Month: October 2014

Mobile Network Operators to deploy more small cells, but backhaul challenges remain

There’s no doubt that mobile network operators (MNOs) need more capacity at a lower total cost of ownership. New backhaul technologies are being considered, and some analysts predict $30 billion will be spent on backhaul equipment between now and 2017. However, with the explosion in demand for wireless bandwidth, which could reach 11.2 exabytes per month by 2017, there will be more small cell installations (to expand capacity due to frequency re-use in each small cell)ne, especially in hard-to-wire locations. These small cell extensions allow carriers to add capacity or coverage in a more targeted manner. However, the design and implementation of the backhaul and fronthaul can be even more complex than a traditional macro site.

“Operators participating in our small cell backhaul survey have yet to scale their small cell deployments, but they are looking to place over 20% of their traffic from the macro network onto small cells by 2018,” notes Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics Research. “But they also tell us that backhaul-specific challenges like planning site acquisition, power and connection sourcing, and cost models have impacted deployment timelines.”

Infonetics Research released excerpts from its 2014 Small Cell Backhaul Strategies: Global Service Provider Survey, which provides insights into operator plans for small cell backhaul.

Infoneticcs-SMALL CELL BACKHAUL SURVEY HIGHLIGHTS:

- Ethernet over fiber is survey respondents’ preferred backhaul technology for outdoor small cells, followed bypoint-to-point microwave and millimeter wave

- Ethernet over fiber is the most-used technology for in-building deployments

- With small cell deployments occurring in a range of locations and with an array of topologies, no single backhaul technology will be a universal solution

- Likewise, no single vendor is likely to dominate the small cell backhaul landscape; it is still early days, but so far survey participants strongly favor a group of vendors with wired and wireless backhaul solutions

- Respondent operators rate price-to-performance ratio, product reliability, and pricing as the top 3 criteria for choosing a small cell backhaul vendor

SMALL CELL SURVEY SYNOPSIS:

For its 34-page small cell backhaul survey, Infonetics interviewed purchase decision makers at 25 incumbent, mobile, competitive, and cable operators from Europe, the Middle East and Africa, Asia Pacific, the Caribbean and Latin America, and North America about their current and future plans for small cell backhaul. The study provides insights into mobile traffic handling, specific backhaul issues related to in-building and outdoor small cells, and vendor preferences. The operators participating in the study control 29% of the world’s telecom capex.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

Ron Mundry, CEO & Founder of Tower Cloud wrote in a Light Reading blog:

To accommodate increasing bandwidth demand, carriers such as Verizon Wireless are deploying more small cells, and sites are becoming smaller, simpler and denser. According to SNS Research, the global market for 3G and 4G plateaued in 2013 at $52 billion, and is expected to drop by 2% annually, falling to $47 billion by 2020. Carriers are shifting spending to heterogeneous networking (HetNet), including small cell, carrier WiFi, distributed antenna systems (DAS) and cloud RAN (C-RAN) hardware. The small cell and carrier WiFi market alone should reach $4 billion in 2015. Mobile network operators are gearing up for a new kind of backhaul architecture that makes better use of the fronthaul radio access network.

The old access/aggregation/core hierarchy model — where data is collected at a base station and backhauled to aggregation points — no longer works in overloaded wireless networks, especially in dense urban areas. Subscribers armed with smartphones and tablets with video capability are putting a strain on the edges of the network, and mobile operators are now using macro cells to extend network access. The result is an evolution in small cell and macro cell applications, and the adoption of new HetNet architectural models to deliver voice and data.

Of course, there are challenges with small cell fronthaul networks. Carriers have to transmit data from both high-power and low-power RRHs to the BBUs, and using small cells can introduce high levels of cell edge interference. There also may be difficulties interfacing with existing macro networks.

And both RRHs and BBUs have to overcome real-estate restrictions. You have to have access rights and power at the RRH from a streetlamp or other street furniture. The BBU has to be optimally placed in relation to the RRH units, and it has to be accessible for maintenance — a combination of an engineering and a real-estate challenge. You also want to make fiber connections from the base station to the RRH and the antenna wherever possible, although wireless fronthaul and backhaul designs are evolving for cell sites deployed along roadsides and to cover rural areas, where fiber is even less practical.

