Month: December 2022

Cybersecurity to be a top priority for telcos in 2023

Telecom has always been susceptible to cyberattacks and data breaches. With increasing deployment of IoT devices, attackers will have more opportunities to obtain our data as more gadgets are connected to our network. OpenRAN, with many more exposed interfaces, widens the attack surface for bad actors.

Different security risks brought on by 5G will leave the sector open to cyberattacks. To strengthen security surrounding connected devices, cloud systems, and the networks that connect them, telecom operators must invest in implementing stringent cybersecurity measures because there is a significant amount of sensitive data dispersed across intricate, private, and private networks.

According to Gartner, there will be 43 billion IoT-connected devices by the end of 2023. For those in charge of cybersecurity, it’s necessary to keep in mind IoT devices, such as smartwatches or human-wearable biometrics, monitoring systems, robotics, alarm systems, sensors, IT devices, and industrial equipment. IoT security is essential as more telecoms embrace the industry and implement these devices in their networks because they can remotely access base stations and data centers.

Finally, enterprises deploying SD-WANs and other private or virtual private networks. In particular:

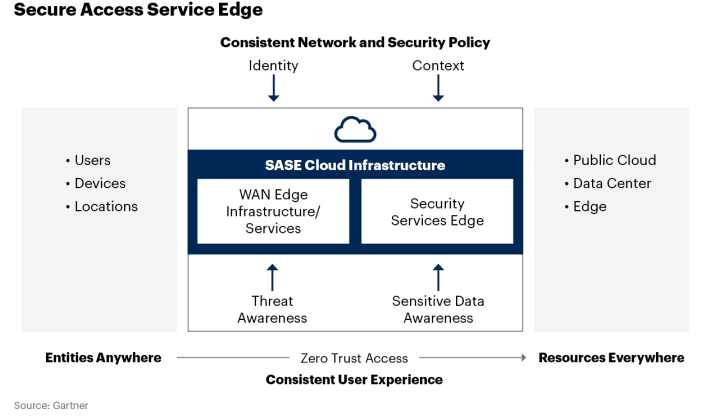

- Secure Access Service Edge (SASE) combines network security functions (such as SWG, CASB, FWaaS and ZTNA), with WAN capabilities (e.g. SD-WAN) to support businesses’ secure access needs. Previously, security for SD-WAN was an open, unresolved issue.

- Secure Service Edge (SSE) is the security components of SASE focusing largely on the cloud access security broker, secure web gateway, and zero-trust network access products to enable secure use of the internet and cloud services for a hybrid workforce working from anywhere,” said Gartner analyst Charlie Winckless.

A Dell’Oro group July 2022 report found that the SSE market grew 40% year-over-year to more than $800 million in the first quarter. A December report noted that SSE achieved its tenth consecutive quarter of sequential revenue expansion in 3Q-2022. Dell’Oro’s Director of Network Security, SASE, and SD-WAN Mauricio Sanchez said the strong growth is a testament to more enterprises preferring cloud-delivered security over traditional on-premises solutions. Sanchez told SDX Central: “The growth factors that have existed largely since the pandemic started are still with us. That’s the shift to hybrid work, the shift of workloads to the cloud, and the importance of the digital experience.”

References:

https://insidetelecom.com/a-look-at-the-telecommunication-industry-trends/

Summary of EU report: cybersecurity of Open RAN

IEEE/SCU SoE Virtual Event: May 26, 2022- Critical Cybersecurity Issues for Cellular Networks (3G/4G, 5G), IoT, and Cloud Resident Data Centers

U.S. cybersecurity firms seek tech standards to secure critical infrastructure

Enterprises Deploy SD-WAN but Integrated Security Needed

Have we come full circle – from SD-WAN to SASE to SSE? MEF’s SD-WAN and SASE standards

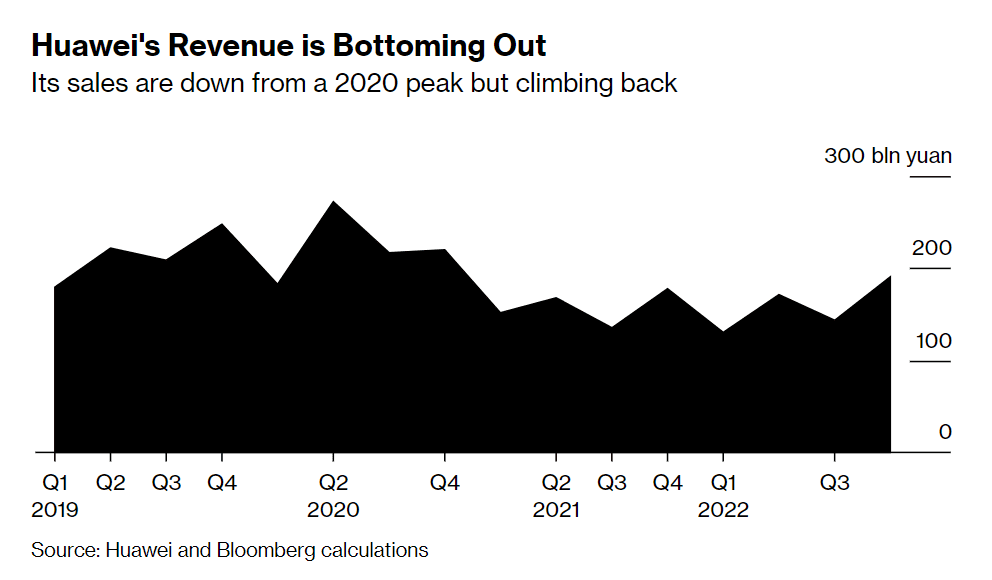

Huawei reports 3rd straight quarter of revenue growth despite U.S. sanctions

Industry Analysts: Important Optical Networking Trends for 2023

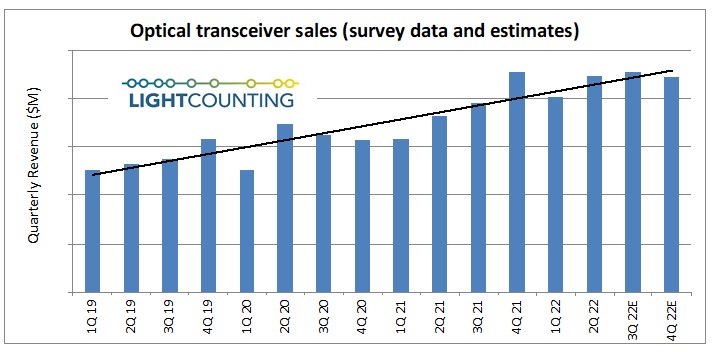

Optical Transceivers:

Optical transceivers save space and reduce the need for additional transmitting and receiving devices because they transmit and receive information all in one device! Additionally, they are an economical, compact tool to enable networks to send information over larger distances, come in a variety of Ethernet speeds from Fast Ethernet to 100 Gigabit Ethernet, and offer great flexibility to grow your network while leveraging existing network devices and infrastructure.

Many newer, high quality Small Form-factor Pluggable (SFP) modules have Diagnostic Monitoring Interface (DMI), which automatically monitors SFP operations such as output and input power, temperature, and supply voltage in addition to providing multimode, single mode, and multi-rate SFP options for more flexibility.

Market Research Future® (MRFR) predicts that the global optical transceiver market will rise to 8 billion in the U.S. by 2023.

