Level 3 Communications: Solid 1Q15 Results–Long-Term Growth Outlook Remains Unclear

by David Dixon of FBR Telecom Services (edited by Alan J Weissberger)

Executive Summary:

Level 3 delivered solid 1Q15 results in its first quarter with full TWTC (tw telecom inc. which they acquired last year) results. Management is executing well and should continue to leverage the global asset platform this year.

Looking into 2016, we believe the advent of a shift to 25G/100G metro networks will reduce the number of optical network elements, lower costs, and be and enabler for direct private networking relationships between content owners and access networks as an alternative to peering and IP transit services on the public Internet.

We think this will create greater pricing pressure for transport services in 2016 and increase disintermediation risk. For the quarter, we were pleased with:

(1) EBITDA (earnings before interest, taxes and amortization) beat analyst estimates,

(2) increase in FY15 adjusted EBITDA and free cash flow guidance, and

(3) achievement of $95M of annualized run-rate adjusted EBITDA synergies since the close of the tw telecom transaction.

Overall company revenue continues to be driven by IP and data services (~45.7% of total CNS revenues), which grew 9.0% Year over Year in constant currency.

Management believes CDN (Content Delivery Network) will see further growth later this year as more capacity is added. Although we welcome continued margin expansion and CDN momentum, we believe these may be affected by the current shift to a paid peering model1 and further architecture shifts from 2016. We think the FCC believes that the paid interconnection model from a decade ago (where voice traffic was 96% versus data traffic of 4%) worked well then and could provide a roadmap for today’s data-biased traffic. Therefore, content companies and intermediary network providers such as LVLT may see higher interconnection rates going forward, provided that rates are “just and reasonable.” The argument today is in terms of which party should set the interconnection rate.

Note 1. Paid Peering is the business relationship whereby service providers (Internet Service Providers (ISPs), Content Distribution Networks (CDNs), Large Scale Network Savvy Content Providers) reciprocally provide access to each others’ customers, but with some form of compensation or settlement fee.

Internet traffic flows between different networks generally in one of two ways, through transit, in which a smaller network passes its traffic through a larger one to connect to the broader Internet; and peering, in which large networks connect with each other. Traditionally, smaller networks paid larger ones for transit services, but peering didn’t require any kind of payment from one company to another. Instead, both networks are responsible for their own costs of interconnecting.

Reference:

Highlights of Peer 2.0 Conference: Aug 3-4, 2014 in Palo Alto, CA

Key Points:

■ 1Q15 results recap. Consolidated revenue of $2.05B was just shy of the consensus estimate of $2.06B. The adjusted EBITDA margin expanded by 130 bps YOY on a pro forma basis to 30.9%, compared with the consensus of 30.4%, and adjusted EBITDA were $635.0M, versus the consensus of $626.1M. Margins benefited from increased synergies associated with the TWTC acquisition.

■ FY15 adjusted EBITDA and Free Cash Flow guidance raised. Management raised full-year 2015 adjusted EBITDA growth guidance to a range of 14% to 17% from 12% to 16% previously. Free cash flow is now anticipated to be in a range of $600M to $650M, up from $550M to $600M.

■ Adjusting estimates: We are lowering our FY15 revenue estimate to $8.6B from $8.7B to account for U.S. dollar strength. Our FY15 adjusted EBITDA estimate increases to $2.6B from $2.5B, as the company should achieve further cost synergies. Our FY15 EPS estimate declines modestly to $1.57 from $1.59. Our estimates remain conservative given the unclear longer-term impact from the likely shift in the peering model, greater price compression from the move in 2016 to 25 GB/100 GB transport services, and adverse demand implications from a shift toward simpler, lower-cost metro networks (a net new build for the industry in 2016) that could raise disintermediation risks for Level 3.

Q &A:

1. What is the real benefit of the tw telecom merger?

CDN services are becoming commoditized, but the LVLT/TWTC combination will allow LVLT to improve scale and scope by leveraging the domestic and global long-haul footprint and TWTC s dense urban fiber network. TWTC s higher-margin enterprisecentric business should benefit from greater scale. LVLT has a network backbone that includes 180,000 miles of fiber across 60 countries. A long-haul and metro network provider makes sense against a backdrop of increasing competitive pressures, but the move by access networks to create their own distributed datacenters and connect directly to regional agnostic datacenters suggests that the outlook for CDN providers is unclear. We think online content relationships will continue to evolve. 12 to 18 Months time frame.

2. Will network changes amid heavy traffic demands trigger greater disintermediation risk for Level 3?

The Internet architecture, traffic flows, and content relationships are changing fast. Many application service providers are leveraging Level 3 utility services to capture network ownership economics as the value continues to move higher up the stack from the networking layer to the application layer.

The telecom industry is migrating to improved utilization through:

(1) SDN and NFV (following Google’s lead) and

(2) application development with Docker that enables coding and linux containers (i.e., applications, storage resources) to work together more easily and be extracted out to a virtual linux container edge.

Utilization is much improved on common processing platforms with simplified routing protocols, thus shifting the demand curve for network traffic as application flows move on private networks from source origination to destination.

The migration to 25 GB/100 GB metro networks could be the enabler for direct private networking agreements in regional datacenters offering greater security and performance attributes relative to public Internet traffic interconnections.

We believe the migration to paid peering agreements and a rationalization of peering agreements is well underway and should continue to affect Level 3 cost structure.

The key driver is mature broadband penetration that has operators focused on incremental costs. We expect this transition to be implemented methodically as the industry migrates to major private interfaces over the next few years.

Today, traffic ratios increasingly determine the nature of the interconnection relationship to a greater extent than traffic volumes. We believe de-peering risk is significant and/or could create a higher cost structure as the eyeball network operators become more disciplined with traffic ratio imbalances above 2:1. 12 to 24 Months time frame.

Nokia CEO defends Alcatel-Lucent merger after disappointing earnings report; Infonetics: It’s the "Airbus of telecom"

Nokia Corp. said that its mainstay network business delivered “unsatisfactory profits” during the first quarter. Nokia’s network division saw its quarterly revenue rise 15% over the year to €2.67 billion ($2.94 billion), the unit’s underlying operating profit for the first quarter fell to €85 million from €216 million, Nokia said in a statement.

The network division’s quarterly underlying operating profit margin fell to 3.2% from 9.3% a year earlier and was well below the company’s long-term target of between 8% and 11%.

Nokia also said that its network unit is now expected to post a full-year 2015 underlying operating profit margin around the midpoint of the long-term target between 8% and 11%.

The networking unit’s “unsatisfactory” profitability was due to higher expenses and more revenue coming from lower-margin hardware sales instead of more lucrative software deals, Chief Executive Rajeev Suri said in a telephone conference call. Suri claimed that every single customer he has spoken to since the Alcatel-Lucent deal was announced has expressed support for the move.

“They see it as a way to ensure there are three strong global competitors and not as a reduction in competition,” Suri said. “It’s a way to protect investments of the past while enabling the innovation of the future,” he added

Suri also sought to address the worry that another merger between two huge equipment makers could run into the same problems as earlier tie-ups.

“It’s not a joint venture but an acquisition and there is clarity in terms of leadership and governance,” he said. “Both the companies have learned from recent transformation and restructuring, and so we can ensure that history does not repeat itself.”

Nokia says it has already appointed an “integration leader” to ensure that integration planning is kept separate from ordinary day-to-day business activities.

Suri also believes that recent technology shifts will aid the merger process. “We’ve been transitioning away from customized hardware and towards open interfaces that can mitigate the pain of expensive swaps,” he said.

