Month: July 2017

5G in India dependent on fiber backhaul investments

Excerpts of an article in the Economic Times of India by Ankit Agarwal:

Executive Summary:

In the wake of growing awareness around Internet of Things (IoT) and the use cases it presents to Indian businesses and consumers, 5G will open a new era of opportunities for telecom operators and ecosystem partners in the country.

AJW Comment: However, fiber backhaul will be needed and that may take some time as India’s fiber infrastructure needs significant improvement.

“One of the fundamental requirements for 5G is strong backhaul which is simply not there and that is the most time consuming part and it is extremely expensive in today’s condition in India,” Jalaj Choudhri, EVP, Reliance Communications said. He adding that even if India is able to circumvent the challenges of standardization and 5G truly becomes available by 2020, yet a good 5G network cannot be expected unless we have a reliable and strong backhaul.

More in this article.

Current Status of 5G in India:

In India, Nokia has recently signed an MoU with wireless network operators BSNL and Airtel to collaborate on 5G technology solutions, and Reliance Jio is working with Samsung to explore various technologies and equipment for 5G.

In the wake of growing awareness around Internet of Things (IoT) and the use cases it presents to Indian businesses and consumers, 5G will open a new era of opportunities for telecom operators and ecosystem partners in the country. Though it’s difficult to get an accurate estimate of the market size right now, IoT is expected to provide a $15 billion market opportunity for Indian businesses by 2020, according to officials at Department of Telecom (DoT). Combine this with the unprecedented growth in the number of smartphone users in India, which is expected to overtake the U.S. in terms of smartphone shipment by 2019. Analysts are optimistic that India will hold around 15% of the world’s smartphone market share by that period – Indian consumers are ready for 5G.

Roadblocks for Indian Operators

Indian operators, however, need to address the issues surrounding 5G infrastructure and deployment. Challenges involving regulatory policies, investments and infrastructure readiness need to be addressed on priority.

Challenges ahead for telecom operators in India are multi-fold compared to their peers in the rest of the world. Diverse geography, disparate population and disparity in economic distribution among the rich and the poor pose serious challenges to operators, preventing uniform investments across different telecom circles. Also, issues such as Right of Way (RoW) have created uncertainty in fiber investments across different states. These apart, the rising cost of air waves and the challenges involved in migrating to new technologies bring additional challenges.

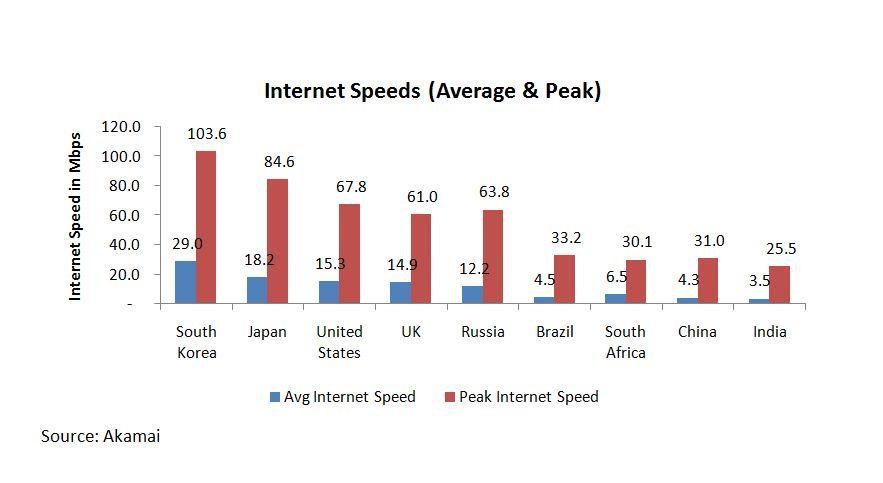

Moreover, the industry’s performance on key indicators such as network speed, coverage and customer service is not satisfactory. For example, average Internet speed in India stands at 3.5 Mbps compared to 29 Mbps in South Korea, 15 Mbps in the U.S., and 4.3 in China (see graph below).

