Month: July 2014

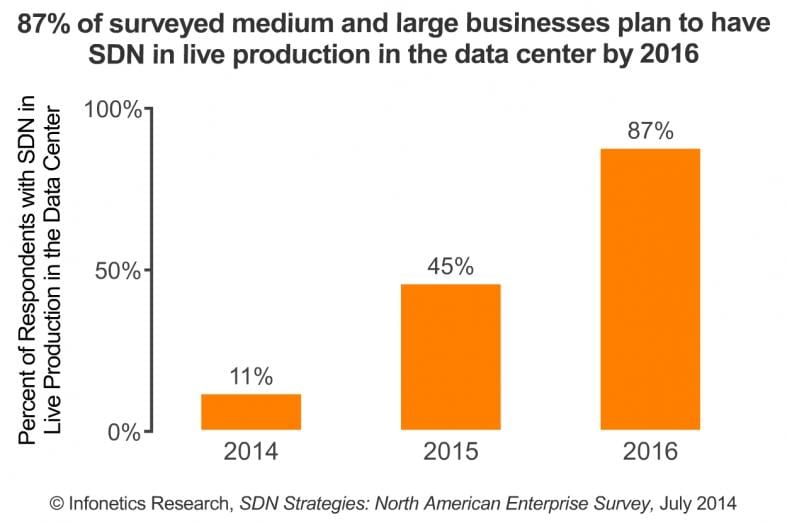

Infonetics survey shows 87% of businesses intend to have SDN live in the data center by 2016 in North America

Infonetics Research released excerpts from its 2014 SDN Strategies: North American Enterprise Survey, which analyzes the trends and assesses the needs of corporate private-network businesses deploying software-defined networking (SDN) in their data centers and campus LANs.

Kim Peinado of Infonetics clarifies the survey results- it is not a forecast!

“We surveyed businesses about their plans and this is what they reported to us. It’s not Infonetics predicting 87% of medium and large businesses planning to have SDN live in the data center by 2016 – it’s businesses we contacted TELLING us that.”

SDN SURVEY HIGHLIGHTS

. Infonetics’ enterprise respondents are expanding the number of data center sites and LAN sites they operate over the next 2 years and are investing significant capital on servers and LAN Ethernet switching equipment

. A majority of survey respondents are currently conducting data center SDN lab trials or will do so this year; 45% are planning to have SDN in live production in the data center in 2015, growing to 87% in 2016 o Respondents’ plans for LAN SDN are nearly identical to their data center plans

. Among respondents, the top drivers for deploying SDN are improving management capabilities and improving application performance, while potential network interruptions and interoperability with existing network equipment are the leading barriers

. Meanwhile, enabling hybrid cloud is dead last on the list of drivers, a sign that SDN vendors have some work to do in educating enterprises that SDN can be an important enabler of hybrid cloud architectures

. On average, 17% of respondents’ data center Ethernet switch ports are on bare metal switches, and only 21% of those are in-use for SDN

. Nearly ¼ of businesses surveyed are ready to consider non-traditional network vendors for their SDN applications and orchestration software

SDN SURVEY SYNOPSIS

For its 42-page SDN enterprise survey, Infonetics interviewed 101 purchase-decision makers at medium and large North American organizations that are implementing software-defined networks (SDNs) now or planning to evaluate SDNs by the end of 2015. The survey provides new data on how the enterprise SDN market is evolving, including insights on the intent of corporate private network buyers to help vendors determine how to invest in product development and position their products in the marketplace. The study delves into deployment drivers and barriers, rollout plans, applications, use cases, vendors installed and under evaluation, and top rated venors.

Analyst Comments:

“Software-defined networking (SDN) spells opportunity for existing and new vendors, and the time to act is now. The leaders in the SDN market serving the enterprise will be solidified during the next two years as lab trials give way to live production deployments in 2015 and significant growth by 2016. The timelines for businesses moving from lab trials to live production for the data center and LAN are almost identical,” notes Cliff Grossner, Ph.D., directing analyst for data center, cloud, and SDN at Infonetics Research. Continues Grossner:

“There’s still some work to do on the part of SDN vendors. Expectations for SDN are clear, but there are still serious concerns about the maturity of the technology and the business case. Vendors need to work with their lead enterprise customers to complete lab trials and provide public demonstrations of success.”

