Month: October 2024

Reuters & Bloomberg: OpenAI to design “inference AI” chip with Broadcom and TSMC

Bloomberg reports that OpenAI, the fast-growing company behind ChatGPT, is working with Broadcom Inc. to develop a new artificial intelligence chip specifically focused on running AI models after they’ve been trained, according to two people familiar with the matter. The two companies are also consulting with Taiwan Semiconductor Manufacturing Company(TSMC) the world’s largest chip contract manufacturer. OpenAI has been planning a custom chip and working on its uses for the technology for around a year, the people said, but the discussions are still at an early stage. The company has assembled a chip design team of about 20 people, led by top engineers who have previously built Tensor Processing Units (TPUs) at Google, including Thomas Norrie and Richard Ho (head of hardware engineering).

Reuters reported on OpenAI’s ongoing talks with Broadcom and TSMC on Tuesday. It has been working for months with Broadcom to build its first AI chip focusing on inference (responds to user requests), according to sources. Demand right now is greater for training chips, but analysts have predicted the need for inference chips could surpass them as more AI applications are deployed.

OpenAI has examined a range of options to diversify chip supply and reduce costs. OpenAI considered building everything in-house and raising capital for an expensive plan to build a network of chip manufacturing factories known as “foundries.”

REUTERS/Dado Ruvic/Illustration/File Photo Purchase Licensing Rights

OpenAI may continue to research setting up its own network of foundries, or chip factories, one of the people said, but the startup has realized that working with partners on custom chips is a quicker, attainable path for now. Reuters earlier reported that OpenAI was pulling back from the effort of establishing its own chip manufacturing capacity. The company has dropped the ambitious foundry plans for now due to the costs and time needed to build a network, and plans instead to focus on in-house chip design efforts, according to sources.

OpenAI, which helped commercialize generative AI that produces human-like responses to queries, relies on substantial computing power to train and run its systems. As one of the largest purchasers of Nvidia’s graphics processing units (GPUs), OpenAI uses AI chips both to train models where the AI learns from data and for inference, applying AI to make predictions or decisions based on new information. Reuters previously reported on OpenAI’s chip design endeavors. The Information reported on talks with Broadcom and others.

The Information reported in June that Broadcom had discussed making an AI chip for OpenAI. As one of the largest buyers of chips, OpenAI’s decision to source from a diverse array of chipmakers while developing its customized chip could have broader tech sector implications.

Broadcom is the largest designer of application-specific integrated circuits (ASICs) — chips designed to fit a single purpose specified by the customer. The company’s biggest customer in this area is Alphabet Inc.’s Google. Broadcom also works with Meta Platforms Inc. and TikTok owner ByteDance Ltd.

When asked last month whether he has new customers for the business, given the huge demand for AI training, Broadcom Chief Executive Officer Hock Tan said that he will only add to his short list of customers when projects hit volume shipments. “It’s not an easy product to deploy for any customer, and so we do not consider proof of concepts as production volume,” he said during an earnings conference call.

OpenAI’s services require massive amounts of computing power to develop and run — with much of that coming from Nvidia chips. To meet the demand, the industry has been scrambling to find alternatives to Nvidia. That’s included embracing processors from Advanced Micro Devices Inc. and developing in-house versions.

OpenAI is also actively planning investments and partnerships in data centers, the eventual home for such AI chips. The startup’s leadership has pitched the U.S. government on the need for more massive data centers and CEO Sam Altman has sounded out global investors, including some in the Middle East, to finance the effort.

“It’s definitely a stretch,” OpenAI Chief Financial Officer Sarah Friar told Bloomberg Television on Monday. “Stretch from a capital perspective but also my own learning. Frankly we are all learning in this space: Infrastructure is destiny.”

Currently, Nvidia’s GPUs hold over 80% AI market share. But shortages and rising costs have led major customers like Microsoft, Meta, and now OpenAI, to explore in-house or external alternatives.

References:

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

SKT-Samsung Electronics to Optimize 5G Base Station Performance using AI

SK Telecom (SKT) has partnered with Samsung Electronics to use AI to improve the performance of its 5G base stations in order to upgrade its wireless network. Specifically, they will use AI-based 5G base station quality optimization technology (AI-RAN Parameter Recommender) to commercial 5G networks.

The two companies have been working throughout the year to learn from past mobile network operation experiences using AI and deep learning, and recently completed the development of technology that automatically recommends optimal parameters for each base station environment. When applied to SKT’s commercial network, the new technology was able to bring out the potential performance of 5G base stations and improve the customer experience.

Mobile base stations are affected by different wireless environments depending on their geographical location and surrounding facilities. For the same reason, there can be significant differences in the quality of 5G mobile communication services in different areas using the same standard equipment.