In this context, it is worth analysing where telecom investments should be directed to make commercial 5G a reality in India by 2020.

Fiber to Drive 5G Rollouts

With a promise of 10Gbps speed, less than 1 ms latency and 90% reduction in network energy utilisation, 5G will spur the next round of telecom infrastructure investments across the globe, say experts. The growth of 5G will be fuelled by the sharp hike in consumer data and the proliferation of IoT devices.

ITU estimates the market for IoT devices will result in over USD 1.7 trillion in value added to the global economy by 2019. In view of these developments, ITU expects that investments on fibre infrastructure will surpass $ 144.2 billion during 2014 – 2019. The fact that 5G network will have to support bursty data from emerging applications like Video on Demand (VoD), IoT, Smart Cities, and the like also makes backhaul (from cell tower to network operators Point of Presence) a critical concern.

In several markets, operators are turning to fiber backhaul as an alternative to costly microwave technologies. Since fiber is essential for both wireline and wireless networks, investors show greater levels of confidence in fiber investment.

Fiber Investment: Where does India stand?

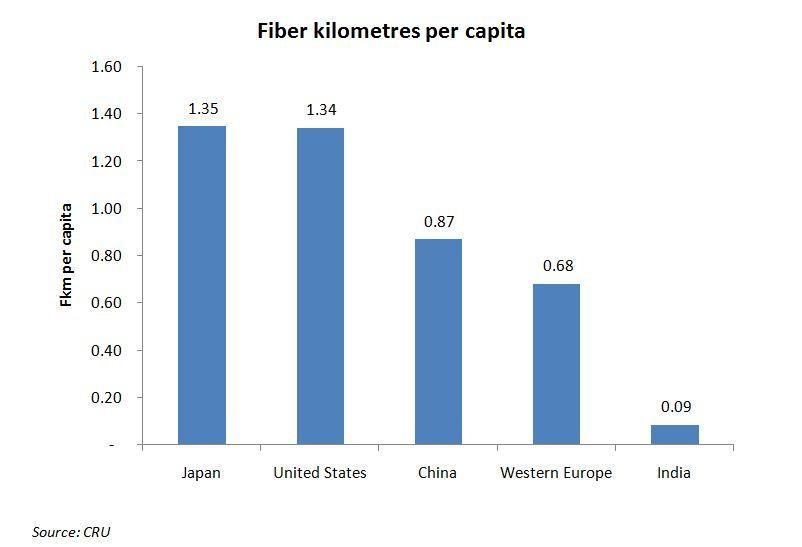

A comparison of optical fiber cable (OFC) rollout among the top performing telecom markets shows that the fiber kilometre (fkm) per capita is much less in India compared to several other key markets. For example, fkm per capita for China with 1.3 billion people is 0.87 whereas that of India with 1.2 billion people is just 0.09 (i.e. one-tenth of China consumption).

In developed markets such as the US and Japan, the score is 1.3 and higher (See graph below).

Preparing 5G Networks in India

The latest Cisco VNI report estimates that global IP traffic will grow at a compound annual growth rate (CAGR) of 23% from 2014 to 2019, and reach 2 zettabyte per year by 2019. Given this, operators across the world are upgrading their backhaul networks with fibre technology. The fact that fibre-based networks are capable of delivering unlimited bandwidth makes them a winning formula for telecom investments.

Leading operators are now mulling ways to reduce the capex associated with fibre deployments. Infrastructure sharing and leasing are gaining popularity among mobile and cable operators in developing markets. In India, the DoT’s amendment of unified license scheme for active infrastructure sharing and the revised public private partnership (PPP) model for BharatNet project adopted last year are two timely steps to boost the infrastructure sharing efforts by operators. Combined with this, a consensus on RoW is also expected soon across all Indian states. A unified RoW policy will pave way for smooth fibre rollout, resulting in faster service rendering.

