Huawei’s “All Bands Go to 5G” Strategy Explained; Partnership with China Telecom Described

Huawei unveiled its “All Bands Go to 5G” strategy for the evolution towards a 5G wireless network at its Global Mobile Broadband Forum 2018 in London last week. This strategy provides suggestions for future development of the wireless network in three key aspects: simplified site, simplified network, and automation.

Huawei Launches the Evolution Strategy for 5G-oriented Wireless Target Network

……………………………………………………………………………………………………………………………………………………………………………

I. Global commercial use of 5G networks has now entered the fast lane.

Massive wireless connectivity has become an inevitable trend. Data traffic on global mobile broadband (MBB) networks has increased rapidly. By 1st half of 2018, the data of usage (DOU) for a number of global operators has exceeded 10 GB, and that in certain Middle East regions has even reached 70 GB. Releasing data traffic helps to promote a positive MBB business cycle in the global wireless industry and ushers in a new era of traffic operation.

By October 2018, new fixed wireless access (FWA) services have been put into commercial use on about 230 networks. About 75 million families can now enjoy the benefits of FWA-based home broadband (HBB) services. In the future, the larger bandwidth capability of 5G will provide fiber-like HBB user experience and enable diverse home entertainment applications such as 4K/8K UHD video and AR/VR. At the same time, new IoT connections are becoming a new source of potential growth for operators. LTE NB-IoT is undergoing rapid development and has seen 58 commercial networks around the world, with industry applications providing millions of connections such as smart gas, water, white goods, firefighting, and electric vehicle tracking. 5G technologies will offer more reliable connection capabilities with shorter latency. Massive wireless connectivity has become an inevitable trend.

The development of the global 5G industry is accelerating in 2018. According to the 5G spectrum report published by GSA in November 2018, the UK, Spain, Latvia, Korea, and Ireland have officially released spectrum resources dedicated for 5G by August 2018. In addition, 35 countries have scheduled related plans. The 5G industry supply chain is steadily growing more and more mature.

Huawei claims to have released 5G commercial CPEs in 2018 (???), and multiple 5G smartphones will be launched in 2019. According to the report released by GSMA, 182 global operators are conducting tests on 5G technologies and 74 operators have announced plans for 5G commercial deployment. Global commercial use of 5G networks has now entered the fast lane, according to Huawei (but not this author).

5G development will enable more commercial application scenarios and promote the continuous development of a digital society. Under such circumstances, Huawei has proposed a new eMBB (enhanced Mobile Broad Band) industry vision for Cloud X featuring smart terminals, broad pipes, and cloud applications. For example, Huawei has shifted the most complex processes of rendering, real-time computing, and service content to the cloud. Thanks to transmission data streams using large bandwidth and ultra-low latency on the 5G network, as well as encoding and decoding technologies that match the cloud and terminals, applications such as Cloud AR/VR can be deployed anywhere anytime, according to the company.

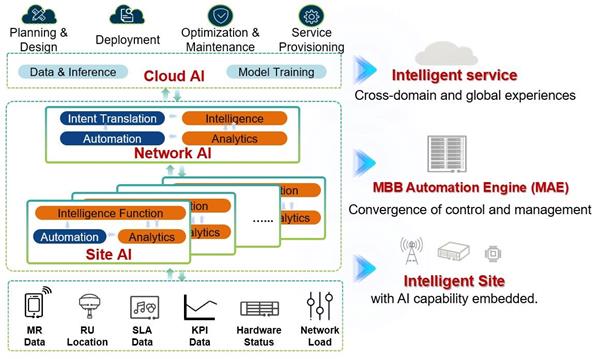

Huawei believes that AI technologies can be adopted in the communication industry. AI-based automation of network planning, deployment, optimization, and service provisioning will enable network O&M to be simplified, unleash network potential, and make networks more intelligent.

II. “LTE Evolution+5G NR” is gaining industry’s consensus for 5G wireless networks.

In the 5G era, wireless spectrum evolution is divided into two phases:

Phase 1: Sub-3 GHz spectrum resources evolve to LTE and 5G non stand alone (based on 3GPP release 15 NR) high frequency bands are introduced.

Phase 2: Sub-3 GHz spectrum resources evolve to 5G NR. “LTE Evo+NR” is realized on the target network.

Therefore, target network evolution in the 5G era can be summarized as “LTE Evolution+5G NR.” In the process of achieving this goal, the global wireless network faces the following challenges:

1. OPEX increases year by year. From 2005 to 2017, global operators’ OPEX/revenue percentage is increased from 62% to 75%. In the future, the coexistence of 2G, 3G, 4G, and 5G will increase the complexity of network O&M. In particular, site TCO is high. Site deployment still faces several issues such as difficult site acquisition, high engineering costs, and high site rentals.

2. 4G-LTE basic services fall back to 2G or 3G. Generally, insufficient 4G network coverage causes VoLTE services to fall back to 2G or 3G, deteriorating voice experience. NB-IoT/eMTC services also require better 4G network coverage. As a result, it is difficult for operators to shut down 2G and 3G networks.

–>The coexistence of four RAN technologies leads to more complex network operation and presents difficulties in reducing OPEX.

