Infonetics: Microwave equipment market slides 17% sequentially in 1Q14 (10% according to Dell’Oro Group)

Infonetics Research released excerpts from its 1st quarter 2014 (1Q14) Microwave Equipment report, which tracks time-division multiplexing (TDM), Ethernet, and dual Ethernet/TDM microwave equipment.

MICROWAVE EQUIPMENT MARKET HIGHLIGHTS:

. Microwave equipment revenue totaled $1 billion worldwide in 1Q14, down 17% sequentially, and down 7% from the year-ago quarter

. Revenue for every microwave product segment-TDM, dual Ethernet/TDM, Ethernet, access, backhaul, transport-declined in 1Q14 from 4Q13

. Backhaul continues to dominate the microwave market, while access and transport remain stable niche segments

. Ericsson held steady atop the microwave equipment revenue share leaderboard in 1Q14, while NEC leapfrogged Huawei to claim the #2 spot

. By 2018, the average revenue per unit (ARPU) for Ethernet-only microwave gear is anticipated to fall to around half its 2013 value

MICROWAVE REPORT SYNOPSIS:

Infonetics’ quarterly microwave equipment report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for Ethernet, TDM, and hybrid microwave equipment by spectrum, capacity, form factor, architecture, and line of sight. Vendors tracked: Alcatel-Lucent, Aviat Networks, Ceragon, DragonWave, Ericsson, Exalt, Huawei, Intracom, NEC, SIAE, ZTE, and others.

ANALYST NOTE:

“The proliferation of LTE-A upgrades and small cells deployments was not enough to stop the microwave equipment market from sliding downward in the first quarter of 2014, a casualty of continuing pricing pressures and inter-technology competition with wireline backhaul alternatives, particularly fiber-based solutions,” notes Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics Research. “The seasonal decline was much more severe than usual, suggesting a deeper malaise in the market.”

Webb adds: “Even with the arrival of 5G towards 2018, the microwave backhaul market may be arriving at the limit of demand for increasing backhaul capacity from the cell site, as many will be more than adequately future-proofed by this point.”

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS:

. China’s huge LTE rollouts and EU network upgrades push carrier capex to $354B this year

. China Mobile increases capital intensity 6% year-over-year

. Carriers going gangbusters with WiFi and Hotspot 2.0

. Small cell market on track to increase 65% this year

. Alcatel-Lucent, Huawei and Cisco get top marks from operators in mobile backhaul survey

According to Dell’Oro Group, the point-to-point Microwave Transmission equipment market declined 10 percent during the trailing four quarter period ending in the first quarter of 2014.

“Demand for microwave transmission equipment has been under pressure for quite some time with little relief in the first quarter of 2014,” said Jimmy Yu, Vice President of Microwave Transmission research at Dell’Oro Group. “We think things will improve as we enter the second half of the year, but this is largely dependent on improving conditions in two of the primary microwave market regions, Europe and India. On a brighter note, packet microwave sales achieved another quarter of positive growth. We estimate that for the trailing four quarter period ending in 1Q14, packet microwave revenue grew 13 percent year-over-year,” Yu added.

In-line with market demand, nearly all major microwave vendors experienced a year-over-year revenue decline. Among the top vendors, Alcatel-Lucent’s microwave revenues faired the best, growing slightly above zero percent due to their strong market position in the Packet Microwave segment.

|

Microwave Transmission Market |

||

|

$3.7 Billion for trailing four quarter period (2Q13 through 1Q14) |

||

|

Manufacturer |

Rank |

Growth Y/Y |

|

Ericsson |

1 |

– 6 % |

|

Huawei |

2 |

– 15 % |

|

Alcatel-Lucent |

3 |

+ 0 % |

|

NEC |

4 |

– 2 % |

The Dell’Oro Group Microwave Transmission Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, ports/radio transceivers shipped, and average selling prices by capacities (low, high and ultra high). The report tracks point-to-point TDM, Packet and Hybrid Microwave as well as full indoor and full outdoor unit configurations. To purchase this report, email Julie Learmond-Criqui at [email protected].

For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.DellOro.com.

Infonetics: Global Carrier Router & Switch Market down 13% in quarter; Up only 2% YoY

Infonetics Research released vendor market share and analysis from its 1st quarter 2014 (1Q14) Service Provider Routers and Switches report.

CARRIER ROUTER AND SWITCH MARKET HIGHLIGHTS:

. The global carrier router and switch market, including IP edge and core routers and carrier Ethernet switches (CES), totaled $3.2 billion in 1Q14, down 13% from 4Q13, and up just 2% from the year-ago quarter

. Revenue for all product segments-IP edge and core routers and CES-declined by double digits sequentially in 1Q14

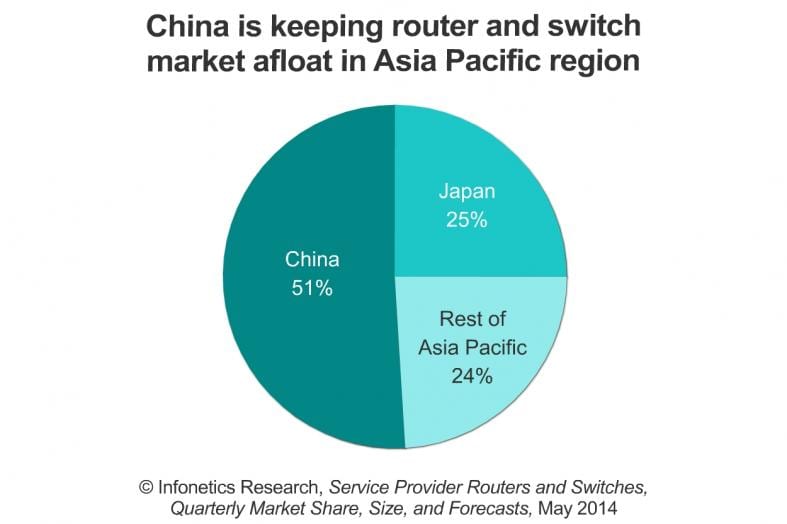

. Likewise, all major geographical regions (NA, EMEA, APAC, CALA) are also down from the prior quarter, though all but N. America are up from the same period a year ago

. The top 4 router and CES vendors stayed in dominant positions in 1Q14, but positions 2-4 played musical chairs: Cisco maintained its lead, Juniper rose to 2nd, Alcatel-Lucent rose to 3rd, and Huawei dropped to 4th

. Infonetics is projecting 5-year (2013-2018) CAGRs of 4.3% for edge routers, 2.9% for core routers, and 0.7% for CES

CARRIER ROUTER/SWITCH REPORT SYNOPSIS:

Infonetics’ quarterly service provider router and switch report provides worldwide, regional, China, and Japan market share, market size, forecasts through 2018, analysis, and trends for IP edge and core routers and carrier Ethernet switches. Vendors tracked: Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Coriant, Ericsson, Fujitsu, Hitachi, Huawei, Juniper, NEC, UTStarcom, ZTE, and others.

