Infonetics: Global Carrier Router & Switch Market down 13% in quarter; Up only 2% YoY

Infonetics Research released vendor market share and analysis from its 1st quarter 2014 (1Q14) Service Provider Routers and Switches report.

CARRIER ROUTER AND SWITCH MARKET HIGHLIGHTS:

. The global carrier router and switch market, including IP edge and core routers and carrier Ethernet switches (CES), totaled $3.2 billion in 1Q14, down 13% from 4Q13, and up just 2% from the year-ago quarter

. Revenue for all product segments-IP edge and core routers and CES-declined by double digits sequentially in 1Q14

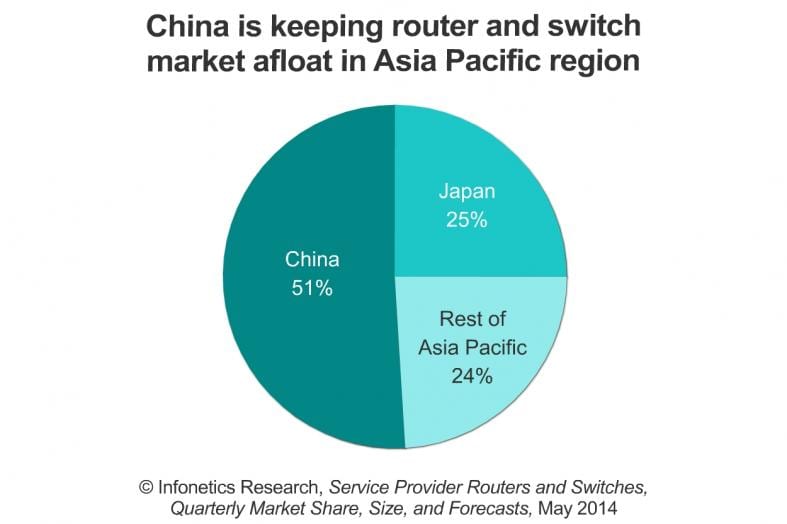

. Likewise, all major geographical regions (NA, EMEA, APAC, CALA) are also down from the prior quarter, though all but N. America are up from the same period a year ago

. The top 4 router and CES vendors stayed in dominant positions in 1Q14, but positions 2-4 played musical chairs: Cisco maintained its lead, Juniper rose to 2nd, Alcatel-Lucent rose to 3rd, and Huawei dropped to 4th

. Infonetics is projecting 5-year (2013-2018) CAGRs of 4.3% for edge routers, 2.9% for core routers, and 0.7% for CES

CARRIER ROUTER/SWITCH REPORT SYNOPSIS:

Infonetics’ quarterly service provider router and switch report provides worldwide, regional, China, and Japan market share, market size, forecasts through 2018, analysis, and trends for IP edge and core routers and carrier Ethernet switches. Vendors tracked: Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Coriant, Ericsson, Fujitsu, Hitachi, Huawei, Juniper, NEC, UTStarcom, ZTE, and others.

RELATED REPORT EXCERPTS:

. China’s huge LTE rollouts and EU network upgrades push carrier capex to $354B this year

. China Mobile increases capital intensity 6% year-over-year

. Networking ports hit $39 billion; 40G booming in the data center, 100G taking off in the core

. SDN and NFV moving from lab to field trials; Operators name top NFV use case

ANALYST NOTE:

“Last quarter, we identified the ‘SDN hesitation,’ where we believe the enormity of the coming software-defined networking and network functions virtualization (NFV) transformation is making carriers be more cautious with their spending. This hesitation reared its head in the first quarter of 2014, where global service provider router and switch revenue increased only 2% from the year-ago quarter,” notes Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research.

“We believe the current generation of high-capacity edge and core routers can be nursed along for a while as the detailed steps of the SDN-NFV transformation are defined by each service provider-and many of the largest operators in the world are involved, including AT&T, BT, Deutsche Telekom, Telefónica, NTT, China Telecom, and China Mobile,” continues Howard. “And there is intensifying focus on multiple CDNs (content delivery networks) and smart traffic management across various routes and alternative routes to make routers and optical gear cooperate more closely.”

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Editor’s Comment:

We’re not at all surprised by this lackluster growth in carrier switch/router market. We think it won’t get any better any time soon. That’s because of all the confusion caused by vendors touting their “SDN/NFV” solutions which don’t interoperate with any other like vendor. Moreover, we see carriers moving to higher speed inter-office optical interconnects with fewer high performance switch/routers and optical ports needed.

Multi-Layer Capacity Planning for IP-Optical Networks, published in the Jan 2014 IEEE Communications magazine does a good job explaining how carriers might save 40-60% of routing ports, transponders and wavelengths in the core network and up to 25% in metro/regional networks. The authors are from Cisco and two well regarded carriers -DT and Telefonica.

One of the key findings: “Applying this methodology to two real data sets provided by two large European network operators, showed significant savings in the total number of required router interfaces, transponders, and wavelengths, on the order of 40–60 percent in the core. In addition, if MLR-A is applied to the aggregation region, it should provide an additional gain up to 25 percent in metro/regional interfaces.”

If that’s the case, then fewer switch/routers will be sold to global carriers in the near future. Furthermore, prices are likely to drop precipitously due to white labeled/ODM built switch/routers that are compatible with various SDN/NFV/Open Networking schemes.