Accordingly, SKT utilized deep learning, which analyzes and learns the correlation between statistical data accumulated in existing wireless networks and AI operating parameters, to predict various wireless environments and service characteristics and successfully automatically derive optimal parameters for improving perceived quality.

Samsung Electronics’ ‘Network Parameter Optimization AI Model’ used in this demonstration improves the efficiency of resources invested in optimizing the wireless network environment and performance, and enables optimal management of mobile communication networks extensively organized in cluster units.

The two companies are conducting additional learning and verification by diversifying the parameters applied to the optimized AI model and expanding the application to subways where traffic patterns change frequently.

SKT is pursuing advancements in the method of improving quality by automatically adjusting the output of base station radio waves or resetting the range of radio retransmission allowance when radio signals are weak or data transmission errors occur due to interference.

In addition, we plan to continuously improve the perfection of the technology by expanding the scope of targets that can be optimized with AI, such as parameters related to future beamforming*, and developing real-time application functions.

* Beamforming: A technology that focuses the signal received through the antenna toward a specific receiving device to transmit and receive the signal strongly.

SKT is expanding the application of AI technology to various areas of the telecommunications network, including ‘Telco Edge AI’, network power saving, spam blocking, and operation automation, including this base station quality improvement. In particular, AI-based network power saving technology was recently selected as an excellent technology at the world-renowned ‘Network X Award 2024’.

Ryu Tak-ki, head of SK Telecom’s infrastructure technology division, said, “This is a meaningful achievement that has confirmed that the potential performance of individual base stations can be maximized by incorporating AI,” and emphasized, “We will accelerate the evolution into an AI-Native Network that provides differentiated customer experiences through the convergence of telecommunications and AI technologies.”

“AI is a key technology for innovation in various industrial fields, and it is also playing a decisive role in the evolution to next-generation networks,” said Choi Sung-hyun, head of the advanced development team at Samsung Electronics’ network business division. “Samsung Electronics will continue to take the lead in developing intelligent and automated technologies for AI-based next-generation networks.”

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

…………………………………………………………………………………………………………………………………….

SKT said it is expanding the use of AI to various areas of its communications network, such as “Telco Edge AI,” network power reduction, spam blocking and operation automation, including basestation quality improvement.

…………………………………………………………………………………………………………………………………….

References:

SK Telecom (SKT) and Nokia to work on AI assisted “fiber sensing”

South Korea has 30 million 5G users, but did not meet expectations; KT and SKT AI initiatives

SKT Develops Technology for Integration of Heterogeneous Quantum Cryptography Communication Networks

India Mobile Congress 2024 dominated by AI with over 750 use cases

Verizon and AT&T cut 5,100 more jobs with a combined 214,350 fewer employees than 2015

Verizon and AT&T won’t stop cutting jobs. Will it ever end?

In a September security filing, Verizon said 4,800 jobs would be cut by March 2025 at a severance cost of about $1.8 billion. Its latest results this week showed headcount had fallen by another 2,700 between July and September, to about 101,200 total employees. Sales growth was flat year over year, reaching $33.33 billion. Service and other revenue growth was offset by declines in wireless equipment revenue

At AT&T, job losses were 2,400 during the same time period, to 143,600 employees down from 149,900 on January 31, 2024. AT&T is expanding its $8 billion cost-reduction program, which includes significant layoffs. The company has reduced its workforce by more than 115,000 employees over the past five years, with further cuts expected in 2024 (Sources: TechBlog, WRAL TechWire).

Combined, the two major U.S. telcos now have only 244,800 employees and that number will surely shrink from now till March 2025. Yet in 2015, they had a combined headcount of 459,150, according to filings with the Securities and Exchange Commission. The disappearance of 214,350 positions since then, almost half the entire workforce, has occurred as telecom has become a more critical feature of most people’s lives with mobile everything and video streaming (mostly over wireline networks).

Tarathip Kwankeeree/iStock/Getty Images Plus

Combined revenues fell from $278.4 billion in 2015 to $256.4 billion last year due entirely to a sales decline at AT&T. Last year, its turnover of $122.4 billion represented a 16% drop on the figure in 2015. But this meant sales per employee rose from about $520,000 to $813,000. At Verizon, they have grown from roughly $741,000 to $1.27 million. The only telecom rival they have had to worry about is T-Mobile US, which launched its disruptive “Uncarrier” campaign before 2015.

For sure, automation, digitization and reliance on artificial intelligence (AI) have all been acknowledged by telco executives as factors in headcount shrinkage. Their objective now is to realize “zero-touch” or “fully autonomous” or “intent-based” networks, which are able to operate themselves and perform tasks with minimal or no human intervention. Such a network essentially manages itself by performing tasks based on predefined goals or “intents,” without requiring manual configuration or troubleshooting. Here’s a quick summary:

-

Zero-touch:This term emphasizes the ability to automatically provision and configure new devices on a network without any manual intervention, essentially “plug and play” functionality.

