Infonetics: Femtocells being positioned as a a home network for voice & mobile BB ; Complementary to WiFi

The telecom industry has talked about Femtocells for years, but not much has happened outside of AT&T giving away femtocell equipment to folks buying iPhones in rural areas (like my cabin in Blue Lake Springs, CA where AT&T doesn’t provide cellular service of any kind). Here’s an article I wrote on this topic over 3 1/2 years ago:

WCA Panel Session: Femtocells and their consequences for Mobile Broadband Technologies

Yesterday, Infonetics Research completed interviews with more than 25% of the network operators in the world that have already launched or plan to launch femtocell services by 2013.

Excerpts follow from the resulting report, Residential Femtocell Service Strategies: Global Service Provider Survey, follow. The report assesses operator needs and analyzes trends in the femtocell market.

FEMTOCELL SURVEY HIGHLIGHTS:

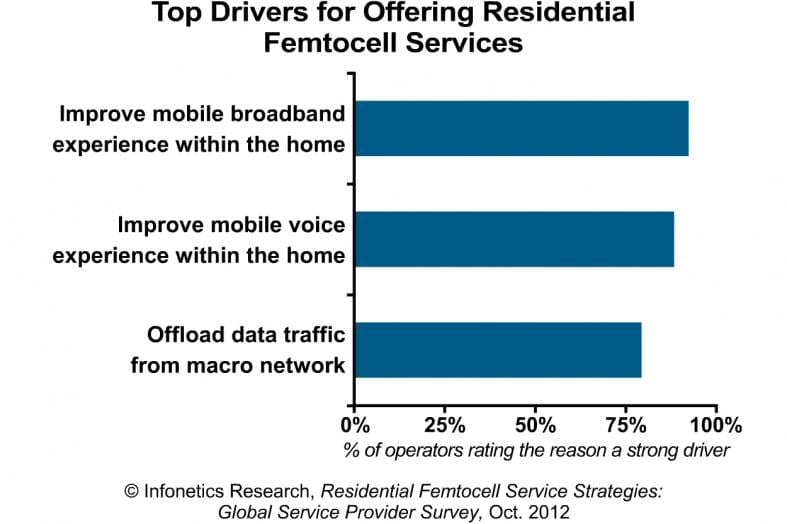

. The top drivers for offering residential femtocell services are improving mobile broadband and voice within the home, and offloading data traffic from macro cellular networks

. 29% of operators surveyed plan to offer FD-LTE femtocell services by 2013

. WiFi, long seen as a competitor to the growth of femtocells in the home, is increasingly being viewed as complimentary by carriers

(AJW comment: Competition from WiFi has been a real sticking point for residential femtocell deployments, especially with so many VoIP/OTP voice services that use WiFi for broadband Internet access)

. Service provider respondents project they will have, on average, 211,000 femtocell subscribers by 2013

(AJW comment: The other huge obstacle for residential femtocells is that the wireless traffic generated/received goes on the wired broadband network. That’s OK if that latter network is owned and operated by the cellular carrier (e.g. AT&T or VZ), but NOT OK otherwise. In the most classic example, AT&T gives a free residential femtocell to rural users that typically have Comcast/Xfinity for an ISP. All the iPhone and iPAD traffic that would otherwise go on AT&Ts 3G/4G network is offloaded to Comcast/Xfinity which doesn’t get a penny extra to carry it.)

FEMTOCELL SURVEY SYNOPSIS:

For its 27-page Residential Femtocell Service Strategies survey, Infonetics asked purchase-decision makers at service providers in North America, Europe/The Middle East/Africa, Asia Pacific, and Latin America about their plans for delivering femtocell services through 2013. Survey participants were asked about current and future femtocell service launches, adoption drivers and challenges, femtocell technologies, service features, add-on services, marketing, advertising, sales strategies, CPE features, form factors, expected service revenue, ARPU, and subscribers.

“Operators are still very much focused on using femtocells to deliver better voice coverage, but our 2012 residential femtocell survey identifies a shift toward a more strategic utilization of femtocells for enhancing the mobile broadband experience and as a means for delivering value-added services like virtual home phone numbers and media file sharing,” explains Richard Webb ([email protected]), directing analyst for microwave, mobile offload, and mobile broadband devices at Infonetics.

Mr. Webb adds, “The business model for more sophisticated femtocell services remains a big question mark. For the market to evolve, vendors need to help operators on pricing and service models so they can drive volumes and enable new service revenue. If it adds up, there’s a real opportunity to leverage the femtocell to put the mobile network at the heart of the home network-something that’s traditionally been beyond the reach of the mobile operator.”

To buy the survey, contact Infonetics: http://www.infonetics.com/contact.asp

From a report released last month, Infonetics 2nd quarter (2Q12) Femtocell Equipment market share and forecast report

FEMTOCELL EQUIPMENT MARKET HIGHLIGHTS:

- Global 2G and 3G femtocell revenue is up 12% in 2Q12 over 1Q12, and is up 43% from the year-ago second quarter

- Every segment of the femtocell market—consumer, enterprise, and public access—grew by double digits in 2Q12, with consumer femtocells accounting for more than 1/2 of 2Q12 revenue

- In 2Q12, Alcatel-Lucent holds on to the #1 spot it nabbed last quarter in the tight race for W-CDMA/HSPA femtocell revenue, with Cisco/ip.access a close 2nd

- W-CDMA/HSPA 3G femtocell revenue is growing at an 84% 5-year compound annual growth rate (2011 to 2016) and is expected to make up 95% of the 3G femtocell market by 2016

- Airvana continues to lead the higher-priced CDMA2000/EV-DO femtocell segment, with Samsung easily maintaining the #2 spot

Analyst Commentary:

“Double-digit revenue growth returned to the femtocell market in the 2nd quarter following a minor seasonal dip the previous quarter,” notes Richard Webb, directing analyst for microwave, mobile offload, and mobile broadband devices at Infonetics Research. “The combination of attractive product feature sets and price points, wider service availability, a growing customer base, and rising shipment volumes is proof positive that the femtocell market has long-term viability.”

Webb continues: “A slight dip in 3G femtocell revenue per unit held back overall revenue growth in the femtocell market in the first part of the year, but price erosion is an important factor that will drive long-term volume growth. Femtocell price erosion is due to a combination of factors, including new component suppliers entering the fray, manufacturing efficiencies, and the continuing scale-up of femtocell shipment volumes. Yet we remain cautiously optimistic that femtocells have sufficient market drivers and support among operators to sustain year-over-year growth through 2016.”

To purchase this or other Infonetics reports, contact Infonetics sales: http://www.infonetics.com/contact.asp

Addendum: Informa Telecoms & Media Small Cells Market Update Report

Julian Bright of Informa Telecoms & Media, recently presented his firm’s latest quarterly market update on small cells. The most important finding was that the number of small cells now exceeded the number of macrocells worldwide. This is helped by Sprint’s 1 million residential femtocell deployments– up from 250,000 in 2011.

Their report also highlights how new femtocell deployments from Telefónica O2, Orange UK, and Bouygues Telecom over the Summer mean that the UK and France have become the first countries globally where all major operators have deployed the technology. Telefónica O2 has made significant public-access progress with the world’s densest femtocell deployment in east London for the Olympics, as well as the launch of public Wi-Fi in central London which will be upgraded imminently to support licensed small cells. Informa predicts market growth to over 90 million small cells by 2016, based on linear growth, of which the vast majority (more than 90%) will be residential.