Dell’Oro: Data Center Switch market declined 9% YoY; SD-WAN market increased at slower rate than in 2019

Market research firm Dell’Oro Group reported today that the worldwide Data Center Switch market recorded its first decline in nine years, dropping 9 percent year-over-year in the first quarter. 1Q 2020 revenue level was also the lowest in three years. The softness was broad-based across all major branded vendors, except Juniper Networks and white box vendors. Revenue from white box vendors was propelled mainly by strong demand from Google and Amazon.

“The COVID-19 pandemic has created some positive impact on the market as some customers pulled in orders in anticipation of supply shortage and elongated lead times,” said Sameh Boujelbene, Senior Director at Dell’Oro Group. “Yet this upside dynamic was more than offset by the pandemic’s more pronounced negative impact on customer demand as they paused purchases due to macro-economic uncertainties. Supply constraints were not major headwinds during the first quarter but expected to become more apparent in the next quarter,” added Boujelbene.

Additional highlights from the 1Q 2020 Ethernet Switch – Data Center Report:

- The revenue decline was broad-based across all regions but was less pronounced in North America.

- We expect revenue in the market to decline high single-digit in 2020, despite some pockets of strength from certain segments.

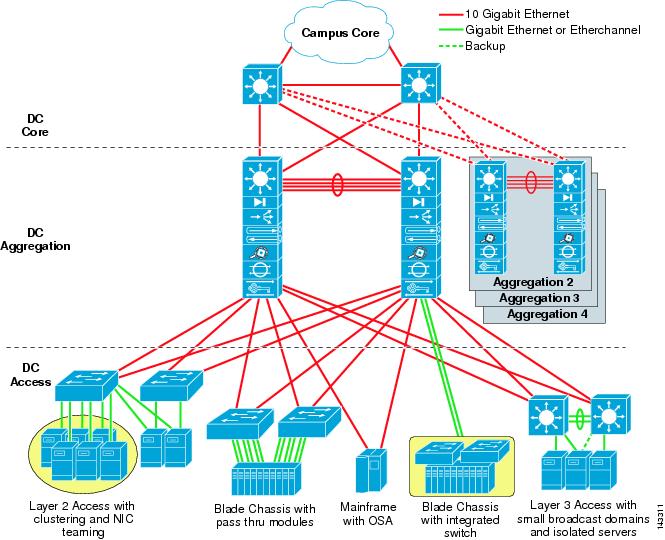

The Dell’Oro Group Ethernet Switch – Data Center Quarterly Report offers a detailed view of the market, including Ethernet switches for server access, server aggregation, and data center core. (Software is addressed separately.) The report contains in-depth market and vendor-level information on manufacturers’ revenue; ports shipped; average selling prices for both Modular and Fixed Managed and Unmanaged Ethernet Switches (1000 Mbps,10, 25, 40, 50, 100, 200, and 400 GE); and regional breakouts. To purchase these reports, please contact us by email at [email protected].

…………………………………………………………………………………………………………………………………………………

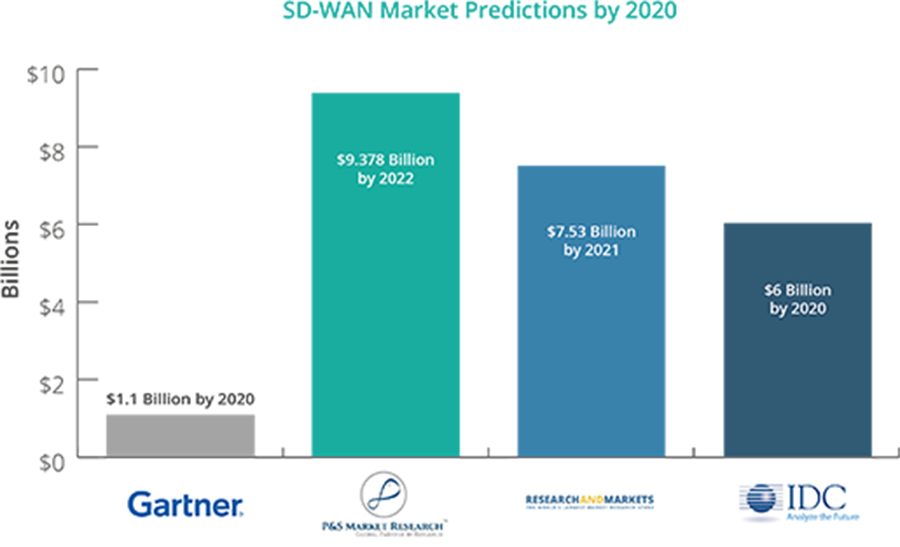

Separately, Dell’Oro Group reported that the market for software-defined (SD)-WAN equipment increased by 24% in the first quarter (year-to-year), which was significantly below the 64% growth seen in 2019. Citing supply chain issues created by the coronavirus pandemic, the market research firm’s Shin Umeda predicted the market will post double-digit growth in 2020 despite “macroeconomic uncertainty.”

- Supply chain disruptions accounted for the majority of the Service Provider (SP) Router and CES Switch market decline in 1Q 2020.

- The SP Router and CES market in China showed a modest decline in 1Q 2020, but upgrades for 5G infrastructure are expected to drive strong demand over the rest of 2020.