Month: June 2022

Proximus to extend fiber coverage to 95% of Belgian premises

Belgian network operator Proximus is teaming up with private equity partners in a bid to deliver gigabit fiber service to 95% of the country. The telco is planning to reach a final joint venture (JV) agreement with I4B by the end of 2022.

The company this week inked a memorandum of understanding (MOU) with I4B – The Belgian Infrastructure Fund – whose founding investors are the Federal Holding and Investment Company (SFPI-FPIM), AG Insurance and Synatom, will act as an anchor investor to the project. I4B’s mission is to finance the development of infrastructure with a positive impact on Belgium’s economic development, while taking into account societal and environmental requirements.

One of the joint ventures will focus on rollouts in the French-speaking Wallonia region of the country while the other will zero in on Dutch-speaking Flanders. Proximus will serve as a minority shareholder for each JV and the anchor tenant on the networks built in each region.

Proximus and I4B plan to spend around €4 billion (approximately $4.2 billion) between the two JVs. Petra De Sutter, Belgium’s deputy prime minister, said in a statement the partnership between Proximus and I4B will help ensure internet access in areas with “no or insufficient connectivity today.”

According to a report released by the FTTH Council Europe in May, Belgium topped the list as the fastest growing fiber market in the European Union (including the U.K.) by percentage. Its figures showed Belgium’s number of homes passed grew 109% between September 2020 and September 2021, outpacing Israel (107%) Greece (90%), Cyprus (83% and the U.K. (80%).

FFTH Council Europe forecast the number of homes passed by fiber in Belgium will skyrocket 568% by 2027 to reach a total of 3.9 million.

References:

https://www.fiercetelecom.com/telecom/proximus-inks-mou-push-fiber-17m-more-locations-belgium

https://www.proximus.com/news/2022/20220629-fiber-rollout.html

FTTH Council Europe: 197 million homes passed in 2026 in EU27+UK

PLDT to support 60 Terabit/s to US and Japan with US-Transpacific Jupiter Cable

Philippine telco PLDT will activate the US-Transpacific Jupiter cable system by July this year, and is expected to further enhance delivery of services and improve customer experience.

The addition of the Jupiter cable system to PLDT’s infrastructure greatly boosts the telco’s extensive fiber network, providing greater capacity in multiple Terabits per second to customers as well as cable diversity to ensure ability to re-route traffic in the event of undersea cable cuts.

“Investments on infrastructure like Jupiter allow PLDT to provide the vital connectivity that powers our digital economy, enabling us to help transform the country into a globally competitive and digitally-empowered nation,” PLDT and Smart FVP and Head of Enterprise Business Group Jojo G. Gendrano said.

“Specifically, this will fortify the Philippines’ position as the next strategic data center hub for global hyperscalers,” Gendrano added.

PLDT’s investment in the Jupiter cable system increases and reinforces the capacities and the resiliency of the telco leader’s existing undersea fiber links, to deliver massive amounts of data traffic going in and out of the country to the US.

Jupiter uses an “open cable model,” which allows consortium members to increase their capacities as needed by investing in technologies that boost data throughput. It terminates in Maruyama and Shima, Japan; Los Angeles (Hermosa Beach) and Pacific City, USA; and Daet, the Philippines, for a total cable length of about 14,600km. It consists of 5 fiber pairs in the main trunk connecting Maruyama and Shima, Japan and Los Angeles. The Jupiter cable system was intially designed with 400Gbps DWDM, for a total system capacity of 60Tbps, or 12Tbps per fiber pair. its main trunk has been ready for service as of May 2021.

Currently the largest among Philippine telcos, Jupiter is anticipated to increase PLDT’s international capacity of 20 Terabit/s to about 60 Terabit/s to US and Japan further establishing its lead, and ready to scale with the growing demands of digital services. These include the delivery of Cloud services, Fintech, and rich media content, which seamlessly complements PLDT’s existing fixed and mobile services.

The Jupiter Cable system is a joint project of global providers spanning 14,000 kilometers from the US to the Philippines bringing PLDT’s total number of international cabling systems to 17.

Jupiter is key to enhancing PLDT’s cable network resilience, increasing the PLDT Group’s submarine cable route diversity, and helps assure customers with sustained capacity availability in support of their growing demand for data and continuing digital transformation.

Currently, PLDT operates the country’s most extensive international submarine cable network and is set to expand further with the completion of two more major international cable systems namely Asia Direct Cable (ADC), and the APRICOT cable system set to be completed in the next two years.

References:

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

The city of Amarillo, TX has selected AT&T to install fiber-to-the-premises (FTTP) networks, covering more than 22,000 customer locations. The project will cost about $24 million (with $2 million coming from the city). The network, which will be built out over three years, still requires final approval by Amarillo and a final contract between AT&T and the city.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build-out.

[Amarillo residents and businesses also served by Altice USA’s Suddenlink Communications.]

