Month: January 2015

FCC Says Broadband Deployment Lacking; Redefinition (25M/3M) Has Huge Implications for AT&T, Verizon & Comcast

In its 2015 Broadband Progress report, released January 29th, the FCC states that U.S. broadband deployment, especially in rural areas, is failing to keep pace with today’s advanced, high-quality voice, data, graphics and video offerings.

http://transition.fcc.gov/Daily_Releases/Daily_Business/2015/db0129/DOC-331760A1.pdf

In an effort to stimulate deployment, the FCC voted 3-2 to change the definition of “broadband” for wireline networks in Section 706 of the Telecommunications Act of 1996 . The redefinition is from 4 Mbps downstream and 1 Mbps upstream (set in 2010) to 25 Mbps downstream and 3 Mbps upstream. The 2010 broadband hurdle rates were said to be “inadequate for evaluating whether advanced broadband is being deployed to all Americans in a timely way,” the FCC found.

“Using the new higher broadband rate benchmark, the 2015 Broadband Progress report finds that 55 million Americans – 17% of the population – lack access to advanced broadband. Moreover, a significant digital divide remains between urban and rural America. Over half of all rural Americans lack access to 25 Mbps/3 Mbps service. The divide is still greater on Tribal lands and in U.S. territories, where nearly 2/3 of residents lack access to today’s speeds. And 35% of schools across the nation still lack access to fiber networks capable of delivering the advanced broadband required to support today’s digital-learning tools.”

Using the new broadband definition, approximately 20% of U.S. wired Internet connections today do not qualify as broadband, including many (mostly DSL connections) that formerly did qualify. For example, this author and many others have AT&T U-Verse Internet, which typically provides downstream rates of either 11Mb/sec or 22Mb/sec (the Uverse Upstream rate is not stated by AT&T). Others have 4Mb/sec and higher ADSL based Internet access. As of yesterday, we don’t have broadband anymore!

The change is designed to protect consumers by ensuring that cablecos (MSOs), telcos, and other Internet access providers don’t offer subpar download speeds as call them “broadband.” It’s also meant to stimulate the telecom/cableco industry into offering higher-quality services to the one-fifth of the population that has little or no Internet access, according to FCC Chairman Tom Wheeler. “We have a problem” when 20 percent of the U.S. doesn’t have access to the new speed. And we have a responsibility to that 20 percent,” Wheeler said.

It appears the FCC is paying more attention on cable’s growing broadband monopoly, as AT&T and Verizon back away from unwanted ADSL Internet access markets to focus on their triple play offerings (U-verse and FiOS, respectively) and 4G-LTE nationwide wireless access. Not only do those telcos not want to upgrade their DSL lines, they’re paying for state laws that ensure nobody else can either. It’s a paradigm that’s needed changing for most of the last decade, and few thought that Wheeler would try to do that. It remains to be seen if AT&T will upgrade U-verse Internet customer speeds as they are almost always served by DSL (only some greenfield U-verse deployments get fiber to the building). Verizon FiOS uses fiber access, which already provides higher speeds than 25M/3M to all its customers.

The redefinition also creates a huge problem for Comcast. Suddenly, the company’s share of the broadband market becomes a lot larger — and that gives regulators and politicians concerned about market concentration/monopoly power more cause to closely scrutinize Comcast’s plans to merge with Time Warner Cable. If that merger closes, approximately 63% of U.S. households would have only one choice for a broadband provider at the new faster speeds, according to a December 2014 memo from the FCC.

Time Warner Cable CEO Rob Marcus said he didn’t think the commission’s “somewhat arbitrary” definition would affect the deal with Comcast. “I don’t anticipate that that has any practical implications for life going forward or for the (the Department of Justice) analysis of the deal,” Marcus said in an earnings call Thursday, January 29th.

