Month: October 2016

IHS: Data Center Network Equipment Up 11% YoY; Software-Defined Enterprise WAN a $1.3 Billion Market by 2020

By Cliff Grossner, Ph.D., senior research director, data center, cloud and SDN, IHS Markit

Bottom Line

- Data center network equipment global revenue—including data center Ethernet switches, application delivery controllers (ADCs), software-defined enterprise wide area network (SD-WAN) and WAN optimization appliances (WOAs)—totaled $3.1 billion in the second quarter of 2016 (Q2 2016), growing 11 percent from a year ago

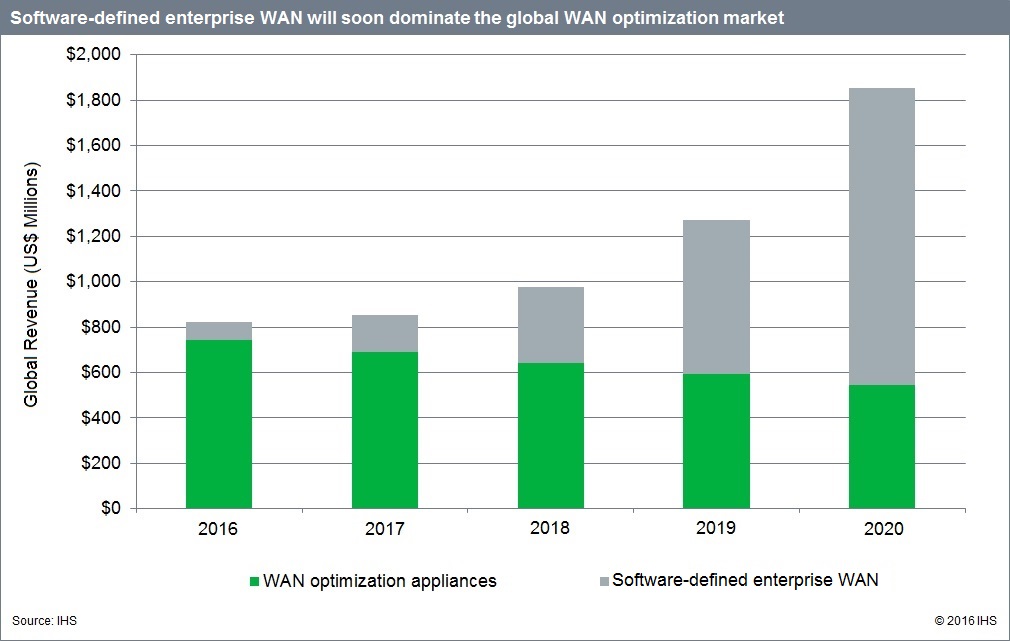

- The SD-WAN segment is forecast by IHS Markit to total $1.3 billion by 2020, pegging triple-digit growth above 90 percent per year through 2020

- Over 12,000 25 gigabit Ethernet (GE) ports shipped in Q2 2016, and triple-digit growth rates are expected out to 2020

IHS-Markit Analysis

Growth continued in the data center network equipment market in Q2 2016, although we anticipate a slowdown to 2018 followed by an increase out to 2020 as a broader transition to SD-WAN begins to take hold and data center and Ethernet switch revenue surges due to the growing adoption of 100GE.

SD-WAN going gangbusters (IHS-Markit opinion)

SD-WAN is gaining ground with service providers and is anticipated to make up 71% of WAN optimization1 revenue in 2020. Borrowing the software-defined networking (SDN) concepts of abstraction for the data plane with centralized control, SD-WAN delivers improved application performance for a fraction of the cost of traditional Multiprotocol Label Switching (MPLS) links, causing a significant shift in enterprise WAN architecture. SD-WAN control can be delivered by a cloud service provider (CSP) from an off-premises cloud, transforming the WAN optimization market in light of SDN.

Note 1. Definition: WAN optimization, also known as WAN acceleration, is the category of technologies and techniques used to maximize the efficiency of data flow across a wide area network (WAN). In an enterprise WAN, the goal of optimization is to increase the speed of access to critical applications and information.

SD-WAN vendors, too, are gaining traction. North American service providers continue to enter the market, including CenturyLink, which is using Versa Networks’ solution, and Verizon, which is partnering with Viptela and Cisco.

We look for declines in the WAN optimization appliance segment to persist as the data center market transitions to SD-WAN.

Editors Note: We believe a “software defined enterprise WAN” is an overlay network with an IP-MPLS VPN as the most common underlay network. Currently, there are no standards and hence no cross network or interoperability of network vendor equipment and/or software. Each network provider’s SD-WAN is unique to that provider and is often a single vendor solution due to the lack of interoperability standards.

FYI, here’s the ONUG white paper on SD-WANs. It’s hardly a design spec!

Cliff Grossner wrote in an email: “SD-WAN, as implemented by most of the vendors is not a replacement for MPLS. It is an overlay on top of MPLS or Broadband services. Essentially an “over the top” play. In the case of a SP offering SD-WAN, they are currently using vendor equipment such as Viptel, Versa, and VeloCloud to provide the service. Perhaps in the future with SDN/NVF vCPE use case this will change.

Many of the solutions SD-WAN solutions allow the use of many different and lower cost link types Broadband(Internet wireline and wireless) along with MPLS. This is the power for the solution allowing a cost reduction for the enterprise.”

The need for speed

1GE ports exhibited a 14% sequential decrease in Q2 2016, which is in line with the move to higher-speed ports, primarily due to increased virtual machine density on servers and improved server performance—especially now that Intel’s Grantley server silicon is shipping in volume. Grantley offers many more cores per CPU than previous generations and in aggregate will push much more data per second onto the network.

10GE, 40GE and 100GE port shipments all posted year-over-year growth in Q2, with 40GE and 100GE leading the way.

Data Center Report Synopsis

The quarterly IHS Markit data center network report provides market size, vendor market share, forecasts through 2020, analysis and trends for data center Ethernet switches, bare metal Ethernet switches, Ethernet switches sold in bundles, application delivery controllers, software-defined enterprise WAN and WAN optimization appliances.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]