Worldwide Radio Access Network (RAN) hits $5B; China’s booming RAN & IoT Markets

Outlook and Analysis:

Operators worldwide are deploying Centralized (C)-RAN architectures to bring simplicity, agility, flexibility and efficiency to mobile networks. However, this is nowhere more apparent than in Asia Pacific, where China has overtaken Japan in C-RAN deployments.

In 2015, China Mobile and China Unicom finally managed to convince their government that C-RAN was the right way to go to achieve energy savings of about 60 percent and have a green footprint. The Chinese operators have aggressive 5G research and development initiatives that include C-RAN. China Mobile has deployed C-RAN in three cities and one province, which led to a rollout of 2,000 sites.

A few C-RAN deployments also happened in EMEA (Europe, Middle East, Africa) and Canada in 2015.

In 2016, IHS expects more C-RAN rollouts in China, along with a few in CALA (Caribbean and Latin America) and Europe, where operators will start to adopt C-RAN as a means to expand their existing footprints by connecting remote radio heads (RRHs) to BBUs of installed base transceiver stations (BTSs).

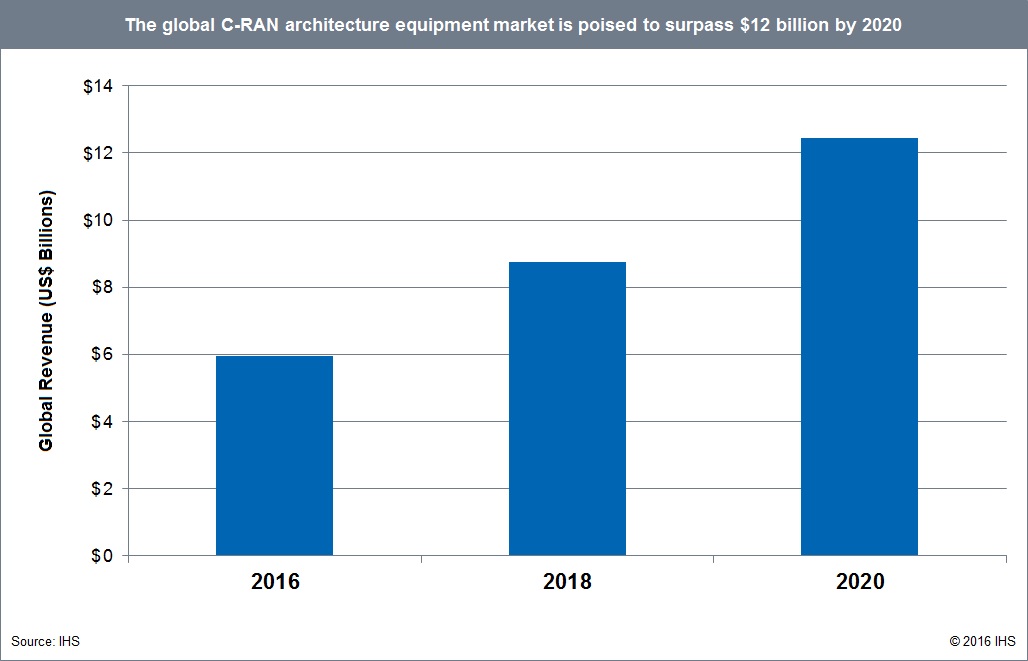

Worldwide C-RAN architecture revenue is forecast to top $12 billion in 2020—a compound annual growth rate (CAGR) of 19.8 percent from 2015 to 2020—primarily driven by RAN expansion in the West and the beginning of 5G rollouts in Japan and South Korea.

Key Points:

- Global centralized RAN (C-RAN) architecture equipment revenue reached $5 billion in 2015, a gain of 18 percent from $4.3 billion in 2014

- The market remains mainly driven by Asia Pacific—with China now in the driver’s seat thanks to China Mobile’s and China Unicom’s C-RAN deployments, followed by Japan with NTT DOCOMO’s “advanced C-RAN architecture” rollout

- The most expensive component in a C-RAN architecture, baseband units (BBUs) accounted for the bulk of C-RAN revenue in 2015

- Nokia Networks once again led the C-RAN market in 2015, and Ericsson remained in second place—but Huawei gained 4 percentage points year-over-year to move into third place, displacing Samsung

C-RAN Report Synopsis:

The IHS Technology C-RAN Architecture Equipment Annual Market Report tracks centralized RAN equipment revenue and units, covering the migration from decomposed to C-RAN architectures including baseband units (BBUs) and remote radio heads (RRHs). The report provides worldwide and regional market size, vendor market share, forecasts through 2020, analysis and trends, and includes a C-RAN Deployment Tracker that shows C-RAN announcements and major developments by region, country, service provider and strategy. Vendors tracked include Alcatel-Lucent, Eblink, Ericsson, Fujitsu, Huawei, NEC, Nokia Networks, Samsung and ZTE.

To buy the IHS report in the Americas, call +1 844 301 7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or[email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

Separately, New GSMA Report Predicts Chinese IoT Market Will Exceed One Billion Connections by 2020

Underpinned by Licensed Low Power, Wide Area Market