As small cell architectures continue to evolve, it will be up to carriers and small cell providers to work together to perfect new design approaches that make engineering and economic sense. The early small cell installations have demonstrated positive price performance, but we have to perfect fronthaul design and closely manage cost of ownership to ensure that the promise of small cell density and the benefits of HetNet are fulfilled.

http://www.lightreading.com/mobile/backhaul/small-cell-fronthaul-wireles…

Highlights of Infonetics Macrocell Mobile Backhaul Equipment, Services & Strategies, +MMW reports

Infonetics Research released excerpts from its latest Macrocell Mobile Backhaul Equipment and Services report, which tracks mobile backhaul equipment vendors, identifies market growth areas, and provides analysis of equipment, connections, and cell sites.

“The macrocell mobile backhaul equipment market continues to be driven by demand for capacity increases to support LTE deployment and 3G network expansion. But there will be few greenfield macro base station deployments and this, combined with increasing pressure on equipment pricing, inhibits revenue growth in the long term,” notes Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics Research.

MACROCELL MOBILE BACKHAUL MARKET HIGHLIGHTS:

. The global macrocell mobile backhaul equipment market totaled $8.4 billion in 2013, and Infonetics expects this slow-growing, mature market to reach over $8.5 billion in 2014

. Microwave is anticipated to comprise 48% of mobile backhaul equipment spending in 2014 and trend downward slightly by 2018, in favor of wired solutions, predominantly fiber-based

. The ongoing HSPA/HSPA+ onslaught across the 3GPP world and growing LTE deployments are fueling Ethernet macrocell backhaul spending, especially microwave and Ethernet

over fiber

. IP edge router revenue is expected to increase in 2014 and continue to grow through 2018, generating a 2013-2018 compound annual growth rate (CAGR) of 2.4%

. Infonetics forecasts a cumulative $45 billion to be spent on macrocell mobile backhaul equipment worldwide over the 5 years from 2014 to 2018

MACROCELL MOBILE BACKHAUL REPORT SYNOPSIS:

Infonetics’ biannual macrocell mobile backhaul report provides worldwide and regional market share, market size, forecasts through 2018, analysis, and trends for macrocell mobile backhaul equipment, connections, and installed cell sites by technology. The report also includes an Operator Strategies Tracker. Companies tracked: Accedian, Actelis, Adtran, Adva, Alcatel-Lucent, Aviat Networks, BridgeWave, Canoga Perkins, Ceragon, Ciena, Cisco, DragonWave, E-band, Ericsson-Redback, FibroLan, Huawei, Intracom, Ipitek, Juniper, MRV, NEC, Overture, RAD, SIAE, Siklu, Sub10 Systems, Telco Systems, Tellabs, Thomson, ZTE, others.

To buy the report, contact Infonetics:

www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS

. Infonetics’ October Mobile Backhaul and Microwave research brief: http://www.infonetics.com/2014-newsletters/Mobile-Backhaul-Microwave-October.html

. Momentum building in millimeter wave market, ignited by outdoor small cells

. Mobile operators evaluating SDN and NFV for more flexible and cost-effective backhaul

. US$1 trillion to be spent on telecom and datacom equipment and software over next 5 years

. Infonetics releases Global Telecom and Datacom Market Trends and Drivers report

. Operators launching 4G-based femtocells to ratchet mobile broadband services

. Carriers going gangbusters with WiFi and Hotspot 2.0

Mobile operators evaluating SDN and NFV for more flexible and cost-effective backhaul:

Infonetics Research released excerpts from its 2014 Macrocell Backhaul Strategies: Global Service Provider Survey, which provides insights into operator plans for macrocell backhaul.

“The mobile network is evolving to incorporate small cells, distributed antenna systems (DASs), remote radio heads (RRHs), and WiFi, and though the macrocell layer still does the heavy lifting when it comes to traffic handling, the backhaul network behind all this is becoming increasingly complex,” notes Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics Research. “Our macrocell backhaul study reveals the extent to which operators are looking at software-defined networking (SDN) and network functions virtualization (NFV) solutions to provide greater backhaul flexibility and cost-savings.”

