U.S. 5G Smartphone Sales Disappoint; Sticker Shock Pricing for 1st Wave of 5G phones

5G Smartphone Sales in U.S. are minuscule:

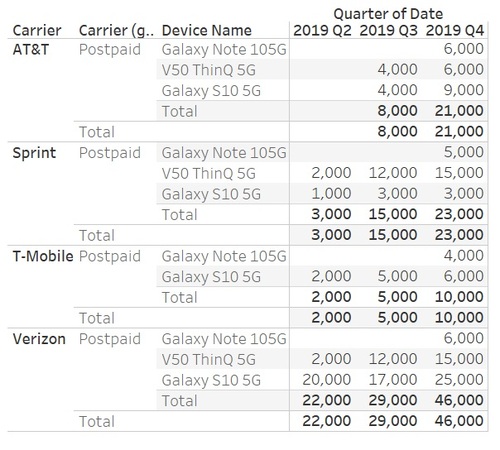

According to BayStreet Research via Lightreading, U.S. wireless network operators sold just 29,000 5G devices by the end of the second quarter. And the firm predicts that the number won’t grow much throughout 2019.

“It’s very small volume,” said Cliff Maldonado, the firm’s founder. “The value proposition [for 5G devices] isn’t clear.”

Pre-standard 5G is definitely in its infancy in the U.S. It only launched a few months ago, and it’s only available in a handful of cities on just a few phones. And those phones aren’t cheap: The Samsung Galaxy S10 5G for Verizon starts at an eye-popping $1,300, for example.

BayStreet Research says 5G phones haven’t been selling very well.

……………………………………………………………………………………………………………………………………………………………………………………………………….

Unlisted in the above chart is the 5G Moto Mod, an accessory that customers can snap on to a handful of existing Motorola smartphones that will allow them to access Verizon’s 5G network. Maldonado estimated just 1,000 to 2,000 sales of that gadget.

BayStreet obtains its figures from public and private data sources. Maldonado pointed out that the company’s third and fourth quarter figures are estimates. He also noted that the forecasts of 5G phone sales in the coming quarters don’t — and can’t — include as-yet-unannounced devices.

Many in the industry have argued that the rollout of 5G in the US could ultimately take up to ten years, considering operators will need to deploy 5G across more potentially millions more small cells, using a wide range of spectrum bands and will have to invest in technologies like mobile edge computing. For now, in the early days of 5G, most potential customers are staying on the sidelines.

Editor’s Note:

It’s extremely important to realize that a given 5G smartphone will only work on one carrier’s network, e.g. an AT&T 5G phone won’t work on Verizon’s 5G network. That’s because each pre-standard 5G wireless carrier uses different RIT specs (most are based on 3GPP Rel 15 NR NSA for the data plane with LTE signaling for the control plane and EPC for the mobile packet core) and different frequencies. So your so called 5G phone will fall back to 4G if you are not in range of your carrier’s pre-standard 5G network. That means limited mobility and certainly none when you travel to a city where your carrier doesn’t have 5G coverage.

All these pre-standard 5G deployments will be trashed and ditched when the IMT 2020 standard is completed and implemented in new standard IMT 2020 phones and base stations/small cells.

………………………………………………………………………………………………………………………………………………………………………………………..

Separately, IHS-Markit reports that the cost of the initial wave of 5G phones is dramatically exceeding expectations, with the price premium as much as 29 times higher than many consumers anticipate, according to a new IHS Markit survey examining consumer perceptions regarding the technology.

A total of 91 percent of survey respondents said they expect to pay more for 5G devices compared to existing 4G LTE smartphones. Three quarters of respondents stated they foresee paying an additional 10 to 25 percent for a 5G-capable phone. With the average sales price (ASP) of a smartphone amounting to $319 in 2019, a 10 percent hike in pricing would add $32 to the cost, while a 25 percent increase would boost it by $80.