AT&T is taking the public/private partnership route here. The telco inked a similar $39.6 million agreement (with about $10 million coming from public funds) last year with Vanderburgh County, Indiana, to build fiber to about 20,000 locations in the rural, southern tip of the state. AT&T also has a $33 million fiber project underway to connect about 20,000 locations in Oldham County, Kentucky.

As noted in an earlier IEEE Techblog post, AT&T’s FTTP buildout/upgrade plan is targeting 30 million locations by 2025. AT&T added 289,000 FTTP subs in Q1 2022, ending the period with a grand total of 6.28 million, and enough to offset a quarterly loss of 284,000 non-fiber subs (including U-verse Internet customers).

“What we’re doing here in Amarillo that’s different is that this is an urban core,” said Jeff Luong, president, broadband access and adoption initiatives for AT&T. “The city of Amarillo identified a specific area that they believe is challenging from a connectivity perspective in their urban core,” he added.

“The area that the city wanted to address is actually the city core. It’s actually an area they feel is underserved,” he said. “We are expanding access, we are providing a very affordable free solution when partnered with ACP [Affordable Connectivity Program] and then we’ll be actively engaging in adoption, digital literacy and other type of activities to ensure that people have access, they can afford it and that they understand how to use the service.”

“We’re working with the public sector to identify areas that are more challenging to build on our own from a private sector perspective and creating these type of public/private partnerships where we, AT&T, will invest our own capital. But the public sector would also contribute a share of the cost to expand fiber connectivity to these locations,” Luong said.

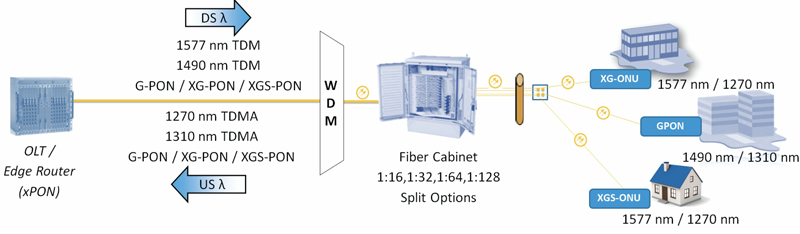

AT&T today delivers services in the area via other technologies, including legacy copper networks. The new fiber overlay, based on XGS-PON, will be capable of delivering symmetrical speeds of 5 Gbit/s, replicating a new mix of multi-gigabit services that AT&T has launched in its other FTTP markets.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build.

About AT&T in Texas:

AT&T customers and FirstNet® subscribers in Texas got a big boost in wireless connectivity and fiber access last year. In 2021, AT&T completed nearly 1,000 wireless network enhancements in Texas, including adding nearly 200 new macro sites. AT&T also made fiber available in more than 300,00 new locations in Texas in 2021. These network improvements will enhance the state’s broadband coverage and help give residents, businesses and first responders faster, more reliable service.

From 2018 to 2020, we expanded coverage and improved connectivity in more communities by investing more than $7.7 billion in our wireless and wireline networks in Texas. This investment boosts reliability, coverage, speed and overall performance for residents and their businesses.

And in Amarillo, we expanded coverage and improved connectivity by investing more than $60 million in our wireless and wireline networks from 2018-2020.

References:

https://www.att.com/local/fiber/texas/amarillo

https://about.att.com/story/2022/amarillo-broadband-access.html

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022

China Broadnet launches 5G mobile service

For the first new operator in the market in 15 years, it’s going to be all uphill. Broadnet’s fate will likely be shaped by three key factors, according to Robert Clark of Light Reading:

1. How level is the playing field?

China’s telecom industry has no body of competition law. In fact, China has no telecommunications law of any kind, despite 40 years of trying. It has an anti-monopoly law, but it has never been applied to a national state-owned corporation.

By some stroke of good fortune, China Broadnet may not face any interconnection, data sharing, number porting or other issues with the incumbent operators. If it does, it will be at the mercy of the MIIT, the NRTA’s bureaucratic arch-rival and default regulator, as well as its larger competitors.

2. Strength of Broadnet’s partnership with market leader China Mobile?

The alliance with the industry giant may give Broadnet some extra backing in dealing with China Unicom and China Telecom. But that will depend on whether China Mobile sees Broadnet as a partner whose success aids its own success, or a competitor who happens to be a customer that can be easily brushed aside.

3. Whether the new 5G competitor will drive the industry into a price war?

That wouldn’t surprise anyone who has seen Rakuten overturn the staid Japanese market in the past two years (see NTT DoCoMo making gains, anticipating pain in price war).

Celona’s 5G LAN solution for private 5G now on Google Distributed Cloud Edge

Celona, an innovator of 5G LAN solutions, today announced it has been selected by Google Cloud to accelerate the delivery of private 5G networks in the U.S. by making its 5G LAN solution available through Google Cloud’s recently announced private cellular network solutions running on Google Distributed Cloud Edge (GDC Edge) [1.].Enterprises using Google Cloud will now enjoy unprecedented agility and economies of scale by bringing new private cellular network services closer to users, data, and applications at the mobile compute edge.

