5G frequencies

CTIA commissioned study: U.S. running out of licensed spectrum; 5G FWA to be impacted first by network overloads

5G networks may begin to run out of spectrum capacity within the next five years, according to a new study commissioned by CTIA and done by the Battle Group. Absent any new spectrum, by 2027, the U.S. is expected to have a spectrum deficit of nearly 400 megahertz. In ten years, by 2032, this deficit could more than triple to approximately 1,400 megahertz. To avoid this deficit, work needs to begin now on filling the spectrum pipeline.

The Executive Summary of the report states:

“Mobile data demand is exploding, with aggregate data downloaded quadrupling in the last seven years. New and innovative uses enabled by 5G, as well as the prospect of 6G applications, point towards further increases in expected demand for mobile network capacity. Unfortunately, the U.S. spectrum landscape appears to be stalled, with no clear prospects for significant spectrum reallocations this year and insufficient bands under consideration for reallocation in the coming years. This lack of a spectrum pipeline, coupled with the lapse of the Federal Communications Commission (FCC) auction authority, has raised the prospect of significant capacity constraints in the terrestrial wireless space, and concern that this may limit the U.S.’s ability to be a leader in this area. This paper investigates this capacity constraint and estimates the likely spectrum deficit the U.S. will face over the next decade absent policymakers allocating additional full power, licensed spectrum.”

Source: Battle Group

………………………………………………………………………………………………………………………………………………

The Battle Group analysis indicates that additional mobile spectrum allocations are necessary if U.S. wireless networks are to be able to supply enough capacity to meet growing demand. It is infeasible to expect non-spectrum inputs to cover the capacity deficit, even using conservative inputs and under the most optimistic scenarios. With aggressive investment in infrastructure and reasonably expected improvements to spectral efficiency, we estimate that in order to meet demand in five years industry will still require approximately 400 megahertz of spectrum in the next 5 years, and over 1,400 megahertz in ten years. This estimate is normalized to exclusively licensed, wide-area, full-power spectrum, with propagation characteristics of 1-2 GHz. Spectrum with other characteristics would change the analysis—for example, if spectrum were only made available with lower power levels, much more would be required to meet demand.

Recent growth in popularity of fixed wireless access (FWA), which provides home broadband over licensed mobile spectrum, will increase the capacity load on licensed networks. In particular, “Fixed wireless access would likely be the first service to be impacted [by network overloads]. Already today home broadband over 5G is only offered in locations where operators have available capacity in the network to provide sufficient quality of service for a home connection. Without additional spectrum, fixed wireless access will not be able to reach its potential scale, limiting the opportunity for additional competition to be injected into the home broadband market.”

“Our analysis indicates that, given the pace of the demand growth, technological solutions and deploying more cell sites are insufficient to ease the capacity constraint currently facing the US cellular networks,” the report concludes. That conclusion is in stark contrast to FWA capacity assurances from the Verizon and T-Mobile (AT&T has yet to offer 5G FWA). “We’re adding far more capacity to our network than the peak usage increase we’re expecting in the fixed wireless market,” Verizon CEO Hans Vestberg proclaimed earlier this year.

“The report’s findings underscore the growing risk to America’s 5G and innovation leadership,” the CTIA warned, citing the Brattle Group report. “Currently the United States has no plan to allocate more midband spectrum for 5G and Congress allowed the FCC’s ability to auction spectrum for licensed, commercial use, to lapse for the first time in its 30-year history. This inaction in the face of a looming spectrum deficit contrasts with other countries: Today the United States trails other countries in 5G spectrum by 378 megahertz on average – a deficit expected to grow to 518 megahertz in five years.”

“Even accounting for extremely optimistic improvements in spectral efficiency and additional infrastructure deployment, the (Battle Group) analysis makes clear that additional 5G-ready spectrum is the only realistic way to meet projected growth in demand.

“The inability to provide adequate capacity to support projected usage growth would lead to poor customer experience, network overload, and otherwise risk forfeiting U.S. leadership in 5G and beyond,” said Dr. Coleman Bazelon, Principal, The Brattle Group.