Comcast has said its market share would grow by less than 1% because Time Warner Cable has virtually no broadband customers at speeds above 25 Mbps. No customer will have fewer choices after the merger because Comcast and Time Warner Cable serve different areas, Comcast has repeatedly stated.

There’s still the chance that regulators could block the transaction or seek specific concessions before approving it. The reviews by the FCC and Justice Department, which is evaluating the merger’s impact on competition, have already been delayed several times as the anniversary of the deal’s announcement nears.

“The market suggests that odds of the deal closing are no higher than 50-50,” Craig Moffett, an analyst at Moffett Nathanson, said in a note to clients Thursday. The merger “has lost its air of inevitability,” he said. Earlier this month, Moffett had said he expected regulators to sign off on the deal. “But if it is rejected, combined Comcast’s share of the broadband market would be the reason,” he wrote in Jan. 8th note to clients.

Comcast says it’s better to measure broadband by including slower speeds, giving it about 35.5% market share in the U.S.

Meanwhile, the debate over a new downstream/upstream rate definition for broadband service mirrors the battle lines over network neutrality. The big Internet content companies including Google, Facebook, Yahoo and Netflix favor strong net neutrality action by the FCC, while the cable and telecommunications companies want the FCC to refrain from reclassifying broadband as a regulated service under Title II of the Communications Act. Earlier this month, Wheeler strongly hinted that Title II will be the basis for new net neutrality rules governing the broadband industry. Title II lets the FCC regulate telecommunications providers as common carriers. President Obama urged the commission to use Title II to impose net neutrality rules that ban blocking, throttling, and paid prioritization (AKA “paid peering).

In a filing with the FCC last week, Matthew Brill, counsel for the National Cable and Telecommunications Association, called the proposed broadband reclassification as “arbitrary and capricious.” He termed the assumptions behind it “hypothetical” that “dramatically exaggerate the amount of bandwidth needed by the typical broadband user.”

AT&T 4Q2014 Earnings Review & Analysis + Future Growth from DTV & Mexico wireless companies

AT&T announced its 4thQ2014 earnings yesterday which slightly topped estimates.

- AT&T’s Wireless segment reported operating revenues of $19.9 billion, up 7.7% from the fourth quarter of the previous year. The Wireline segment had revenues of $14.6 billion which was down 1.0% year-over-year.

- In the fourth quarter, AT&T had 405,000 U-verse high speed Internet subscriber net adds, which would make a grand total of over 12 million U-verse high speed Internet subscribers. 73,000 U-verse TV subscribers were added.

- Total revenue at of AT&T’s wireline segment was $14,572 million, down 1% year over year (yoY). Also, Service revenues were down 1.3% to $14,240 million. Equipment revenues grossed $332 million, up 17.7%. Operating expenses increased 1.2% to $13,107 million. Meanwhile, the operating income increased 0.8% to $1,465 million. Quarterly operating margin stood at 10.1% against 9.9% in the year-ago quarter.

- At the end of fourth-quarter 2014, AT&T had 24.778 million voice connections, down 13% year over year. In the reported quarter, the company lost 1.442 million voice connections, down 78.7%. At the end of the preceding quarter, AT&T had 16.028 million high-speed broadband connections, down 2.4% year over year. The company also lost 0.458 million broadband connections compared with a loss of 0.002 million connections in the prior-year quarter.

- Similarly, at the end of 4Q-2014, AT&T had 5.943 million video connections, up 8.8%. However, the company lost 0.124 million video connections in the said quarter.

- Highlights of 4Q-2014 Earnings: http://www.att.com/gen/landing-pages?pid=5718 http://www.att.com/Investor/Earnings/4q14/ib_4q14.pdf

- Earnings Conference Call:

http://phx.corporate-ir.net/phoenix.zhtml?c=113088&p=irol-EventDetails&EventId=5178862

- The company expects continued consolidated revenue growth and earnings growth should be in the low-single digit range. Margins are expected to expand across all of AT&T’s segments.