RELATED REPORT EXCERPTS:

. China’s huge LTE rollouts and EU network upgrades push carrier capex to $354B this year

. China Mobile increases capital intensity 6% year-over-year

. Networking ports hit $39 billion; 40G booming in the data center, 100G taking off in the core

. SDN and NFV moving from lab to field trials; Operators name top NFV use case

ANALYST NOTE:

“Last quarter, we identified the ‘SDN hesitation,’ where we believe the enormity of the coming software-defined networking and network functions virtualization (NFV) transformation is making carriers be more cautious with their spending. This hesitation reared its head in the first quarter of 2014, where global service provider router and switch revenue increased only 2% from the year-ago quarter,” notes Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research.

“We believe the current generation of high-capacity edge and core routers can be nursed along for a while as the detailed steps of the SDN-NFV transformation are defined by each service provider-and many of the largest operators in the world are involved, including AT&T, BT, Deutsche Telekom, Telefónica, NTT, China Telecom, and China Mobile,” continues Howard. “And there is intensifying focus on multiple CDNs (content delivery networks) and smart traffic management across various routes and alternative routes to make routers and optical gear cooperate more closely.”

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Editor’s Comment:

We’re not at all surprised by this lackluster growth in carrier switch/router market. We think it won’t get any better any time soon. That’s because of all the confusion caused by vendors touting their “SDN/NFV” solutions which don’t interoperate with any other like vendor. Moreover, we see carriers moving to higher speed inter-office optical interconnects with fewer high performance switch/routers and optical ports needed.

Multi-Layer Capacity Planning for IP-Optical Networks, published in the Jan 2014 IEEE Communications magazine does a good job explaining how carriers might save 40-60% of routing ports, transponders and wavelengths in the core network and up to 25% in metro/regional networks. The authors are from Cisco and two well regarded carriers -DT and Telefonica.

One of the key findings: “Applying this methodology to two real data sets provided by two large European network operators, showed significant savings in the total number of required router interfaces, transponders, and wavelengths, on the order of 40–60 percent in the core. In addition, if MLR-A is applied to the aggregation region, it should provide an additional gain up to 25 percent in metro/regional interfaces.”

If that’s the case, then fewer switch/routers will be sold to global carriers in the near future. Furthermore, prices are likely to drop precipitously due to white labeled/ODM built switch/routers that are compatible with various SDN/NFV/Open Networking schemes.

Cisco Embraces SDN, Commits (Again) to Leading the Shift – Scott Thompson, FBR Capital Markets

Scott Thompson’s report/edited by Alan J Weissberger:

Introduction:

Cisco Live! 2014, the company’s premier annual developer/customer event in the U.S., seems to have helped frame Cisco as a company that is carefully and conscientiously navigating a rapidly shifting communications equipment landscape. The company appears to be gaining a reasonable amount of momentum with its new products and architectures, including its Nexus 9000 platform and CRS-X, and it appears that Cisco has joined the SDN “revolution” with a credible architecture story. While we expect there may be potential for near-term upside to consensus estimates, we remain cautious. We continue to believe that the longer-term architectural impacts of SDN could challenge Cisco’s business.

Nexus 9000 is the product to beat:

Cisco’s new Nexus 9000 platform seems to be one of the switches to beat in the data center networking space. We suspect Cisco has found a way to use the platform not only to deliver industry-leading pricing for 10G Ethernet ports, but also to lever the product’s higher density and optical capacities to keep revenue consistent with Nexus 5000 and 7000 run-rates.

Cisco believes the gross margin mix on the newer products it recently released, or is about to release, is higher than past products. If immediately accretive, we believe this could help bolster management’s ability to keep consolidated GMs above 60%. The Nexus 9000 has several different configurations based around the Trident II chipset. While stand-alone Trident II silicon is standard in the low-end 9000 platform, Cisco’s custom ASICs add functionality such as VXLAN routing, extra memory, and expansive VLAN capacity to scale to several times the size or previous TCAM capacities. This flexible configuration not only blurs the lines between the switching and routing lines but also provides a full range of cost points, potentially able to lead the industry on price and protect Cisco’s market share with less impact to margins than we had at first expected.

Cisco’s Sales Team:

Cisco’s sales team is poised to gain traction with the Nexus 9000. It has been several quarters since the Cisco sales team has had an industry-leading networking product to ignite the sales engine. We expect the Nexus 9000, and the series of products that are likely to follow, represents a product that could drive a significant switching upgrade cycle. These types of cycles often drive margin share gains for Cisco, and we expect this to be no different.

Competitors likely to come under pressure from Cisco’s expected aggressive pricing and sales tactics could be Juniper, Brocade, and to some extent Alcatel-Lucent and Ciena. Time will tell how aggressively Cisco will cannibalize its existing product, but industry trends appear to encourage it.

Cisco shifts its focus to software-centric solutions:

Cisco Live marked a notable change in Cisco’s product strategy, from mostly hardware to a more hybrid combination of hardware, software, and cloud applications. With bold statements such as “infrastructure is a commodity,” CEO Chambers foreshadowed a shift in key product offerings: software and infrastructure as a service that delivers holistic solutions instead of stand-alone products.

We expect the Cisco ONE suite and smart licensing to be available in Fall 2014, with sales beginning to ramp as early as 2015.

Will white box (low-cost,non-branded ODM bulit hardware) be a threat to Cisco in the next 6-18 months?

Although we believe white box may not take a sizable portion ofmarket share away from Cisco, we believe it will likely put greaterthan-expected pressure on pricing. We believe this to be one of Cisco s main gross margins challenges in 2014 and 2015.

Will new and unexpected entrants into the data networking space take market share from Cisco in the next 2+ years?

Significant technical and strategic shifts are affecting the IT landscape. We expect Cisco to be threatened, and we expect these to become threats to an increasingly large number of IT players as technology shifts drive the industry toward consolidation.

TiECon 2014 Summary-Part 4: Highlights of IBM keynote- What Really Matters for IoT

Introduction:

In our fourth and final article on TiECon 2014, we summarize the Internet of Things (IoT) market opportunites and advice for entrepreneurs, as described by Sandy Carter, IBM VP & General Manager of IBM Ecosystem Development during her TiECon IoT keynote speech on May 16th. Consistent with the theme of TiECON, Ms Carter addressed where IoT entrepreneurs should concentrate their time and what they need to do to succeed.

Sandy contrasted the common vs. unique aspects of the IoT, identified three customer use cases and several common roles, examined consumer vs. enterprise focus, and suggested where new innovation and investment can produce material improvements over the next several years. It was a very well researched and clearly presented talk.

Presentation Take-aways:

As one might expect, investment and opportunities in the IoT are expanding rapidly. And that will continue for many years. By 2020, it’s forecast that $300B in incremental revenue will derive from IoT products and services (source of that forecast was not identified).

Three items are needed for the above IoT forecast to be realized, according to Ms Carter:

- Focus on domain knowledge expertise, value drivers, and design (focus on outcome- not the devices(s)).

- Integrated solution that includes data analytics and cognitive computing along with monitoring sensors.

- Ecosystem that includes many different types of vendors, service providers, software suppliers and system integrators.

The IoT opportunity exists by vertical industry segment rather than a single monolithic market (which confirms what all IoT market researchers have said to date). The top ranked IoT industry verticals (in order of revenue opportunities) are: auto, healthcare, industrial, retail, asset management, utilities/energy, home monitoring & control/building automation.