“Coleman’s report helps define the risk of continued inaction on spectrum. We need more 5G spectrum to meet increasing data demand, support new innovation and enable the speeds and capacity necessary to fuel future innovation,” said CTIA President and CEO Meredith Attwell Baker. “We now have a target for future action. More full-powered, exclusive-licensed spectrum is key to both our economic and national security. Letting auction authority lapse sent the wrong signal to the rest of the world. We need to restore it quickly with a defined set of new auctions.”

“Our analysis indicates that, given the pace of the demand growth, technological solutions and deploying more cell sites are insufficient to ease the capacity constraint currently facing the U.S. cellular networks. Spectrum availability is the key to solving the capacity shortfall and Congress, the FCC, and other policymakers should work to allocate more spectrum for licensed mobile uses in a timely manner,” said co-author Dr. Paroma Sanyal, Principal, The Brattle Group.

CTIA said that the U.S. now trails other countries in 5G spectrum by 378 megahertz on average—a deficit expected to grow to 518 megahertz in five years. One of CTIA’s top goals this year is to generate support among lawmakers for rules that would take the 3.1-3.45GHz band from the DoD and reallocate it to 5G network operators.

“Spectrum repurposing is a difficult and time-consuming process, and unfortunately there is not an adequate pipeline of spectrum anticipated to meet wireless demand today. Our analysis gives a glimpse of the stunted wireless future if policymakers do not act,” said Dr. Bazelon.

Another mechanism to increase wireless network capacity involves building more cell sites, including small cells. In its report, the Brattle Group estimated a total of 298,001 macro cell sites in the US in 2022 alongside 150,399 small cells. (Those figures don’t quite dovetail with the 209,500 macrocell sites and 452,200 outdoor small cell nodes counted in a study commissioned by the Wireless Infrastructure Association, the main trade association for the US cell tower industry.) Regardless, the Brattle Group predicts those figures will grow to 324,943 macro cell sites and 364,428 small cells by 2027.

But the report argues that cell site growth won’t keep pace with user’s data demands. “Therefore, if historical technology trends hold and forecasted traffic patterns are realized, these solutions are unlikely to be sufficient to meet rapidly growing traffic,” according to the report.

Therefore, the report concludes that the only way to prevent network overloads is to release more licensed spectrum to 5G network operators – which is CTIA’s main political goal.

References:

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

On AT&T’s earnings call this week, CEO John Stankey provided these highlights:

- AT&T network teams have also consistently outpaced our mid-band 5G spectrum rollout objective. In fact, we now reach 150 million mid-band 5G POPs, more than double our initial 2022 year-end target. Our goal remains to deploy our spectrum efficiently and in a manner that supports traffic growth. In the markets where we have broadly deployed mid-band 5G, 25% of our traffic in these areas already takes advantage of our mid-band spectrum.

- We also expect to continue our 5G expansion, reaching more than 200 million people with mid-band 5G by the end of 2023.

- AT&T had more than 1.2 million AT&T Fiber net adds last year. The fifth straight year we’ve totaled more than 1 million AT&T Fiber net adds. And after 2.9 million AT&T Fiber net adds over the last 2.5 years, we’ve now reached an inflection point where our fiber subscribers outnumber are non-fiber DSL subscribers. The financial benefits of our fiber focus are also becoming increasingly apparent as full year fiber revenue growth of nearly 29% has led to sustainable revenue and profit growth in our Consumer Wireline business. As we scale our fiber footprint, we also expect to drive margin expansion.

- AT&T has the nation’s largest and fastest-growing fiber Internet, and we expect continued healthy subscriber growth as we grow our fiber footprint. As we keep expanding our subscriber base will drive efficiencies in everything we do. AT&T considers fiber a multiyear opportunity that will transform the way consumers’ and businesses’ growing connectivity needs are met in the ensuing decade and beyond.