Pluggable optics:

400ZR coherent pluggable optics emerged as a connectivity tool for metro-distributed data center connectivity. In 2023, look for three additional innovations to enable even more opportunities for coherent pluggables.

High-performance pluggables with 0 dBm transmit power and low out-of-band noise will enable coherent pluggable transceivers to cover a richer set of use cases, including deployment in metro networks with multiple cascaded ROADMs. This increased transceiver performance will also push some pluggables beyond the 600-km metro threshold and into a portion of the long-haul network.

Advances in intelligent pluggables management, as being defined in the 28-member Open XR Forum and with inputs to other organizations like the OIF, will ease deployment complexity and enable operational support for advanced functionality like remote diagnostics, auto-discovery, spectrum analysis, and streaming telemetry in all types of non-optical hosts, including switches and routers.

A new class of coherent pluggables, such as Infinera’s ICE-XR with digital subcarrier technology, will enable commercial deployment of point-to-multipoint architectures, where a single high-speed (e.g., 400G) hub optic can communicate with multiple lower-speed (e.g., 25G to 100G in 25G increments) optics without requiring intermediate electrical aggregation – thus reducing the amount of equipment, space, and power utilized and the total cost of network ownership by up to 70% over multiple years.

Heavy Reading’s optical networking analyst Sterling Perrin sees “pluggable optics everywhere” being a dominant theme. “This includes the continuing trends in 400ZR and ZR+ but also a big focus on migrating down to small coherent 100G pluggables, pluggables across 5G XHaul networks, and pluggables in PON,” he writes in a note to Light Reading.

Data center transmission:

In 2023, look for modular, distributed data center deployments to accelerate, along with 400 Gb/s, 600 Gb/s, and 800 Gb/s per wavelength coherent optical connectivity to support their interconnection

Modular data centers, where construction and integration tasks are moved offsite and then shipped and assembled onsite, are becoming mainstream and enabling compute and storage to be quickly and reliably deployed in all types of settings – from just a few racks in a small hut to megawatts of equipment in a multi-story configuration. In 2023, look for modular, distributed data center deployments to accelerate, along with 400 Gb/s, 600 Gb/s, and 800 Gb/s per wavelength coherent optical connectivity to support their interconnection.

Lisa Huff, Omdia’s senior principal analyst covering optical components will keep an eye out for whether 800G and 1.6T transmission will show up next in data centers. “We are in the middle of 400G deployment inside the data center and, as always, there is much hype around what the next data rate will be,” she writes.

“Omdia expects to see 2x400G and 8x100G solutions start to be deployed inside the data center in 2023, but we will not see high-volume deployment until about 2025 when DR4 and FR4 variants mature and 400G starts to slow down,” she writes. Deployments of 1.6T may start in 2026, but Huff said it might be 2027 or later before we see significant volume.

Coherent routing:

Omdia Senior Principal Analyst Timothy Munks said that with data traffic growing at the network’s edge, network operators are looking for better solutions to collect and move that data into metro and core networks.

“The convergence of IP and optical, or coherent routing, provides cost effective aggregation and transport of diverse traffic streams and offers network operators a pure pay-as-you-grow business model for adding capacity,” he writes.

In this video, Cisco’s Bill Gartner, SVP/GM Optical Systems & Optics, chats with Phil Harvey to discuss their Leading Lights Award and how Routed Optical Networking is transforming infrastructure and the economics of the network.

References:

Have we come full circle – from SD-WAN to SASE to SSE? MEF’s SD-WAN and SASE standards

Backgrounder – SD-WAN and SASE:

A software-defined wide area network (SD-WAN) uses software-defined network technology, mostly to communicate over the Internet using overlay tunnels which are encrypted when destined for internal organization locations. If standard tunnel setup and configuration messages are supported by all of the network hardware vendors, SD-WAN simplifies the management and operation of a WAN by decoupling the networking hardware from its control mechanism. This concept is similar to how software-defined networking implements virtualization technology to improve data center management and operation.[1] In practice, proprietary protocols are used to set up and manage an SD-WAN, meaning there is no decoupling of the hardware and its control mechanism.

A key application of SD-WAN is to allow companies to build higher-performance WANs using lower-cost and commercially available Internet access. That enables businesses to partially or wholly replace more expensive private WAN connection technologies such as MPLS. When SD-WAN traffic is carried over the Internet, there are no end-to-end performance guarantees. In sharp contrast, Carrier MPLS VPN WAN services are not carried as Internet traffic, but rather over carefully-controlled carrier capacity, and do come with an end-to-end performance guarantee.

Gartner’s 2022 SD-WAN Magic Quadrant report identified Cisco, Fortinet, VMware, Palo Alto Networks, Hewlett Packard Enterprise (HPE) Aruba, and Versa Networks as market leaders. The analyst firm estimates the top 10 vendors make up more than 80% of the market. To determine SD-WAN leaders, Gartner reviewed vendors’ product capabilities such as the ability to operate as a branch office router, and having a centralized management for devices, zero-touch configuration, and VPN with a basic firewall. The analyst firm also reviewed vendors’ business and financial performance based on their volume of customers, sites, and contracts.

Gartner coined the acronym SASE (Secure Access Service Edge) in an August 2019 report The Future of Network Security in the Cloud and expanded its functionality in their 2021 Strategic Roadmap for SASE Convergence. SASE combines network security functions (such as SWG, CASB, FWaaS and ZTNA), with WAN capabilities (e.g. SD-WAN) to support businesses’ secure access needs. Previously, security for SD-WAN was an open, unresolved issue.

SASE is a holistic framework that brings security and networking connectivity together through a cloud-centric base. Businesses can save equipment, human and financial resources thanks to SASE’s underlying cloud design, and they can scale performance with minimal hardware needs.

Omdia Analyst Fernando Montenegro describes SASE as a “framework architecture, not a solution.”

MEF SD-WAN and SASE Standards:

In August 2019, the MEF published the industry’s first global standard defining an SD-WAN service and its service attributes. SD-WAN Service Attributes and Services (MEF 70). The MEF SD-WAN standard describes requirements for an application-aware, over-the-top WAN connectivity service that uses policies to determine how application flows are directed over multiple underlay networks irrespective of the underlay technologies or service providers who deliver them. However, it does not address interoperability because it does not specify either a UNI or NNI protocol stack.

MEF 70 defines:

- Service attributes that describe the externally visible behavior of an SD-WAN service as experienced by the subscriber.

- Rules associated with how traffic is handled.

- Key technical concepts and definitions like an SD-WAN UNI, the SD-WAN Edge, SD-WAN Tunnel Virtual Connections, SD-WAN Virtual Connection End Points, and Underlay Connectivity Services.

SD-WAN standardization offers numerous benefits that will help accelerate SD-WAN market growth while improving overall customer experience with hybrid networking solutions. Key benefits include:

- Enabling a wide range of ecosystem stakeholders to use the same terminology when buying, selling, assessing, deploying, and delivering SD-WAN services.

- Making it easier to interface policy with intelligent underlay connectivity services to provide a better end-to-end application experience with guaranteed service resiliency.

- Facilitating inclusion of SD-WAN services in standardized LSO architectures, thereby advancing efforts to orchestrate MEF 3.0 SD-WAN services across automated networks.

- Paving the way for creation and implementation of certified MEF 3.0 SD-WAN services, which will give users confidence that a service meets a fundamental set of requirements.

