Month: August 2012

Infonetics Research: Microwave equipment mkt to hit $6 billion by 2016; Ericsson recaptures lead from NEC

Editor’s Note: Previous Infonetics Microwave Survey report is detailed here:

Overview:

Infonetics Research just released excerpts from its 2nd quarter 2012 (2Q12) Microwave Equipment vendor market share and forecast. The report analyzes TDM, Ethernet, and dual Ethernet/TDM microwave equipment by spectrum, capacity, form factor, and architecture. Mobile backhaul is clearly the main microwave market driver, especially with data traffic from many more small cells needing to be backhauled to the ISP/service provider point of presence. While nano cells permit spectrum re-use (thereby increasing throughput for a given geographical coverage area) they require more backhaul points and equipment.

In Dell’Oro Group’s recently released market report, the mobile backhaul market, including transport and routers & switches, is forecast to reach $9 billion by 2016. The traditional wireline transport segment of wireless backhaul (microwave, fiber, and copper transport) is predicted to grow at a 2 percent compounded annual growth rate to $6 billion by 2016.

MICROWAVE EQUIPMENT MARKET HIGHLIGHTS (Infonetics Research):

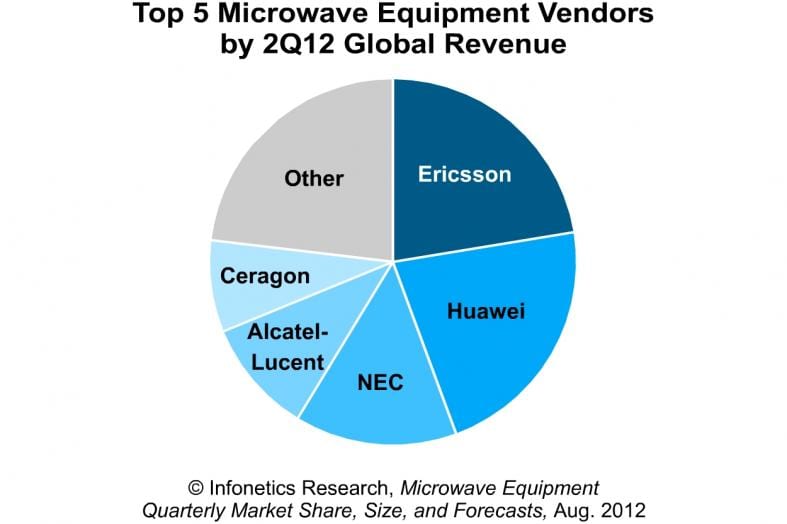

. The global microwave equipment market totaled $1.2 billion in 2Q12, up 16% from the previous quarter and down 6% from the year-ago 2nd quarter

. Ericsson regained the #1 position in the global microwave equipment market in 2Q12, edging past Huawei by a hair

. NEC, the microwave market share leader just a quarter ago, slipped to 3rd

. Regionally, EMEA (Europe, Middle East, Africa) had the strongest 2nd quarter, capturing around 50% of global

market share

ANALYST NOTE:

“The microwave equipment market rebounded nicely in the 2nd quarter thanks to strong performances from Ericsson

and Huawei,” notes Richard Webb, directing analyst for microwave at Infonetics Research. “Huawei had a huge quarter, its biggest ever for microwave equipment. The operator now counts some of the world’s major tier 1 international operators as its microwave customers and often supplies their operations across many countries.”

Webb adds: “Despite choppy performance in recent quarters, we expect the microwave equipment market to grow to $6 billion by 2016, driven by a continuing demand for increased mobile backhaul capacity and the proliferation of small cells.”

REPORT SYNOPSIS:

Infonetics’ quarterly Microwave Equipment report provides worldwide and regional market size, vendor market share,

forecasts, and analysis for Ethernet, TDM, and hybrid microwave equipment by spectrum, capacity, form factor, and architecture. Companies tracked include Alcatel-Lucent, Aviat Networks, Ceragon, DragonWave, ECI Telecom, Ericsson,

Exalt, Huawei, NEC, Nokia Siemens Networks, ZTE and others.

To buy the report, contact Infonetics sales: http://www.infonetics.com/contact.asp.