- AT&T Fiber will be passing 30 million-plus consumer and business locations within our existing wireline footprint by the end of 2025. We finished last year with approximately 24 million fiber locations passed, including businesses, of which more than 22 million locations are sellable, which we define as our ability to serve. We remain on track to reach our target of 30 million plus passed locations by the end of 2025. The simple math would suggest 2 million to 2.5 million consumer and business locations passed annually moving forward. As we previously shared, build targets will vary quarter-to-quarter in any given year based on how the market is evolving.

- AT&T’s Gigapower joint venture announcement with a BlackRock infrastructure fund has not yet closed, we’re very excited about the expected benefit. Through this endeavor, Gigapower plans to use a best-in-class operating team to deploy fiber to an initial 1.5 million locations, and I would expect that number to grow over time. This innovative risk-sharing collaboration will allow us to prove out the viability of a different investment thesis that expanding our fiber reach not only benefits our fiber business, but also our mobile penetration rates. But what makes me most enthusiastic about this endeavor is that we believe Gigapower provides us long-term financial flexibility and strategic optionality and what we believe is the definitive access technology for decades to come, all while sustaining near-term financial and shareholder commitments.

- AT&T sees huge opportunities to connect people who previously did not have access to best-in-class technologies through broadband stimulus and Broadband Equity, Access, and Deployment (BEAD) funding. As I shared before, we truly believe that connectivity is a bridge to possibility in helping close the digital divide by focusing on access to affordable high-speed Internet is a top priority of AT&T. The intent of these government programs is to provide the necessary funding and support to allow both AT&T and the broader service provider community that means to invest alongside the government at the levels needed to achieve the end state of a better connected America.

- Our commitment to fiber is at the core of our strategy. In footprint, we’re on track to deliver our 30 million plus location commitment and we’re building the strategic and financial capabilities to take advantage of further opportunities as they emerge.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

AT&T’s open disaggregated core routing platform was carrying 52% of the network operators traffic at the end of 2022, according to Mike Satterlee, VP of AT&T’s Network Core Infrastructure Services in an interview with SDxCentral. Satterlee described this platform as the carrier’s “common” or “core backbone,” which supports about 594 petabytes of data traffic per day. This core backbone is a multi-part architecture spanning from AT&T’s nationwide network switch and cloud provider connections to its consumer- and enterprise-facing broadband and mobility services.

AT&T’s core platform uses Broadcom’s Jericho2 hardware design and Ramon switching chips, the carrier’s distributed disaggregated chassis (DCC) white box router architecture, and Israel based DriveNets Network Cloud (DNOS) software. It’s fed by AT&T’s edge router platform that sits in regional connection points. It uses the Broadcom silicon, Cisco software platform, and hardware from UfiSpace.

Satterlee said AT&T is running a nearly identical architecture in its core and edge environments, though the edge system runs Cisco’s disaggregates software. Cisco and DriveNets have been active parts of AT&T’s disaggregation process, though DriveNets’ earlier push provided it with more maturity compared to Cisco.

“DriveNets really came in as a disruptor in the space,” Satterlee said. “They don’t sell hardware platforms. They are a software-based company and they were really the first to do this right.”

AT&T began running some of its network backbone on DriveNets core routing software beginning in September 2020. The vendor at that time said it expected to be supporting all of AT&T’s traffic through its system by the end of 2022.

“It’s completely open in the sense that either vendor software could run in either places of the network,” Satterlee explained, adding that this was very helpful during the COVID-19 pandemic. “By having a common platform it’s just a matter of switching out the [network operating system] so we were able to very quickly redirect equipment for different use cases within AT&T and it was just a simple software change controlled by SDN.”

AT&T is targeting 65% of its traffic running on the disaggregated architecture by the end of this year. This will be important to support AT&T’s fiber and 5G push, which was enhanced late last year through a deal the carrier struck with BlackRock to expand its fiber footprint.

John Gibbons, assistant VP for AT&T’s Network Infrastructure Services, added that this also paves the way for the carrier to roll out 800-gigabit support for its backbone. “We don’t have to swap out the core router to get to 800-gig,” Gibbons said. “We can actually add to the current chassis. … We can add the new box to start growing it out from there. That’s the flexibility. It’s like the building-block model.

