Author: Alan Weissberger

Nokia’s Bell Labs to use adapted 4G and 5G access technologies for Indian space missions

Nokia’s Bell Labs is receptive to collaborating with the Indian Space Research Organization (ISRO), government agencies, and private players in India’s space sector to support future lunar missions with 4G, 5G and other advanced wireless networking technologies. Thierry Klein, President of Bell Labs Solutions Research, visited India in late June to explore potential partnerships and deepen engagement with the country’s growing space ecosystem. In an interview with Moneycontrol, Klein said India’s space ambitions present a compelling opportunity for collaboration.

“We are in a lot of conversations globally, working with government agencies and private companies to see how we can support their missions from a communications perspective. This is really the reason why I came to India—because it is a great opportunity for me to learn more about the space ecosystem and build relations and explore collaboration opportunities with the Indian space sector,” Klein said. He emphasized that while these space networks make use of existing 3GPP 4G and 5G cellular specifications, they must be drastically reengineered to withstand extreme temperatures, mechanical stress, radiation, and power constraints.

With India opening its space sector to private participation and international collaboration, Nokia’s proposed engagement could bring advanced telecom capabilities to future Indian lunar missions. Klein affirmed the company’s openness to working with both public and private entities in India to advance lunar and deep space communications.

India plans to launch the Chandrayaan-4 mission in 2027, aiming to bring back samples of moon rocks to Earth. Chandrayaan-4 will involve at least two separate launches of the heavy-lift LVM-3 rocket, which will carry five different components of the mission that will be assembled in orbit.

Asked if Nokia Bell Labs is engaging with ISRO, which is the primary agency in India for space exploration and research, Klein said, “Yeah, we definitely want to engage with them [ISRO]. I met people from both the government and private companies. They are very interested in continuing the conversations on both sides, the private sector as well as the public sector. I have had lots of conversations and lots of interest in exploring working together.”

Nokia Bell Labs has been developing cutting-edge communication systems for future lunar missions, with the aim of supporting the growing global interest from governments, such as India, and private space enterprises in establishing a permanent presence on the Moon and, eventually, Mars.

“Unlike the Apollo era, which relied on basic voice and low-resolution imagery, future lunar missions will demand high-definition video, data-rich applications, and low-latency networks to support scientific research, mining, transportation, and habitation on the Moon,” said Klein.

To meet those demands, Bell Labs is adapting commercial-grade 4G and 5G cellular technologies, currently used globally on Earth, for use in space. The first real-world test of this technology was conducted during the Intuitive Machines IM-2 mission, which landed on the moon on March 6, 2024, and successfully demonstrated a functioning 4G LTE network on the lunar surface.

“So that’s been our vision for seven or eight years, and that’s what we’ve really done with the Intuitive Machines 2 mission…We built the first cellular network and wanted to prove that we could do this. It was a technology demonstration to show that we can take something based on the networks we use on Earth, make all the necessary adaptations I mentioned, deploy the network, operate it successfully, and prove that cellular technology is a viable solution for space operations,” Klein said.

Klein said Bell Labs envisions the Moon’s communication infrastructure developing similarly to Earth’s surface networks, supporting permanent lunar bases, while satellites in lunar orbit provide 5G-based backhaul or coverage for remote regions. “We think of 5G as both providing surface capabilities as well as orbit-to-surface capabilities,” he said, likening it to non-terrestrial networks (NTNs) on Earth.

The company initially opted for 4G due to its maturity at the time the project began in 2020. Looking ahead, the migration to 5G is on the horizon, likely coinciding with the shift to 6G on Earth in 2030. “We would expect that we have 5G on the lunar surface by 2030,” Klein said, explaining that staying one generation behind Earth networks allows lunar missions to benefit from economies of scale, mature ecosystems, and deployment experience.

Nokia and Intuitive Machines successfully delivered a 4G LTE network to the Moon. However, a planned wireless call couldn’t be made because the Athena lander tipped over, limiting its ability to recharge. Still, Nokia’s Lunar Surface Communications System (LSCS), including its base station, radio, and core, ran flawlessly during the 25-minute power window.

Klein also revealed that Nokia is working with Axiom Space to integrate 4G LTE into next-generation space suits, which are slated for NASA’s Artemis III mission in 2027. Nokia continues to engage with governments and commercial partners globally. “Everybody realizes there is a need for communication. We are really open to working with anybody that we could support,” Klein said.

References:

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

U.S. military sees great potential in space based 5G (which has yet to be standardized)

China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Telecoms.com’s survey: 5G NTNs to highlight service reliability and network redundancy

Telecoms.com survey results, presented in the report Private networks and NTNs: Transcending the boundaries of 5G, highlight the reinforcement of service reliability and additional layer of network redundancy as the most frequently selected impact of the convergence of 5G and Non Terrestrial Networks (NTN)s, according to nearly half of respondents. Engineers and developers are the biggest proponents of this impact with more than three in five respondents highlighting its value from a technical perspective. The extra network redundancy is backup connectivity from NTNs to existing 5G networks (e,g, dye to a cell tower failure or massive power outage) and the ability to ensure continued service whether in times of crisis or otherwise.

Meanwhile, two in five C-Suite executives think it’s either too early to determine the benefits or that NTNs will only achieve a minimal impact on 5G performance, hinting that they may need more convincing to achieve full buy-in.

‘Deployment costs’ are identified as the top concern when converging NTNs with 5G for many organisations in telecoms and particularly so for CSPs, while ‘cost of infrastructure’ is the most frequently selected key challenge slowing down the large-scale adoption of private 5G.

The cost barrier is neither new nor surprising for these topics, or for many other telecom topics being surveyed, but what this is compounded with now is a global economy that hasn’t been stable for some time, whether due to the global pandemic, or the ever-growing number of wars around the world.

On private 5G, the report also highlights several 5G standalone features that are considered most important to enterprises. Here, network responsiveness (low latency, handover time, and ultra-low data rates) is flagged as the top feature closely followed by network slicing in radio (that is, reserving capacity for specific applications).

The report argues that “while these results shed light on key technical capabilities that telecom professionals consider to be critical for the use of enterprises in a private 5G environment, it is also important to note that focusing on business outcomes and use cases versus technical capabilities is likely more meaningful in discussions with enterprises.”

………………………………………………………………………………………………………………………………………

3GPP introduced NTN into its Release 17, which provided an initial framework and Release 18 which included enhancements. 3GPP continues to work on NTN in Release 19 and beyond, focusing on aspects like onboard satellite processing, Ku-band frequencies, and integration with terrestrial networks.

-

Release 17: This release introduced the initial framework for 5G NTN, including support for NB-IoT and 5G NR NTN.

-

Release 18: This release focused on performance enhancements and additional frequency bands for 5G NTN.

-

Release 19 and beyond: Future releases, including 19, will continue to build on the NTN standard, with plans to enhance onboard satellite processing, expand to Ku-band frequencies for 5G NTN, and improve the integration between terrestrial and non-terrestrial networks.

3GPP looks forward to the continuous collaboration with ITU-R WP 4B for the finalization of Recommendation ITU-R M.[IMT-2020-SAT.SPECS], which will be the official standard for 5G satellite to ground communications.

