IHS-Infonetics: Optical Network Equipment Spending Trends + Huge Growth for 100G Optical Ports

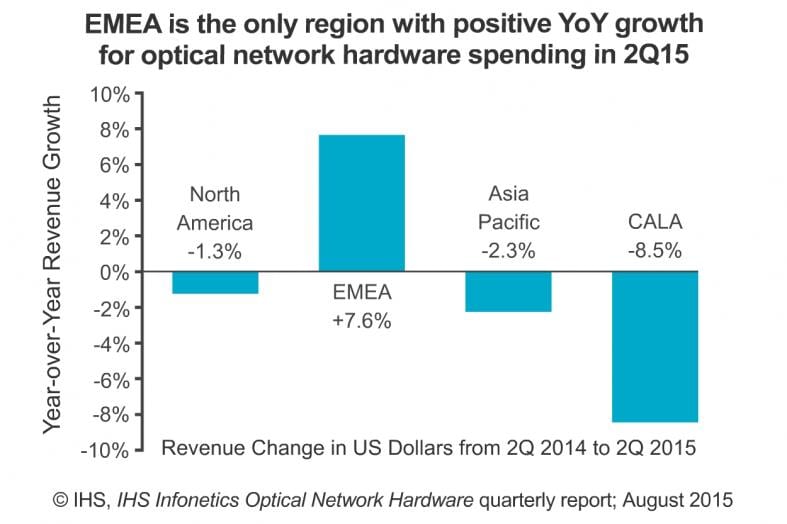

IHS-Infonetics just released vendor market share and preliminary analysis from its 2nd quarter 2015 (2Q15) IHS Infonetics Optical Network Hardware report (Full report published by August 24th). According to the report, global optical network hardware revenue (WDM and SONET/SDH) grew 22% sequentially in 2Q15, but was flat on a year-over-year basis. Europe is the only major world region that posted positive year-over-year growth in 2Q15, up 8%.

OPTICAL MARKET HIGHLIGHTS:

- On a rolling 4-quarter basis, WDM equipment spending further extended 3 years of consecutive growth

- Spending on WDM equipment grew 23 % in 2Q15 from 1Q15, and was up 6 % from 2Q14

- WDM gear comprised 86 % of total worldwide optical hardware revenue in Q2

- Spending on optical network hardware in Asia Pacific surged 36% in 2Q15 from the previous quarter, but is down 2% from one year ago

- Alcatel-Lucent announced an intention to merge with Nokia, an action IHS does not expect to have any transformative effects on ALU’s optical business or the competitive landscape

Analyst Quote:

“With three consecutive quarters of good results under its belt, Europe is signaling a reversal of the terrible optical spending that we’ve seen in the region over the last five years,” said Andrew Schmitt, research director for carrier transport networking at IHS. “This strength is concentrated in Alcatel-Lucent, Ciena and Infinera.”

“When taking into account currency effects, the results are even stronger – adjusted for exchange rate, optical spending in Europe saw a 30 % year-over-year growth rate in the second quarter when measured in euros,” Schmitt said.

OPTICAL REPORT SYNOPSIS:

The quarterly IHS Infonetics Optical Network Hardware market size, share and forecast report, led by analystAndrew Schmitt, examines the vendors, markets and trends related to metro and long haul WDM and SONET/SDH equipment used to build optical networks. The report also tracks Ethernet optical, SONET/SDH/POS and WDM ports. Vendors tracked include Adtran, Adva, Alcatel-Lucent, Ciena, Cisco, Coriant, Cyan, ECI, Fujitsu, Huawei, Infinera, NEC, Padtec, Transmode, TE Connectivity, Tyco Telecom, ZTE, others.

To purchase the report, please visit www.infonetics.com/contact.asp

RELATED RESEARCH

- Huge Growth for 100 Gigabit Optical Ports as Operators Increase Network Capacity