Note 1. Google Distributed Cloud Edge is a fully managed product that brings Google Cloud’s infrastructure and services closer to where data is being generated and consumed. Google Distributed Cloud Edge empowers communication service providers to run 5G Core and Radio Access Network (RAN) functions at the edge.

………………………………………………………………………………………………………………………………..

Google Cloud and Celona are working together to offer turnkey enterprise private 5G networks with the ability to run network management, control, and user plane functions on Google Distributed Cloud Edge wherever it resides. The combined solution addresses distinct performance, service-level, and economic needs of key industry verticals by combining dedicated network capabilities with full edge-computing application stacks. Celona’s solution delivers a complete end-to-end 5G LAN developed for enterprise environments.

“We are excited to partner with Celona to help IT professionals improve application connectivity through private 5G,” said Tanuj Raja, Global Director, Strategic Partnerships at Google Cloud. “Deployed on Google Distributed Cloud Edge, Celona’s end-to-end private network solution enables enterprises to simplify and operate private 5G networks at scale and with the flexibility they need.”

“The combination of 5G LANs and edge compute unlocks a new generation of enterprise IT architecture capable of keeping up with the immense rate of digital transformation and automation occurring across almost every industry,” said Rajeev Shah, Celona’s co-founder and CEO. “The intrinsic agility of our edgeless enterprise architecture gives organizations tremendous flexibility and scale by bringing closer together critical network services and mobile edge compute applications.”

Celona’s Edgeless Enterprise architecture is anchored by the Celona Edge, a cloud-native 4G/5G private core network operating system that delivers an all-in-one network service overlay with advanced policy-based routing, QoS, and security segmentation functions. Celona’s unique approach supports the convergence of radio access network (RAN), application, and network service traffic, automatically shifting the delivery route of services based on performance, policy requirements, and network paths’ real-time health. It is the only private 5G solution in the industry that has been purpose-built to help organizations easily deploy, operate, and integrate 5G cellular technology with their existing infrastructure.

Since launching the first fully integrated 5G LAN platform in November 2020, Celona has seen strong demand from a range of enterprises, managed service providers, and mobile network operators looking to satisfy strategic digital business initiatives not adequately addressed today by Wi-Fi or other networking technologies. The company’s diverse customer base includes world-class organizations such as Verizon, NTT Ltd, SBA Communications, St. Luke’s Hospital System, Purdue Research Foundation, Stanislaus State University, and many other brand-named enterprises.

Celona’s 5G LAN platform is used by manufacturers, retailers, hospitals, schools, and supply-chain leaders to drive transformational results for a wide range of mission-critical use cases that require the deterministic wireless connectivity on private & interference-free cellular spectrum and fast mobility for a new generation of highly mobile devices and robotics infrastructures.

ABOUT CELONA:

Celona, the enterprise 5G company, is focused on enabling organizations of all sizes to implement the latest generation of digital automation initiatives in enterprise wireless. Taking advantage of dynamic spectrum sharing options such as CBRS in the United States, Celona’s Edgeless Enterprise architecture is designed to automate the adoption of private cellular wireless by enterprise organizations and their technology partners. For more information, please visit celona.io and follow Celona on Twitter @celonaio.

MEDIA CONTACT:

David Callisch

Celona, Inc.

[email protected]

+1 (408)504-5487

References:

https://www.celona.io/resources/celona-partners-with-google-cloud-for-5g-lans

https://www.celona.io/resources/5g-lan-provider-celona-is-named-a-cool-vendor-by-gartner

How organizations are using Google Distributed Cloud Edge with 5G LANs to streamline operations by visiting https://www.celona.io/community-stories/google-distributed-cloud-edge-and-celona-5g-lans

Clearwave Fiber to build all fiber Internet access network in Kansas

Clearwave Fiber (not to be confused with the now defunct Clearwire WiMAX network provider) will begin building a state-of-the art, all-fiber Internet access network in Lansing, KS. This latest expansion marks the company’s first network presence in Kansas and underscores its goal to bring the most advanced and fastest Internet available to more than 500,000 homes and businesses across the United States by 2027. Clearwave Fiber is scheduled to begin construction of the all fiber network in Kansas this month.

Clearwave Fiber’s Vice President of Kansas, Stormy Supiran, stressed the importance of the company’s investment to consumers and the broader local community.

“We are committed to providing underserved communities with the high-speed connectivity that is essential for families, businesses, and local economies; without these essential services, many of the communities we are targeting may struggle to survive,” said Supiran. “We are excited to extend services to Lansing, and we look forward to becoming long-term partners to the community.”

Featuring gigabit download and upload speeds, Clearwave Fiber will bring ten times more speed to consumer doorsteps at a time when fast, reliable Internet is becoming increasingly critical to modern households. “More and more, we see households where multiple bandwidth-intensive activities occur simultaneously and many consumers’ Internet connections just aren’t up to the task,” said Clearwave Fiber’s Midwest President, Byron Cantrall. “The Clearwave Fiber network solves that problem.”

