Month: December 2012

Infonetics: Ethernet Access Device market highlights; Ethernet microwave gear up 5% due to backhaul demand

Market research firm Infonetics Research latest Ethernet Access Devices report includes market size, market share, and forecasts – for both copper and fiber optic Ethernet Access Devices (EADs).

ETHERNET ACCESS DEVICES MARKET HIGHLIGHTS:

. Globally, the Ethernet access device market fell 4% in the first half of 2012 (1H12) from the second half of 2011 (2H11), despite growth in the EFM (Ethernet First Mile) bonded copper EAD segment

. Infonetics forecasts the EAD market to top $1.3 billion by 2016

. While North America, where EADs first took off, remains the largest market with 54% revenue share in 1H12, Latin America is the fastest-growing region for EADs

. ADVA took the lead in global Ethernet access device revenue share in 1H12, followed by Ciena, Overture, and

Actelis

. Actelis continues to lead the fast-growing EFM bonded copper EAD segment

EAD REPORT SYNOPSIS:

Infonetics’ biannual Ethernet access devices report provides worldwide and regional market size, vendor market share,

forecasts, analysis, and trends for copper EADs (EFM bonded copper, Ethernet over TDM bonded circuits), fiber EADs, copper EAD ports (100M), and fiber EAD ports (100M, 1G, 10G, 100G). Companies tracked include Accedian, Actelis,

Adtran, ADVA, Axerra, Canoga Perkins, Ciena, FibroLAN, IPITEK, MRV, Omnitron OMS, Overture, RAD, Tellabs, Telco Systems, Zhone, and others.

Analyst Comment:

“With so many operators moving to fiber as they upgrade building sites and mobile backhaul from TDM to Ethernet, fiber-based EADs will remain a much bigger market than copper EADs,” anticipates Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research. “That said, it is clear that a growing number of mobile backhaul

operators and transport providers are turning to EFM (Ethernet First Mile-IEEE 802.3ah standard) bonded copper technology, taking advantage of its extended reach and capacity in many applications and locations where fiber is too expensive for the return on investment. In fact, EFM bonded copper EAD sales were up while fiber and Ethernet over TDM EAD sales were down in the first half of 2012.”

“TDM-based EADs aside, the EAD market is growing nicely on an annual basis, strongly influenced by healthy Ethernet service uptake. We expect operators to spend close to $5.6 billion cumulative on EADs over the five years from 2012 to 2016.”

To buy the report, contact Infonetics Sales: http://www.infonetics.com/contact.asp

Infonetics Research released excerpts from its 3rd quarter 2012 (3Q12) Microwave Equipment market size, market share, and forecast report, which analyzes time-division multiplexing (TDM), Ethernet, and dual Ethernet/TDM microwave equipment by spectrum, capacity, form factor, and architecture.

“The microwave equipment market held steady overall in the 3rd quarter, with wildly varying results across segments,” reports Richard Webb, directing analyst for microwave, mobile offload, and mobile broadband devices at Infonetics Research. “Current trends will continue, with TDM microwave equipment declining precipitously; the large dual-mode TDM/Ethernet microwave segment waning as well but at a much slower rate; and Ethernet-only microwave equipment

surging year after year, powered by sustained mobile macrocell backhaul demand.”

Webb adds: “Among the top 3 players in the market, leader Ericsson posted a 7% revenue gain to give them nearly a quarter of the global market, their strongest standing since early 2011; Huawei, who had more than doubled their microwave revenue the previous quarter, saw a 19% decline this quarter; and NEC’s microwave revenue rose 17%, putting them within 1 market share point of Huawei. Alcatel-Lucent continue to lead the fast-growing Ethernet microwave segment.”

MICROWAVE MARKET HIGHLIGHTS:

. While flat quarter-over-quarter in 3Q12, the worldwide microwave equipment market is down 4% from the year-ago 3rd quarter, to $1.24 billion, weighed down by flagging sales of TDM and dual TDM/Ethernet microwave equipment

. Meanwhile, the Ethernet microwave equipment segment is up 5% year-over-year and is forecast by Infonetics to grow at a 38% CAGR from 2011 to 2016

. In 3Q12, backhaul equipment made up 85% of total microwave revenue

. EMEA (Europe, the Middle East and Africa) accounted for the highest regional proportion of microwave revenue, ahead of Asia Pacific, North America, and Latin America

REPORT SYNOPSIS:

Infonetics’ quarterly microwave equipment report provides worldwide and regional market size, vendor market share,

forecasts, analysis, and trends for Ethernet, TDM, and hybrid microwave equipment by spectrum, capacity, form factor, and architecture. Companies tracked include Alcatel-Lucent, Aviat Networks, Ceragon, DragonWave, ECI Telecom, Ericsson, Exalt, Huawei, NEC, Nokia Siemens Networks, ZTE, and others.