Email from Cliff Grossner received July 29, 2014:

As Kimberly said, we are reporting data shared with us by North American enterprises, not making our own prediction.

The caveats that I would add 1) actual deployments may occur slower that intended, and 2) having SDN live in the DC does not mean that ALL of the network in the DC is SDN.

My interpretation of the result is that after completing the lab and production trials, some portion of the DC network will go in-use for SDN by the survey respondents.

One also needs to look at our definition for SDN (below), which is fairly broad as it includes use of RESTful APIs and other programmable interfaces with published APIs. We do not include CLI scripting, or use of NETCONF and SNMP as SDN.

Definition of SDNs (software-defined networks):

Deliver automation of the network through increased programmability. Inherent to SDNs are a method to abstract and separate a control plane from the data plane, providing centralized control of physical switches or providing network virtualization overlays. SDNs include a method (APIs or specialized protocols such as OpenFlow, etc.) that can be used by applications, SDN controllers, or orchestration software to ask for network state, information, or services.

To buy the report, contact Infonetics at:

www.infonetics.com/contact.asp

Related article:

Open Data Center Alliance Accelerates Enterprise Path to Software-Defined Networking with New Usage Model Publication

http://vmblog.com/archive/2014/07/23/open-data-center-alliance-accelerat…

AT&T Plans GigaPower Debut In Dallas/Ft. Worth this Summer; 100 Candidate Cities on Drawing Board

AT&T will upgrade its U-verse fiber to the premises service with speeds up to 1 Gbps through its GigaPower program in parts of Dallas and Fort Worth, TX this summer. The company said it would begin at speeds up to 100 Mbps, with upgrades to 1 Gbps by the end of the year. U-verse is AT&T’s high-speed broadband double and triple play service to residential subscribers. However, both U-verse TV and U-verse Internet are available as single service offerings.

In Austin,TX – the first market to get access to AT&T’s GigaPower platform -the giant telco is initially offering 300 Mbps, and plans to accelerate to 1-Gig sometime later this year. Google Fiber has begun to build out its 1-Gig infrastructure in Austin so that must be providing AT&T with motivation and incentive to build out GigaPower in Austin.

AT&T has not announced pricing for GigaPower services in Dallas/Ft. Worth. In Austin, the broadband service runs $70 per month; $100 per month when paired with the U-verse Voice Unlimited service; $120 per month with the U200 TV package with HBO; and $150 per month with U200 TV with HBO and U-verse Voice Unlimited. All offers come with one-year commitments that could result in an early termination fee of up to $348, The Austin version of U-verse with GigaPower is also capped at 1 terabyte per month. AT&T charges $10 for each additional bucket of 50 Gigabytes above that threshold, with a maximum monthly overage charge of $30.

Note: From my own personal U-Verse customer experience (2+ years), prices rise sharply afer the one year promo ends.

AT&T is considering a plan to expand GigaPower to as many as 100 candidate cities, and has proposed to expand GigaPower to an additional 2 million customers as a condition of its pending acquisition of DirecTV.

AT&T’s U-verse service attracted 488,000 new customers in the quarter, bringing the total to 11.5 million subscribers. Total U-verse revenues, including business,were up 27.9% year over year. U-verse is now a $13 billion annualized revenue stream for AT&T.

Overall U-verse revenues increased by almost 28% y-o-y on the back of solid growth in U-verse TV and Broadband Internet revenues. U-verse TV added 190,000 subscribers in Q2 to take its total user base to 5.9 million and U-verse high speed Internet added 488,000 new subscribers in the quarter to take its total to 11.5 million.

This rise in subscriptions helped the company improve its proportion of U-verse subscribers to total broadband users to 70% in Q2 2014 from 55% in the year-ago quarter. And why not? The cost-performance of U-verse Internet is much better than the older ATM over ADSL Internet.

References:

http://www.multichannel.com/news/technology/att-preps-summer-gigapower-d…

http://www.att.com/att/gigapowercities/

http://www.forbes.com/sites/greatspeculations/2014/07/24/atts-q2-earning…

Infonetics: Cisco, Brocade, HP, and Juniper lead Enterprise Network Vendors

Infonetics Research released excerpts from its 2014 Enterprise Networking and Communication Equipment Vendor Scorecard, which profiles, analyzes, and ranks the 7 leading vendors of enterprise networking, network security, and communication equipment and software worldwide: Alcatel-Lucent, Avaya, Brocade, Cisco, HP, Juniper, and NEC.

