Aryaka state of WAN report

New Findings in Aryaka’s 2022 State of the WAN Report: Cloud Adoption, Hybrid Workplaces, Convergence of Network and Security with SASE

Overview:

Aryaka®, a leader in fully managed Cloud-First WAN solutions, today published its 2022 State of the WAN Report, offering a compendium of insights into global SD-WAN and SASE planning. 1,600 information technology (IT) enterprise decision makers across global enterprises answered the survey, the largest response to the survey since its inception.

Key trends identified in this year’s report include:

- A quarter of the respondents state they have closed 25-50% of their office sites, dovetailing into overall hybrid work initiatives where 75% state that at least a quarter of their employees will remain remote permanently post-pandemic.

- Accelerating digital transformation initiatives also impact legacy data centers, with 51% planning to eliminate their use within the next 24 months as they move to the cloud.

- The surveyed group says Microsoft Teams (58%) and Office 365 (55%) are among the most widely adopted SaaS applications, followed by Zoom and Google Docs (35%).

- A quarter of respondents expect budgets to grow by 25% or more in the next year, with a full three-quarters projecting at least a 10% growth. Investment appears to be accompanied via cost savings.

- A move to simplify, adopting a more cloud-centric and agile approach, is driving convergence. In the context of network and security, trends include the Secure Access Service Edge (SASE), with 64% deploying or planning to deploy over the next year. Over two-thirds will opt for a managed SASE to help address complexity and costs, but challenges include complexity at 40%, a single or dual-vendor approach at 39%, and developing a phased migration strategy at 33%. Observability and control should help with deployments, identified by over two-thirds as a top imperative.

- 29% state that they are already deploying what they consider to be a SASE architecture, with another 56% planning to deploy in the next 12-24 months.

- What capabilities do the respondence require? The top responses are SD-WAN at 34%, a Cloud Secure Web Gateway (SWG) at 30%, and Firewall as a Service (FWaaS) at 17%.

“This year’s Aryaka State of the WAN includes many valuable insights backing up trends we see in the industry. These include the effects of hybrid work, with 75% projecting a quarter of their employees to remain at least part-time remote, and cloud connectivity demands skyrocketing with 51% planning to move away from traditional data centers over the next two years. Both initiatives will require more sophisticated network-as-a-service (NaaS) solutions with integrated security offerings,” said Scott Raynovich founder and chief analyst of Futuriom.

“The sixth edition of the Global State of the WAN (SOTW) is one of the largest such surveys in the world,” said Shashi Kiran, CMO of Aryaka. “It packages an enormous number of insights from decisions makers from all over the world, drawn from CIOs, CISOs as well as network, security and cloud practitioners. The 2022 edition reveals new enterprise trends on workplaces, cloud adoption, convergence and several other areas putting a spotlight on the impact of the Covid-19 pandemic in the process. We hope this resource serves as a handy companion for enterprise architects engaged in planning their WAN, security and cloud infrastructure for years ahead.”

SD-WAN vendors have long touted the technology’s application- and policy-based routing capabilities as the antidote to network performance and complexity. However, customers are increasingly looking for ways to offload that complexity and consolidate services under a single roof. “There’s a fragmented value chain for SD-WAN, which we’ve seen before and now for SASE as well,” Kiran said.

Of those surveyed, 45% said they were considering a consolidated SASE architecture, up from 39% last year. However, enterprises’ desire for managed services doesn’t stop at SD-WAN or SASE. Respondents expressed a desire for managed last-mile and multi-cloud connectivity. “There is inherent complexity in all of these areas and having something that is managed and delivered as a service appears to be important,” Kiran said.

Year-on-Year Trends and Shifting Priorities:

In Aryaka’s 2021 State of the WAN Report, 21% indicated that half of their workforce would be working remote post-pandemic. This year that number increased by 11%, with 32% reporting that at least half of their workforce would be permanently remote.

Collaboration and Productivity suites have gained traction. The Microsoft suite has gained momentum, with Teams identified by respondents as the most deployed application, growing its footprint by over half, from 34% in 2021 to 58% this year. Conversely, Google Docs dropped from 41% last year to 35% today with Microsoft 365 now at 55%.

For China, basic connectivity concerns dropped noticeably from the last report, at 45% in 2021 to 30% today. In contrast, compliance and regulatory issues are now in the lead at 50%.