Samsung Wins Key LTE Contract in UK- company on track to be important LTE Infrastructure vendor!

And you thought Samsung Electronics was just a mobile device/smartphone/tablet vendor?

The South Korean conglomerate has been selected to provide the UK’s smallest cellco by subscribers, Hutchison 3G UK (H3G UK), with a Long Term Evolution (LTE) Radio Access Network (RAN), as well as 3G/LTE core infrastructure solutions (likely to be the LTE Evolved Packet Core (EPC)).

In a press release confirming the announcement, Samsung noted that this marks its first commercial mobile network rollout in Europe. It has confirmed that it will deploy LTE base stations, including all associated systems and network support services, across H3G UK’s existing infrastructure. The complete LTE network infrastructure solution will be trialled this year ahead of a full deployment and commercial launch in 2013.

Dave Dyson, CEO of H3G UK, which offers services under the ‘Three’ (‘3’) banner, said of the announcement: “Three’s customers will start benefitting from this investment in our core network early next year and those benefits will grow further as we deploy new spectrum … Samsung’s advanced network technology will help us to continue to deliver the most enjoyable smartphone experience. In Samsung’s home market operators are busy turning off 2G. In the UK Three is the only operator without a 2G network which means more and more consumers are choosing the network built for the internet.”

Youngky Kim, Executive Vice President and General Manager, Telecommunication Systems Business at Samsung Electronics meanwhile noted: “This contract marks a significant milestone for Samsung and further demonstrates our commitment to the European market.”

Samsung is betting that expanding sales of LTE equipment will help catapult it to the top of the industry. According to research firm Dell’Oro Group, the LTE equipment market could grow 45 percent annually over the next five years.

UK regulator Ofcom granted permission to the country’s largest cellco, Everything Everywhere, to build out LTE this year in its 1.8GHz spectrum. This is on condition it sells some of those frequencies to 3UK. Hence, Samsung is likely to expand its 3UK deployment.

Everything Everywhere welcomed the Ofcom green light, which will enable it to go live with LTE this year. “4G will drive investment, employment and innovation and we look forward to making it available later this year, delivering superfast mobile broadband to the UK,” the operator said in a statement, though it did not detail any roll-out plans at this stage.

Ofcom restated its previous position on 1.8GHz refarming, saying: “Ofcom has concluded that varying EE’s 1800MHz licences now will deliver significant benefits to consumers, and that there is no material risk that those benefits will be outweighed by a distortion of competition. Delaying doing so would therefore be to the detriment of consumers,” it said.

“The decision takes account of the forthcoming release of additional spectrum in the 800MHz and 2.6GHz bands, in an auction process set to begin later this year, which will enable other operators to launch competing 4G services from next year.”

Clearly, Samsung wants to build on its success in WiMAX by becoming a viable LTE infrastructure vendor – a goal which eluded it in 3G. The South Korean vendor has won a 4G-LTE network contract from 3UK, is one of the vendors selected for Sprint’s Network Vision (LTE) program, and has LTE deals in South Korea, Japan and the Middle East.

For more information see:

http://www.rethink-wireless.com/2012/08/28/samsung-scores-uk-carriers-cleared-lte.htm

FierceWireless http://www.fiercewireless.com/story/samsung-exec-crows-us-lte-contract-wins/2012-02-21#ixzz253Gzn7Vp

Infonetics: Huge Pop in China Boosts Global Service Provider Router & Switch Market in 2Q 2012!

Infonetics Research just released vendor market share standings and preliminary analysis from its 2nd quarter 2012 (2Q12) Service Provider (SP) Routers and Switches report. Surprisingly, China sales made the quarter positive, where without China it would’ve been negative for total sales of SP routers and switches. But the year over year results were down 9%, according to Infonetics.

“A nearly 50% increase in revenue in China propped up the global service provider router and switch market in the 2nd quarter,” notes Michael Howard, Infonetics Research’s co-founder and principal analyst for carrier networks. “China was the differentiating factor between a positive worldwide quarter and one that otherwise would have been down.”

Mr Howard adds: “While Cisco has long led the global IP edge and core router market by very comfortable margins (and whose share is steady from this time last year), Alcatel-Lucent, Juniper and Huawei have been fighting it out every quarter for the past year-and-a-half for the next three leadership positions. The race tightened considerably in the 1st half of 2012, with Huawei taking the #2 spot in the 2nd quarter.”