When selling IoT solutions, vendors and service providers must target the right buyer within the company they’re trying to sell to. For example, the IoT solution provider should determine if it is the facility manager vs IT manager vs department head. Value driven use cases will also be important for the IoT provider to demonstate solutions for the industry segment(s) relevant to the targeted customers.

IoT Integrated solution opportunities identified were:

- Data collection at $87B

- Analystics at $237B

- Cognitive Computing at $370B

- Data analytics that are optimized for each customer was said to be a $180B opportunity in 2016.

Note: The timeframe for the first three forecasts were not mentioned during Sandy’s keynote. The source noted on the slide was an Harbor Research report: Where will value be created in IoT, April 7, 2014. When attempting to search on line for same, we could only find a 2013 forecast from that firm:

http://harborresearch.com/wp-content/uploads/2013/08/Harbor-Research_IoT-Market-Opps-Paper_2013.pdf

IoT Collaboration Examples:

1. IBM is working with Honda to collect data related to battery performance in electric vehicles (EV) on the road. The objective is to analyze massive amounts of data to better determine how those EV batteries operate. To improve battery life and perfomance, the data will be optimized for decision making. That will result in increased EV performance and enhanced customer satisfaction.

Other IoT opportunities for EV were said to be: device performance, maintenance contracts, warranties/recalls, and customer service.

2. IBM is working with the Flint River Basin Partnership to collect, analyze, and optimize data from various sensor readings. The objective is to make more informed irrigation scheduling decisions to conserve water, improve crop yields and mitigate the impact of future droughts. That will be done by analyzing and optimizing unstructured sensor data to predict irrigation needs based on weather conditions or crop health. The result of this collaboration will be the deployment of innovative conservation measures to enhance agricultural efficiency by up to 20 percent.

An extension of the above opportunites would be to utlize mutliple protocols and technologies to collect and analyze data from many different devices. Then to merge and reconcile that unstructured data from multiple input sources.

3. Streetline (http://www.streetline.com/company/in-the-news/) has been working with the city of Los Angeles on an optimized parking solution. The system collects and analyzes parking spot data and makes decisions to optimize parking spot usage. This has reduced traffic congestion and resulted in increased motorist satisfaction. It’s also generated more parking revenue fo the city of L.A.

Note: Sandy predicted that over 100B sensor readings would be made daily by 2020 (she didn’t say whether that was global or just for the U.S.)

Suggested IoT Ecosystem Value for Entrepreneurs:

- End to end technology and business monitoring

- Raise capital/ procure investments

- Scale globally- using one or more partner companies or a network of companies

- Mentoring as a recipe for success

- Cloud connect your thoughts (meaning that part of the solution is data analytics/number crunching/cognitive computing in the cloud)

- Address security and privacy concerns in the provided IoT system solution

The connected car was presented as an IoT ecosystem example. The IBM Watson Cloud, with over 1700 developers, was given as an example of IoT cognitive computing (probably the best cloud solution available in this author’s opinion). For more information on Watson: http://www.ibm.com/smarterplanet/us/en/ibmwatson/ecosystem.html

Summary and Conclusions:

What really matters (reiterated):

- Focus with domain knowledge as driver of value. Concentrate on long term growth, revenues and profits.

- Offer an Integrated solution: collect, analyze, optimize data.

- Build an ecosystem with mentoring, capital and global scale.

Bottom line:

To succeed in the IoT marketplace a company must provide an integrated solution (likely with one or more partner companies) that collects, analyzes, and optimizes unstructured data from “things.” Then design, operate and manage.

From her keynote speech, it’s clear that Sandy Carter recognizes the opportunities available in leveraging the Internet of Things (IoT) for both established corporations (like IBM) and entrepreneurs alike. She also provided valuable insight into what it takes to be successful in this large, emerging market.

TiECon 2014 Summary-Part 3: Highlights of Qualcomm’s Keynote -Proximity’s Role in the Internet of Everything (IoE)

Introduction:

Cloud-based services have already evolved to support the Internet of Everything1 (IoE). But what about use cases in which no roundtrip to a server in the Cloud is called for? What about the “Internet of Things near or close to me”?

Rob Chandhok, SVP of Qualcomm Technologies Inc. and President of Qualcomm Interactive Platforms, discussed IoE use cases for direct peer connection and communication among devices and apps that are physically near the user. Proximal networking, in which the Cloud is accessed only when it makes sense and only by one member of the network, opens up a vast array of new possibilities for developers, entrepreneurs, and brands alike.

Rob is responsible for Qualcomm strategies that address how people can take advantage of and benefit from the Internet of Everything, wearable computing and augmented reality as Qualcomm drives the next level of user experience in a massively interconnected and mobile-centric world.

Note 1. Qualcomm doesn’t seem to distinguish between the Internet of Things (IoT) and the Internet of Everything (IoE) as per this article. Qualcomm states on its IoE web page:

“When smart things everywhere are connected together, we will be able to do more and be more. This is the Internet of Everything (IoE), a paradigm shift that marks a new era of opportunity for everyone, from consumers and businesses to cities and governments….”

“Qualcomm is creating the fabric of IoE for everyone everywhere to enable this Digital Sixth Sense.”

Presentation:

The Internet of Everything (IoE) is already here and it will get a whole lot bigger. There’s been a massive surge in connected things that’s already begun. Gartner Group (and others) have forecast 25B permanently connected things by 2020. Over half of those connected devices will be non-handsets, such as lights, speakers, security cameras, plug-in electric vehicles, and various types of home/industrial appliances.

There’ll be new connections, new device capabilities and enhanced user experiences. That translates into awareness (capturing data about you and your environment), connectivity (exchanging information to/from the cloud), and interactivity (relevant, seamless information and control). Physical layer protocols (e.g. WiFi, Zigbee, Blue Tooth, 3G/4G) for wireless connected devices should be able to change without changing the software/firmware in them.

Today, IoE is cloud based and fragmented, with different cloud systems for each type of appliance, e.g. speakers, TV, refrigerators, washing machines, etc. This author believes this has to change if IoE is to realize its potential and be a huge market (or industry vertical markets).

A successful IoT architecture will be more complex than client/server computing. A heterogeneous IoE will bring many challenges, including: discovery, identity, adaptation, manage, interoperate, exchange information and services, security, and privacy. Let’s take identity as an example. It includes such capabilities as determing what servers are nearby, what interfaces and APIs are available for the devices along with other attributes. Security involves eliminating attacks and thwarting bad actors from the public Internet.

IoE “near me,” is a dynamic subset of the IoE that involves proximity. Towards that end, an open source software platform called AllJoyn, https://www.alljoyn.org/ was created to provide a meaningful interaction between smart things via a common language. AllJoyn was initially developed by Qualcomm Innovation Center, Inc. and is now a collaborative open source project of the AllSeen Alliance, It gives manufacturers and developers the tools they need to invent new ways for smart things to work together.

AllJoyn was said to facilitate and/or provide: an open connectivity framework over both wireless and wire-line networks, interoperability between connected devices/things, core services as basic building blocks, and an ecosystem that addresses many vertical industry use cases.

