Infonetics: Self Organizing Networks & Performance Optimization Strategies

Overview:

Market research firm Infonetics Research released excerpts from its new Self-Organizing Network (SON) and Optimization Strategies: Global Service Provider Survey, for which Infonetics interviewed wireless, incumbent, and competitive operators around the world about their network optimization strategies and SON deployment plans.

ANALYST NOTE:

“While SON is up and running in a few LTE networks around the world, we were surprised to find that some of the large

incumbents we surveyed for our SON and optimization study have deployed SON as the key optimization tool in their 3G networks as well,” reports Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. “Since SON was originally developed for LTE, this finding is fascinating and draws to a close the debate over whether SON could be used in legacy networks.”

SON AND OPTIMIZATION SURVEY HIGHLIGHTS:

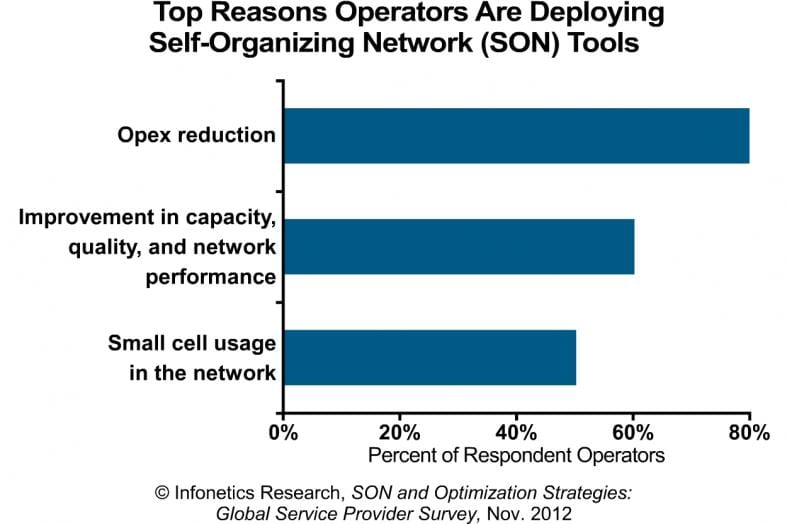

. The chief drivers for deploying SON are opex reduction; improvement in capacity, quality, and network performance; and small cell usage in the network.

. Automatic neighbor relations (ANR) is the most deployed SON feature among respondent operators

. 80% of operators interviewed rate complexity as the #1 barrier to deploying SON

. Survey respondents view Ericsson, Huawei, and Nokia Siemens Networks as the top SON vendors

. A majority of respondents consider SON an unproven and immature technology

In an email exchange with this author, Stephane Teral wrote: “Infonetics Research doesn’t cover Distributed Antenna Systems (DAS) in our Mobile Infrastructure report, but we know it’s a $1B/year market – tiny compared to $45 to $50B/year for mobile infrastructure which was in that report which was cited in your viodi.com article. Small cells will be part of a whole strategy along with carrier aggregation, Self Organizing Networks (SON), etc… to address capacity issues in specific areas.”

SURVEY SYNOPSIS:

For its new 24-page SON and optimization survey, Infonetics interviewed independent wireless, incumbent, and competitive operators in Europe, North America, and Asia about their network optimization strategies and SON deployment plans. The study provides insights into SON features, drivers, implementation barriers, technical challenges, and vendors. Operators surveyed together represent 1/3 of the world’s telecom capex and carrier revenue and 16% of all mobile subscribers.

To buy the survey, contact Infonetics: http://www.infonetics.com/contact.asp

RELATED INFONETICS RESEARCH:

. Latest Infonetics Mobile, Wireless, and Small Cells research brief: http://bit.ly/SL16eJ

. LTE jumps 30% in Q3, NSN doubles LTE revenue; mobile gear set for growth in 2013

. Japan’s mobile market grows 3-fold on the wings of LTE, China puts 3G first

. 3G and 4G self-organizing network (SON) software market set to double in 2013

. Telecom outsourcing, managed services a $76 billion opportunity by 2016

. Small cell is the buzz but DAS (Distributed Antenna System) is the biz, say operators in latest Infonetics survey

. Femtocells offer opportunity to put the mobile network at the heart of the home network

. Femtocell market spikes 12% in Q2; Alcatel-Lucent nabs W-CDMA femto lead

. A first: Increased ARPU now a top driver for LTE upgrades

. Mobile broadband will push mobile services to $976 billion by 2016; SMS, voice persevere

. Voice over LTE gaining momentum (at long last)

Related Article (published today, with comments from Stephane Teral):

http://viodi.com/2012/12/05/infonetics-mobile-infrastructure-market-down-in-quarter-small-cells-not-so-hot/

What about Small Cells for spectrum re-use as a mobile access performance optimization strategy?

Some believe that Small Cells will solve the mobile data capacity crunch. Alcatel-Lucent: “Small cells could solve the mobile broadband capacity crunch. A number of reports have identified the metro market as one of the driving factors in femtocell growth as operators use femtocells to provide fill-in coverage for congested metro areas..” http://tinyurl.com/asfzuk4

Infonetics’ Stephane Teral wrote in an email, “Small cells will be part of a whole strategy along with carrier aggregation, Self Organizing Networks (SON), etc… to address capacity issues in specific areas.”