Infonetics study details enterprise plans for cloud services; firm sees virtualization boosting application delivery controllers

Market research firm Infonetics Research released excerpts from its new Cloud Service Strategies: North American Enterprise Survey, which explores enterprises’ plans for the adoption and usage of cloud services.

“There is no doubt, the cloud has come of age,” notes Sam Barnett, directing analyst for data center and cloud at Infonetics Research. “While investments in cloud outsourcing are small in comparison to internal IT/data center spending, they are growing each year, with the number of enterprise organizations turning to cloud technology to manage budgets and transform service delivery increasing significantly in the last two years.”

Barnett adds: “The cloud is no longer about outsourcing IT infrastructure and functions-it’s about right-sizing them.”

CLOUD SURVEY HIGHLIGHTS:

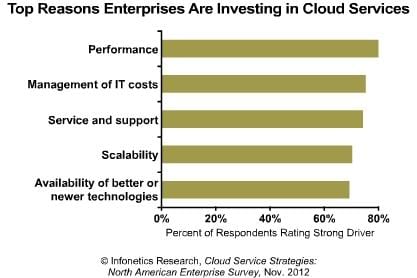

. 91% of enterprises interviewed use cloud services today, growing to 100% by the end of 2014

. The leading drivers for deploying cloud services are application performance and management of IT costs

. Software as a service (SaaS) is the most widely adopted cloud technology among respondent operators

. Survey respondents cite Microsoft, IBM, and Cisco as the top cloud service providers, although unexpected vendors dominate the cloud landscape in key technology deployment areas

SURVEY SYNOPSIS:

For its 25-page cloud service strategies survey, Infonetics interviewed purchase-decision makers at 107 North American enterprises about their current usage of cloud services as well as their plans for deploying cloud-based services through 2014. Survey participants were asked about cloud service delivery types (SaaS, IaaS, and PaaS), uses, deployment drivers, barriers, and vendors.

To buy the survey, contact Infonetics Sales: http://www.infonetics.com/contact.asp

For the latest in Cloud Data Center & Networking trends, please see:

Separately, Infonetics Research released preliminary results for the application delivery controller (ADC) and wide area network (WAN) optimization markets from its 3rd quarter 2012 (3Q12) Data Center Network Equipment report.

(Full report will be published December 7, 2012)

“While ADCs and WAN optimization appliances posted modest revenue gains in the 3rd quarter, the pace of growth in these segments decelerated year-over-year,” notes Sam Barnett, directing analyst for data center and cloud at Infonetics Research. “Top-line revenue growth in the ADC market is slowing due to the lower ASPs associated with virtual solutions versus their hardware-based counterparts, and saturation at the high end of the WAN optimization market is pressuring near-term growth.”

Barnett adds, “We believe this will change as more virtualized solutions enter the mainstream, helping to restore higher levels of overall growth to the WAN optimization and application delivery controllers markets.”

DATA CENTER NETWORK EQUIPMENT MARKET HIGHLIGHTS:

. Worldwide ADC revenue rose 5% in 3Q12 from 2Q12, but year-over-year (YoY) growth decelerated again and now stands at +6%, falling from +27% YoY growth in 3Q11

. F5 continues to lead the pack in ADCs, capturing nearly half of 3Q12 revenue; Citrix and Cisco round out the top 3 market share slots

. Cisco recently announced its intention to exit the ADC market, presenting an opportunity for F5 and Citrix to grow market share going forward

. WAN optimization revenue grew 3% sequentially in 3Q12, but is down 4% from the year-ago 3rd quarter

. Perennial leader Riverbed again dominated the WAN optimization segment in 3Q12, with almost 3/5 market share; Cisco remains solidly in 2nd place

REPORT SYNOPSIS:

Infonetics’ quarterly data center network equipment report provides worldwide and regional market size, vendor market share, forecasts, analysis, and trends for data center Ethernet switches (general purpose, purpose-built, and blade switches), ADCs, and WAN optimization appliances. Companies tracked include Alcatel-Lucent, Blue Coat, Brocade, Cisco, Citrix, Dell, F5, HP, IBM (BNT), Juniper, Radware, Riverbed, and others.

To buy the report, contact Infonetics Sales: http://www.infonetics.com/contact.asp