“We are confident we can execute as discussed and expect no change in planned cost reductions from the transaction,” said Timo Ihamuotila, Nokia’s CFO.

Suri’s defense of Nokia’s bid for Alcatel-Lucent came just a day after Odey Asset Management, the French company’s second-biggest shareholder, was reported by the Financial Times (subscription required) to have described the deal as “unacceptable.”

The investment group, which owns around 5% of Alcatel-Lucent’s stock, is said to have complained that Nokia’s bid massively undervalues Alcatel-Lucent and is really a merger “dressed up as a takeover.”

Last week, ratings agency Fitch Ratings Ltd. weighed in with its own downbeat assessment of the deal, arguing it would do little to ease competition.

“Other major vendors will use the time it takes for the deal to complete to try and strengthen their own position,” said Fitch in a published statement. “In some markets, such as the US, competition should ease in the longer term, but in others the picture is less clear.”

Read more at: http://www.lightreading.com/business-employment/business-transformation/nokias-suri-defends-alcalu-deal-against-critics/d/d-id/715417?itc=lrnewsletter_lrweekly

In a note to Infonetics clients, Stéphane Téral, Research Director, Mobile Infrastructure and Carrier Economics wrote:

“The problem is that we’ve reached the end of the (mobile infrastructure) cycle—2015 is a peak year (see our November 2014 Service Provider Capex, Revenue, and Capex by Equipment Type market size and forecasts)—and the next one will require scale and scope, including a new type of software-based networking equipment that combines telecoms, media, and IT. Alcatel-Lucent and Nokia both lack end-to-end capabilities as well as the scale of their most direct competitors, Ericsson and Huawei, so they can’t fully embrace the new ICT era that is bringing the likes of Cisco, IBM, Oracle, and HP to their traditional service provider turf. Now was the right time for Europe to create its telecom champion, the same way as the European Aeronautic Defense and Space Company N.V. (EADS) was created in July 2000 (reorganized and renamed Airbus Group in January 2014).”

“The Finnish-French tie-up (Nokia-Alcatel-Lucent) recorded sales of €25.9B last year and has a market cap of more than €45B, directly rivaling Ericsson (€25B), which was passed by Huawei last year. Put another way, the Airbus of telecoms will become the world’s second-largest vendor by revenue, neck and neck with Ericsson.”

“Regarding the scale and viability of the deal, make no mistake, this definitely is the Airbus of telecoms that is about to take off and fly for the next decade or so. The size of this Airbus is now on par with Ericsson’s and directly comparable with Huawei’s. And finally, this deal will arm the 2 companies with tremendous R&D capabilities (e.g., Bell Labs) to build an arsenal of technologies to fight Huawei. Now it’s all about execution as usual, so let’s see after the deal is closed in a year.”

To buy Infonetics reports: Infonetics Research – Contact

Anders Bylund wrote:

The core networking division that accounts for 84% of Nokia’s overall sales saw strong sales growth, but its operating profits took a 61% year-over-year haircut. Nokia offered many detailed explanations for this swooning profitability, but it all boils down to one thing: The company just isn’t executing like it used to.

This first-quarter report is actually weaker than it looks, because the Nokia technologies boost won’t last. Will it be enough to scuttle the pending deal? Maybe not, but maybe it would be for the best. Like I said when the merger was announced, Nokia is underpaying for Alcatel-Lucent, but I’m not sure why the Finns want to own it in the first place.

Nothing has changed, except the road to Mergerville suddenly gained a few additional roadblocks. I’m not at all convinced that this deal will happen, and Nokia may have damaged its own operations beyond repair by reaching for this strange combination.”

http://www.fool.com/investing/general/2015/04/30/whats-wrong-with-nokia-corporation-adr-today.aspx

AT&T Q1 earnings fall, revenue flat as U-verse & wireless subs increase; DirectTV deal to close 2Q2015

Note: See below for comments from noted FBR analyst David Dixon.

AT&T Earnings Report Review & Analysis:

AT&T reported a first-quarter profit of $3.2 billion, which topped analysts’ predictions. That was compared with a profit of $3.65 billion a year earlier. Revenue edged up 0.3% to $32.6 billion.

AT&T expanded its U-verse Pay TV base by 50,000 subscribers in the first quarter, while adding 440,000 broadband Internet customers, the company said Wednesday. U-verse TV penetration at the end of Q1 was 22%, while U-verse broadband Internet penetration was 21%. AT&T had U-verse residential revenues of $5.7 billion in Q1, noting that U-verse triple play services (high speed Internet, TV and voice over IP) now represents 69% of the company’s wireline consumer revenues, up from 59 percent in the year-ago period.

The Dallas, TX telecom giant added 441,000 mainstream wireless subscribers in the quarter, down from 625,000 a year earlier. But that total appeared to mask the loss of about 270,000 phone customers. The number was driven by the addition of 711,000 new 3G/4G tablet subscribers (free tablets with a data plan), which are less lucrative than phones.

AT&T encouraged customer loyalty by offering free tablets and data rollover plans. The moves were in response to T-Mobile US Inc.’s series of promotions as well as Sprint Corp.’s half-price offer. AT&T added a net 441,000 monthly wireless subscribers, compared with its “400,000 range” forecast on March 10.

The user gain “suggests that the company is performing well in a market characterized by low organic growth and promotion pricing,” said John Butler, a senior telecommunications analyst with Bloomberg Intelligence.

[Rival Verizon Communications Inc. reported that in the quarter Tuesday, it added 565,000 mainstream customers while losing 138,000 phone subscribers.]

AT&T Chief Financial Officer John Stephens said the company expects to close its DIRECTV purchase in the current quarter, and California Gov. Jerry Brown endorsed the deal in a letter to the Federal Communications Commission.

“We expect the DirecTV transaction will close this quarter,” John Stephens, AT&T’s CFO and SVP, said on Wednesday’s earnings call. He expressed confidence that the combo of AT&T and DirecTV will exceed their original $1.6 billion in expected cost synergies, now seeing them exceed a $2.5 billion run rate by year three.

Stephens appeared unworried about competition posed by Google’s new Project Fi, which will use WiFi and Sprint’s and T-Mobile’s 4G networks to deliver services initially to one device, the Motorola Nexus 6, and start at $20 per month. “It’s got a very limited number of devices,” Stephens said. “That’s not generally the way we like to present options to customers. We like to provide a lot…My understanding also is that there’s going to be very limited distribution and customer care.”

References:

http://about.att.com/story/att_first_quarter_earnings_2015.html

http://www.multichannel.com/news/technology/att-u-verse-adds-50k-tv-440k-internet-sub-q1/390022

http://www.wsj.com/articles/at-t-adds-441-000-core-wireless-subscribers-…

http://www.bloomberg.com/news/articles/2015-04-22/at-t-beats-profit-esti…

http://uk.reuters.com/article/2015/04/22/usa-att-directv-idUKL1N0XJ1FB20… (CA governor backs AT&T-DirecTV merger to FCC)

Comments from FBR analyst David Dixon:

While the competitive environment is intense, AT&T achieved solid subscriber metrics with wireless postpaid net adds of 441,000 and prepaid net adds of 98,000, modestly outpacing Wall Street estimates of 418,000 and (35,000), respectively. Postpaid churn declined to a record low of 1.02%. Although 1Q’s impressive subscriber and churn results are testaments to AT&T’s improving network, we believe it will take time to fully eliminate consumer perception of an inferior network to Verizon, which is tracking significantly better in terms of consistency of service according to third party results.

