While the market has experienced something of a plateau of late as many operators are approaching late-phase LTE deployment having already upgraded their backhaul, renewed growth is definitely on the horizon,” said Richard Webb, research director for mobile backhaul and small cells at IHS. “Developing countries later to the LTE party, such as India, will drive steady growth over the next few years, which will gain extra momentum from early 5G adopters.”

MOBILE BACKHAUL REPORT SYNOPSIS:

The biannual IHS Infonetics Macrocell Mobile Backhaul Equipment report provides worldwide and regional market share, market size, forecasts through 2019, analysis and trends for macrocell mobile backhaul equipment, connections and installed cell sites by technology. Companies tracked: Accedian, Actelis, Adtran, Adva, Alcatel-Lucent, Aviat Networks, Canoga Perkins, Ceragon, Ciena, Cisco, DragonWave, E-band, Ericsson, FibroLan, Huawei, Intracom, Ipitek, Juniper, MRV, NEC, Overture, RAD, SIAE, Telco Systems, Tellabs, ZTE, others. To purchase research, please visit www.infonetics.com/contact.asp.

WEBINAR: SDN AND NFV FOR SMALL CELLS AND BACKHAUL:

Join analyst Richard Webb Oct. 29 at 11:00 AM ET for Leveraging SDN and NFV for Small Cells and Backhaul, an event examining the challenges and opportunities for combining SDN and NFV in the backhaul network. Register here.

RELATED RESEARCH:

- NEC and Alcatel-Lucent Claim Lead in IHS Microwave Equipment Scorecard

- Plateau for Microwave Equipment Market until 5G Gets Underway in 2017

- Operators Forging Ahead with SDN in Macrocell Backhaul Networks

- Mobile Backhaul Market Plateau Will Be Short Lived, IHS Says

- Mobile Operators Turning to Ethernet Microwave for Voice and Data Backhaul

Verizon Petitions FCC to provide Wi-Fi calling with TTY waiver

Verizon is taking steps to enable Wi-Fi voice on its wireless network. The carrier has submitted a petition to the FCC requesting that the regulatory body grant it a waiver identical to the one it gave to AT&T earlier this month for WiFi calling without TTY service.

Enabling Wi-Fi voice calling is problematic for the FCC, because the underlying technology doesn’t reliably support TTY (teletypewriter), a decades-old service used by the hearing impaired. AT&T complained to the FCC last month that competitors T-Mobile and Sprint merely disregarded the rules around TTY support when they launched Wi-Fi calling.

Verizon plans to research and deploy RTT (real-time text) technology, a successor to TTY. However, the company maintains that it’s not ready to roll out the technology across its network just yet. It hopes to do so during the period that its requesting the waiver for—through 2017, or the same length of a waiver that AT&T was granted.

“Verizon plans to meet the same conditions enumerated in the AT&T Waiver Order. Specifically, Verizon agrees to inform its customers through multiple channels that TTY is not supported on these services for calls to 911 and inform customers of alternative means to reach 911 services. Verizon will also inform the Commission and customers of its progress toward the deployment of RTT as described in the AT&T Waiver Order. And Verizon is seeking a waiver for the same duration as that granted to AT&T,” according to Verizon’s petition.

“Because Verizon is seeking a waiver identical to the waiver granted to AT&T and committing to the same conditions that were fully considered by the Commission on a well-developed record, there is no need for the Commission to seek additional public comment here and the Commission should promptly grant this petition.”

If Verizon can get its TTY waiver, then it will be able to support “true” Wi-Fi calling on both iOS and Android devices which would both be able to make calls over Wi-Fi through their native dialers rather than a separate mobile app.

References:

http://www.theverge.com/2015/10/25/9611746/verizon-wi-fi-calling-feature-seeks-fcc-approval

http://www.pcmag.com/article2/0,2817,2493836,00.asp

http://appleinsider.com/articles/15/10/06/att-granted-fcc-waiver-to-activate-wi-fi-calling-amid-tiff-with-t-mobile-sprint

http://apps.fcc.gov/ecfs/document/view?id=60001330537

http://transition.fcc.gov/Daily_Releases/Daily_Business/2015/db1006/DA-15-1141A1.pdf

FCC takes steps to facilitate mobile broadband & nex gen wireless technologies above 24 GHZ

The FCC has issued a Notice of Proposed Rulemaking (NPRM) that proposes new rules for wireless broadband operating in frequencies about 24 GHz. The NPRM proposes to create new flexible use service rules in the 28 GHz, 37 GHz, 39 GHz, and 64-71 GHz bands. It proposes to make these bands available using a variety of authorization schemes, including traditional wide area licensing, unlicensed, and a shared approach that provides access for both local area and wide area networks.