SERVICE PROVIDER ROUTER AND SWITCH MARKET HIGHLIGHTS:

- The global service provider router and switch market, including carrier Ethernet switches and IP edge and core routers, grew 4% in 2Q12 from the previous quarter, to $3.5 billion

- From the year-ago 2nd quarter, the overall carrier router and switch market is down 9%, as service providers generally remain cautious, particularly in North America and Europe

- Latin America is the only major world region posting an increase in carrier router and switch revenue on a year-over-year basis (up 57% in 2Q12 over 2Q11)

- ZTE posted especially strong gains in carrier Ethernet switches (CES) in 2Q12, particularly in China where CESs are being used in major mobile backhaul deployments

REPORT SYNOPSIS:

Infonetics’ quarterly Service Provider Routers and Switches report provides worldwide and regional market share, market size, forecasts, and analysis for IP edge routers, IP core routers, and CES. The report tracks the IP Edge market by application (multiservice edge, broadband remote access server, Ethernet access transport, and Ethernet service edge) and covers Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Ericsson, Extreme, Force10, Fujitsu, Hitachi Cable, Huawei, Juniper, NEC, Nokia Siemens, Orckit-Corrigent, Tellabs, ZTE, and others.

To buy the report, contact Infonetics Research at:

http://www.infonetics.com/contact.asp.

Related Articles:

http://viodi.com/2012/08/23/zte-reports-huge-drop-in-profits-telecom-death-spiral-continues/

http://www.reuters.com/article/2012/07/16/us-zte-shares-idUSBRE86F00E20120716

Pyramid & Infonetics: LTE Drives Mobile Data Growth- Better Spectral Efficiency, Lower Latency, Increased ARPU

According to Pyramid Research, the US telecom market generated $389.6bn in service revenue in 2011, a 5.2% increase over the previous year, and represents the highest growth rate since 2007. Mobile data was the single most important driver behind this trend, generating $10.1bn more revenue in 2011 than in 2010. We expect to see service revenue grow at a more subdued 2.9% CAGR over the 2012-2017 period.

There are many subcategories of mobile data that are contributing to the top line, with mobile broadband data packs for smartphones, tablets, e-readers and M2M among the most notable. Connected cars, for instance, make for an interesting opportunity within the M2M space. Sprint estimates that already 4% of cars are wirelessly connected today. Sprint expects that having at least two wireless connection streams will eventually become commonplace —one for entertainment (music, video) and one for emergency use (similar to the OnStar service today). These initiatives and others will serve to drive mobile data to become a $120.1bn market in 2017.

Pyramid says the U.S. will continue to lead the world in total LTE subscriptions, making up 25.2 percent of total global Long Term Evolution (LTE) subscriptions in 2017, according to a new report titled, US: Bundling and Mobile Data Revenue Drive Telecom Market Growth.

“By 2017, LTE will be the most prevalent form of mobile cellular connectivity in the U.S., with 41.3 percent of subscriptions,” says Pyramid Research Analyst, Emily Smith. Even though there are many different forces at play that are

driving operators toward LTE, like the spectrum crunch, data QoS concerns and operational costs, Pyramid expects to continue seeing a market for older 2G and 3G technologies over the forecast period. “For the near future, investment in

these networks will continue, while 1xRTT remains the most dependable voice technology for CDMA operators like Sprint, leaving a small percentage of subscriptions as 2.5G-only through 2017,” she adds.

http://www.pyramidresearch.com/store/CIRUNITEDSTATES.htm?sc=LR081312_CIRUSA

Not to be outdone, Infonetics Research released excerpts from its 2012 LTE Deployment Strategies:

Global Service Provider Survey, for which incumbent, competitive, and mobile operators were interviewed about their Long Term Evolution (LTE) network drivers, deployment plans, challenges, and service offerings.

“Despite the global gloom, there are better days ahead for mobile operators,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. “For the first time since we began tracking LTE in 2008, increased average revenue per user (ARPU) is among the top LTE upgrade drivers, along with spectral efficiencies that are driving down the cost per gigabyte. As a result, operators’ bottom line should improve for a change.”