However, the actual pricing of the first wave of 5G phones is far higher. For instance, Samsung’s S10 5G phone is retail priced at $1,300, a 335 percent premium compared to the $388 average for the company’s existing 4G smartphone models. In dollar terms, this would represent a $912 increase in price, an order of magnitude higher than consumers’ expectations.

It should be noted that this comparison is of a flagship smartphone price against an industry ASP. Naturally, newer technologies almost always come first to premium smartphones, which typically are two to three times as much as industry ASP. Also, given the nature of 5G radio design, these early 5G smartphones are configured with larger-than-typical displays and packed with extra features such as time-of-flight (ToF) cameras to enable AR applications. All of these extras do contribute to a higher-than-expected retail price from a consumer perspective.

In another example, the Huawei Mate 20 X 5G smartphone carries a retail price of $1,200, a more than 400 percent premium compared to $295 for the company’s 4G models.

This pricing discrepancy could instill sticker shock among many consumers. While such pricing premium is not likely to impact early adopters, it could slow sales of 5G devices to the wider, more mainstream consumer market.

“The 5G market is primed for massive growth, with the transition to the new technology expected to occur at a much faster pace than any previous wireless generation during the first five years of deployment,” said Joshua Builta, senior principal analyst at IHS Markit. “However, as with each new wireless generation, the first wave of phones carries sky-high costs because of the additional electronics required to support the enhanced features. With smartphone brands passing these additional costs down to consumers, many buyers will be turned off by the high prices and will wait until they come down before purchasing a 5G phone.”

Expectation of price premium for 5G smartphones:

Fast wireless technology makes slow initial progress:

Global 5G handset shipments are expected to soar to 424.5 million units in 2023. However, shipments will start rather modestly, amounting to just 9.5 million in 2019—the first year of deployment—and only 73.7 million in 2020. This represents a slower initial rate than for 4G LTE when it first deployed a decade ago, although the longer-term outlook for subscriber growth for 5G is more optimistic than for 4G.

The early 5G smartphones analyzed by IHS Markit demonstrate why their cost and pricing is so elevated. For example, some 5G phones include a highly complex radio-frequency (RF) subsystem designed to support millimeter wave capability for high-speed data transfer. Specifically, in the U.S., the Moto Z3 with 5G Mod and a version of the Samsung Galaxy S10 5G both integrate multiple separate millimeter wave antenna modules that are strategically placed throughout the device to allow clear signal reception. When considering that most smartphone designs employ just one antenna module, it’s easy to see how this redundant design drives up costs significantly.

Lower prices for a bigger market:

However, just as occurred in the 4G LTE era, 5G phone pricing is expected to decline quickly. Prices will begin to decrease next year as phone OEMs use more efficient designs employing multimode modems. Within the next few years, prices will fall to between the $700 to $800 range, making them more affordable for price-conscious consumers. Elsewhere, markets such as China will deploy a standalone (SA) 5G network which will further simplify RF front-end design requirements to further push down the industry ASP.

Consumer expectations:

Many consumers equate 5G with faster data speeds and aren’t aware of the technology’s other benefits. As a result, their low expectations for pricing premiums may not take into account all of the advantages and allures of 5G technology.

For example, improved immersive entertainment experiences like virtual reality (VR) have been cited as a key benefit of 5G. The 5G standard eventually can provide the kind of ultra-low latency that VR requires. However, fewer than 30 percent of survey respondents said they would increase their use of VR with the arrival of 5G.

As the market waits for prices to decline, brands may be able to overcome consumer reticence regarding pricing by promoting the other attributes of 5G beyond speed.

About IHS Markit Digital Orbit:

IHS Markit’s Digital Orbit report summarizes the results of a survey on how consumers perceive 5G and how they intend to use the new technology. The survey was conducted May 22-27 among 2,031 respondents, 95 percent of whom were US-based. The median age of the survey respondents was 43, and 63 percent lived in urban areas.

