Counterpoint Research: Global Smartphone Market Reaches its Lowest Q3 Levels in a Decade

Global sales of smartphones fell 8% in the third quarter from a year earlier amid a “slower-than-expected recovery in consumer demand,” with both Apple and Samsung losing market share to competing brands during the period, according to Counterpoint Research. Highlights:

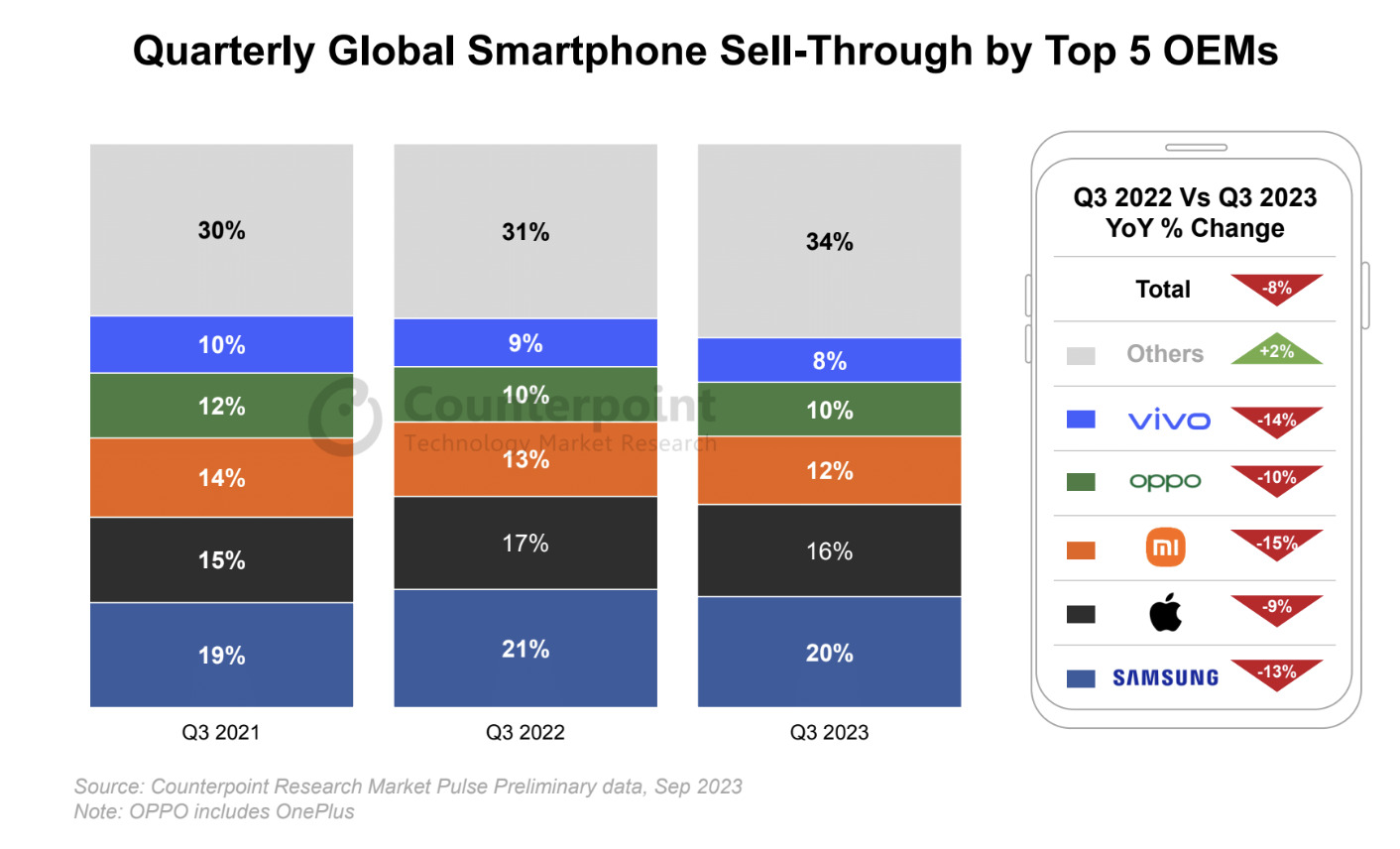

- Global smartphone sell-through declined 8% YoY but grew 2% QoQ in Q3 2023.

- Samsung led the market but declined YoY to reach its lowest quarterly level in the last decade.

- A shorter period of iPhone 15 availability in Q3 led to a shift in demand to the next quarter.

- The top five brands’ cumulative share declined in Q3 as challengers’ share grew.

- HONOR, Huawei and Transsion Group were among the only top brands to record YoY growth

The July-September sales figure represented the lowest third-quarter level in a decade, the technology market research firm said, noting that year-over-year global smartphone sales have now fallen for nine consecutive quarters.