In March Clearwave acquired the assets of RG Fiber, a fiber network provider near Kansas City, Kansas. This was Clearwave’s first entry into Kansas. At the time, the company said that it planned to expand RG Fiber’s network and bring more fiber services to other communities in Kansas that do not currently have access to fiber.

For many consumers, Internet touches every facet of daily life. Remote work, telehealth, and virtual learning all require robust, reliable connections. A 2021 study by Deloitte indicated that 55% of U.S. households include one or more remote workers, and 43% include at least one household member attending virtual classes.

Cable One formed the Clearwave Fiber joint venture in January. Its JV partners include a trio of private equity firms: GTCR, Stephens Capital Partners and the Pritzker Organization. At the time, Cable One said that the new entity would target deployments of fiber to residential and business customers within and adjacent to its existing markets.

For more information, visit clearwave.com/home.

Clearwave Fiber is an Internet service provider based in Savannah, GA that operates a more than 2,000 route-mile fiber network serving cities across the Midwest and Southeast regions of the United States. Delivering advanced telecommunications solutions with an emphasis on exceptional customer care and community engagement, they provide fiber to business, enterprise, and residential customers in more than 90 municipalities in Illinois and Kansas. It is a joint venture formed by operator Cable One.

References:

https://www.fiercetelecom.com/broadband/clearwave-fiber-will-expand-fiber-footprint-kansas

Ericsson focuses on private 5G in China due to national directives

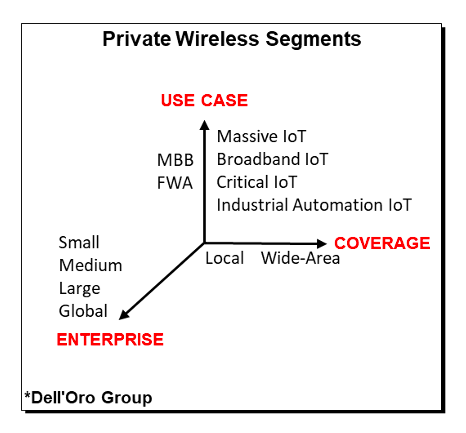

Ericsson will shift its focus towards helping Chinese businesses to build their own private 5G networks, according to an excerpt from a report by Caixin Global. The news outlet cited remarks by Fang Ying, president of Ericsson’s China operations, at a news briefing on 22 June. Fang said there are growth opportunities in the private 5G networks sector after the aggressive pace of construction in 5G infrastructure nationwide over the past three years.

Dell’Oro Group’s Stefan Pongranz explains this increased focus on private 5G in China are stimulated by several key national directives:

(1) The Made in China 2025 Initiative, which pushes for greater usage of industrial robotics and automation in 10 key strategic sectors,

(2) The Internet Plus Plan, an initiative to transform, modernize, and equip traditional industries with more advanced technologies, and

(3) Set Sail Action Plan for 5G Applications, which targets 3,000 private industrial networks and a 35% 5G penetration rate in large industrial enterprises by 2023.

Huawei, Ericsson, and Nokia are all reporting some initial success with private 5G industrial opportunities. Verizon has explored multiple solutions and found that Celona’s 5G LAN technology is easy to scale downward, could be setup in hours, and straight-forward to integrate with the existing LAN.

Perhaps more importantly, the RAN is just one piece of the private 5G puzzle. While there is limited data at this juncture to suggest that the average private RAN network as a share of total cost of ownership (TCO) will be materially different than the public RAN share (10% to 15% of total TCO), it is safe to assume that the value, the role and the importance of the RAN will differ significantly depending on the segment and the use cases.

In short, it is still early days when it comes to private 5G. But the opportunity is large and private 5G is projected to surpass $1 billion by 2025. Optimized private solutions and services will play an important role simplifying and accelerating private LTE and 5G. And if Cisco and AWS are right, it will be interesting to see how the private 5G ramp will impact the RAN vendor dynamics.

References:

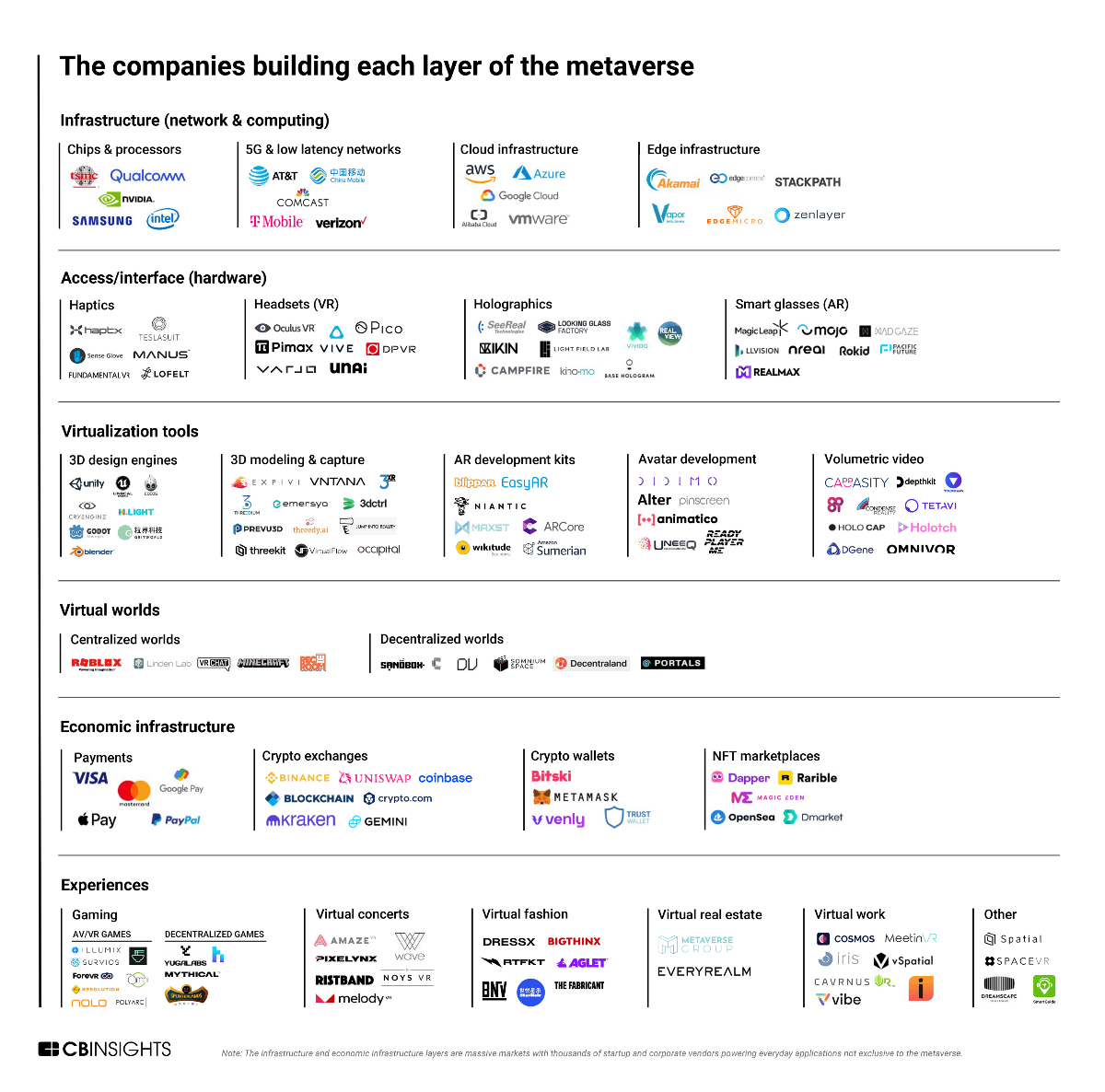

CB Insights: The Metaverse Explained & Companies Making it Happen

The metaverse could be tech’s next trillion-dollar opportunity, according to Mark Zuckerberg of Facebook/Meta Platforms. The business world is obsessed with “the metaverse”: the concept of shared worlds driven by virtual products and digital experiences that are highly immersive and interactive.

We already have virtual worlds featuring live concerts and online games where players spend hundreds of hours — but metaverse enthusiasts see a future where entire societies thrive in an online realm inhabited by avatars of real people.

While the space is still in early days, the longer-term implications may not be trivial. Some users — especially younger ones — may eventually earn, spend, and invest most of their money in digital worlds. The metaverse could represent a $1T market by the end of the decade, according to CB Insights’ Industry Analyst Consensus.

The metaverse is a vision, not a specific technology. For enterprises, this ambiguity can make it challenging to figure out how to tap into the emerging trends the metaverse represents. Below are the companies making it a reality:

The metaverse requires compute and processing infrastructure that can support both big data flows and low latency. Tech emerging within categories such as chips & processors, 5G, cloud infrastructure, and edge infrastructure, will prove vital to creating a seamless, lag-free experience in the metaverse.

Chips & processors: Advancements in this space will support the intense computing and processing requirements of metaverse applications.

New metaverse-focused hardware — e.g., virtual reality (VR) headsets and augmented reality (AR) glasses — is being designed to support intense workloads related to high-fidelity graphics and artificial intelligence (AI) on smaller, lightweight devices. Qualcomm chips stand out in this arena — the tech giant claims its Snapdragon chips have been used in over 50 AR/VR devices, including popular VR headsets like Meta’s Oculus and HTC Vive. Qualcomm also recently announced the launch of its $100M Snapdragon Metaverse Fund, which will invest in the extended reality (XR) space.

Additionally, Intel claims that the metaverse will necessitate a 1000x increase in computational efficiency, including advancements in 5G and hybrid edge-cloud infrastructures. That said, new chips will also be required to power these critical low latency computing networks. In February 2022, the semiconductor company released details on new chips that will support high-power data centers and 5G networks.

5G & low latency networks: 5G wireless tech will power high-resolution metaverse applications — such as immersive worlds or gaming — by supporting reliable, flexible, and low latency networks for connected devices.