- For fiscal 2015, AT&T expects adjusted earnings per share to grow in the range of low single digit. Capital expenditures are expected at around $18 billion.

Randall Stephenson, AT&T chairman and CEO, commented about AT&T’s future during a fourth quarter earnings call that was broadcast online:

“Our transactions with DIRECTV and Mexican wireless companies Iusacell and Nextel Mexico will make us a very different company. We’ll be unique in the industry because we’ll be able to offer integrated capabilities across a diversified base of services, customers, geographies and technology platforms. After we close DIRECTV, our largest revenue stream will come from business-related accounts, followed by U.S. TV and broadband, U.S. consumer mobility and then international mobility and TV.”

“We will be the only company with mobile Internet spanning both countries,” Stephenson said of the company expanding into Mexico. “We have the makings for strong and very viable Mexico strategy. We like these assets. We think these assets are sufficient to go in there and compete and take share.“

Stephenson was talking about the diversification of AT&T’s revenue stream through it’s pickup of DirectTV, as well as recent acquisitions of wireless players in Mexico. When asked whether AT&T might be considering moving into the Canadian wireless market, Stephenson said he had enough on his plate. “On Canada, I think right now we have about as much as a company can handle,” he said.

Aside from moving into different geographies, Stephenson stressed that AT&T’s DirecTV acquisition will allow it to deliver video content across devices.

“We’re looking at multiple channels and channel lineups that we’ll be able to deliver to our wireless subscribers,” Stephenson said. “Stay tuned…this is of high priority to us.”

Stephenson made the comments as both AT&T and Verizon are under pressure to find new revenue streams. AT&T’s fourth quarter subscriber numbers leaned heavily on tablets, which have picked up the slack as smartphones reach saturation. AT&T added 854,000 net postpaid subscribers, a 51 percent increase over the same quarter last year. AT&T added just 148,000 net postpaid smartphones and 969,000 postpaid tablets in the quarter.

For reference, Verizon added about 600,000 smartphones and 1.4 million tablets in the fourth quarter. Stephenson said AT&T would update more specific guidance once the DirecTV purchase is approved.

FBR’s David Dixon wrote in a note to clients (and this author):

AT&T reported 4Q14 mixed results as it continues to face stiff competition from Verizon and its smaller rivals – Sprint and T-Mobile. While the company was able to achieve 3.8% YoY revenue growth in 4Q2015, adjusted wireless service EBITDA (Earnings before Interest, Taxes and Amortization) margins declined by approximately 60 bps YoY, driven by a higher number of smartphone upgrades and gross subscriber adds. Although AT&T was able to deliver net adds of 854,000, surpassing consensus expectations of 793,000, much of the growth was driven by lower-ARPU tablet net adds of 969,000. Postpaid churn increased by 11 bps YoY to 1.22%.

During the fourth quarter, AT&T increased LTE network coverage to over 300 million PoPs. Despite improvement in network quality and root metric ranking results, AT&T still faces the challenge of being a premium-priced provider amid customer perception of an inferior network to that of Verizon (this takes time to change), which will likely continue to affect churn. Diversification into DTV, the growing Mexican market, and mobile video delivery will likely alleviate some churn pressure. AT&T management expects to close the DTV transaction in 1H15.

* Diversification is key to growth. AT&T has embarked on diversification into the Mexican wireless carrier market in the face of domestic competitive pressures that are unlikely to abate. We see a favorable Mexican regulatory environment and view AT&T’s desire to mitigate churn risk in the U.S. market positively. AT&T management believes DTV and Mexican acquisition will achieve adjusted EPS in the single-digit range and deliver multi-year synergies that are higher than previously announced.

* Project VIP (Velocity IP) completion drives capex reduction. With the majority of Project VIP milestones complete, management expects FY15 capex to be around $18 billion, a decline of approximately $3.2 billion compared with FY14. The company will shift focus to free cash flow generation to help pay down debt (from DTV acquisition).

