Cogent Communications CEO: MPLS VPNs to be replaced by VPLS & SD-WANs; Reasons to Deploy SD-WANs?

Dave Schaeffer, CEO of Cogent Communications, told investors during last week’s 2018 Citi Global TMT West Conference that there is a migration away from MPLS VPNs to Ethernet VPLS (Virtual Private LAN Service) [1] and SD-WANs.

“Cogent has focused on selling dedicated Internet access which is still the primary product (actually service) of our company. However, VPN services represent 17% of total revenues and 25% of corporate revenues. Most corporate customers supplement Internet access with a private network. The vast majority of those private networks are based on MPLS based services (e.g. MPLS VPNs), which are very difficult to install, manage, or modify. They’re also very expensive on a per transmitted bit basis.”

- VPLS, which is based on MPLS in the core network, has been a very successful offering for Cogent (see reference below). Shaeffer said that at the end of Q3-2017 an average of 12.5 customers out of 50 in a commercial building are using it (in addition to Internet access). VPLS has a huge advantage on a cost per bit basis over MPLS VPNs.

Note 1. Virtual Private LAN Service (VPLS) is a way to provide Ethernet-based multi-point to multi-point communication over IP or MPLS networks. It allows geographically dispersed sites to share an Ethernet broadcast domain by connecting sites through pseudo-wires.

- SD-WANs are very effective at low speeds. SD-WAN vendors are consolidating on IP SEC with 2**32 bit encryption (15% encryption overhead). At higher bandwidths (10M-100Mb/sec), the encryption tax has been 40% to 50% which resulted in a very low adoption of higher speed SD-WANs.

“As the equipment vendors have improved the efficiency of their processors, allowing encryption to occur in a multipath format through the processor instead of serially we’re seeing that efficiency go from like 40 or 50% to the high 80%. As that occurs, SD-WAN will become the dominant platform for location-to-location private networking and will replace MPLS,” Schaeffer added.

“The result for Cogent is an expansion in our addressable market. As we think about our corporate business in the U.S. and Canada, it is a $9 billion dedicated internet access market of which 10% of the market is on-net for Cogent and 90% is off-net.”

Schaeffer added that “out of the 90% off-net, roughly 40% of that total market is addressable through circuits we can buy from one of 90 off-net fiber providers.” However, approximately 1/2 of potential corporate customers don’t have fiber to their buildings.

“Fifty percent of corporate locations still don’t have fiber to them today and are therefore out of Cogent’s addressable market because we have made a conscious decision not to support fixed wireless, coax or twisted pair as a last mile connection due to low reliability, long provisioning times and low throughput,” Schaeffer said.

Since Cogent has decided not to use twisted pair, coax or fixed wireless for last mile access, there’s a large portion of the corporate market that it isn’t now able to address. But that might change with SD-WANs gaining popularity.

“What SD-WAN does is expands the market by allowing customers to bring their own bandwidth from locations that we are unwilling to purchase those sub optimal (non fiber based) tail circuits.”

Schaeffer said “the MPLS market is predicated on bandwidth costing 15 times as much per megabit as DIA (Dedicated Internet Access) bandwidth and that’s unsustainable. The U.S. MPLS addressable market, now worth $45 billion annually, will collapse to a $3 billion market (Schaeffer didn’t say when that would happen).” When that happens, Cogent believes their business will expand.

“We benefit two ways: our addressable market got a third bigger and we got a second reason for a customer to buy services from Cogent,” Schaeffer said. “That’s why we feel so confident about our corporate business continuing to perform even though our footprint expansion has continued to slow down.”

Author’s Note: It’s not clear how that will happen as Schaeffer didn’t say Cogent would offer SD-WANs.

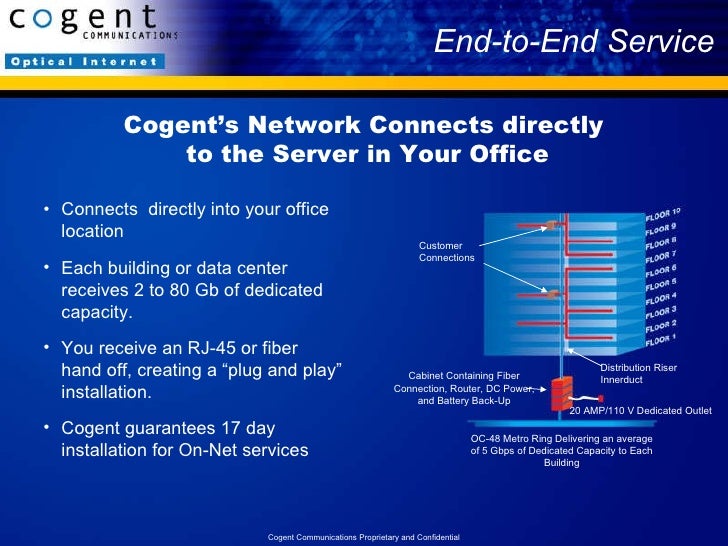

Cogent’s network stretches over 199 markets throughout 41 countries in North America, Europe and Asia, with over 57,400 route miles of long-haul fiber and more than 31,070 miles of metropolitan fiber serving over 720 metropolitan rings.

Our end-to-end optical transport network consists of IP-over-WDM fiber links running up to 1200 Gbps intercity capacity and 320 Gbps on metropolitan rings, located in Cogent’s major markets throughout North America, Europe and Asia.

On the IP layer, Cogent’s Tier 1, IPv6 and MPLS enabled network has direct IP connectivity to more than 6,075 AS (Autonomous System) networks around the world with over 162.4 Tbps internetworking capacity.

Being a facilities-based carrier, Cogent takes advantage of full end-to-end control over its transport and routing technology to provide reliable and scalable service.

………………………………………………………………………………………………..

Separately, a survey from the SIP School asked this question:

What are the main reasons for you to deploy or investigate SD WAN solutions?

Answers from survey respondents:

- Better Use of Existing Links – 158

- Cost Savings – 148

- Improved WAN Performance – 114

- Failover – 95

- Security – 87

- Intelligent Routing – 83

- Analytics & Visibility – 50

…………………………………………………………………………………………………………….

References:

https://www.fiercetelecom.com/telecom/cogent-s-ceo-multi-location-sd-wan-services-will-replace-mpls

https://www.veracast.com/webcasts/citigroup/tmt2018/69111247817.cfm?0.0889053993034