Investment Analysts: Soft Telecom Capital Spending (CAPEX), but 5G in China to Grow 25% in 2020

Investor’s Business Daily reports that Goldman Sachs‘ Rod Hall and Bank of America‘s Tal Liani issued separate notes Tuesday and Wednesday which came to the same conclusion: Despite the ultra hyped 5G buildup, they see overall telecom capital spending remaining soft in 2020.

Hall said, “Telco capital spending trends look set to be muted with China being the only driver of growth,” in his note, issued Tuesday. He sees 5G growth in China of 25% this year, but predicts only a 2% hike in global telecom capital spending.

Hall added: “The carrier environment is challenged globally by flat or declining revenue streams with 5G thus far offering limited or no additional revenue opportunities.”

BofA’s Liani concurred in his Wednesday note. He sees global telecom capital spending up only 1% to 2% in 2020, despite 5G network build-outs. The 5G build-out may fail to impress U.S. wireless customers over the next 12 months, he adds. “Contrary to the belief that the U.S. is an early leader with 5G, we see potential for users to be disappointed with either lack of coverage or lack of improvement, or both,” Liani said. Here is an excerpt of his January 8, 2020 note to clients:

5G becomes mainstream, but the U.S. will likely lag:

5G traction remains front and center for 2020, and we expect the first phase of a major smartphone refresh cycle in 2H20, with all major vendors launching 5G devices. In 2019, we saw initial network build-outs, and we expect the device/semiconductor ecosystem to catch up in 2020, supporting and enabling ubiquitous 5G devices. However, some regions may lag behind, particularly the US where a lack of quality 5G spectrum injects delays vs. certain parts of Europe, China, Korea and Japan where mid-band spectrum is more readily available. Our top pick related to this theme is Qualcomm as the semi provider benefits from 5G devices and the China launch.

Verizon Communications and AT&T likely will lower spending on existing fourth-generation networks, says Goldman Sachs’ Hall. They’ll also pare back spending on wireline networks. “Although U.S. 5G deployments should advance in 2020 our U.S. telecom team expects wireless capex to be roughly flat in 2020 as 5G increases are mostly offset by slowing non-5G spending,” Hall said.

Makers of electronic chips, network gear and fiber-optic technologies should gain from the 5G build-out, analysts say. Other5G stocks to watch will be tied to the deployment of “small cell” antennas, radio access network equipment as well as cloud computing infrastructure. Goldman Sachs favors fiber-optic play Corning. It’s cautious on gear makers Nokia and Ericsson.

Liani said Apple’s expected launch of 5G iPhones in late 2020 could be a game-changer. However, he says consumers may be disappointed in the 5G network coverage and 5G speeds provided by Verizon, AT&T, T-Mobile US and Sprint. That’s because not enough mid-band radio spectrum is available yet for 5G services, Liani said.

He calls Qualcomm one of the best 5G stocks to buy because it’s dependent on smartphone sales, not core network upgrades. Qualcomm‘s customers include Apple and Chinese smartphone makers.

In 2020, we see potential for mass device availability to usher in the first meaningful device upgrade cycle for 5G,” Liani added. “In 2021 and 2022, we expect the network equipment investments to potentially pick up once again as 5G usage accelerates and new applications emerge. Most importantly, however, spectrum availability drives both network upgrades and likely customer satisfaction with the new 5G networks.

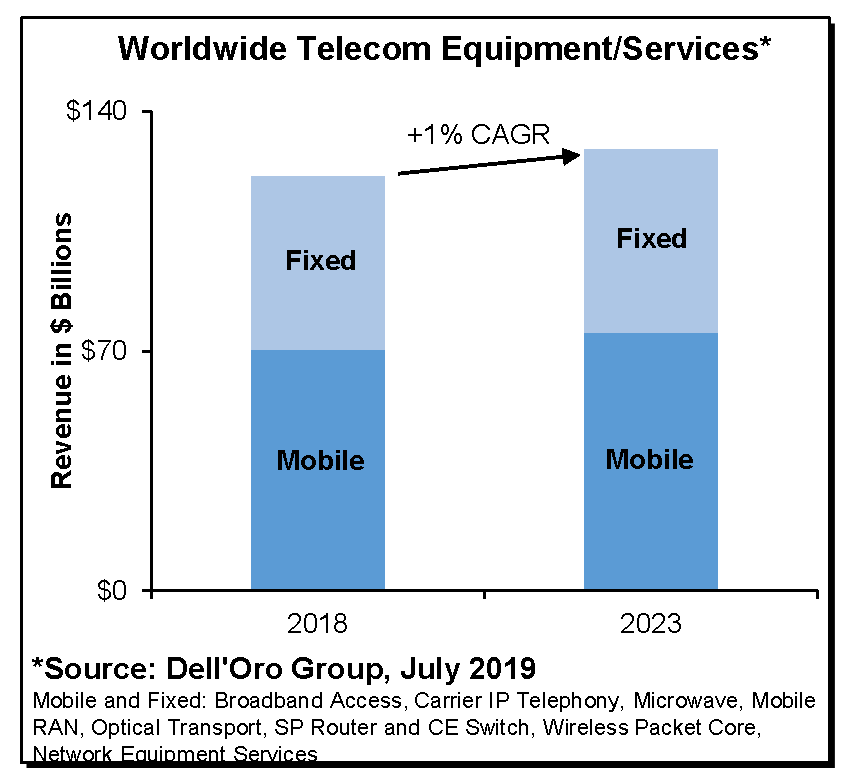

Let’s close with an interesting graph from Dell’Oro Group which shows very little growth in telecom equipment/services through 2023:

Reference:

https://www.investors.com/news/technology/5g-stocks-telecom-capital-spending/

……………………………………………………………………………………………………………………………………………………………………………..

Addendum: BoAML – Hardware vendors bow to the white box:

Hardware standardization and white box networking continue and drive changes in IT equipment purchasing behavior. Hardware vendors are increasingly being forced to react to three major realities:

1) public cloud capex represents the majority of growth and some companies (e.g. Cisco) find it hard to penetrate,

2) software is taking the forefront, with vendors of traditional networking gear, like ADC, switching, or routing, facing significant pricing pressure and a new breed of competitors, and

3) the value is also pushed to semiconductors, with Cisco’s SiliconOne semiconductor strategy and the proposed acquisition of Acacia designed to address the associated risk and opportunity

Lastly, the trends of software-defined networking, white boxes, and cloud migration come together to support our fifth major trend for 2020: the shift to software-defined branch/campus offices. In our view, this trend began with SD-WAN, continued with Cisco’s Catalyst 9k introduction, and comes fully together with the acceleration of WiFi 6.

One thought on “Investment Analysts: Soft Telecom Capital Spending (CAPEX), but 5G in China to Grow 25% in 2020”

Comments are closed.

March 15, 2020:

Beijing has put 26,000 5G base stations into operation, with 5G users reaching about 800,000, according to the Beijing Municipal Communications Administration.

Beijing municipal government rolled out policies in the past year to support the telecom industry by slashing the expenses in carrying out 5G infrastructure construction, said the administration in a statement.

According to a report compiled by the China Academy of Information and Communications Technology, the 5G commercialization in China is expected to generate a direct gross output of 10.6 trillion yuan (about 1.51 trillion U.S. dollars) from 2020 to 2025, plus an indirect gross output of about 24.8 trillion yuan.

Given the complexity of the current epidemic control and the economic development, it is an important and pressing task to expedite the development of 5G technology, said Chen Zhaoxiong, vice minister of Industry and Information Technology, recently.

http://www.xinhuanet.com/english/2020-03/15/c_138880135.htm