………………………………………………………………………………………………………………………………………………………

References:

https://tc-resources.telecoms.com/free/w_defa8859/

https://www.3gpp.org/technologies/ntn-overview

ITU-R recommendation IMT-2020-SAT.SPECS from ITU-R WP 5B to be based on 3GPP 5G NR-NTN and IoT-NTN (from Release 17 & 18)

Standards are the key requirement for telco/satellite integration: D2D and satellite-based mobile backhaul

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

Momentum builds for wireless telco- satellite operator engagements

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Téral Research: 5G SA core network deployments accelerate after a very slow start

5G deployments started with the non-standalone (NSA) mode (using a 4G core network) and are now gradually migrating to Stand Alone (SA) core network to unleash a plethora of use cases. 5G SA offers improved latency and bandwidth, enabling advanced services and applications. 5G SA goes far beyond mobile and will eventually become the network that bridges all networks together, with the new sophisticated service-based architecture (5G SBA) designed by the 3GPP. Although many of the network functions (NFs) featured in the 5G SBA come from existing ones currently active in 2G/3G and 4G networks, novel functions such as the network slice selection function (NSSF) are being introduced.

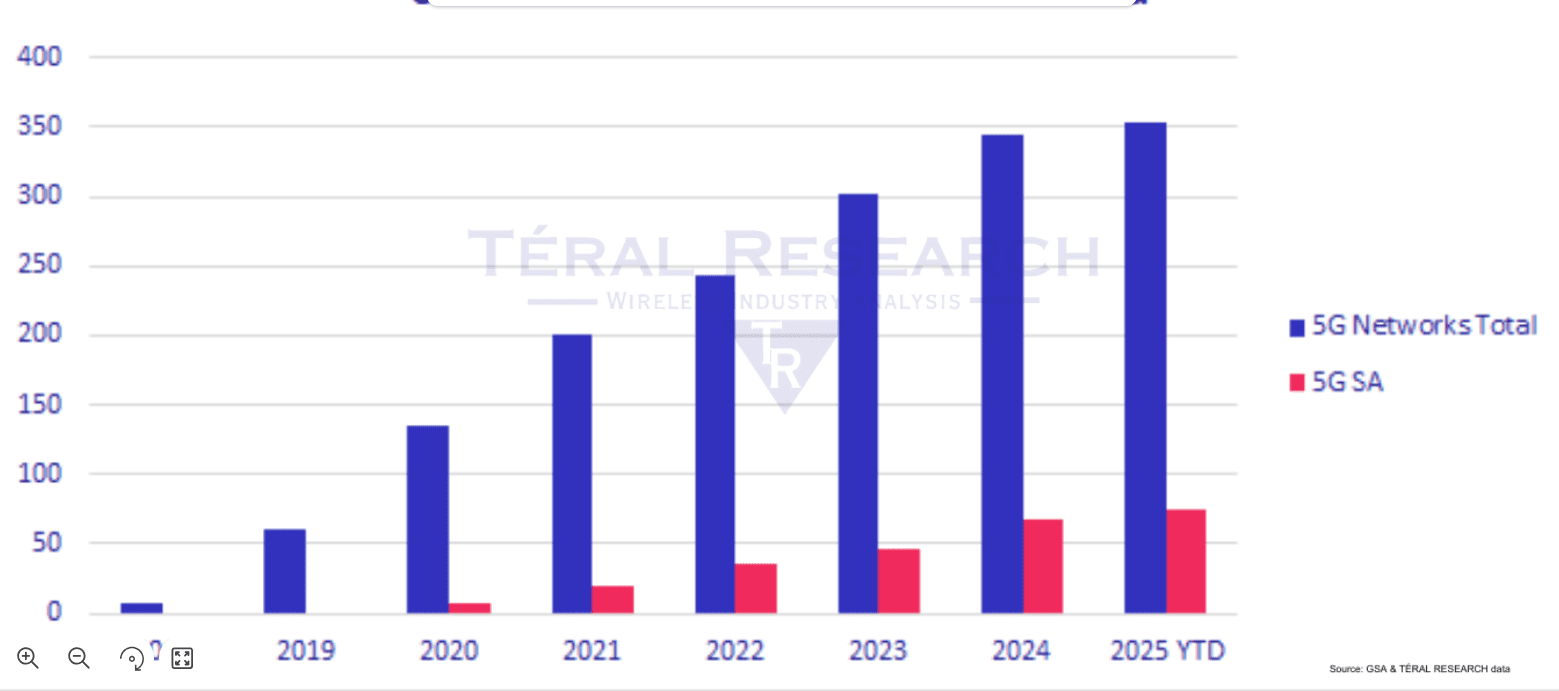

After a very slow start during the past five years, Téral Research [1.] says the migration to 5G SA has increased. Of the total 354 commercially available 5G public networks reported at the end of 1Q25, 74 are 5G SA – up from 49 one year ago.

Note 1. Based on a communications service provider (CSP) survey and discussions with many vendors, Téral Research’s 5G SA report analyzes several of the 5G Core SBA functions and provides global and regional market sizes and forecasts by focusing on the NFs implemented by CSPs (e.g., UDM, UDR, AUSF, NRF, NEF and NSSF, PCF, BSF, CHF) to enable use cases beyond enhanced mobile broadband (eMBB), fixed wireless access (FWA), and private 5G.

……………………………………………………………………………………………………………………………………………………………………..

2024 had the highest number of 5G SA commercial launches: 21 networks went live to offer commercial 5G SA services last year. The success of FWA services, the introduction of smartphone plans enabled by the increasing number of available 5G SA devices, and the rise of VoNR drove this SA migration.

Key findings include:

-

Network slicing is taking off for various services, including for military use cases.

-

The single vendor approach remains predominant for each domain.

-

67% of 5G SA core deployment are cloud-based but due to data sovereignty concerns,

CSPs favor private cloud infrastructures.

-

The global 2024 market for 5G SA Core + SDM + Policy & Charging grew 12% YoY and hit $3.8B, slightly below our forecast.

-

Sustained by its domestic market, Huawei leads global 2024 sales for 5G SA Core + SDM + Policy & Charging, followed by Ericsson and Nokia, respectively. However, Nokia leads the global commercial 5G SA footprint. ZTE comes in fourth place for global total sales and second for 5G SA core sales behind Huawei.

In the meantime, technical challenges related to 5G network architecture complexity, 3GPP methods for exchanging information across 4G vs. 5G, policy orchestration and enforcement, real-time analytics and insights and data analytics are still lingering but being solved.

Built on a solid CSP pipeline of 559 cellular networks in the world that have yet to be migrated to 5G SA, Téral’s model produced a forecast that shows the global 5G SA Core/5G Data Management/5G Policy market to cross the $4B bar by year-end, which is 20% YoY growth. Last year’s downward revision put our forecast on track and therefore we have not made any significant change in this forecast update.

……………………………………………………………………………………………………………………………………

Editor’s Note: In 2025, about a dozen more mobile network operators (MNOs) are expected to deploy 5G Standalone (SA) networks, according to Fierce Network and Moniem-Tech. This will include some major CSPs like AT&T and Verizon, who have previously deployed 5G SA on a limited basis. ……………………………………………………………………………………………………………………………………

In the long run, Teral foresees a significant ramp up in CSPs’ migration to 5G SA that adds to the ongoing activity continuously fueled by the emergence of new use cases going beyond eMBB, FWA, and private 5G. Therefore, Téral expects the market to grow at a 2025-2030 CAGR of 11%. Asia Pacific will remain the largest market throughout the forecast period and 5G SA core the most important domain to start with, followed by 5G Data Management.

Finally, the disaggregated multi-domain nature of 5G core SBA brings a broad range of contenders that include the traditional telecom network equipment vendors, a few mobile core specialists, a handful of subscriber data management (SDM) specialists, a truck load of policy and charging rules function (PCRF) players, the OSS/BSS providers and the system integrators and providers of IT services.