With the Iusacell transaction closed and Nextel Mexico closing in 2Q15, we think there now may be greater impetus for AT&T to again attempt to sell consumer wireline assets because the “maintain and harvest for cash” versus “maintain and invest in fiber upgrades” are both negative NPV decisions in our view.

Selling AT&T’s 38 data centers also makes sense but for a different reason, namely that the advent of 25G/100G metro optical gear that enables direct connections to servers (the application layer) in regional datacenters enables more direct non-public Internet connections with reliable classes of service.

DTV transaction update:

Management anticipates DTV acquisition will receive regulatory approval and should be complete in 2Q15. Cost synergies are expected to reach $2.5 billion (up from $1.6 billion prior) including savings in the supply chain, installation, customer care, and combined billing. We believe this was well received by investors as there could be additional revenue opportunities from a combined entity (i.e. bundling). It appears a CMCSA/TWC merger would likely be struck by regulatory authorities, but we do not believe an AT&T/DTV merger will face the same challenge due to the lack of coverage overlap and monopolistic fears.

Wireline Access Line Sales back on the table?

We believe management is exploring consumer access line sales given the decision to maintain and upgrade copper plant to fiber is significantly NPV negative in our view. We continue to watch these developments closely.

Can AT&T drive earnings growth?

Smartphone activations remain significant. Strategic initiatives with Samsung and Google, coupled with support of the Windows Phone ecosystem by MSFT, NOK, and other OEMs, are key to lower wireless subsidy pressure, but it is in the early days. We think AT&T will continue to consider pricing action to augment growth once the LTE network build is complete, but competitive intensity is likely to increase in FY15, so this will prove difficult absent consolidation or until T Mobile US becomes spectrum challenged, which we think is still years away (following vendor checks at MWC 2015).

How will AT&T fare in the changing wireless landscape in 2015 and beyond?

Our strategic concerns for AT&T include (1) the Apple eSIM impact, should Apple be successful in striking wholesale agreements; (2) the Google MVNO impact, which could strip the company of additional connectivity revenue; and (3) a Wi-Fi first network from Comcast, coupled with a wholesale agreement with a carrier, which would enable a competitor and increase pricing pressure.

How do we assess AT&T s spectrum position, compared with other carriers?

AT&T made a decisive move to regain sweet spot spectrum in the AWS3 auction. AT&T is behind Verizon in spectrum and out of spectrum in numerous major markets, according to our vendor checks. However, with additional density investment, it is reasonably well positioned to benefit from the combination of coverage layer (700 MHz and 850 MHz) and capacity layer (1,700 MHz and 1,900 MHz and soon to be confirmed 2300 MHz) spectrum and will focus on LTE and LTE Advanced, as well as refarming 850 MHz/1,900 MHz spectrum for additional coverage and capacity. Yet, this nonstandard LTE band will cost more capex and take longer to implement. In the short run, aggressive cell splitting is expected, and metro Wi-Fi and small-cell solutions with economic backhaul solutions are becoming available, allowing for greater surgical reuse of existing spectrum assuming AT&T (like Verizon) can make the necessary business model shift to LTE underlay networks using dedicated spectrum (e.g. 3.5GHz). AT&T s 3G small cell tests steered it to instead buy $20B in the AWS3 auction, but the industry has moved through the challenge of outdoor small cells that are co-channeled with macro networks these carried substantial load, but also destroy equivalent capacity on the macro network due to mis-coordination and interference. As a result macro networks carried less traffic, but still looked fully loaded. Putting small cells in other shared or unlicensed spectrum with supervision from and/or carrier aggregation with the macro is the way forward and AT&T needs to regain its early industry leadership in this area.

Verizon Top U.S. Wireless Carrier: No DISH Deal Expected – VZ to benefit from Refarming & Capacity Spectrum Supply

By David Dixon of FBR Captial Markets &Co. (edited by Alan J Weissberger):

Note: As everyone knows, Verizon acquired all of Verizon WIreless from Vodafone and has sold off a good part of its wireline business to Frontier Communications. Hence, it’s more of a wireless carrier than ever before!

http://www.reuters.com/article/2015/02/05/us-verizon-comms-divestiture-idUSKBN0L92UG20150205

David Dixon’s Commentary:

First, we think competitive intensity should stabilize this year as T-Mobile US increasingly focuses on EBITDA relative to net subscriber add growth and Softbank substantially reduces capital investment to stabilize free cash flow amid a spectrum business model shift.

Second, we do not believe the market appreciates how close the Verizon network is to being ready to deploy a quality VoLTE network nationwide. This opens up the path to lower cost and spectrally efficient LTE-only devices, providing additional CDMA spectrum refarming opportunities in the 850MHz band (in addition to its plans to refarm 1900MHz spectrum) and flexibility in how it chooses to participate in the 2016 broadcast incentive auction. Third, 150MHz of 3.5GHz spectrum should be auctioned in 2016. This changes the capacity spectrum supply curve amid an industry business model shift underway to use small cells to manage capacity challenges versus macro network spectrum.

During 2015, we think VZ will maintain price discipline while continuing to explore divestiture opportunities, which could potentially include the MCI backhaul n

etwork and Terremark given the shift to a virtualized distributed data center network platform.

Better-than-expected underlying spectrum position. We do not believe Verizon needs a spectrum deal with DISH or to aggressively participate in the broadcast incentive auction. This is due to the combination of

(1) spectrum refarming opportunities in both the 1900MHz and 850MHz spectrum bands (as VoLTE ramps);

(2) increased managed capacity spectrum supply with 500MHz of 5GHz spectrum (which bonds to licensed spectrum adding downlink capacity) and following FCC approval last Friday of 150MHz of shared 3.5GHz spectrum; and

(3) the industry business model shift underway from macro to small cell LTE underlay networks, where small cells on dedicated capacity spectrum will increasingly manage network congestion.

Small Cell opportunity for VZ:

A change in the industry network engineering business model is underway toward using small cells on dedicated spectrum to manage more of the heavy lifting associated with data congestion. Verizon demonstrated this shift during the AWS3 auction when it modeled a lower cost small cell network for Chicago and New York. We expect CEO Lowell McAdam to manage this shift from the top down to mitigate execution risk due to cultural resistance from legacy outdoor RF design engineers whose roles are at risk as the macro network is de-emphasized. Enablers include the advent of LTE, increased spectrum supply across multiple spectrum bands including LTE licensed, unlicensed (e.g., 500MHz of 5GHz spectrum), and shared frequencies (e.g., 150MHz of 3.5GHz spectrum) amid a fundamental FCC spectrum policy shift from exclusive spectrum rights to usage-based spectrum rights, which should dramatically increase LTE spectrum utilization similar to Wi-Fi. Previously, outdoor small cells co-channeled with the macro network proved challenging. While they can carry substantial load, they also destroy equivalent capacity on the macro network due to miscoordination and interference, so the macro network carries less traffic but still looks fully loaded. AT&T discovered this in its St Louis trials that in part steered it toward buying $20 billion of AWS3 spectrum. However, the industry trend is toward LTE underlay networks where small cells are put in other shared or unlicensed spectrum with supervision from and/or carrier aggregation with the macro network. Coordination across all cells is still required for this to work, and while Verizon s initial proposals for 5GHz are downlink only, we think uplink will also be used in the longer term. This is because the uplink needs more spectrum resources for a given throughput and we are seeing higher uplink usage trends in the Asian enterprise segment and from Internet of Things (e.g., security cameras)

Does Verizon have sufficient spectrum depth to drive revenue growth longer term, or does it need to aggressively acquire spectrum in future auctions or in the secondary market (e.g., DISH)?

