Infonetics & Insight Research Corp paint different pictures & forecasts for Global Telecom CAPEX

Overview:

Market research firms Infonetics Research and the Insight Research Corp have huge differences in their global telecom capex forecasts. Infonetics is quite postive stating 2012 global capex increased almost 4% year over year in 2012. Meanwhile, Insight Research Corp says that capex spending among fixed-line operators continues to decline, with the only capex growth coming from the mobile operators in developing countries

1. Infonetics Research: Fundamental Telecom and Datacom Market Drivers

Infonetics released excerpts from its December 2012 Fundamental Telecom and Datacom Market Drivers report, which analyzes global and regional market trends and conditions affecting service providers, enterprises, subscribers, and the global economy. The firm estimates that global CAPEX was up approximately 4% (Year-over-Year) in 2012, outpacing global GDP growth of about 3.4%.

FUNDAMENTAL TELECOM AND DATACOM MARKET DRIVERS:

. Globally, mobile service revenue is the main growth engine in the overall telecom/datacom market, up 4.3% year-over-year in the first half of 2012.

. User mobility, specifically BYOD anywhere, is putting pressure on carriers to move to a single network for fixed and mobile access, internet traffic, and private/premium services.

. Data traffic growth is outstripping transport equipment costs: traffic is climbing 29% annually while equipment costs are falling 10%.

. Software-defined networks (SDNs) are here to stay, but not today: SDNs are on service providers’ minds, but it is a longer-term challenge to find implementations of hybrid SDN and non-SDN in live networks.

. The phase out of stimulus monies and pressure on government budgets is decreasing public sector spending and taking a bite out of overall enterprise growth.

. With security top of mind due to unprecedented threats and the growing BYOD trend, businesses everywhere are looking to integrate security into everything from smartphones to routers and switches, and are evaluating data center security appliances, cloud security services, and security for virtualized environments and public and private clouds.

ANALYST NOTE:

“As we’re ending 2012, Europe’s crisis remains uncontained and is now spreading to Germany. The potential of shaking business confidence everywhere in the world has risen to new heights, and the IMF lowered its growth forecast and is warning of recession risks due to downward revision of global GDP, which now stands at 3.3%. Economic readings are worrisome everywhere but the U.S., but so far the impact on global telecom and enterprise remains tame, and we’re forecasting capex to grow nearly 4% in 2012 over 2011,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Téral adds: “With the announcement of AT&T’s and Deutsche Telekom’s multi-billion dollar investment plans, next year’s capex outlay looks brighter.”

REPORT SYNOPSIS:

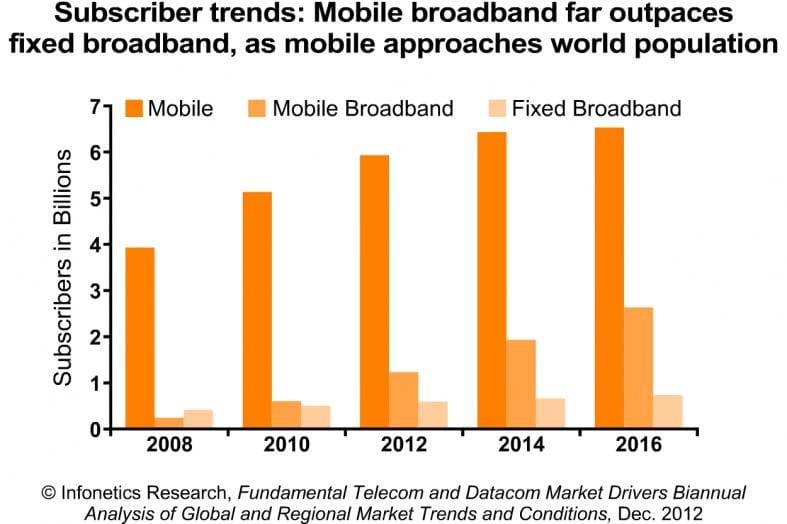

Infonetics’ market drivers report is published twice annually to provide analysis of global and regional market trends and conditions affecting service providers, enterprises, subscribers, and the global economy. The report assess the state of the telecom industry, telling the story of what’s going on now and what is expected in the near and long term, including spending trends; subscriber forecasts; macroeconomic drivers; and key economic statistics (e.g., unemployment, OECD indicators, GDP growth). The 40-page report is illustrated with charts, graphs, tables, and written analysis.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