MACROCELL BACKHAUL SURVEY HIGHLIGHTS

- Infonetics’ survey respondents have yet to scale their small cell deployments, but anticipate they will place over 20% of traffic from the macro network onto small cells by 2018

- When asked if or when they will introduce software-defined networking (SDN) into the backhaul network, 29% of respondents say they are deploying or plan to deploy SDN at some point, while the majority (63%) are evaluating it as a possibility with no set timeframe

- Among those surveyed, Ethernet on fiber will be the most-used technology for macrocell backhaul connections by 2016, followed by Ethernet-only microwave

- Downstream bandwidth is the top-ranked service-level agreement (SLA) metric, rated very important by 92% of operators surveyed, followed by jitter, latency, and upstream bandwidth

- Survey respondents not only seek vendors with strong macrocell backhaul product portfolios, but partners who can also support their strategies for holistic, flexible future-proofed networks

MOBILE BACKHAUL NFV WEBINAR

View on-demand analyst Richard Webb’s Making Mobile Backhaul Flexible with NFV and SDN, a webinar exploring how network functions virtualization (NFV) and software-defined networking (SDN) can be used to automate transport networks:

http://w.on24.com/r.htm?e=847425&s=1&k=C8E5B08CA6062C0E9F5C670CA7E7880E.

MACROCELL SURVEY SYNOPSIS:

For its 28-page macrocell backhaul survey, Infonetics interviewed purchase decision makers at 25 incumbent, mobile, competitive, and cable operators from EMEA, Asia, Latin America, and North America about their current and future plans for macrocell backhaul. The study provides insights into operator deployment strategies, technologies, capacity requirements, packet timing and synchronization methods, SLA metrics, and vendor preferences. The operators participating in the study control 29% of the world’s .telecom capex

To buy the report, contact Infonetics:

http://www.infonetics.com/contact.asp

Infonetics Research released excerpts from its latest Millimeter Wave Equipment report, which tracks licensed and unlicensed millimeter wave equipment by market application (access, backhaul, and transport).

“Although the millimeter wave market is still modest in scale at this point, the enhanced capacity capabilities delivered by this technology will be invaluable as a backhaul aggregation solution for small cell deployments as they scale up,” says Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics Research.

Webb continues: “We expect millimeter wave to play a significant role in outdoor small cell backhaul, which will become the primary long-term market driver.”

MILLIMETER WAVE EQUIPMENT MARKET HIGHLIGHTS

- Infonetics projects the overall millimeter wave equipment market to grow to $755 million by 2018

- The outdoor small cell backhaul segment of the millimeter wave equipment market is forecast by Infonetics to outpace all other segments of the market, growing at a 101% CAGR from 2013 to 2018

- Licensed E-band 70–90GHz equipment accounted for 93% of millimeter wave sales in the first half of 2014 (1H14)

- 90% of millimeter wave equipment revenue in 1H14 came from mobile backhaul applications, up from 85% in the second half of 2013 (2H13)

- Currently, the top 3 players in millimeter wave gear are E-Band Communications, NEC, and Siklu (in alphabetical order), though Infonetics expects some consolidation to take place over the next 2 years as the market grows and more of the large mainstream microwave vendors move in from the wings

REPORT SYNOPSIS:

Infonetics’ biannual millimeter wave report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for unlicensed V-band (57–64GHz), licensed E-band (70–90GHz), and W-band (75–110GHz) millimeter wave equipment by network application (access, backhaul, transport). The report tracks units, revenue, and ARPU and follows Aviat Networks, Ceragon, E-Band, Ericsson, Fujitsu, Huawei, Intracom, NEC, Remec (BridgeWave), SIAE, Siklu, Sub10 Systems, and others.