References:

Téral Research :: June 2025 5G SA Core, SDM and Policy

Ookla: Europe severely lagging in 5G SA deployments and performance

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Building and Operating a Cloud Native 5G SA Core Network

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

5G SA networks (real 5G) remain conspicuous by their absence

Big Tech and VCs invest hundreds of billions in AI while salaries of AI experts reach the stratosphere

Introduction:

Two and a half years after OpenAI set off the generative artificial intelligence (AI) race with the release of the ChatGPT, big tech companies are accelerating their A.I. spending, pumping hundreds of billions of dollars into their frantic effort to create systems that can mimic or even exceed the abilities of the human brain. The areas of super huge AI spending are data centers, salaries for experts, and VC investments. Meanwhile, the UAE is building one of the world’s largest AI data centers while Softbank CEO Masayoshi Son believes that Artificial General Intelligence (AGI) will surpass human-level cognitive abilities (Artificial General Intelligence or AGI) within a few years. And that Artificial Super Intelligence (ASI) will surpass human intelligence by a factor of 10,000 within the next 10 years.

AI Data Center Build-out Boom:

Tech industry’s giants are building AI data centers that can cost more than $100 billion and will consume more electricity than a million American homes. Meta, Microsoft, Amazon and Google have told investors that they expect to spend a combined $320 billion on infrastructure costs this year. Much of that will go toward building new data centers — more than twice what they spent two years ago.

As OpenAI and its partners build a roughly $60 billion data center complex for A.I. in Texas and another in the Middle East, Meta is erecting a facility in Louisiana that will be twice as large. Amazon is going even bigger with a new campus in Indiana. Amazon’s partner, the A.I. start-up Anthropic, says it could eventually use all 30 of the data centers on this 1,200-acre campus to train a single A.I system. Even if Anthropic’s progress stops, Amazon says that it will use those 30 data centers to deliver A.I. services to customers.

Amazon is building a data center complex in New Carlisle, Ind., for its work with the A.I. company Anthropic. Photo Credit…AJ Mast for The New York Times

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Stargate UAE:

OpenAI is partnering with United Arab Emirates firm G42 and others to build a huge artificial-intelligence data center in Abu Dhabi, UAE. The project, called Stargate UAE, is part of a broader push by the U.A.E. to become one of the world’s biggest funders of AI companies and infrastructure—and a hub for AI jobs. The Stargate project is led by G42, an AI firm controlled by Sheikh Tahnoon bin Zayed al Nahyan, the U.A.E. national-security adviser and brother of the president. As part of the deal, an enhanced version of ChatGPT would be available for free nationwide, OpenAI said.

The first 200-megawatt chunk of the data center is due to be completed by the end of 2026, while the remainder of the project hasn’t been finalized. The buildings’ construction will be funded by G42, and the data center will be operated by OpenAI and tech company Oracle, G42 said. Other partners include global tech investor, AI/GPU chip maker Nvidia and network-equipment company Cisco.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Softbank and ASI:

Not wanting to be left behind, SoftBank, led by CEO Masayoshi Son, has made massive investments in AI and has a bold vision for the future of AI development. Son has expressed a strong belief that Artificial Super Intelligence (ASI), surpassing human intelligence by a factor of 10,000, will emerge within the next 10 years. For example, Softbank has:

- Significant investments in OpenAI, with planned investments reaching approximately $33.2 billion. Son considers OpenAI a key partner in realizing their ASI vision.

- Acquired Ampere Computing (chip designer) for $6.5 billion to strengthen their AI computing capabilities.

- Invested in the Stargate Project alongside OpenAI, Oracle, and MGX. Stargate aims to build large AI-focused data centers in the U.S., with a planned investment of up to $500 billion.

Son predicts that AI will surpass human-level cognitive abilities (Artificial General Intelligence or AGI) within a few years. He then anticipates a much more advanced form of AI, ASI, to be 10,000 times smarter than humans within a decade. He believes this progress is driven by advancements in models like OpenAI’s o1, which can “think” for longer before responding.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Super High Salaries for AI Researchers:

Salaries for A.I. experts are going through the roof and reaching the stratosphere. OpenAI, Google DeepMind, Anthropic, Meta, and NVIDIA are paying over $300,000 in base salary, plus bonuses and stock options. Other companies like Netflix, Amazon, and Tesla are also heavily invested in AI and offer competitive compensation packages.

Meta has been offering compensation packages worth as much as $100 million per person. The owner of Facebook made more than 45 offers to researchers at OpenAI alone, according to a person familiar with these approaches. Meta’s CTO Andrew Bosworth implied that only a few people for very senior leadership roles may have been offered that kind of money, but clarified “the actual terms of the offer” wasn’t a “sign-on bonus. It’s all these different things.” Tech companies typically offer the biggest chunks of their pay to senior leaders in restricted stock unit (RSU) grants, dependent on either tenure or performance metrics. A four-year total pay package worth about $100 million for a very senior leader is not inconceivable for Meta. Most of Meta’s named officers, including Bosworth, have earned total compensation of between $20 million and nearly $24 million per year for years.

Meta CEO Mark Zuckerberg on Monday announced its new artificial intelligence organization, Meta Superintelligence Labs, to its employees, according to an internal post reviewed by The Information. The organization includes Meta’s existing AI teams, including its Fundamental AI Research lab, as well as “a new lab focused on developing the next generation of our models,” Zuckerberg said in the post. Scale AI CEO Alexandr Wang has joined Meta as its Chief AI Officer and will partner with former GitHub CEO Nat Friedman to lead the organization. Friedman will lead Meta’s work on AI products and applied research.

“I’m excited about the progress we have planned for Llama 4.1 and 4.2,” Zuckerberg said in the post. “In parallel, we’re going to start research on our next generation models to get to the frontier in the next year or so,” he added.

On Thursday, researcher Lucas Beyer confirmed he was leaving OpenAI to join Meta along with the two others who led OpenAI’s Zurich office. He tweeted: “1) yes, we will be joining Meta. 2) no, we did not get 100M sign-on, that’s fake news.” (Beyer politely declined to comment further on his new role to TechCrunch.) Beyer’s expertise is in computer vision AI. That aligns with what Meta is pursuing: entertainment AI, rather than productivity AI, Bosworth reportedly said in that meeting. Meta already has a stake in the ground in that area with its Quest VR headsets and its Ray-Ban and Oakley AI glasses.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

VC investments in AI are off the charts:

Venture capitalists are strongly increasing their AI spending. U.S. investment in A.I. companies rose to $65 billion in the first quarter, up 33% from the previous quarter and up 550% from the quarter before ChatGPT came out in 2022, according to data from PitchBook, which tracks the industry.

This astounding VC spending, critics argue, comes with a huge risk. A.I. is arguably more expensive than anything the tech industry has tried to build, and there is no guarantee it will live up to its potential. But the bigger risk, many executives believe, is not spending enough to keep pace with rivals.

“The thinking from the big C.E.O.s is that they can’t afford to be wrong by doing too little, but they can afford to be wrong by doing too much,” said Jordan Jacobs, a partner with the venture capital firm Radical Ventures. “Everyone is deeply afraid of being left behind,” said Chris V. Nicholson, an investor with the venture capital firm Page One Ventures who focuses on A.I. technologies.

Indeed, a significant driver of investment has been a fear of missing out on the next big thing, leading to VCs pouring billions into AI startups at “nosebleed valuations” without clear business models or immediate paths to profitability.