- Ciena, Cisco and Infinera Lead 2015 Optical Network Hardware Scorecard

- Packet-Optical Transport Deployments Slower Than Anticipated

- Europe Exiting Optical Spending Slump, Data Centers Bullish on 100G

- In Data Center Optics Market, 40G Transceivers Ubiquitous, 100G Accelerating

- In Telecom Optics Market, 100G Transceiver Growth Suppressed Until 2016

- OTN Switch Spending Up 40 Percent from a Year Ago

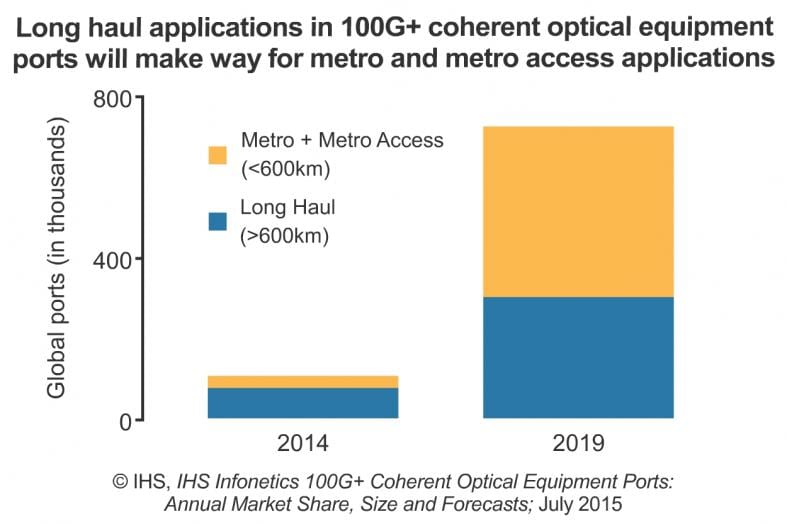

Separately, IHS-Infonetics reports that Coherent 100G port shipments for metro regional optical networks grew 145 % in 2014 from the prior year, and are anticipated to grow another 118 % in 2015.

“Adoption of 100G coherent technology has surged, first in long haul networks and now becoming a material part of metro networks. The expansion of 100G into new markets was the catalyst for our 100G+ coherent optical ports report, which provides an accurate, in-depth picture of how 100G technology is being used today and how it’ll be used in the future as the landscape grows increasingly complex,” said Andrew Schmitt, research director for carrier transport networking at IHS.

“100G is poised to explode in 2016 as new equipment built specifically for the metro reaches the market, allowing 100G technology to economically reach new portions of the network such as metro edge and metro regional,”Schmitt said.

100G+ COHERENT OPTICAL PORT MARKET HIGHLIGHTS:

- 2014 was a banner year for 100G port shipments, led by massive purchases in China from China Mobile

- Most of 100G coherent technology deployed in 2014 was for long haul applications, but metro regional (<600km) and metro access (<80km) applications will start ramping in 2016

- 100G market share is concentrated in a small circle of players: Alcatel-Lucent, Ciena, Huawei, Infineraand ZTE; the only potential catalyst for shifts will come from deployment in shorter reach metro and datacenter applications—the next growth vector for 100G

- Sometime in 2017–2018, 100G coherent will make another quantum jump, displacing 10G in the 80km or less metro-access market

100G OPTICAL REPORT SYNOPSIS:

The 20-page IHS Infonetics 100G+ Coherent Optical Equipment Ports market size, vendor market share and forecast report provides detailed granularity for 100G+ coherent and non-coherent port shipments on optical transport equipment, tracking the evolution of 100G as operators increase the flexibility and capacity of their networks. The report tracks 100G by application, including metro regional, metro access and long haul, as well as specific technology derivatives such as flex-coherent and direct-detect 100G.

To purchase the report, please visitwww.infonetics.com/contact.asp

Competing market research firm Dell’Oro Group says the optical transport network equipment market will grow at a 10% compounded annual growth rate (CAGR). Demand for metro WDM capacity will drive up the overall optical transport revenues to $15 billion by 2019 according to this Dell’Oro report.

Exposed url:

During this four-year period, service providers will continue to deploy a mix of 100G and 200G wavelengths in their networks. The research firm forecast that over 75 percent of WDM capacity will be from 100G wavelengths, while 200G will contribute nearly 25 percent of WDM metro equipment revenue by 2019.

Jimmy Yu, VP of optical transport market research at Dell’Oro Group, said in a release that the majority of metro equipment sales will come from traditional service providers, but content providers and financial trading companies will contribute to overall growth as they install their own 100G networks.

“The majority of metro equipment purchases will still be made by telecom service providers, expanding their metro network capacity for higher speed services, but we also see a strong trend towards enterprises such as Internet content providers and financial institutions procuring and installing their own high speed 100 Gbps links. This trend is being powered by the increasing importance of data centers to a company’s core business,” Yu said.

“The network still needs a lot of raw bandwidth and WDM is the best equipment to deliver that. While high demand for long haul equipment will continue, the biggest growth that we are projecting is in metro applications. The majority of metro equipment purchases will still be made by telecom service providers, expanding their metro network capacity for higher speed services, but we also see a strong trend towards enterprises such as Internet content providers and financial institutions procuring and installing their own high speed 100 Gbps links. This trend is being powered by the increasing importance of data centers to a company’s core business,” added Mr. Yu.