Our strategic concerns for AT&T in 2015 and beyond include:

(1) Apple eSIM impact should Apple be successful striking wholesale agreements;

(2) Google MVNO impact, which could strip the company of the last bastion of connectivity revenue; and

(3) a WiFi first network from Comcast, coupled with a wholesale agreement with a carrier, which

would enable a competitor and increase pricing pressure.

Author’s Note: Cablevision has already announce a VoIP/WiFi network in New York. Called Freewheel, the service will offer unlimited data, talking and texting worldwide for $29.95 a month, or $9.95 a month for Cablevision’s Optimum Online customers — a steep discount compared with standard offerings from traditional cellular carriers. Freewheel customers initially must use a specific Motorola Moto G smartphone, which is being sold for $99.95. The service goes on sale next month, and no annual contract is required.

http://www.nytimes.com/2015/01/26/business/media/cablevision-to-introduce-wi-fi-based-phone-plan.html?_r=0

New ETSI Group on millimetre Wave Transmission (ISG mWT)

ETSI’s recently announced Industry Specification Group on millimetre Wave Transmission (ISG mWT) held its first meeting at ETSI on 14-15 January 2015 and immediately commenced work developing a set of five specifications.

At this meeting Mr. Renato Lombardi of Huawei Technologies was elected as the chairman of the Industry Specification Group while Mr. Nader Zei of NEC Europe was elected as the vice chairman.

“ISG mWT was conceived as an industry wide platform to prepare for large scale usage of millimetre wave spectrum in current and future transmission networks by improving the conditions to make millimetre wave spectrum a suitable and convenient choice for all stakeholders. The ISG aims to be a worldwide initiative with global reach and to address the whole industry: national regulators, standards organizations, telecom operators, product vendors and key component vendors.” said Mr. Lombardi, newly elected chairman of ETSI’s ISG mWT.

During the meeting, a plan was agreed to develop five new specifications. These cover:

- An analysis of the maturity and field proven experience of millimetre wave transmission

- Potential applications and use cases of millimetre wave transmission

- An overview of V-band and E-band worldwide regulations

- An analysis of V-band street level interference

- Analysis of the millimetre wave semiconductor Industry technology status and evolution.

Millimetre wave spectrum, in the 30GHz to 300GHz range, offers more available spectrum than in lower bands with larger channel bandwidths granting a fibre like capacity. The spectrum can be made available readily and can be reused easily, and lower licensing costs lead to lower total cost of ownership and lower cost per bit of radio systems.

Participation in the millimetre Wave Transmission Industry Specification Group is open to all ETSI members as well as organizations who are not members, subject to signing ISG Agreements. A complete list of ISG mWT members is published on the ETSI Portal pages for mWT.

For information on how to participate please contact: [email protected]

References:

http://www.etsi.org/news-events/news/861-2014-new-industry-specification-group-on-millimetre-wave-transmission-at-etsi

https://portal.etsi.org/Portals/0/TBpages/mWT/Docs/Introduction%20to%20mWT%20ISG%20v1-0.pdf

http://www.etsi.org/technologies-clusters/technologies/millimetre-wave-transmission

About ETSI

ETSI produces globally-applicable standards for Information and Communications Technologies (ICT), including fixed, mobile, radio, converged, aeronautical, broadcast and internet technologies and is officially recognized by the European Union as a European Standards Organization. ETSI is an independent, not-for-profit association whose more than 700 member companies and organizations, drawn from 64 countries across five continents worldwide, determine its work programme and participate directly in its work.

For More Information on ETSI, Contact: Claire Boyer:

Tel: +33 (0)4 92 94 43 35 Mob: +33 (0)6 87 60 84 40

Email: [email protected]

Infonetics: 25GE & 50GE to transform Data Center network architectures; 2 SDN models to converge

Infonetics Research, now part of IHS Inc. (NYSE: IHS), today released excerpts from its 3Q14 Data Center Network Equipment report, which tracks data center Ethernet switches, Ethernet switches sold in bundles, application delivery controllers (ADCs) and WAN optimization products.