Conclusions:

Big tech companies and VCs acknowledge that they may be overestimating A.I.’s potential. Developing and implementing AI systems, especially large language models (LLMs), is incredibly expensive due to hardware (GPUs), software, and expertise requirements. One of the chief concerns is that revenue for many AI companies isn’t matching the pace of investment. Even major players like OpenAI reportedly face significant cash burn problems. But even if the technology falls short, many executives and investors believe, the investments they’re making now will be worth it.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.nytimes.com/2025/06/27/technology/ai-spending-openai-amazon-meta.html

Meta is offering multimillion-dollar pay for AI researchers, but not $100M ‘signing bonuses’

https://www.theinformation.com/briefings/meta-announces-new-superintelligence-lab

OpenAI partners with G42 to build giant data center for Stargate UAE project

AI adoption to accelerate growth in the $215 billion Data Center market

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Networking chips and modules for AI data centers: Infiniband, Ultra Ethernet, Optical Connections

Superclusters of Nvidia GPU/AI chips combined with end-to-end network platforms to create next generation data centers

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Verizon partners with Nokia to deploy large private 5G network in the UK

Nokia and Verizon Business are collaborating to deploy a private 5G network across the Thames Freeport, a major UK industrial cluster including the Port of Tilbury and Ford Dagenham. This project is one of the UK’s largest private 5G deployments. It aims to modernize operations, boost efficiency, and drive economic growth in the region. The Thames Freeport, a 34 km-wide economic corridor, is the site of the deployment. This includes major industrial sites like the Port of Tilbury, Ford Dagenham, and DP World London Gateway. The deployment will cover 1,700 acres across multiple industrial sites within the Freeport.

Nokia will be the sole hardware and software provider, utilizing its Digital Automation Cloud (DAC) and MX Industrial Edge (MXIE) solutions.

This private 5G network will enable advanced use cases like AI-driven data analytics, predictive maintenance, process automation, autonomous vehicle control, and real-time logistics orchestration, according to Telecoms Tech News. The network is expected to modernize port operations, improve cargo handling, and enhance overall efficiency in the Freeport. The project also aims to boost the local economy, support job creation and training, and foster innovation and R&D collaborations.

Verizon and Nokia win a Thames Freeport private 5G deal. (Art by midJourney for Fierce Network)

“Band 77 in the U.K. is available at low cost on a local-area licensed basis — enterprises can readily get access to exclusive use mid-band spectrum in the 3.8-4.2 GHz range. The U.K. regulator, Ofcom, has pioneered this model globally,” said Heavy Reading Senior Principal Analyst for Mobile Networks Gabriel Brown in an email to Fierce Network. Brown noted that though it is based in the U.S., Verizon has an established smart ports business in the U.K., with the Port of Southhampton one of its private 5G network clients. He added the operator also has an ongoing relationship with Nokia around private 5G. “This new win shows advanced wireless technologies can scale to support nationally critical infrastructure with diverse stakeholders and use cases,” Brown said.

“To date, over 530 licenses have been issued to more than 90 licensees in this frequency range,” said SNS Telecom & IT 5G research director Asad Khan.

Verizon Business has been working on building its ports business for a while now, having already scored the aforementioned Southampton deal in April 2021. And its efforts appear to be paying off.

“I know there’s been chatter about how Verizon Business was able to outbid domestic carriers,” AvidThink Principal Roy Chua stated. “It’s likely some combination of demonstrated expertise in rolling out similar deployments and favorable financial terms. Definitely a win for Verizon Business (and Nokia) for sure.”

References:

https://www.fierce-network.com/wireless/verizon-and-nokia-win-one-largest-private-5g-projects-uk

U.S. Home Internet prices DECLINE amidst fierce competition between wireless carriers and cablecos

Home internet prices in the U.S. are being driven down by fierce competition between mobile carriers offering Fixed Wireless Access (FWA) and cable internet companies offering legacy Hybrid Fiber Coax connections. The increased competition has driven down the cost of home internet service, a welcome break for consumers when prices are rising for many other essential products. The price of home internet service fell 3.1% in May from a year earlier, while the overall consumer-price index rose 2.4%, according to the Labor Department.

The WSJ reports that major home-internet service providers including Verizon VZ, Comcast/Xfinity and T-Mobile launched a flurry of price-lock guarantees, promising steady rates for as long as five years. CableCos Charter, which is acquiring Cox, unveiled a three-year deal last year.

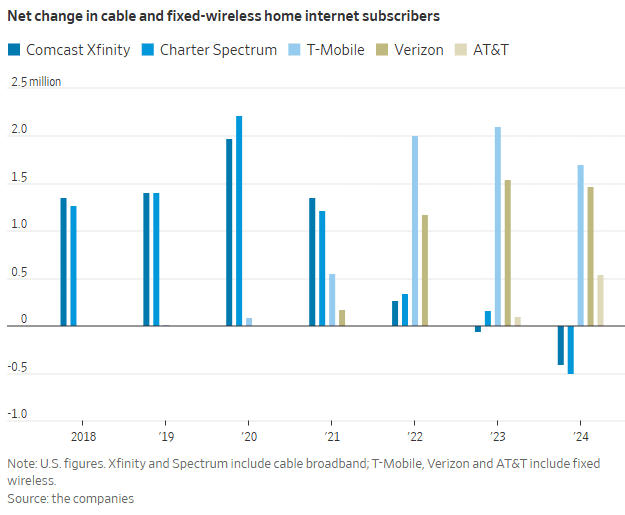

Cable companies have struggled to retain broadband internet subscribers since mobile carriers began offering more affordable 5G fixed-wireless access (FWA) internet service in 2018. FWA, which relies on over the air transmission to cell towers instead of HFC access, brought competition into markets where cable companies had long enjoyed being the only game in town. Now both types of providers are growing more aggressive to attract—and keep—customers.

“The cable companies went from gaining subscribers and raising rates every year to declining subscribers and giving people price locks,” said John Hodulik, a UBS analyst. “They’re seeing churn rise in their broadband subscriber base. And they’re trying to nip that in the bud.” Fixed wireless can sometimes cost half as much as a cable-provided internet plan. Though network congestion and other connectivity issues can be an issue for some users, the lower price point has been luring cable customers away.

T-Mobile, Verizon and AT&T added a combined 3.7 million FWA customers in 2024. In sharp contrast, Comcast’s Xfinity and Charter’s Spectrum lost more than 900,000 home internet subscribers. That’s depicted in this graph:

“Our pricing wasn’t breaking through in the marketplace,” said Steve Croney, chief operating officer for Comcast’s connectivity and platforms business. He said the company’s five-year price lock, introduced in April, competes well against the telecom companies’ offerings.

Frank Boulben, chief revenue officer at Verizon’s consumer group, said his company has been trying to address the “pain points” customers have with cable companies, such as price hikes. That’s why the telco is emphasizing FWA vs its FiOS fiber to the home based service. Boulben said his company would focus on selling fiber service to customers as it becomes available to them.