LTE SURVEY HIGHLIGHTS:

. Almost 1/3 of the operators that Infonetics surveyed plan to use their 2G and 3G networks for voice services as long as possible

. TD-LTE continues to gain momentum, spearheaded by China Mobile’s participation in the LTE standards process

. Single radio voice call continuity (SRVCC) is on track to become commercially available in Fall 2012, but 84% of operators surveyed don’t expect the feature to be ready this year

. EMEA (Europe, Middle East, Africa) leads in the number of LTE deployments worldide, while North America is home to 80% of the more than 10 million global LTE subscribers

LTE SURVEY SYNOPSIS:

For this LTE Service Provider Survey, Infonetics interviewed incumbent, competitive, and mobile operators about their LTE network build-out plans, deployment migration scenarios, challenges, technical and commercial drivers, and the LTE services, features, and devices they plan to offer. Service providers surveyed together represent 31% of the world’s telecom capital expenditures (capex) and 29% of the world’s telecom carrier revenue, and come from EMEA (Europe, Middle East, Africa), North America, Asia Pacific, and Latin America. To buy the survey, contact Infonetics sales: http://www.infonetics.com/contact.asp.

Profile of Prolific Inventor & ComSoc NA Director Yigang Cai

Introduction and Overview

For the third time in four years, ComSoc NA Director Yigang Cai, PhD was honored with the 2011 Bell Labs Inventors Award in the Product and Services group category. His contributions cover Messaging, Mobile Applications and Mobile Service technology and markets. The annual Bell Labs Inventors Award recognizes and honors individuals who exemplify excellence, innovation and creativity by outstanding patent contributions across Alcatel-Lucent (ALU).

In addition to being a prolific inventor, Yigang did a splendid job as ComSoc NA Distinguished Lecture Tour (DLT) Director in 2009-2011. As ComSocSCV Chair, this author was very impressed with Dr. Cai’s dedication and strong commitment to that volunteer job. This year (2012), we’ve collaborated on several issues that improved operations of local ComSoc NA Chapters.

About Yigang Cai, PhD

Yigang Cai was an Associate Professor in Department of Mechanical Engineering at Zhejiang University before he moved to the United States in 1989. He obtained his BS, MS and PhD degrees from Zhejiang University, Hangzhou, China. Yigang joined AT&T-Bell Labs in 1995. He has worked as a systems engineer in his Lucent, and Alcatel-Lucent (ALU) career and engaged in research and development of many wire-line and wireless communication products. Dr. Cai became a Distinguished Member of Bell Labs Technical Staff in 2000.

An Inventor Par Excellence!

As of July 31, 2012, Yigang has filed 231 US patent applications, and had 145 patents granted worldwide. That’s a phenomenal total by any stretch of the imagination!

Yigang’s numerous invention submissions address a wide range of technology areas. During 2010- the most recent ALU Inventor time period- Yigang’s contributed total forty-three patent filings:

- Twenty-nine contributions address VOIP and Web Applications such as Location Based Services, Messaging, Subscriber Data Management and Profiling, Billing/Payment Systems, IMS Solutions and VoIP Infrastructure.

- Eleven contributions address Mobile/Wireless Core Networks including the Mobile Switching Center, Mobility management, the Evolved Packet Core, Handsets, 3GPP Services, and LTE.

- Two contributions address Video and Media Applications such as Multimedia Applications, and TV Video Applications.

- One contribution addresses Service Aware Networks such as Multimedia Gateways.

Many of Yigang’s contributions have been implemented in ALU products and delivered to customers such as Verizon Wireless (VZW). Others are under development so that they can be included in new ALU products that are expected to be delivered to customers, including VZW and AT&T, in the near future.

Yigang’s contributions impact ALU products that include LTE SMS GW, SMSC, MSC, 5119 BMGW, real time payment system (8610 ICC and 8620 SurePay) policy control manager (5780 DSC), Universal Message Center. Yigang continues to be one of the most prolific inventors in ALU. Yigang’s contributions are not only numerous but are also high in quality. In particular, thirty-one of Yigang’s forty-three contributions have been designated by ALU as “high quality” (i.e., internal rank 1 or 2) and are scheduled for international patent filing. Several contributions have been submitted to standards development organizations for potential adoption. Moreover, substantial contributions have been made in ALU focus areas, which include: Messaging, Subscriber Data Management and LTE. Many of those are likely to be implemented in ALU products.