These proposed rules are an opportunity to move forward on creating a regulatory environment in which these emerging next-generation mobile technologies – such as so-called 5G mobile service – can potentially take hold and deliver benefits to consumers, businesses, and the U.S. economy.

“Building off of years of successful spectrum policy, this NPRM proposes to create new flexible use service rules in the 28 GHz, 37 GHz, 39 GHz, and 64-71 GHz bands. The NPRM proposes to make these bands available using a variety of authorization schemes, including traditional wide area licensing, unlicensed, and a shared approach that provides access for both local area and wide area networks.

In addition, the NPRM provides a path for a variety of platforms and uses, including satellite uses, to coexist and expand through market-based mechanisms,” the FCC wrote in a press release.

http://transition.fcc.gov/Daily_Releases/Daily_Business/2015/db1022/DOC-335993A1.pdf

CTIA vice president of Regulatory Affairs Scott Bergmann called the NPRM an “important step” towards clearing additional spectrum. He wrote in a statement:

“Today’s action also reminds us that the diversity of 5G applications will require a broad range of spectrum types, including low and medium band spectrum, below 3 GHz and between 3 – 6 GHz, as well as streamlined infrastructure siting and more backhaul. The move to bring to market high band spectrum in bands above 24 GHz offers the potential for increased capacity and speeds, lower lag time and high density connections to unleash the Internet of Things. We look forward to working with the Commission to address a flexible framework for service in these bands that encourages continued investment and innovation to deliver the next waves of connected wireless applications.“

Diminishing Outlook for a DISH Spectrum Deal As Small Cell Deployments Gain Momentum, by David Dixon, FBR

Attribution: This blog post was written by David Dixon of FBR and edited by Alan J Weissberger

Executive Summary:

Competition is dampening returns, but VZ’s strategy is on track. Though behind on IoT, densification is helping to address 75% YOY data traffic growth; usage per customer should help augment revenue growth. Chicago and New York should benefit from the launch of unlicensed LTE in 2016 at relatively low cost, with AWS 3 spectrum utilized in 2017/2018. While DISH spectrum leasing provides a free option, VZ is also well positioned to leverage more low-cost capacity spectrum via 150 MHz of 3.5 MHz spectrum (70 MHz of priority access + 80 MHz of unlicensed spectrum).

The industry has rallied around the 3.5 GHz spectrum to build an effective ecosystem that should allow the spectrum to be put into use quickly. This, combined with refarming opportunities in the 850 MHz and 1.9,Ghz bands, has VZ well positioned on the spectrum front. We still think a DISH spectrum acquisition is unlikely, but a leasing agreement could be a useful Plan B, should VZ’s small cell strategy run into speed bumps.

Key Points:

■ 3Q15 earnings recap. Consolidated revenue of $33.2B (+5.0% YOY) was ahead of consensus’ $33.0B but below our $33.5B estimate, driven by a 5.4% YOY increase in wireless revenue, partially offset by a 2.3% YOY decline in wireline revenue. Consolidated EBITDA of $11.5B were below our Street-comparable estimate of $11.8B. Retail postpaid net adds were 1,289,000, with churn of 0.93% and a retail prepaid net loss of 80,000. The 3Q15 adjusted EPS of $1.04, after a $0.05 non-cash pension re-measurement adjustment, compared to our Street-comparable estimate of $1.02.

■ Divestitures and accounting changes drive lower EPS growth in 2016. Specifically: (1) Converting from a subsidized to installment wireless phone model increased earnings in 2015, as 100% of the equipment sale was recorded as revenue. However, 30% of the base is now not on subsidized pricing (expected to increase to 50% in 2016), normalizing the earnings impact); (2) divested Frontier properties are classified as discontinued operations, driving a $0.13–$0.14 EPS lift from discontinued depreciation expense; (3) a loss of higher-margin properties with stranded centralized costs, with some of the cost savings realized after the labor agreement; (4) losses for start-up businesses.