“Pretty much everything we spoke about supports our two biggest initiatives, which is growing the AT&T fiber broadband as well as 5G, and it’s all the underpinnings of those services,” Gibbons said.

References:

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Deploys Dis-Aggregated Core Router White Box with DriveNets Network Cloud software

Russian government to allocate 24.25-27.5 GHz band for 5G services (Russian made base stations)

The Russian Ministry of Digitization has proposed the allocation of the 24.25-27.5 GHz band [1.] for 5G services. The band is currently used by radio-relay stations. The 4 GHz band is also planned to be used by public networks, for 5G services.

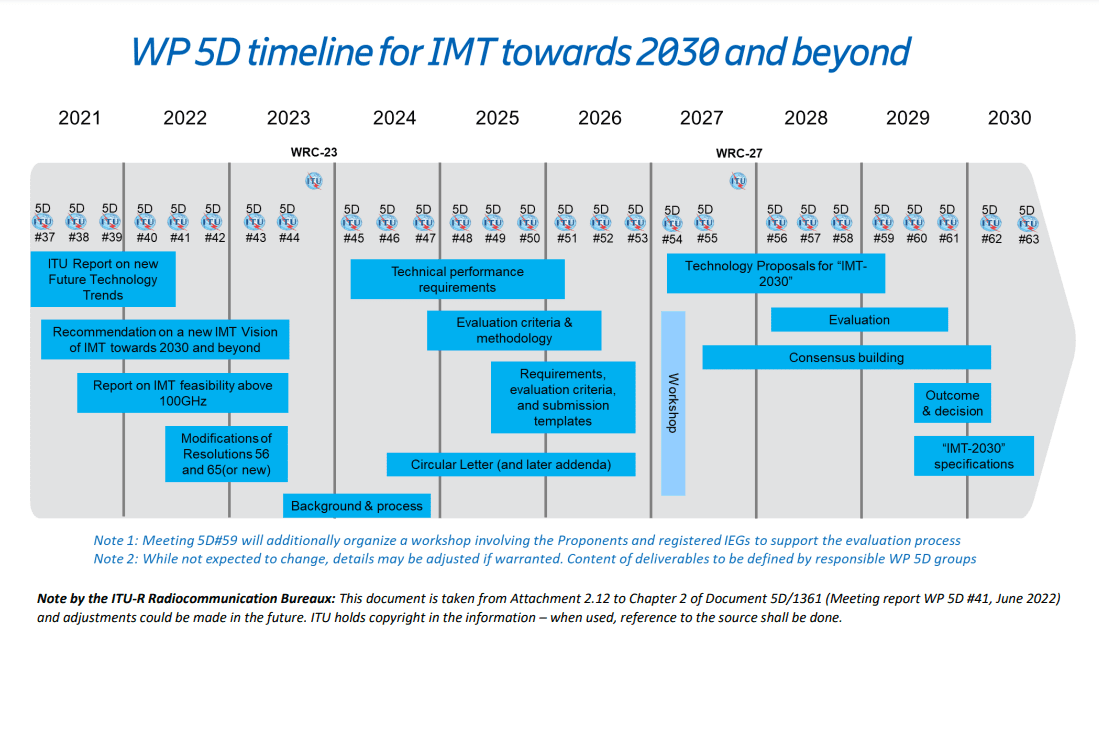

Note 1. While WRC19 allocated the frequency bands of 24.25-27.5 GHz, 37-43.5 GHz, 45.5-47 GHz, 47.2-48.2 and 66-71 GHz for the deployment of 5G networks, ITU-R WP5D has not yet agreed on the revision of M.1036 – the Frequency Arrangements for Terrestrial IMT (including 5G).

………………………………………………………………………………………………………………………………………………………………………………………………………………

The Russian Ministry also proposed the conversion of the 4 GHz band to “civilian,” which will help Russian network operators simplify the necessary expertise for 5G networks and obtain guarantees of the use of the band. Part of the initiative is expected to go into effect in 2023. It will help improve Internet speed and facilitate the introduction of 5G in Russia.