A renewed interest in ROI was reflected in this year’s report, with 36% of those responding having cost concerns, an increase of 16% compared to last year. Though budgets are expected to increase by 25%, both for networking and security, the focus on ROI implies that these increases must be spent judiciously.

IT professionals were less concerned vs previous years about the newness of the technology (28% vs 31% in 2021), and whether applications will perform properly (29% vs 36% in 2021), speaking to a greater confidence in application support. As change management takes priority, there is an increased focus on observability and control, increasing by 9% (69% vs 60% last year).

Aryaka 6th Annual State of the WAN 2022 – Four Themes:

1. Acceleration of Remote and Hybrid Work: The report looks at challenges in supporting the hybrid workforce, hybrid work trends, and investments planned to support this new environment. 75% state that at least a quarter of their employees will remain hybrid post-pandemic, aligned with the closure of physical facilities, with a quarter stating they have closed 25-50% of their office sites. Effectively managing worker movement between on-premises and remote requires dynamic bandwidth reallocation, identified by 61% as very important.

2. Application Performance and Consumption: In addition, the report dives into the diversity of applications in use and resulting challenges, how enterprises plan to address these, and potential concerns. As noted earlier, collaboration and productivity applications like Microsoft Teams and Office 365 experienced some of the strongest growth, but there was an overall uptick in SaaS application adoption including Zoom (35%), Salesforce (28%), and SAP/HANA (25%). Performance still must improve, with 42% identifying slow performance for remote and mobile users a key issue, followed by 37% calling out slow performance at the branch.

3. Managing Complexity and Managed Services Adoption: The report addresses what managed services enterprises expect, including SD-WAN and SASE implementation plans and budgets, as well as perceived barriers to adoption. This section also looks at MPLS migration. In evaluating managed services, enterprises continue to demand more from their providers, and are looking for a wider set of offers, an all-in-one SD-WAN and SASE that includes the WAN (45%), security (67%), application optimization (40%), last mile management (29%), and multi-cloud connectivity (27%). The movement to SD-WAN and SASE also follows the movement away from MPLS, with 46% planning to terminate some or all contracts over the next year. Enterprises are generally bullish on their budgets, with a quarter expecting it to grow by 25% or more, and a total of three quarters expecting at least 10% growth.

4. Networking and Security Convergence Including a SASE Architecture: SASE represents a promise of a converged Cloud-First architecture, but there are concerns on complexity and adoption. 42% state that lackluster application performance is a time sink, and 34% consider security to be a major priority. This path to SASE adoption includes setting a strategy (35%), phasing out of legacy VPNs (32%), as well as consolidating cloud security with zero-trust (29%).

Top desired capabilities include a SWG (47%), SD-WAN (36%), and FWaaS (28%). Implementation concerns identified earlier are balanced by expected advantages that include time and cost reduction (37%), as well as agility (33%), while decision-making is still mostly distributed across networking and security, 41% state it is now consolidated. Finally, over two-thirds plan to consume SASE as a managed offer.

What are the biggest challenges you’re facing with your WAN?

Total Responses 1,386

- High complexity/difficult to manage or maintain 37%

- Slow access to cloud services & SaaS applications 33%

- Slow performance of on-premises applications 32%

- Long deployment times to bring up new sites 29%

- Lack of adequate security 28%

- Poor voice or video quality 23%

- High cost 20%

- Lack of visibility 20%

*Respondents chose maximum three responses

–>The WAN continues to be a challenge, impacting manageability, performance, security, agility, and cost.

Study Methodology:

The Sixth Annual Global Aryaka 2022 State of the WAN study surveyed over 1600 enterprise decision makers and practitioners including CIOs, CTOs, as well as IT, network, and security managers. Respondents were based in the Americas, EMEA, and APAC, with their companies representing every vertical, led by technology, software, manufacturing, financial, and retail. The survey asked respondents about their networking and performance challenges, priorities, and their plans for 2022 and beyond.

Download the Report:

Download Aryaka’s 6th Annual State of the WAN Report here.

…………………………………………………………………………………………………………………………………………………………………………………………………..

