ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Every single telecom operator in the world is now attempting to transform from telco to techco, to break free from their antiquated, legacy, and stale connectivity business and evolve to sell technology platforms, a considerably more lucrative and promising business. Their success is not guaranteed, and many find it difficult – if not impossible – to unshackle themselves from their history and comfort zone.

ABI Research now says it’s measuring the progress of telco transformation by quantifying the number of patents that telcos hold and also measuring their involvement in standards-setting initiatives like 3GPP (whose specs are standardized by ETSI and ITU-R).

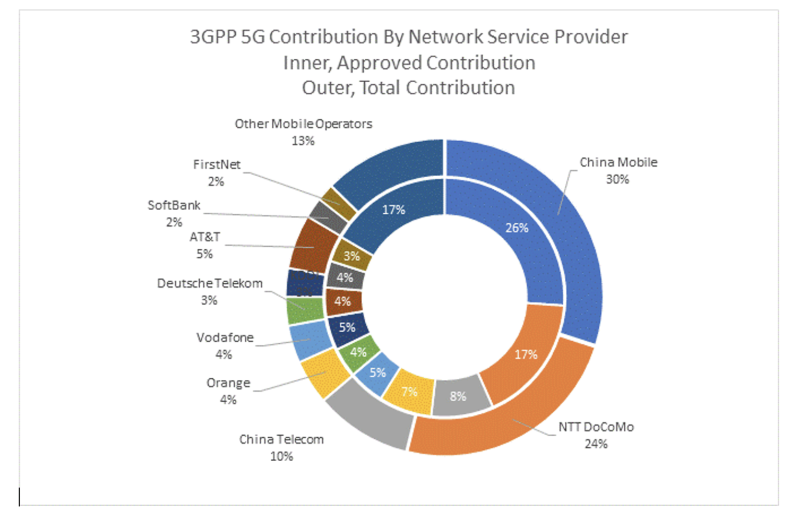

Telecom operators from China and Japan are currently at the forefront of technology transformation, which shows in their involvement in 3GPP and patent holdings,” says Dimitris Mavrakis, Senior Research Director at ABI Research. “China Mobile, NTT Docomo, and China Telecom have invested time, effort, and capital in both domains, which now translates to significant expertise, knowledge, and recognition in the industry. Although this is not the only metric for innovation, these leading network operators are well suited to transforming their business, technology, and strategic platforms to look to the future.”

The findings of the latest ABI Research report on telecom operator innovation indicate that they consistently contribute to 3GPP work, approximately 8% of the total contribution. Of these telecom operator contributions to 3GPP, 43% originate from China, 29% from Japan, 14% from Europe, and 12% from the United States. Leading operators are China Mobile, NTT Docomo, China Telecom, Orange, Vodafone, and Deutsche Telekom. Their Standards Essential Patent (SEP) holdings are similar, with China Mobile and NTT Docomo leading the market.

Standards contributions and patent holdings are good measures of willingness to innovate and get involved in leading the market. “Telecom operators must get involved and not let other companies lead the direction of the market – especially when geopolitics and semiconductor supply constraints are affecting the market. With 5G Advanced and upcoming 6G, they have the technology to innovate, but they must now take more risks and lead the market,” Mavrakis concludes.

Fierce Wireless asked why T-Mobile didn’t rank, given the good progress that it’s made with its 5G SA network and network slicing trials. Mavrakis said, “T-Mobile US is part of Deutsche Telekom, which is represented in the chart above. They are indeed making progress toward network slicing, but our report measures 3GPP standards activities and patents, which is a different area of innovation.”

These findings are from ABI Research’s Telco versus Techco: Operators’ Role in Shaping Cellular Innovation and 3GPP Standards application analysis report. This report is part of the company’s Cellular Standards & IPR research service, which includes research, data, and ABI Insights. Based on extensive primary interviews, Application Analysis reports present in-depth analysis on key market trends and factors for a specific application, which could focus on an individual market or geography.

…………………………………………………………………………………………………………………………………

Separately, ABI Research says 5G end-user services deployment continue to accelerate in China, which is very much leaving other markets in its wake. Not only does it have 3.2 million 5G base stations up and running, but also a wide range of 5G-to-Business (5GtoB) applications.