Last year MEF introduced an updated version of its SD-WAN standard, MEF 70.1, which added critical enhancements. MEF is also currently at work on version MEF W70.2 and MEF W119 Universal SD-WAN Edge, which will address the need for interoperability, among other things.

In December 2022, MEF published two Secure Access Service Edge (SASE) standards defining 1.] SASE service attributes, common definitions & a framework and 2.] a Zero Trust framework that together allow organizations to implement dynamic policy-based actions to secure network resources for faster decision making and implementation for enterprises. MEF’s SASE standard defines common terminology and service attributes which is critically important when buying, selling, and delivering SASE services. It also makes it easier to interface policy with security functions for cloud-based cybersecurity from anywhere. MEF’s Zero Trust framework defines service attributes to enable service providers to implement and deliver a broad range of services that comply with Zero Trust principles.

- SASE Service Attributes and Service Framework Standard: specifies service attributes to be agreed upon between a service provider and a subscriber for SASE services, including security functions, policies, and connectivity services. The standard defines the behaviors of the SASE service that are externally visible to the subscriber irrespective of the implementation of the service. A SASE service based upon the framework defined in the standard enables secure access and secure connectivity of users, devices, or applications to resources for the subscriber. MEF’s SASE standard (MEF 117) includes SASE service attributes and a SASE service framework.

- Zero Trust Framework for MEF Services: The new Zero Trust Framework for MEF Services (MEF 118) defines a framework and requirements of identity, authentication, policy management, and access control processes that are continuously and properly constituted, protected, and free from vulnerabilities when implemented and deployed. This framework also defines service attributes, which are agreed between a subscriber and service provider, to enable service providers to implement and deliver a broad range of services that comply with Zero Trust principles.

–>PLEASE SEE Pascal Menezes CTO of MEF COMMENTS BELOW THIS ARTICLE.

………………………………………………………………………………………………………………………………………………………………………………..

Enter SSE (Secure Service Edge):

In it’s above referenced 2021 report, Gartner defined SSE (Secure Service Edge) which is a separate entity that doesn’t include SD-WAN. “SSE is the security components of SASE focusing largely on the cloud access security broker, secure web gateway, and zero-trust network access products to enable secure use of the internet and cloud services for a hybrid workforce working from anywhere,” Gartner analyst Charlie Winckless told SDxCentral.

Telefónica tapped cloud security vendor Zscaler to develop a new managed SSE platform in a bid to address changing workforce dynamics and cloud consumption. The announcement illustrated a growing trend around the Gartner-coined product category, in which cloud security and SASE vendors alike announce “new” products and services around the buzzword.

But for the most part, these SSE products aren’t so much new as they’re rebranded and repackaged SASE services that’ve been stripped of their SD-WAN capabilities, if they ever had them in the first place. Zscaler’s SSE is built around the same Zscaler Internet Access and Zscaler Private Access products that, just a few months ago, it was calling SASE.

“The contrast is that SASE focuses on a user’s secure access needs as a part of the solution. SSE, on the other hand, mainly focuses on cloud-centric security services for the protection of users,” according to Juta Gurinaviciute, Forbes Councils Member and CTO for NordLayer, a remote access security provider. Gurinaviciute explained that SSE is SASE minus SD-WAN. SSE is essentially a way for enterprises to focus more on cloud-based security as a stepping stone to a full SASE service. She wrote:

As per Gartner’s suggestion, some companies may select a single-provider SASE offering, while others prefer partnered SD-WAN and SSE offerings from separate providers based on companies’ needs. Your business may have already invested in SD-WAN in advance. SSE would be a more meaningful choice in the short-term in such a case. If your company’s current setup doesn’t need SD-WAN, security may be a much more urgent requirement, in which case SSE would make more sense. Even if your organization only has a single regional branch or a simple branch, SSE may still be helpful.

Considering all of these reasons, SASE, the implementation of which may seem challenging and daunting for security professionals, can be done much faster with SSE adaptation first. The journey can be completed much more smoothly using this option, and SSE may benefit a wide range of companies that need robust protection.

“I think everybody’s really excited about SASE because enterprises keep asking about it,” Omdia Analyst Adeline Phua told Light Reading in a recent podcast. “It’s got so much buzz in the market.” However, Phua found that excitement about SASE/SSE hasn’t necessarily equated to mass adoption of the service. “We’re thinking that maybe adoption is really hitting that tipping point, only to find out when we talk to service providers and to enterprises that the adoption is really not there yet,” she added.

A Dell’Oro group July 2022 report found that the SSE market grew 40% year-over-year to more than $800 million in the first quarter. A December report noted that SSE achieved its tenth consecutive quarter of sequential revenue expansion in 3Q-2022. Dell’Oro’s Director of Network Security, SASE, and SD-WAN Mauricio Sanchez said the strong growth is a testament to more enterprises preferring cloud-delivered security over traditional on-premises solutions. Sanchez told SDX Central: “The growth factors that have existed largely since the pandemic started are still with us. That’s the shift to hybrid work, the shift of workloads to the cloud, and the importance of the digital experience.”

While Dell’Oro forecasts the overall SASE market to grow to $8 B for the full year 2023, an Omdia survey found that SD-WAN is only expected to achieve 87% market penetration at the end of 2023. Omdia’ Phua says that enterprises which are using SD-WAN aren’t deploying it at all their sites. Part of the problem stems from supply chain challenges triggered by COVID-19 which have resulted in a shortage of products and SD-WAN deployment delays.

Where service providers can make progress in assisting their enterprise customers’ adoption of SASE is by providing it as a managed service with significant value add “on top of just the staff, the platform itself,” explained Omdia’s Fernando Montenegro. That might look like providing more visibility into network health and potential security threats.

Phua echoed Montenegro’s assessment: “Service providers will still need to keep looking out for new innovations and what else can we onboard to make sure that is a more complete solution for the enterprise customers. So there’s still a lot of way to go in terms of this journey.”

References:

https://en.wikipedia.org/wiki/SD-WAN#

https://www.gartner.com/en/documents/3957375

https://www.gartner.com/en/documents/3999828

https://www.lightreading.com/sd-wan/looking-ahead-sase-is-too-messy/a/d-id/782090?

Dell’Oro: SASE Market grew 33% in 2022; forecast to hit $8B in 2023

Gartner: SASE tops Gartner list of 6 trends impacting Infrastructure & Operations over next 12 to 18 months

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

Enterprises Deploy SD-WAN but Integrated Security Needed

MEF survey reveals top SD-WAN and SASE challenges

MEF New Standards for SD-WAN Services; SASE Work Program

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

ITU-T: 25 years of increasing fixed-broadband speeds over copper and fiber optic networks

by ITU News

The ITU Telecommunications standardization (ITU-T) working groups on broadband access over metallic conductors (Q4/15) and optical systems for fiber access networks (Q2/15), established in 1997 (25 years ago), laid the foundations for fixed broadband and have since then facilitated the meteoric rise in access speeds. Both groups are part of ITU-T Study Group 15, which looks at networks, technologies and infrastructures for transport, access and home.

DSL: ITU-T Q4/15 was formed to make DSL globally scalable:

“What followed was a 25-year journey of dedicated engineers fighting physics for ever-higher broadband speeds, through several generations of ITU-standardized DSL technology,” says Q4/15 Rapporteur Frank Van der Putten (a strong colleague of this author from 1996-2002 when both of us worked on ADSL and VDSL standards in T1E1.4 and the ADSL Forum).