MPLS to SD-WAN Migration (Source: Aryaka):

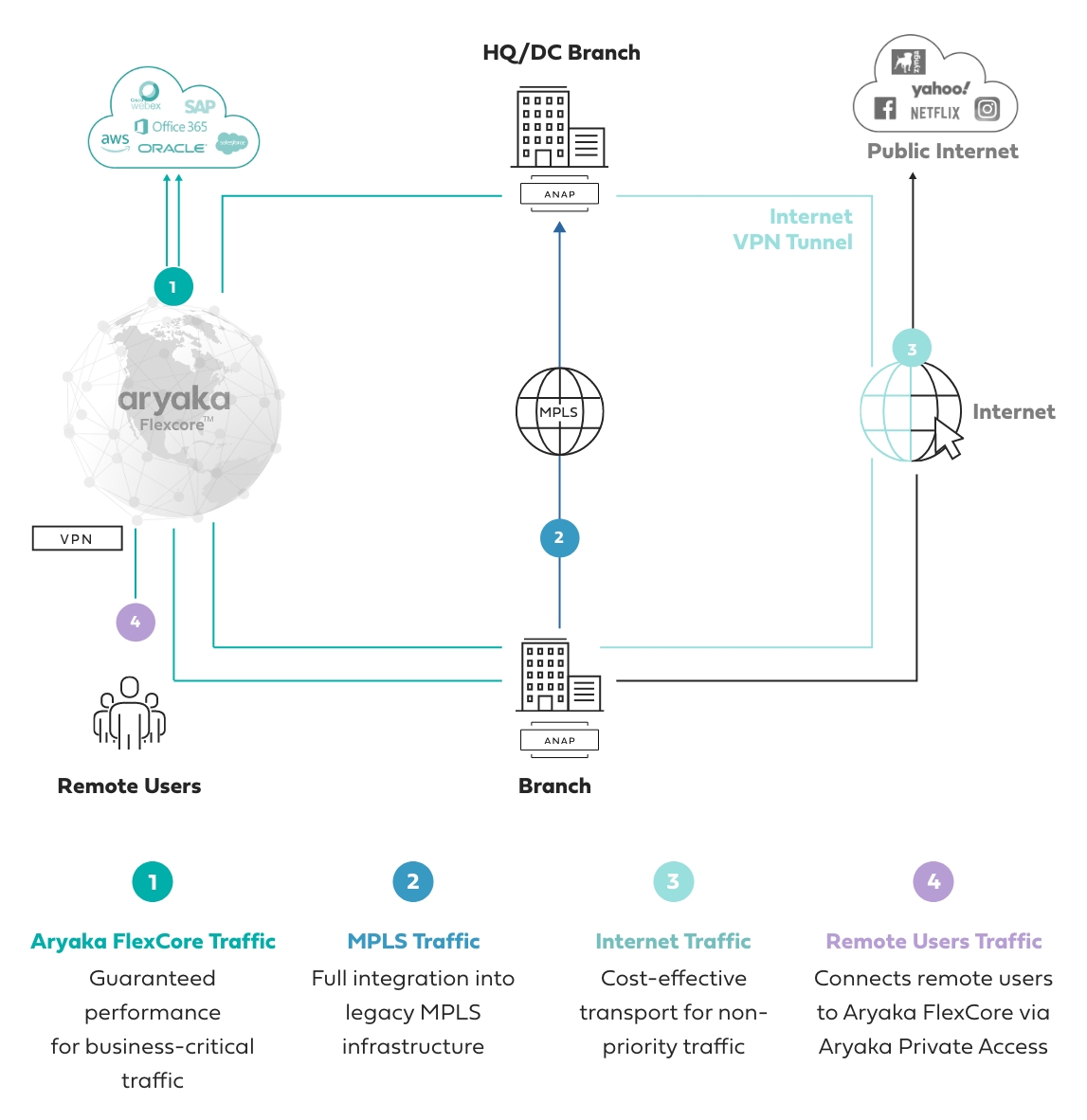

Aryaka’s fully managed SD-WAN and SASE solution leverages a flexible core architecture, FlexCoreTM, optimized for per-site and per-application performance requirements. It offers full per customer resource reservation, end-to-end, at a global level. The HybridWAN solution also leverages direct MPLS and public internet connectivity options.

Aryaka manages the last-mile internet link performance with patented technology to eliminate packet loss and deliver on superior latency and jitter performance. By leveraging a private global L2 network, Aryaka eliminates the issue of guaranteeing deterministic QoS when multiple service provider administrative domains are involved (which is almost always the case in a global network).

Aryaka customers rely on its architecture to deliver on better-than-MPLS performance at a global level and at reduced cost, either augmenting the existing MPLS infrastructure or replacing it altogether over time.

Source: Aryaka

References:

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

Dell’Oro: SD-WAN market grew 45% YoY; Frost & Sullivan: Fortinet wins SD-WAN leadership award