The only report of its kind, Infonetics’ scorecard evaluates vendors on criteria using actual data and metrics, such as direct feedback from buyers, vendor market share, share momentum, financials, and solution portfolio. This approach eliminates subjective scoring and ensures vendors are assessed accurately and fairly.

Infonetics sub-divides the Enterprise Network & Communications Infrastructure market into three categories:

Here’s the $ sales breakdown for each market segment for calendar years 2012 and 2013:

|

Segment

|

CY12

|

CY13

|

|

Communication

|

$11.3

|

$10.6

|

|

Networking

|

$32.6

|

$34.0

|

|

Security

|

$9.2

|

$9.2

|

|

Grand Total

|

$53.0

|

$53.8

|

ENTERPRISE SCORECARD HIGHLIGHTS:

. The enterprise networking and communication infrastructure market is highly fragmented, with well over 100 vendors vying for a piece of this US$50 billion market

. Repeating its performance in last year’s scorecard, Cisco once again earned the highest overall score by far, attaining perfect scores in 6 of 7 criteria and even improving on market share momentum

. The battle for 2nd place heated up this year, with Brocade holding on to the #2 spot again thanks to its strong financials, and is followed very closely by HP and Juniper

. HP captured the #1 position for market share momentum

. Juniper ranks among the top 3 vendors for 5 of Infonetics’ scorecard criteria: market share momentum, financials, product reliability, technology innovation, and service and support

. NEC’s #1 position in Japan’s enterprise telephony market helped place it 5th in Infonetics’ 2014 scorecard

SCORECARD SYNOPSIS:

Infonetics’ 29-page enterprise vendor scorecard evaluates the leading enterprise networking and communication equipment vendors using criteria that are commonly used by buyers to select vendors, demonstrate success in the marketplace, and position a vendor for success. The matrix rankings are based on 7 criteria including market share; market share momentum; financials; solution breadth; technology innovation; product reliability; and service and support. Companies ranked: Alcatel Lucent, Avaya, Brocade, Cisco, HP, Juniper, and NEC.

ANALYST NOTE:

“Cisco dominates the enterprise networking and communication market by a wide margin, due to offering the broadest solution portfolio, receiving positive feedback from enterprises, and capturing significant market share. The battle for second place is raging between Brocade, HP, and Juniper, and each has unique strengths: Brocade has the strongest financials, HP is growing the fastest, and Juniper has experienced the highest improvement in enterprise feedback,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research and lead author of the report.

To buy the report, contact Infonetics:

http://www.infonetics.com/contact.asp.

RELATED RESEARCH (See http://www.infonetics.com/market-research-report-highlights.asp):

. US$1 trillion to be spent on telecom and datacom equipment and software over next 5 years

. Infonetics releases Global Telecom and Datacom Market Trends and Drivers report

. Cloud is our #1 networking initiative, say businesses in Infonetics’ latest survey

. PBX-based video buoys videoconferencing market

. Security and data center vendors renew focus on DDoS as attacks multiply; Arbor leads

. Integrated security solutions gain share in network security market in 1Q14

. Cisco entrenched atop enterprise session border controller (eSBC) market

. Wireless LAN access point ASPs on the rise, sparked by 802.11ac

. Enterprise router market off to a rough start, plunges 14% sequentially

. Ethernet switch market down 15% in the first quarter as growth stalls

RECENT AND UPCOMING ENTERPRISE RESEARCH:

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at www.infonetics.com/login.

. DDoS Mitigation Strategies & Vendor Leadership: N.A. Enterprise Survey (June)

. WLAN Infrastructure Vendor Scorecard (July)

. Analyst Note: Genband Unveils Kloud & Kandy (July)

. Business Cloud VoIP & UC Services Forecast (Aug.)

. Next Generation Threat Prevention Strategies & Vendor Leadership Survey (Aug.)

. Enterprise Routers Forecast (Aug.)

. Enterprise Unified Communications & Voice Equipment Forecast (Aug.)

. Enterprise Switches Forecast (Sept.)

. Wireless LAN Equipment & WiFi Phones Forecast (Sept.)

. Enterprise Session Border Controllers Forecast (Sept.)

Infonetics: $1 trillion to be spent on telecom and datacom equipment and software over next 5 years!