-

Fully autonomous:This signifies a network that can not only self-configure but also monitor its own health, diagnose issues, and take corrective actions independently, adapting to changing conditions without human input.

-

Intent-based:This concept focuses on expressing the desired network behavior or outcome through high-level instructions (“intents”), which the system then translates into specific actions to achieve that goal.

It remains to be seen if such zero-touch, autonomous, intent based networks will live up to their potential and promise.

References:

https://www.lightreading.com/ai-machine-learning/AT&T-and-Verizon-cut-5,100-jobs-as-AI-fears-grow-

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

Inside AT&T’s newly expanded $8 billion cost-reduction program and huge layoffs

Tech layoffs continue unabated: pink slip season in hard-hit SF Bay Area

Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

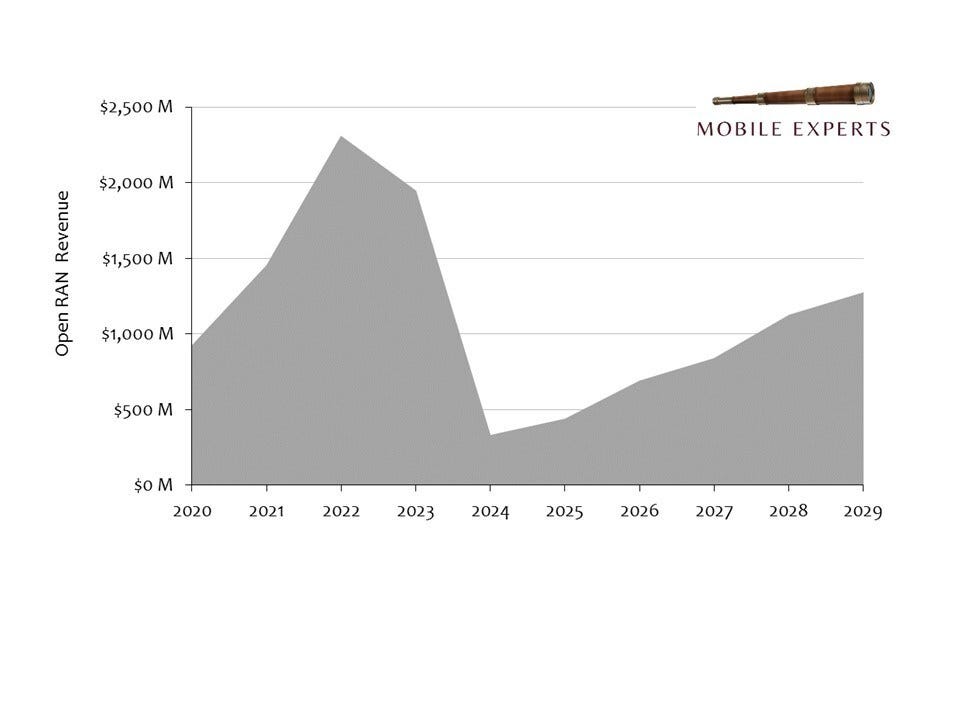

As expected, the Open RAN market ‘screeched to a halt’ during 2024. Mobile Experts released a new report on Open RAN, which it described as ‘the most bizarre market growth profile ever seen in the wireless market.’ After ‘great success’ with deployment in greenfield networks by the DISH Networks in the U.S., Rakuten in Japan and 1&1 in Germany, the market research firm is predicting a significant slump this year with a very slow recovery (see chart below).

“Our revenue chart for Open RAN looks like the Grand Canyon,” said Joe Madden, Principal Analyst at Mobile Experts. “All of the big clean-sheet O-RAN deployments have finished their major buildout phase, so now the market will transition to upgrades on legacy networks. But legacy networks will use Open RAN differently.”

“Many people don’t understand why legacy mobile operators are rejecting the original Open RAN business model and are choosing a Single Software business model instead. This report provides clear guidance on why the market is fundamentally changing.”

……………………………………………………………………………………………………………………………………

Comment and Analysis:

The original Open RAN business model called for multiple vendors to provide the equivalent of a disaggregated base station. That is why it was dubbed “Open.” However, legacy carriers prefer a closed solution, where a single vendor is the primary supplier of hardware and software for an Open RAN system. This limits the supply chain diversification that O-RAN was designed to promote and pushes out new vendors. Some examples of single vendor Open RAN solutions include:

-

AT&T and Ericsson: AT&T’s five-year, $14 billion Open RAN contract is a single vendor Open RAN deal.

- Deutsche Telekom and Nokia: Deutsche Telekom’s contract with Nokia includes the initial deployment of Fujitsu radios in Northern Germany.

- NTT DOCOMO and Nokia: NTT DOCOMO will use Nokia as its vendor to deploy Open RAN.