■ Estimate changes; lower price target. We lower our FY15 and FY16 estimates to account for divestitures, accounting impacts, and lower phone sales volume in 4Q (anniversary of iPhone 6 launch in 4Q14). FY15 revenue/EBITDA/ EPS estimates decline to $131.1B/$46.2B/$3.95, from $131.8B/$46.5B/$3.96; FY16 revenue/EBITDA/EPS estimates decline to $133.0B/$47.2B/$4.03, from $137.1B/$48.4B/$4.12.

Our Thoughts – Time Frames for Impact:

1. Aside from being well positioned on spectrum for the macro network, how what is the small cell opportunity as an alternative to more macro network spectrum going forward?

A change in the industry network engineering business model is underway toward using small cells on dedicated spectrum to manage more of the heavy lifting associated with data congestion. Verizon demonstrated this shift during the AWS3 auction: It modeled a lower-cost small cell network for Chicago and New York. We expect CEO Lowell McAdam to manage this shift from the top down to mitigate execution risk due to cultural resistance from legacy outdoor RF design engineers, whose roles are at risk as the macro network is de-emphasized.

Enablers include the advent of LTE, increased spectrum supply across multiple spectrum bands including LTE licensed, unlicensed (500 MHz of 5 GHz spectrum) and shared frequencies (150 MHz of 3.5 GHz spectrum), amid a fundamental FCC spectrum policy shift from exclusive spectrum rights to usage-based spectrum rights, which should dramatically increase LTE spectrum utilization (similarly to WIFI).

Previously, outdoor small cells co-channeled with the macro network proved challenging: While they can carry substantial load, they also destroy equivalent capacity on the macro network due to mis-coordination and interference, so the macro network carries less traffic but still looks fully loaded. AT&T discovered this in its St. Louis trials that, in part, steered it toward buying $20 billion of AWS3 spectrum.

However, the industry trend is toward LTE underlay networks, where small cells are put into other shared or unlicensed spectrum with supervision from and/or carrier aggregation with the macro network. It still requires good coordination across all cells for this to work; while Verizon initial proposals for 5 GHz are downlink only, we think uplink will also be used longer term because uplink needs more spectrum resources for a given throughput; we see higher uplink usage trends in the Asian enterprise segment and from Internet of Things (security cameras).

Time frame:12 to 18 Months

2. Does Verizon have sufficient spectrum depth to drive revenue growth longer term? Or does it need to aggressively acquire spectrum in future spectrum auctions or in the secondary market (DISH)?

The short answer is yes. Verizon carries 80% of data traffic on 40% of its spectrum portfolio; its combined nationwide CDMA and LTE spectrum depth is 115 MHz, ranging from 88 MHz (Denver) to 127 MHz (NYC). We expect AWS3 capacity spectrum to be deployed in 2017/18. Investors may not be crediting Verizon with potential to source more LTE spectrum from refarming of CDMA to LTE (22 MHz to 25 MHz) used today for CDMA data (22 MHz to 25 MHz).

Critically, network performance data show Verizon network close to the required performance threshold for a VoLTE-only service, suggesting there is additional refarming potential for the 850 MHz band (25 MHz) used today for CDMA voice and text. This band is likely to be transitioned in 5 MHz x 5 MHz LTE slivers to run parallel with the expected linear (voluntary) ramp, versus exponential (forced) ramp in VoLTE service.

More low-band spectrum is key for the surging IoT and M2M segments, which are proving to be more thirsty than “bursty.”

Time frame: 2 Years+

Millward Brown global survey: On line (OTT) video just as popular as conventional TV

This is a follow on to the recent post noting opposition to the FCC reclassifying linear OTT suppliers as pay tv providers.

A Millward Brown global survey of 13,500 multiscreen viewers concludes that the lure of online video extends to adults of all ages. The survey polled people who own a TV and either a smartphone or tablet—in 42 countries on what they think about video advertising. People are spending as much time watching online video as they spend watching TV, The survey also found an average online viewing time of 204 minutes a day for people ages 16 to 45, split evenly between TV and online.

Forty-nine percent of people liked mobile-app videos that reward people with virtual incentives like points for playing games, and 31 percent of consumers responded favorably to skippable mobile preroll ads. Only 14 percent of people said that they liked mobile pop-ups, the ads that take over a screen, and 15 percent tolerated nonskippable video ads.

http://www.adweek.com/news/technology/young-or-old-everyone-seems-online-video-much-tv-now-167541

Lot of new OTT players, competing with Netflix.