3Q14 DATA CENTER MARKET HIGHLIGHTS:

. The global data center Ethernet switch market put in a good showing in 3Q14, up 5 percent sequentially to $2.2 billion; positive forces include the U.S. public sector and cloud service providers

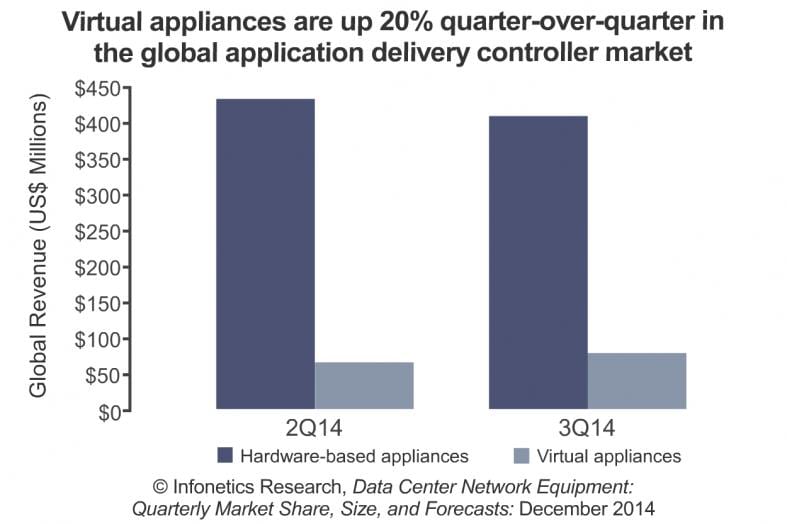

. Though worldwide application delivery controller revenue is down 2 percent in 3Q14 from 2Q14, the ADC market has grown consistently on a year-over-year basis for the last six quarters

. Virtual Application Delivery Controller (ADC) appliances are up 20 percent from the previous quarter

. Globally, WAN optimization revenue is up 9 percent sequentially in 3Q14, but down 1 percent from the year-ago third quarter

. There are more new entrants in the WAN optimization space with Siaras and Viptela jumping in, but the market has yet to return to long-term growth

“The data center switching market is poised for another transformation with 25GE and 50GE enabling new data center network architectures targeting large cloud service providers looking to migrate from 10GE switching and server connectivity to 100GE switching and 25GE server connectivity,” said Cliff Grossner, Ph.D., directing analyst for data center, cloud and SDN at Infonetics Research.

Grossner added: “A new generation of Broadcom switching silicon will add 25GE and 50GE to the mix of port speeds in the data center for 2015.”

References:

1. Overview of 25G & 50G Ethernet Specification, Draft 1.4 from a consortium (NOT an IEEE 802.3 standard yet)

http://25gethernet.org/sites/default/files/25G%20and%2050G%20Specificati…

2. Ethernet Switch Market: 40G growth; 2.5G and 25G Ethernet coming, but not IEEE 802.3 standards yet

3. A new video discussing beyond 25Gigabit Ethernet from Ethernet Alliance 2014 Rate Debate

DATA CENTER REPORT SYNOPSIS:

Infonetics’ quarterly data center equipment report provides worldwide and regional market size, vendor market share, forecasts, analysis and trends for data center network equipment, including data center Ethernet switches, ADCs, WAN optimization appliances, and Ethernet switches sold in bundles. Vendors tracked: A10, Alcatel Lucent, Arista, Array Networks, Aryaka, Barracuda, Blue Coat, Brocade, CloudGenix, Cisco, Citrix, Dell, Exinda, F5, HP, Huawei, IBM, Ipanema, Juniper, Kemp, NEC, Radware, Riverbed, Siaras, Silver Peak, Talari, VeloCloud, Viptela and others.