Yigang is one ALU employee who surely does not work in a silo. While several contributions are solo efforts, many are collaborative efforts with a variety of different inventive teams, with other co-inventors of individual inventive teams being located in China, Europe, the United States, or all three continents. For many of these border-crossing collaborative invention teams, Yigang is the lead US-based co-inventor.

An ALU employee that worked with Yigang and drafted several of his patent applications said, “I find him extremely collegial, always willing to share his expertise so that the best end-product/result is achieved. He is responsive throughout the patent process, responding faithfully and timely despite other, enormous demands on his time.”

That’s a very powerful testimonial! ComSoc is most fortunate to have Yigang Cai as our NA Director. If you have the opportunity to work with him, you are most fortunate!

Appendix: Yigang’s top 10 patents in 2010 (the most recent ALU time frame)

In the considered ALU time frame, Yigang contributed to forty-three positive filing decisions. Ten contributions currently considered of most commercial import follow:

1. Message Delivery over LTE Networks (3GPP Services).

Contribution embodiment/s address LTE messaging strategy, architecture and methods and are the basis for a brand new ALU product LTE SMS GW which will be deployed to VZW network in 2010.

2. Sequential Message Delivery for FDA Processing and Store-and-Forward Processing (Messaging).

Contribution embodiment/s propose a key evolution with a FDA/MDA configuration of SMS/MMS network, were built into ALU’s SMSC release 11.0 and deployed to the VZW network beginning in November of 2009 when VZW began a network upgrade from the current single SMSC to a FDA/MDA configuration. ALU has 58 pair of SMSC (~50 sites) in the VZW network and the configuration of most will be upgraded. ALU revenue confirmed from VZW will be ~$40 million in 2010-11 for 4 geo-sites. The complete network upgrade is expected to take at least 5 years and while ALU does not have VZW’s commitment yet, the upgrade’s revenue impact is conservatively estimated at ~$120 million.

3. Voice Notification to the Destination of a Text Message That is Engaged in a Voice Call (Messaging).

Contribution embodiment/s create a ‘whispering’ SMS when an end user is in a voice session. ‘Whispering SMS’ is expected to be a great application in the near future.

4. SIP Response Encapsulation for SMS Delivery over IP Network (Messaging).

Contribution embodiment/s provide a new method in SIP messaging so that SMS can be delivered over IP networks, eliminating unnecessary delivery acknowledgement/ report messaging and handling. The method can be used for other SIP applications and standards evolution. Its first application will be in the VZW network.

5. Messaging Waiting Notification to External Message Center (Mobile Switching Center).

Contribution embodiment/s were a key MSC feature for the Verizon Wireless (VZW) network. FDA/MDA evolution. Embodiments were implemented in ALU MSC and delivered to VZW.

6. SMS Message Delivery over Broadband Data Networks (Evolved Packet Core or EPC).

Contribution embodiments provide a new direct SMS delivery over EVDO (3G) network when bypassing MSC and SMSC. Embodiments were implemented in a new ALU product 5119 BMGW and deployed in VZW network in November of 2009. Similar embodiments were deployed for AT&T in 2011.

7. A Method for Delivering Dynamic Policy Rules to an End User, According on Subscribers Account Balance and Service Subscription Level (Billing).

Contribution embodiment/s provide a new method for interactions between OCS and PCRF in 3GPP policy and charging control (PCC) for mobile broadband services, IPTV and other applications. The contribution is an ALU value position to enhance the PCC capability on the real time payment system (8610 ICC and 8620 SurePay) and the policy control manager (5780 DSC).

8. Text Messaging over an eHRPD Network (Messaging).

Contribution embodiment/s provide a SMS/MMS message deliver over LTE/eHRPD networks. The contribution is in a road map and will be implemented in a new ALU product Universal Message Center for North America and other regions’ customers.