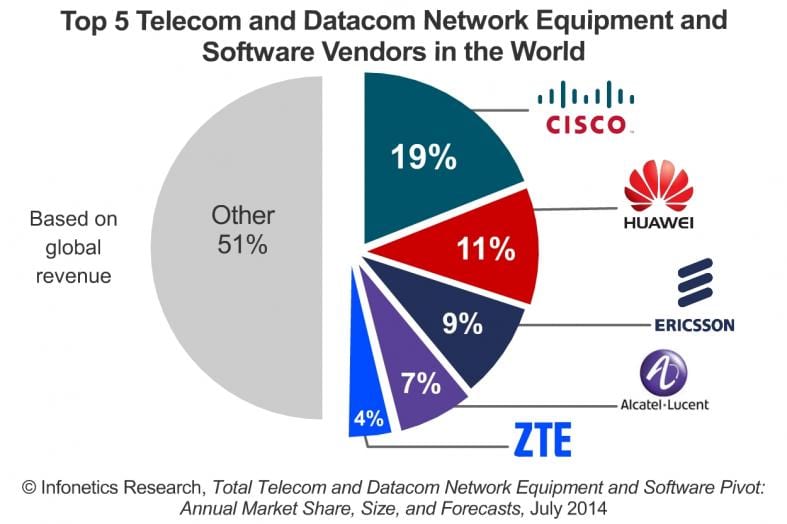

Infonetics Research released data from its 2014 Telecom and Datacom Network Equipment and Software report, which provides a big picture of the health of the overall market. Network equipment bought by service providers as well as by SMBs and enterprises is tracked in the report, separately and together to gauge how the entire market is doing and to see who leads overall (see Report Synopsis in the release for a list of equipment and software categories).

“Despite the fact that enterprises and service providers are in the middle of massive network upheavals due to the evolution of software-defined networking (SDN) and network functions virtualization (NFV) technology, the telecom and datacom networking equipment and software market is on track to grow annually through 2018 with the fastest growth coming in 2015,” notes Jeff Wilson, principal analyst at Infonetics Research.

Michael Howard, co-founder of Infonetics and co-author of the report, adds, “Looking at just the service provider equipment space, we’re seeing a shakeup in vendor market share, with Huawei leapfrogging longtime number-one Ericsson to take the top spot in 2013. While Huawei’s been doing well in a number of regions, China’s economy is a key factor keeping Huawei’s growth so strong.”

TOTAL TELECOM AND DATACOM MARKET HIGHLIGHTS:

Based on global revenue, the overall telecom and datacom network equipment and software market share leaders are, in rank order: Cisco, Huawei, Ericsson, Alcatel-Lucent, and ZTE – the same top 5 vendors with virtually the same shares as the year prior .

Vendor share positions held steady in the enterprise segment, with Cisco in the driver’s seat and followed distantly by tightly bunched Avaya, Brocade, HP, and Juniper (listed in alphabetical order) .

Worldwide, sales of telecom and datacom equipment and software came to $183 billion in 2013, an uptick of 3% versus the previous year.

Asia Pacific put some breathing room between itself and North America in the regional race for telecom/datacom equipment and software revenue, growing 6% year-over-year as compared to North America’s 4.5%; this trend is expected to continue through at least 2018.

Infonetics is projecting a cumulative $1.01 Trillion will be spent by service providers and enterprises on telecom/ datacom gear and software over the 5 years from 2014 to 2018.

REPORT SYNOPSIS:

Infonetics’ annual datacom and telecom equipment and software pivot report compiles worldwide and regional market size, vendor market share, and forecasts through 2018 from all of its reports that track enterprise and service provider gear. It is the majority of all data networking and telecom equipment for service providers, cable companies, and small, medium, and large organizations, excluding consumer electronics.

The 11 major categories of equipment and software tracked in Infonetics’ report include broadband aggregation; broadband CPE; pay TV; optical network hardware; carrier routing, switching, and Ethernet; service provider VoIP and IMS; service provider mobile/wireless infrastructure; service enablement and subscriber intelligence; security; enterprise and data center networks; and enterprise communications.

Companies tracked include Alcatel-Lucent, Avaya, Brocade, Ciena, Cisco, Ericsson, Fujitsu, HP, Huawei, Juniper, Motorola, NEC, Nokia, Samsung, Siemens, ZTE, and many others.