Building on prior work by Alliance for Telecommunications Industry Solutions (ATIS) committee T1E1.4 and European Telecommunications Standards Institute (ETSI) working group TM6, the DSL technologies standardized by ITU now connect over 600 million homes and businesses to the Internet.

“DSL changed the world by enabling mass-market broadband,” Van der Putten says.

DSL enabled rapid broadband deployment at low cost because it used the existing telephone wires to the home.

“Championed at first by an impassioned few, continually provoking debates among Q4/15 experts, it has been an intellectual catalyst for the advancement of communications technology,” he adds. “We are proud to have played a part in that.”

While ADSL (asymmetric DSL), as defined by ITU in 1999, could deliver 8 megabits per second (Mbit/s), it was followed by ADSL2plus in 2003 at 24 Mbit/s and the very high speed VDSL2 at 70 Mbit/s. With the introduction of vectoring, VDSL2 reached 100 Mbit/s by 2010 and 300 Mbit/s by 2014.

In 2014, G.fast raised the bar to 1 Gbit/s, doubling this to 2 Gbit/s in 2016. Its successor standard, MGfast, achieves an aggregate bit rate up to 8 gigabits per second (Gbit/s) in Full Duplex mode and 4 Gbit/s in Time Division Duplexing mode.

The architecture standards for DSL, G.fast and MGfast were defined by the Broadband Forum (once known as the ASDL forum), which also plays a key part in promoting interoperability.

Van der Putten explains: “Both technologies intend to meet service providers’ need for a complement to the fibre-to-the-home technologies in scenarios where G.fast or MGfast prove the more cost-efficient strategy.”

The continual upgrading of ITU’s standards has also sparked huge upward revisions in forecasts for the life left in traditional telephone wiring.

Future directions for Q4/15 work include G.fast-based backhaul, MGfast at aggregate data rates of 10 Gbit/s, and ultra-low latency transmission optimized for 5G wireless back/mid-haul, he says.

…………………………………………………………………………………………………………………………………………………………………………………………………………

Cost-efficient fiber access – PON and FTTH:

ITU-T Q2/15 paved the way for passive optical network (PON) technologies as a highly cost-efficient means of enabling FTTH. Optical access networks now serve over a billion users worldwide, mostly based on PON. Q2/15 works closely with Full Service Access Network (FSAN), which collects system requirements from operators to determine common requirements for ITU standards.

“The result has been systems ideally suited for a large group of networks and applications,” says Q2/15 Rapporteur Frank Effenberger.

“The first widely deployed system, G-PON [Gigabit PON], is found almost everywhere now,” he adds.

Q2/15 has developed seven generations of PON systems. The first, pi-PON, operated at 50 Mbit/s. This was followed by A-PON (155 Mbit/s), B-PON (622 Mbit/s), G-PON (2.5 Gbit/s), XG(S)-PON (10 Gbit/s), and NG-PON2 (4 x 10 Gbit/s).

To provide the basis for interoperability, ITU standards specify the control system for PON systems. Q2/15 has also developed a range of implementer’s guides and works closely with FSAN, ATIS, and the Broadband Forum to foster common designs and interoperability.

From 10 to 50 Gbit/s PONs:

Demand for higher capacity keeps growing fast. Optical access solutions also support 5G wireless communications and innovation for smart cities and factories.

“What we are seeing is a gradual evolution from G-PON to XG-PON [a 10G, or 10 Gbit/s, network] and XGS-PON [a 10G symmetric network], which is now being deployed at scale in many countries,” says Effenberger.

The latest generation of ITU-standardized PON, known as “Higher Speed PON”, provides for speeds of 50 Gbit/s per wavelength, up from the 10 Gbit/s of its predecessors. Market demand for Higher Speed PON is expected to begin in 2024.

“Given the large size and cost of the fixed access network, upgrades generally come once per decade,” says Effenberger.

Higher Speed PON includes both single-channel 50 Gbit/s systems to succeed XG(S)-PON and multi-channel 50 Gbit/s systems to succeed today’s NG-PON2 – a 40G PON that operates at 10Gbit/s per wavelength.

Although Higher Speed PON offers a five-fold capacity increase over its predecessors, it has been designed to work with the same fibre plant as G-PON, XG(S)-PON and NG-PON2.

“A successful technology requires a coincidence of both technical feasibility and strong global market demand,” notes Effenberger. “We strongly believe that 50G PON will provide the right capacity, at the right price, and at the right time.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

All-fiber future at Gbit/s speeds:

Q2/15 aims to continue delivering higher-capacity PON solutions, such as a multi-wavelength version of Higher Speed PON, and speeds even higher than 50 Gbit/s on a single wavelength. But passive networks cannot handle all foreseen demand.

“Certain applications will require more dedicated and higher-capacity solutions than PON,” says Effenberger, highlighting the motivations behind Q2/15’s development of various point-to-point bidirectional optics with speeds of 1 Gbit/s, 10 Gbit/s, 25 Gbit/s, and 50 Gbit/s.

Q2/15 continues to study 100 Gbit/s transmission and point-to-point wavelength connections over a shared optical distribution network based on wavelength division multiplexing. “These are likely to find use in wireless fronthaul applications, given their exacting latency requirements,” says Effenberger.

References:

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T and a unit of investment titan BlackRock will form a joint venture to operate a commercial fiber-optic platform, with AT&T as its first wholesale tenant. The objective is to further propel AT&T’s fiber ambitions outside of the carrier’s traditional 21-state wireline footprint and move on AT&T’s long-simmering fiber expansion plans. The newly formed joint venture (JV) — Gigapower, LLC — expects to provide a best-in-class fiber network to internet service providers (ISPs) and other businesses across the United States.

The Gigapower joint venture will operate the commercial fiber service. That service – not to be confused with AT&T’s previous “GigaPower” broadband offering – will be targeted at internet service providers (ISPs) and enterprises.

BlackRock’s work in the venture will be through its Alternatives division and through a fund managed by its Diversified Infrastructure business. That business recently raised $4.5 billion in initial investor commitments. AT&T executive veteran Bill Hogg was named CEO of Gigapower.

The JV’s initial plans are to deploy a multi-gigabit fiber network to 1.5 million customer locations using a commercial open access platform. This will be incremental to AT&T’s own fiber deployment plans targeted at reaching more than 30 million locations within its 21-state wireline footprint by the end of 2025. The JV will tap into AT&T’s nationwide 5G wireless service to support sales outside of its traditional wireline footprint. This will allow it to take advantage of AT&T’s already established enterprise arrangements and more quickly get a sales channel up and running.

“Now more than ever, people are recognizing that connecting changes everything,” said John Stankey, CEO of AT&T. “With this joint venture, more customers and communities outside of our traditional service areas will receive the social and economic benefits of the world’s most durable and capable technology to access all the internet has to offer.”

“We are excited to form the Gigapower joint venture in partnership with AT&T, which will be serving as not only a joint owner but also the first wholesale tenant. We believe Gigapower’s fiber infrastructure designed as a commercial open access platform will more efficiently connect communities across the United States with critical broadband services,” said Mark Florian, Global Head of Diversified Infrastructure, BlackRock. “We look forward to partnering with Gigapower’s highly experienced management team to support the company’s fiber deployment plans and shared infrastructure business model.”