In late June 2022, the Ministry of Digital Science reported that the 3.4-3.8 GHz frequency range [2.] will not be used for 5G networks. Instead, a frequency band of 4.8-4.9 GHz was chosen for Russia’s 5G networks.

Note 2. The Ministry noted that the 3.4-3.8 GHz frequency range is a priority for 5G, but in Russia it is occupied by other services, including power services. After the end of the ten-year licensing period in 2021, operators asked the State Commission on Radio Frequencies (GKRCH) to extend the licenses for another year so as not to abruptly disconnect customers. The SCRF extended the operators’ permission to use the frequencies until July 1, 2022. Rostelecom, MegaFon and VimpelCom filed a petition to extend the permit for frequencies of 3.4-3.8 GHz, used to provide wireless Internet access services using WiMAX technology, but were refused.

………………………………………………………………………………………………………………………………………………………………………………………………………………

The ministry also expects that the implementation of 5G networks will be carried out with network equipment of local origin. That edict was promulgated BEFORE sanctions on Russia for its war in Ukraine. In September 2021, the Ministry of Finance of Russia decided that by 2023 only Russian made base stations could be installed on the communication network. It is assumed that within 2-3 years mass production of such LTE standard stations will be organized, then it is planned to switch to 5G standard base stations.

References:

https://tadviser.com/index.php/Article:Frequencies_for_5G_in_Russia

WRC 19 Wrap-up: Additional spectrum allocations agreed for IMT-2020 (5G mobile)

6 GHz band proposed for WiFi/5G in Asia Pacific region, but it’s not in ITU-R M.1036

It’s well known that mid-band spectrum is very important in the on-going digital evolution as it strikes a good technical trade-off between coverage and capacity. Without adequate spectrum, ubiquitous 5G connectivity fundamental to the digital economy will not materialize.

In his published paper entitled “Optimizing IMT and Wi-Fi mid-band spectrum allocation: The compelling case for 6 GHz band partitioning in Asia-Pacific,” Scott Minehane called on policymakers, regulators, and mobile network operators (MNOs) in Asia Pacific to allocate adequate mid-band spectrum for both IMT and Wi-Fi services. Findings in this paper were also presented in the ITU Regional Radiocommunication Seminar 2021 for Asia-Pacific.

What Scott failed to mention is that neither WRC or ITU-R WG 5D have approved the use of 6 GHz (C-band spectrum) for terrestrial IMT (3G, 4G, 5G) as that band is NOT in the proposed revision to ITU-R M.1036. After 4.800-4.990 GHz, the next band in M.1036 is 24.25-27.5 GHz.

In the United States in April 2020, the FCC made a massive 1200 MHz of bandwidth available in this band for Wi-Fi and other unlicensed technologies such as 5G New Radio/ITU M.2150 in unlicensed bands (not an official ITU-R standard).

Nonetheless, here is Minehane’s case for 6 GHz as published earlier this week in Telecom Review Asia:

In Asia, where more than 4.3 billion people reside in areas subject to monsoons and frequent heavy rainfall, C-Band spectrum is crucial as it is not susceptible to rain attenuation. However, with C-Band being the preferred spectrum widely used by satellite operators in the region, many countries do not have enough 3.5 GHz band to allocate to mobile operators in order to support advanced 5G and future 6G deployments.

As mobile data consumption surge in populous capital cities such as Jakarta, Bangkok, Hanoi, Kuala Lumpur, and Phnom Penh, there is a real threat that spectrum demand would outstrip spectrum supply in the near future. In fact, the GSMA has projected that countries require 2 GHz of mid-band spectrum over the next decade to deliver the full potential of 5G networks.

With spectrum demand on the rise, and competition for frequency bands intensifying, the 6 GHz band has been identified as the ideal substitute for 3.5 GHz because of its good propagation properties and large contiguous bandwidth of 1200 MHz. Comparatively, mmWave is an ill fit in the region as rain attenuation results in significant path loss. Commercially, utilizing 6 GHz for 5G deployment is also more viable (then mmWave) as capex and opex costs are foreseen to be much lower.