4 thoughts on “U.S. 5G Smartphone Sales Disappoint; Sticker Shock Pricing for 1st Wave of 5G phones”

Comments are closed.

Huawei key to 5G smartphones hitting 160M device sales in 2020 – Strategy Analytics

Global sales of 5G smartphones are forecast to hit 160 million next year, but that growth hinges in part on Huawei, and on China meeting aggressive 5G targets, according to new research from Strategy Analytics.

Sales of 5G phones in China could reach 80 million in 2020, with the country expected to be the largest 5G smartphone market, said David Kerr, SVP at Strategy Analytics, in a news release about the report.

“Significantly, China holds the key to 5G volumes in 2020. The winner in China will have huge leverage for driving down the learning curve of 5G devices,” said Ville Petteri-Ukonaho, associate director at Strategy Analytics, in a statement.

As Huawei faces uncertainty in international markets, including a current trade dispute with the United States, the tech vendor has ramped up its domestic efforts, and the research firm believes Huawei is best positioned to capture most of China’s 5G smartphone sales

“By Q2 2019 it [Huawei] had expanded its smartphone market share [in China] to almost 40%, far outpacing all other competitors,” said Kerr. “It is well positioned to leverage that dominant position to take a commanding lead in China’s 5G smartphone market in 2020 and beyond.”

The firm noted that while Samsung is the clear global 5G leader, the company only holds a 1% share of the Chinese phone market.

“If China meets its aggressive targets, Huawei could cut deeply into Samsung’s 5G leadership, positioning it for recovery and growth in Western Europe and other global markets,” added Kerr.

Still, Huawei this week faced further challenges from the U.S. government, which placed an additional 46 Huawei affiliates on the Commerce Department’s Entity List that prohibits U.S. suppliers from selling technology components to the Chinese vendor. Huawei and 70 affiliates were first placed on the trade blacklist in May.

This comes as the agency also granted another 90-day extension of its Temporary General License, to allow U.S. companies time to transition away from Huawei equipment.

In a new report from Bloomberg, the outlet said Huawei’s internal estimates show the company expects to sell 60 million fewer phones this year than it would have had U.S. burdens not been imposed.

In Europe, Huawei smartphone shipments fell by 16% to 8.5 million units in the second quarter, reducing the vendor’s market share to 18.8%, according to a recent report from market research company Canalys.

https://www.fiercewireless.com/devices/huawei-key-to-5g-smartphones-hitting-160m-2020-strategy-analytics

From Strategy Analytics press release:

Ken Hyers, Director at Strategy Analytics, said, “As China goes, so goes the 5G ambitions of chip-makers Qualcomm, MediaTek, and Unisoc, all of whom have been applauding the rapid rise in the number of 5G models licensed in recent months.”

Ville Petteri-Ukonaho, Associate Director at Strategy Analytics, added, “Significantly, China holds the key to 5G volumes in 2020. The winner in China will have huge leverage for driving down the learning curve of 5G devices.”

David Kerr, Senior Vice President at Strategy Analytics, added, “Samsung is the undisputed global 5G leader, but currently has just a 1% share of the Chinese smartphone market. China is expected to be the largest 5G smartphone market, with 5G phone sales potentially hitting 80 million in 2020. Huawei has recently accelerated and intensified its efforts in its home market to counter international uncertainty. By Q2 2019 it had expanded its smartphone marketshare there to almost 40%, far outpacing all other competitors. It is well positioned to leverage that dominant position to take a commanding lead in China’s 5G smartphone market in 2020 and beyond.”

Kerr continued, “If China meets its aggressive targets, Huawei could cut deeply into Samsung’s 5G leadership, positioning it for recovery and growth in Western Europe and other global markets.”

