Highlights:

- Samsung continued its growth thanks to strong sales of the Galaxy Note 10 and Galaxy A series. The improved product-mix helped it post better profits.

- Huawei grew a healthy 28.5% YoY globally. It captured a record 40% market share in China. It rebounded in Europe after the decline mid-year caused by the US trade ban. As it continues its aggressive push, there’s an increased need for careful inventory management in China and Europe in Q4 2019.

- Apple iPhone shipments were down 4% YoY. However, initial uptake for the iPhone 11 series was robust. In the US, pre-orders and the first week of sales, saw more demand for the iPhone 11 Pro Max and iPhone 11 Pro, but the standard iPhone 11 rose quickly into the best-seller’s list.

- Apple’s price corrections in China and elsewhere with iPhone 11 and iPhone XR stimulated demand during the last week of September.

- Realme was the fastest-growing brand for the second successive quarter, capturing 7th place globally. Strong performances in India and Indonesia drove its growth.

Counterpoint believes the key OEMs with the largest installed bases, especially in developed regions, will rely on 5G as a key point of differentiation and will encourage their users to upgrade. Already, 5G rollouts have been faster than 4G was in its first few months, with 15 commercially available 5G devices and many more lined-up for launch in the last few months of 2019. Nevertheless, 5G smartphones only accounted for 2% of shipments in Q3 2019 and will contribute relatively little to the overall market for the full year 2019. But, 2020 will likely be a breakout year for 5G smartphone adoption,rekindling smartphone demand.

Note: This author completely disagrees with that last conclusion. We don’t think 5G smartphone adoption will achieve any real market traction till late 2021-early 2022.

Analyst Contacts:

Neil Shah | Peter Richardson

SOURCE Counterpoint Research

…………………………………………………………………………………….

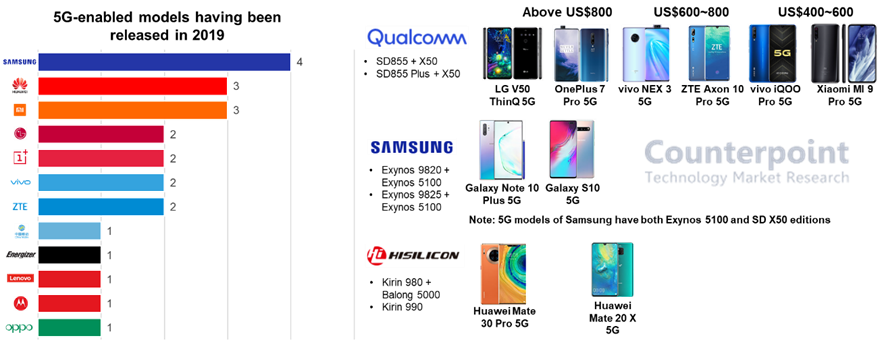

Looking at the current scenario, Xiaomi, famous for its commitment to affordability, launched the cheapest 5G model in China at the end of September. The new flagship of Xiaomi’s number series, MI 9 Pro 5G, has a starting price of roughly US$520.

Exhibit 1: 5G enabled new models in 2019

According to the analysis of the 5G cost structure, we expect an addition of US$50 to implement the sub-6Ghz only by using a standalone 5G modem.

