Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

Tech companies have been consistently laying off employees since late 2022. As of April 25th, some 266 tech companies have laid off nearly 75,000 workers in 2024, according to the independent layoff-tracking site layoffs.fyi. A total of 262,682 workers in tech lost their jobs in 2023 compared with 164,969 in 2022. The volume of layoffs in 2023 — a total of 1,186 companies — also surpassed 2022, when 1,061 companies in tech laid off workers — and that total was more than in 2020 and 2021 combined.

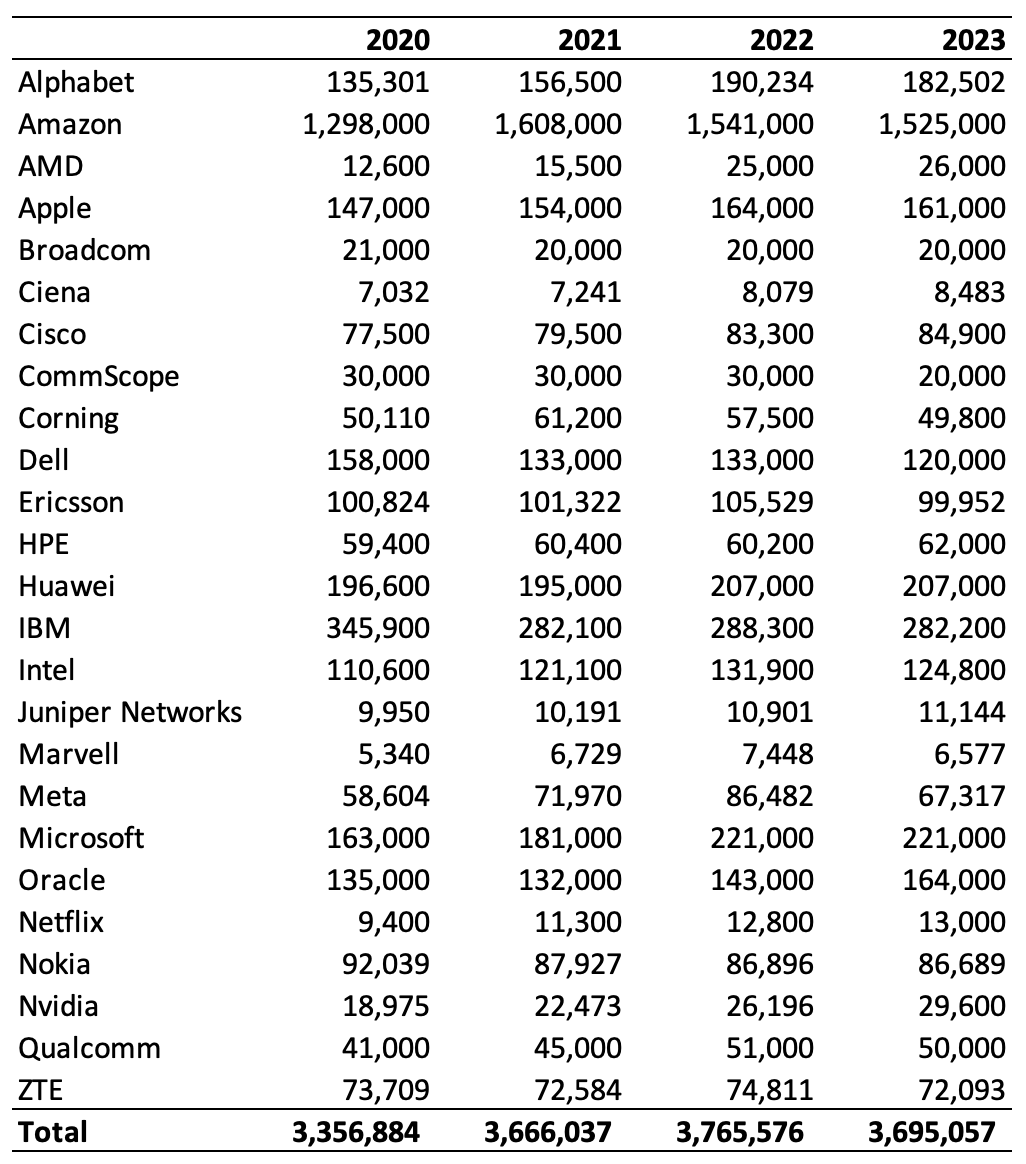

Big Tech companies Alphabet (Google’s parent), Amazon, Apple, Meta, Microsoft and Netflix, collectively cut nearly 45,500 jobs in their most recent full fiscal year. Since 2020, however, they have added more than 358,500, bringing total headcount to nearly 2,170,000. Excluding Amazon, which accounts for 70% of that figure, job numbers fell by around 29,700 last year but have grown by 131,500 since 2020 (data from earnings reports and SEC filings – see chart below).