To purchase the report: www.infonetics.com/contact.asp

In a long phone conversation with Cliff, I asked him to comment on the four SDN architectural models for the data center. There are (at least) 4 architectural models with many variations of each/different protocols used:

- Centralized SDN controller supporting many data forwarding plane (“packet engines”) distributed throughout the network. Strict separation of Control and Data planes with Open Flow v1.3 as the southbound API from Control Plane to Data Plane(s).

- Network Virtualization/overlay of a logical network over a smaller physical network. Often, there is a L2 over L3 tunneling protocol (e.g. VxLAN) used to effectively create VLANs over a physical WAN

- Network equipment vendor, e.g. Cisco offering programmable interface for more control over its switch/router, e.g. configuration, re-routing decisions, policy, monitoring, troubleshooting,etc. That largely replaces CLI commands.

- Network operator/provider, (e.g. AT&T Netbond) offering a SDN WAN with proprietary routing protocol and other programmable features. Only the suppliers/vendors chosen are privy to the network operator’s spec, which when implemented in equipment, won’t work on any other provider’s network.

After considering the above, Cliff wrote in an email: “If you relax the Openflow constraint, then I think models 1&3 are the same. This is what I refer to as the underlay model.” Of course, that implies that the vendor specific approach to SDN totally separates the Control and Data Planes, which are implemented in different boxes.

We didn’t discuss the role of the new speed Ethernet specs for the data center. Those were covered in this article:

Ethernet Switch Market: 40G growth; 2.5G and 25G Ethernet coming, but not IEEE 802.3 standards yet

https://techblog.comsoc.org/2014/12/11/ethernet-switch-market…

ETSI Network Functions Virtualisation (NFV) completes first phase of work while Open NFV accelerates

Executive Summary:

ETSI’s Network Functions Virtualisation (NFV) Industry Specification Group (ISG) has successfully completed Phase 1 of its work with the publication of 11 ETSI Group Specifications. These specifications build on the first release of ISG documents published in October 2013 and include an infrastructure overview, an updated architectural framework, and descriptions of the compute, hypervisor and network domains of the infrastructure. They also cover management and orchestration, security and trust, resilience and service quality metrics.

These documents result from 2 years of intensive work by more than 240 organizations sharing the same common goal to quickly define Network Functions Virtualization. “I’d like to thank all of the NFV ISG participants for their tremendous dedication through our numerous face-to-face meetings and conference calls to evolve the NFV vision from the original operator whitepaper and bring these documents to publication” said Steven Wright, Chair of ETSI NFV ISG.

This second release of NFV documents (see below) is important to industry because it lays the foundation for this technology. It provides common and agreed definitions of the key concepts of NFV and allows the many players involved to speak a common language and collaborate with each other. This collaboration is evident in the success of the NFV Proof of Concept programme (also part of the first phase of NFV work), which has already produced over 30 multi-company demonstrations of the capabilities of NFV.

All published NFV documents are freely downloadable at:http://docbox.etsi.org/ISG/NFV/Open/Published/

ISG NFV Continues:

NFV Phase 2 is now well underway. Work started immediately after the eighth plenary meeting in November 2014 on 28 new documents and more are expected over the coming 2 years. The main objectives of this second phase of work are to encourage interoperability building upon the achievements made in the first two years of the ISG. This new phase of work will include both normative and informative content. Adding normative requirements will provide the clarity required for interoperability and formal testing. Another key element of Phase 2 will be to work more closely with other standards bodies to help focus their work and to avoid duplication, and to collaborate within open source projects developing NFV implementations.

Operators and vendors alike recognise the benefits of the ISG’s collaborative approach and its innovative standardization cooperation model, built upon assertive goals, pragmatism, lightweight process, and unprecedented degree of network operator collaboration, enabling the first phase of NFV work to be completed in record time. “Phase 1 exceeded our expectations in fostering an open NFV ecosystem and influencing standards development organizations, open source communities and vendor roadmaps; achieving and validating interoperability at critical reference points is the key focus for phase 2” said Don Clarke, Chair of NFV ISG NOC.