- Verizon and Nokia and Samsung Networks: Verizon has been using “Open RAN-capable” virtual RAN (vRAN) systems from Nokia and Samsung Networks for several years, but that is not true Open RAN as per O-RAN Alliance specs. Verizon could evolve its vRAN deployments with Samsung Networks into an Open RAN architecture, following the recent appointment of Open RAN advocate Yago Tenorio as its CTO.

–>Meanwhile, there are still no official standards for Open RAN- only O-RAN Alliance specs.

The new report lays out the expected revenue in hardware (radios, servers, antennas) and software (vDU, vCU, RIC, xApp, rApp, and dApp) through 2029, as major operators like AT&T, Vodafone, Verizon, Telus, DoCoMo, and others begin to buy mobile infrastructure from alternative vendors.

“The US Government is pumping hundreds of millions of dollars into Open RAN,” continued Mr. Madden. “But sadly, the biggest challenge of Open RAN will not be addressed by NOFO and other government grants. Each grant will be too small to fix the fundamental economic challenge of Open RU hardware. The market will solve the problem anyway, without government help. Get our report for the details.”

Here’s a chart of Open RAN revenue by year:

Subscribers to the Open RAN 2024 report will receive:

- Full access to the 40-page Open RAN 2024 report;

- Clear breakdowns of the 5-year forecast in an Excel spreadsheet;

- Detailed technical background and architectural analysis;

- Insight into the pace of upcoming projects with legacy operators; and

- Access to the analysts behind the reports.

References:

https://www.telecoms.com/open-ran/open-ran-market-fell-83-in-2024

https://mobile-experts.net/reports/p/oran24?rq=open%20RAN

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN

Parallel Wireless deploys 1,500 Open RAN sites across Africa; partners with Hotspot Network in Nigeria

DISH Wireless Awarded $50 Million NTIA Grant for 5G Open RAN Center (ORCID)

Deutsche Telekom Network Day: Fiber, Mobile Network, Open RAN and 5G SA Launch in 2024

NTT DOCOMO OREX brand offers a pre-integrated solution for Open RAN

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Initiatives and Analysis: Nokia focuses on data centers as its top growth market

Telco is no longer the top growth market for Nokia. Instead, it’s data centers, said Nokia’s CEO Pekka Lundmark on the company’s Q3 2024 earnings call last week. “Across Nokia, we are investing to create new growth opportunities outside of our traditional communications service provider market,” he said. “We see a significant opportunity to expand our presence in the data center market and are investing to broaden our product portfolio in IP Networks to better address this. There will be others as well, but that will be the number one. This is obviously in the very core of our strategy.”

Lundmark said Nokia’s telco total addressable market (TAM) is €84 billion, while its data center total addressable market is currently at €20 billion. “I mean, telco TAM will never be a significant growth market,” he added to no one’s surprise.

Nokia’s recent deal to acquire fiber optics equipment vendor Infinera for $2.3 Billion might help. The Finland based company said the combination with Infinera is expected to accelerate its path to double-digit operating margins in its optical-networks business unit (which was inherited from Alcatel-Lucent) . The transaction (expected to close in the first half of 2025) and the recent sale of submarine networks will reshape Nokia’s Network Infrastructure business to be built around fixed networks, internet-protocol networks and optical networks, the company said. Data centers not only require GPUs, but they also require optical networking to support their AI workloads. Lundmark said the role of optics will increase, not only in connections between data centers, but also inside data centers to connect servers to each other. “Once we get there, that market will be of extremely high volumes,” he said.

Pekka Lundmark, Nokia CEO– Photo: Arno Mikkor

- In September, Nokia announced the availability of its AI era, Event-Driven Automation (EDA) platform. Nokia EDA raises the bar on data center network operations with a modern approach that builds on Kubernetes to bring highly reliable, simplified, and adaptable lifecycle management to data center networks. Aimed at driving human error in network operations to zero, Nokia’s new platform reduces network disruptions and application downtime while also decreasing operational effort up to 40%. Nokia says its new EDA platform helps data center operators reduce errors in network operations. Nokia said it hopes to remove the risk of human error and reduce network disruptions and application downtime.

- A highlight of the recent quarter is a September deal with self proclaimed “AI hyperscalar” CoreWeave [1.] which selected Nokia to deploy its IP routing and optical transport equipment globally as part of its extensive backbone build-out, with immediate roll-out across its data centers in the U.S. and Europe. Raymond James analyst Simon Leopold said the CoreWeave win was good for Nokia to gain some exposure to AI, and he wondered if Nokia had a long-term strategy of evolving customers away from its telco base into more enterprise-like opportunities. “The reason why CoreWeave is so important is that they are now the leading GPU-as-a- service company,” said Lundmark. “And they have now taken pretty much our entire portfolio, both on the IP side and optical side. And as we know, AI is driving new business models, and one of the business models is clearly GPU-as-a-service,” he added.