III. 5G-oriented simplified networks are built to effectively meet challenges and promote 5G business success.

Peter Zhou, CMO of Huawei Wireless Network Product Line, illustrated the evolution strategy for 5G-oriented wireless target network. This strategy aims to help operators resolve the preceding challenges and commercialize 5G. The evolution strategy includes three key aspects: simplified site, simplified network, and automation.

Simplified site enables full outdoor base stations and facilitates site acquisition, deployment, and TCO saving.

Along with the development of Moore’s Law, the 7 nm technology has enjoyed widespread commercial adoption throughout the chip manufacturing industry, and BBUs are becoming more and more integrated. In recent years, lithium battery technology has seen rapid development, and the energy density of lithium batteries is far more superior to that of lead-acid batteries. The development of new technologies makes full outdoor wireless base stations a reality. Peter Zhou pointed out, “Using componentized outdoor BBUs, blade power modules, and blade batteries, full outdoor macro base stations can be deployed on poles without shelters or cabinets. This greatly reduces the upgrade cost of existing sites, decreases the difficulty and cost of obtaining new sites, and helps operators reduce TCO by 30% and above.”

Antenna reconstruction is required for 5G deployment on the C-band. Currently, 70% urban sites cannot deploy new antennas due to insufficient antenna space. In order to resolve this problem, Huawei proposes the “1+1” antenna solution. That is, one multi-band antenna is used to support all sub-3 GHz bands, and one Massive MIMO AAU is used to support C-band NR. In total, two antennas are able to support all operator’s frequency bands. This solution greatly simplifies site space, reduces site OPEX, and realizes 5G NR deployment with insufficient antenna space.

Simplified network realizes the construction of an LTE full-service foundation network and ensures “Zero Fallback” for three basic services.

In the 5G era, the coexistence of multiple RAN technologies (2G/3G/4G/5G) results in complex networks and high O&M costs. Therefore, basic voice, IoT, and data services need to be migrated to the LTE network so that the LTE network becomes the bearer network for basic services and 2G and 3G networks enter the life cycle development phase. Huawei’s Peter Zhou emphasized that, “The LTE network needs to be built as a full-service foundation network to achieve ‘Zero Fallback’ for basic services such as voice, IoT, and data. Therefore, LTE must be planned based on the coverage of basic services rather than the traditional population coverage.”

“Simplified site, simplified network, and automation help operators reduce TCO, simplify the network architecture, reduce operation costs, and fully unleash the network potential. This lays a solid foundation for the successful commercial use of 5G networks and helps the industry to identify the goal and direction for future network evolution. Huawei also wishes to work more closely with industry partners to innovate continuously, build a 5G business ecosystem, and finally achieve a better connected digital society.”

……………………………………………………………………………………………………………………………………………….

Separately, China Telecom announced it had partnered with Huawei for investment in 5G innovation and has begun researching how to commercialize 5G technology. Both parties intend to leverage their advantages to develop the 5G service innovation base, build an industry ecosystem alliance, and research the usage scenarios and business models of 5G services. Huawei Wireless X Labs in Shenzhen, simulates 5G technologies and usage scenarios, and works with upstream and downstream industry partners to jointly develop industry standards and plans. China Telecom leverages the resources of 5G trial networks and existing industry customers to develop new 5G applications, driving the development of the entire 5G industry and improving China Telecom’s influence in the 5G field.

Application Models

Based on the first of six 5G trial network, China Telecom Shenzhen is exploring 5G application models. During the 5G Unmanned Aerial Vehicle (UAV) flight test and inspection demonstration, remote control personnel experienced VR capabilities and remote HD video transmission over a low-latency 5G network. Both the maiden test flight and inspection were completed successfully, demonstrating the ability of 5G to support UAV applications. This means that aerial photography, unattended inspection, logistics transportation, security identification, and other industrial applications will be driven by the rapid development of 5G in the telecom sector, creating a strong foundation for China Telecom to explore new vertical industries. In tests on Gbps-level experience buses, 5G provided an average speed of more than 1 Gbps and a peak rate of 3 Gbps, allowing passengers to experience mobile 4K IPTV, 16-channel HD video streams, and VR applications while traveling. This paves the way for China Telecom’s plans of 5G and IPTV convergence.

To achieve its goal of connecting 50 5G sites by the end of 2018 while constructing its transport network, China Telecom Shenzhen upgraded its existing IP RAN to deploy and verify 5G technologies, enabling the co-existence of both 4G and 5G. In addition, the operator gained valuable engineering experience and developed scenario-based solutions for subsequent 5G construction.

Addressing 5G challenges for the smooth evolution of live networks

While bringing a wide variety of services, 5G also brings challenges in terms of bandwidth, latency, connections, and the slicing of transport networks. GNodeBs, however, deliver five to ten times more bandwidth than eNodeBs. 5G services such as Internet of Vehicles (IoV) require the latency to be one-tenth of what they are with 4G. In terms of connections, the cloudification of wireless and core networks brings full-mesh connections, requiring flexible scheduling on the transport network. In addition, 5G’s differentiated services require network slicing, with a focus on isolation and the automated management of network slices on transport networks. To cope with these challenges, China Telecom Shenzhen assessed the existing IP RAN, opting to upgrade and expand core and aggregation devices and replace specific access devices for 5G transport. To quickly deploy 5G services and fully reuse the existing network, China Telecom Shenzhen implemented the smooth evolution solution for the transport network in pilot areas.