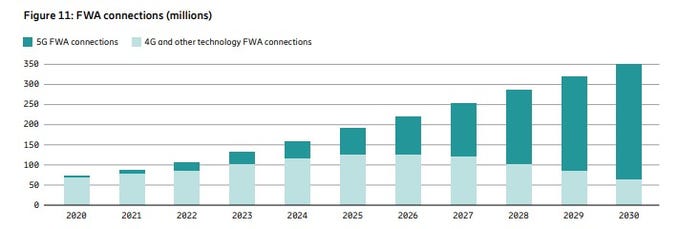

Is FWA the ONLY real killer application for 5G? Even though it was NOT one of the envisioned use cases? Ericsson’s recently released Mobility Report says FWA will account for more than 35% of all new fixed broadband connections, with an expected increase to 350 million by the end of 2030. The report states that more than half of all network service providers (wireless telcos) who offer FWA now do so with “speed-based monetization benefits enhanced by 5G.”

About 80% of the global network operators sampled by Ericsson currently offer FWA, with the most rapid area of growth among CSPs (communications service providers) offering 5G-enabled speed-based tariff plans. These opportunities are about the ability to offer a range of subscriber packages with different downlink and uplink data options with 5G FWA. As with fiber deals, “increasing monetization opportunities for CSPs compared to earlier generations of FWA.” 51% of operators with FWA offerings now include these speed-based options, which is up from 40% on the same period in June 2024 and represents a 27.5% increase. The June 2024 number had grown 50% on the June 2023 equivalent.

Source: Ericsson Mobility Report

…………………………………………………………………………………………………………………………………………………………………..

“We are at an inflection point, where 5G and the ecosystem are set to unleash a wave of innovation,” said Erik Ekudden, Ericsson Senior Vice President and Chief Technology Officer. “The recent advancements in 5G standalone (SA) networks, coupled with the progress in 5G-enabled devices, have led to an ecosystem poised to unlock transformative opportunities for connected creativity. Service providers have recognized this potential of 5G and are beginning to monetize it through innovative service offerings that extend beyond merely selling data plans. To fully realize the potential of 5G, it is essential to continue deploying 5G SA and to further build out mid-band sites. 5G SA capabilities serve as a catalyst for driving new business growth opportunities.”

Fixed-wireless doesn’t work everywhere. Besides congestion weak signals can make coverage spotty. If your cell phone doesn’t pick up 5G coverage smoothly, fixed-wireless from the same company probably won’t work either.

Verizon, AT&T and T-Mobile are winning converts to FWA at a faster pace than many anticipated, said Jonathan Chaplin, a managing partner at equity research firm New Street Research. Charter agreed to buy Cox last month for $21.9 billion in equity and assume $12 billion of its outstanding debt, in part to acquire scale to better compete with fixed wireless access. However, fixed-wireless growth can’t last indefinitely. The wireless networks on which they run will eventually hit capacity, limiting how many subscribers they can add. Chaplin estimates the networks can support around 19 million total fixed-wireless subscribers—which he predicts they will reach in about five years, accounting for planned network expansions that the companies have announced. When that limit is reached, cable companies may regain the upper hand and keep growing their fiber customer base, Chaplin said.

The big three wireless carriers (AT&T, Verizon and T-Mobile) have all been investing in fiber-based wired networks via build-outs and acquisitions. AT&T is bringing new customers in via FWA, with the long-term goal to convert them to fiber-based service, said Erin Scarborough, who runs that company’s broadband and connectivity initiatives.

References:

https://www.telecoms.com/5g-6g/ericsson-says-fwa-is-boosting-telco-monetization-opportunities

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.consumeraffairs.com/news/cable-vs-wireless-war-is-driving-prices-down-062525.html

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

FWA a bright spot in otherwise gloomy Internet access market

Google Cloud targets telco network functions, while AWS and Azure are in holding patterns

Overview:

Network operators have used public clouds for analytics and IT, including their business and operational support systems, but the vast majority have been reluctant to rely on hyper-scaler public clouds to host their network functions. However, there have been a few exceptions:

1. AWS counts Boost Mobile, Dish Network, Swisscom and Telefónica Germany as network operators running part of their 5G network in its public cloud. In a cloud-native 5G stand alone (SA) core network, the network functions are virtualized and run as software, rather than relying on dedicated hardware.

a] Dish Network is using Nokia’s cloud-native, 5G standalone core software which is deployed on the AWS public cloud. This includes software for subscriber data management, device management, packet core, voice and data core, and integration services. Dish invokes several AWS services, including Regions, Local Zones and Outposts, to host its 5G core network and related components.

b] Swisscom is migrating its core applications, including OSS/BSS and portions of its 5G core, to AWS according to Business Wire. This is part of a broader digital transformation strategy to modernize its infrastructure and services.

c] Telefónica Germany (O2 Telefónica) has moved its 5G core network to Amazon Web Services (AWS). This move, in collaboration with Nokia, makes them the first telecom company to switch an existing 5G core to a public cloud provider, specifically AWS. They launched their 5G cloud core, built entirely in the cloud, in July 2024, initially serving around one million subscribers.

2. Microsoft’s Azure cloud is running AT&T and the Middle East’s Etisalat 5G core network. AT&T is using Microsoft’s Azure Operator Nexus platform to run its 5G core network, including both standalone (SA) and non-standalone (NSA) deployments, according to AT&T and Microsoft. This move is part of a strategic partnership between the two companies where AT&T is shifting its 5G mobile network to the Microsoft cloud. However, AT&T’s 5G core network is not yet commercially available nationwide.

3. Ericsson has partnered with Google Cloud to offer 5G core as a service (5GCaaS) leveraging Google Cloud’s infrastructure. This allows operators to deploy and manage their 5G core network functions on Google’s cloud, rather than relying solely on traditional on-premises infrastructure. This Ericsson on-demand service recently launched with Google seems aimed mainly at smaller telcos, keen to avoid big upfront costs, or specific scenarios. To address much bigger needs, Google has an Outposts competitor it markets under the brand of Google Distributed Cloud (or GDC).

A serious concern with this Ericsson -Google offering is cloud provider lock-in, i.e. that a telco would not be able to move its 5GCaaS provided by Ericsson to an alternative cloud platform. Going “native,” in this case, meant building on top of Google-specific technologies, which rules out any prospect of a “lift and shift” to AWS, Microsoft or someone else, said Eric Parsons, Ericsson’s vice president of emerging segments in core networks, on a recent call with Light Reading.

……………………………………………………………………………………………………………………………………………………………………….

Google Cloud for Network Functions:

Angelo Libertucci, Google’s global head of telecom told Light Reading, the “timing is right” for a Google campaign that targets telco networks after years of sluggish industry progress. “The pressures that telcos are dealing with – the higher capex, lower ARPU [average revenue per user], competitiveness – it’s been a tough two years and there have been a number of layoffs, at least in North America,” he told Light Reading at last week’s Digital Transformation World event in Copenhagen.

“We run the largest private network on the planet,” said Libertucci. “We have over 2 million miles of fiber.” Services for more than a billion users are supported “with a fraction of the people that even the smallest regional telcos have, and that’s because everything we do is automated,” he claimed.

“There haven’t been that many network functions that run in the cloud – you can probably name them on less than four fingers,” he said. “So we don’t think we’ve really missed the boat yet on that one.” Indeed, most network functions are still deployed on telco premises (aka central offices).

Image Credit: Google Cloud Platform

Deutsche Telekom has partnered with Google earlier this year to build an agentic AI called RAN Guardian, which can assess network data, detect performance issues and even take corrective action without manual intervention. Built using Gemini 2.0 in Vertex AI from Google Cloud, the agent can analyze network behavior, detect performance issues, and implement corrective actions to improve network reliability, reduce operational costs, and enhance customer experiences. Deutsche Telekom keeps the network data at its own facilities but relies on interconnection to Google Cloud for the above listed functions.

