CB Insights: The Metaverse Explained & Companies Making it Happen

The metaverse could be tech’s next trillion-dollar opportunity, according to Mark Zuckerberg of Facebook/Meta Platforms. The business world is obsessed with “the metaverse”: the concept of shared worlds driven by virtual products and digital experiences that are highly immersive and interactive.

We already have virtual worlds featuring live concerts and online games where players spend hundreds of hours — but metaverse enthusiasts see a future where entire societies thrive in an online realm inhabited by avatars of real people.

While the space is still in early days, the longer-term implications may not be trivial. Some users — especially younger ones — may eventually earn, spend, and invest most of their money in digital worlds. The metaverse could represent a $1T market by the end of the decade, according to CB Insights’ Industry Analyst Consensus.

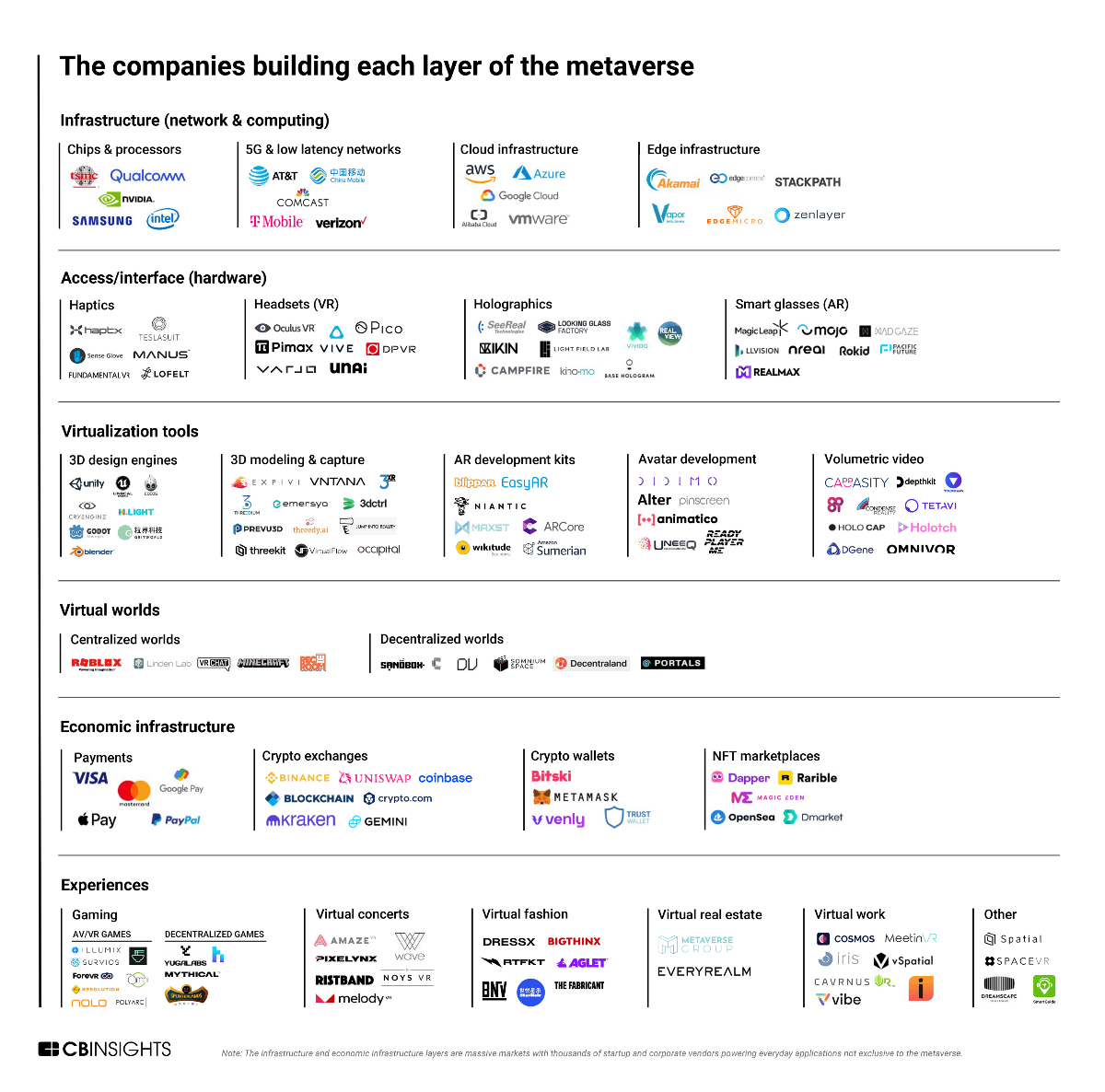

The metaverse is a vision, not a specific technology. For enterprises, this ambiguity can make it challenging to figure out how to tap into the emerging trends the metaverse represents. Below are the companies making it a reality:

The metaverse requires compute and processing infrastructure that can support both big data flows and low latency. Tech emerging within categories such as chips & processors, 5G, cloud infrastructure, and edge infrastructure, will prove vital to creating a seamless, lag-free experience in the metaverse.