Note 1. CoreWeave rents graphical processing units (GPUs) to artificial intelligence (AI) developers. A modern, Kubernetes native cloud that’s purpose-built for large scale, GPU-accelerated workloads. Designed with engineers and innovators in mind, CoreWeave claims to offer unparalleled access to a broad range of compute solutions that are up to 35x faster and 80% less expensive than legacy cloud providers.

……………………………………………………………………………………………………………………………………………………………

Nokia says its IP Interconnection can provide attractive business benefits to data center customers including:

- Improved security – Applications and services can be accessed via private direct connections to the networks of cloud providers collocated in the same facility without traversing the internet.

- Reduced transport costs – Colocated service providers, alternative network providers and carrier neutral network operators offer a wide choice of connections to remote destinations at a lower price.

- Higher performance and lower latency – As connections are direct and are often located closer to the person or thing they are serving, there is a reduction in latency and an increase in reliability as they bypass multiple hops across the public internet.

- More control – Through network automation and via customer portals, cloud service providers can gain more control of their cloud connectivity.

- Greater flexibility – With a wider range of connectivity options, enterprises can distribute application workloads and access cloud applications and services globally to meet business demands and to gain access to new markets.

……………………………………………………………………………………………………………………………………………………………

Nokia’s Data Center Market Risks:

The uncertainty is whether spending on GPUs and optical network equipment in the data center will produce the traffic growth to justify a decent ROI for Nokia. Also, the major cloud vendors (Amazon, Google, Microsoft and Facebook) design, develop, and install their own fiber optic networks. So it will likely be the new AI Data Center players that Nokia will try to sell to. William Webb, an independent consultant and former executive at Ofcom told Light Reading, “There may be substantially more traffic between data centers as models are trained but this will flow across high-capacity fiber connections which can be expanded easily if needed.” Text-based AI apps like ChatGPT generate “minuscule amounts of traffic,” he said. Video-based AI will merely substitute for the genuinely intelligent form.

References:

https://www.datacenterdynamics.com/en/news/nokia-eyes-data-center-market-growth-as-q3-sales-fall/

https://www.nokia.com/blog/enhance-cloud-services-with-high-capacity-interconnection/

https://www.lightreading.com/5g/telecom-glory-days-are-over-bad-news-for-nokia-worse-for-ericsson

Nokia wins multi-billion dollar contract from Bharti Airtel for 5G equipment

Nokia has secured a multi-billion dollar contract with India’s Bharti Airtel, one of the country’s leading telecom operators, which is expanding its 5G network. The deal with Airtel would be for Nokia’s latest AirScale mobile radios that support upgrading an existing network to 5G-Advanced and reduces energy costs, according to the sources.

- Ericsson won a multi-billion dollar contract from Bharti Airtel, Reuters reported on Monday. Airtel is also in talks with Samsung about buying 5G equipment, a source told Reuters.

- Samsung has been trying to grow its network equipment business, but has so far lagged Nokia and Ericsson. Samsung won its first 5G contract with Airtel in 2022. India has blocked its mobile carriers from using 5G telecom equipment made by China’s Huawei.

Backgrounder:

India is the world’s second-largest smartphone market where telcos such as Airtel, Reliance Jio and Vodafone Idea have been spending billions of dollars to upgrade their networks to 5G. Bharti Airtel’s 5G market share in India is over 90 million subscribers, as of June 2024. Airtel and Reliance Jio are the only two telcos in India that offer 5G services.

……………………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………………..

The Nokia-Bharti Airtel deal is indicative of the intensifying competition among telecom operators and equipment manufacturers in India’s 5G market. For Nokia, the agreement represents a significant rebound and consolidation of its presence in India, amidst previous challenges and the competitive pressures exerted by rivals such as Ericsson and Samsung.As India stands on the cusp of a 5G revolution, the successful execution of this deal could serve as a blueprint for similar agreements, thereby accelerating the pace of 5G deployment across the nation.

India Mobile Congress 2024 dominated by AI with over 750 use cases

As expected, Artificial Intelligence (AI) took center stage at India Mobile Congress 2024 (IMC 2024), as a diverse spectrum of tech and telecom companies, including startups and educational institutions, showcased over 900 technology use case scenarios, including 750 AI-based use cases during the 4-day conference in New Delhi, India. IMC 2024 hosted over 400 exhibitors, about 900 startups and participation from over 120 countries.