Network upgrade for co-existence of 4G and 5G

The co-deployment of eNodeB and gNodeB is the optimal choice for transport networks, and China Telecom Shenzhen verified different co-existence solutions. Access ring devices can be upgraded and expanded to satisfy the requirements of 50GE ring networking and allow 4G and 5G services to share the same access ring. When access devices need to be replaced, China Telecom Shenzhen can establish a new 5G access ring, which can share the core and aggregation layer to achieve unified service bearing.

E2E large capacity to meet HD video transmission requirements

As China Telecom continues to explore 5G services, the convergence of 5G and IPTV has become its focus. To meet the requirements of 4K IPTV video transmission using 5G, the transport network must have large bandwidth transmission capabilities. China Telecom Shenzhen upgraded the access layer from an eNodeB GE ring to a 50GE ring, and upgraded the core and aggregation layer from a 10GE network to a 100GE network, allowing high-bandwidth connections between base stations and the core network.

References:

https://techblog.comsoc.org/2018/11/06/gsma-5g-spectrum-guide-vs-wrc-2019/

11 thoughts on “Huawei’s “All Bands Go to 5G” Strategy Explained; Partnership with China Telecom Described”

Comments are closed.

New Zealand bans Huawei from 5G:

https://www.wsj.com/articles/new-zealand-bars-huawei-from-its-5g-network-over-security-fears-1543408355

UK and Germany grow wary of Huawei as US turns up pressure-Delegation from Washington warns against using Chinese supplier for 5G networks. US, Australia and New Zealand have already blocked the use of Huawei 5G equipment on national security grounds.

The UK and Germany are growing wary of allowing Huawei, the Chinese telecoms company, to install 5G equipment in their countries after a US delegation visited Europe to urge heightened vigilance against national security threats.

UK security officials on Thursday issued a new public warning to Huawei, saying the Chinese company must fix problems in the equipment it provides to British networks or risk a further deterioration in what is an increasingly strained relationship.

The clear message delivered by the US delegation this month and in online communications is that Germany and the UK as key American allies must safeguard the security of their telecoms networks and supply chains, said people familiar with the situation.

The warnings come as Germany and the UK are preparing for auctions next year for 5G, a superfast service that will enable a new generation of digital products and services. Huawei is the world’s biggest telecoms equipment supplier and has been seen as a frontrunner to build the first networks in both countries, where it has conducted extensive 5G tests.

The UK’s National Cyber Security Centre (NCSC), part of the digital intelligence agency GCHQ, said Huawei must fix problems, highlighted in July, that pose “new risks in UK telecommunications networks”.

The issues came to a head in a tense meeting between the board set up to scrutinize Huawei equipment and the Chinese company earlier this month, said government officials and telecoms executives.

“As you might imagine there are some strains in the relationship as we deal with the issues set out in the latest oversight board report,” the spokesperson said. “But we remain committed to working with the company to put it right.”

Banning Huawei outright from providing 5G equipment to UK providers or removing them from existing telecoms networks remains unlikely, officials said. But the message to the Chinese company is clear.

“They are slowing down Huawei to allow the rest of the market to catch up,” said one former intelligence official. “If I was part of oversight board or government, I would be putting the boot in right now.”

UK security officials rejected the suggestion they are hardening their stance in response to growing pressure from the US, insisting the concerns are not based on Huawei’s Chinese origins as a company but on the way the company manufactures software and equipment which makes critical telecoms networks vulnerable to cyber attack.

A spokesperson for Huawei said: “We are grateful for this feedback and committed to addressing these issues. Cyber security remains Huawei’s top priority, and we will continue to actively improve our engineering processes and risk management systems.”

New Zealand this week became the latest country to take action against Huawei, blocking one of its biggest telecoms operators from using Huawei’s 5G equipment. The US and Australia have already blocked the company on national security grounds.

In Germany, officials said the mood in government was growing increasingly wary of Huawei’s potential involvement in building the country’s 5G network. While it is too early to say if Berlin will ban the Chinese company from participating, concerns in some parts of the government, including the foreign and interior ministries, is deepening, officials said.

“The US influence on this has really intensified recently,” said one German official, who requested anonymity.

Cui Haifeng, vice-president of Huawei in west Europe, told the Financial Times in Hamburg that the company was doing everything possible to allay concerns over security. Asked if Germany was set to issue a ban, he said: “So far, I never heard about this kind of thing.”

“[For] every technology for us at Huawei we always try to put the security and safety as top priorities so all the design, products and services will be safe,” Mr Cui said.

Raffaello Pantucci, director of international securities studies at UK think-tank RUSI

“The NCSC has concerns around a range of technical issues and has set out improvements the company must make,” a government spokesperson said. “In the UK, the conversation with regard to China has definitely shifted with the hawks becoming kind of dominant,” Mr Pantucci added.

The main US concern over Huawei equipment is that the company’s ties to the Chinese government could enable snooping or interference. Huawei has strongly denied such charges.