Chips & processors: Advancements in this space will support the intense computing and processing requirements of metaverse applications.

New metaverse-focused hardware — e.g., virtual reality (VR) headsets and augmented reality (AR) glasses — is being designed to support intense workloads related to high-fidelity graphics and artificial intelligence (AI) on smaller, lightweight devices. Qualcomm chips stand out in this arena — the tech giant claims its Snapdragon chips have been used in over 50 AR/VR devices, including popular VR headsets like Meta’s Oculus and HTC Vive. Qualcomm also recently announced the launch of its $100M Snapdragon Metaverse Fund, which will invest in the extended reality (XR) space.

Additionally, Intel claims that the metaverse will necessitate a 1000x increase in computational efficiency, including advancements in 5G and hybrid edge-cloud infrastructures. That said, new chips will also be required to power these critical low latency computing networks. In February 2022, the semiconductor company released details on new chips that will support high-power data centers and 5G networks.

5G & low latency networks: 5G wireless tech will power high-resolution metaverse applications — such as immersive worlds or gaming — by supporting reliable, flexible, and low latency networks for connected devices.

As of 2022, each of the leading telecom companies in the US offers a 5G network. Some are experimenting with 5G in gaming and AR/VR. For example, in April 2021, Verizon partnered with VR startup Dreamscape Immersive to build immersive learning and training applications on Verizon’s 5G network. Three months later, AT&T partnered with Meta’s Reality Labs to show how 5G could be utilized to generate more seamless augmented reality experiences.

Cloud infrastructure: Cloud infrastructure will enable metaverse companies, especially those hosting virtual worlds and experiences, to store and parse through the vast amounts of data they generate.

In 2018, Epic Games‘ Fortnite generated 5 petabytes of data per month (that’s equivalent to 2.5T pages of standard text). In order to store and make sense of this data, Fortnite runs almost entirely on Amazon Web Services (AWS), where it uses cloud computing to aggregate and analyze information from its otherwise unwieldy data stream.

Advancements in this space will also help people access the metaverse on devices that lack sufficient processing power for applications like high-res graphics and AI — cloud computing allows experiences to be processed on a remote server and then streamed to a device, such as a PC, VR headset, or phone. While this back-and-forth communication with an external server can lag, related developments in edge computing and 5G will help to reduce latency.

Edge infrastructure: Edge computing will be used for metaverse applications that depend on real-time responses, such as AR/VR and gaming.

Edge computing enables data from low-power devices to be processed closer to where it is created — i.e., at “the edge.” This can be particularly helpful when it comes to situations that require information to be processed in real time — such as utilizing hand-tracking sensors on a VR headset or processing commands during competitive gaming. In fact, edge infrastructure companies like Stackpath and Zenlayer list gaming and virtual reality among their main focus areas.

Edge processing is heavily interrelated with cloud computing. While cloud infrastructure handles workloads that do not require minimal latency, such as loading out-of-sight objects in a game, edge infrastructure handles inputs that need a very quick response, like player movements. Some companies develop blended offerings. For example, Akamai offers edge-cloud hybrid services to a number of high-profile gaming companies, including Roblox and unicorn Riot Games.

Access/interface (hardware)

This layer includes hardware devices that allow people to experience the metaverse. While this category encompasses connected devices like mobile phones, PCs, and gaming consoles, it is predominantly centered around emerging technologies designed to enhance immersion in a virtual setting.

Haptics: Haptic startups are developing technology to bring the sense of touch into virtual worlds.

Some startups, such as HaptX and Sense Glove, are developing gloves that grant virtual objects tangibility. Bridging micro-vibrations, pneumatic systems for force resistance, and motion tracking, this technology can give the impression that digital objects have texture, stiffness, and weight.

In the future, haptic technology may extend well beyond a person’s hands. Scotland-based Teslasuit is developing complete bodysuits to provide whole-body haptic feedback and climate control in virtual environments.

Headsets (VR): These companies are developing VR goggles — currently considered the main entry point to metaverse applications. These devices provide visual and audio content to users to immerse them in a digital setting.

One of the most popular VR headsets is Meta’s Oculus, which saw a surge in consumer interest during the 2021 holiday season.

Startups have followed suit. Varjo, for example, uses lidar and computer vision to bring depth perception, eye-tracking, and hand-tracking to its VR headsets.

Holographics: These companies use light diffraction technology to project 3D objects into physical spaces. These holograms, like augmented reality, bring digital experiences into the physical world.

While holographic technology is still in its early stages, it has the potential to be applied to a wide range of use cases, from hologram-led set design and performances to product design and medicine. Base Hologram is using the tech to bring popular artists like Whitney Houston and Buddy Holly back to the stage, while Israel-based RealView Imaging renders holograms of a patient’s internal organs to help with surgical planning.

The technology has a long way to go before it sees widespread success, but companies currently working in the space have given us an idea of what to expect down the road.

Smart glasses (AR): Companies here are developing glasses or contact lenses with AR capabilities.

While not all applications of AR glasses are directly related to the metaverse — for example, AR tools designed exclusively to help engineers fix refrigerators do not revolve around shared experiences — the companies featured in this category are setting the foundation for a bridge between physical and virtual worlds.

