FCC Approves AT&T-Direc-TV; Imposes Conditions to Improve Broadband Competition?

After almost one year of regulatory review, AT&T closed its $49 billion acquisition of DirecTV which makes it the largest U.S. pay-TV company. As expected, the Federal Communications Commission announced on Friday that it’s approved AT&T’s merger with DirecTV, attaching conditions intended to address the potential harms of the merger. Earlier this week, the U.S. Justice Department announced that it would not challenge the acquisition.

“The conditions also ensure that the benefits of the merger will be realized,” the FCC said in a news release. Federal regulators were reviewing the deal to determine whether it would serve the public interest or stifle competition. Those regulators have said they’re more worried about providing choice in Internet access and new, online video options than they are about concentration in the declining pay TV business (go-go cord-cutters!).

–>We strongly feel it’s the latter- less choice of providers leads to less competition and ultimately higher prices!

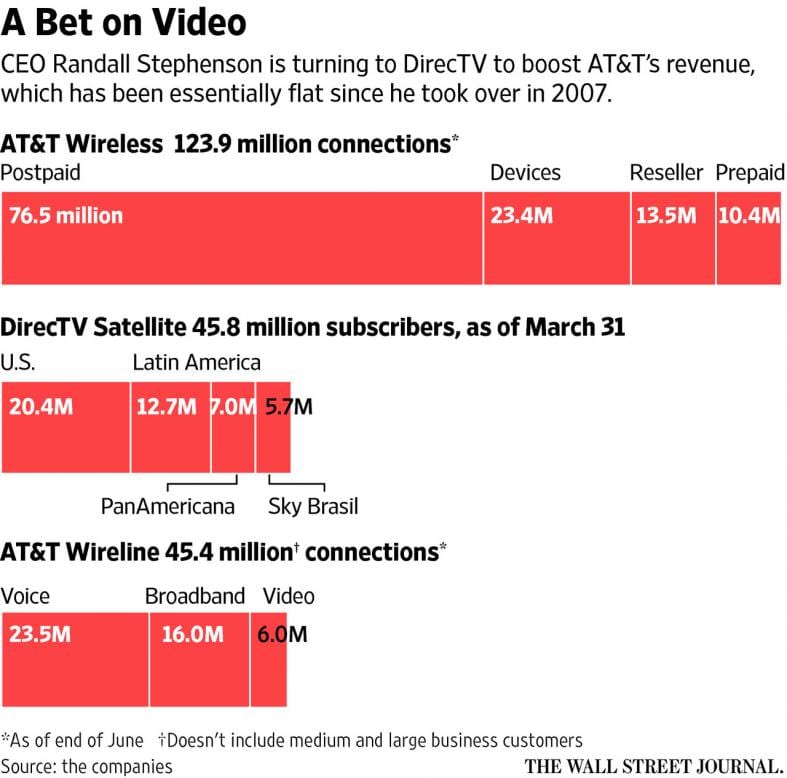

“We’re now a fundamentally different company,” AT&T Chief Executive Randall Stephenson in a press release. The company said it will serve more than 26 million U.S. customers and more than 19 million in Latin America, making it the world’s biggest pay-TV company.

[AT&T reported its earnings on Thursday. Profits dropped 14% to $3.04 billion. The company said integration related expenses from prior deals weighed on the results. Revenue edged up to $33.02 billion- an increase of only 1.4%. The number of new mainstream wireless subscribers fell by 60%. AT&T’s annual revenue growth since 2007 has averaged a miniscule 1.6%, according to data from FactSet.]

AT&T Chief Strategy Officer John Stankey will be chief executive of a new division called AT&T Entertainment & Internet Services, which includes DirecTV and the division that also includes AT&T’s broadband and video business. As the biggest pay-TV provider, AT&T could have more bargaining power with content companies.

“We are more confident than ever about the opportunity this transaction brings,” AT&T Chief Financial Officer John Stephens said on a conference call Thursday.

“We’ll now be able to meet consumers’ future entertainment preferences, whether they want traditional TV service with premier programming, their favorite content on a mobile device, or video streamed over the Internet to any screen,” Randall Stephenson, chairman and chief executive of AT&T, said in a statement.

Conditions Imposed on the 2nd “new AT&T”:

Note: the 1st “new AT&T” was when SBC acquired AT&T in 2006 and kept the AT&T name/

Approval of the deal came with a number of conditions, including some aimed at introducing more competition into the broadband Internet market, an issue emphasized by FCC commissioner Tom Wheeler in his comments earlier this week.The FCC is requiring AT&T to expand its high-speed, fiber-optic broadband Internet service to 12.5 million customer locations and eligible schools and libraries. That’s about 10 times its current size. The FCC said this addresses the concern that the merger would eliminate one choice for television service in the areas where AT&T and DirecTV previously competed. By expanding Internet service, the commission said, consumers will have more options to use services that rely on broadband to deliver video, such as Netflix, Amazon and Hulu. AT&T also will be required to offer broadband services to people with low incomes at discounted rates.

The company also will be required to submit its carrier inter-connection agreements for review by the FCC. Those agreements include “paid peering,” which allow a video streaming company like Netflix to pay a fee to a distributor, like Comcast or AT&T, for better service, when they create a lot of traffic for the network. The commission said that the condition recognized the importance of those agreements to online video service and said that it would monitor them to make sure that AT&T would not deny or impede access to its networks in anti-competitive ways.

The conditions remain in effect for four years after the merger closes. The FCC also required AT&T to retain an internal compliance officer and an independent, external compliance officer to make sure that the company abides by the deal conditions.

A serious concern about the deal is that AT&T is the only major Internet Service Provider whose customers face “data caps” for wireline broadband Internet access1. The merger could increase the incentive of AT&T to deploy such usage-based pricing to limit access to online video in favor of its own traditional television service. As a condition of the deal, regulators forbade AT&T from deploying discriminatory practices that would disadvantage online video services.

Note 1. AT&T Data Caps: “Residential AT&T High Speed Internet service includes 150 gigabytes (GB) of data each billing period, and most residential AT&T U-verse High Speed Internet service (up to 75 Mbps) includes 250GB of data each billing period.”

Public Interest Groups Weigh In:

Some public interest groups, though, were disappointed. “I thought after the Comcast-Time Warner Cable deal that maybe the commission was going to travel down a little different road in consolidation and begin to say no to some of these deals,” said Michael Copps, a former Democratic member of the FCC and a special adviser to the Common Cause public interest group.

“What they are basically saying is you have to treat everybody like you treat yourself, and so I think that is probably the most important protection against anticompetitive practices,” said Gene Kimmelman, the chief executive of Public Knowledge, a consumer advocacy group, and a former antitrust official at the Justice Department.

More Media Mergers Ahead?

The combination of AT&T, one of the country’s two largest wireless/wire-line telco and Internet Service Providers (via AT&T-Yahoo), and DirecTV, the country’s largest satellite TV provider, is the biggest media merger this year and will create the country’s largest television distributor with about 26 million subscribers, surpassing Comcast, the current leader.

“The fact that this deal closed with probably pretty reasonable conditions gives a little bit more confidence that Charter and Time Warner Cable would close, and maybe down the road opens the door for other deals,” said Amy Yong, a media analyst with Macquarie Group.