The short answer is yes, we believe it does. Verizon s combined nationwide CDMA and LTE spectrum depth is 115MHz ranging from 88MHz in Denver to 127MHz in New York City. We expect AWS3 capacity spectrum to be deployed in 2017/2018. Investors may not be crediting Verizon with the potential to source more LTE spectrum from the refarming of CDMA to LTE (22MHz to 25MHz) used today for CDMA data (22MHz to 25MHz). Network performance data shows that Verizon s network could be close to the required performance threshold for a VoLTE-only service, which suggests there is additional refarming potential for the 850MHz band (25MHz) used today for CDMA voice and text. This band is likely to be transitioned in 5MHzx5MHz LTE slivers to run parallel with the expected linear (voluntary) ramp versus exponential (forced) ramp in VoLTE service.

Mobile Infrastructure Spending in China Jumped 51% in 2014 (Infonetics); Grafting Probe to End 4G Party in China?

Infonetics Research, now part of IHS Inc. (NYSE: IHS), today reported that mobile infrastructure spending soared in 2014, led by W-CDMA network expansion at China Unicom and robust TD-LTE eNodeB deployments at China Mobile.

Based on Infonetics’ 2015 global Mobile Infrastructure Equipment report, the country specific Mobile Infrastructure and Subscribers in China market share, size and forecasts report tracks the 2G, 3G and LTE infrastructure markets and subscribers in China.

MOBILE INFRASTRUCTURE IN CHINA MARKET HIGHLIGHTS:

. The Chinese mobile infrastructure market came to US$11.1 billion in 2014, a 51 percent jump over 2013

. China’s mobile operators added 58 million mobile subscribers in 2014, pushing the number of total subscribers to 1.3 billion

. Around 60 percent of Chinese mobile subscribers are on China Mobile’s network

. Huawei and ZTE together commanded over 60 percent of China’s 2014 base transceiver station (BTS) unit shipments

“Looking at mobile capex, China delivered again in 2014 via a balancing act that had China Telecom cutting capex by nearly a third, China Unicom increasing spending by almost a quarter and China Mobile shelling out more than the two combined,” said Stéphane Téral, research director for mobile infrastructure and carrier economics at Infonetics Research, now part of IHS.

“China Mobile blew up its own target of TD-LTE rollouts, ending the year with 720,000 TD-LTE eNodeBs. That’s 570,000 above last year and well in excess of its own plan of bringing the footprint up to 500,000, illustrating China Mobile’s commitment to exit the TD-SCDMA era as fast as possible,” Téral said.

CHINESE MOBILE REPORT SYNOPSIS:

Infonetics’ annual China mobile equipment report provides market size, vendor market share, forecasts through 2019, analysis and trends for 2G GSM, 3G CDMA2000 (TD SCDMA, W-CDMA) and 4G LTE (E-UTRAN, EPC) mobile network equipment and subscribers in China. The report also includes an LTE deployment tracker. Vendors tracked: Alcatel-Lucent, Datang Mobile, Ericsson, Fiberhome, Huawei, Potevio, Newpostcom, Nokia Networks, ZTE, others.

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

EJL Wireless Research today announced a new report that analyzes the near and mid term impact on the global wireless telecom infrastructure market due to the current grafting probe in China.

“We have analyzed the current grafting probe in China and we believe that the impact on the wireless telecom sector is far more severe than the industry is currently anticipating and may have significant consequences for key wireless OEMs. Our current outlook for the situation in China has shifted from being a bright star in the wireless universe to one that has gone supernova and is now a tremendous black hole. The 4G party is prematurely over in China until the situation has stabilized and operations return to a new normal in China. Wireless equipment demand has sharply declined since the middle of Q1 2015 and our current outlook for Q2 and the second half of 2015 is cautious with an extremely negative bias,” said founder and President, Earl Lum.

The wireless infrastructure equipment ecosystem has suffered through a feast and famine situation since early 2014 due to the roll out of 4G TDD-LTE by China Mobile. This has severely strained the supply chain within the industry as double and triple bookings and expedited orders have been replaced with order push outs and cancellations. Our analysis reveals that three base station equipment OEMs have the greatest exposure from the slowdown in China. They are Alcatel-Lucent, Huawei Technologies, and ZTE. There are also two key RF semiconductor suppliers that have significant risk and exposure. They are Freescale Semiconductor and NXP Semiconductors, says Lum.

EJL Wireless Research continues to lead the wireless market research segment with innovative and cutting edge research such as its “Under the Radar” series of products.

The report is currently available for purchase and information can be downloaded at: http://www.ejlwireless.com

Reference: http://www.giiresearch.com/report/ejl328559-china-wireless-infrastructure-industry-outlook.html

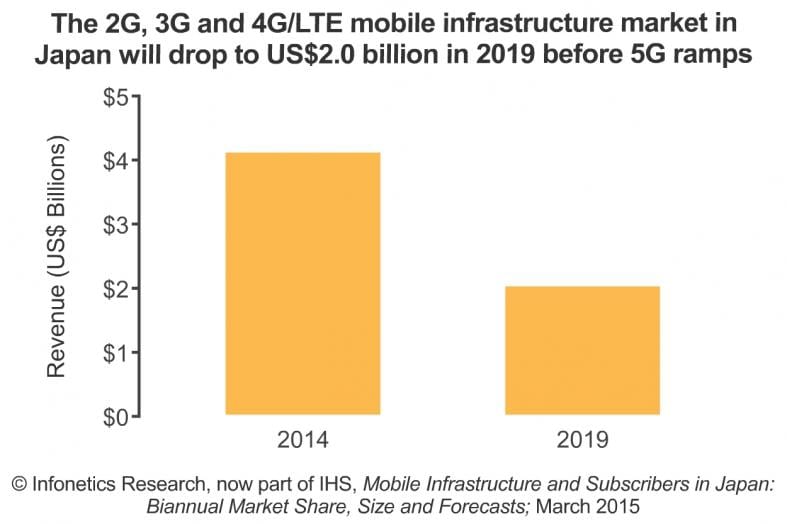

Separately, Infonetics reported that the mobile infrastructure market in Japan fell 19% year-over-year in 2014, to $4.1 billion, as 3G investments in the region stalled.

“As we forecast, the Japanese mobile infrastructure dropped by double digits in 2014 as a severe cut in 3G investments drove a decline that LTE could not offset despite the addition of over 100,000 eNodeBs,” said Stéphane Téral, research director for mobile infrastructure and carrier economics at Infonetics Research, now part of IHS.

“All three Japanese mobile operators, KDDI, NTT DOCOMO and SoftBank Mobile, have passed critical LTE mass deployments and will be tactically adding new macro eNodeBs while gearing up for 3.5GHz small cell deployments for capacity upgrades in 2016,” Téral said.

JAPAN MOBILE INFRASTRUCTURE MARKET HIGHLIGHTS:

. The Japanese government, which requires operators to continually invest in mobile infrastructure, freshly freed up the 3.5GHz band, which will shift the action from FDD to TDD LTE

. Among Japan’s mobile operators, only KDDI and NTT DOCOMO increased LTE spending in 2014; Softbank Mobile slashed its total mobile spend by a quarter

. Nokia Networks is king of the Japanese radio market, owing largely to its LTE prowess

. Japan had 145,053,600 mobile subscribers in 2014, up 6 percent over 2013

. Infonetics/IHS expects the 2G, 3G and 4G/LTE mobile infrastructure market in Japan to fall to $2 billion in 2019, a 2014-2019 CAGR of -13 percent, before 5G ramps up

JAPANESE MOBILE REPORT SYNOPSIS:

Infonetics’ biannual Japan mobile equipment report provides market size, vendor market share, forecasts through 2019, analysis and trends for 3G (W-CDMA, CDMA2000) and 4G LTE (E-UTRAN, EPC) mobile network equipment and subscribers in Japan. The report also includes an LTE deployment tracker. Vendors tracked: Ericsson, Fujitsu, Hitachi, Huawei, NEC, Nokia Networks, Panasonic, Samsung, ZTE and others.