More generally, the US is worried about the potential application of China’s National Intelligence Law, approved in 2017, which states that Chinese “organisations and citizens shall . . . support, co-operate with and collaborate in national intelligence work”. The risk, said US officials, is that this could mean that Chinese companies overseas are called upon to engage in espionage.

https://www.ft.com/content/6719b6b2-f33d-11e8-9623-d7f9881e729f (on line sub required)

Why the Huawei arrest is a huge problem for U.S.-China trade relations

https://finance.yahoo.com/news/huawei-arrest-huge-problem-u-s-china-trade-relations-134014282.html

…………………………………………………………………………….

BT to strip Huawei from core networks, limit 5G access

https://www.scmp.com/tech/gear/article/2176573/british-telecoms-giant-bt-group-strip-huawei-core-networks-limit-5g-access

What is Huawei, and why the arrest of its CFO matters, By Julia Horowitz, CNN Business

The arrest of a top Huawei executive has roiled the business world and threatens to derail the tenuous trade truce between the United States and China. Experts are warning that what happens with Weng’s case could have huge implications for the broader US-China relationship.

https://www.cnn.com/2018/12/06/tech/what-is-huawei/index.html

Financial Times reports: Huawei spat comes as China races ahead in 5G (on line subscription required)

A leaked memo, apparently written by a senior National Security Council official, revealed as far back as the start of this year exactly how worried the US is about Huawei. The rise of the Chinese company to become the world’s biggest supplier of telecoms equipment has given China a huge boost over the US in the race to introduce and develop 5G, the next generation of mobile communications, the memo complained.

“We are losing,” it said. “Whoever leads in technology and market share for 5G deployment will have a tremendous advantage towards [ . . .] commanding the heights of the information domain.”

Eleven months on, those fears have mushroomed into open conflict between Washington and Beijing, with American officials pushing allied countries to ban Huawei from building their 5G networks, citing concerns over security and the company’s unclear links to the Chinese state. The arrest and planned extradition to the US of Meng Wanzhou, Huawei’s chief financial officer and daughter to the company’s founder, has further exacerbated the spat.

Several countries have begun to trial 5G networks, though the full international standards have not yet been agreed. The shift to the new technology carries profound implications, and countries are wary of being left behind. 5G is “by no means simply a ‘faster 4G’”, the US memo said, describing it instead as “a change more like the invention of the Gutenberg Press”. It will bring higher speeds, lower lag times between network and device, and a much larger capacity to transfer data. Together, these features are expected to underpin self-driving cars, AI and machine-to-machine communications that will transform the way everything from homes to hospitals to factories operate.

References:

https://asia.nikkei.com/Business/Companies/SoftBank-to-remove-existing-Huawei-equipment-amid-security-concerns

https://www.reuters.com/article/us-usa-china-huawei-japan-idUSKBN1OC0E5

https://www.cnbc.com/2018/12/13/japans-softbank-to-replace-huawei-equipment-nikkei-reports.html

Doors are slamming shut for Huawei around the world

By Charles Riley, CNN Business Updated 5:45 PM ET, Fri December 14, 2018

https://www.cnn.com/2018/12/14/business/huawei-deutsche-telekom-orange/index.html

A deeper tech concern is at the core of the U.S.-Huawei spat, By John Pomfret

February 4, 2019 Washington Post:

Over the past few months, the U.S. government has launched an assault against Chinese telecommunications giant Huawei for three publicly acknowledged reasons: Huawei, as the Justice Department alleges, was involved in sanctions-busting with Iran. The company also allegedly stole U.S. technology and even awarded its employees bonuses to do so. And third, because Huawei is a Chinese company and Chinese law mandates that it follow the orders of its security services, anything Huawei installs in equipment used by a U.S. ally could pose a security risk to the United States.

But, in the three-dimensional chess game that is U.S.-China relations, underlying this battle is another conflict with China over technology and U.S. concerns that it is losing the fight. This battle centers on the rollout of 5G telecommunications technology that is expected to reshape not only modern economies but modern warfare, too. And so far, China appears to be ahead — very far ahead.

This matters because 5G will produce enormously faster broadband speeds — upward of 10 gigabits per second — with no lags. This web of connectivity could facilitate the introduction of highways with driverless cars, advanced automation on factory floors and a brave new world where machines effortlessly exchange oceans of data. It could also transform warfare with integrated military operations that would make today’s joint operations look like children playing in a kindergarten sandbox. Imagine squadrons of pilotless fighters, drones and smart missiles along with a coordinated cyberattack.

Tragically for the United States, China’s efforts to roll out its 5G network have lacked any of the catalyzing drama associated with the Soviet Union’s launch of Sputnik, the world’s first satellite, in 1957. According to a report last year by Deloitte, since 2015, China has outspent the United States by an estimated $24 billion in wireless communications infrastructure.

Density is key to 5G. A successful network needs more cell towers than 4G. That means more small cells on telephone polls and street lamps. According to the Deloitte report, China Tower, the world’s leader in building these relay stations, has invested $17.7 billion since 2015, beating all its U.S. rivals combined.

Nationwide, China today has 1.9 million wireless sites compared to 200,000 in the United States. For every 10 square miles, China has 5.3 sites, while the United States has a paltry 0.4. Chinese telecommunications firms are on track to begin standalone 5G service in 2020, five years ahead of their U.S. counterparts. Faced with this disparity, the Deloitte reports warns that “China and other countries may be creating a 5G tsunami, making it near impossible to catch up.”