“Do I then decide to keep it (network functions and data) on-prem and maintain that pre-processing pipeline that I have? Or is there a cost benefit to just run it in cloud, because then you have all the native integration? You don’t have any interconnect, you have all the data for any use case that you ever wanted or could think of. It’s much easier and much more seamless.” Such autonomous networking, in his view, is now the killer use case for the public cloud.

Yet many telco executives believe that public cloud facilities are incapable of handling certain network functions. European telcos including BT, Deutsche Telekom, Orange and Vodafone, have made investments in their own private cloud platforms for their telco workloads. Also, regulators in some countries may block operators from using public clouds. BT this year said local legislation now prevents it from using the public cloud for network functions. European authorities increasingly talk of the need for a “sovereign cloud” under the full control of local players.

Google does claim to have a set of “sovereign cloud” products that ensure data is stored in the country where the telco operates. “We have fully air-gapped sovereign cloud offerings with Google Cloud binaries that we’ve done in partnership with telcos for years now,” said Libertucci. The uncertainty is whether these will always meet the definition. “If sovereign means you can’t use an American-owned organization, then that’s another part of the definition that somehow we will have to find a way to address,” he added. “If you are cloud-native, it’s supposed to be easier to move to any cloud, but with telco it’s not that simple because it’s a very performance-oriented workload,” said Libertucci.

What’s likely, then, is that operators will assign whole regions to specific combinations of public cloud providers and telco vendors, he thinks, as they have done on the network side. “You see telcos awarding a region to Huawei and another to Ericsson with complete separation between them. They might choose to go down that route with network vendors as well and so you may have an Ericsson and Google part of the network.”

“We’re a platform company, we’re a data company and we’re an AI company,” said Libertucci. “I think we’re happy now with being a platform others develop on.”

………………………………………………………………………………………………………………………………………………………………………………….

Cloud RAN Disappoints:

Outside a trial with Ericsson almost two years ago, there is not much sign of Google activity in cloud RAN, the use of general-purpose chips and cloud platforms to support RAN workloads. “So far, no one’s really pushed us down into that area,” said Libertucci. AWS, by contrast, has this year begun to show off an Outposts server built around one of its own Graviton central processing units for cloud RAN. Currently, however, it does not appear to be supporting a cloud RAN deployment for any telco.

………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/cloud/google-preps-public-cloud-charge-at-telecom-as-microsoft-wobbles

Deutsche Telekom and Google Cloud partner on “RAN Guardian” AI agent

Key Objectives of WG Technology Aspects at ITU-R WP 5D meeting June 24-July 3, 2025

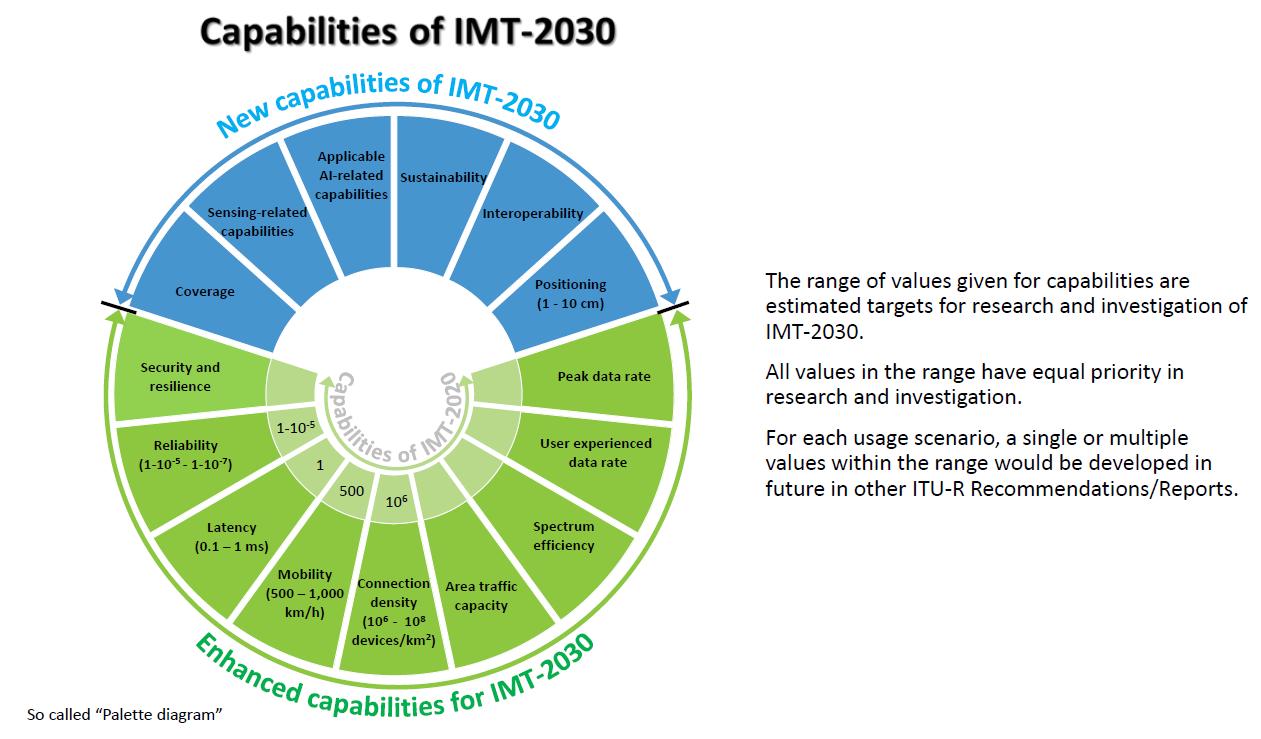

ITU-R WP 5D is responsible for the overall radio system aspects of the terrestrial component of International Mobile Telecommunications (IMT) systems, comprising the current IMT-2000, IMT-Advanced and IMT-2020 as well as IMT for 2030 and beyond. Note that 5D’s work is only for terrestrial radio access network interfaces. It does not include 5G or 6G Core network or satellite network access.

ITU-R WP5D Technology Aspects Working Group (WG) consists of several Sub Working Groups (SWGs):

SWG IMT SPECIFICATIONS, SWG EVALUATION, SWG RADIO ASPECTS, SWG IMT UNWANTED EMISSIONS, SWG IMT COORDINATION

Key objectives of WG Technology Aspects at their June 24-July 3, 2025 meeting include:

- Continue revising Recommendation ITU-R M.2150-2 (5G) and Recommendation ITU‑R M.2012-6 (IMT Advanced aka 4G), including consideration of further revision based on contribution;

- Continue working on revision of Document IMT-2030/2 “Process” – submission, evaluation process and consensus building process for IMT-2030;

- Start to work on candidate technology submission template for IMT-2030 (6G);

- Continue working on Report ITU-R M.[IMT-2030.TECH PERF REQ] – minimum requirements related to technical performance for IMT-2030 radio interface(s);

- Continue working on Report ITU-R M.[IMT-2030.EVAL] – Guidelines for evaluation of radio interface technologies for IMT-2030;

- Continue working on Report ITU-R M.[IMT-TROPO DUCT MITIGATION] – Mitigation of interference for IMT network under tropospheric ducting effect;

- Continue working on the documents of unwanted emission characteristics of base/mobile stations using the terrestrial radio interfaces of IMT-2020.