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

VoLTE WEBINAR:

Join Infonetics analyst Stéphane Téral on May 7 at 11:00 AM ET for The Path to VoLTE, an event exploring the architectural challenges of voice over LTE and how to overcome them using real-world use cases. Join live or watch on-demand at http://w.on24.com/r.htm?e=975258&s=1&k=7AC297AEFFA3005C5D20DF360C468B35

Infonetics NA Survey: Use Cases & Motivation for SDN Campus LAN Deployment

Infonetics Research, now part of IHS Inc. (NYSE: IHS), conducted in-depth surveys with businesses in the U.S. and Canada about the enterprise LAN Software Defined Networking (SDN) market and found that 72% of respondents plan to have campus LAN SDN in live production by the end of 2017.

Infonetics interviewed IT purchase-decision makers at medium and large organizations for its latest study, Campus LAN SDN Strategies: North American Enterprise Survey, which examines how the local area network will evolve with SDN. In this client note, Infonetics identifies early uses of SDN in the campus LANs.

A SDN Campus LAN can take the form of an abstracted control plane with a centralized policy “engine.”

· In some use cases the WiFi-controller evolves to be an SDN controller – controlling wired and wireless networks, OpenFlow or restful APIs to the network elements are used.

· In some cases, the network management software evolves to be an SDN controller using OpenFlow or RESTful APIs southbound (from Control plane down to Data plane), and providing programmable APIs northbound (Control plane to applications).

Infonetics found the main campus LAN use case is multi-tenancy—the separation of different groups or departments, usually including some sort of security (Kanazawa University Hospital, Ballarat Grammar school). Multitenancy is also a use case for the enterprise DC examples (Fidelity, Golman Sachs, Nippon Express).

CAMPUS LAN SDN SURVEY HIGHLIGHTS:

When asked about barriers to deploying SDN, respondents most often cited interoperability with existing network equipment/management systems, lack of in-house SDN skills and potential network interruptions. SDN-capable applications for the campus LAN represent one of the biggest opportunities for third-party SDN, existing virtualization and open source vendors, though existing network vendors are still contenders. Survey respondents most often identified Cisco, HP, Juniper, Microsoft and VMware (in alphabetical order) as the top SDN vendors.

“Expectations for software-defined networking in the campus LAN are clear. Businesses taking part in our study want SDN to provide operational cost savings by integrating with existing networks, delivering better security, simplifying management and improving application performance. And they want all this without network interruptions,” said Cliff Grossner, Ph.D., Infonetics’ research director for data center, cloud and SDN.

“Enterprises’ top use cases for LAN SDN are focused on automation for provisioning, wired and wireless LAN unification, BYOD, and improved security enforcement at the network access point,” Grossner added. Other top use cases include: applications visibility, optimize network performance and traffic flow, and centralized network management.

Here are the top reasons survey respondents cited for deploying SDN in the campus LAN:

LAN SDN SURVEY SYNOPSIS:

For its Infonetics’ 25-page Campus LAN SDN strategies survey, Infonetics interviewed businesses in North America about their views on how the enterprise LAN SDN market will evolve to help vendors determine how to invest in product development and position their products in the marketplace. The study provides insights into respondents’ plans to implement SDN, including deployment drivers and barriers, rollout plans, applications, use cases, vendors installed and under evaluation, top-rated vendors, and more.

To purchase the report: www.infonetics.com/contact.asp

More info at: http://www.infonetics.com/pr/2015/Enterprise-LAN-SDN-Survey-Highlights.asp

End Note:

Cliff wrote in an email, “No doubt, the Data Center Ethernet switching market is in transformation and the traditional vendors need to set new strategies to succeed.”

In the coming weeks, this author will interview Cliff Grossner and post a summary here or at viodi.com/author/alanweissberger

Infonetics: Carrier Router & Switch Market Analysis; Research & Markets: Uncertainty over Net Neutrality

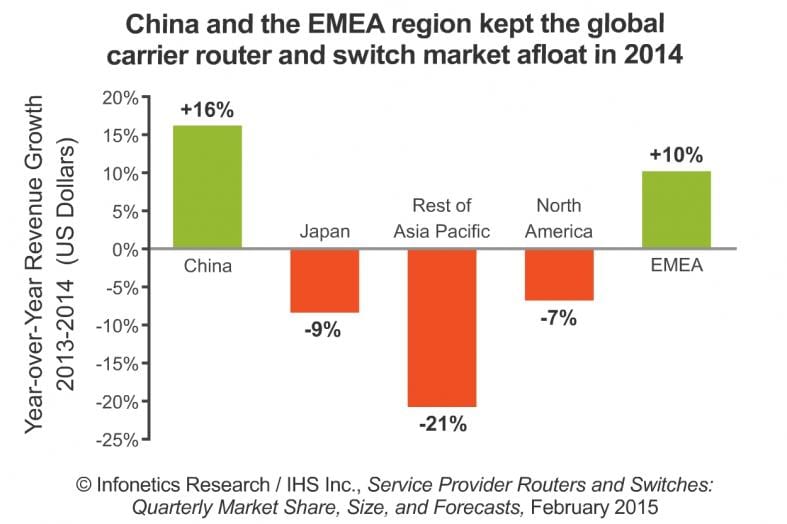

Technology market research firm Infonetics Research, now part of IHS Inc. (NYSE: IHS), this week reported that service provider router and switch revenue totaled $14.6 billion worldwide in 2014, essentially flat over 2013 as SDN (software-defined networking) hesitation slowed spending.

“We’ve been talking about this for the past year and it’s still true: the enormity of the coming SDN-NFV transformation is making carriers more cautious with their spending,” said Michael Howard, senior research director for carrier networks at Infonetics Research, now part of IHS. “But this does not mean that router and switch spending will take a sizeable downturn. Rather, we look for the market to slowly climb to $17 billion in 2019, a five-year compound annual growth rate (CAGR) of just over 3 percent-unchanged from our previous forecasts.”

Infonetics’ fourth quarter 2014 (4Q14) and year-end Service Provider Routers and Switches report contains vendor market share, size and forecasts for the foundational network equipment-IP edge and core routers, vRouters and carrier Ethernet switches (CESs)-that enables voice, video and data communications.

MORE CARRIER ROUTER AND SWITCH MARKET HIGHLIGHTS:

. Worldwide service provider router and switch revenue was $3.8 billion in 4Q14, up 2 percent on a quarter-over-quarter and year-over-year basis

. Sales in the core router segment dipped 5 percent in 2014 from the previous year as expected due to the volume of capacity already “in the ground”

. Carriers in North America exercised caution in their router/switch spending in 2014, sending revenue down 7 percent from 2013

. However, the other major geographical regions-EMEA, Asia Pacific and Latin America-were in positive territory in 2014

. China came to the rescue of a flat 2014 Asian telecom economy with a double-digit increase over the previous year

. On the whole in 2014 and 4Q14, the top 4 router and CES manufacturers-Alcatel-Lucent, Cisco, Huawei and Juniper-stayed in dominant positions, together taking 85 percent of revenue

CARRIER ROUTER / SWITCH REPORT SYNOPSIS:

Infonetics’ quarterly service provider router and switch report provides worldwide, regional, China and Japan market share, market size, forecasts through 2019, analysis and trends for IP edge and core routers, vRouters and carrier Ethernet switches. Vendors tracked: Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Coriant, Ericsson, Fujitsu, Hitachi, Huawei, Juniper, NEC, UTStarcom, ZTE, others.