Web APIs offer developers access to web service capabilities -from virtual objects to physical things. AllJoyn APIs give developers access to the capabilities of smart devices/things. They are also building blocks to access system resources. An objective is to make AllJoyn the lingua franca of the IoE, analagous to the role of HTTP for the world wide web.

Going forward, innovation will be crticially important for the IoE and “Proximal Networking.” It’s a “green field rich in opportunity for entrepreneurs with vision,” according to Rob.

References:

What it is: https://www.alljoyn.org/about

Documentation and guides – https://allseenalliance.org/developerresources/alljoyn/docsdownloads

General Info and FAQs – https://allseenallianceorg/developer resources/faqs

AllJoyn SDKs – https://www.alljoyn.org/docs-and-downloads

An AllJoyn tutorial is available once a developer establishes an on line account at: https://www.alljoyn.org/user/register

Post-TiECON Research – Basics of AllJoyn:

Every AllJoyn application requires a BusAttachment to attach to the Bus in order to advertise, discover, and communicate with other applications. The BusAttachment is the gateway (between a developer’s application and other applications) that handles all of the lower-level networking stacks. It provides a basis for several processes one develop in their application.

Most applications will have only one BusAttachment in which they use to interact with the AllJoyn API calls.

Other processes that every AllJoyn application must follow include:

•Advertise and/or Discovery

•Create a bus interface and bus object

•Create and join sessions

•Interact over the interface

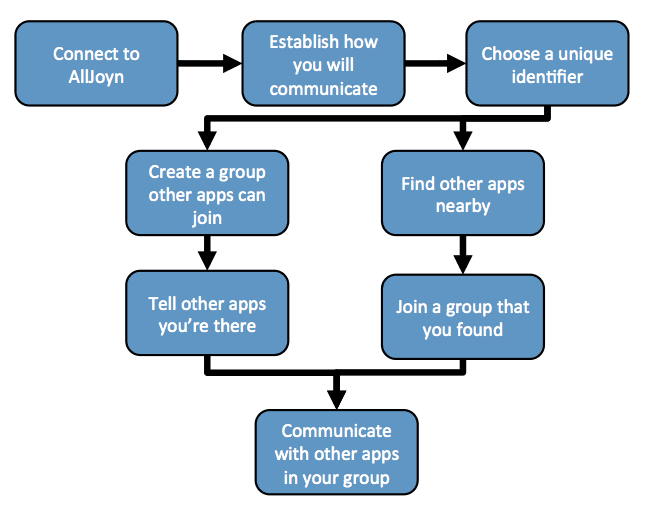

AllJoyn application process

Figure 1 below illustrates the workflow process to build an AllJoyn application. The first three steps form the basis for the remaining steps in the process

Figure 1. AllJoyn application workflow

TiECon 2014 Summary-Part 2: Highlights of Industrial IoT Infrastructure Session

Introduction:

In this second article on TiECon 2014, we examine the key issues, technologies, standards and technical challenges for the Industrial Internet and related Industrial Internet of Things (IoT) as discussed in the Infrastructure for IoT panel session. Note that the IoT is referred to as IoE by Cisco and also by Qualcomm.

Infrastructure for (Industrial) IoT Session Abstract:

The key components required for the Industrial IoT were detailed in this panel session. Many questions were raised:

- Should all data be sent from devices to the cloud or is some form of intelligent decision making needed at the network edge?

- What Physical layer interfaces are needed in IoT devices? Note that there are many physical media types, from various types of Ethernet on shielded and unshielded twisted pair to IEEE 802.11 WiFi, IEEE 802.15.4 Zigbee, Z-Wave and EnOcean. Will this “alphabet soup” of acronyms be dwindled down to a few Physical layer interfaces that most IoT endpoints will support?

- Similarly, there are many services layers, from various flavors of ZigBee profiles, to legacy industrial protocols like LonWorks, BacNet, SCADA, DALI and many more. And there are many management platforms in the works.

- What’s needed for IoT security?

- Given the diversity in the technical ecosystem, do we need to get to a common set of Industrial Internet standards, or is that not possible?

Moderator: Paul R. Teich, Moor Insights & Strategy

Panelists:

- Carl Stjernfeldt, Shell Technology Ventures

- Joseph J. Salvo, Complex Systems Engineering Laboratory at GE Global Research

- Nate D’Anna, Cisco Systems

A few introductory remarks worth noting:

- Shell is using the IoT in oil drilling operations where “last mile” connectivity in the ocean is quite challenging – 9K feet under the surface of the ocean.

- GE is buliding out an “Industrial Internet,” which is a virtual network overlay on a physical network.

- A consortium of companies (AT&T, Cisco, GE, IBM and Intel) was launched in late March 2014 to foster interoperability in the Industrial Internet. Goals are to identify requirements for open interoperability standards and define common architectures to connect smart devices, machines, people, processes and data.

- Cisco has a $100M venture fund to invest in the IoE and move it forward.

- There’s a huge need to get real time data from a variety of complex industrial sub-systems (e.g. a jet engine) via satellite, microwave, fiber optic long haul or short range WiFi/Zigbee wireless networks.

- Trade-off between bandwidth vs reliability is very important for the Industrial Internet and ruggedized IoT applications.

Several important questions need to be addressed for the Industrial IoT:

- There’s a lot of IoT data collected for compute/storage. How much is actually needed and how should data decision making be made so that not all data collected is sent from industrial premises to the cloud?

- Where do IoT standards take over from customized, vendor specific solutions?

- How will minds and machines be connected in the Industrial Internet?

Here are the panelists opinions on these and related issues.

Each layer of the protocol stack will need flexibility to accomodate measuring, monitoring, analytics, automated decision making in the field, and other tasks.

Shell colects a tremendous amount of data in the field, but uses “intelligent pushback” to get large amounts of that data processed, analyzed with the results coveyed to a decision maker in the field (presumably, a human operator).

GE sees a strong trend of “data commoditization and lower level knowledge.” Today, everyone has access to lots of data and information. Future market and technical differentiation will be centered around decision making, learning what data to forget/discard and what to retain/remember.

Managing the onslaught of incoming real time data (monitoring status, alarms and measurements) will be critical in the industrial world. Smarter and faster edge devices that monitor complex real time systems and make decisions what data to retain and what to push back (to the cloud/data center) for number crunching.

Cisco sees a huge industrial customer demand for collecting large amounts of data. They believe decision making is needed at the network edge – to only send relevant data to the cloud for processing. “Make decisions locally, by smart devices at the edge of the network,” said Cisco’s Nate D’Anna.

GE sees the context of data becoming more important than the data itself, said Joseph Salvo of GE’s Complex Systems Engineering Laboratory. There’s a need for data storage centers to only retain relevant data from connected devices with most of it discarded at the network edge. This seems identical to Cisco’s view expressed above.

Mr. Salvo sees a hyper-connected world with a changing role for computation and big data. Analyzing vast amounts of data, predicting and changing system performance are the key attributes of this new computational model. “We are at an inflection point. The next wave of productivity will connect brilliant machines and people,” he said.