Source: “Premium Prospects for OTT in the USA” study from MTM, Ooyala and Vindicia

Opposition Mounts: Should FCC regulate linear OTT service providers as pay TV operators (MVPDs)?

Introduction:

FCC chairman Tom Wheeler has said there’ll be a final vote this fall on his proposal to define real time (AKA date/time or “linear”) over-the-top video services as pay TV services that are delivered by multichannel video programming distributors (MVPDs).

Regulation of MVPDs stems from the 1992 Cable Act (approved despite veto of President Bush Sr). The act was created in order to amend the Communications Act of 1934 to provide increased consumer protection and to promote increased competition in the cable television and related markets, and for other purposes.

Currently, the MVPDs include cable, satellite, and telecom companies that offer pay TV service. However, real time (date and time or linear) Internet based video services like Dish Networks Sling TV, HBO Go, ESPN3, etc aren’t considered to be MVPDs under the current law. The FCC has proposed changing that law for linear OTT, but not for Video On Demand (VoD) providers.

Wheeler’s stated goal is to insure non-discriminatory access to programming for both cable and broadcast. To do that he is seeking to read out the “facilities-based” requirement in the definition of MVPD. Cable operators and over-the-top services alike have registered reservations about that move (see For and Against below).

Backgrounder:

U.S. law requires that pay TV distributors (like Comcast, Time Warner Cable, and DirecTV) and programmers (like NBC, ESPN, and CNN) negotiate “in good faith” over the rights to broadcast content to customers. The distributors have to pay for the content, and the programmers aren’t allowed to indiscriminately withhold those rights.The law established a cumbersome term for pay TV service providers (MVPDs).

The Federal Communications Commission released a Notice of Proposed Rulemaking (NPRM) proposing to classify over-the-top (OTT) video programming providers as MVPDs if they delver “linear” programming. The FCC proposes that it will facilitate the availability of cable and broadcast television programming to OTT providers and enhance consumer choice and competition in the video market.

The reclassification would require OTT providers to carry certain programming and to comply with other regulations currently imposed on MVPDs like cable providers. The proposal would also give OTT video providers certain legacy negotiating and carriage rights with respect to both cable and broadcast programming.

The most important implication of that rule change is that programmers would then be forced to negotiate with Internet TV services just as they have to negotiate with cable companies.Services like Dish’s Sling TV and Sony’s PlayStation Vue currently offer small bundles of channels from companies with which they have been able to strike deals. The same is expected of Apple’s widely expected (but unannounced) Internet TV service. However, if the definition of MVPD is changed to include these new services, they could have access to many more channels, and thus offer a more diverse programming line-up.

The exact implications of reclassification aren’t yet clear, since these Internet-only services are intentionally offering fewer channels than traditional pay TV packages. It’s also worth noting that the rule change wouldn’t affect Netflix and other subscription services that only offer on-demand video; it only applies to live television services. Still, the prospect of a rule change clearly has many companies nervous.

For and Against:

1. The TV network affiliates of ABC, CBS, Fox, and NBC, which aren’t owned by the larger companies of the same name, filed their own comment in favor of the rule change. They’re excited because it would require that internet TV services gain their consent for retransmitting their broadcasts, just like cable companies have to under the 1992 Cable Act.

2. Disney, Fox, and CBS filed a joint comment to the FCC explaining that they were firmly against changing the definition of MVPD to include internet TV. “The proposal to expand the definition of MVPD raises significant and complex questions that could jeopardize the nascent state of the over-the-top market,” the companies said.Essentially, they argue that market forces have created a healthy environment for internet video to thrive, and that more government regulation is not only unnecessary, but could, as they put it, “limit the opportunity for consumers to obtain their desired video programming in a variety of new manners.” Other programmers, like AMC, and many cable companies, like Cablevision, are against the rule change for similar reasons.

Opinions:

1. Rep. Frank Pallone (D-N.J.), in his first media policy speech as ranking member of the House Energy & Commerce Committee, recently advised the FCC to “hit the pause button on regulating streaming video…In the case of defining online video providers as cable companies, I do not think we can say yes,” he said. Pallone added: “Some have urged the FCC to help prop up some video business models through additional regulation. The companies that first asked for help claimed that new entrants must be defined as cable companies if they are to get access to content. They were essentially worried that they could not compete with traditional cable companies without importing cable regulations to the online world.But consumer demand since then has driven the market to create new business models and new ways to distribute programming.”