To get ahead, China has leveraged its systemic differences with the United States. A few decades ago, American analysts scoffed at China’s continued use of communist-era “Five-Year Plans” to manage its economy. Not anymore. According to Deloitte, China’s most recent plan earmarks $400 billion for 5G-related investments, dwarfing anything similar in the United States. China’s government has forced its three big telecommunications providers to work together to build 5G, something the U.S. government could not do. China also has strong-armed leading Chinese Internet platform companies — such as Baidu, Alibaba, Tencent, JD.com and ride-sharing company Didi Chuxing — into taking a nearly $12 billion stake in one telecom provider, China Unicom, to subsidize its 5G rollout.

China has harnessed the full weight of its national government to ensure that Chinese firms are at the forefront of standards-setting negotiations worldwide. In a report released in November, the Eurasia Group consulting firm estimated that, while China was on the sidelines of the standards setting for 3G and 4G, Chinese firms could end up holding upward of 40 percent of the standard essential patents for standalone 5G.

China is not the only country ahead of the United States in 5G. Japan has far more sites per 10 square miles — 15.2 — than both China or the United States. Germany has made similar progress to China’s — with nearly 10 times more sites per 10 square miles than in the United States. But, despite some of President Trump’s claims, neither Japan nor Germany are considered threats to the United States.

At root, the issue here is trust. U.S. moves against Huawei are driven by a fear that the Chinese Communist Party not only rejects the values of a Western liberal economic system but also is at war with those values across the globe. What’s more, U.S. officials worry that the Communist Party has conscripted Huawei in this battle, both as a weapon to dominate cutting-edge technology and as an agent that can conduct espionage on the West.

Despite Huawei’s protestations that American worries about espionage are unwarranted, its executives routinely cross the line between state and private actors. Take Meng Wanzhou, Huawei’s chief financial officer, who was detained in Vancouver in December and has now been charged with bank fraud in connection with Huawei’s alleged sanctions busting in Iran. She reportedly had eight passports, one a Chinese government official passport. Wang Weijing, the Chinese employee arrested in January in Poland on espionage charges, worked for the Chinese consulate in Gdansk before joining Huawei, again blurring the distinction between Chinese officialdom and private sector.

Seen in this light, the American actions against Huawei mix both an independent law enforcement action and a high-stakes worldwide contest with a government whose core ideology is increasingly inimical to U.S. values.

So, what’s next?

Just a few years ago, pundits heralded the victory of globalization and the onset of a borderless world. Now, the Huawei case raises the prospect of a newly bifurcated globe, split into technological spheres of influence. The United States and its closest allies — Canada, Australia, New Zealand, Great Britain and Japan — are coalescing into one. China leads another. In the developed world, Germany and France are sitting on the fence. In the global south, Malaysia and Indonesia are up for grabs. And Huawei is at the center.

https://www.washingtonpost.com/opinions/2019/02/04/deeper-tech-concern-is-core-us-huawei-spat/?noredirect=on&utm_term=.8a0f7456b478

Read more:

The Post’s View: The Huawei indictment tells a story of deceit and corporate espionage

Josh Rogin: The U.S. government shouldn’t partner with Huawei

Michelle Caruso-Cabrera: The Huawei case shows how China’s ambitions are on a collision course with the U.S.

Michael Morell and David Kris: It’s not a trade war with China. It’s a tech war.

Barron’s: A U.S. Ban of Huawei Would Reshape the Telecom Market

The next salvo in the escalating battle between the U.S. and China could come through an executive order that bans U.S. telecom companies from using equipment from certain foreign companies. Any order would largely be directed at Chinese telecom giant Huawei Technologies. The ban, based on national-security concerns, could be good for Huawei’s rivals, problematic for foreign telecom operators, and worrisome for those keeping tabs on the deepening rift between the two economic superpowers.

The Trump administration is reportedly preparing an executive order for such a ban. The overall effort is aimed at keeping certain foreign-company equipment out of the next generation of wireless networks, or 5G.

Shenzhen-based Huawei, the world’s largest telecom-equipment maker, is in the crosshairs of the push. It has risen to dominance by often providing more-advanced and lower-cost gear than rivals and is now akin to Apple (AAPL), Qualcomm (QCOM), and Cisco Systems (CSCO) rolled into one. But Huawei has also long drawn scrutiny from U.S. security and intelligence officials, who have warned that its equipment could be used for spying by the Chinese. Privately held Huawei has denied the allegations, and officials have said the U.S. should offer evidence to prove its charges.

Analysts describe a ban on the use of Huawei in U.S. telecom networks as mostly symbolic, given its limited presence here; many major U.S. carriers have said they won’t use Huawei for 5G. But a ban would bolster the case the U.S. has been making to allies to blacklist Huawei from their networks—where its gear is much more prevalent.

The obvious loser from a ban is Huawei, but it would probably try to offset lost sales by intensifying its push into emerging markets, while continuing to reduce its dependence on U.S. companies, says TS Lombard China policy analyst Eleanor Olcott. Huawei didn’t respond to a request for comment about a potential ban.

European telecom operators could be among the losers if governments there ban Huawei from their respective networks. Many telecom operators in Germany and Britain use Huawei’s equipment. United Kingdom–based Vodafone Group has said it is temporarily halting purchases of Huawei gear for the core of its 5G network.