Security is certainly a critical issue. It must take into account the hardware, software, network, devices/components as well as the human factor, according to Salvo. It must recognize the context of what’s happening in the industrial systems being monitored/controlled. Note: No security standards, methods or procedures were identified.

Standards help market adoption as they facilitate interoperability, mass production and lower costs. However, there are a plethora of wireless and wire-line connectivity standards which might have to be supported for different IoT market segments. This may create a “matrix of pain,” said one panelist. It could be that IP (Network Layer protocol) will be the lowest common denominator that all Internet connected “things” support. Speaking for GE, Salvo said: “The Industrial Internet wants interoperability (over vendor specific solutions). Like USB I/O devices that auto-configure and work.” Joe suggested that the (Industrial Internet) market will determine the best standards.

Surprisingly, there was no discussion of the need for a robust network (for the Industrial Internet/IoT) with lightening speed fault isolation and failure recovery. Something that the public Internet often doesn’t provide.

GE’s Jeff Immelt: GE believes that the Industrial IoT will accelerate the push towards Big Data. “Industrial data is not only big, it’s the most critical and complex type of big data,” said Jeff Immelt, GE Chairman and CEO. “Observing, predicting and changing performance is how the Industrial Internet will help airlines, railroads and power plants operate at peak efficiency.”

Note on Future TiECon 2014 articles:

Two TiECON IoT keynotes will be summarized in future articles are Proximity’s Role in the Internet of Everything (IoE) by Qualcomm and What Really Matters for IoT by IBM.

TiECon 2014 Summary-Part 1: Qualcomm Keynote & IoT Track Overview

Introduction:

This is the first in a multi-part article series on TiECon 2014 – the two day annual conference of The Indus Entrepreneurs (TiE). We summarize the Qualcomm keynote in this blog post and touch on the Internet of Things (IoT) track.

With 4,200 attendees, this year’s TiECON was the largest of all time. That’s a testimonial to the superb organization and planning, which produced excellent content on a variety of topics and subject areas that were of interest to technologists, entrepreneurs and private investors. The top notch technical sessions included: keynotes, panel discussions, lightening rounds with start-ups, and break-through thinker presentations.

This author has covered TiECon for the last several years along with TiE-Silicon Valley (SV) events of interest to IEEE ComSoc readers. TiE-SV and IEEE ComSocSCV have had a strategic partnership since 2010. In Sept 2013, they held a well attended joint workshop – Quantified Self: The next frontier in mobile self-tracking .

Qualcomm CEO Steve Mollenkopf’s Opening Keynote:

The opening TiECon keynote was a fireside chat with Qualcomm CEO Steve Mollenkopf, who was introduced by Anand Chandrasekher, Sr. Vice President at the same company. The conversation was moderated by Mohan Gyani -now a private investor, but previously President and CEO of AT&T Wireless Mobility Services. The format was a Q &A type of “conversation.”

A 20 year Qualcomm veteran, Mr. Mollenkopf provides executive oversight to current and future technology development activities, further strengthening the company’s ability to successfully navigate an increasingly complex and competitive market for wireless infrastructure components and software. He also serves as a member of Qualcomm’s executive committee, helping to drive Qualcomm’s overall global strategy.

What is Qualcomm? “We are a technology company company that invests in core technology that’s needed for big changes in the (IT) industry. We try to be fairly flexible in the way in which we go to market, always through partners,” he said. Technology licensing (#1) and chipsets (# 2) are the Qualcomm deliverables which generate revenues and profits for the company.

Here are a few of Mollenkopf important points, observations and opinions:

- Scale is very important when pursuing innovation. Qualcomm’s scale (of operations and R&D investment) enables the company to pursue new areas of opportunity that smaller companies couldn’t afford to undertake.

- Corporate culture is the most strategic asset. It gets you through periods of uncertainty.

- Need to preserve a spirit of innovation which includes being nimble (i.e. quick to change direction/iterate) and learning from one’s mistakes.

- Qualcomm tends to focus on a small number of eco-system customers, but the company has a large partner base.

- Qualcomm likes to partner1 with other companies, because they can’t cover all aspects of the many technologies that are now coming together in the wireless/mobility marketplace.

- Qualcomm wants technology to move forward, rather than stagnate.

- Advice for entrepreneurs: embrace the uncertainty of not knowing what’s next; keep sights high; pay attention to new technologies; innovate; make changes along the way to be successful

1. Post TiECON quote for clarification: “We work in a particular space that requires a lot of focus, so we have a very concentrated customer base, but we have an enormous partner base. So our direct customers are really much smaller than a lot of other companies in terms of raw numbers, but we deal with a lot of ecosystem players and we try to be the behind-the-scenes partner for technology.”

Is technological change coming too fast? “There’s a gap between what people envision and what they can deliver. There is so much more we can do with (wireless) networks, e.g. a sea of sensors.”

How does the cloud effect Qualcomm? “For quite some time, (desirable and effective) cloud based services have been needed to be successful in the smart phone business. The portfolio of cloud services has driven smart phone growth. Many mobile device components were needed for that: graphics, wireless connectivity/radios, CPU core, multi-media/video, etc.”

What about the future? “Wireless networks will need to be able to move huge amounts of data through networks and this will be a huge opportunity for Qualcomm. We have to take advantage of that.”

“Future cloud services will need more wireless bandwidth to and from mobile devices and connected sensors. At the (wireless) network edge, a decision must be made as to how much data to send back to cloud servers,” Steve added. Note that this needed intelligence for decision making at the network edge was touched upon in future sessions and is not trivial.

Mollenkopf positioned Qualcomm as a company that “provides technology for (partner) companies to succeed without making a large investment (in wireless infrastructure). Qualcomm technology scales to a large number of developers.” And that will produce a huge amount of wireless devices. “We want to get services enabled on 200M (mobile) devices per quarter,” Steve added. Summing up Mollenkopf said, “As technology gets integrated into mobile devices there will be more of a need for Qualcomm chip sets.”

Steve said that mid to lower tier smart phones will produce future growth for the smart phone market. The high end is still growing, but it’s growth rate is not as high as it was.

Note: IDC forecasts that high end smartphone growth will be in single digits by 2017, while #1 maker Samsung has lowered its internal smart phone sales forecast for 2014.

Mollenkopf: “Qualcomm is getting the cost structure right for these lower priced smart phones2. A lot of the Intellectual Property (IP) for high end smart phones trickles down to the mid and lower end.”

2. Post TiECON quote for clarification: “We’ve been actually very successful in driving mid-tier and low-tier. Part of our business strategy is to see the transition of 2G networks onto 3G and onto 4G. And part of that is getting the cost structure right. So we’ve been, I think, fairly successful in doing that. If you look at our numbers, I think we’re actually adding customers in that area, which is good. Now if you look at the growth of the high-end segments, relative to what it was let’s say a couple of years ago, the growth rate is not as high and it’s also – it is still growing. And technology tends to be very, very important.”

Mohan Gyani in conversation with Qualcomm CEO Steve Mollenkopf at TiECON 2014

A huge gap exists between the amount of data people want to get on their mobile devices and what can be delivered (and stored) economically. Lots of innovation in wireless networks and services will be needed to enable the network to get much of that data moved back and forth (between the network and the device). Innovation at the business model level will also be important here, Steve said. Pricing of services and data by network operators is such an example.