As of 2022, each of the leading telecom companies in the US offers a 5G network. Some are experimenting with 5G in gaming and AR/VR. For example, in April 2021, Verizon partnered with VR startup Dreamscape Immersive to build immersive learning and training applications on Verizon’s 5G network. Three months later, AT&T partnered with Meta’s Reality Labs to show how 5G could be utilized to generate more seamless augmented reality experiences.

Cloud infrastructure: Cloud infrastructure will enable metaverse companies, especially those hosting virtual worlds and experiences, to store and parse through the vast amounts of data they generate.

In 2018, Epic Games‘ Fortnite generated 5 petabytes of data per month (that’s equivalent to 2.5T pages of standard text). In order to store and make sense of this data, Fortnite runs almost entirely on Amazon Web Services (AWS), where it uses cloud computing to aggregate and analyze information from its otherwise unwieldy data stream.

Advancements in this space will also help people access the metaverse on devices that lack sufficient processing power for applications like high-res graphics and AI — cloud computing allows experiences to be processed on a remote server and then streamed to a device, such as a PC, VR headset, or phone. While this back-and-forth communication with an external server can lag, related developments in edge computing and 5G will help to reduce latency.

Edge infrastructure: Edge computing will be used for metaverse applications that depend on real-time responses, such as AR/VR and gaming.

Edge computing enables data from low-power devices to be processed closer to where it is created — i.e., at “the edge.” This can be particularly helpful when it comes to situations that require information to be processed in real time — such as utilizing hand-tracking sensors on a VR headset or processing commands during competitive gaming. In fact, edge infrastructure companies like Stackpath and Zenlayer list gaming and virtual reality among their main focus areas.

Edge processing is heavily interrelated with cloud computing. While cloud infrastructure handles workloads that do not require minimal latency, such as loading out-of-sight objects in a game, edge infrastructure handles inputs that need a very quick response, like player movements. Some companies develop blended offerings. For example, Akamai offers edge-cloud hybrid services to a number of high-profile gaming companies, including Roblox and unicorn Riot Games.

Access/interface (hardware)

This layer includes hardware devices that allow people to experience the metaverse. While this category encompasses connected devices like mobile phones, PCs, and gaming consoles, it is predominantly centered around emerging technologies designed to enhance immersion in a virtual setting.

Haptics: Haptic startups are developing technology to bring the sense of touch into virtual worlds.

Some startups, such as HaptX and Sense Glove, are developing gloves that grant virtual objects tangibility. Bridging micro-vibrations, pneumatic systems for force resistance, and motion tracking, this technology can give the impression that digital objects have texture, stiffness, and weight.

In the future, haptic technology may extend well beyond a person’s hands. Scotland-based Teslasuit is developing complete bodysuits to provide whole-body haptic feedback and climate control in virtual environments.

Headsets (VR): These companies are developing VR goggles — currently considered the main entry point to metaverse applications. These devices provide visual and audio content to users to immerse them in a digital setting.

One of the most popular VR headsets is Meta’s Oculus, which saw a surge in consumer interest during the 2021 holiday season.

Startups have followed suit. Varjo, for example, uses lidar and computer vision to bring depth perception, eye-tracking, and hand-tracking to its VR headsets.

Holographics: These companies use light diffraction technology to project 3D objects into physical spaces. These holograms, like augmented reality, bring digital experiences into the physical world.

While holographic technology is still in its early stages, it has the potential to be applied to a wide range of use cases, from hologram-led set design and performances to product design and medicine. Base Hologram is using the tech to bring popular artists like Whitney Houston and Buddy Holly back to the stage, while Israel-based RealView Imaging renders holograms of a patient’s internal organs to help with surgical planning.

The technology has a long way to go before it sees widespread success, but companies currently working in the space have given us an idea of what to expect down the road.

Smart glasses (AR): Companies here are developing glasses or contact lenses with AR capabilities.

While not all applications of AR glasses are directly related to the metaverse — for example, AR tools designed exclusively to help engineers fix refrigerators do not revolve around shared experiences — the companies featured in this category are setting the foundation for a bridge between physical and virtual worlds.

As AR gains popularity, particularly for social purposes, the tech will evolve into a tool that more effectively blends virtual and real-world elements — such as interacting with someone’s metaverse avatar at an event — further blurring the line between consumers’ online and offline identities.

Currently, China-based Nreal is developing AR glasses equipped with web browsing and video streaming capabilities for the everyday consumer. Others, like Magic Leap, are developing AR headsets for enterprise use cases.

Deloitte’s 2022 telecom industry outlook, questions and recommendations for telcos

Executive Summary:

In 2022, the telecom industry will face new opportunities and challenges presented by a dynamic regulatory, technological, and competitive environment. Deloitte’s annual telecom outlook dials into the biggest trends shaping the telecommunications industry, from more competitive broadband markets to cybersecurity in the 5G era.