The focus of the AI-enabled use cases was on conservation, convenience, efficiency, safety, automating hazardous tasks, assisting humans and others. AI-based virtual agents were taking over the workloads at contact centers while addressing the shortage of doctors in remote areas. Some key use cases included solutions for railway safety, including AI-based systems that can detect and send alerts on unusual activity on tracks. In particular:

- Reliance Jio offered attendees a glimpse of PhoneCall AI, a highly anticipated feature for transcribing and summarizing phone calls, which is currently in alpha testing phase. Jio also presented a 5G intelligent village concept powered by AI. Farmers can now use their mobile phones to take pictures of crops, allowing AI to detect diseases and recommend solutions, improving crop health and yield. Jio facilitates the delivery of these solutions to homes or nearby retail stores, empowering farmers by enabling higher revenue and better employment opportunities. Jio also showcased its JioKrishi Agri IoT device for agriculture. The IoT device with multiple sensors takes farming into the digital age, providing real-time data on crop health and enabling optimal irrigation and fertilization. Connected to the AI-enabled JioKrishi app, farmers can receive recommendations for fertilizers or pesticides, including the quantities to use, and order farm supplies—ensuring end-to-end farm solutions.

- Bharti Airtel launched India’s first AI-powered spam detection solution to combat spam calls and messages. This network-based tool provides real-time alerts, helping users reduce spam effectively. Ericsson showcased a 5G-powered robotic dog, Rocky, who can assist authorities with efficient emergency response by sending alerts in time that can help authorities deal with emergencies like fire outbreaks.

- Vodafone Idea demonstrated the transmission of real-time diagnostic reports over its high-speed network, enabling doctors to conduct video consultations remotely. The solution offers over 30 medical tests, including vitals and blood screenings, at a cost of under ₹250, making healthcare more accessible in rural areas.

- C3iHub, a Technology Innovation Hub established at IIT Kanpur and funded by Department of Science & Technology (DST), addressed cybersecurity of cyber-physical systems, with a key focus on critical infrastructure, automotive, and drones.

- Indian Council of Agriculture Research (ICAR) showcased over a dozen AI-based solutions for smart agriculture and even aquarium management, with AI-enabled feed for fish. The AI system detects the right time for feeding and releases food accordingly while also monitoring water quality and sending alerts to owners. Mahindra University students displayed AI-based solutions to bolster shrimp farming (raising shrimp in controlled environments). The tool constantly monitors and ensures conditions are ideal for shrimp farming. India Mobile Congress, Asia’s largest digital technology forum, has become a well-known platform across the globe for showcasing innovative solutions, services and state-of-the-art use cases for industry, government, academics, startups and other key stakeholders in the technology and telecom ecosystem.

- Nokia showcased technologies spanning 5G, 6G, AI/ML and network infrastructure, aimed at driving innovation and promoting a sustainable future.

- Prime Minister Narendra Modi interacted with pioneering startups including Signalchip, Wisig Networks, and female led startups like Astrome and Easiofy Solutions, showcasing India’s leadership in cutting-edge technology innovations.

IMC 2024 showcased groundbreaking ideas and innovations from prestigious academic institutions like IITs and IIMs. Through LLMs such as BharatGen, IMC highlighted the cutting-edge research and technological advancements emerging from these institutions, demonstrating their role in shaping the future of telecom and technology in India.

References:

https://telecomtalk.info/jio-showcases-ai-tools-industry5-5g-imc2024/983400/

India’s Success in 5G Standards; IIT Hyderabad & WiSig Networks Initiatives

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

India Mobile Congress 2018: Telecom Equipment Vendors to Invest over Rs 4,000 crore in India; Samsung in Spotlight

U.S. Cellular to Sell Spectrum Licenses to Verizon in $1 Billion Deal

The WSJ reports that U.S. Cellular is selling a portion of its retained spectrum licenses to Verizon for $1 billion in cash as it looks to monetize the spectrum that wasn’t included in the proposed sale to T-Mobile. The Chicago-based telco, which caters to a base of mostly rural customers (approximately 4.5 million) across several states, on Friday said the deal includes the sale of 663 million megahertz point-of-presences of its cellular spectrum licenses. The deal is expected to close in mid-2025.

Under the terms of the agreement, U.S. Cellular will also sell 11 million megahertz point-of-presences of its advanced wireless services, and 19 million megahertz point-of-presences of its personal communications services licenses. The company said it has entered into additional agreements with two other mobile operators for the sale of other selected spectrum licenses.

TDS, the majority shareholder of U.S. Cellular, has delivered its written consent to approve the Verizon transaction.

Each transaction is dependent upon the closing of the proposed sale of the company’s cellular wireless operations and select spectrum assets to T-Mobile.

In May, T-Mobile agreed to buy much of U.S. Cellular’s operations which included about 30% of UScellular spectrum holdings, all of its customers and its retail stores in a deal worth $4.4 billion. That deal still requires regulatory approvals. It would give T-Mobile more than four million new customers and a trove of valuable spectrum rights to carry more of their data over the air.

According to the financial analysts at New Street Research, UScellular managed to score a higher-than-expected sale price to Verizon. “We valued these licenses at $812 million, and so this transaction is a 23% premium,” they wrote in a note to investors Friday morning.