As AR gains popularity, particularly for social purposes, the tech will evolve into a tool that more effectively blends virtual and real-world elements — such as interacting with someone’s metaverse avatar at an event — further blurring the line between consumers’ online and offline identities.

Currently, China-based Nreal is developing AR glasses equipped with web browsing and video streaming capabilities for the everyday consumer. Others, like Magic Leap, are developing AR headsets for enterprise use cases.

One thought on “CB Insights: The Metaverse Explained & Companies Making it Happen”

Comments are closed.

The Metaverse Is Quickly Turning Into the Meh-taverse- Disney and Microsoft both closed projects tied to the digital realm this month

The metaverse was a hot thing in tech less than two years ago, but is now facing a harsher reality. Slow user adoption, driven in part by expensive hardware requirements and glitchy tech, and deteriorating economic conditions have put a damper on expectations the metaverse will drive meaningful revenue soon. Recently:

-Walt Disney Co. has shut down the division that was developing its metaverse strategies,

-Microsoft Corp. recently shut down a social virtual-reality platform it acquired in 2017.

-Meta Platforms Inc. (formerly Facebook) is focused more on artificial intelligence, CEO Mark Zuckerberg said on an earnings call last month.

Meanwhile, the price for virtual real estate in some online worlds, where users can hang out as avatars, has cratered. The median sale price for land in Decentraland has declined almost 90% from a year ago, according to WeMeta, a site that tracks land sales in the metaverse.

“What many people are coming to realize is that this transformation is farther away,” said Matthew Ball, a venture capitalist and author of a book about the metaverse.

Tech companies have been slashing jobs and abandoning projects deemed nonessential. Mr. Zuckerberg, who championed the metaverse as the next iteration of the mobile internet a mere 18 months ago, dubbed 2023 “the year of efficiency.” His company laid off 11,000 employees in the fall and said this month that it would cut a further 10,000 positions and various projects, including some that are based in its metaverse division, the Journal previously reported.

“A lot of companies and businesses understandably feel like if they need to reduce head count or spending overall, this kind of category would seem to be a pretty easy target,” said Scott Kessler, a tech-sector analyst at research firm Third Bridge Group. Investments in artificial intelligence promise returns in the nearer term, he added.

“All these things that are going on, related to AI, seem to be able to be used and leveraged now,” he said. With the metaverse, “no one knows when you’re going to reach critical mass.”

Even at the height of the metaverse craze, some tech executives were less enamored with online realms. “I want to try and work on technologies that bring people’s heads up—get them to enjoy the real world,” David Limp, senior vice president of devices and services at Amazon.com Inc., said at The Wall Street Journal’s Future of Everything Festival last year.

Meta has spent billions of dollars trying to build out the metaverse since changing its name. But its flagship app, Horizon Worlds, struggled to gain and retain users within the first year after the renaming, according to internal documents viewed by the Journal. Sales of its Quest 2 virtual-reality headsets, which are used to access Horizon Worlds and other virtual-reality apps, were also down in the most recent quarter, the company said.

Mr. Zuckerberg isn’t walking away from the metaverse, signaling that it remains a long-term focus for the company after AI. “The two major technological waves driving our road map are AI today and, over the longer term, the metaverse,” he said last month.

On that call, “AI” was mentioned 28 times. The word “metaverse” was mentioned on seven occasions. Meta didn’t respond to a request for comment.

The pivot at Disney comes amid its recent leadership change and restructuring. Chief Executive Robert Iger returned to the company in November and has started slashing costs. The company last month said it plans to cut 7,000 jobs and reduce costs by $5.5 billion.

Microsoft also bet big on the idea of online digital realms, though struggled with implementing that vision. In addition to shutting down AltSpaceVR, the company’s work on augmented-reality headsets was plagued by problems, the Journal reported last year. The company has since restructured the HoloLens team and trimmed its budget, the Journal has reported. Microsoft said it “remains committed to the metaverse” with both hardware and software tools.

Smaller companies such as Decentraland and the Sandbox where users have been able to buy virtual land and build their own worlds have seen some of the most success so far. But even so, land sales are down. The median price per square meter in Decentraland has dropped from about $45 a year ago to $5, according to data from WeMeta, the firm that tracks the sales.

A spokesperson for the Decentraland Foundation, which oversees the platform, said land sales aren’t indicative of user growth. A spokesperson for the Sandbox said all of the new land they have put up for sale over the past six months has sold out.

Despite a broad reduction in metaverse engagement, the online realms can still draw eyeballs. Decentraland, which saw a 25% decline in active users from November to January, is seeing an uptick this week from Metaverse Fashion Week, an event where brands such as Dolce & Gabbana and Tommy Hilfiger are participating, according to DCL Metrics, a site that tracks users in the digital realm.

“It is obvious that hype around the metaverse has receded. But we should not mistake this for a lack of progress,” said Mr. Ball, the venture capitalist who is bullish on the metaverse. “Change isn’t that fast.”

https://www.wsj.com/articles/the-metaverse-is-quickly-turning-into-the-meh-taverse-1a8dc3d0