Gigapower plans to deploy a reliable, multi-gig fiber network to an initial 1.5 million customer locations across the nation using a commercial open access platform. The Gigapower fiber deployment will be incremental to AT&T’s existing target of 30 million-plus fiber locations, including business locations, by the end of 2025. Combined with existing efforts within AT&T’s 21-state footprint, this capital efficient network deployment will advance efforts to bridge the digital divide, ultimately helping to provide the fast and highly secure internet people need. This network expansion will also help spur local economies in each of the communities in which Gigapower operates.

“Fiber is the lifeblood of digital commerce,” said Bill Hogg, CEO of Gigapower. “We have a proven team of professionals building this scalable, commercial open access wireline fiber network. Our goal is to help local service providers provide fiber connectivity, create the communications infrastructure needed to power the next generation of services and bring multi-gig capabilities to help close the gap for those who currently are without multi-gig service.”

Tammy Parker, Principal Analyst at GlobalData, a leading data and analytics company, wrote:

“AT&T is pursuing a shrewd path to extend its fiber footprint nationwide without assuming all the risk by itself. Although the new Gigapower platform will be operated as a joint venture with BlackRock, offering commercial open access to not only AT&T but also other internet service providers and businesses, the carrier’s influence features prominently: the moniker ‘GigaPower’ was formerly applied to AT&T’s fiber-based service, which was renamed ‘AT&T Fiber’ in October 2016.

“The Gigapower platform will serve customers outside of AT&T’s traditional 21-state wireline footprint, and as the platform’s first wholesale tenant AT&T will be able to sell fiber service in more wireline markets, complement its nationwide mobile service footprint, and enable the carrier to market fixed-mobile service bundles in those markets. Over time, AT&T should be able to leverage this dual-technology capability to not only attract new customers and revenue streams, but also increase customer retention as subscribers who take multiple services from a carrier tend to be ‘stickier’ and less likely to stray to a rival service provider.

“The AT&T and BlackRock JV poses a competitive challenge to cable providers and regional fiber providers, whose broadband reaches are geographically restricted, though those carriers could possibly become tenants on the open access Gigapower platform to extend their own footprints.

“Gigapower will also help AT&T extend its fiber offerings to compete against the highly successful fixed wireless access (FWA) services being marketed by rivals T-Mobile US and Verizon to residential and business broadband customers both inside and outside of AT&T’s existing wireline service area. However, unlike FWA services, which can ride on top of existing mobile network coverage and are often self-installable, fiber requires the deployment of new infrastructure and truck rolls to the premises to be served, impacting time to market for AT&T and BlackRock’s ambitious plan. Additionally, Gigapower’s initial footprint will cover only 1.5 million customer locations, and it is unclear what the deployment timeline will be.

“After largely extracting itself from its previous foray into entertainment, AT&T continues doubling down on its broadband focus, committing to both 5G and fiber nationwide. AT&T’s JV with BlackRock has the potential to alter the broadband landscape, not only by enabling AT&T to market fiber in more markets but also by providing a platform for public-private broadband partnerships between Gigapower and local municipalities. However, it will take time to see results from this long-term play.”

References:

https://www.sdxcentral.com/articles/analysis/att-bags-blackrock-for-gigapower-fiber-jv/2022/12/

Ovzon receives an order from Swedish Space Corporation for SATCOM-as-a-Service

Satellite hardware company Ovzon today received an order from their new partner Swedish Space Corporation (SSC), for Ovzon’s SATCOM-as-a-Service [1.]. The initial contract covers a period during the first half of 2023.

Ovzon’s SATCOM-as-a-Service is the markets leading integrated solution. It combines Ovzon’s ultra-small mobile satellite terminals, highly resilient and high-performance satellite networks, and the best-in-industry service and support from Ovzon’s Network Operations Center (NOC).

Note 1. SATCOM-as-a-Managed Service is an end-to-end turnkey service for high-throughput connectivity that can support the demands of users on base, at varied tactical locations and during critical missions — anytime and anywhere.

With this contract, Ovzon deepens its collaboration with SSC, which acts both as the main party in the dialogue with customers, mainly within the Swedish government, and as a partner in the delivery of the service. Both are important parts of the end-to-end solution that has now been created to meet the specific and critical needs of these end customers.

“We are very happy and proud to receive this first order in collaboration with SSC. We provide the customer with a world-leading all-Swedish and highly efficient satellite communication service based on Swedish technology and innovation. The service enables a new level of capability needed in a world of heightened geopolitical unrest. Of course, we also hope for continued cooperation around our satellite Ovzon 3 and its unique features with increased mobility, performance, and resiliency. Ovzon 3 will further strengthen the ability of customers who must be able to conduct vital societal functions and protect critical infrastructure during operations in complex and vulnerable situations”, says Per Norén, CEO of Ovzon.

The Ovzon T5 is an all-in-one, laptop-sized broadband terminal providing access to the high throughput Ovzon satellite service as per this image:

In January 2022, Ovzon secured a $9.8 million contract for 14 months of Satcom as a Service (SaaS) for the Italian Fire and Rescue Service. The service will equip the Italian Fire and Rescue Service with a communications network that can support data and voice communications, and high-definition video streaming.

“Fires are an increasing threat in Italy, as climate change factors become visible in areas such as the Mediterranean. The complexity and risk to safety and rescue and disaster recovery operations requires reliable and fast communication and Ovzon’s satellite communication solution is a perfect solution for this need,” said Gaetano Morena, CEO of Gomedia Satcom.

About Ovzon:

Ovzon offers world-leading mobile satellite communications services, SATCOM-as-a-Service, to customers across the globe. The services combine high data speed with high mobility. Ovzon’s SATCOM-as-a-Service meets the growing demand for global connectivity for customers with high performance and security requirements such as Defense, Emergency Services, NGOs, Media and Commercial organizations. Ovzon was founded in 2006 and has offices in Stockholm, Sweden, Herndon, VA and Tampa, FL in the USA. Ovzon is listed on Nasdaq Stockholm Mid Cap. For more information visit www.ovzon.com.

For further information, please contact: Per Norén, CEO, [email protected], +1 206 931 7232

References:

Hindu businessline: Indian telcos deployed 33,000 5G base stations in 2022

As 2022 nears an end, India based telcos like Reliance Jio and Bharti Airtel have deployed about 33,000 base stations for 5G services. Sources in India’s Department of Telecommunications told businessline that the telcos deployed around 10,000 base stations in December, taking the cumulative number of base stations deployed for 5G services to about 33,000.

[For another report on 5G base stations in India see; 20,980 base stations installed for 5G, about 2,500 being set up per week, Government tells Rajya Sabha | Headlines (devdiscourse.com)]

Telecom operators commenced deploying the 5G network after Prime Minister Narendra Modi inaugurated 5G services on October 2. Only Reliance Jio and Bharti Airtel have commenced 5G capex, as debt-laden Vodafone Idea is still trying to raise additional funds to commence capital expenditure for its 5G network.

Quoting the Ministry of Communications report to the Rajya Sabha, businessline reported last week that the telcos had deployed about 21,000 base stations for 5G services till November 26. According to senior DoT officials, the telcos have added more than 10,000 additional base stations to that number.

Since operators need to deploy 2–6 base stations per tower, the number of telecom towers for 5G has not increased substantially in the past three months. The two operators alone would have deployed 3,000 to 4,000 telecom towers for 5G services.