Steve stated that the Internet of Things (IoT) was an extension of Qualcomm’s existing business as it requires both mobile connectivity and wireless LANs (e.g. WiFi, Zigbee, etc). Note that Qualcomm now owns Atheros Communications- a leading WiFi chip maker.

“Qualcomm is building a portfolio of products to enable the Internet of Everything (IoE),” Steve said. “Scale is very important to deliver on the very large surface area that will exist for the IoE/IoT,” he added.

What about “wearables?” “Health monitoring and wireless healthcare in general is a great, but different opportunity for Qualcomm. What’s needed is for the health care industry to fully embrace innovation in the IT industry. The supply chain for wearables is an opportunity.”

In closing, Mollenkopf said what every entrepreneur is told many times, “We need to make mistakes and (quickly) learn from failures.”

Internet of Things (IoT) Track Overview:

The major IoT trends and the disruptive opportunities which they may create were comprehensively covered during the no-nonsense, commercial free, IoT technical sessions on Friday, May 16th. We attended the IoT track, because that area has tremendous potential for use of various communications technologies- both wireless and wireline. It is likely to be adopted by many industry verticals (i.e. market segments). The areas that will be most impacted by IoT include: startup innovation, consumer value and enjoyment, societal benefit, entrepreneurial companies, established device and network vendors, and network/cloud service providers.

Note: Cisco and Qualcomm refer to IoT as the Internet of Everything or IoE.

McKinsey Global Institute’s Disruptive Technologies report calls out the Internet of Things (IoT) as a top disruptive technology trend that will have an impact of as much as $6 Trillion on the world economy by 2025 with 50 billion connected devices! Many are predicting 20 or 25 billion connected devices by 2020.

For sure, IoT will be a huge market, but not monolithic. Each vertical industry will have its own opportunities and challenges. Lack of industry standards, security (business), and privacy (consumer) are the biggest obstacles for IoT to overcome and be successful. These issues must be resolved for IoT to reach it’s promise and potential.

At Cisco Live annual conference, CEO John Chambers said the Internet of Everything (IoE) has changed the way the world looks at data and technology. “The simple concept, as you move forward with IoE, is that you have to get the right information at the right time to the right device to the right person to make the right decision. It sounds simple, but it is very, very difficult to do, and is almost impossible to do …….”

The IoT related sessions at TiECON 2014 included the following:

- Road Through the Cloud to the Internet of Things

- Lightning Round I (of start-up companies)

- IoT Overview

- Infrastructure of IoT

- Connected Things

- Bridging the old with the new

- Proximity’s Role in the Internet of Everything

- Lightning Round II (of start-up companies)

- IoT for the Masses

- Connected Health Comes Alive

- IoT in Business

- The Future of IoT

- The Internet of Things: What Really Matters

- Where are VCs Investing in IoT?

More information on the TiECON 2014 IoT track is at: http://tiecon.org/internet-of-things

Time and space constraints necessitates coverage of only a select few of the above IoT sessions. We’ve picked the one’s that provided new, pertinent information on relevant technologies, markets and barriers to success. They will be covered in part II, which will be posted in a few days.

In the meantime, please comment in the box below the article to express your preferences and/or opinions. Log in with your IEEE web account.

AT&T to Buy DirecTV for $49 Billion, but deal may depend on NFL Sunday Ticket renewal

As rumored for several months, AT&T Inc.agreed to buy satellite TV provider DirecTV for $48.5 billion, or $95 per share. Both companies described the deal as transformational as they seek to take on cable companies and online video providers, delivering content to multiple screens —on living room TVs, PCs, tablets and mobile phones. The takeover was most likely stimulated by Comcast’s pending merger with Time Warner Cable which was proposed in February. AT&T and DirecTV expect the deal to close within 12 months.

With 5.7 million U-verse TV customers and 20.3 million DirecTV customers in the U.S., the combined AT&T-DirecTV entity would serve 26 million customers. That would make it the second-largest pay TV operator behind a combined Comcast-Time Warner Cable, which would serve 30 million subscribers.

“What it does is it gives us the pieces to fulfill a vision we’ve had for a couple of years – the ability to take premium content and deliver it across multiple points: your smartphone, tablet, television or laptop,” AT&T’s Chairman and CEO Randall Stephenson said on a conference call with journalists on May 18th.

However, the proposed acquisition could face unique regulatory scrutiny from the Federal Communications Commission (FCC) and Department of Justice. Unlike the cable company merger, the AT&T-DirecTV deal would effectively cut the number of video providers from four to three for about 25 percent of U.S. households. That’s a situation that could result in higher prices for consumers and usually gives regulators cause for concern.

Stephenson said those concerns would be addressed with a number of what he called “unprecedented” commitments. Among them:

– DirecTV would continue to be offered as a standalone service for three years after the deal’s closing.

– AT&T would offer standalone broadband service for at least three years after closing, so consumers could consume video from Netflix and other online services, with download speeds of at least 6 megabits per second where feasible.

– AT&T would expand high-speed broadband access to 15 million more homes – beyond the 70 million that could now get AT&T service – within four years.

– AT&T vowed to abide by the open Internet order from 2010 that the Federal Communications Commission is now in the process of revising after a court struck it down.

– AT&T vowed to sell its roughly 9 percent stake in Latin American wireless carrier América Móvil for about $5 billion.

“This is going to prove to be a pro-competitive and pro-consumer transaction,” Stephenson said.

The announcement also explicitly emphasizes that the new partners are committed to net neutrality despite all the recent FCC happenings. The two companies will demonstrate “continued commitment for three years after closing to the FCC’s Open Internet protections established in 2010, irrespective of whether the FCC re-establishes such protections for other industry participants following the DC Circuit Court of Appeals vacating those rules.” (These are the rules that were recently struck down and only impact Comcast at the moment due to that company’s previous merger with NBCU.)

Stephenson and DirecTV CEO Michael White both said the merger would allow the combined company to offer video over multiple screens, but acknowledged that deals with content providers to expand service on multiple platforms still need to be negotiated.

AT&T can walk away from this merger if DirecTV isn’t able to renew its prize “Sunday Ticket” offering with the National Football League (NFL) on “substantially…the terms discussed between the parties,” AT&T said in a filing with the Securities and Exchange Commission. DirecTV’s current deal with the NFL expires at the end of the 2014 football season. AT&T said it wouldn’t be able to seek damages if DirecTV fails to renew the deal “so long as DirecTV used its reasonable best efforts to obtain such renewal.”

On a call with analysts Monday morning (May 19th), DirecTV Chief Executive Mike White reiterated that he is “highly confident” DirecTV can renew the deal “before the end of the year.” He noted that both he and AT&T CEO Randall Stephenson met with NFL Commissioner Roger Goodell and New England Patriots owner Robert Kraft to convey “why this transaction is great for the NFL…as well as great for us.”

The proposed merger/acquisition/deal is Mr. Stephenson’s biggest bet so far and is AT&T’s largest acquisition since its 2006 purchase of BellSouth for $85 billion. Mr. Stephenson became CEO in 2007 after his predecessor, Ed Whitacre, took a regional phone company and turned it into a national giant- in effect re-creating the Bell System and negating its divestiture.

