Juniper Research: 5G connectivity opportunity for the connected car market

The number of connected vehicles globally is set to grow from 192 million this year to more than 367 million in 2027, with 5G connectivity set to play a key role in the development of the market, according to a new report from Juniper Research. The company’s new Connected Vehicles research report provides an independent analysis of the future evolution of this fast-paced market and advanced connectivity solutions within the automotive industry. It provides a comprehensive study of the increase in constant connectivity technology features in cars being adopted by automotive original equipment manufacturers, how the rise of 5G is impacting the connected cars market expansion, and the key role mobile network operators have in driving the market forward in order to offer advanced connectivity and an enhanced driving experience.

The analyst firm believes the growth will be driven by improvements in both advanced driver assistance systems (ADAS), the attraction of enhanced in-vehicle infotainment systems, and the transformative potential of 5G’s high-speed and low-latency capabilities. However, maximizing 5G’s potential impact will require “effective collaborations between automotive OEMs and [mobile network] operators,” according to the authors of the report, who believe the 5G connectivity opportunity presented to telcos by the connected vehicle sector will be worth US$3.6bn in 2027.

According to the co-author of the research, Nick Maynard, “5G can allow automotive OEMs [original equipment manufacturers] to upgrade the in-vehicle experience. In a vehicle market transitioning to electric vehicles, improving the user experience is key. Operators hold the critical role in enabling this in a reliable way, making them the partners of choice as their 5G networks rapidly expand.” Connected vehicles utilising 5G will be able to exchange information “between the various elements of the transport system and third-party services.”

| Key Market Statistics | |

| Market size in 2023: | 192 million vehicles in service |

| Market size in 2027: | 367 million vehicles in service |

| 2023 – 2027 Market Growth: | 91% |

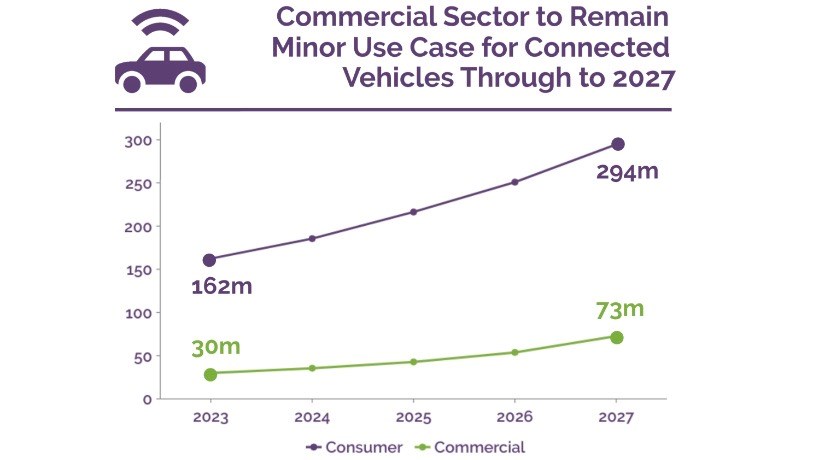

The report is upbeat overall, but notes that commercial use cases are proving more difficult to find and justify than those for ordinary automobile drivers. According to the Juniper Research team, by 2027 commercial vehicles will account for no more than 20% of connected vehicles worldwide, only a slight increase from the 16% that commercial vehicles will account for this year.

The research shows that such slow uptake is because commercial vehicle design is not yet fully exploiting the potential of connectivity beyond simple emergency call features and basic connected infotainment systems. The report recommends that automotive OEMs prioritize integrations with common fleet tracking systems out of the factory to maximise the benefits of connectivity, and to enable commercial fleet owners to maximize efficiency in their processes.

All types of connected vehicle technologies are still ‘works in progress,’ according to Juniper Research.

Various types of connected vehicle technologies are being pursued and improved. Vehicle-to-infrastructure (V2I) connectivity is used mainly to ensure vehicle safety as the vehicle communicates with road infrastructure and shares and receives information, such as traffic flows, road and weather conditions, speed limits, accident reports, and so on. Meanwhile, vehicle-to-vehicle (V2V) connectivity primarily permits the real-time exchange of information between vehicles.