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

A related report by Research & Markets is cautious on the outlook for network equipment:

Network Transmission Market Analysis and Equipment Forecast: ROADMS, DWDM, Routers and Switches and the Impact of Net Neutrality

“Internet traffic is beginning to slow in growth rate, tending toward the low teens. With the lower growth rate of traffic, one will see lower investment growth following in transmission equipment, as the market will remain cautious after the rather recent bitter experiences. In addition, as the Report also shows that the specter of Net Neutrality hangs over the market, with the doubt it is creating causing even more caution as to investment and purchases.”

“This Report will then examine traffic on the network and, through analysis, show that traffic from four major sources (AAA lines, H-H lines, Mobile lines and International) is responsible for the vast preponderance of traffic and traffic growth. Forecasts will then be provided (thru 2020) for these classes of traffic and for the Internet as a whole.

Based on the information from the traffic forecasts, the uncertainty from regulation (Net Neutrality) and the capital investment plans and forecasts, the Report will then provide equipment sales forecasts (units and dollars) for ROADMs, DWDM, Routers, and Switches (all carrier class) thru 2020 for North America and for the World. Detailed descriptions of each type of equipment being forecast is also provided.”

Infonetics: Wireless LAN Gear Nears $5 Billion in 2014; 802.11ac Access Points Replacing 802.11n

Infonetics Research, now part of IHS Inc. (NYSE: IHS), today reported that almost 1.2 million 802.11ac access points shipped in the fourth quarter of 2014 (4Q14)-a quarter of all access points-cannibalizing 802.11n rather than the older 802.11a/b/g access points. Astonishingly, a pull back in K-12 school sales of WiFi has had a negative effect on the total WiFi equipment market in the U.S. (see analyst quote below).

Infonetics’ 4Q14 and year-end Wireless LAN Equipment and WiFi Phones market share, size and forecast report tracks enterprise access points, wireless LAN (WLAN) controllers and WiFi phones.

WLAN MARKET HIGHLIGHTS:

. Worldwide wireless LAN (WLAN) equipment revenue reached $4.9 billion in 2014, growing just 6 percent over 2013-a far cry from the 20-percent-plus annual increases of a few years ago

. In 4Q14, WLAN equipment sales totaled $1.3 billion, up 5 percent quarter-over-quarter, and up 10 percent year-over-year

. Though demand for WiFi connectivity continues unabated-access point shipments were up 22 percent year-over-year in 2014-revenue growth has run out of steam due to fewer service provider and K-12 WiFi sales, 802.11ac not yet lifting ASPs, controller-less approaches and low-cost solutions

. There was higher than usual demand for WiFi phones in 4Q14, influenced by a large number of deals, but this isn’t expected to be sustained in 2015

. Despite fickle economic conditions, EMEA (Europe, Middle East, Africa) was the fastest-growing major region in 2014, up 9 percent

. Among the top 5 WLAN vendors-Aruba, Cisco, HP, Ruckus and Zebra-Ruckus led revenue growth in 2014

“A pullback in K-12 spending in the US has caused a significant slowdown in the WLAN market, which, after having grown at double-digit rates for several years, grew only 6 percent in 2014,” said Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research, now part of IHS.

“The good news is that the fourth quarter of 2014 looks to be the turning point. RFP activity from K-12 customers is accelerating in anticipation of new funding in 2015, and that, coupled with the introduction of 802.11ac wave 2 access points, will drive renewed growth in 2015,” Machowinski said.

WIRELESS LAN REPORT SYNOPSIS:

Infonetics’ quarterly WLAN equipment report provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis and trends for WLAN infrastructure, including access points by type and technology, WLAN controllers, and enterprise single-mode WiFi phones. Vendors tracked: Aerohive, Alcatel-Lucent Enterprise, Aruba, Brocade, Buffalo, Cisco, D-Link, Extreme, Juniper, Meru, Netgear, HP, Huawei, Ruckus, Spectralink, TP Link, Ubiquiti, Vocera, Xirrus, Zebra, others.

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

Is Sprint Poised to Make a Strategic Misstep under New CEO? FBR Capital Markets

Posted on behalf of David Dixon, FBR Capital Markets

Sprint CEO Marcello Claure has undertaken a strategic review of Sprint’s competitive positioning according to our vendor checks. Claure is an entrepreneur who seeks to move quickly to reposition the company. While he is not a network engineer, he understands that the network is a strategic asset and is seeking approval to undertake a major network investment program, which we believe is approximately $25 billion over the next five years, and could realign the company with Ericsson. The challenge is the deteriorating FCF position of the company and a desire to achieve FCF positive status. This suggests a materially lower annual capex spending program of $3 billion is warranted, but at this level, Sprint is at risk of under-investing and at risk of weakening its franchise value further unless the company embraces a technological shift that is underway. Recall that management is expected to provide full calendar-year 2015 capex during the next earnings call. This will be shaped by the company’s strategic decision on its network strategy.

Mr. Claure has brought in Truco as his strategic Network Advisors led by trusted friend Sol Trujillo. Claure and Trujillo developed a solid, trusted relationship while Claure was at Brightstar and Trujillo led Telstra (he was formerly head of US West). However, this strategic advisory group is advocating a premature network rip and replace programsimilar to what was undertaken under Network Vision and similar to what has recently been undertakenby CSL Limited in Hong Kong. The question for investors is whether CEO Claure can be convinced to makethe right decision for Sprint investors at this juncture ahead of a major industry technology shift.

At this stage it appears he may be too reliant on the Truco advisory group which many believe are backward network engineering thinkers, trying to convince the company to adopt the second (high cost high risk)strategic approach described below. This would be an unfortunate misstep and a missed opportunityto embrace the technology shift underway in our view.Improving indoor and outdoor coverage and capacity is a major strategic challengefor Sprint.Coverage capex is expensive while Sprint can manage data usage growth within its existing footprintvery cheaply with aggressive 2.5GHz deployments on the macro network.

We see three strategies open to Sprint to improve coverage and progressively deploy VoLTE (an IP based LTE application that would allow the company to wind down its CDMA footprint and re-farm spectrum for LTE):

(1) Add macro cell sites.

Management could agree to add more macro cell sites (approximately 10,000)– The cost is high at approximately $3 billion capex and higher opex due to higher backhaul and siterental expenses. Furthermore, the time to deploy is long – up to 18 months to get a site underway.Network Vision proved this cannot be done quickly. For this reason the best macro site based coverageimprovement strategy was through M&A with T Mobile to create a bona fide healthy third operator thatcould better compete with AT&T and Verizon with dramatically improved consistency of service through a densified network grid of cell sites that could also facilitate the elimination of the CDMA networkthrough an accelerated refarming strategy similar to the advantage that AT&T and Verizon have todayin this regard.

(2) Convert its 1.9GHZ spectrum to uplink.