Removing and replacing Huawei gear with other, higher-priced alternatives could cost the industry billions of dollars, analysts say. Three of Germany’s telecom operators use Huawei in their networks. European telecoms have warned that cutting out Huawei could delay the 5G rollout on the Continent by at least two years.

Australia was among the first to ban Huawei, and the companies that took the biggest hit were telecom operators like Singapore Telecommunications ’ Optus and TPG Telecom (TPM.Australia), says Chris Lane, Asia-Pacific telecom analyst for Sanford Bernstein. TPG shares fell 33% from late August to the end of the year.

No one walks away a clear winner from a Huawei ban. But in the near term, Scandinavia’s Nokia (NOK) and Ericsson (ERIC) would benefit by losing their lower-cost rival in wireless-network equipment. Yet Nokia’s executives were hesitant to trumpet the prospects of market share gains in a recent conference call for fear of raising China’s ire and risking their sales in the world’s largest 5G telecom-equipment market, says Krishna Chintalapalli, a telecom analyst at Ariel Investments.

Of the two firms, Nokia has more areas where it can gain share because it also competes with Huawei in its optical and routing businesses. The diversity in its business and a more attractive valuation are among the reasons that Raymond James analyst Simon Leopold favors Nokia, citing the diversity in its business and a more attractive valuation. At a recent price of $6.36, Nokia trades at roughly 19 times earnings-per-share estimate for the next 12 months, slightly below its five-year average, while Ericsson, at $9.38, trades around 23 times, slightly above its average. Leopold has an Outperform rating on Nokia and sees 18% upside for the stock. He has a Market Perform on Ericsson. But any Huawei benefit won’t be immediate. “Any transition is like turning around an oil tanker situation. It can take multiple quarters, even more,” Leopold says.

Samsung Electronics (005930.Korea) is a smaller rival in telecom equipment but could also benefit as telecom operators try to hedge their bets and diversify their equipment suppliers. The company’s deep pockets could allow it to increase spending to fight for some of the market share and close the gap with its rivals.

Huawei also dominates optical equipment, and a backlash against the Chinese company could help its two biggest rivals in that business, Nokia and Ciena (CIEN). The impact may show up more in Ciena’s results since it is a pure play in the optical space, Leopold says.

On the router side of the business, Cisco and Juniper Networks (JNPR) could gain some share if telecom operators move away from Huawei. Carriers’ equipment is the main pipeline for data traffic and therefore most vulnerable to a cyberattack or cyberespionage. Both Juniper and Cisco have the advantage of not having much business in China, insulating them from potential retaliation. Leopold rates both companies at Overweight, with a price target of $28 for Juniper and $52 for Cisco, upside of 5% and 9%, respectively.

For some companies, the threat of retaliation is real, given China’s willingness to boycott products from specific nations. Korean cosmetic makers and tour operators experienced that treatment in late 2017 after South Korea installed a U.S.-made antimissile system.

But when it comes to technology, China may have a harder time with such boycotts. “Maybe Nokia’s market share goes down a bit, but I don’t see them kicking out Western companies completely,” Chintalapalli says.

“Their domestic market is large, but if they become a tech island nation, they can’t see what others are doing and be a fast follower. That stymies the innovation they are trying to get.”

https://www.barrons.com/articles/potential-impact-of-a-huawai-ban-51550096018

Chinese tech billionaire mocks Trump’s eagerness to expand 5G

Ren Zhengfei, the founder of Chinese telecommunications company Huawei, told CBS News that “5G is not an atomic bomb,” in reference to President Trump’s eagerness to expand the 5G infrastructure.

The giant tech company is leading the charge on China’s efforts to dominate the global 5G space and has established contracts with over 30 countries, a move that puts China on the path towards wireless broadband hegemony.

The White House has made American dominance in 5G infrastructure a critical component of its national security strategy. The expansion and transition into the 5G space will set a platform for innovation and revamped research, allowing stronger and more reliable connectivity, faster data transfer speeds, a wider bandwidth.

Ren said of the U.S., “they’ve been regarding 5G as the technology at the same level of — some other military equipment.”

5G technology is still not secure and is vulnerable to cyberattacks, something the Trump administration has repeatedly accused China of doing. Breaches into the wireless networks could jeopardize American intelligence. For that reason, the White House has deemed Huawei a threat to national security.

NOW FOR A TOTALLY UNSUBSTANTIATED CLAIM FROM A FORMER US GOVT OFFICIAL WHO APPARENTLY BLINDLY ACCEPTS THE 5G HYPE, ESPECIALLY RELATED TO PERFORMANCE WHICH CAN NOT BE MEASURED TILL THE RAN/RIT/SRITs are standardized in IMT 2020:

“It is so much faster, and it allows such a larger data flow that it significantly enhances the capabilities of an intelligence service to steal data,” former CIA acting director Michael Morell told CBS. “5G is going to allow a much larger number of devices to be connected to the Internet. When you connect more devices, you create more platforms from which an intelligence service can spy from.”

https://www.washingtonexaminer.com/news/chinese-tech-billionaire-mocks-trumps-eagerness-to-expand-5g

How China’s Huawei took the lead on 5G –Washington Post:

As U.S. officials have pressured allies not to use networking gear from Chinese technology giant Huawei over spying concerns, President Trump has urged American companies to “step up” and compete to provide the next generation of high-speed, low-lag wireless service known as 5G.