As part of the deal, AT&T plans to sell its long-held $6 billion stake in Latin American phone giant America Movil SAB to avoid regulatory conflicts.

Assessment:

Growth is slowing in some markets, like pay TV and wireless subscriptions, and is exploding in others, like streaming video. Last year, pay TV subscribers in the U.S. fell for the first time, dipping 0.1 percent to 94.6 million, according to Leichtman Research Group.

While AT&T and DirecTV are doing better than cable companies at attracting TV subscribers, DirecTV’s growth in the U.S. has stalled while AT&T is growing the fastest of any TV provider. The companies are betting that bigger scale will give them the resources to invest in new capabilities and the leverage to create commercial arrangements in the media world.

AT&T, which has 5.7 million subscribers for its U-Verse TV service, will become a more powerful force in pay TV by joining with the larger DirecTV. Theoretically, as a bigger provider, a combined AT&T – DirecTV could get better rates from companies that license TV programming.

Many Wall Street analysts have questioned whether DirecTV has significant strategic value to AT&T, especially as U.S. wireless competition has picked up with the resurgence of T-Mobile and SoftBank Corp.’s acquisition of Sprint Corp. last year. DirecTV offers neither fixed-line or mobile Internet service, and its rights to airwave frequencies for satellite TV are not the kind that AT&T can use to improve its mobile phone network. Still, Mr. Stephenson has talked exuberantly about how the growth of online video helps boost demand for its Internet and mobile services.

AT&T has started approaching media companies about a potential “over the top” Web video service that would run on wireless broadband connections and serve up TV programming, people familiar with the matter said. Last month, AT&T entered a joint venture with the Chernin Group (media mogul Peter Chernin) to invest in online video services. The company said it is weighing a number of online-video options, including launching niche services or premium on line video streaming products like Netflix offers. In particular, the acquisition raises the prospect that AT&T customers might someday be able to watch TV program episodes or football games over a fast cellular broadband connection without subscribing to a traditional pay-TV service. But developing such offerings may be difficult. Nothing is likely to change in the short term for AT&T or DirecTV customers.

Other Opinions:

John Bergmayer, senior staff attorney with advocacy group Public Knowledge, warned that AT&T will need to demonstrate that new services would offset any harm to the wireless and video markets.

“The industry needs more competition, not more mergers,” he said. “The burden is on AT&T and DirecTV to show otherwise.”

“It just doesn’t make sense to me,” said New Street Research analyst Jonathan Chaplin, who asserts that AT&T would be better off buying Dish Network because of that company’s wireless-spectrum holdings.

Blair Levin, former chief of staff at the Federal Communications Commission and author of its road map for expanding Internet access, said it’s not immediately clear how the deal would impact consumers. While the deal could be perceived as eliminating a competitor in 25% of the country and result in higher prices, DirecTV is a national service and therefore prices may stay in check due to competition in other markets. AT&T will also be able to package wireless-phone service with home-TV subscriptions, which could result in better deals. Mr. Levin said AT&T’s acquisition of DirecTV was likely a response to Comcast’s Time Warner deal.

“Sometimes, deals are driven by hope and opportunity and sometimes they’re driven by fear and locking down customer bases,” Mr. Levin said.

Global optical spending down y-o-y, but up 8% for WDM; 100G takes off in Core+ PON Market report

OPTICAL MARKET HIGHLIGHTS:

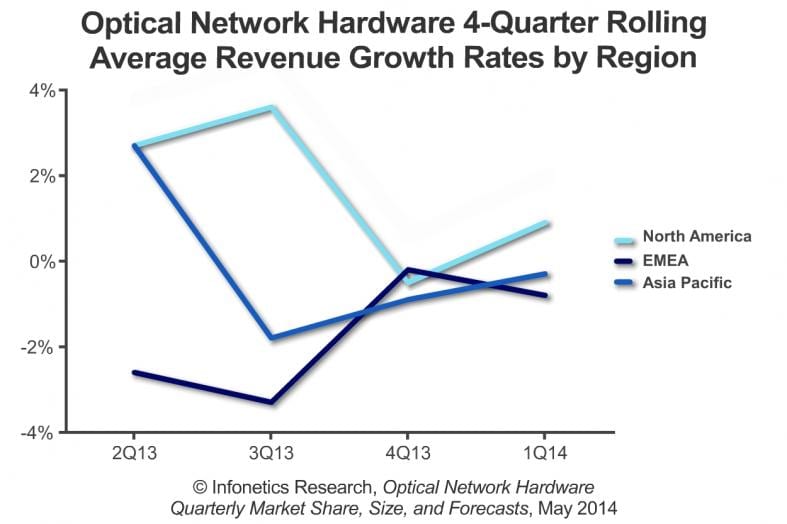

. Global optical spending is down yet again as legacy SONET/SDH continues to slide: Optical network hardware revenue, including WDM and SONET/SDH, declined 2% year-over-year in 1Q14

o On a rolling 4-quarter basis, total optical spending was roughly flat

. The WDM segment notched its 7th straight quarter of year-over-year growth, up 8%

. EMEA experienced a seasonal 4Q to 1Q drop, but this effect is no longer evident in the U.S., a result of large carriers changing spending patterns and smaller carriers operating on a more project-oriented, rather than calendar-oriented, purchasing cycle

. On a year-over-year basis for 1Q14, Huawei’s revenue market share slipped, Ciena’s soared 26%, and Alcatel-Lucent’s lifted 8%

ABOUT THE OPTICAL REPORT:

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, forecasts through 2018, analysis, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/POS ports, and WDM ports. Vendors tracked: Adtran, Adva, Alcatel-Lucent, Ciena, Cisco, Coriant, Cyan, ECI, Fujitsu, Huawei, Infinera, NEC, Padtec, Transmode, Tyco Telecom, ZTE, and others.

. Networking ports hit $39 billion; 40G booming in the data center, 100G taking off in the core

. Infinera, Fujitsu, Cisco, Ciena, and Huawei top new optical networking vendor scorecard

. OTN switching is booming; Alcatel-Lucent, Ciena, and Infinera cashing in

. Optical gear spending flat in 4Q13 as North America sags and EMEA surges

“And this revenue is flowing primarily into the hands of five companies: Alcatel-Lucent, Ciena, Cisco, Huawei, and Infinera,” adds Schmitt.

RECENT OPTICAL RESEARCH from Infonetics:

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at http://www.infonetics.com/login.

. Analyst Note: Post-OFC Analysis-Equipment (Apr.)

. Analyst Note: Ericsson-Ciena Deal: P-OTS, SDN & 100G for Routers (Apr.)

. Analyst Note: 100G Market Update-4x Growth in 2013 (Apr.)

. ROADM Components Market Size & Forecasts (May)

. Packet-Optical, MPLS & Control Plane Strategies: Global Service Provider Survey (May)

INFONETICS WEBINARS:

Visit https://www.infonetics.com/infonetics-events to register for upcoming webinars, view recent webinars on demand, or learn about sponsoring a webinar.

