IHS Markit: Data center network equipment revenue reached $13.7 billion in 2017

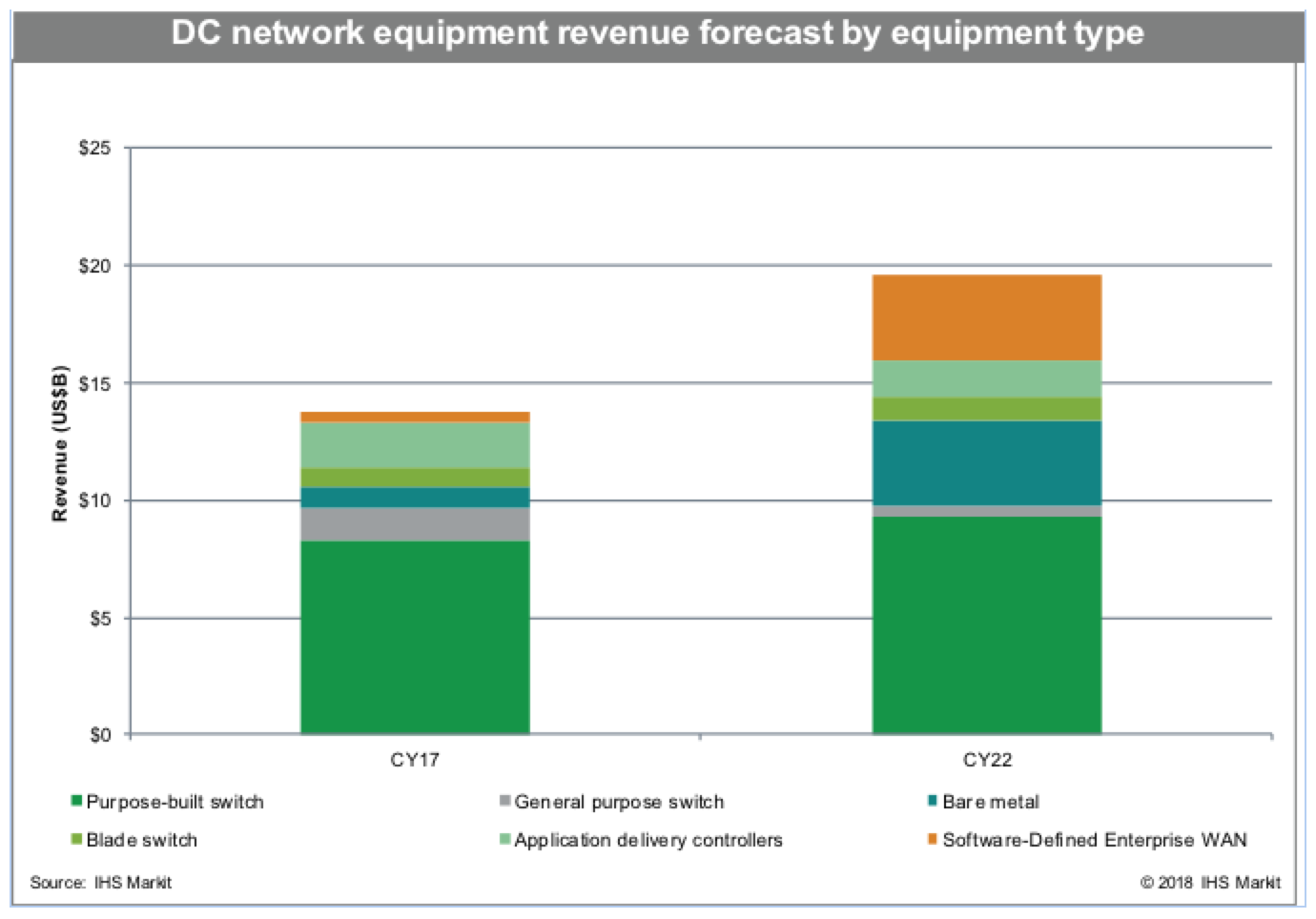

Data center network equipment revenue, including data center Ethernet switches, application delivery controllers (ADCs) and software-defined enterprise WAN (SD-WAN), totaled $13.7 billion in 2017, increasing 13 percent over the previous year.

In the short term, investment in physical infrastructure is still driving data center network equipment revenue growth. However, in 2018 and 2019 the effect of server virtualization will slow the market, with fewer — but higher capacity — servers reducing the need for data center Ethernet switch ports, along with the move to virtual ADCs.

“The adoption of lower-priced bare metal switches will cause revenue growth to slow,” said Clifford Grossner, Ph.D., senior research director and advisor, cloud and data center research practice, IHS Markit. “The ongoing shift to the cloud not only moves network equipment out of the enterprise data center, but also requires less equipment, as the cloud represents data center consolidation on a wide scale.”

Data center network equipment highlights

- Data center network equipment revenue was on the rise, year over year, in all regions: North America and Europe, Middle-East and Africa (EMEA) each increased 10 percent in 2017; Asia Pacific (APAC) was up 23 percent; and Caribbean and Latin America (CALA) rose 2 percent.

