IHS on Mobile Infrastructure Market: 2016 revenue -10% despite strong Q4

By Stéphane Téral, senior research director and advisor, mobile infrastructure and carrier economics, IHS Markit

Highlights

- A solid Q4 2016 was not enough to save the year for the mobile infrastructure market

- LTE (Long Term Evolution) was down by double digits in Q4 and is expected to see further declines in 2017

- Ericsson, Huawei and Nokia led mobile infrastructure market share in 2016

IHS Markit Analysis

In Q4 2016, the global macrocell mobile infrastructure market totaled $11 billion, rising 7 percent sequentially, driven by strong activity in a few Asian countries such as India, Myanmar and Vietnam. On a year-over-year basis, the market declined 14 percent, dragged down by all regions—and confirming that the market has entered the post-LTE-peak era.

LTE was somewhat the bright spot, up 6 percent quarter-over-quarter driven by E-UTRAN (evolved UMTS terrestrial radio access networks), but down 16 percent year-over-year. 2G/3G was up 10 percent sequentially, kept alive by W-CDMA (wideband code division multiple access) in Japan.

But none of this was enough to save the year for mobile infrastructure.

Looking at the full-year 2016, worldwide mobile infrastructure revenue totaled $43 billion, falling 10 percent from 2015’s $48 billion and also dragged down by all regions, with China in the driver’s seat. Revenue for the software that goes with 2G, 3G and 4G networks grew just 2 percent in 2016 from 2015, to $15.5 billion, mostly driven by LTE-A (LTE-Advanced) upgrades.

In the battle for market share, Ericsson, Huawei and Nokia nabbed the top three spots in 2016. The Chinese vendors were hit by the decline in China, a market where they are the most exposed.

As of January 30, 2017, 581 total commercial LTE networks have been launched. All indicators point to a year of LTE decline in 2017 as a result of diminishing rollouts worldwide. Moreover, we forecast the LTE market to decline at a CAGR (compound annual growth rate) of -12.4 percent from 2016 to 2021, sinking to $12 billion from its peak of $25.9 billion in 2015.

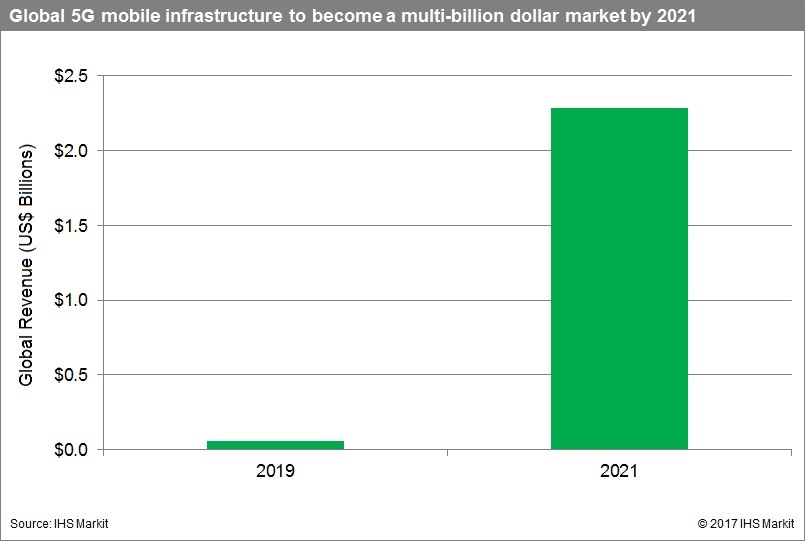

Early 5G rollouts won’t be enough to push the overall market back into growth territory, although by 2021 5G mobile infrastructure is projected to be a multibillion-dollar market worldwide.

Mobile Infrastructure Report Synopsis

The quarterly IHS Markit mobile infrastructure report tracks more than 50 categories of equipment, software and subscribers based on all existing generations of wireless network technology, including radio access networks, base transceiver stations, mobile softswitching, packet core equipment and E-UTRAN macrocells. The report provides worldwide and regional market size, vendor market share, forecasts through 2021 (including a preliminary 5G forecast), deployment trackers, in-depth analysis and trends.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or AmericasLead [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or[email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]