While telcos have commenced deploying 5G towers in the majority of Indian States, the national capital Delhi is experiencing the fastest deployment of 5G services. Almost a third of all the base stations deployed are located in Delhi. Therefore, users in Delhi NCR will experience the best 5G services.

References:

Telecom operators deploy 33,000 5G base stations this year – The Hindu BusinessLine

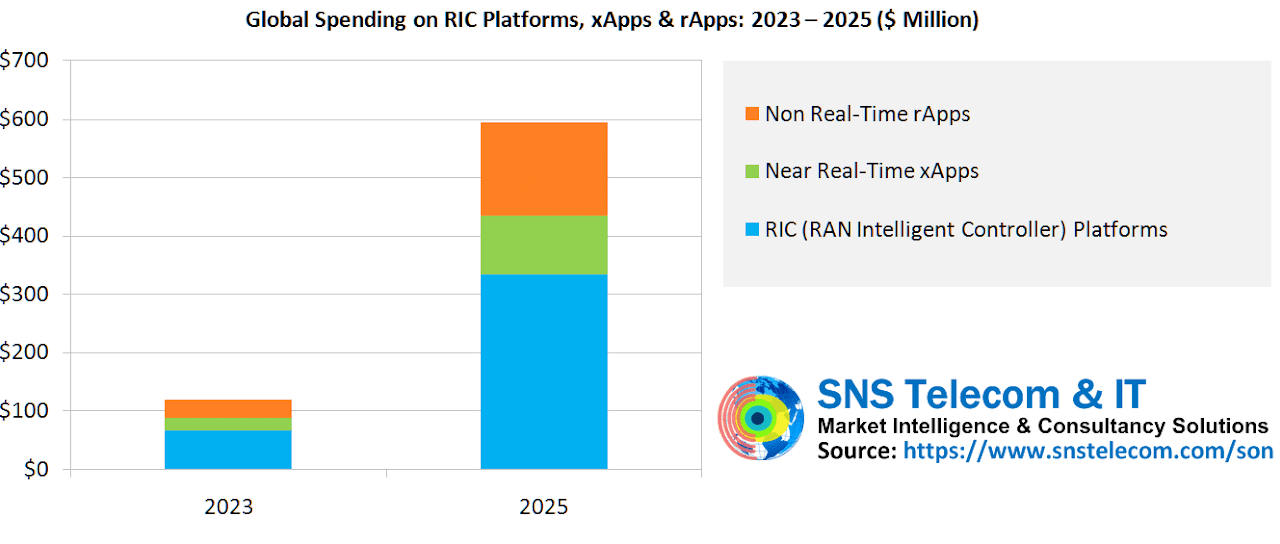

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

Global spending on Open RAN compliant RIC (RAN Intelligent Controller) platforms, xApps and rApps will reach nearly $600 Million by the end of 2025, according to a new report by SNS Telecom & IT. The market research and consulting firm estimates that global spending on RIC platforms, xApps and rApps will reach $120 Million in 2023 as initial implementations move from field trials to production-grade deployments. With commercial maturity, the submarket is further expected to quintuple to nearly $600 Million by the end of 2025.

Annual investments in the wider SON (Self-Organizing Network) [1.] market – which includes licensing of embedded D-SON features, third party C-SON functions and associated OSS platforms, in-house SON capabilities internally developed by mobile operators, and SON-related professional services across the RAN, mobile core and transport domains – are expected to grow at a CAGR of approximately 7% during the same period.

Note 1. SONs (Self-Organizing Networks) are radio access networks (RANs) that automatically plan, configure, manage, optimize, and heal themselves. SONs can offer automated functions such as self-configuration, self-optimization, self-healing, and self-protection.technology minimizes the lifecycle cost of running a mobile network by eliminating manual configuration of network elements at the time of deployment right through to dynamic optimization and troubleshooting during operation. Besides improving network performance and customer experience, SON can significantly reduce the cost of mobile operator services, improving the OpEx-to-revenue ratio and deferring avoidable CapEx. SONs strive to make complicated network administration a thing of the past by enabling the creation of a plug-and-play environment for both simple and complex network tasks.

…………………………………………………………………………………………………………………………………………………………………….

- AT&T is among the first mobile operators to invest in the development of Open RAN-aligned RIC functionality and associated applications – particularly xApps for real-time RAN control and optimization. Since 2019, the operator has been collaborating with Nokia and other partners to co-develop an RIC software platform and identify xApp use cases, in alignment with the O-RAN Alliance architecture, to enable RAN programmability for easy integration of new services, as well as AI (Artificial Intelligence) and ML (Machine Learning)-driven algorithms for automated optimization. At present, the mobile operator is trialing interference management, traffic steering and energy savings-related xApps across a 200-cell site cluster in New Jersey.

- As a precursor to rApp capabilities, rival operator Verizon has deployed Qualcomm’s RAN automation platform that uses AI/ML-driven algorithms to automate the optimization of new 5G NR cell sites and simplify the development of custom SON applications for its wireless network.

- New entrant DISH Network Corporation is trialing VMware’s RIC as the platform on top of which RAN applications will run. Through the trial, DISH will specifically evaluate VMware’s RIC on its ability to create custom solutions from a vibrant ecosystem of xApps and rApps, use RAN programmability and intelligence for network automation, and enhance security to monitor and protect RAN traffic at the point it enters the network.

Europe

- In Europe, Vodafone is actively investing in RIC applications within the framework of its wider Open RAN initiative. The mobile operator group – in collaboration with Cohere Technologies, VMware, Capgemini Engineering, Intel Corporation and TIP (Telecom Infra Project) – has successfully completed a multi-vendor PoC (Proof-of-Concept) trial, which demonstrated a two-fold increase in the capacity of a 5G NR cell site using a programmable, AI-based RIC platform supporting a mix of Open RAN components from multiple vendors. As part of the trial, Vodafone used Cohere’s Spectrum Multiplier xApp running on VMware’s distributed RIC to enable more efficient use of spectrum through a novel MU-MIMO (Multi-User MIMO) scheduler.

- In addition, Vodafone is collaborating with Juniper Networks and Parallel Wireless to carry out a multi-vendor RIC trial for tenant-aware admission control use cases using Open RAN standards-compliant interfaces. The trial is initially running in Vodafone’s test labs in Türkiye with plans to move into the mobile operator group’s test infrastructure.

- DT (Deutsche Telekom) is hosting the SD-RAN outdoor field trial in Berlin, Germany, that integrates the ONF’s (Open Networking Foundation) near real-time RIC and end-to-end 5G platform with Open RAN components from various vendors, including xApps for controlling RUs (Radio Units), DUs (Distributed Units) and CUs (Central Units). As part of a separate effort, DT has been collaborating with VMware and Intel Corporation to develop, test and validate an open-standards compliant intelligent vRAN solution, which also features an RIC element.

- Telefónica’s German business unit has connected a Nokia-supplied RIC to a mobile communications cluster – initially spanning 11 RAN nodes supporting 5G NR, LTE and 2G coverage in Berlin’s Hellersdorf district – within its live commercial network. In the initial “learning” phase of operation, the RIC will continuously analyze network data to detect unusual behavior of radio cells. In the second phase, the near-real-time RIC will take AI-driven decisions to dynamically balance the load of the radio cells, selecting optimum parameters from the network data obtained and continuously adjust them in near real-time. Since 2021, Telefónica has also been collaborating with NEC Corporation in validating and implementing cutting-edge Open RAN technologies and various use cases at its lab in Madrid, Spain, including AI-driven RIC applications for RAN optimization.