- Today, Amazon reported better-than-expected earnings and revenue for the first quarter, driven by growth in advertising and cloud computing. Operating income soared more than 200% in the period to $15.3 billion, far outpacing revenue growth, the latest sign that the company’s cost-cutting measures and focus on efficiency is bolstering its bottom line. AWS accounted for 62% of total operating profit. Net income also more than tripled to $10.4 billion, or 98 cents a share, from $3.17 billion, or 31 cents a share, a year ago. Sales increased 13% from $127.4 billion a year earlier.

- Google parent Alphabet also posted robust profits, with net income in the latest quarter soaring 57% to $23.7 billion while revenue grew 15% in the quarter. That’s despite job cuts of 12,115 and net headcount reduction of ~8,000 in 2023.

- Microsoft last week managed 20% year-over-year growth in third-quarter net income, to around $21.9 billion, on 17% growth in sales, to $61.9 billion. The number of Microsoft employees was unchanged in 2023 from the previous year, despite the company laying off 11,158 employees. Future headcount reductions may be necessary to help pay for Microsoft’s multi-billion-dollar splurge on AI and the data centers needed to train the Large Language Models and associated generative AI technology. But few expect job cuts to slow Microsoft down.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

As expected, telecom vendors, which have many fewer employees, than Big Tech had a higher percentage of job reductions. CommScope, Corning, Dell, Ericsson, and Nokia, suppliers to some of the world’s biggest telcos, shed nearly 36,500 jobs last year as large IT customers spent less on new equipment.

The following table shows the total number of jobs per year for many vendors/cloud service providers.

Source: Light Reading & company reports/SEC filings

Huawei was the exception to the telecom vendor layoff craze (even ZTE reduced its workforce in 2023). Despite U.S. sanctions and a European backlash against the company, Huawei gained 12,000 employees in 2022, giving it a workforce of 207,000 that year. The number was unchanged in 2023, according to its recently published annual report. Restrictions have not been as effective at hindering Huawei’s progress as the U.S. had hoped.

On the semiconductor side, Intel experienced a net workforce reduction of 7,100 jobs. Profits have tanked because of market share losses, a downturn in customer spending on equipment (explained partly by the earlier build-up of inventory that happened after the pandemic) and investments in new foundries designed to challenge the Asian giants of TSMC and Samsung. Big Tech moves to build in-house AI augmented processor chips that can substitute for Intel’s microprocessors are among the problems the company faces. Intel’s profits have collapsed, just as they have at the mobile networks business group of silicon customer Nokia, and it is at risk of displacement by chip rivals in important markets.

These big tech layoffs are a peculiar outlier in an otherwise strong employment environment: The unemployment rate has hovered between 3.4% and 3.8% since Feb. 2022, bureau data shows. And quit rates, which reflect a lack of worker confidence, this year are consistently at some of the highest levels in more than 20 years, according to the Federal Reserve Bank of St. Louis.

In summary, Big Tech companies continue to thrive financially, but they are also making strategic adjustments, including job cuts, as they navigate the evolving landscape of technology and generative AI. The emphasis on AI development, large language models, and cloud services remains a key driver for their growth and profitability. Telecom vendors are facing tremendous pain due to continued reduction in telco CAPEX which may persists for many years.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.nerdwallet.com/article/finance/tech-layoffs

US cable and telecom network operators feel the pain

Bloomberg: Higher borrowing costs hurting indebted wireless companies; industry is 2nd largest source of distressed debt

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

High Tech Layoffs Explained: The End of the Free Money Party

One thought on “Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors”

Comments are closed.

According to RationalFX.com. at least 11,000 employees in the technology sector have lost their jobs since the beginning of the year. That’s after a staggering 280,991 employees were terminated as the tech industry wrestled with economic uncertainty and shifting market demands. Over half of these layoffs – 157,950 – were announced by U.S. companies, underscoring the country’s significant role in the ongoing workforce reductions. PC maker Dell led the way by cutting 18,500 positions, followed by Intel and Amazon, each eliminating approximately 15,000 jobs.

The redundancies in the U.S., including in many Silicon Valley companies, are a result of over-hiring during the pandemic and high inflation. But there are other factors at play with recession fears and companies’ increased focus on AI being just two of them. Many companies have announced restructuring plans aiming to increase efficiency and profitability. Interestingly, 2023 and 2024 were extremely profitable for many businesses that reported increased revenues, record-high earnings for shareholders, and expansion to new markets.

https://www.rationalfx.com/forex-brokers/the-tech-industrys-workforce-crisis-2024s-layoffs-surpass-280000-and-continue-in-2025/