2. Ajit Pai was one of two FCC commissioners to state his reservations about the proposed rule change after it was announced by Wheeler. Speaking at a Churchill Club breakfast on Friday July 17th, he made his position to the rule change official: “This morning I’d like to make it clear I strongly oppose this proposal.” Pai went on to lay out the reasoning behind his decision. He said it was important to perpetuate an environment where: “21st century entrepreneurial spirit isn’t saddled with 20th century rules and regulations.”

Mr. Pai claims the benefits provided to OTT video providers covered by the rule change are illusory. He said that even with the rule change, OTT providers would not fit the definition of a pay TVprovider being used by the patent office. So, it is likely the online companies would still not be able to benefit from the statutory license which allows MVPDs to carry local TV channels. However, hewarned that this would create a burden on OTT providers, because if a local programmer wanted carriage on their service the OTT provider would be required to negotiate with them. Further, Pai saidonline providers might end up facing other MVPD regulations on pricing, ad volume, employment practices, and even on the wiring inside a customer’s home; though it is unclear what these MVPD regulations mean in the OTT world.

3. Assistant Attorney General Bill Baer remarks on October 9, 2015 Keynote Address at the Future of Video Competition and Regulation Conference Hosted by Duke Law School:

“With respect to video programming, the streaming option is transformative. Programmers now have the Internet as an alternative to distribution over traditional broadcast, satellite and cable networks. Over the top programming via broadband Internet connections increasingly competes with what consumers used to access solely from their cable or satellite provider.

In 2009, there were two scripted original series delivered exclusively through online services – by 2014, there were 27. This new distribution option also lowers barriers to entry for non-traditional content, like YouTube and e-sports, and allows established programmers to deliver more tailored services. Networks can offer content a la carte, like CBS All Access and HBO Now/Go, or expand programming through services like ESPN3.

The FCC also took smart and measured action to protect competition with its recent Open Internet Order. That Order set out some simple, bright-line rules: broadband providers may not block access to lawful content; they may not throttle lawful content; and they may not take money to favor some lawful content over others. The Order, which the Justice Department is proud to help defend in court, effectuates the public policy Congress mandated in 1996 by ensuring that cable companies or other broadband providers don’t disadvantage competitors offering consumers video services via their broadband connections. This helps protect consumer choices and ensures that incumbents that sell both video and broadband internet do not use their control over broadband to suppress competition in video.

Sometimes the concern with undue restrictions on competition stems from incumbents seeking laws and regulations that would impede opportunities for rivals to challenge their control over the pipeline. We see that debate playing out in efforts by some internet service providers to seek state laws precluding local communities from encouraging alternatives to local broadband monopolies. The FCC, through its Municipal Broadband Order, targets those obstacles in order to allow municipalities to expand broadband availability. This helps bring greater competition to exactly the part of the industry that needs it the most.

The future of video competition should be left for the market to decide. Our role as antitrust enforcers and competition advocates is not to pick winners or losers. Our job is to make sure that existing bottlenecks are eliminated, that mergers don’t create new ones, and that our enforcement and policy efforts let competition thrive and innovation continue for consumers’ benefit.”

What’s Your Take?

Readers are invited to weigh in with their opinions via the comment box below this article. Alternatively, you can email the author at: [email protected]

Comment from Ken Pyle of Viodi View:

Excellent summary. This has been a long time coming. This 2008 obscenity ruling foreshadowed the long reach of the FCC into the Internet using video as its Trojan Horse. http://viodi.com/2008/06/24/fcc/

References:

https://apps.fcc.gov/edocs_public/attachmatch/FCC-14-210A1.pdf

http://www.broadcastingcable.com/news/washington/pallone-fcc-dont-redefine-otts-cable-ops/144861

http://www.justice.gov/opa/speech/assistant-attorney-general-bill-baer-delivers-keynote-address-future-video-competition

http://qz.com/375566/the-really-important-policy-affecting-the-future-of-tv-that-no-one-is-talking-about/

http://www.nscreenmedia.com/fcc-commissioner-says-no-to-ott-mvpd-regulation-change/

https://apps.fcc.gov/edocs_public/attachmatch/DOC-334437A1.pdf

http://www.broadcastingcable.com/news/washington/fccs-wheeler-ott-report-and-order-fall/142159

https://en.wikipedia.org/wiki/Cable_Television_Consumer_Protection_and_Competition_Act_of_1992