According to China’s Ministry of Industry and Information Technology (MIIT), the country has built or upgraded more than 3.2 million 5G base stations—accounting for 30% of the overall mobile base stations nationwide—which has already exceeded the initial target of deploying 2.9 million 5G base stations by the end of 2023. A fourth mobile operator, China Broadnet, has also been issued a 5G mobile cellular license to help stimulate consumer and enterprise competition.

5G subscriber adoption has been robust. At the end of 1Q 2023, the number of 5G subscriptions in the country had increased to around 1.3 billion, which is an increase of more than 53% from approximately 850 million 5G subscribers as of March 2022. The China Telecom Research Institute reported that the average download speed for 5G is a very robust 340 Megabits per Second (Mbps).

China’s mobile operators have seen an overall increase in service revenue. China Mobile reported an 8.1% Year-over-Year (YoY) increase in telecommunication service revenue, with mobile Average Revenue per User (ARPU) up 0.4% to CNY49 (US$6.9). China Telecom also reported a 3.7% YoY increase in mobile communications service revenue with mobile ARPU up 0.4% to CNY45.2 (US$6.3), whereas China Unicom saw a 3-year consecutive growth in mobile ARPU to CNY44.3 (US$6.2).

Growth in revenue has been primed by an expansion in revenue models the telcos can offer. Revenue for China Mobile’s 5G private networks also saw an increase of 107.4% YoY growth, reaching RMB2.55 billion (US$365.5 million) by December 2022. Meanwhile, China Unicom experienced a spike in 5G industry virtual private network customers from 491 to 5,816 between June 2022 and June 2023. Across the board, the three operators have collectively reached a cumulative total of more than 49,000 5G commercial enterprise projects, with China’s MIIT reporting that the operators have built more than 6,000 5G private networks, to date.

China’s mobile cellular ecosystem is not resting on its laurels. Urged on by China’s government, the sector has been embracing 5G-Advanced, as underpinned by The 3rd Generation Partnership Project’s (3GPP) Release 18. Included in Release 18 are greater support for Artificial Intelligence (AI) integration, 10 Gigabits per Second (Gbps) for peak downlink and 1 Gbps for peak uplink experience, supporting a wider range of Internet of Things (IoT) scenarios, and integrated sensing & communication. Information gathered through sensors can enable communication to be more deterministic, which improves the accuracy of channel conditions assessment. Another example is dynamic beam alignment for vehicle communications using Millimeter Wave (mmWave). China’s mobile operators and vendors are keen to adopt 5G-Advanced due to its ability to support a 10X densification of IoT devices compared to 5G. There is also support for passive 5G IoT devices that can be queried by campus and/or indoor small cells to provide telemetry-related data. Instead of a field or warehouse worker, or even an Autonomous Guided Vehicle (AGV) with a portable Radio Frequency Identification (RFID) reader, the campus cellular network can track asset tags in real time and remotely—eliminating the need to check up and down warehouse aisles individually.

5G-Advanced (not yet standardized) deployments are materializing in China. China Mobile Hangzhou launched its Dual 10 Gigabit City project in early 2023. This project focuses on using 5G-Advanced technologies to support applications such as glasses-free Three-Dimensional (3D) experiences on different devices during the Asian Games. Such early experimental projects are not limited to only one city in China. To the northeast of Hangzhou, China Mobile Shanghai has also started its own project to build the first 5G-Advanced intelligent 10 Gigabit Everywhere City (10 GbE City). The network is built using the 2.6 Gigahertz (GHz) network initially for the main urban areas before expanding the coverage to the entirety of Shanghai.

5G deployment, integration, and usage is accelerating. The China Academy of Information and Communications Technology anticipates that US$232 billion will have been invested in 5G by 2025. An additional US$37.9 billion (RMB3.5 trillion) of investment will also take place in the upstream and downstream segments of the industrial chain. During a 2023 Science and Technology Week and Strategic Emerging Industries Co-creation and Development Conference, MIIT stated that 5G connectivity has been integrated into “60 out of 97 national economic categories, covering over 12,000 application themes.” ABI Research has not verified all the use cases reported by MIIT, but ABI Research’s ongoing research into the 5G-to-Business (5GtoB) market in Asia has validated that there are a wide range of 5GtoB trials, pilots, and commercial rollouts taking place in China.

A further ABI Insight that you may find interesting is “China Telecom Is the First Operator Worldwide to Launch a “Device-to-Device” Service on a Smartphone to Improve Coverage.”

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

References:

https://www.fiercewireless.com/5g/abi-research-praises-china-mobile-ntt-docomo-5g-innovation