Importantly, they argued that, as a result, the low band spectrum owned by EchoStar’s Dish Network might be worth more than they had previously calculated. “If we apply the premium to lowband licenses, based on this new mark, Dish’s 600 MHz portfolio would be worth $16 billion, up from $12 billion currently,” they wrote.

The New Street analysts speculated that UScellular’s remaining spectrum holdings will eventually be sold.

“This spectrum transaction took longer than we expected, and it is for fewer of the licenses than we expected,” they wrote of UScellular’s new deal with Verizon. “The monetization of the remaining [UScellular] spectrum could take time, but it will all be sold eventually.”

They argued that UScellular’s remaining, unsold spectrum holdings – which stretch across lowband holdings like 700MHz as well as mid band spectrum like C-band – could be worth as much as $3.2 billion.

But the analysts cautioned that it can be difficult to extrapolate spectrum values from just one transaction alone. For example, the licenses involved in the transaction between Verizon and UScellular are mostly located in smaller markets and therefore may not be directly comparable to spectrum licenses located in bigger cities. Further, most of the spectrum involved in the deal is low band, and so values might be different for large chunks of mid band spectrum.

References:

https://www.lightreading.com/5g/how-verizon-s-1b-uscellular-spectrum-deal-affects-echostar-s-dish

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

UScellular’s Home Internet/FWA now has >100K customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

According to a new report from Dell’Oro Group, the overall RAN market is now facing a second consecutive year of steep declines. That follows 40 to 50% revenue growth between 2017 and 2021. While the pace of decline is expected to moderate after 2024, downward pressure is likely to persist until 6G becomes a reality.

In addition to the typical market fluctuations that have shaped the RAN landscape over the past 30-plus years, the overpromising of 5G and its inability to significantly alter the flat revenue trend among operators are fueling increased skepticism regarding the need for substantial investments in new technologies (like 5G Advanced, 5G RedCap or O-RAN).

“Some skepticism is warranted. After all, operators invested over $2 trillion in wireless capex between 2010 and 2023 to build out 4G and 5G, yet revenues remain flat,” said Stefan Pongratz, Vice President of RAN and Telecom Capex research at Dell’Oro Group. “Looking ahead, operators will need to optimize their spectrum roadmaps to address various data traffic scenarios. Our base case assumes that mobile data traffic growth will continue to slow, enabling operators to improve their capital intensity ratios, which will in turn put further downward pressure on the RAN market. However, additional capacity will eventually be required, and at that point, leveraging larger spectrum bands and the existing macro grid will likely offer the most cost-effective solution,” Pongratz added.

Additional highlights from the new 6G Advanced Research Report:

- Total RAN revenues are projected to trend downward until 2029

- 6G RAN revenues to approach $30 B by 2033

- Sub-7 GHz and CM-wave macros are expected to dominate the 6G mix by 2033

Dell’Oro Group’s 6G Advanced Research Report offers a complete overview of the RAN market by region and by technology, with tables covering manufacturers’ revenue for 5G NR and 6G by frequency, including Sub-7 GHz, cmWave, and mmWave. The report also covers Cloud RAN, small cells, and Massive MIMO. To purchase this report, please contact by email at [email protected].

References:

6G RAN to Approach $30 B by 2033, According to Dell’Oro Group

https://www.ericsson.com/en/blog/2023/6/cm-wave-spectrum-6g-potent-enabler

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Highlights of Dell’Oro’s 5-year RAN forecast

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Nokia, Windstream Wholesale and Colt complete world’s first ultra-fast 800GbE optical and IP service trial

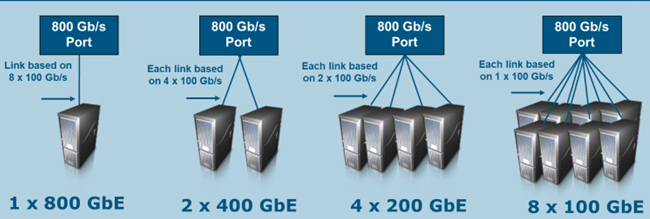

Nokia, Windstream, and Colt Technology Services have completed an 800 Gigabit Ethernet (800 GbE) trial spanning 8,500km between London and Chicago over a subsea and terrestrial route. The trial showcased innovative power-saving networking technologies from the three global tech businesses to test the boundaries of next-generation wavelength, capacity, speed and latency between two of the world’s largest financial trading hubs.

Colt’s five transatlantic subsea cables and part of its extensive terrestrial fiber optic network were connected with Windstream Wholesale’s domestic U.S. low latency, optical fiber Intelligent Converged Optical Network (ICON) monitoring speed and performance. Colt and Windstream Wholesale have partnered to demonstrate the world’s first transoceanic 800 gigabit ethernet (GbE) end-to-end service transport from router to router over 1Tbps optical transport. The trial was successfully delivered using Nokia’s sixth-generation Photonic Service Engine (PSE-6s) coherent optics and 7750 Service Router (SR) high-performance routing platforms boosting internet service speeds and supporting ultra-high wavelength capacity, while maintaining power efficiency.