. The Role of Service Delivery Platforms in M2M and IoT (May 20: Attend)

. Unlocking Revenues with Carrier Ethernet 2.0 Wholesale E-Access (May 29: Attend)

. How to Get the Best Out of DAS, Small Cells, and WiFi (June 5: Attend)

. Diameter Signaling Control for LTE Networks (June 12: Attend)

. The Roadmap for ROADM Network Expansion (View on-demand)

. 100G in the Metro: When and Where It Will Be Economical (View on-demand)

. Coherent Optics: Cheaper, Better, Faster (July 24: Sponsor)

TO BUY REPORTS, CONTACT:

- N. America (West), Asia Pacific: Larry Howard, [email protected], +1 408-583-3335

- N. America (East, Midwest), L. America: Scott Coyne, [email protected], +1 408-583-3395

- EMEA, India, Singapore: George Stojsavljevic, [email protected], +44 755-488-1623

- Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

Research and Markets released a related optical networking report today:

Passive Optical Network (PON) Equipment Market – Global Industry Analysis, Size, Share, Growth, Trends And Forecast, 2013 – 2019

Passive optical network (PON) is a point to multipoint telecommunication network. PON is a fiber to home/premises (FFTH/FFTP) architecture which serves multi premises through unpowered optical splitters and a single optical fiber. Optical fiber splitters do not require electricity for signal transmission, which makes it an energy saving technology. The split ratio depends on the structure of the PON used, such as Gigabyte passive optical network (GPON) and Ethernet passive optical network (EPON) among others.

Major market participants profiled in this report include Huawei Technologies Comp. Ltd., Alcatel-Lucent S.A., Calix Inc., ZTE Corp. and Tellabs Inc. among others.

http://www.researchandmarkets.com/research/5h62hk/passive_optical

Sputtering Earnings at Alcatel-Lucent Reflect a Difficult Network Infrastructure Market

Slowing demand for wireless infrastructure products took a toll on first-quarter revenue at Alcatel-Lucent (ALU), but executives remain optimistic that company will regain its footing after a temporary lull — which they also attributed to a companywide restructuring. The company posted a €73 million loss in the first three months of the year, compared with a €353 million loss in the same period in 2013. ALU benefited from continuing cost-cutting, which is expected to total €1 billion by the end of next year. Alcatel-Lucent is undergoing a major restructuring that includes cutting an estimated 10,000 jobs worldwide.

Commenting on the earnings report, ALU CEO Michel Combes said:

“We began 2014 as we ended 2013 — totally focused on driving implementation of The Shift Plan. Having put the Group in the right financial direction last year we are encouraged by the continued progress shown in the first quarter of 2014. This confirms the industrial logic of the strategic choices we have made and provides a good start on which to build during the rest of 2014 as we work towards our objective of bringing the Group as a whole back to positive free cash flow by 2015.”

ALU may have overextended itself by “trying to do too many things,” it will establish a solid competitive foundation by redoubling its efforts in technologies such as ultra-broadband access, virtualization and the cloud.

The company said that “traction around our IP mobile packet core solutions” is particularly strong, and that the 7950 XRS IP Core router attracted four new deals during the quarter, including contracts with cable operators, one of the target markets identified by the CEO.

ALU claims they’ve sustained their strong position in IP edge routing (#2 ranking). Further expansion in IP core, Enhanced Packet Core (EPC) for LTE and data centers took place in 2013. The IP router division (with the above three components) has attained double digit growth the last three years.

Mt View, CA based Nuage Networks- a wholly owned ALU subsidiary- is part of their IP router division. Nuage had three customer wins in 2013 and is involved in 20+ trials. From the earnings call transcripti: “Our Nuage venture kept up momentum and added two new commercial wins during the quarter, including the recently announced Numergy, which brings the total to date to five.”

In the transport equipment business, the network equipment vendor noted that “terrestrial optics recorded its first quarter of year-over-year growth since 2011,” driven by 26 new deals for the 1830 Photonic Service Switch (PSS), while 100G shipments represented 30% of total WDM line cards shipments in the quarter, compared with 19% a year ago. Alcatel-Lucent is also engaged in two new 400G OTN trials, with Ontario Research and Innovation Optical Network (ORION) and Telekom Austria AG (NYSE: TKA; Vienna: TKA).

IP Platforms, which includes the company’s Network Function Virtualization (NFV) and cloud systems, recorded an increase in revenues from IMS (VoLTE), SDM (Subscriber Data Management) and Customer Experience (Motive) systems, but revenues were down due to declining sales of legacy platforms and “portfolio rationalization.”

In the Access business, Alcatel-Lucent says 4G/LTE revenues improved, driven by sales in the US, but 2G and 3G (which combined represent less than 25% of wireless access sales) were down. In fixed access, FTTX and VDSL2 sales are improving, and discussions with operators about the potential of G.fast (vectored DSL) have begun. A decline in legacy system sales countered those gains, though. (SeeTelekom Austria Tests G.fast.)

One of the most important events for Alcatel-Lucent during the first quarter was that it received a binding offer from China Huaxin for 85 percent of its Enterprise business unit, which makes IP telephony and Ethernet switching equipment. The deal values the unit at a!268 million, and is expected to close during the third quarter, Alcatel-Lucent said.

IP routing was the best-performing product category. Revenue from fixed access, wireless access and IP transport products also increased, while managed services struggled. The best-performing region was Asia Pacific, where sales grew by 19 percent, while sales in all other regions dropped.

On May 8th, Japanese wireless network operator NTT DoCoMo announced that Alcatel-Lucent was one of six vendors with which it will conduct experimental trials of emerging “5G” technologies (which have not been standardized yet). NTT doesn’t expect to have a 5G cellular system ready for commercial deployment until 2020, but it’s important for Alcatel-Lucent to get a foot in to secure its long-term prospects.

Alcatel-Lucent wasn’t the only networking equipment vendor that saw its quarter-on-quarter results worsen. It is suffering from the same malaise as other network infrastructure vendors, according to Mark Newman, chief research officer at Informa Telecoms & Media. Investments in wireless networks have trailed off, and because Alcatel-Lucent is in the middle of a reorganization it is more vulnerable than some competitors, Newman said.

Telecom infrastructure companies like ALU as well as Ericsson and Nokia (formerly Nokia-Siemens) are facing competition from fast-growing Chinese rivals like Huawei and ZTE. Those and other Chinese rivals are competing for lucrative contracts, particularly in emerging markets in Latin America and Asia. Network equipment vendors also are struggling to persuade many of their customers, which are primarily the world’s cellphone operators, to buy new networking equipment and increase the sector’s already large debt burden. It is not a pretty picture.

“We expect Alcatel-Lucent to show further improvement in profitability through the course of the year,” analysts at Liberum Capital in London told investors in a research note on Friday, May 9th.

References:

http://www.alcatel-lucent.com/investors/financial-results/q1-2014

http://www1.alcatel-lucent.com/4q2013/pdf/Q4-2013-master-earnings-slides-Feb06-web.pdf;jsessionid=FZJJNNO11MBORLAWFRSHJHFMCYWGQTNS

Network World/IDG News Service (5/9)

Light Reading (5/9), Light Reading (5/8)