To buy the report, contact Infonetics:

Huawei Displays SDN and NFV Technologies at SDN & OpenFlow World Congress in Germany

Huawei today showcased its software-defined networking (SDN) and network functions virtualization (NFV) technologies at the SDN & OpenFlow World Congress in Dusseldorf, Germany. At the event, Huawei discussed how industry partners can best utilize these technologies to further the development of the telecom industry, with specific focus on how its SoftCOM strategy will continue to help address this industry trend.

The SDN World Congress was advertised as an opportunity to examine developments, debate the issues and showcase the reality of SDN and NFV – and promises to be another milestone occasion for the whole market – carriers, data centres and enterprises. There’s a NFV FORUM and Proof of Concept Zone – endorsed by ETSI as Forum Partner- at this conference as well.

“Huawei’s SoftCOM will unleash the full potential of SDN and NFV, building an open and flexible network infrastructure for the ICT industry. We hope to work with all industry participants to create a future-oriented open network ecosystem in the cloud ICT era,” said Ken Wang (Shengqing), President of Global Marketing and Solutions, Huawei.

As ICT technologies become increasingly cloud-based, telecom carriers are faced with the pressure of increased development costs and sluggish revenue growth. In this new era of ICT, carriers must now focus on evolving their businesses to address these challenges and regain competency. Based on the concepts of cloud computing, SDN, and NFV, Huawei developed the future-oriented telecom network architecture strategy, SoftCOM, which aims to help reconstruct the telecom industry from the perspectives of network architecture, network functions, as well as service and Observation and Measurements (O&M) models. The SoftCOM strategy enables telecom carriers to realize comprehensive network evolution and business transformation, thus creating and seizing new value opportunities through ICT integration. This approach will further help with establishing and advancing an open, interconnected, and innovative ecosystem, to increase and better leverage the aggraded industry value.

Focusing on technological development driven by business requirements, Huawei has experimented with numerous SDN and NFV innovations across all network fields and launched corresponding solutions to help carriers implement full-scale network and business transformation for the future. To date, Huawei has worked with more than 20 leading carriers around the world including Telefonica, China Mobile, China Unicom, and China Telecom, on over 60 joint SDN- and NFV-related innovation projects. In 2014, Huawei and global carriers executed several commercial SDN and NFV deployments, including the world’s first commercial SDN deployment in cooperation with China Telecom, the SDN-based Wo cloud project in cooperation with China Unicom, the SDN-based hybrid cloud project in cooperation with China Telecom, and an NFV-based vIMS joint project in Europe.

The SDN & OpenFlow World Congress saw Huawei reveal its new Flexible Ethernet solution and an innovative network architecture MobileFlow, as well as several prototype systems of its new technologies at the event. The Flexible Ethernet solution has the flexibility to support various dynamic software-configured combinations of different Ethernet sub-interfaces. It marks different data connections and services that require different data traffic, and match them to their correspondent sub-interfaces accordingly. The Flexible Ethernet is an Ethernet revolution that will change the industry dominated by the traditional fixed Ethernet forever, and would greatly impact the future IP network architecture. In addition, the MobileFlow structure has realized unified deployment of mobile network control functions through cloud, while the previous plane model is only capable of service forwarding and processing. Through the southbound interface, the mobile controller is now able to conduct fine-grained forwarding control of the distributed forwarding devices, and also open the control capability to their application layers.

Huawei will continue to focus on the development of its SDN and NFV-based cloud technology, with the aim of facilitating the industry’s network structural transformation for the future.

About Huawei Huawei is a leading global information and communications technology (ICT) solutions provider with the vision to enrich life through communication. Driven by customer-centric innovation and open partnerships, Huawei has established an end-to-end ICT solutions portfolio that gives our customers competitive advantages in telecom and enterprise networks, devices and cloud computing. Huawei’s 150,000 employees worldwide are committed to creating maximum value for telecom operators, enterprises and consumers. Our innovative ICT solutions, products and services have been deployed in over 170 countries and regions, serving more than one third of the world’s population. Founded in 1987, Huawei is a private company fully owned by its employees.