The companies say that 800G marks a breakthrough in service bandwidth, doubling capacity to support advanced network applications like AI data center networking, content delivery networks, and financial data hub connections.

| Ethernet Rate | AUI | BP | Cu Cable | MMF 50m | MMF 100m | SMF 500m | SMF 2km |

|---|---|---|---|---|---|---|---|

| 400 Gb/s | — | — | — | — | — | — | 4 pairs |

| 800 Gb/s | 8 lanes | 8 lanes | 8 pairs | 8 pairs | 8 pairs | 8 pairs | 8 pairs |

Quotes:

Buddy Bayer, Chief Operating Officer of Colt Technology Services, said: “Pushing the boundaries of technology innovation is a fundamental part of our customer commitment: it means we stay a step ahead of the market, so we’re ready when our customers ask, “What’s next for us?” This trial has seen us build a powerful industry collaboration to explore the ‘what’s next?’. It’s tested the limits of infrastructure performance and capability across thousands of miles of land and sea with incredible networking technologies, and it’s demonstrated the power and potential of what can be achieved, without skipping a beat.”

Joe Scattareggia, President of Windstream Wholesale, said: “Our latest innovation represents a true game-changer for global connectivity. By partnering with two extraordinary leaders in the industry, we’re enabling unprecedented bandwidth capabilities that are essential for driving AI-powered applications worldwide for our customers. As an optical technology leader, Windstream Wholesale and our partners are establishing 800GbE as the next evolutionary advancement increase for wave services. This collaboration has pushed the boundaries of what’s possible, creating a network solution like no other. Together, we’re not just meeting the demands of the future—we’re shaping it.”

Federico Guillén, President of Network Infrastructure at Nokia, said: “Such an ambitious project — to link two of the world’s most important financial hubs — sets the bar very high for network capacity, speed, security and reliability. This demonstration would simply not have been possible without the commitment of Nokia and our partners to the highest standards of innovation in networking technology. Together, we are redefining the art of the possible for IP and optical networks enabling cross-continental subsea and terrestrial communications.”

Following the successful completion of the trial, the organizations are currently exploring options to bring 800GbE connectivity services to market for global business customers.

Resources and additional information:

Webpage: Nokia PSE-6s

Webpage: Nokia Optical Networks

About Nokia:

As a B2B technology innovation leader, we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks. In addition, we create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

With truly open architectures that seamlessly integrate into any ecosystem, our high-performance networks create new opportunities for monetization and scale. Service providers, enterprises and partners worldwide trust Nokia to deliver secure, reliable and sustainable networks today – and work with us to create the digital services and applications of the future.

About Colt Technology Services:

Colt Technology Services (Colt) is a global digital infrastructure company which creates extraordinary connections to help businesses succeed. Powered by amazing people and like-minded partners, Colt is driven by its purpose: to put the power of the digital universe in the hands of its customers, wherever, whenever and however they choose.

Since 1992, Colt has set itself apart through its deep commitment to its customers, growing from its heritage in the City of London to a global business spanning 40+ countries, with over 6,000 employees and more than 80 offices around the world. Colt’s customers benefit from expansive digital infrastructure connecting 32,000 buildings across 230 cities, more than 50 Metropolitan Area Networks and 250+ Points of Presence across Europe, Asia, the Middle East, Africa and North America’s largest business hubs.

Privately owned, Colt is one of the most financially sound companies in the sector. Obsessed with delivering industry-leading customer experience, Colt is guided by its dedication to customer innovation, by its values and its responsibility to its customers, partners, people and the planet.

For more information, please visit www.colt.net

About Windstream Wholesale:

Windstream Wholesale is an innovative optical technology leader that delivers fast, flexible, and customized wavelength and dark fiber solutions to carriers, content providers, and hyperscalers in the U.S. and Canada. Windstream Wholesale is one of three brands managed by Windstream. The company’s quality-first approach connects customers to new opportunities and possibilities by delivering a full suite of advanced communications services. Windstream also offers fiber-based broadband to residential and small business customers in 18 states as well as managed cloud communications and security services to mid-to-large enterprises and government entities across the U.S. Windstream is a privately held company headquartered in Little Rock, Ark. Additional information about Windstream Wholesale is available at windstreamwholesale.com. Follow us on X (Twitter) @Windstream and LinkedIn at @Windstream.

To view the Windstream Wholesale network map, visit https://www.windstreamwholesale.com/wp-content/uploads/2022/05/Windstream-Wholesale-National-Network.pdf

References:

https://standards.ieee.org/beyond-standards/ethernets-next-bar/