Noting that there is no one-size-fits-all approach for the 6 GHz band allocation in a heterogeneous region like the Asia Pacific, Minehane said, “The key is having a customized approach for the 6 GHz band in the Asia Pacific, where emphasis is placed on the early partitioning of the 6 GHz band between IMT and Wi-Fi, as this is the largest remaining single block of spectrum which could be allocated for mobile services in the mid-band.”

Partitioning of the 6 GHz band for IMT and Wi-Fi would balance competing demands for spectrum. To secure the short- and long-term economic benefits of both services, Minehane proposed allocating 500 MHz of the lower 6 GHz band (5925-6425 MHz) for Wi-Fi and 700 MHz of the upper band (6425-7125 MHz) for IMT.

“Making about 700 MHz of 6 GHz spectrum available for IMT services is a good start towards future-proofing 5G advanced and 6G services. Moreover, adequate IMT spectrum fosters healthy competition in the sector, where say 3 to 4 providers prioritize delivering superior customer services and experiences to differentiate themselves,” said Minehane. “From an economic perspective, IMT services also generate greater benefits than Wi-Fi services.”

Source: Qualcomm

Amid uncertainties in how new technologies unravel in the long-term, diversification of the 6 GHz band offers flexibility in future decision-making. Apart from addressing the spectrum demands set out by the GSMA, Minehane recommended making provision for more IMT spectrum as it offers the flexibility to be upgraded to the future 6G or switched to Wi-Fi. However, switching from unlicensed Wi-Fi use to licensed IMT uses will be impossible owing to the proliferation of user-based equipment.

Minehane noted that allocating the entire 6 GHz band to Wi-Fi to bridge the digital divide is futile, as low band spectrum is most suited to deliver connectivity to the underserved in rural areas.

Besides, better, faster, and more secure experiences with 4G or 5G, compounded with more affordable, unlimited data plans result in consumers using less Wi-Fi and data offloading. In South Korea, for instance, about 52% of mobile data traffic was handled by 5G. In Canberra, supported by Australia’s largest free public Wi-Fi network, Wi-Fi usage declined sharply when prices in mobile data dropped even during the pandemic. Similarly, enterprises are likely to rely more on 5G than Wi-Fi 6.

Effective spectrum management is instrumental to economic recovery, growth, and resilient. One of the biggest challenges regulators face is the refarming of spectrum to tap onto the potential of emerging innovations. To this end, regulators need to formulate a long-term spectrum roadmap and strategy to chart progress. Another challenge is keeping spectrum auctions affordable, so that operators can invest in upgrading network infrastructure.

Despite these prevailing challenges, Minehane stressed that collectively, the region is forward-looking. Individual countries are stepping up on initiatives and engaging in ongoing dialogues to discuss spectrum management approaches. The 3GPP has also embarked on standardization work to grow the 6 GHz band ecosystem.

Concluding, Minehane expressed hopes that policymakers would increase IMT spectrum allocations and maximize the value created by key spectrum in the years and decades to come.

Addendum: 14 Oct 2021 Email from Joanne Wilson, Deputy to the Director ITU Radio Communications Bureau (ITU-R) who spoke at SCU:

“ITU-R Recommendations are voluntary (non-binding) unless they, or parts thereof, have been incorporated by reference (IBR) into the Radio Regulations. Rec ITU-R M.1036 has not been incorporated by reference into the Radio Regulations and its implementation is voluntary. As a recommendation that addresses the frequency arrangement for an application (not a service!), there would be no context under which M.1036 would be considered for IBR. Still, M.1036 is one of the most heavily debated recommendations because most countries follow it as the basis for their subsequent domestic rulemakings.”

References:

https://www.fcc.gov/document/fcc-opens-6-ghz-band-wi-fi-and-other-unlicensed-uses-0

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.1036-6-201910-I!!PDF-E.pdf