To buy the report, contact Infonetics:

AT&T/ Chernin Group Joint Venture. Buys Creativebug For $10 Million; Renames JV Company

AT&T’s online-video joint venture with Chernin Group has made its first acquisition. It’s paying $10 million for Creativebug according to a SEC filing. San Francisco-based Creativebug was founded in 2012 and features more than 300 online classes on arts and crafts.

According to the Creativebug site, the service offers some free content alongside paid offerings, including unlimited access to workshops for $9.95 per month, and an a la carte option that hawks single workshops starting at $9.95 each. Workshop categories include bookbinding, crochet, embroidery, felting, kids crafts, patchwork, stamping and home decor.

AT&T and its partner, the Chernin Group, also renamed their over-the-top video joint venture company Otter Media which will be focused on acquiring, investing in and launching OTT video services, AT&T and The Chernin Group committed to invest $500 million in the venture when they announced it in April.

Reference:

http://www.multichannel.com/news/technology/chernin-att-jv-buys-creativebug-10-million/375916#sthash.rfF13jl7.dpuf

Open Interconnect Consortium Competes with Qualcomm led AllSeen Alliance & ITU-T IoT-GSI Standards Initiatives

Intel, Samsung and Dell have established the Open Interconnect Consortium (OIC). The new consortium has pledged to develop and distribute specifications for the emerging Internet of Things. It is competing with the AllSeen Alliance, which was founded by Qualcomm.

The group, which also includes Atmel, Broadcom, and Wind River (owned by Intel), will focus on creating an open-source standard for wirelessly connecting devices to one another and to the Internet. Like other open-source projects, the member companies pledge to donate intellectual property, or IP, that all members and others can work on and use.

“We’d like to quickly get the key industry players to structure the standards properly” for devices to interoperate, said Imad N. Sousou, general manager of Intel’s open-source technology center. Products using the Open Interconnect standard will most likely come out in 2015, he said.

Intel’s Gary Martz said the OIC wil first establish standards around connectivity, discovery and authentication of devices, and data-gathering instruments in “smart homes,” consumer electronics and enterprises. OIC will certify devices compliant with its standards. The group will work on standards encompassing a range of wireless technologies including Wi-Fi, Bluetooth, ZigBee and NFC (near-field communication).

Analysis:

The reason for all this activity is sheer numbers, and potentially a lot of market power. The IoT is expected to eventually touch some 200 billion cars, appliances, machinery and devices globally, handling things like remote operation, monitoring and interaction among Internet-connected products.

So far, such connections are at best uneven, but workable uniform standards could help that get better.

It’s likely that the communications standards governing these things will also affect the means for collecting data about the behavior of both devices and the people that use them. That makes it a very important future subset of the Internet, since data like that will inform things like future product development and what ads individual consumers are shown.

Why didn’t the Interconnect group just go with AllSeen, which started earlier and is signing up product companies — even if the project was initiated by the Intel rival Qualcomm? “Intel and its partners evaluated all of the existing work,” Mr. Sousou said. “It’s not being done in a way that will drive widespread adoption.”

According to people in the consortium, who asked not to be named in order to sustain relations with AllSeen members, many of the other chip companies did not trust Qualcomm to fully part with its intellectual property.

There is also an ITU-T standardization effort for the IoTs which has been ongoing for several years. The Global Standards Initiative on Internet of Things (IoT-GSI) promotes a unified approach in ITU-T for development of technical standards (Recommendations) enabling the Internet of Things on a global scale. ITU-T Recommendations developed under the IoT-GSI by the various ITU-T Questions – in collaboration with other standards developing organizations (SDOs) – will enable worldwide service providers to offer the wide range of services expected by this technology. IoT-GSI also aims to act as an umbrella for IoT standards development worldwide. The IoT-GSI group will have its tenth meeting 12-18 November 2014 in Geneva, Switzerland.

Caroline Gabriel of Rethink Wireless wrote:

The OIC is short on details of its approach so far, though it will publish its code later this quarter, but its announcements suggest it will be a rival to AllJoyn in using the weight of its big-name backers to establish a de facto standard. It says it will devise, and contribute to open source, a peer-to-peer protocol which handles device discovery and authentication. However, Intel says the key difference from AllJoyn is that the OIC code will be created collaboratively, rather than forming a supporters’ club around an existing technology from a single firm.

This will certainly not be the last body formed to help the big chip vendors – all of them in urgent need of a leadership role in at least some aspects of IoT standards – to position themselves as standards setters. As seen in other technology markets, the array of would-be standards will gradually consolidate as the real market makers – such as the large-scale consumer and industrial devices vendors – make their choices.