To rise to the global standards and solidify their stand in the country, Indian operators need to pump in more funds in optical fibre and related technologies. With fibre playing a pivotal role in improving broadband connectivity and building robust 4G/5G backhaul capabilities, operators will find the investment worth of a grab. As penetration improves, they will be in a position to lower tariffs and identify new monetisation opportunities. ARPU will improve, and the market will stabilise gradually.

As the second largest telecom market in the world, India promises great potential for investors. Industry watchdogs believe India and China combined are capable of transforming world’s telecom landscape in the next decade. Recent developments reveal that Chinese operators and technology vendors have come a long way in 5G tests and trials. Now, it’s the turn of Indian operators to prove their readiness to 5G.

This is an exciting time for India, and the impact of 5G and its associated enablement of M2M, IoT, Autonomous driving and AR/VR can be anticipated. Given the 5G requirement for latency reduction (from 50ms to 1 ms) and speed from 100 Mbps to 10Gbps, the fibre deployment in the country will need to increase from current market of 16-18 million fkm per year to at least 2-3x per year. 5G will also require a multi-fold increase in small cells deployment, with each small cell having backhaul on fibre. The percentage of tower backhaul on fibre for the operators will need to increase significantly from 20% to 70-80% levels.

The current main drivers for the increase in deployment lie in the increased 4G deployments in Tier 1 and Tier 2 cities, increased Fibre-to-the-Home (FTTH) deployments by telecom operators, ISP’s and MSO providers. For example, ACT has recently launched 1Gbps broadband service in Hyderabad, which 20x faster than the market average of 50 Mbps. The other drivers for increase in fibre demand include the rural broadband project – BharatNet and large connectivity projects by the Defence. Lastly, optical fibre is a critical component to make the Smart Cities project a success.

Enabling early adoption of 5G, Sterlite Tech is working closely with key stakeholders – DOT, TRAI, telecom operators, equipment vendors and start-ups to enable 5G deployments in the country. Sterlite Tech is actively involved in 5G readiness solutions, and, is a key member of the Telecom Infra Project (TIP) led by Facebook, to completely transform telecom networks using SDN/NFV and make them 5G ready.

DISCLAIMER: The views expressed are solely of the author and ETTelecom.com does not necessarily subscribe to it. ETTelecom.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.

China Telecom: IoT partnerships with 3 network operators; Huawei NB-IoT award from GSMA

China Telecom’s 3 New IoT Partnerships:

China Telecom has entered three new partnership agreements aimed at accelerating the development of services based on an Internet of Things (IoT) open platform.

The operator has announced an expanded partnership with HKT to cover the development of a common IoT open platform to serve the operators’ customers in the combined geographical footprints of mainland China and Hong Kong.

With the arrangement, each network operator’s customers will be able to deploy IoT and M2M services on the other’s network.

The joint offering will allow seamless switching of IoT subscription between networks by integrating the two commonly-deployed embedded universal integrated circuit card platforms. The multi-domestic service is supported by the Ericsson Device Connection Platform (DCP).

China Telecom also announced a similar strategic partnership with Norway-based Telenor Group. That partnership will allow customers from China Telecom and Telenor Connexion to deploy IoT and Machine-to-Machine (M2M) services in each other’s network. It enables China Telecom’s multi-national enterprise customers with outbound IoT business to deploy their assets and offerings under Telenor Connexion’s networks in the European and other Asian Markets.

Similarly, Telenor Connexion’s global customers can enjoy the benefits of the rapidly growing Chinese market by leveraging on China Telecom’s IoT network resources and business capabilities. The seamless switching of IoT subscription between networks is achieved by the integration of the two commonly deployed eUICC platforms which are the key component of IoT collaboration across borders.

To recap, China Telecom’s multi-national enterprise customers will gain access to Telenor Connexion’s IoT networks in Europe and Asian markets, and will serve as Telenor Connexion’s preferred partner for connectivity in China.

…………………………………………………………………………..

A separate agreement with Orange Business Services will enable both companies to serve their respective enterprise customers through a combined footprint across three continents – Asia, Europe and Africa.