- 25GE and 100GE data center switching ports increased three-fold year over year.

- New 200/400GE developments are underway, and shipments expected to begin in 2019.

- Long-term growth in the data center network equipment market is expected to slow to 6 percent in 2022, as SD-WAN revenue growth slows due to the migration from the enterprise dater center to the cloud.

- SD-WAN revenue is anticipated to reach $3.6 billion by 2022; the next wave for SD-WAN includes increased analytics, with artificial intelligence (AI) and machine learning (ML) providing multi-cloud connectivity.

Revenue results from key segments

- Data center Ethernet switch revenue rose 13 percent over the previous year, reaching $11.4 billion in 2017.

- SD-WAN market revenue hit $444.1 million for the full-year 2017.

- Bare metal switch revenue was up 60 percent year over year in the fourth quarter of 2017.

- ADC revenue was down 5 percent year over year in 2017.

Research synopsis

The IHS Markit Data Center Networks Intelligence Service provides quarterly worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends for data center Ethernet switches by category (purpose-built, bare metal, blade, and general purpose), port speed (1/10/25/40/50/100/200/400GE) and market segment (enterprise, telco and cloud service provider). The intelligence service also covers application delivery controllers by category (hardware-based appliances, virtual appliances), SD-WAN (appliances and control and management software), FC SAN switches by type (chassis, fixed) and FC SAN HBAs.

Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Broadcom, Cavium, Cisco, Citrix, CloudGenix, Dell, F5, FatPipe, HPE, Huawei, InfoVista, Juniper, KEMP, Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, ZTE and others.

5 thoughts on “IHS Markit: Data center network equipment revenue reached $13.7 billion in 2017”

Comments are closed.

An important issue to be resolved is how much AI, ML and data analytics will be embedded in data center equipment vs the mobile edge network or customer premises server/gateway. This could change the mix of IT equipment sold in the future.

Certainly true about AI/ML/DL at the network edge. IDC forecasts 2022 will be the market ramp up year for AI in the “Intelligent Edge” network/computing.

IHS Markit: Optical Data Center Interconnect (DCI) market grew 26%, reaching $2.6 billion in 2017

According to a biannual IHS Markit report, optical data center interconnect (DCI) hardware revenue increased by 26% worldwide year-over-year, reaching $2.6 billion in 2017. IHS Markit predicts that this market will surpass $5 billion in annual sales by 2022, representing nearly 30% of all wavelength division multiplexing (WDM) equipment spending.

“The optical DCI equipment market experienced very strong momentum in 2017,” said Heidi Adams, IHS Markit senior research director, IP, and optical networks. “Moving forward we are forecasting continuing growth, as service providers, internet content providers, and enterprises make additional investments to connect expanding and proliferating data center facilities.”

Within the optical DCI market, the compact DCI transport equipment sub-segment grew to $483 million in revenue in 2017, which is more than a 200% increase, says IHS Markit. The continual rise of digital transformation at enterprises worldwide, and the increase in video, enterprise applications, and additional content that is hosted and delivered through the cloud will cause ongoing growth in this segment.

Compact DCI equipment demonstrates an expanding industry trend toward optical equipment disaggregation, as different functions in the optical network can be addressed by open hardware platforms and connected via software-defined networking (SDN) controllers and applications.

“As disaggregated equipment configurations get proven out in DCI applications, we can see usage expanding to address other areas in metro optical and enterprise applications,” said Adams.

Total optical transport network (OTN) hardware sales rose 4% year-over-year to a total of $11.3 billion in 2017. According to the market research and analysis firm, OTN transport has experienced a decline despite the growth of OTN switching as a percentage of total optical equipment sales.

Internet content providers ( ICPs) have standardized on Ethernet as the adopted technology to deliver sub-wavelength aggregation and switching, while traditional carriers prefer OTN. An important part of this decline can be attributed to the optical DCI emergence and web-scale ICPs influence, HIS Markit reports.

“With no legacy TDM traffic or connection-oriented services to support, the business case for introducing OTN services, OAM and/or OTN switching infrastructure is less apparent,” said Adams. “As a result, a new class of ‘OTN-free’ WDM equipment, optimized for the requirements of web-scale and data center operators, has emerged.”

The packet-optical transport system (P-OTS) segment revenue grew by 10% compared to the previous year, hitting $2.5 billion in 2017. The firm expects that as DCI becomes an essential application for optical networks in the future, the effect will be a pull-through for P-OTS platforms.The ability for P-OTS equipment to support both will make it an ideal platform for service providers to deliver DCI as a service, or to offer a combination of dedicated Ethernet and wavelength services for DCI, says the firm.

The biannual IHS Markit DCI, OTN and packet-optical hardware report covers worldwide and regional vendor market share, market size, forecasts through 2022, analysis and trends for OTN transport and switching hardware, packet-optical transport systems and data center interconnect equipment.