Backgrounder on IMT 2030 (6G):

Recommendation ITU R M.2160 ‒ “Framework and overall objectives of the future development of IMT for 2030 and Beyond” identifies IMT-2030 capabilities which aim to make IMT-2030 (6G) more capable, flexible, reliable and secure than previous IMT systems when providing diverse and novel services in the intended six usage scenarios, including immersive communication, hyper reliable and low latency communication (HRLLC), massive communication, ubiquitous connectivity, artificial intelligence and communication, and integrated sensing and communication (ISAC).

IMT-2030 can be considered from multiple perspectives, including users, manufacturers, application developers, network operators, verticals, and service and content providers. Therefore, it is recognized that technologies for IMT-2030 can be applied in a variety of deployment scenarios and can support a range of environments, service capabilities, and technology options.

IMT-2030 is also expected to be built on overarching aspects which act as design principles commonly applicable to all usage scenarios. These distinguishing design principles of the IMT‑2030 are including, but are not limited to sustainability, security and resilience, connecting the unconnected for providing universal and affordable access to all users independent of the location, and ubiquitous intelligence for improving overall system performance.

………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

ITU-R WP 5D reports on: IMT-2030 (“6G”) Minimum Technology Performance Requirements; Evaluation Criteria & Methodology

Highlights of 3GPP Stage 1 Workshop on IMT 2030 (6G) Use Cases

ITU-R WP 5D reports on: IMT-2030 (“6G”) Minimum Technology Performance Requirements; Evaluation Criteria & Methodology

Ericsson and e& (UAE) sign MoU for 6G collaboration vs ITU-R IMT-2030 framework

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

ITU-R WP5D invites IMT-2030 RIT/SRIT contributions

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

NGMN: 6G Key Messages from a network operator point of view

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

ZTE’s AI infrastructure and AI-powered terminals revealed at MWC Shanghai

ZTE Corporation unveiled a full range of AI initiatives under the theme “Catalyzing Intelligent Innovation” at MWC Shanghai 2025. Those innovations include AI + networks, AI applications, and AI-powered terminals. During several demonstrations, ZTE showcased its key advancements in AI phones and smart homes. Leveraging its underlying capabilities, the company is committed to providing full-stack solutions—from infrastructure to application ecosystems—for operators, enterprises, and consumers, co-creating an era of AI for all.

ZTE’s Chief Development Officer Cui Li outlined the vendor’s roadmap for building intelligent infrastructure and accelerating artificial intelligence (AI) adoption across industries during a keynote session at MWC Shanghai 2025. During her speech, Cui highlighted the growing influence of large AI models and the critical role of foundational infrastructure. “No matter how AI technology evolves in the future, the focus will remain on efficient infrastructure, optimized algorithms and practical applications,” she said. The Chinese vendor is deploying modular, prefabricated data center units and AI-based power management, which she said reduce energy use and cooling loads by more than 10%. These developments are aimed at delivering flexible, sustainable capacity to meet growing AI demands, the ZTE executive said.

ZTE is also advancing “AI-native” networks that shift from traditional architectures to heterogeneous computing platforms, with embedded AI capabilities. This, Cui said, marks a shift from AI as a support tool to autonomous agents shaping operations. Ms. Cui emphasized the role of high-quality, secure data and efficient algorithms in building more capable AI. “Data is like fertile ‘soil’. Its volume, purity and security decide how well AI as a plant can grow,” she said. “Every digital application — including AI — depends on efficient and green infrastructure,” she said.

ZTE is heavily investing in AI-native network architecture and high-efficiency computing:

- AI-native networks – ZTE is redesigning telecom infrastructure with embedded intelligence, modular data centers and AI-driven energy systems to meet escalating AI compute demands.

- Smarter models, better data – With advanced training methods and tools, ZTE is pushing the boundaries of model accuracy and real-world performance.

- Edge-to-core deployment – ZTE is integrating AI across consumer, home and industry use cases, delivering over 100 applied solutions across 18 verticals under its “AI for All” strategy.

ZTE has rolled out a full range of innovative solutions for network intelligence upgrades.

-

AIR RAN solution: deeply integrating AI to fully improve energy efficiency, maintenance efficiency, and user experience, driving the transition towards value creation of 5G

-

AIR Net solution: a high-level autonomous network solution that encompasses three engines to advance network operations towards “Agentic Operations”

-

AI-optical campus solution: addressing network pain points in various scenarios for higher operational efficiency in cities

-

HI-NET solution: a high-performance and highly intelligent transport network solution enabling “terminal-edge-network-computing” synergy with multiple groundbreaking innovations, including the industry’s first integrated sensing-communication-computing CPE, full-band OTNs, highest-density 800G intelligent switches, and the world’s leading AI-native routers

Through technological innovations in wireless and wired networks, ZTE is building an energy-efficient, wide-coverage, and intelligent network infrastructure that meets current business needs and lays the groundwork for future AI-driven applications, positioning operators as first movers in digital transformation.

In the home terminal market, ZTE AI Home establishes a family-centric vDC and employs MoE-based AI agents to deliver personalized services for each household member. Supported by an AI network, home-based computing power, AI screens, and AI companion robots, ZTE AI Home ensures a seamless and engaging experience—providing 24/7 all-around, warm-hearted care for every family member. The product highlights include:

-

AI FTTR: Serving as a thoughtful life assistant, it is equipped with a household knowledge base to proactively understand and optimize daily routines for every family member.

-

AI Wi-Fi 7: Featuring the industry’s first omnidirectional antenna and smart roaming solution, it ensures high-speed and stable connectivity.

-

Smart display: It acts like an exclusive personal trainer, leveraging precise semantic parsing technology to tailor personalized services for users.

-

AI flexible screen & cloud PC: Multi-screen interactions cater to diverse needs for home entertainment and mobile office, creating a new paradigm for smart homes.

-

AI companion robot: Backed by smart emotion recognition and bionic interaction systems, the robot safeguards children’s healthy growth with emotionally intelligent connections.

ZTE will anchor its product strategy on “Connectivity + Computing.” Collaborating with industry partners, the company is committed to driving industrial transformation, and achieving computing and AI for all, thereby contributing to a smarter, more connected world.

References:

ZTE reports H1-2024 revenue of RMB 62.49 billion (+2.9% YoY) and net profit of RMB 5.73 billion (+4.8% YoY)

ZTE reports higher earnings & revenue in 1Q-2024; wins 2023 climate leadership award

Malaysia’s U Mobile signs MoU’s with Huawei and ZTE for 5G network rollout

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

Dell’Oro: RAN revenue growth in 1Q2025; AI RAN is a conundrum

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Deloitte and TM Forum : How AI could revitalize the ailing telecom industry?

IEEE Techblog readers are well aware of the dire state of the global telecommunications industry. In particular:

- According to Deloitte, the global telecommunications industry is expected to have revenues of about US$1.53 trillion in 2024, up about 3% over the prior year.Both in 2024 and out to 2028, growth is expected to be higher in Asia Pacific and Europe, Middle East, and Africa, with growth in the Americas being around 1% annually.

- Telco sales were less than $1.8 trillion in 2022 vs. $1.9 trillion in 2012, according to Light Reading. Collective investments of about $1 trillion over a five-year period had brought a lousy return of less than 1%.

- Last year (2024), spending on radio access network infrastructure fell by $5 billion, more than 12% of the total, according to analyst firm Omdia, imperilling the kit vendors on which telcos rely.

Deloitte believes generative (gen) AI will have a huge impact on telecom network providers:

Telcos are using gen AI to reduce costs, become more efficient, and offer new services. Some are building new gen AI data centers to sell training and inference to others. What role does connectivity play in these data centers?