To buy the report, contact Infonetics Sales: http://www.infonetics.com/contact.asp

Small Cells will have a HUGE effect on Microwave Backhaul:

There is industry-wide agreement that “small cells” are going to be needed but a marked lack of consensus on exactly what kinds of small cells will be needed and when; how they will be deployed; and how Ethernet backhaul networks will need to be optimized and adapted to support them.

Infonetics’ Michael Howard discussed this topic at the Oct 2012 IEEE ComSocSCV meeting. He said, “When small cells are installed (likely in 2013-2014), they will be mounted on light poles and street lights in downtown metro areas. They’ll use microwave backhaul to reach a macro aggregation cell, which will most likely be located in a cell tower with fiber connectivity and backhaul to the ISP or other carrier’s point of presence.”

It appears that forthcoming small cell mobile backhaul (MBH) will mostly use microwave & mm transmission systems, while MBH for macro cells will be a mix of millimeter wave and fiber.

The entire meeting report is available at:

Infonetics study details enterprise plans for cloud services; firm sees virtualization boosting application delivery controllers

Market research firm Infonetics Research released excerpts from its new Cloud Service Strategies: North American Enterprise Survey, which explores enterprises’ plans for the adoption and usage of cloud services.

“There is no doubt, the cloud has come of age,” notes Sam Barnett, directing analyst for data center and cloud at Infonetics Research. “While investments in cloud outsourcing are small in comparison to internal IT/data center spending, they are growing each year, with the number of enterprise organizations turning to cloud technology to manage budgets and transform service delivery increasing significantly in the last two years.”

Barnett adds: “The cloud is no longer about outsourcing IT infrastructure and functions-it’s about right-sizing them.”

CLOUD SURVEY HIGHLIGHTS:

. 91% of enterprises interviewed use cloud services today, growing to 100% by the end of 2014

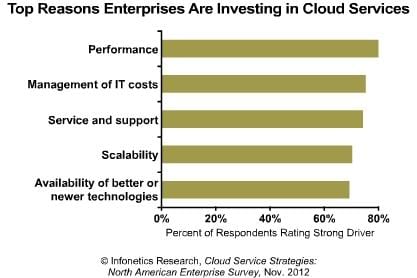

. The leading drivers for deploying cloud services are application performance and management of IT costs

. Software as a service (SaaS) is the most widely adopted cloud technology among respondent operators

. Survey respondents cite Microsoft, IBM, and Cisco as the top cloud service providers, although unexpected vendors dominate the cloud landscape in key technology deployment areas

SURVEY SYNOPSIS:

For its 25-page cloud service strategies survey, Infonetics interviewed purchase-decision makers at 107 North American enterprises about their current usage of cloud services as well as their plans for deploying cloud-based services through 2014. Survey participants were asked about cloud service delivery types (SaaS, IaaS, and PaaS), uses, deployment drivers, barriers, and vendors.

To buy the survey, contact Infonetics Sales: http://www.infonetics.com/contact.asp

For the latest in Cloud Data Center & Networking trends, please see:

Separately, Infonetics Research released preliminary results for the application delivery controller (ADC) and wide area network (WAN) optimization markets from its 3rd quarter 2012 (3Q12) Data Center Network Equipment report.

(Full report will be published December 7, 2012)

“While ADCs and WAN optimization appliances posted modest revenue gains in the 3rd quarter, the pace of growth in these segments decelerated year-over-year,” notes Sam Barnett, directing analyst for data center and cloud at Infonetics Research. “Top-line revenue growth in the ADC market is slowing due to the lower ASPs associated with virtual solutions versus their hardware-based counterparts, and saturation at the high end of the WAN optimization market is pressuring near-term growth.”

Barnett adds, “We believe this will change as more virtualized solutions enter the mainstream, helping to restore higher levels of overall growth to the WAN optimization and application delivery controllers markets.”

DATA CENTER NETWORK EQUIPMENT MARKET HIGHLIGHTS:

. Worldwide ADC revenue rose 5% in 3Q12 from 2Q12, but year-over-year (YoY) growth decelerated again and now stands at +6%, falling from +27% YoY growth in 3Q11

. F5 continues to lead the pack in ADCs, capturing nearly half of 3Q12 revenue; Citrix and Cisco round out the top 3 market share slots

. Cisco recently announced its intention to exit the ADC market, presenting an opportunity for F5 and Citrix to grow market share going forward

. WAN optimization revenue grew 3% sequentially in 3Q12, but is down 4% from the year-ago 3rd quarter

. Perennial leader Riverbed again dominated the WAN optimization segment in 3Q12, with almost 3/5 market share; Cisco remains solidly in 2nd place

REPORT SYNOPSIS:

Infonetics’ quarterly data center network equipment report provides worldwide and regional market size, vendor market share, forecasts, analysis, and trends for data center Ethernet switches (general purpose, purpose-built, and blade switches), ADCs, and WAN optimization appliances. Companies tracked include Alcatel-Lucent, Blue Coat, Brocade, Cisco, Citrix, Dell, F5, HP, IBM (BNT), Juniper, Radware, Riverbed, and others.

To buy the report, contact Infonetics Sales: http://www.infonetics.com/contact.asp