Management could improve coverage by converting 1.9GHz spectrum to uplink (FD LTE) and aggregate the 1.9GHz downlink spectrum with 2.5GHz downlink. Thisis Ericsson’s preferred approach in our view that fits neatly with its challenge in being behind theindustry in TD LTE yet needing to re establish a 4G relationship with Sprint and cement is networkterritory. Under this strategy there is significant deployment risk. For example, Sprint needs to ripand replace the baseband unit (BBU) at each site which is premature in our view. While this is aneasier undertaking relative to a site rip and replace, there is still significant interoperability testing (IOT) network optimization and development issues to address.

The Network vision program highlighted significant deployment issues and nothing has improved in the E&C industry to suggest Sprint could successfully complete a major rip and replace project. In fact the environment has worsened. For example, Ericsson acknowledges it had twice the size of the team they have now. Previously, higher capex spending drove a healthy ecosystem and the industry had a lot more incentive to commit to Sprint.

Bottom line, if pursuing this path, management would need to be more pragmatic about the upgradetimeline of three to five years. We believe CEO Claure favors this strategy but this plays into the hands of Ericsson which was rejected by China Mobile as a TD LTE vendor and had to fire most of its engineeringbase in this area as a result. TD LTE is an industry trend and we believe this option is a backward stepfor the company ahead of a major technology shift that is underway across the industry to embrace lowcost LTE overlay networks using low cost small cells on dedicated spectrum bands.

(3) Focus on indoor small cells on dedicated 2.5GHz spectrum to improve coverage and achieve more offload.

In our view this is the lowest risk and lowest cost strategy for the company. The use of adedicated spectrum band, (i.e. inside LTE Band 41 – 2.5GHz spectrum) to create an LTE overlay networkis the industr

ZTE, Huawei and NSN (now 100% owned by Nokia) are key vendors and trials are occurring this year ahead of commercial deployment in 2017. NSN is moving ahead nicely and both NSN and Alcatelhave received official requests from China Mobile so they will have to make TD LTE and massive MIMO a reality in 3 years so the question is why proceed with a high risk rip and replacement of the network prematurely with high deployment risk.

Recall that management is expected to provide full calendar-year 2015 capex during the next earningscall. This will be shaped by the company’s strategic decision on its network strategy and could rangefrom $3 billion to $5.5 billion in our view as a result.

Note: IEEE ComSoc is grateful that FBR Capital Markets permits us to share it’s very incisive telco research at this web site. Special thanks and acknowlegement to David Dixon, the author of the above post.

Cutting through the Hype: Will the real 4G (LTE-A) please stand up and tell us what 5G is?

Introduction:

While LTE roll-outs continue to increase, especially in developed countries, LTE Advanced (true 4G as defined by ITU-R) has not been deployed on a large scale anywhere that we know of (ABI Research disagrees- see section below). We’re told by Stephane Teral (quoted below), LTE Advanced is just a software upgrade from LTE. If that’s so why don’t we see large scale LTE Advanced deployment in the U.S.?

For example, Verizon has announced it would have 110% LTE coverage in the U.S. by the end of 2015. But they haven’t announced full LTE Advanced (AKA LTE-A) capabilities.

http://www.verizonwireless.com/news/LTE/Overview.html

Infonetics: LTE Deployments Stimulate 10% Growth in Mobile Infrastructure Market in 2014:

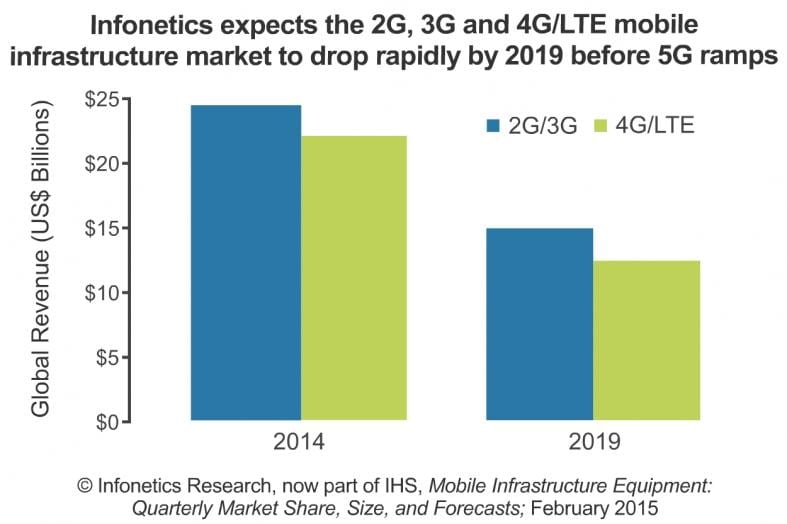

Infonetics Research, now part of IHS Inc. (NYSE: IHS), today reported that for the full-year 2014, LTE alone pushed mobile infrastructure revenue up 10 percent over 2013, to $46.8 billion worldwide, due in large part to China Mobile’s massive TDD LTE deployment.

“We have consistently said that LTE was supposed to pull the entire mobile infrastructure market out of the funk, and so far it has. LTE revenue grew 69 percent in 2014 from the previous year,” said Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research, now part of IHS. “That said, we’ve reached the peak of LTE buildouts on this planet+, and we believe market dynamics will cause the mobile macro infrastructure industry to enter a long-tail decline beginning in 2016 until 5G eventually kicks in.”

+ Over the last couple of years, Stephane has repeatedly told this author: “If you want to increase LTE buildouts, do so on another planet.” Today, he reiterated that comment along with one on LTE Advanced: “Mobile network operators are upgrading to LTE-Advanced but that is mainly a software job driving software revenue not hardware, which is what my forecast is all about. We’re done with blanketing the planet with eNBs as we know them; for more eNB business, get a seat on SpaceX and go to Mars!

Stephane expects the mobile infrastructure market to drop by almost half from nearly $47 billion to $27 billion from 2014 to 2019!

MOBILE INFRASTRUCTURE MARKET REPORT:

Infonetics’ fourth quarter 2014 (4Q14) and year-end Mobile Infrastructure Equipment report tracks more than 50 categories of equipment, software and subscribers based on all existing generations of wireless network technology. Here are a few HIGHLIGHTS:

. Infonetics/IHS expects the 2G/3G/4G mobile infrastructure market to drop from nearly $47 billion to $27 billion from 2014 to 2019, as the planet reaches the end of macrocell mobile deployments

. By Infonetics’/IHS’s count, China Mobile has rolled out 700,000 eNodeB units as of January 2015 and plans to add another 300,000 this year

. The rest of the world is moving fast to LTE too, with the Global Mobile Suppliers Association (GSA) estimating that over 450 commercial LTE networks will be launched by the end of 2015

. In 4Q14, global macrocell mobile infrastructure revenue totaled $12 billion, up 8 percent from 3Q14, and up 10 percent from 4Q13 as unabated TDD-LTE activity in China overshadowed strong LTE and 3G activity in Europe and the Middle East

. For the full-year 2014, the overall 2G/3G/4G infrastructure market share leaders are Ericsson, Huawei and Nokia Networks (in alphabetical order)

. Nokia Networks continues to advance, helped by a strong position in the US due to Sprint and T-Mobile US, as well as massive LTE deployments in China

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

LTE Advanced Explained:

LTE Advanced consists of many different components–from carrier aggregation to HetNets to coordinated multipoint and more. Because of this, not all operators are likely to deploy LTE Advanced n the same way with the same feature sets. In fact, most experts say that every LTE-A deployment will be unique.

https://www.qualcomm.com/invention/research/projects/lte-advanced

Mike Haberman, Verizon’s vice president of network support, said last December that Verizon is testing carrier aggregation right now on its network to ensure it can work properly, and devices that can support carrier aggregation will come into the market after that. Carrier aggregation, which is the most well-known and widely used technique of the LTE Advanced standard, bonds together disparate bands of spectrum to create wider channels and produce more capacity and faster speeds.