9. Charging Method Selection for Service Data Flows Based on the Data Services Being Requested (Billing).

Contribution embodiment/s allow LTE gateways and the PCEF to consult charging rules to the PCRF when providing flow and service data to the PCRF, during establishing and updating IP-CAN. The contribution will significantly enhance 8610 ICC and 8620 SurePay by involving LTE/EPC network charging.

10. Registration Notification for SMS over LTE (Mobile Management/ Evolved Packet Core).

Contribution embodiment/s provide a method for subscriber databases (HSS and/or AAA) to push a registration notification to IP-SM-GW when subscriber registers/ deregisters to LTE/EPC networks. The contribution will be built in a roadmap into HSS/AAA and a new ALU product Universal Message Center.

Yigang with ALU CEO Ben Verwaayen:

AT&T Acquiring & Shifting 2G Wireless Spectrum to Support LTE Network Buildout

AT&T has taken two major steps to gather additional wireless spectrum to build out its Long Term Evolution (LTE) network over the next five years. AT&T has repeatedly stated that it will soon run out of the necessary airwaves to adequately meet the wireless demands of its customers if it doesn’t get more spectrum. The company made two announcements last week to gain more spectrum.

1. On Aug. 2, AT&T agreed to acquire NextWave Wireless, a failing carrier with spectrum that the Federal Communications Commission has been trying to repurpose for years.

The plans for the NexWave LTE spectrum are also a ways off. While NextWave is in dire financial straits, the use of its spectrum for LTE data services has yet to be approved by the FCC. However, the owner of the adjacent spectrum, Sirius XM and AT&T filed a joint proposal that would clear up a number of engineering issues and as a result would open the 2.3GHz Wireless Communications Service (WCS) to use as an LTE data band. The FCC filing outlined a number of limitations on WCS operations that would prevent AT&T’s WCS operations from interfering with Sirius XM’s audio services.

AT&T bought NextWave at the bargain-basement price of $25 million, plus a contingent payment of about $25 million plus cash and other assets to pay off NextWave’s debt, for a total of $600 million. NextWave originally bought the WCS spectrum in 1997, but was involved in a protracted legal battle with the FCC after NextWave declared bankruptcy and defaulted on its payment for the spectrum. NextWave got the rights to the spectrum in 2004, but has been unable to use the spectrum because of the potential for interference with Sirius XM.

2. In an Aug. 3 FCC filing, AT&T announced that it would phase out its 2G data network by the beginning of 2017. This will enable the company to free up spectrum for added capacity on its 3G and LTE mobile Internet network.

“Throughout this multi-year upgrade process, we will work proactively with our customers to manage the process of moving to 3G and 4G devices, which will help minimize customer churn,” the company said in the filing.

As of June 30th, roughly 12 percent of AT&Ts contract customers were still on its 2G network, which is primarily designed for voice and text messages, with relatively low data speeds. An AT&T spokesperson told eWEEK that AT&T will be working with customers who are still using 2G services to provide options that will meet their needs. AT&T has relatively few customers who currently depend on 2G data, and that number is expected to diminish through attrition by 2017. AT&T no longer sells 2G devices. By freeing up 2G spectrum, AT&T will have more space available for LTE, in much the same way that Sprint is phasing out its iDEN spectrum so it has room for LTE. Currently, it’s unclear which of its services AT&T considers 2G and plans to shut down. ( eWEEK questions to the AT&T spokesperson did not provide details as to what services in AT&T’s spectrum are planned for shutdown when support for 2G ends.)

GSM, which is what AT&T uses for its voice technology is the international standard and is used throughout the world, is technically a 2G standard, but the 2G data standard that AT&T uses is General Packet Radio Service (GPRS), which is not widely used although it is widely available on the AT&T network.

For more information, please see this eWEEK article:

Comment & Analysis

Mr. Téral adds: “The prophecies of doom for mobile operators’ SMS/MMS cash cow are being overplayed. Despite the popularity of over-the-top messaging applications like Apple’s iMessage and WhatsApp, our data shows SMS growing every year from 2012 to 2016, delivering a cumulative $1 trillion in operator revenue during those 5 years. And over that same period, voice revenue will decline only slightly, still making up a sizable chunk of operator revenues.”

Another issue with the spectrum swap from 2G to 3G/4G is timing. Won’t AT&T need a lot more spectrum for 3G/4G and even LTE Advanced before 2017?