Infonetics: Cisco leads in Session Border Controllers; $377 billion to be spent on VoIP and UC services over next 5 years!

Infonetics Research recently released two reports that highlight the growing market for enterprise VoIP and Unified Communications.

1. Enterprise Session Border Controllers market size and forecast report (bi-annual) provides worldwide and regional market size, market share, forecasts, analysis, and trends for enterprise SBC revenue and sessions by system and business size in North America, Asia Pacific, EMEA (Europe, Middle East, Africa), and Central and Latin America. Companies tracked include Acme Packet, Adtran, AudioCodes, Avaya, Cisco, Dialogic, Edgewater, GENBAND, Ingate, Innomedia, Media5, OneAccess, Sangoma, Siemens Enterprise, Sonus Networks, and others.

Note: A Session Border Controller (SBC) is a device regularly deployed in Voice over Internet Protocol (VoIP) networks to exert control over the signaling and usually also the media streams involved in setting up, conducting, and tearing down telephone calls or other interactive media communications. SBCs are inserted into the signaling and/or media paths between calling and called parties in a VoIP call, predominantly those using the Session Initiation Protocol (SIP), H.323, and MGCP call-signaling protocols.

2. VoIP and UC Services and Subscribers report features a Hosted PBX/UC Provider Tracker and provides worldwide and regional market share, market size, forecasts, analysis, and trends for VoIP services, including residential/SOHO, hosted VoIP and UC, IP connectivity, and managed IP PBX services. Companies tracked include AT&T, Cablevision, Charter, Comcast, Cox, Embratel, France Télécom, KDDI, LG Uplus, LibertyGlobal, NTT, ONO, Optus, Rogers, SFR, SK Broadband, SoftBank, Telecom Italia, Time Warner Cable, Verizon, Vonage, and others.

To buy these reports, contact Infonetics: http://www.infonetics.com/contact.asp

Enterprise Session Border Controllers (E-SBCs) are being used to facilitate complex Unified Communication (UC) feature interworking, simplify interconnection via SIP (Session Initiated Protocol) trunking and enhance services around local enterprise policies. There are several sales models for E-SBCs: customer owned and operated, hosted or managed by a service provider, reselling equipment and software as a packaged service.

ENTERPRISE SBC MARKET HIGHLIGHTS:

- Worldwide revenue for enterprise SBCs hit $82.5 million in the first half of 2012 (1H12)

- Systems with fewer than 800 sessions comprise the largest share of enterprise SBC sales

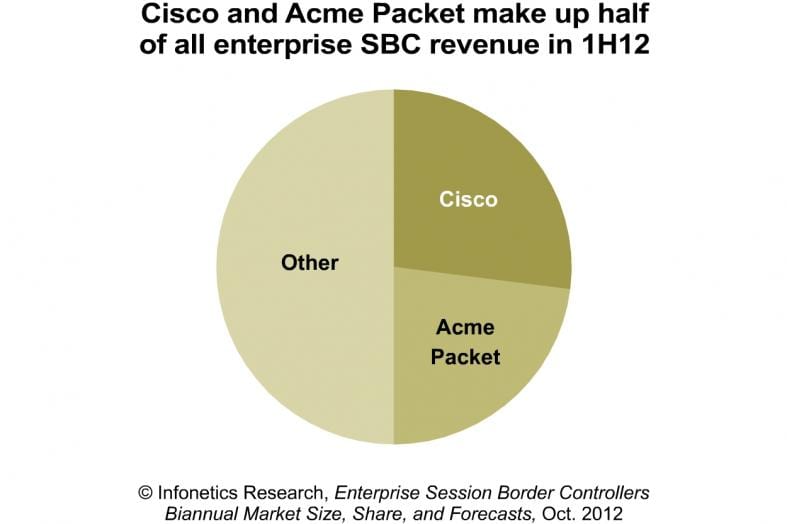

- Cisco and Acme Packet are the top enterprise SBC vendors by 1H12 global revenue share

- Competitive pressures during the first half of the year impacted average revenue per session downward

- Infonetics Research forecasts the enterprise SBC market to grow strongly, topping $430 million in 2016

“For the first time ever, Cisco captured the lead in the enterprise session border controller market, taking 26% revenue market share in the first half of 2012,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research. “Cisco’s been able to turn its market-leading position in IP PBXs into an advantage, selling its enterprise SBCs with new IP PBX and unified communications deployments.”

VOIP AND UC SERVICES MARKET HIGHLIGHTS:

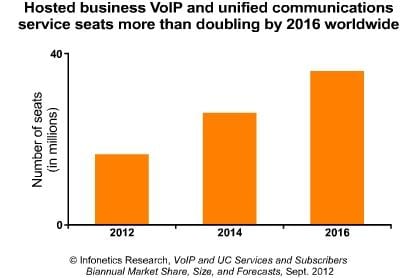

- Infonetics predicts a cumulative $377 billion will be spent on business and residential/SOHO VoIP services over the 5 years from 2012 to 2016, driven primarily by SIP trunking and hosted VoIP/UC services

- NTT, the perennial leader of residential VoIP market, topped 14 million subscribers in 2Q12

- Roughly 15%–20% of all new IP PBX lines sold are part of a managed service or outsourced contract, making managed IP PBX the largest segment of business VoIP services

- SIP trunking revenue grew 23% in the first half of 2012 compared to the second half of 2011, led by strong activity in North America

“The SIP trunking and hosted UC segments were marked by strong growth and dynamic supplier landscapes in the first half of 2012,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research. “Cisco’s been able to turn its market-leading position in IP PBXs, VoIP gateways, and data networking equipment into an advantage, upselling its enterprise SBCs to this customer base as they transition to services such as SIP trunking.”

Contact: [email protected]

Infonetics also released excerpts from its UC Deployment Strategies and Vendor Leadership: North American Enterprise Survey, which explores enterprise plans for unified communications (UC) and their perceptions of UC vendors.

VOIP AND UC SERVICES MARKET HIGHLIGHTS:

- Infonetics predicts a cumulative $377 billion will be spent on business and residential/SOHO VoIP services over the 5 years from 2012 to 2016, driven primarily by SIP trunking and hosted VoIP/UC services

- NTT, the perennial leader of residential VoIP market, topped 14 million subscribers in 2Q12

- Roughly 15%–20% of all new IP PBX lines sold are part of a managed service or outsourced contract, making managed IP PBX the largest segment of business VoIP services

- SIP trunking revenue grew 23% in the first half of 2012 compared to the second half of 2011, led by strong activity in North America

“Our unified communications survey reveals a really important shift taking place as enterprises increasingly use mobile devices to access UC applications,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research. “Survey respondents indicate that smartphones and tablets will be the two most widely used devices for UC in 2013, passing traditional computers and deskphones.”

To buy this survey, contact Infonetics: http://www.infonetics.com/contact.asp