For more information:

Set Top Box Market is NOT Monolithic- Satellite, Cable, OTT, IPTV, etc from Infonetics + Research & Markets

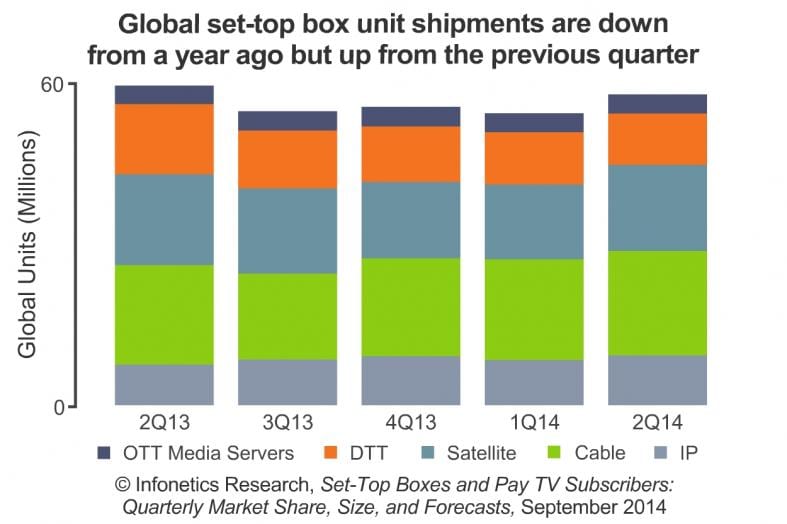

I. Infonetics Research released excerpts from its 2nd quarter 2014 (2Q14) Set-Top Boxes and Pay TV Subscribers report, which tracks IP, cable, satellite, and digital terrestrial (DTT) set-top boxes (STBs) and over-the-top (OTT) media servers.

2Q14 SET-TOP BOX MARKET HIGHLIGHTS:

. Globally, set-top box (STB) revenue-including IP, cable, satellite, and DTT STBs and OTT media servers-is up 4% in 2Q14 from 1Q14, to $4.8 billion

. STB unit shipments grew 7% sequentially in 2Q14, but are down 3% from the year-ago 2nd quarter of 2013

. Cable STB revenue increased by 3% sequentially in 2Q14, and unit shipments grew 4% during this same period

. Arris, the worldwide STB market share leader, gained almost 2 share percentage points in 2Q14 over 1Q14

. Over-the-top (OTT) media servers are quickly becoming the STB of choice for pay TV providers in emerging markets such as China, where free video content is abundant and service providers are looking to bundle live streaming video with their own broadband offerings

. The worldwide STB market is forecast by Infonetics to be essentially flat, i.e. growth at a -0.05% compound annual growth rate (CAGR) – from 2013 to 2018, when it will total $19.2 billion.

. Surprise forecast: In 2018, satellite STBs are expected to contribute the majority of STB revenue at 36%

“The global set-top box (STB) market is in a fascinating period of mixed signals. While quarterly unit shipments are up, on a year-over-year basis shipments are down. And though nearly all STB product categories saw volume increases in 2Q14, satellite shipments continue a downward trend, while cable set-tops are growing due to an ongoing refresh cycle in North America and Europe,” says Infonetics’ Jeff Heynen, principal analyst for broadband access and pay TV.

STB REPORT SYNOPSIS:

Infonetics’ quarterly STB report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for IP STBs; cable and satellite STBs (digital, hybrid, video gateways, media players); DTT STBs; and OTT media servers. The report also tracks telco IPTV and cable and satellite video subscribers. Vendors tracked: ADB, Apple, Arris, Changhong, Cisco, Coship, DVN, Echostar, Huawei, Humax, Jiuzhou, Kingvon, Netgem, Pace, Roku, Sagemcom, Samsung, Skyworth Digital, Technicolor, ZTE, others.

To buy report, contact Infonetics: www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS:

. DOCSIS channels pass 1 million for first time in Q2; CCAP revenue up 42%

. Broadband aggregation equipment passes $2B in 2Q14 as operators ‘binge on broadband’

. Fixed broadband infrastructure investments are rebounding in Brazil

. OTT and multiscreen TV drive spending on broadcast and streaming video equipment

. 802.11ac routers to make up nearly a third of WiFi-enabled router shipments by 2015

II. Research and Markets has announced the addition of the “Global and China Set-Top Box (STB) Industry Report 2014” report to their offering.