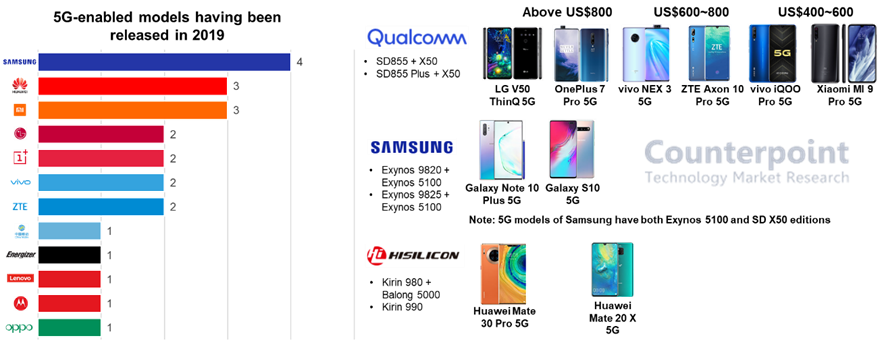

However, costs can be reduced through the integration of a modem with the SoC (System on a Chip). Huawei’s Kirin 990 and Samsung’s Exynos 980 had taken a step ahead in this direction, and Qualcomm is expected to launch its first 5G SoC in the Snapdragon 700 family by the end of 2019. Besides, both Qualcomm, MediaTek plans to mass-produce respective 5G flagship platform SDM865, MTK6885, in Q1 2020.

Exhibit 2: 5G platform timeline in 2019 & 2020

Given the fragmented frequency allocation, we expect smartphone brands targeting North America and parts of European markets will customize designs with an external 5G model for mmWave, even though, most 5G models will resort to a 5G SoC for a cheaper sub-6Ghz only solution.

Given the fragmented frequency allocation, we expect smartphone brands targeting North America and parts of European markets will customize designs with an external 5G model for mmWave, even though, most 5G models will resort to a 5G SoC for a cheaper sub-6Ghz only solution.

To sum up, we believe that 5G smartphones will be available in the mid-end price bands over the course of 2020. As a result, cheaper solutions for a next-generation offering will unlock consumer demand for upgrades of their smartphones.

…………………………………………………………………………………………….