However, an LTE network that includes just one feature, e.g. Carrier Aggregation, can’t really be called LTE-A in this author’s opinion.

ABI Research on LTE Advanced:

ABI Research states that at the end of 2014, LTE-Advanced covered its first 100 million people worldwide, just 4 years since the network’s inception. ABI Research predicts that the coverage will reach 1 billion in 4 more years.

At the end of 2014, there were 49 commercially available LTE-Advanced networks around the world. Western European operators lead the commercialization with 20 operators, followed by 13 in Asia-Pacific; however, North America still commands the largest population coverage at 7.8%. “All four major operators of the United States have either commercially deployed (AT&T and Sprint) or have been actively deploying (Verizon and T-Mobile) their LTE-Advanced networks,” comments Lian Jye Su, Research Associate of Core Forecasting.

Globally, a number of major auctions are expected to take place in several major markets in 2015. The Telecom Regulatory Authority of India has just recently confirmed a LTE spectrum auction on the 25th of February. In France, the government has recently approved the reassignment of the 700 MHz band for telecom services. At this moment, the FCC of the United States is currently conducting an auction for AWS-3 spectrum. “As heavy subscribers’ data traffic growth has exploded, ABI Research anticipates fierce competition for more spectrum, as well as an active migration to VoLTE and higher data modulation schemes such as LTE and LTE-Advanced, which has higher spectral efficiency,” adds Jake Saunders, VP and Practice Director of Core Forecasting.

https://www.abiresearch.com/press/lte-advanced-coverage-reaches-100-million-people-t/

Whither 5G?

Consequently, all the recent hype about 5G seems premature. While 3GPP is working on the essential components of 5G, the ITU-R hasn’t fully defined it yet. Here’s the official ITU-R progress report on 5G:

“The detailed investigation of the key elements of “5G” are already well underway, once again utilizing the highly successful partnership ITU-R has with the mobile broadband industry and the wide range of stakeholders in the “5G” community. In 2015, ITU-R plans to finalize its “Vision” of the “5G” mobile broadband connected society. This view of the horizon for the future of mobile technology will be instrumental in setting the agenda for the World Radio communication Conference 2015, where deliberations on additional spectrum will take place in support of the future growth of IMT.”

http://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/default.aspx

Alcatel-Lucent’s View of 5G:

5G is “still a technology push story, not a market pull one,” Michael Peeters, Wireless CTO for Alcatel-Lucent, told Mobile World Live.

http://www.mobileworldlive.com/alcalu-sees-technology-push-5g-hype-driver-regrets-4-5g-moniker

“Operators have two primary approaches to 5G: one which is driven by their research organisations which need to understand whatever 5G may be in order to be ready and to drive the direction of research and standards; and another which is driven by commercial and operational needs which are trying to understand how 5G fits into future operations and revenue streams. It is clear that today the first one is the more important one,” he said.

There are two “likely, or rather, visible” paths for operators looking to make the most of 5G, Peeters continued.

The first will be through the continued support of “ultra broadband applications”, solving capacity issues where heavy users are connected to networks. And the second is “enabling the world of ubiquitous IoT” – “where an infinity of devices (real, or virtual i.e. applications) each use almost zero bandwidth, but nonetheless eat up all of the control plane of the network.”

A Wireless Expert’s Views on 5G:

Here’s the Introduction section of a recent blog post by Chetan Sharma: Technology & Strategy Consulting:

Exposed url: http://www.chetansharma.com/5G.htm

“The deployment of LTE otherwise known as 4G is in full swing. Operators in US, Japan, Korea, Finland, Australia, and others started deploying the new technology some years ago and are nearing completion of their network build out. Others in Europe and Asia are on an aggressive schedule to catch-up. We can expect that a majority of the operators will have LTE up and running in the next couple of years. Operators have sunsetted 2G. In some instances they even stopped investing in 3G and are putting all of their investments in the 4G bucket. As mobile networks transition to all IP, operators will be able to re-farm their spectrum assets for 4G deployments. Beyond LTE, operators are looking at LTE-A to provide more efficiency and network bandwidth to consumers.

In mature LTE markets like the US, Korea, and Japan, the talk has shifted to the next generation technology evolution – 5G. Even Europe, which still has a long way to go before their 4G is built out have set their sights on 5G to recapture the mantle and the pride of the GSM days. Korea and Japan led the world in 3G but lost the lead of 4G to the US. They both are eager to be considered leaders in 5G. Japanese government has set the ambitious goal of having 5G by the Tokyo Olympics in 2020. US regulators have started to talk about 5G and the future spectrum needs as well.

Since the launch of 1G networks in late seventies and the eighties, we are now onto the 5th iteration of the network technology evolution. We have gone through a lot of technology skirmishes but with 4G and likely with 5G, we are narrowing the differences between technology options giving significant technology scale advantages to the ecosystem.

As network technologies have evolved, the application landscape has changed as well. 1G or AMPS was all about basic voice services. GSM and CDMA (2G) digitized mobile and we saw basic messaging and data services introduced into the market. 3G (WCDMA, EVDO) introduced the potential of data services to the ecosystem and the consumers. The launch of iMode in Japan became the poster child of data services for much of the 3G evolution around the globe. Midway in the 3G growth, new players like Apple and Google entered the ecosystem and laid the foundation of unprecedented data and application growth. Business models and control points in the ecosystem changed overnight. The insatiable data demand led to the acceleration of the 4G services in many leading markets. For the first time, the network technology was data-led. We are clearly moving towards an IP infrastructure where voice is just another app running on the data network.

In fact, data is the primary revenue engine for the services providers and rest of the ecosystem. In Japan, almost 80% of the revenue now comes from data services. In the US, we are approaching 60%. Other nations are not far behind. Even the emerging markets have caught up very fast and in some instances leap-frogging their western counterparts in certain application and services segments.

All through last four generations, the fundamental business model of “metering” remained the same. Barring some exceptions, there has been a direct correlation of usage and revenues. Will 5G be any different?

Another significant standard that has evolved is Wi-Fi. The impact of Wi-Fi on the mobile ecosystem can’t be overstated. It has become so pervasive that we have ask the question how long before nationwide Wi-Fi first networks start to make a run for the wallet share in major markets. How will Wi-Fi fit in with 5G, will the two standards merge?

Will 5G offer new business models or explore a different relationship between usage and cost? Will consumers warm up to the idea of value-based pricing? Or Will access just become a commodity layer like water and electricity and most of the value will reside in the platform and application layers? Though we have started to see the shifts (as discussed in detail in our 4th wave series of papers), how fast will future accelerate? Will the ecosystem landscape be markedly different than what we have in place today?

We won’t know the answer to some of these questions for a while but it is worth exploring the lessons from the past and potential disruptions that 5G could bring to the ecosystem that benefits the end customers. In the end, it might not be about the technology at all but about the business models that shape the technology landscape. This paper explores 5G through the lens of the past and explores the wireless world beyond 2020.”

Conclusions:

We’ll leave it to the reader to sort out the buzz/hype from market reality. To this author, it’s alarming that Infonetics projects the ENTIRE MOBILE INFRASTRUCTURE MARKET TO DECLINE precipitously over the next four years, while wireless network equipment vendors are talking the talk about 5G!