The network operators have also agreed to collaborate on the development of new service models supporting global IoT opportunities and to explore the potential of enhancing existing IoT capabilities and applying emerging technologies such as mobile IoT.

GSMA functions to connect participants throughout the global mobile communications ecosystem, including almost 800 operators and over 300 enterprises. The association lays significant emphasis on addressing common concerns to best serve the interests of mobile operators worldwide. GSMA’s “Best IoT Innovation for Mobile Networks” award identifies and rewards Internet of Things (IoT) products, solutions, services, and new business models to highlight innovative breakthroughs based on new technological developments and standards of mobile networks.

Huawei’s NB-IoT solution comprises an NB-IoT terminal chipset, terminal operation system LiteOS, NB-IoT RAN and EPC, OceanConnect (a cloud platform for IoT management), and OpenLab that helps related enterprises develop IoT services and applications. The goal of the Huawei NB-IoT solution is to jointly build a better connected IoT solution and ecosystem with operators and partners from a diverse range of vertical industries. Huawei was the first to launch associated products after 3GPP released standards formulated for NB-IoT – one of multiple competing “standards” for Low Power WANs (LPWANs) targeted at the (non LAN) IoT market.

In 2016, Huawei began conducting NB-IoT trial applications in conjunction with mainstream network operators and partners. In early 2017, Huawei launched Boudica120, the world’s first commercial NB-IoT chip.

http://www.huawei.com/en/news/2017/6/GSMA-Best-IoT-Innovation-Mobile-Networks-Award

Highlights of IoT Developers Conference, April 26-27, 2017 in Santa Clara, CA

Windstream Joins ONAP & Open Source Telco Movement Led by AT&T/ China

Windstream Communications has become a corporate member of the Open Network Automation Platform (ONAP) Linux Foundation project, joining an open-source technology initiative for the first time.

ONAP was formed through the merger of open source ECOMP (contributed by AT&T) and Open Orchestrator Project (OPEN-O), two of the largest open source networking initiatives. It was the big hit of the 2017 Open Networking Summit as we reported in this blog post.

The ONAP Project is focused on creating a harmonized and comprehensive framework for real-time, policy-driven software automation of virtual network functions. ONAP includes participation by prominent networking suppliers and industry-leading service providers from around the world. It’s primary objective is to enable software, network, IT, and cloud providers and developers to rapidly create new services which can be monetized.

The ONAP draft architectural principles, presented at their May 2017 meeting at AT&T Bell Labs in NJ, can be read here.

……………………………………………………………………………………………….

“Combined with our rapid advances in SDN, Windstream’s participation in ONAP increases the value of our network for all of our customers, as we move to virtualization and cloud-based technologies that offer affordable and efficient next-generation services,” said Art Nichols, vice president of network architecture and technology for Windstream.

“For example, not only does our SDNow solution offer automation and accelerated service delivery, but it forges the path that will allow us to deliver flexible, on-demand services across our multi-vendor network ecosystem.”

“Traditionally, we have always worked with engineering groups and maybe a little bit with IT on the back side” in planning this kind of transition, Windstream’s Jeff Brown told Light Reading in an interview.

“In this new world, you are blending IT and engineering and a lot of crossover resources. So, from the IT perspective, [ONAP] was called out as a group that was taking the leadership role as far as developing open standard work with other companies we have similarities with and with some of our vendors as well.”

Windstream has been informally monitoring multiple open source efforts and supporting the concept of open source for some time now, Brown told Light Reading. The move to more actively engage in orchestration through ONAP was driven by the growing influence of Windstream’s IT department in its transition to software-defined networking, he added.

“In any type of industry forum, whether standards-based or not, you have to make the determination of what kind of resources you can dedicate to it,” Brown notes. Having just come out of meetings around MEF and proofs-of-concept for its 2017 event, he says the same discussions come up there. “We don’t have groups allocated that can do that type of thing and work with vendors,” he says.

https://wiki.onap.org/display/DW/Draft+Architecture+Principles

http://about.att.com/innovationblog/onap

Open Network Summit: ONAP Steals the Show with Broad Support