“We cannot allow any other country to outcompete the United States,” Trump said Friday at a White House event to unveil the administration’s next steps on 5G – a massive airwaves auction and a proposed $20 billion broadband infrastructure fund.

There’s just one problem: Barely any U.S. companies manufacture the technology’s most critical components.

The absence of a major U.S. alternative to foreign suppliers of 5G networking equipment underscores the growing dominance of Huawei, which has evolved into the world’s biggest supplier of telecom equipment, sparking fears within the Trump administration that a 5G network powered by Huawei’s wireless parts could endanger national security. And it throws into sharp relief the years-long retreat by U.S. firms from that market.

Carriers such as Sprint and Verizon have moved swiftly to launch 5G services for consumers. But the wireless networking gear the industry relies on still comes from foreign suppliers: four companies – Sweden’s Ericsson, Finland’s Nokia and China’s Huawei and ZTE – account for two-thirds of the global market for telecom equipment, according to analyst estimates.

Some U.S. technology giants such as Cisco sell switches and routers that reside in the innermost parts of a carrier’s network. But despite its size, Cisco doesn’t compete in the market for “radio access,” or the wireless infrastructure that allows cell sites to connect with smartphones and other mobile devices.

“There is no U.S.-based wireless access equipment provider today that builds those solutions,” said Sandra Rivera, a senior vice president at Intel who helps guide the chipmaker’s 5G strategy.

It’s this part of the Internet ecosystem that is increasingly important as more devices and appliances gain wireless connectivity and smart capabilities. 5G is expected to shape technological innovation for years to come, providing mobile data connections for virtual-reality headsets, driverless cars and more. Proponents say 5G eventually will support download speeds of 1,000 megabits per second, roughly 100 times faster than today’s 4G standard.

The rising global demand for 5G equipment highlights how the United States, a technology leader in other respects, is largely absent from the wireless networking industry. It reflects the decline of a once vibrant ecosystem of American companies that formerly went toe-to-toe with the likes of Nokia and Ericsson. And it puts a focus on Chinese firms such as Huawei, whose rise to prominence has come at the expense of Western networking titans and sparked a global campaign by U.S. officials eager to persuade allies not to allow Chinese equipment into their networks.

At the dawn of the wireless age 30 years ago, U.S. companies jostled for primacy in wireless networking. Companies such as Motorola and Lucent – an offshoot of the old AT&T monopoly – were sources of innovation, exploring new ways of delivering voice and data wirelessly. It was Lucent, for example, that helped introduce Code Division Multiple Access, or CDMA, a mobile technology that promised to improve the capacity of wireless carriers.

But their fortunes declined around the turn of the century as they failed to keep pace with a changing market. No U.S. company stepped in to fill the gap as those companies faded – partly because of the growing strength of foreign alternatives and partly because of the immense scale required to survive in that line of business, according to industry experts.

“Lucent basically collapsed because they didn’t have a big enough wireless arm to keep them afloat when the Internet backbone [business] collapsed” in the dot-com bust, said Roger Entner, a telecom analyst at Recon Analytics. “Motorola, over time, simply became less competitive because the other vendors had more economies of scale.”

Motorola and Lucent’s wireless infrastructure businesses were soon gobbled up by Finland’s Nokia and France’s Alcatel, respectively. One reason the European companies proved so successful, Entner said, was because the European industry agreed from the start to develop a common standard for wireless communication, known as GSM, that all European telecoms would share. By contrast, the industry in North America took a looser approach, with some carriers backing network technologies that weren’t mutually compatible.

Take CDMA. First developed for mobile use in the 1990s, the standard was technologically superior, allowing carriers such as Verizon to pump more traffic through their cell sites over the same amount of time compared with alternative standards. But the technology created headaches for consumers who found they couldn’t keep their phones when they switched from Verizon to a network like T-Mobile’s, which ran on GSM.

While the American approach allowed for more technological experimentation and innovation, a fragmented market based on competing standards made it more challenging for U.S. wireless equipment sellers to amass a large customer base.

Today, Nokia and Ericsson are the top providers of telecommunications networking gear in North America and are No. 2 and No. 3, respectively, in the world. The two companies each recorded revenue of about $25 billion last year.

But both have been surpassed by Huawei, which in the span of three decades has become the world’s largest provider of telecom equipment.

“I do think the Western companies did underestimate how credible Huawei was,” said Paul de Sa, a telecom industry analyst and co-founder of the advisory firm Quadra Partners. “There were executives who basically laughed [at the idea] that Huawei or ZTE could compete.”

Founded in the late 1980s by Ren Zhengfei, a former engineer for the Chinese military, Huawei began as a technology supplier for Chinese customers. But by the early 2000s, Huawei had begun selling globally, and now does a robust business not only in network equipment but also in consumer smartphones and enterprise services. Last month, the privately held company reported that it had finished 2018 with revenue of $107 billion, up 20 percent despite the U.S. campaign. Profits rose 25 percent, the company said, to $8.8 billion.

To give another perspective on Huawei’s enormous influence, the company’s chief rivals, Nokia and Ericsson, account for 17 percent and 13 percent of the global market for telecom equipment, respectively, according to figures compiled by the research firm Dell’Oro Group.