The Global and China Set-Top Box (STB) Industry Report 2014 is a professional and in-depth study on the current state of the global set-top box industry with a focus on the Chinese market.

The report provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. The set-top box market analysis is provided for both the international and Chinese domestic situations including development trends, competitive landscape analysis, key regions development status and a comparison analysis between the international and Chinese markets.

Development policies and plans are also discussed and manufacturing processes and cost structures analyzed. Set-Top box industry import/export consumption, supply and demand figures and cost price and production value gross margins are also provided.

The report focuses on thirteen industry players providing information such as company profiles, product picture and specification, capacity production, price, cost, production value and contact information. Upstream raw materials and equipment and downstream demand analysis is also carried out. The set-top box industry development trends and marketing channels are analyzed. Finally the feasibility of new investment projects are assessed and overall research conclusions offered.

For more information visit http://www.researchandmarkets.com/research/7b85kd/global_and_china

Media Contact: Laura Wood, +353-1-481-1716, [email protected]

SIP trunking services market expected to grow 35% in 2014 & top $8 billion by 2018

Infonetics Research released excerpts from its new SIP Trunking Services market size and forecasts report, which tracks Session Initiation Protocol (SIP) trunking revenue, trunks, and average revenue per trunk.

SIP trunking is a means of synthesizing the Session Initiation Protocol and Voice over Internet Protocol (VoIP) to provide telephony services over data networks. The two leading SIP trunk providers are BroadVoice and 8×8, Inc.

SIP TRUNKING SERVICES MARKET HIGHLIGHTS:

. The global SIP trunking services market is on track to grow 35% in 2014, to $4.4 billion

. The biggest market for SIP trunking services is North America, although new geographic markets continue to open up, helping fuel growth

. More and more businesses are making the switch to SIP trunking, but they are not cutting 100% of connections to SIP on day one; rather, SIP is typically being deployed at one or two sites to start

. Infonetics expects continued strong worldwide growth for SIP trunking over the next five years, forecasting the market to reach $8 billion in 2018

. SIP trunking is being pitched alongside hosted PBX and unified communications (UC) services as more businesses seek hybrid solutions

“There is no denying the world is moving to IP, and SIP has become the de facto solution of choice for businesses for IP connections. In North America, slightly more than 20% of the installed business trunks are SIP trunking today, with significant upside opportunity,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research.

SIP REPORT SYNOPSIS:

Infonetics’ annual SIP trunking services report provides worldwide and regional market size, forecasts through 2018, analysis, and trends for SIP trunking revenue, trunks, and average revenue per trunk.

To buy the report, contact Infonetics:

www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS:

. Infonetics’ October Enterprise Voice, Video, and UC research brief:

http://www.infonetics.com/2014-newsletters/Enterprise-Voice-Video-UC-October.html

. Over 3/4 of N. American businesses surveyed plan to use SIP trunking by 2016

. Shift to software and services in enterprise videoconferencing market tamps revenue growth

. Enterprise session border controller (eSBC) market up 8% in 2Q14

. PBX market struggles linger in first half of 2014; UC up 31% from year ago

. Cloud PBX and unified communication services a $12 billion market by 2018

References:

Analysis of the North American VoIP Access and SIP Trunking Services Market 2013-2020