Strategy Analytics provides a snapshot analyses for the outlook for 5G smartphone market in this Insight report: 5G Smartphone Sales: China to Drive Rapid Growth in 2020.

https://news.strategyanalytics.com/press-release/devices/strategy-analytics-huawei-holds-key-5g-market-reaching-160-million-2020

China 5G rollout to drive first smartphone shipment rise in 4 years – IDC:

The global smartphone market is set to return to growth for the first time in 4 years in 2020 on the back of China’s huge investment in 5G technology, according to the latest report from IDC. Worldwide shipments are expected to grow 1.5 percent year on year in 2020 to just over 1.4 billion following falls of 0.3 percent in 2017, 4.3 percent in 2018 and an expected 1.4 percent this year. The 2020 figure is set to include 190 million 5G smartphones, accounting for 14 percent of the total, driven by recent developments in the China market along with anticipation of aggressive activity from the smartphone supply chain and OEMs, said IDC.

The report expressed the hope that 5G smartphone prices will quickly come down quickly to boost the growth of this market segment. “Following three straight years of declining smartphone volumes there leaves little room for 5G to raise smartphone ASPs,” said IDC, adding that Android vendors are expected to drive down the cost of 5G smartphones starting with a host of first quarter announcements at both CES and MWC. Apple is expected to enter the 5G smartphone market in September 2020, with the real focus around pricing and market availability.

In contrast to the expected rapid 5G growth in China, demand in other markets such as Australia, Japan, and Korea in Asia/Pacific as well as some European countries is set to be slower than predicted, added IDC. The report said shipments so far in the second half of 2019 have come in much lower than expected, with accelerated 5G adoption globally depending on factors such as the arrival of 5G networks, operator support, as well as substantial price reductions.

https://www.telecompaper.com/news/china-5g-rollout-to-drive-first-smartphone-shipment-rise-in-4-years-idc–1317726

Chris Penrose, AT&T’s senior vice president of Advanced Mobility and Entertainment Solutions, told CNET on Wednesday at CES that the company plans to have 15 5G phones this year.

Most of the phones will be capable of taking advantage of AT&T’s low-band 5G spectrum as well as its higher-frequency millimeter wave. Additional devices like laptops, tablets and hotspots will also be available, but no exact number of products were given.

The low-band 850Mhz network, which AT&T calls simply “5G,” went live in December and is currently active in 19 markets. Penrose says that the company plans to expand this network to cover 200 million people “by the summer.”

As with T-Mobile’s similar low-band network, speeds on 5G are comparable to 4G LTE (which AT&T has confusingly branded as 5GE) though it covers wider areas and can reach inside buildings.

The millimeter-wave network, which AT&T calls “5G Plus,” has been live since late 2018 and most recently expanded to parts of 35 cities, but has thus far limited access only to developers. As with Verizon’s millimeter-wave network, 5G Plus offers significantly faster speeds than low-band 5G, but its coverage is often severely limited to a handful of outdoor locations in the cities where it’s live.

Penrose equates AT&T’s 5G strategy to a chocolate chip cookie, with the cookie representing the larger low-band 5G footprint and the chips equating to the assortment of millimeter-wave cities “sprinkled in across the country.”

New phones, Penrose says, will enable consumers to have access to the “entire cookie” and tap into AT&T’s full 5G network.

While it is unclear when the next batch of 5G phones will arrive, rumors point to Samsung’s next Galaxy S line being among the first phones to support both flavors of 5G. Samsung announced Saturday that it will be hosting an Unpacked event, the method it traditionally uses to launch major new mobile products, on Feb. 11 in San Francisco.

Ronan Dunne, head of the Verizon Consumer Group, told CNET on Tuesday that his company plans to have 20 5G devices in 2020 with some being priced under $600 later this year.

Penrose would not go into specifics on pricing for AT&T’s 5G devices but did say that the company will be “competitive in the marketplace.”

https://www.cnet.com/news/at-t-will-have-15-5g-phones-in-2020-cover-200-million-people-by-summer/