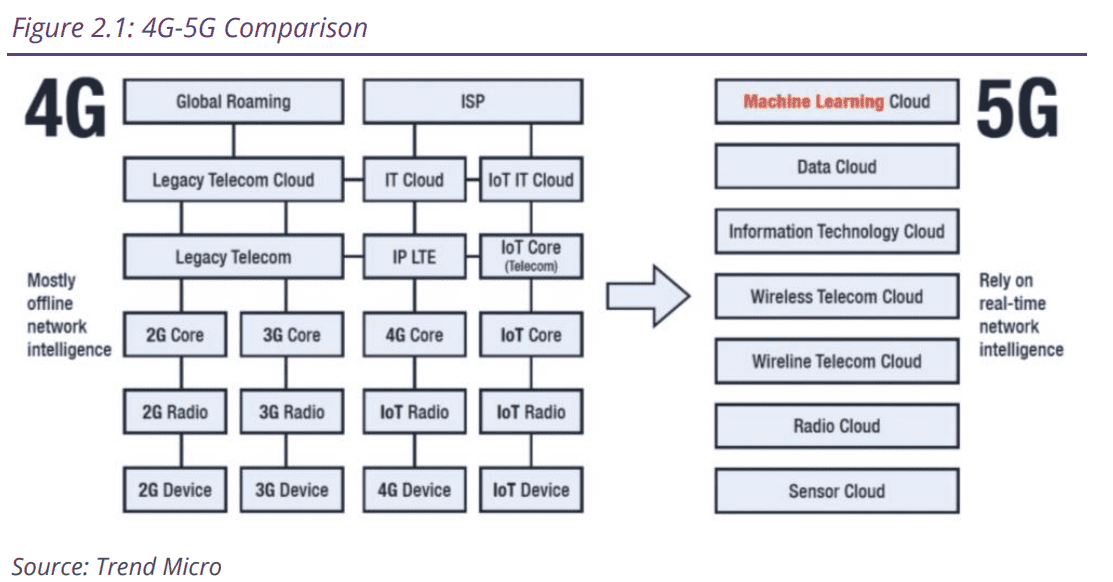

Vehicle-to-cloud (V2C) connectivity is enabled via 4G/LTE networks and is mainly used for downloading over-the-air (OTA) vehicle updates, remote vehicle diagnostics or to connect with internet of things (IoT) devices. Vehicle-to-pedestrian (V2P) connectivity is a newer safety technology that uses sensors to detect pedestrians and other ‘obstacles’ and provides collision warning and avoidance guidance. Lastly, vehicle-to-everything (V2X) connectivity is exactly what it says it is – the combination of all the above connectivity systems and methods.

Of course, connected vehicle technology is not solely concerned with conventional automobiles. Self-driving vehicles will also exploit connection technologies to communicate with the road infrastructure and cloud platforms, but as incidents of crashes, injuries and deaths proliferate, self-driving vehicles are getting some bad press and would-be user enthusiasm is waning. Again, much stock is again being placed on the ability of 5G to help make self-driving vehicles not only safer but much more intelligent and responsive – it is very much a work in progress.

References:

Connected Car Market Research: Size, Trends, 2023-27 (juniperresearch.com)

Telcos to play critical 5G role in connected vehicles sector – report | TelecomTV

One thought on “Juniper Research: 5G connectivity opportunity for the connected car market”

Comments are closed.

Vehicle connectivity is a must-have for any new vehicle. Whatever it is called (5G, 4G, whatever), it will be increasingly important as indicated by the above charts.

Tesla sets the bar for the auto industry.

Connectivity for Tesla’s own purposes (e.g. software updates) is standard. There is a premium option that allows, according to their website, access to things, such as Live Traffic Visualization, Sentry Mode – View Live Camera, Satellite-View Maps, Video Streaming, Caraoke, Music Streaming, and Internet Browsing. Three years ago, they used to charge $9.95 per month for the premium option. Now, the pricing information is in the Tesla App, so it’s not clear what they charge.

https://www.tesla.com/support/connectivity#connectivity

Another example of vehicle connectivity is given by Halo.Car, a Las Vegas-based car rental company that uses teleoperators to deliver electric cars to the car renter. This vehicle is driven remotely by a driver at a desk. Although they still have safety drivers and chase vehicles, they are making rapid progress. Key to this is the triple redundancy provided by three network carriers. This, and the multiple, low-cost cameras they add to standard cars, seems to be their secret sauce to what they are doing and hope to do.

https://viodi.com/2023/01/07/the-puppy-dog-rental-car-a-bridge-to-autonomy/

They are using whatever T-Mobile, AT&T, and Verizon give them and have figured out a way to create real-time failover as well as adapt for the least latency. It also helps that they keep their cars to a maximum of 25 MPH when driven by a remote operator.

I suspect that each auto manufacturer is similarly optimizing the network(s) for their vehicles.