The ETSI NFV ISG held its first meeting in January 2013. Since then it has grown to over 240 participating organizations.

List of recently published specifications

The following is the list of the 11 NFV specifications which completes phase 1 of NFV:

- GS NFV 002 – Architectural Framework

- GS NFV 003 – Terminology for Main Concepts in NFV

- GS NFV-INF 001 – Infrastructure Overview

- GS NFV-INF 003 – Infrastructure; Compute Domain

- GS NFV-INF 004 – Infrastructure; Hypervisor Domain

- GS NFV-INF 005 – Infrastructure; Network Domain

- GS NFV-INF 010 – Service Quality Metrics

- GS NFV-MAN 001 – Management and Orchestration

- GS NFV-REL 001 – Resiliency Requirements

- GS NFV-SEC 003 – NFV Security; Security and Trust Guidance

- GS NFV-SWA 001 – Virtual Network Function Architecture

About ETSI:

ETSI produces globally-applicable standards for Information and Communications Technologies (ICT), including fixed, mobile, radio, converged, aeronautical, broadcast and internet technologies and is officially recognized by the European Union as a European Standards Organization. ETSI is an independent, not-for-profit association whose more than 700 member companies and organizations, drawn from 64 countries across five continents worldwide, determine its work programme and participate directly in its work.

For more information please visit: www.etsi.org.

ETSI Contact:

Claire Boyer

Tel: +33 (0)4 92 94 43 35

Mob: +33 (0)6 87 60 84 40

Email: [email protected]

The Open NFV (OPNFV) is a new open source project focused on accelerating NFV’s evolution through an integrated, open platform.

OPNFV will establish a carrier-grade, integrated, open source reference platform that industry peers will build together to advance the evolution of NFV and to ensure consistency, performance and interoperability among multiple open source components. Because multiple open source NFV building blocks already exist, OPNFV will work with upstream projects to coordinate continuous integration and testing while filling development gaps.

The initial scope of OPNFV will be on building NFV Infrastructure (NFVI), Virtualized Infrastructure Management (VIM), and including application programmable interfaces (APIs) to other NFV elements, which together form the basic infrastructure required for Virtualized Network Functions (VNF) and Management and Network Orchestration (MANO) components. OPNFV is expected to increase performance and power efficiency; improve reliability, availability, and serviceability; and deliver comprehensive platform instrumentation.

OPNFV will work closely with ETSI’s NFV ISG, among other Standards Development Organizations (SDOs), to drive consistent implementation of standards for an open NFV reference platform. Increasingly, standards are being drafted in conjunction with major open source projects. Since feedback from open source implementations can drive the rapid evolution and adoption of standards, this tight coordination of otherwise independent processes is crucial to the establishment of an NFV ecosystem. When open source software development is aligned with standards development, it can root out issues earlier, identify resolutions, and potentially establish de facto standards, resulting in a far more economical approach to platform development.

More info at:

https://www.opnfv.org/

https://www.opnfv.org/software/technical-overview

In Feb 2014, the TM Forum announced its Zero-touch Orchestration, Operations and Management (ZOOM) project.

ZOOM’s goal is to define a vision of the new virtualized operations environment, and a management architecture based on the seamless interaction between physical and virtual components that can easily and dynamically assemble personalized services. In addition, ZOOM aims to identify and define new security approaches to protect infrastructure, functions and services across all layers of software and hardware; and complement ongoing work within the European Telecommunications Standards Institute (ETSI) and other organizations so that the Forum and its members are working together with other industry leaders to provide the management platform and transformation guidance to support successful deployment of network functions virtualization (NFV).

http://www.tmforum.org/PressReleases/TMForumBuildsBlueprint/54445/article.html

Infonetics: Telecom Revenue Growth Stalls as Datacom Growth Accelerates

Infonetics, now part of IHS Inc. (NYSE: IHS), released excerpts from its latest Global Telecom and Datacom Market Trends and Drivers report. In the report, Infonetics analyzes global and regional market trends and conditions.