- BT Group is trialing Nokia’s Open RAN standards-compliant RIC platform across a number of sites in the city of Hull (East Riding of Yorkshire, England), United Kingdom, to optimize network performance for customers of the EE mobile network. French telecommunications giant Orange is also evaluating Open RAN standards-compliant RIC, xApps and rApps provided by various suppliers.

- In Asia, Japan’s Rakuten Mobile is embedding Juniper Networks’ RIC solution into its operating platform to support RAN automation and optimization-related applications.

- NTT DoCoMo is collaborating with NEC Corporation and NEC’s subsidiary Netcracker to jointly develop a RIC platform aimed at improving performance, enhancing customer experience, reducing power consumption and minimizing operational costs.

- Rival Japanese mobile operator KDDI has been collaborating with Samsung to trial various E2E (End-to-End) network slicing-related use cases with an RIC platform in Tokyo, Japan.

- China Mobile has also been working with multiple equipment vendors and third-party suppliers to develop and implement Open RAN standards-compliant RIC, xApps and rApps. Among other engagements, the mobile operator has collaborated with Nokia to carry out a field trial of an AI-powered RAN over its live commercial LTE and 5G NR network infrastructure. Specifically, the trial evaluated AI-based UE traffic prediction in Shanghai and an ML-enabled network anomaly detection solution across more than 10,000 4G/5G cells in Taiyuan.

The “SON (Self-Organizing Networks) in the 5G & Open RAN Era: 2022 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the SON market, including the value chain, market drivers, barriers to uptake, enabling technologies, functional areas, use cases, key trends, future roadmap, standardization, case studies, ecosystem player profiles and strategies. The report also provides global and regional market size forecasts for both SON and conventional mobile network optimization from 2022 till 2030, including submarket projections for three network segments, six SON architecture categories, four access technologies and five regional submarkets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

The report will be of value to current and future potential investors into the SON and wider mobile network optimization market, as well as SON-x/rApp specialists, OSS and RIC platform providers, wireless network infrastructure suppliers, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “SON (Self-Organizing Networks) in the 5G & Open RAN Era: 2022 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: https://www.snstelecom.

For a sample of the report please contact: [email protected]

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 5G, LTE, Open RAN, private cellular networks, IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies, and vertical applications.

References:

https://www.snstelecom.com/ric-xrapps

https://www.celona.io/network-architecture/self-organizing-network

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

StrandConsult: 2022 Year in Review & 2023 Outlook for Telecom Industry

Selected Comments by John Strand, CEO of StrandConsult:

Spectrum:

While we can fault the Chinese government for its authoritarian ways, it deserves credit for allocating the right radio spectrum frequencies to its best technological use in the case of 5G. Simply put, if you want to deploy 5G, you need mid-band spectrum in the 2.6-6 GHz range, the frequencies which maximize data transmission across distance. This is nothing more than basic physics and technocratic management, but US policymakers are failing on this front.

As of this writing the US Congress still has not reauthorized the auction authority of the Federal Communications Commission (FCC). To align the incentives and economics to best serve Americans, the FCC should have perpetual auction authority. Today the FCC only received a 3-month extension, which expire in March 2023!.

It’s hard to contemplate a modern nation being so irresponsible. We are talking about the ability of the US government to raise hundreds of billions of dollars being put on ice because the Defense Department can’t modernize. Simply put, the US military lost its spectrum edge by waging wars with non-peers for two decades. Instead of upgrading to the most spectrally-efficient tools on the appropriate frequency, the Pentagon is entrenched with bloated legacy systems on the mid-band beachfront with 12 times the spectrum that’s available for 5G.

It is remarkable that the US has achieved such incredible wireless success to date with the limited access to frequencies. But to compete with China in the future, the US will need a more aggressive approach to making mid-band spectrum available for exclusive licensed use. China has not been so foolish to squander its spectrum resources. It just unveiled a high-power, low-frequency P-band (216-450 MHz) satellite-hunting radar, reported to detect and track low-orbiting satellites and functions around the clock in all weather conditions. Observers dubbed it the “Anti-Starlink” system.

Broadband fair cost recovery:

As countries look at their populations and those who suffer a lack of digital equity, particularly people of color, low-income, and the elderly, they will see that the traditional concept of universal service should come to an end. Taxing broadband subscriptions for the sake of raising money for infrastructure does not scale when it comes to closing the digital divide for the poor.

Making the cost of broadband higher for end users undermines its affordability for the digital poor and disenfranchised. Countries will increasingly look at Big Tech to foot the bill for the unrecovered costs they impose on networks. Closing the digital divide globally and getting some 3 billion people online for the first time are also the goals of the International Telecommunications, now led by a woman for the first time in its history.

South Korea, the world’s #1 broadband nation, has long recognized that content providers have a financial responsibility to ensure the quality and delivery of their data and has had operated a cost recovery regime since 2016. South Korea enjoys the highest adoption of FTTH (86%) and 5G (47%) in part because end users are not forced to bear the full burden of the cost of broadband.

Indeed, Google’s gambit to undermine the policy effort of good faith negotiation for cost recovery backfired. It is a bad look for a company which is the single largest source of traffic in South Korea hijacking the democratic process.

Google Korea launched a series of Google ads against a Korean Assembly bill and enjoined South Korean YouTubers to join. Asia-Pacific Vice President for YouTube Gautam Anand warned that the bill would “penalize the companies that provide the content, and the creators who share a living with them.” Some 265,000 YouTubers signed the petition.

However Google’s lobbying practices came under fire in one Assembly hearing which revealed that South Korea’s leading internet advocacy non-profit OpenNet, which was founded with Google as the sole sponsor, received some $10 million to espouse favorable policy. Lawmakers questioned the relationship for what appeared to be lobbying efforts outside the organization’s remit and an official financial disclosure from the organization that noted a far lower figure than the actual gift from Google.

Big Tech may grumble about not getting to free access to networks, but they are enjoying record profits in the country. Google Korea reported its 2021 sales grew almost a third over the prior year to 292.3 billion won with 88 percent operating profit.

Netflix, another person non grata that enjoys record profits in South Korea, declares that it has “no obligation to pay for or to negotiate for the use of” another’s network. Strand Consult has detailed the Scrooge-worthy saga of Netflix’s litigation against a local broadband provider in Netflix v. SK Broadband. The David and Goliath Battle for Broadband Fair Cost Recovery in South Korea.

In the US, there is bipartisan Congressional support for the FCC to investigate the feasibility of a fair cost recovery regime. With Congress having failed to rein in Big Tech on the antitrust front, fair cost recovery remains one of the few rational, evidence-based methods to address Big Tech’s abuse of market power, namely its perversion of public policy to achieve its corporate goals and the free use of public and private resources.

Economists will have a field day exploring the cost recovery business models: market-based pay as you go (PAYG), ad taxes, usage fees, USF surcharges and so on. While there is no one size fits all for every country, there is an increasingly recognition that broadband policy must evolve. The prevailing models of broadband access where enshrined when email was the killer app of the internet more than 30 years ago. No one knew that video entertainment would become the key use case and account for 80% of the internet’s traffic. It’s time to update policy to reflect reality.