In this way, the OIC has scored one big point, by netting Samsung, although the Korean firm’s semiconductor division does not necessarily influence the alliances made by its consumer products activities. It will be positive to see some of those market makers taking some decisions, or risk the chip giants tearing IoT platforms into fragments with their politicking, before the segment has even gained scale.

References:

http://www.openinterconnect.org/

http://bits.blogs.nytimes.com/2014/07/08/standard-behavior-in-an-interne…

http://news.techworld.com/data-centre/3529314/samsung-intel-dell-team-on…

http://www.rethink-wireless.com/2014/07/08/intel-leads-anti-qualcomm-iot…

https://techblog.comsoc.org/2014/05/26/tiecon-2014-summary-part-3…

http://www.itu.int/en/ITU-T/techwatch/Pages/internetofthings.aspx

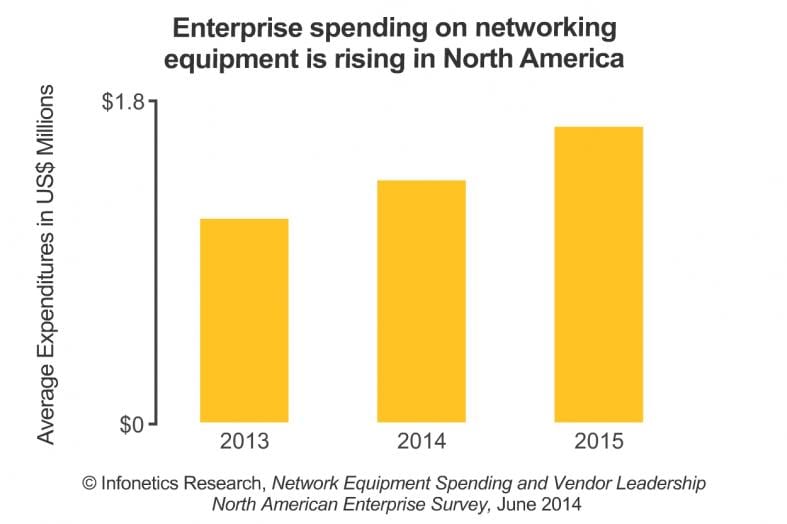

Infonetics: Cloud is Top Priority for N. America Enterprise Network Spending

Infonetics Research released excerpts from its 2014 Network Equipment Spending and Vendor Leadership: North American Enterprise Survey, which explores businesses’ top networking initiatives, budget priorities and growth, investment drivers and barriers, and vendor preferences.

NETWORK EQUIPMENT SPENDING SURVEY HIGHLIGHTS:

. Respondent companies spent, on average, over $1.1 million on networking equipment in 2013, and they expect to increase spending by 19% this year

. Wireless LAN (WLAN) budget allocations are on the rise among those surveyed, becoming the #2 investment area for 2014

. The economic outlook for North America is positive and companies are looking to capitalize on new opportunities, leading to an expenditure shift from headquarters to branch offices

. Around 3/4 of respondents consider Cisco the top network equipment vendor, an even better showing than in Infonetics survey last year

. Juniper has made major gains from last year, moving up 3 positions in respondent ratings

ANALYST NOTE:

“Our just-finished survey on network equipment spending indicates the outlook for network equipment is healthy. Enterprises are expecting double-digit growth in their expenditures this year and next. How they are spending their budgets is changing, and allocations towards wireless LAN, network monitoring, and switches are growing. Greater spending on branch office infrastructure is also anticipated, a sign of confidence in continued economic expansion,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research.

Machowinski adds: “One of the most interesting findings is that cloud has emerged as the number-1 networking initiative over the next 12 months. Companies are embracing the cloud in a services model as well as building their own cloud-architected data centers, and this means upgrades to network infrastructure.”

Author NOTE:

For several years, the issue of a standardized cloud network interface and architecture has been neglected. The alternatives includes: public Internet, private line [to cloud service providers (CSP) Point of Presence (PoP)], IP MPLS VPN, Ethernet for Private Cloud (a MEF initiative) and hybrid/combinations of the above. Each CSP offers a different set of alternative interfaces and architectures- often via third parties. It’s amazing that this issue hasn’t drawn more attention from the official standards bodies (IEEE started an initiative in this area in 2011, had 1 meeting and then it went dark- with no notice given to the meeting attendees, including this author.).