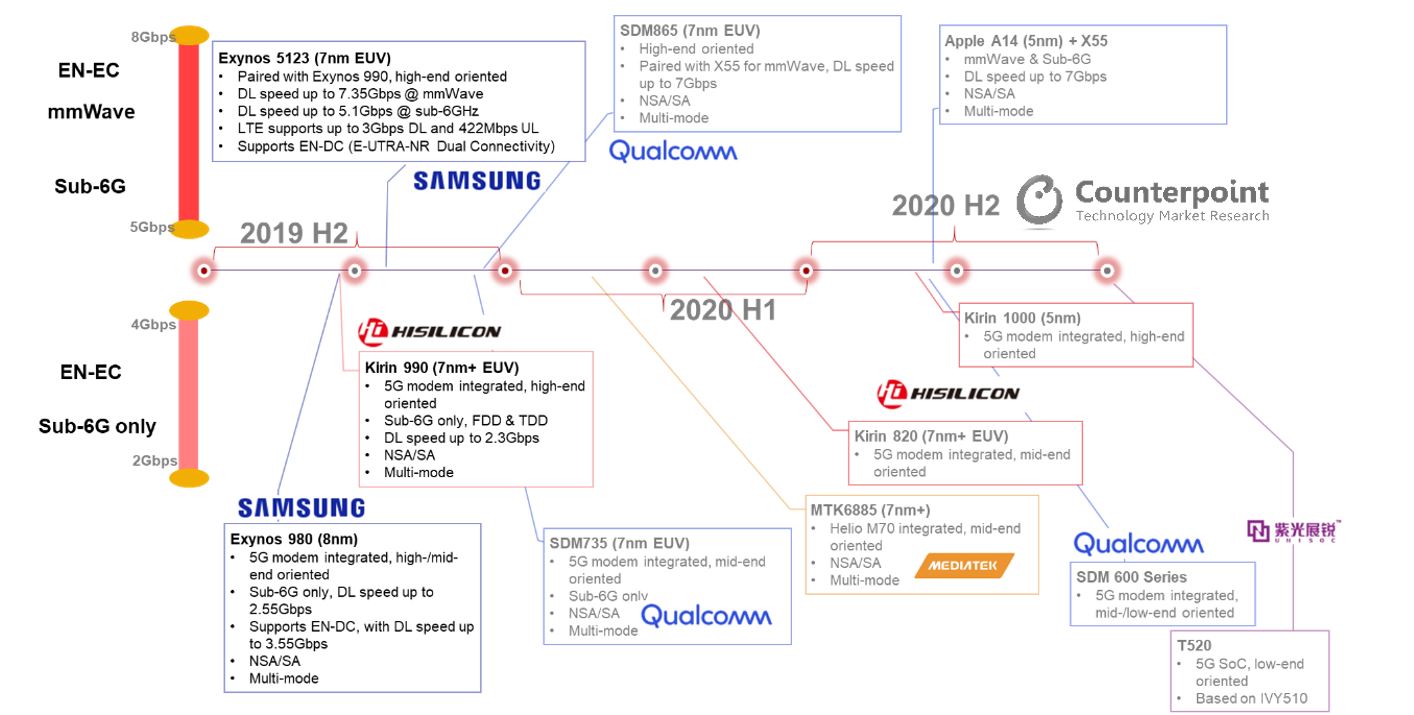

The global smartphone market remained almost flat during Q3 2019, reaching 380 million units in shipments, as compared to 379.8 million units in Q3 2018. In terms of brands, Huawei, Realme, and Samsung registered positive growth, increasing their market share globally. Stronger demand in India and China in September, helped the global smartphone market to halt the seven-month streak of year-on-year (YoY) declines.

Commenting on the smartphone market recovery, Shobhit Srivastava, Research Analyst at Counterpoint Research, noted, “The global smartphone market ended a long period of continuous YoY declines in Q3 2019 due to increased shipments in India and China, the two top-focus markets for every player in the mobile value chain. In India, smartphone OEMs started preparing early for the festive Diwali season this year with healthy channel buildups. In China, Huawei, OPPO & vivo (HOV) continued to see healthy channel demand ahead of National Day Golden Week holiday break in October which led the market to grow a positive 6% sequentially. This along with upcoming holiday season in the next quarter, should drive up the overall smartphone demand into a positive growth territory for the second half of this year compared to the last year.”

Exhibit: Smartphone Shipment Market Share 2019 Q3

Source: Counterpoint Research: Quarterly Market Monitor 2019 Q3

Note: The shipment numbers for all brands exclude certified refurbished devices.

Huawei continued to defy the market decline with a 4% increase in market share globally.

Commenting on Huawei’s continued growth Tarun Pathak, Associate Director at Counterpoint Research, said, “The US trade ban on Huawei did not affect the overall brand’s shipments and growth in Q3 2019 after the uncertainties in June. Huawei’s strategy to supplement its decline in overseas market share with domestic push paid off handsomely. The rising sense of nationalism towards Huawei amidst US-China trade war coupled with aggressive go-to-market strategy in China helped Huawei boost mindshare and marketshare domestically. Outside China, the widening gap being created in overseas markets such as Europe, Latin America & Middle East due to the lack of shipping new models with Google services gives a window of opportunity especially Samsung, Xiaomi and others to capture share away.

Huawei, though will have to be careful of the inventory levels in domestic market as the market could quickly transition to the upcoming 5G wave which could affect its market share in coming quarters.”

Commenting on the 5G progress, Peter Richardson, Research Director at Counterpoint Research, highlighted, “The 5G rollouts from both networks and devices over the past twelve months have been faster than the 4G era, and we expect the rollouts to further accelerate going into 2020. 5G smartphones already accounted for 2% of the market in Q3 2019, growing over 200% sequentially. China has already commenced rolling out the 5G networks and the massive market scale it brings for the entire industry will make 2020 the breakout year for 5G, This should catalyze the slowing smartphone volume demand over the past couple of years and certainly continue to boost the upward trend in the overall smartphone Average-Selling-Price (ASP).”

Key Takeaways:

- The top three brands, Samsung, Huawei and Apple, together cornered almost half of the smartphone market, with the rest of the market left for hundreds of other brands to compete fiercely.