Huawei’s market share, at 28 percent, is nearly as large as both of them combined.

Despite an early reputation for cheap knockoff hardware, Huawei today is recognized for low prices, reliable equipment and engaging customer service, analysts say. As Huawei has invested in its own research and development, even Western telecom companies acknowledge that Huawei’s products are as good as – if not better than – competing equipment from Nokia or Ericsson.

“About 25 percent of our members have Huawei or ZTE” in their networks, Carri Bennet, an attorney for the Washington-based Rural Wireless Association, told lawmakers at a recent House Judiciary subcommittee hearing.

Gordon Smith, the chief executive of Sagent, a network intelligence and analytics company formerly known as Clover Telecom, estimated that Huawei gear typically costs “tens of percents” less than the competition’s.

With the support of China’s state-owned development bank, Huawei also has been able to undercut competitors with attractive financing for its products. In February alone, Huawei announced partnerships with wireless carriers in eight countries, including Iceland, Switzerland, Saudi Arabia and Turkey.

It doesn’t hurt that Huawei serves a massive domestic market in China, which grants it tremendous advantages of scale that many tech companies, including American ones, are hungry to access themselves. China is so critical to Apple, for example, that the iPhone maker blamed the country’s economic slowdown for a downward revision in Apple’s recent quarterly sales estimates – the company’s first such warning in 15 years.

Huawei’s success, however, has been clouded by allegations of intellectual property theft.

The U.S. government accused two Huawei units this year of trying to copy a robotic arm used by T-Mobile to test smartphones. (Huawei has pleaded not guilty.) In the past, Huawei has also been accused of stealing technology from Cisco; the two firms became locked in a legal dispute in 2003 and settled months later, after Huawei conceded that Cisco-made code had ended up in a Huawei product. The code was later removed.

Then there is Nortel Networks’ discovery in 2004 that hackers – traced to IP addresses in Shanghai – had stolen nearly 1,500 sensitive files from the Canadian telecom giant’s computer systems. The company’s subsequent investigation failed to prove China’s direct involvement, much less Huawei’s. But after analyzing the stolen files – which bore cryptic names such as “Photonic Crystals and Large Scale Integration,” “Eco_Strategy.ppt” and “HDX R2 Standard Reconfigurations Test Plan – Draft 0.2†³ – and a months-long probe, Nortel’s security adviser at the time, Brian Shields, became convinced Huawei benefited indirectly from the breach. The file names, a list of which Shields provided to The Washington Post, have not been previously reported.

“Nobody would be interested in these kinds of documents other than a competitor,” Shields said. “In my opinion, looking at what the hackers went after, it is likely these documents made it to Huawei.”

That seemingly ancient history is newly relevant, as U.S. officials argue that incorporating Huawei gear into U.S. carriers’ 5G networks poses a significant spying risk.

At an industry conference in Barcelona in February, U.S. officials urged allies in bilateral meetings not to use Huawei equipment over concerns that it could enable eavesdropping by authoritarian regimes. U.S. partners largely acknowledge the risk but have asked for more concrete evidence to back up the case.

“The Europeans really keep pushing for this concept of, ‘Where’s the smoking gun?’ ” said a person familiar with the discussions, who spoke on the condition of anonymity to speak more freely about the closed-door meetings. “They say, ‘Hey, we don’t want security threats, either . . . but you can’t just come in here and tell us that there is a unity of interest between Beijing and Huawei and have that be the end of your presentation.’ ”

Some analysts say that in a previous era, America’s allies might have been more sympathetic to the Trump administration’s message. But Trump’s conduct, they say – berating NATO allies, canceling a visit to a World War I memorial because of rain, calling Europe a “foe” on trade – has not helped.

“In a world where the U.S. had more soft power,” Entner said, “I’m pretty sure the Europeans would be a lot more receptive.”

[email protected]

A bruising fight is under way between the U.S. and China over 5G, which promises superfast data transmission that will underpin autonomous driving vehicles, robotic assembly lines, remote surgery and other emerging businesses.

Telecommunications operators are expected to spend hundreds of billions of dollars in the coming years to build out the networks. In China, the government and major carriers have said they plan trials of 5G in 2019 and aim to roll it out on a larger scale in 2020. In the U.S., companies are expected to test pilot network installations by the end of the year and the government is preparing to auction off broad swaths of airwaves.

The U.S. has effectively barred Huawei from domestic 5G networks and is trying to persuade allies to do likewise, saying that the Chinese company is beholden to the Communist Party and thus presents an espionage and security risk in networks that will be pervasive.

Huawei denies the allegations. The firm is the world’s largest maker of telecommunications equipment, a leader in superfast 5G technology and a top seller of smartphones globally.

Huawei has long said that it doesn’t pose a cybersecurity threat and has denied all of the legal charges against it.

Recently, its founder, the former Chinese army engineer Ren Zhengfei, has given a series of interviews defending the company while also praising President Trump, telling CNBC in an interview set to air this week that Mr. Trump is a “great president” whose tax policies are “helping revitalize enterprises.”

https://www.wsj.com/articles/china-investigates-ericsson-over-licensing-as-5g-competition-heats-up-11555332158