ABOUT THE SURVEY:

For its 27-page network equipment spending survey, Infonetics interviewed 207 North American organizations that have at least 100 employees about their networking equipment, plans, and purchase considerations over the next two years. The survey provides insights into networking initiatives, budget priorities and growth, investment drivers and barriers, and vendor preferences.

Vendors named in the survey include Alcatel-Lucent, Apple, Aruba, Avaya, Brocade, Cisco, D-Link, Dell, Extreme/Enterasys, HP, Huawei, IBM, Juniper, Linksys, Microsoft, Motorola, Oracle, Netgear, others.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

More info at: http://www.infonetics.com/pr/2014/Enterprise-Network-Equipment-Spending-Survey-Highlights.asp

Public Cloud Services growing at 23%:

Separately, gllobal spending on public cloud services reached US$45.7 billion last year and will experience a 23 percent compound annual growth rate through 2018, according to analyst firm IDC.

Some 86 percent of the 2013 total came from cloud software, which encompasses both SaaS (software as a service) applications and PaaS (platform as a service) offerings, with the remaining 14 percent generated by cloud infrastructure, IDC said on July 7th.

IDC ranked Amazon.com first in the PaaS market, with Salesforce.com and Microsoft tied for second place, followed by GXS and Google. Amazon was also No. 1 in the infrastructure category, followed by Rackspace, IBM, CenturyLink and Microsoft.

Geographically, the U.S. accounts for 68 percent of the overall public cloud market, but this figure will fall to 59 percent by 2018 as Western Europe’s take rises from 19 percent to 23 percent and growth picks up in emerging markets, IDC said.

“We are at a pivotal time in the battle for leadership and innovation in the cloud. IDC’s Public Cloud Services Tracker shows very rapid growth in customer cloud service spending across 19 product categories and within eight geographic regions. Not coincidentally, we see vendors introducing many new cloud offerings and slashing cloud pricing in order to capture market share. Market share leadership will certainly be up for grabs over the next 2-3 years,” said Frank Gens, Senior Vice President and Chief Analyst at IDC.

The SaaS market – accounting for 72% of the total public cloud services market and forecast to grow at a 20% CAGR over the forecast period – is dominated by Enterprise Applications cloud solutions such as enterprise resource management (ERM) and customer relationship management (CRM), followed by Collaborative applications. System Infrastructure Software cloud solutions – the other major part of the SaaS market, including Security, Systems Management, and Storage Management cloud services – drove 21% of the 2013 SaaS market. From a competitive perspective, the SaaS service provider ecosystem is largely led by Salesforce.com followed by ADP and Intuit. Traditional software vendors Oracle and Microsoft hold the 4th and 5th positions, respectively.

The PaaS market – accounting for 14% of the market in 2013 with a forecast CAGR of 27% – is composed of a wide variety of highly strategic cloud app development, deployment, and management services. In 2013 and 2014, PaaS spending has been largely driven by Integration and Process Automation solutions, Data Management solutions, and Application Server Middleware services. From a market share standpoint, the 2013 PaaS market was led by Amazon.com, followed by Salesforce.com and Microsoft (both share the number 2 position). GXS and Google hold the 4th and 5th positions, respectively.

More info at: http://www.idc.com/getdoc.jsp?containerId=prUS24977214

Qualcomm buys Wilocity to accelerate high speed WiFi chip development

Qualcomm announced on July 2nd that it had acquired Wilocity, a developer of 802.11ad WiGig chips. The companies previously collaborated on WiGig technology, a faster version of Wi-Fi. Qualcomm is integrating the Wilocity technology into its Snapdragon 810 chipsets for mobile devices, hoping to gain a competitive advantage against Broadcom. Qualcomm had previously purchased Atheros Communications in 2011 to get into the WiFi chip business.

Wilocity’s fast gigabit wireless-data capabilities will be included in sample products being shipped to customers, Qualcomm said yesterday in a statement. The company didn’t disclose terms of its purchase of the startup, which is based in Caesarea, Israel.

SoC devices capable of the new higher-speed 802.11ad (Wi Gig) will go on sale next year, said Amir Faintuch, president of Qualcomm’s Atheros division, which has been an investor in Wilocity since 2008.