- Samsung continued its growth at 8.4% YoY, capturing over one-fifth of the global smartphone market. This is due to strong Note 10 and Galaxy A series sales. The company also posted an increased profit with an improved product mix. The company will continue to launch new A series smartphones, including some models with 5G, to try and maintain momentum. Huawei’s loss in overseas market would be a big opportunity for Samsung in coming quarters.

- Huawei grew a very healthy 28.5% YoY globally. It captured a record 40% market share in the Chinese smartphone market. As it continues its aggressive push in the market, it will have to keep a check on inventory levels in China and Europe in Q4 2019.

- Apple iPhone shipments were down 4%, and as a result revenues fell 11% YoY. The positive response for the latest iPhone 11 series during the tail end of the quarter is a silver lining for Apple going into the holiday season quarter. In US pre-orders and the first week of sales saw early adopters buying more of the iPhone Pro Max and iPhone Pro but the iPhone 11 rose quickly then on into the top seller’s list. Apple’s price corrections in China and elsewhere with the iPhone 11 and XR, as well as introducing a new palette of colors, stimulated demand during the last week of September offsetting the sharp annual decline earlier months.

- Realme remained the fastest-growing brand for the second time. It also climbed up the ladder in global rankings since its last appearance. This is one of the fastest ramp-ups of companies to-date. Strong performances in India and expansions overseas drove its growth. This was also the fourth consecutive quarter that Realme was within the top 5 brands in India.

- BBK Group (OPPO, Vivo, Realme, and OnePlus) is close to becoming the largest smartphone manufacturer group globally, accounting for over 20% of the global smartphone market and three of its brands in the top 10.

- The market consolidated further with the top 10 brands’ market share increasing to 83% from 78% a year ago.

Global Smartphone Shipments Reached 380 Million Units, Showing Signs of Market Recovery

Given the fragmented frequency allocation, we expect smartphone brands targeting North America and parts of European markets will customize designs with an external 5G model for mmWave, even though, most 5G models will resort to a 5G SoC for a cheaper sub-6Ghz only solution.

Given the fragmented frequency allocation, we expect smartphone brands targeting North America and parts of European markets will customize designs with an external 5G model for mmWave, even though, most 5G models will resort to a 5G SoC for a cheaper sub-6Ghz only solution.

China 5G rollout to drive first smartphone shipment rise in 4 years – IDC:

The global smartphone market is set to return to growth for the first time in 4 years in 2020 on the back of China’s huge investment in 5G technology, according to the latest report from IDC. Worldwide shipments are expected to grow 1.5 percent year on year in 2020 to just over 1.4 billion following falls of 0.3 percent in 2017, 4.3 percent in 2018 and an expected 1.4 percent this year. The 2020 figure is set to include 190 million 5G smartphones, accounting for 14 percent of the total, driven by recent developments in the China market along with anticipation of aggressive activity from the smartphone supply chain and OEMs, said IDC.

The report expressed the hope that 5G smartphone prices will quickly come down quickly to boost the growth of this market segment. “Following three straight years of declining smartphone volumes there leaves little room for 5G to raise smartphone ASPs,” said IDC, adding that Android vendors are expected to drive down the cost of 5G smartphones starting with a host of first quarter announcements at both CES and MWC. Apple is expected to enter the 5G smartphone market in September 2020, with the real focus around pricing and market availability.

In contrast to the expected rapid 5G growth in China, demand in other markets such as Australia, Japan, and Korea in Asia/Pacific as well as some European countries is set to be slower than predicted, added IDC. The report said shipments so far in the second half of 2019 have come in much lower than expected, with accelerated 5G adoption globally depending on factors such as the arrival of 5G networks, operator support, as well as substantial price reductions.

https://www.telecompaper.com/news/china-5g-rollout-to-drive-first-smartphone-shipment-rise-in-4-years-idc–1317726

I need to to thank you for this fantastic read on the smartphone market! I certainly loved every bit of it. I have you bookmarked to look at new IEEE Techblog posts…