2. The Insight Corp: Global Telecom CAPEX Hampered by Funding Problems

Capital expenditures (Capex) by telecommunications service providers globally will be very uneven, with North America, Europe and the Latin American-Caribbean regions showing little or no growth and only Asia-Pacific and Africa continuing to make investments in telecommunications hardware and software to keep up with burgeoning customer demand for new services, says a new market analysis report from The Insight Research Corporation.

“Customers in every region are pinching pennies and the demand for advanced applications is uncertain. The confluence of these trends means a further erosion of operator margins, which in turn will affect investments into infrastructures and new technologies since funding is now more difficult to obtain,” says Insight Research President Robert Rosenberg.

“The difficulty in finding funding now faced by many operators will certainly slow down, if not derail, the rolling out of investments in NGNs, WiMAX, LTE, or converged services,” Rosenberg concluded.

Insight’s report, “Telecommunications and Capital Investments: Impacts of the Financial Crisis on Worldwide Telecommunications, 2012-2017,” states that Capex is expected to increase at a compounded rate of 1.5 percent, from $207 billion in 2012 to $223.3 billion in 2017. The report notes that capex spending among fixed-line operators continues to decline, and the only growth in capex spending comes from the mobile operators in developing countries that continue increase their capital outlays to meet the pent up demand for service.

“Although demand for telecommunications services may be income inelastic and may actually grow, services will nonetheless come under pricing pressure as operators fight for more cost-focused customers and new device purchases are delayed. On the other hand, demand for advanced applications is more uncertain. This will result in further erosions of operator margins, which in turn will affect investments into infrastructures and new technologies since funding will be more difficult to obtain. It will prompt operators to search for further improvements in internal efficiencies, including infrastructure sharing and workforce reductions. Will the credit crunch derail investments in NGNs and converged services? How will OEMs fare during the economic maelstrom, where are the opportunities for operators, what are the risks, and which operators are best equipped to weather the crisis? “

AW Comment: Doesn’t sound too upbeat to me :–((

For more information on this report, please see:

http://www.insight-corp.com/reports/invest12.asp

http://www.insight-corp.com/ExecSummaries/invest12ExecSum.pdf

http://bbpmag.com/wordpress2/2012/12/global-telecom-capex-hampered-by-funding-problems/

Comment from Infonetics on the apparent differences in the 2 forecasts (apples & oranges?):

noticed that the excerpts from Insight’s forecast are about the future, whereas the excerpts from ours focus on our expectations for 2012 (final figures are not in yet so 2012 figures are still forecasts at this point).

So comparing the numbers is a little like comparing apples to oranges.

Our 5-year CAGR for capex for 2011–2016 is 2.7%. Insight’s is 1.5% for 2012–2017 (different set of years). Also, they could be counting slightly different things in their definition of capex. That’s why we can’t comment on their forecast.

If you want to use the specific growth figure we expect for 2012 over 2011, it’s 3.6% (we rounded it to “nearly 4%” in the press release). That is still slightly ahead of 2012 GDP forecasts (also just a forecast at this point until final figures are in).

When Stéphane says 2013 looks brighter, he means capex spending should be slightly better next year than this year on a worldwide basis, though he stresses in his report that things still look bleak in a lot of places, especially Europe , on a macroeconomic level. That’s why it was such big news that Deutsche Telekom committed to spending so much over the next 3 years – they’re spending despite the (difficult) economic environment.

Kimberly Peinado

Director of Marketing, Infonetics Research

Editor’s Note: This author is very appreciative of Kim’s efforts to share breaking news about Infonetics very high quality market research reports. She also sends me graphs, like the one that appears in this article Thanks a lot Kim!

References:

http://viodi.com/2012/12/25/global-telco-capex-may-surprise-on-the-upside-in-2013/