Sarah Reedy of Light Reading wrote: “Qualcomm is integrating super-fast 60GHz WiFi into its Snapdragon 810 chipsets, a move that it says will advance the entire WiFi ecosystem now that its acquisition of multi-gigabit wireless leader Wilocity is complete.”

“The tri-band reference design based on the Qualcomm Snapdragon 810 will enable 4K video streaming from the phone to the TV in the home, peer-to-peer content sharing, networking, wireless docking, and instantaneous cloud access.”

Companies like Cisco, Dell, Microsoft Corp. (Nasdaq: MSFT), and others plan to use the new integrated chipsets first in the connected home and enterprise. Cormac Conroy, Qualcomm’s VP of product management and engineering, says to expect the Snapdragon 810 platform to start shipping in smartphones and tablets in the second half of the year. He also calls small cells from companies like Cisco a “natural fit,” but those are further down the pipeline.

Sixty Gigahertz is an in-area technology, which means that, while it doesn’t necessarily require line-of-sight, it cannot penetrate walls. It’s ideal for open spaces of any size but can’t cover a whole home on its own. Qualcomm says its tri-band WiFi chips will integrate the multi-gigabit performance of 802.11ad operating in the 60GHz spectrum band with 802.11ac in the 5GHz band and 802.11b/g/n in the 2.4GHz band with handoff in between them to ensure it works everywhere.

“We think this is an important step in our overall vision and mission to deliver high-speed wireless connectivity, mobile computing, and networking,” Conroy says. “This announcement is not just ‘Qualcomm acquires a company.’ The message is Qualcomm and a number of leading partners think 60GHz will be a very important technology across multiple use cases.”

Read more at:

http://www.lightreading.com/components/comms-chips/qualcomm-advances-wig…

Highlights of Infonetics Global Telecom and Datacom Market Trends and Drivers report

Infonetics Research recently released excerpts from its latest Global Telecom and Datacom Market Trends and Drivers report,which analyzes global and regional market trends and conditions.

TELECOM AND DATACOM MARKET TRENDS:

. The International Monetary Fund (IMF) anticipates the world economy will expand 3.6% in 2014 (+0.06 from 2013) amid recoveries in the UK and Germany and slowing growth in Japan, Russia, Brazil, and South Africa

. Mobile service revenue remains the main telecom/datacom growth engine worldwide, led by the unabated rise of mobile broadband

. To avoid falling into the role of pipe provider, many service providers are deploying or weighing new architectural options such as caching/content delivery networks, distributed BRAS/BNG, next-gen central offices, distributed mini data centers, and video optimization

. Software-defined networks (SDNs) and network functions virtualization (NFV) have the attention of nearly all service providers, who are on the long road to widespread deployments

. Big data is becoming more manageable: Operators are leveraging subscriber and network intelligence to support marketing and loyalty strategies, churn management, and automation/optimization of networks using SDN and NFV

. The cloud, mobility, BYOD, and virtualization are the top trends driving enterprise networking and communication technology spending, with North America leading the way

REPORT SYNOPSIS:

Infonetics’ market drivers report is published twice annually to provide analysis of global and regional market trends and conditions affecting service providers, enterprises, subscribers, and the global economy. The report assess the state of the telecom industry, telling the story of what’s going on now and what’s expected in the near and long term, including spending trends; subscriber forecasts; macroeconomic drivers; and key economic statistics (e.g., unemployment, OECD indicators, GDP growth). The 44-page report is illustrated with charts, graphs, tables, and written analysis.

“Expect a slowdown in the Americas, but for a change, Europe will be in the telecom capex driver’s seat this year!” says Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. “We’re forecasting global carrier capex to rise 4%, with EMEA as the growth engine despite unabated low-single-digit revenue declines all across Europe. After waiting for so many years to upgrade their networks, Europe’s ‘Big 5’-Deutsche Telekom, Orange, Telecom Italia, Telefónica, and Vodafone-have decided it’s time to take the plunge.”

Co-author of the report Matthias Machowinski, Infonetics’ directing analyst for enterprise networks, adds: “Economic expansion in mature economies and falling unemployment in Europe is driving stronger growth in enterprise telecom and datacom expenditures this year. We expect the network infrastructure segment to be the main beneficiary of growing investments, followed by security. The communication segment will likely have another challenging year, as companies evaluate their deployment strategy going forward.”

To buy report, contact Infonetics: www.infonetics.com/contact.asp