There is a gen AI gold rush expected over the next five years. Spending estimates range from hundreds of billions to over a trillion dollars on the physical layer required for gen AI: chips, data centers, and electricity.16 Close to another hundred billion US dollars will likely be spent on the software and services layer.17 Telcos should focus on the opportunity to participate by connecting all of those different pieces of hardware and software. And shouldn’t telcos, whose business is all about connectivity, be able to profit in some way?

There are gen AI markets for connectivity: Inside the data centers there are miles of mainly copper (and some fiber) cables for transmitting data from board to board and rack to rack. Serving this market is worth billions in 2025,18 but much of this connectivity is provided by data centers and chipmakers and have never been provided by telcos.

There are also massive, long-haul fiber networks ranging from tens to thousands of miles long. These connect (for example) a hyperscaler’s data centers across a region or continent, or even stretch along the seabed, connecting data centers across continents. Sometimes these new fiber networks are being built to support sovereign AI—that is, the need to keep all the AI data inside a given country or region.

Historically, those fiber networks were massive expenditures, built by only the largest telcos or (in the undersea case) built by consortia of telcos, to spread the cost across many players. In 2025, it looks like some of the major gen AI players are building at least some of this connection capacity, but largely on their own or with companies that are specialists in long-haul fiber.

Telcos may want to think about how they can continue to be a relevant player in the part of the connectivity space, rather than just ceding it to the gen AI behemoths. For context, it is estimated that big tech players will spend over US$100 billion on network capex between 2024 and 2030, representing 5% to 10% of their total capex in that period, up from only about 4% to 5% of capex for a network historically.

Where the opportunities could be greater are for connecting billions of consumers and enterprises. Telcos already serve these large markets, and as consumers and businesses start sending larger amounts of data over wireline and wireless networks, that growth might translate to higher revenues. A recent research report suggests that direct gen AI data traffic could be in exabyte by 2033.24

The immediate challenge is that many gen AI use cases for both consumer and enterprise markets are not exactly bandwidth hogs: In 2025, they tend to be text-based (so small file sizes) and users may expect answers in seconds rather than milliseconds,25 which can limit how telcos can monetize the traffic. Users will likely pay a premium for ultra-low latency, but if latency isn’t an issue, they are unlikely to pay a premium.

Telcos may want to think about how they can continue to be a relevant player in the part of the connectivity space, rather than just ceding it to the gen AI behemoths.

A longer-term challenge is on-device edge computing. Even if users start doing a lot more with creating, consuming, and sharing gen AI video in real time (requiring much larger file transmission and lower latency), the majority of devices (smartphones, PCs, wearables, or Internet of Things (IoT) devices in factories and ports) are expected to soon have onboard gen AI processing chips.26 These gen accelerators, combined with emerging smaller language AI models, may mean that network connectivity is less of an issue. Instead of a consumer recording a video, sending the raw image to the cloud for AI processing, then the cloud sending it back, the image could be enhanced or altered locally, with less need for high-speed or low-latency connectivity.

Of course, small models might not work well. The chips on consumer and enterprise edge devices might not be powerful enough or might be too power inefficient with unacceptably short battery life. In which case, telcos may be lifted by a wave of gen AI usage. But that’s unlikely to be in 2025, or even 2026.

Another potential source of gen AI monetization is what’s being called AI Radio Access Network (RAN). At the top of every cell tower are a bunch of radios and antennas. There is also a powerful processor or processors for controlling those radios and antennas. In 2024, a consortium (the AI-RAN Alliance) was formed to look at the idea of adding the same kind of generative AI chips found in data centers or enterprise edge servers (a mix of GPUs and CPUs) to every tower.The idea would be that they could run the RAN, help make it more open, flexible, and responsive, dynamically configure the network in real time, and be able to perform gen AI inference or training as service with any extra capacity left over, generating incremental revenues. At this time, a number of original equipment manufacturers (OEMs, including ones who currently account for over 95% of RAN sales), telcos, and chip companies are part of the alliance. Some expect AI RAN to be a logical successor to Open RAN and be built on top of it, and may even be what 6G turns out to be.

…………………………………………………………………………………………………………………………………………………………………………….

The TM Forum has three broad “AI initiatives,” which are part of their overarching “Industry Missions.” These missions aim to change the future of global connectivity, with AI being a critical component.

The three broad “AI initiatives” (or “Industry Missions” where AI plays a central role) are:

-

AI and Data Innovation: This mission focuses on the safe and widespread adoption of AI and data at scale within the telecommunications industry. It aims to help telcos accelerate, de-risk, and reduce the costs of applying AI technologies to cut operational expenses and drive revenue growth. This includes developing best practices, standards, data architectures, ontologies, and APIs.

-

Autonomous Networks: This initiative is about unlocking the power of seamless end-to-end autonomous operations in telecommunications networks. AI is a fundamental technology for achieving higher levels of network automation, moving towards zero-touch, zero-wait, and zero-trouble operations.

-

Composable IT and Ecosystems: While not solely an “AI initiative,” this mission focuses on simpler IT operations and partnering via AI-ready composable software. AI plays a significant role in enabling more agile and efficient IT systems that can adapt and integrate within dynamic ecosystems. It’s based on the TM Forum’s Open Digital Architecture (ODA). Eighteen big telcos are now running on ODA while the same number of vendors are described by the TM Forum as “ready” to adopt it.

These initiatives are supported by various programs, tools, and resources, including:

- AI Operations (AIOps): Focusing on deploying and managing AI at scale, re-engineering operational processes to support AI, and governing AI operations.

- Responsible AI: Addressing ethical considerations, risk management, and governance frameworks for AI.

- Generative AI Maturity Interactive Tool (GAMIT): To help organizations assess their readiness to exploit the power of GenAI.

- AI Readiness Check (AIRC): An online tool for members to identify gaps in their AI adoption journey across key business dimensions.

- AI for Everyone (AI4X): A pillar focused on democratizing AI across all business functions within an organization.

Under the leadership of CEO Nik Willetts, a rejuvenated, AI-wielding TM Forum now underpins what many telcos do in business and operational support systems, the essential IT plumbing. The TM Forum rates automation using the same five-level system as the car industry, where 0 means completely manual and 5 heralds the end of human intervention. Many telcos are on track for Level 4 in specific areas this year, said Willetts. China Mobile has already realized an 80% reduction in major faults, saving 3,000 person years of effort and 4,000 kilowatt hours of energy each year, thanks to automation.

Outside of China, telcos and telco vendors are leaning heavily on technologies mainly developed by just a few U.S. companies to implement AI. A person remains in the loop for critical decision-making, but the justifications for taking any decision are increasingly provided by systems built on the core underlying technologies from those same few companies. As IEEE Techblog has noted, AI is still hallucinating – throwing up nonsense or falsehoods – just as domain-specific experts are being threatened by it.

Agentic AI substitutes interacting software programs for junior technicians, the future decision-makers. If AI Level 4 renders them superfluous, where do the future decision-makers come from?

Caroline Chappell, an independent consultant with years of expertise in the telecom industry, says there is now talk of what the AI pundits call “learning world models,” more sophisticated AI that grows to understand its environment much as a baby does. When mature, it could come up with completely different approaches to the design of telecom networks and technologies. At this stage, it may be impossible for almost anyone to understand what AI is doing, she said.

References:

Sources: AI is Getting Smarter, but Hallucinations Are Getting Worse

McKinsey: AI infrastructure opportunity for telcos? AI developments in the telecom sector