http://www.businesswire.com/news/home/20141001006535/en/Research-Markets…

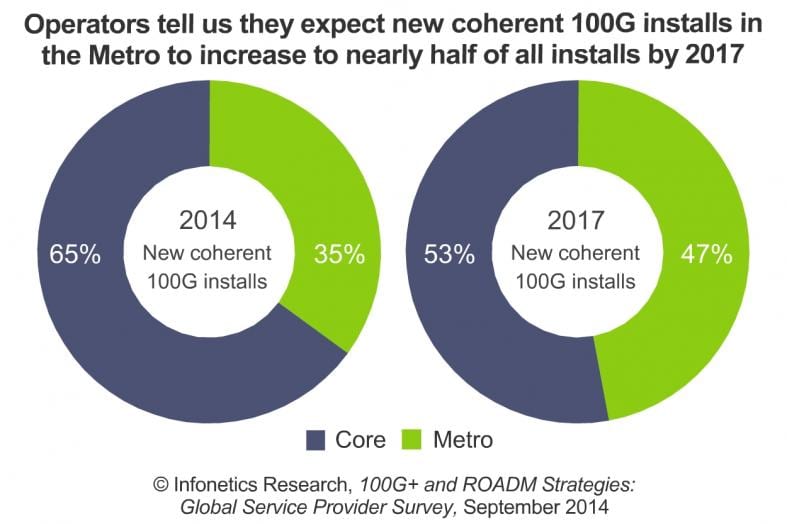

Infonetics: 100G+ coherent network equipment moving to the metro

Infonetics Research released excerpts from its 2014 100G+ and ROADM Strategies: Global Service Provider Survey, which details the plans of operators transitioning optical transmission and switching equipment to higher-speed 100G+ wavelengths.

100G+ AND ROADM SURVEY HIGHLIGHTS:

. Respondent operators have reasonable expectations for pricing for coherent metro-regional and access applications versus the core

. When it comes to end-use applications for metro 100G, study participants view data center interconnect as the clear killer app for the next 12 months

. Respondents also expect a greater uptake of 100GE transport when compared to previous years’ Infonetics surveys

. Those surveyed expect 100G WDM to account for almost 40% of all metro wavelength deployments and 75% of the core network in 2017

. Pluggable CFP and CFP2 technology is perceived by respondents as a more important technology for the metro this year than it was last year

“The big battleground for vendors of 100G-and-beyond coherent equipment and components has shifted to the metro as winners for long reach core applications have been decided,” says Andrew Schmitt, principal analyst for carrier transport networking at Infonetics Research.

“There are two very distinct markets for coherent technology. One market is deploying long haul coherent today and will transition to metro in the coming years. But there is another, separate (network provider) customer type that is already fully committed to deploying coherent technology in the metro today,” Schmitt adds. “These two markets have major implications for the supply chain regarding product specialization and the relative lack of interest in flex coherent technology by

some customers.”

ABOUT INFONETICS’ 100G/ROADM SURVEY:

For its 19-page 100G+ and ROADM (Reconfigurable Optical Add/Drop Mulltiiplexer) strategies survey, Infonetics interviewed 31 incumbent, competitive, mobile, and cable operators from EMEA, North America, and Asia that have an optical transport network using WDM. Together, the respondents represent a significant 33% of the world’s telecom revenue and 36% of global capex. The survey covers 100G WDM price points, metro coherent wavelength deployment trends, end-use applications for metro 100G, metro and core technology adoption rates, and key technologies for optical transport.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

http://www.infonetics.com/pr/2014/100G-ROADM-Strategies-Survey-Highlight…

FREE OPTICAL WEBINAR AND WHITEPAPER:

Join Infonetics analyst Andrew Schmitt Oct. 28 at 11:00 A.M. EDT for Building More Efficient Networks with Multi-Layer Packet-Optical, an event examining how network operators are building more capable and efficient networks. Register to attend live or access the replay at:

http://w.on24.com/r.htm?e=846242&s=1&k=C66A31488593733FC7770651A4A1DD98

RELATED REPORTS & BLOG POSTS:

. Infonetics’ October Optical research brief:

http://www.infonetics.com/2014-newsletters/Optical-October.html

Top 10 Things to Look for in a Metro 100G Platform

http://www.cyaninc.com/blog/2014/09/09/top-10-things-to-look-for-in-a-me…

Fujitsu unveils 100G coherent CFP for metro networks

http://www.lightwaveonline.com/articles/2014/09/fujitsu-unveils-100g-coh…

Infinera Targets Cloud for 100G Network Between Data Centers

https://www.sdncentral.com/news/infinera-gets-cloud-happy-100g-network-d…