Cloud Infrastructure Spending

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

According to the International Data Corporation (IDC) Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on compute and storage infrastructure products for cloud infrastructure, including dedicated and shared environments, increased 13.5% year over year (YoY) in the fourth quarter of 2021 (4Q-2021) to $21.1 billion. This marked the second consecutive quarter of year-over-year growth as supply chain constraints have depleted vendor inventories over the past several quarters. As backlogs continue to grow, pent-up demand bodes well for future growth as long as the economy stays healthy, and supply catches up to demand.

For the full year 2021, cloud infrastructure spending totaled $73.9 billion, up 8.8% over 2020. IDC predicts spending on cloud infrastructure services to increase 21.7% in 2022 to $90.0 billion.

The service provider category includes cloud service providers, digital service providers, communications service providers, and managed service providers. In 4Q21, service providers as a group spent $21.2 billion on compute and storage infrastructure, up 11.6% from 4Q20. This spending accounted for 55.4% of total compute and storage infrastructure spending. For 2021, spending by service providers reached $75.1 billion on 8.5% year over year growth, accounting for 56.2% of total compute and storage infrastructure spending. IDC expects compute and storage spending by service providers to reach $89.1 billion in 2022, growing at 18.7% year over year.

At the regional level, year-over-year spending on cloud infrastructure in 4Q21 increased in most regions.

- Asia/Pacific (excluding Japan and China) (APeJC) grew the most at 59.5% year over year.

- Canada, Central and Eastern Europe, Japan, Middle East and Africa, and China (PRC) all saw double-digit growth in spending.

- The United States grew 5.6%.

- Western Europe and Latin America declined for the quarter.

For 2021, APeJC grew the most at 43.7% year over year. Canada, Central and Eastern Europe, Middle East and Africa, and China all saw double-digit growth in spending. Japan grew in the high single digits, while Western Europe grew in the low single digits. The United States grew 1.5%. Latin America declined for the year. For 2022, cloud infrastructure spending for most regions is expected to grow with the highest growth expected in the United States at 27.8%. Central and Eastern Europe is the only region expected to decline in 2022 with spending forecast to be down 21.7% year over year.

Longer term, IDC expects spending on compute and storage cloud infrastructure to have a compound annual growth rate (CAGR) of 12.6% over the 2021-2026 forecast period, reaching $133.7 billion in 2026 and accounting for 68.6% of total compute and storage infrastructure spend. Shared cloud infrastructure will account for 72.0% of the total cloud amount, growing at a 13.4% CAGR. Spending on dedicated cloud infrastructure will grow at a CAGR of 10.7%. Spending on non-cloud infrastructure will flatten out at a CAGR of 0.5%, reaching $61.2 billion in 2026. Spending by service providers on compute and storage infrastructure is expected to grow at a 11.7% CAGR, reaching $130.6 billion in 2026.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

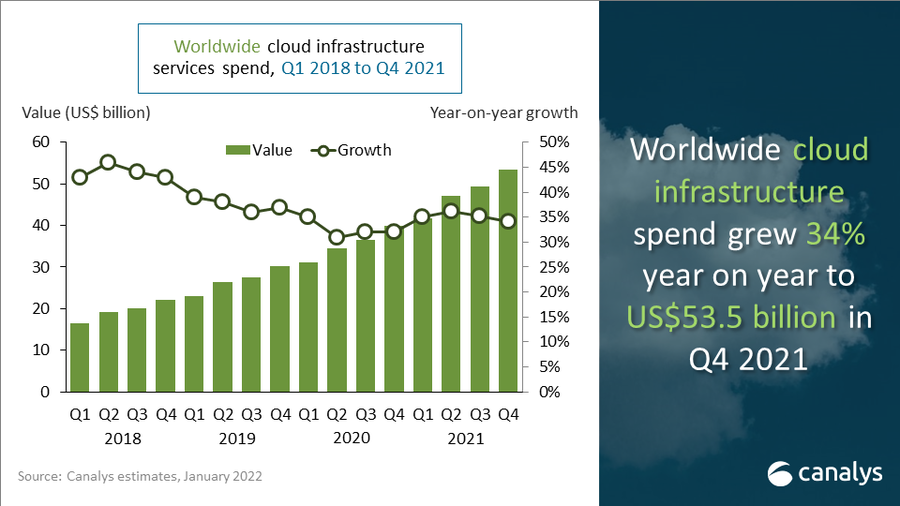

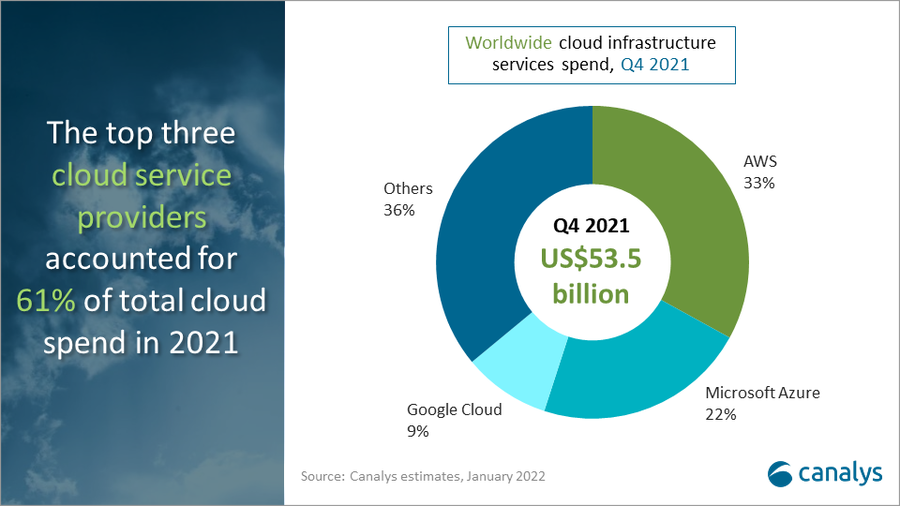

Separately, Amazon Web Services (AWS) led with 33% of spending on cloud infrastructure services in Q4 2021, according to a Feb 3, 2022 blog post from research group Canalys. Meta, previously known as Facebook, recently chose AWS as a long-term strategic cloud service provider and continues to deepen the relationship as Meta begins to move away from social media to become a broader metaverse company over the next five years. AWS also announced key customer wins across retail, healthcare and financial services and emphasized a key agreement with Nasdaq to migrate markets to AWS to become a cloud-based exchange.

Microsoft Azure was second with 22% of spending, followed by Google Cloud with 9%. The three companies accounted for 64% of total cloud investment for 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

IDC’s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment is designed to provide clients with a better understanding of what portion of the compute and storage hardware markets are being deployed in cloud environments. The Tracker breaks out each vendors’ revenue into shared and dedicated cloud environments for historical data and provides a five-year forecast. This Tracker is part of the Worldwide Quarterly Enterprise Infrastructure Tracker, which provides a holistic total addressable market view of the four key enabling infrastructure technologies for the datacenter (servers, external enterprise storage systems, and purpose-built appliances: HCI and PBBA).

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service.

Shared cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The shared cloud market includes a variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters; these services in total are called public cloud services. The shared cloud market also includes digital services such as media/content distribution, sharing and search, social media, and e-commerce.

Dedicated cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In dedicated cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

For more information about IDC’s Enterprise Infrastructure Tracker, please contact Lidice Fernandez at [email protected].

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48998722

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Gartner: Global public cloud spending to reach $332.3 billion in 2021; 23.1% YoY increase