TELECOM AND DATACOM MARKET TRENDS:

. Macroeconomic indicators point to moderate global economic growth of 3 percent for the full-year 2014 due to persistent weaknesses in the Eurozone and a significant slowdown in Brazil and Russia

. Global mobile service revenue barely budged in the first half of 2014 (1H14), up just 0.5 percent from the same period a year ago, badly dragged by Europe again

. Mobile data services (text messaging and mobile broadband) rose again in every region in 1H14, driven by the increasing usage of smartphones

. Mobil broadband services grew 26 percent year-over-year, enough to offset the decline of SMS revenue

. Key trends affecting the enterprise networking and communication markets include the adoption of cloud services, the use of cloud architectures in enterprise data centers, and security becoming a part of every IT decision

REPORT SYNOPSIS:

Infonetics’ overall market trends and drivers report is published twice annually to provide analysis of global and regional market trends and conditions affecting service providers, enterprises, subscribers and the global economy. The report assess the state of the telecom industry, telling the story of what’s going on now and what’s expected in the near and long term, including spending trends, subscriber forecasts, macroeconomic drivers and key economic statistics (e.g., unemployment, OECD indicators, GDP growth). The 40 page report is illustrated with charts, graphs, tables, and written analysis.

“Overall, growth in telecom revenue continues to slow in every geographic region. Europe’s 5 largest service providers-Deutsche Telekom, Orange, Telecom Italia, Telefónica, and Vodafone-continue to experience declining revenue, though less pronounced than in the past 3 years. And in North America, AT&T and Verizon have signaled that the mobile services price war started by T-Mobile US is taking a bite,” said Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Co-author of the report Matthias Machowinski, Infonetics’ directing analyst for enterprise networks, added: “After a weak 2013, enterprise networking and communication revenue growth accelerated in 2014 thanks to a resurging North American market and stepped-up investments in security infrastructure. We expect similar results in 2015, when strong end-user demand in North America and Asia Pac is likely to be offset by a slowdown in Europe.”

To purchase the report, contact Infonetics:

www.infonetics.com/contact.asp

RELATED RESEARCH (http://www.infonetics.com/market-research-report-highlights.asp)

. Mobile broadband overtakes SMS as largest generator of mobile data revenue

. Infonetics projects Cloud-RAN architecture market to top $10 billion by 2018

. Ethernet switch market accelerating with 2.5G and 25G Ethernet speeds on horizon

. iPhone 6 drives uptick in smartphone market

. Nearly a quarter of all access points are now 802.11ac, shows WLAN market report

Comment & Analysis:

The strong mega trend of using commodity hardware has pressured all IT equipment vendors, especially telecom where there’s fierce global competition from Huawei, ZTE and other Asian equipment companies. It’s not likely to reverse anytime soon.

Here’s a quote from Infonetics latest Broadcast and Streaming Video Equipment and Pay TV Subscribers report, which tracks pay-TV subscribers and video equipment sold to telco IPTV, cable and satellite TV providers.

“The cost of encoding and transcoding platforms continues to come down, pressuring video and broadcast equipment revenue as pay-TV providers move to generic hardware platforms and, ultimately, network functions virtualization (NFV) rather than dedicated platforms,” said Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

Continued Heynen: “This is a long-term shift that will keep video revenue from growing more significantly, despite the fact that pay-TV providers must fundamentally alter their video processing environments to support linear, over-the-top (OTT) and multiscreen content that continues to grow exponentially.”

So with slowing revenue growth in almost all communications sectors it will certainly be a survival of the fittest battle amongst existing telecom/network equipment companies with profit margins under severe pressure.