In 2023, Strand Consult will launch an update to its earlier report Middle Mile Economics: How streaming video entertainment undermines the business model for broadband. The new report describes an investigation of 50 broadband providers in 24 US states. It finds that middle mile costs are growing 2-3 times faster than household broadband revenues, that traffic from Big Tech consumes as much as 90 percent of network capacity, and that few, if any, broadband providers have been able to monetize the increase in video streaming entertainment traffic in their network.

Metaverse: Second Life 2.0?

Meta (formerly Facebook) calls its Metaverse, “the future of digital connection…moving beyond 2D screens and into immersive experiences in the metaverse, helping create the next evolution of social technology.” It’s all very exciting, the dream (or nightmare) of science-fiction turned into a commercialized reality of being ever closer to people you don’t know in a digital world. The big question is whether it will become a reality or whether it will be a replay of Second Life, which flopped big time.

To test whether the Metaverse will succeed, try innovation expert Clay Christiansen’s milkshake test. The milkshake test attempts to gauge whether a new product or service can become a reliable, affordable substitute. For example, some order a milkshake for breakfast at the fast-food drive though because it is as filling as breakfast (We are not weighing in on the nutrition here!). The milkshake question whether the firm—Meta–can produce a quasi-food beverage (or experience) such that it gets enough users with the right monetization.

For Strand Consult the more interesting questions are whether Meta will pay for the radio spectrum and infrastructure which the asserted “successor” to the mobile network will require. Meta announced a $19.2B investment in the new online world for 2023. That’s about half of the capex that the world’s mobile operators spend on RAN in a good year.

Few of the people gushing about the marvels of the Metaverse have stopped to think what it would cost, along with the other proposed online “verses”. If you are concerned about online streaming video entertainment consuming as much as 90 percent of internet bandwidth today, how will it be for broadband providers to recover costs when even more data to be pumped into networks? How will such a broadband subscription be price in today’s framework? Is it such that users are asking for every Meta bell and whistle, or do they just want some of the experience? There will need to be some policy innovation and business model upgrade before the Metaverse is real.

Emergence of the Titanium Economy: Over the top vs. Net Centric?

Strand Consult is excited about 5G and the mobile industry’s continuous improvement of its networks. 5G for home broadband, also known as Fixed Wireless Access (FWA), is a game changer and can substitute for wireline broadband in many cases. While the tower is connected to a larger network with wires and/or radio links, no wires are required to the customer’s premises, only a wireless receiving device. FWA is soon expected to account for 10 percent of all US broadband connections.

What’s beyond home broadband is the bigger question for 5G. Many want to see 5G transform industry and bring a new era of advanced healthcare, transportation, and manufacturing. Indeed some leading manufacturers already integrate 5G into their production like John Deere, Bosch, ASML and some carmakers. Even more exciting is the manufacturing renaissance afoot in USA led by small and mid-cap companies earning returns that rival the online tech/software sector. They are not widely known or discussed, but there are some 4000 of them, driving about $200b in revenue. Their startup costs are relatively low, and they take advantage of 5G, and 5G enabled AI, robotics, automation, and cloud computing. Strand Consult’s suggested holiday reading on this topic is The Titanium Economy: How Industrial Technology Can Create a Better, Faster, Stronger America by Nick Santhanam, Gaurav Batra, and Asutosh Padhi.

Strand Consult is keenly interested in the 5G value chain, where monetization will occur, and who will win. The big question is whether operators are positioned to capture the value in applications or services, or whether over the top (OTT) third parties be the winners. If 4G is any guide, the content and application providers took the prize.

Network monetization has long dogged the mobile telecom industry. In 2009, GSMA launched a suplement to premium SMS, a reboot of SMS payment introduced in 1999. However, few or non innovations succeed. Strand Consult’s report OneAPI – Next Generation Value Added Services in the Mobile Industry described many of the challenges to launch this kind of mobile network business models.

Simply put, the long-term trend for consumer monetization by mobile operators goes in a negative direction. It may be a boon for consumers that broadband prices have stayed constant (if not fallen) during this cost-of-living crisis, in the long term it does not scale for mobile operators to continually upgrade networks with better technology if they earn declining returns. This can be improved on the policy front with consolidation, lowering costs so operators can get a better case for investment. Strand Consult suggests that countries should move from 4 to 3 mobile network operator markets, as Strand Consult details in its report Understanding 4 to 3 mobile mergers.

Another needed policy reform is to modernize net neutrality. Strand Consult predicts that policymakers will pick this up in 2023.

Net neutrality:

Following the lead of United Kingdom’s Ofcom which proposes to modernize its rules, Strand Consult predicts that European and Latin American telecom regulators will issue a call for evidence on the performance of net neutrality regulation. Invariably they will find that the policy is failing consumers, innovators, and investors. These countries want to move forward with 5G smart networks, but they have policy designed to maintain a dumb pipe. This can’t be resolved, even with the proffered “5G slicing” techniques.

More important, consumers are denied their freedom of choice by being forced to value all data uniformly and equally when their preferences show that they place different values on different data. Policymakers will see that they are trading away billions of dollars in network investment for the sake of a “look good, feel good policy” which does not serve consumers, startups, or investors. Simply put, no leading 5G nation has hard net neutrality rules, and yet they protect consumers and the ecosystem with competition law and transparency rules. Strand Consult will launch a report on this topic in early 2023. Check out our library of reports and research notes covering this issue for the last decade.

Mobile operators will mature their ESG practices

Green energy consumption is a big deal in broadband. Many mobile telecom operators have formalized in Environmental, Social and Governance (ESG) goals into key performance indicators. Yet the corporate maximization of ESG by some companies has led to “greenwashing”, deceptive marketing to create the illusion of goodness and to hide malpractice perpetuated by ESG practices and regulation.

Politicians, regulators, and business leaders often claim to be focused on sustainability. Yet, few fully appreciate the difference between being truly sustainable and just “less bad”. The traditional ESG metrics of CO2 emissions, energy consumption, etc. are used as proxies for sustainability progress, but often performance is merely incrementally improved and then celebrated as sustainability. This is not sustainable – it is just “less bad” performance, as the negative impact is still there.

As such, the Future-Fit Business Benchmark has emerged for clear, actionable guidance to perform without negatively impacting people, society and the planet. European solar power producer Better Energy uses Future Fit in its provision of Purchasing Power Agreements for certified green energy to mobile telecom operators and content/application companies, and its performance model is likely to be adopted even more widely.

Another key learning is that operating parallel infrastructures with small cells is not sustainable. The business case for small cell is in network sharing. Mobile operators in United Kingdom just announced trials of a shared small cell network which hosts all 4 mobile operators.

Conclusions:

Strand Consult’s Christmas wish is that the war in Ukraine will end in 2023. We have a simple choice in this world: democratic capitalist systems with promote human freedom, rights and flourishing OR totalitarian systems which demand control over public and private life and prohibit opposition. Mobile networks telecom networks improve quality of life for their users. In 2023 Strand Consult will continue its work in policy transparency to ensure that mobile telecom networks have sustainability, security, and integrity.

This past year In 2022 Strand Consult published many research notes and reports, and featured half a dozen industry experts on our guest blog. Strand Consult’s analysis was quoted in some 1000 news stories globally. Our work took us to all the continents but Antarctica. Our readership continues to grow. For the last 22 years, Strand Consult has made predictions for the coming year. You can check our archive to see whether we were right.

Sincerely, John Strand, CEO