However, Counterpoint expects that trend of declines to come to a “halt” in the fourth quarter, as sales benefit from the full impact of the recently launched iPhone 15, the festival season in India, the 11.11 Singles’ Day holiday in China, Christmas, and end-of-year promotions later in the quarter. Counterpoint noted that third-quarter sales were up from the second quarter and that a good performance in September despite the limited availability of the new iPhones provides reason for optimism.

Global market leader Samsung saw its share of the global smartphone market drop to 20% in the third quarter from 21% a year earlier, as sales fell 13%. Apple’s share of the global smartphone market also fell 1 percentage point, to 16%, as its sales declined 9%.

The top five global brands — which also include Chinese smartphone makers Xiaomi, OPPO, and Vivo — made up a combined 64% of the global smartphone market in the third quarter of 2023, down from about 68% in 2022 and 2021, according to Counterpoint’s data. The Chinese companies recorded even steeper smartphone sales declines than Samsung and Apple as they “worked towards strengthening their positions in key markets like China and India while continuing to slow down expansionary efforts in overseas markets,” the report noted.

HONOR, Huawei and Transsion Group gained share and were among the only brands to record YoY growth in Q3. Huawei grew driven by the launch of the Mate 60 series in China, while HONOR’s growth was led by strong overseas performance. Transsion brands continued to expand while also benefiting from the recovery in the Middle East and Africa (MEA) market.

MEA was the only region to record YoY growth in Q3, owing to improvements in macroeconomic indicators. Most developed markets, like North America, Western Europe and South Korea, recorded steep declines. However, we expect most developed markets to grow in Q4 largely due to the delayed effect of the iPhone launch.

Following a strong September, we expect the momentum to continue till the year-end, beginning with the full impact of the iPhone 15 series along with the arrival of the festive season in India, followed by the 11.11 sales event in China and ending with the Christmas and end-of-year promotions across regions. In Q4 2023, we expect the market to halt its series of YoY declines.

However, the market is expected to decline for the full year of 2023, reaching its lowest level in the decade largely due to a shift in device replacement patterns, particularly in developed markets. Notably, the recovery of emerging markets before the global market and the growth of brands outside of the top five indicate the shifting dynamics and opportunities in the global smartphone market.

About Counterpoint Research:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

References:

Global Smartphone Market Reaches its Lowest Q3 Levels in a Decade; Apple’s Share at 16%

Omdia: Global smartphone shipments decline in 2Q23 for 8th consecutive quarter

GfK: Global telecom market (x-North America) posts 9.7% revenue drop; smartphone revenues -10.2% in 2022

IDC: Global smartphone market will remain challenged through 1st half of 2023

3 thoughts on “Counterpoint Research: Global Smartphone Market Reaches its Lowest Q3 Levels in a Decade”

Comments are closed.

Do you have a report on U.S. vendor market shares of smartphones and smartwatches as of Q3’23?

IEEE does not generate or sell Market Research Reports on Smartphones or Smartwatches OR ANYTHING ELSE!

Please redirect your question to Counterpoint or other market research firm that sells such reports.

The global smartphone market continued its comeback in Q1 as shipments increased 6 per cent year on year for a total 296.9 million as Samsung took over the top spot from Apple, data from Counterpoint showed. Samsung took a 20 per cent share of market shipments (up from 17 per cent the previous quarter), while Apple fell to 17 per cent. Apple’s shipments declined 13 per cent year on year. Counterpoint Research attributed most of the market’s shipment surge to strong performances across Europe, Middle East and Africa (MEA), the Caribbean, and Latin America. Prachir Singh, senior research analyst at Counterpoint, stated MEA was the fastest growing region due to strong shipments by Tecno, Xiaomi and Honor. He noted China’s shipments were boosted by robust Lunar New Year sales and Huawei’s comeback in the market. He explained Europe, especially Central Europe and Eastern Europe, grew the most compared to a difficult Q1 2023, while the mature markets of North America and Japan declined. Record first quarter revenue Global smartphone revenue grew by 7 per cent year on year, the most ever in a first calendar quarter. Apple led smartphone market revenue with a 43 per cent share, despite an 11 per cent decline in its revenues year-on-year, while Samsung’s smartphone market revenue grew by 2 per cent. Jeff Fieldhack, research director for Counterpoint, stated Apple’s performance was impacted by increased competition in China, record low upgrades in the US and “a difficult compare from last year due to iPhone 14 Pro’s supply shifting to Q1 2023”. He noted emerging markets provide long term growth opportunities for Apple as well as the upcoming inclusion of AI on its devices. Samsung’s success was driven by a strong performance from its Galaxy S24 series as well as an early refresh of its Galaxy-A series. Last month data house IDC reported Q1 smartphone shipments rose 7.8 per cent to 289.4 million units, the third consecutive quarter of shipment growth.

https://www.mobileworldlive.com/apple/samsung-on-top-in-global-smartphone-bounceback/