The telecom sector continued to make progress in augmenting its network capacity with additional fiber and wireless deployments to meet the constant demand for higher-speed networks in 2021. However, as we start the new year, we see an emerging set of issues and opportunities presented by a dynamic regulatory, technological, and competitive environment that may influence the sector’s progress in the coming year:

- The potential for more competitive broadband markets. Faster mobile and fixed wireless connections create more viable alternatives to wired connections and new opportunities for bundled service offerings and business models for service providers. With ever-expanding options for high-quality communication and internet services from telecom, cable, wireless, and satellite internet providers, consumers will enjoy enhanced flexibility in purchasing and consuming services in the new year. However, these trends may also lead to a more competitive environment in 2022.

- A shift to more decentralized government broadband infrastructure funding. The $1 trillion Infrastructure Investment and Jobs Act (IIJA) passed in November earmarks $65 billion for continued broadband adoption and deployment. While government programs dedicated to expanding and improving telecommunication infrastructure and services have traditionally been managed at the federal level, it appears the bulk of the bill’s federally allocated broadband dollars will flow through more decentralized state-based models.

- Rising interest in multi-access edge computing (MEC) and private cellular networks. The enterprise market for private cellular networks and edge computing is gaining momentum. The market is still nascent but promises to be competitive, with many different players vying for their share. Network operators will have to compete against other players, who may prove key partners in delivering their solutions. Ecosystem players will likely begin to stake out and define their role in this emerging but rapidly evolving market in the coming year.

- The need to reassess cybersecurity and risk management in the 5G era. While the widespread adoption of 5G offers many benefits, it also creates new security concerns and challenges. As operators have taken steps to evaluate and minimize threats arising from 5G and software-centric networks in their own organizations, they are in a unique position to offer 5G security services to enterprises seeking to deploy their own advanced wireless networks.

Strategic Questions for telcos to consider:

• With spectrum being a scarce resource, how can operators prioritize its use to maximize its value? • How can operators use FWA to create additional synergies between their wireless and fiber asset deployments to improve their cost structure and benefit customers?

• While telcos may initially benefit as a wholesale provider of wireless capacity, what are the long term consequences if mobile virtual network operators begin using their wireless scale to build out their own networks?

• What should the telco’s role be in developing and delivering 5G private cellular networks and enterprise-oriented edge solutions? Will it take the form of spectrum leases, fiber backbone, and backhaul, or something more?

• What are the telco’s core competencies and value proposition in delivering 5G enterprise networks? Which business models will allow telcos to optimize value?

• What capabilities are required to execute on a given strategy or business model? Can telcos develop new capabilities internally? To what extent should they do so?

• How can telcos use their approach to cybersecurity as an opportunity to differentiate themselves and capture value in the 5G enterprise market?

• Where can telcos switch from reactive security mechanisms to more proactive ones?

• As telcos migrate from legacy networks to modern architectures, do they have appropriate risk management and governance organizations in place?

Recommendations for Telcos:

• Reassess core value proposition in an evolving competitive landscape with more players vying for the same customers.

• Reevaluate how and where to participate in terms of both service offerings and geographies. • Look for ways to differentiate services on non-performance attributes since consumers perceive minor differences among provider offerings.

• Determine organizational effectiveness in monitoring and responding to more distributed, state-based mechanisms for awarding federally allocated broadband funds.

• Monitor ecosystem and business model development in the emerging 5G enterprise edge compute and private cellular network markets.

• Build on the unique position to offer differentiated 5G security and risk management services to enterprises seeking to deploy advanced wireless networks.

References:

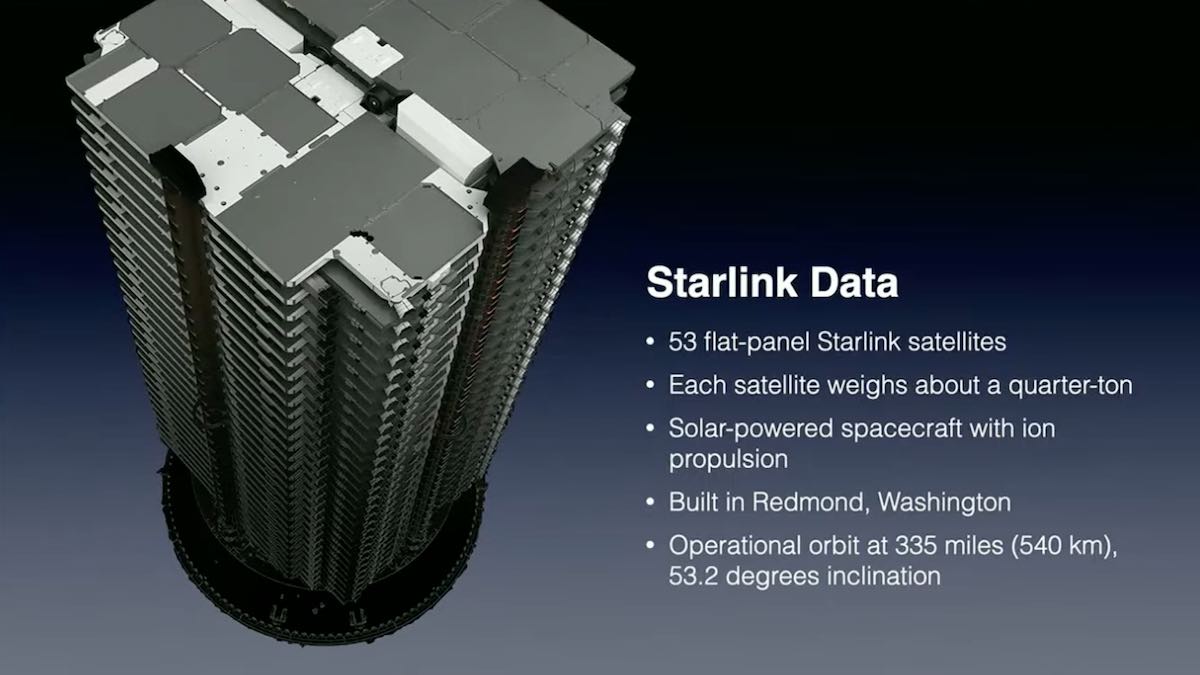

LEO satellite status report, Starlink’s progress, dealing with space junk

There are currently 4,852 operating satellites in Low Earth Orbit (LEO) from some eighty nations, though roughly half are U.S. commercial and government/military satellites. They are essential for everything from nuclear command and control, climate observation to GPS, and the internet, streaming video, and ATMs. Moreover, an already crowded earth orbit is getting worse. The private sector is driving the new space economy enabled by new technologies to miniaturize satellites, like the aforementioned cubesats. Google and Elon Musk’s SpaceX alone plan to launch some 50,000 cubesats in this decade.

Currently, Starlink (owned by SpaceX) has approximately 2,200 small satellites in LEO and working. That’s about half of SpaceX’s planned first-generation network of 4,408 Starlink satellites.

The 4,400 satellites will be spread among five different orbital “shells” at different altitudes and inclinations. SpaceX, founded and led by Elon Musk, has stated it eventually intends to launch as many as 42,000 satellites.

An explosion of private-sector space business—from satellite launches and space shuttles to the quest for mining asteroids and planets—has blurred the line between civilian and military activities, racing ahead of any duly considered global regulation. Dealing with space junk, however, is the most promising area for cooperation. The threat of space debris to all nations’ vital economic and national security assets in space—democracy-autocracy polarization notwithstanding—would, like climate change, seem such an instance.

Last November, Russia shot a missile into space to test its anti-satellite technology to see if it could destroy or incapacitate one of its own orbiting satellites. It did. The U.S. State Department says that missile smashed the Russian spacecraft into 1,500 large pieces and hundreds of thousands of smaller fragments, which resulted in a dangerous cloud of debris. That forced the crew aboard the ISS (International Space Station) to take shelter in their escape pops, SpaceX’s Dragon capsule. The resulting debris passed close to the ISS, but didn’t hit it. The crew was fine, but the incident highlighted just how big of a problem space debris can be.

In mid April, U.S. vice president Kamala Harris said the US would not conduct tests like this and called on other countries to do the same, but that promise won’t reduce the space junk already out there. Missile tests are just one way that space debris is created. Sometimes used rockets and old satellites are intentionally left up in space threatening to hit satellites or space rockets. And the more of it that space junk floating around, the harder it will be to avoid.

The U.S. Department of Defense’s Space Surveillance Network is the premier mechanism for monitoring space junk. Russia has some orbital monitoring capacity, but few other states do. Moreover, in addition to its unrivaled space surveillance capacity to monitor debris, the United States already has Spacing Sharing Agreements with over 100 nations to provide data and notifications to avoid collisions. These are important global public goods that can provide diplomatic leverage for shaping space rules and standards on space debris. The United States had given a heads-up to China about such risks during the Obama administration, according to well-placed sources.

In addition, private sector firms and startups in Japan, the United States, and Europe are devising ways to remove space debris, in what appears to be a coming sector of the space economy. The U.S. Space Force’s technology arm is already exploring the possibility of funding private firms to remove space debris. There are a range of methods of space junk removal being developed from satellite magnets, nets, harpoons, and even spider-like webs. These are all likely future contractors, bearing the risks of research and development.

International cooperation will be needed to effectively clean up space junk. There are only a handful of high-performance space-faring states—the United States, Russia, China, the EU, Japan, and India. As discussed above, the United States is well-positioned as first among equals to launch an ad hoc public-private coalition of space powers partnering with the private sector to pool resources and (non-national security-sensitive) capabilities to better monitor and clean up space debris and seek mutually acceptable codes of conduct and rules for such activities.

Robert Manning and Peter Wilson suggest the methods and procedures should be based an open architecture with adherence to the principle of form follows function: open to emerging space powers—South Korea, Brazil, Israel, and others.

References:

https://www.ucsusa.org/resources/satellite-database

https://nationalinterest.org/feature/coming-anarchy-outer-space-201934

https://arstechnica.com/video/watch/the-space-junk-problem