Month: April 2013

UPDATE: AT&T Finally Launches Digital Life Home Security & Automation system; Emerging Devices & M2M Focus Intact

April 26, 2013 UPDATE: AT&T debuts Digital Life home network in 15 cities

AT&T is launching its Digital Life home security and monitoring service in 15 cities — some large, some midsize — with

plans to expand to 50 locations by midyear, the telecom says. In competing with companies such as ADT,

AT&T will allow people to use either mobile devices or PCs to keep an eye on various activities and appliances through Web-connected cameras and sensors hooked up to a broadband connection.

http://news.cnet.com/8301-1035_3-57581532-94/at-t-rolls-out-home-security-and-monitoring-service/

http://gigaom.com/2013/04/25/att-launches-its-internet-of-things-effort-and-its-pretty-big/

We previously wrote:

In January 2013, AT&T issued a press release indicating that their Digital Life Home Security and Automation system for “the connected home” would be available to consumers in March this year.

http://www.att.com/gen/press-room?pid=23652&cdvn=news&newsarticleid=35917

In mid-March of this year AT&T upped the number of cities it said would be covered at the outset from eight to 15. It has targeted availability in 50 cities by year end.

http://www.att.com/gen/press-room?pid=23947&cdvn=news&newsarticleid=36199

AT&T told Telecoms.com that demand following trials in two US cities [Atlanta and Dallas] led to an expansion of launch plans. “In response to customer feedback we’re nearly doubling the number of cities where we plan to introduce Digital Life,” the firm said. “As a result, we’re adjusting the launch timing. This allows us to align our marketing and operational plans to accommodate the expanded launch. We will share pricing details when we launch the service this spring.”

But the Digital Life page on AT&T’s website currently displays a static form inviting prospective customers to register for details of future availability in their home area. https://my-digitallife.att.com/support/digitallife

Digital Life will be based around home security and monitoring solutions initially, before expanding into areas like utility management. It will compete with similar connected home automation systems from Verizon and Comcast. Subscription security services in the US have a far lower churn rate than wireless/mobile services. Industry averages for home security system customer lifecycle was said to be on the order of six to seven years.

“AT&T Digital Life is a game-changing wireless centric home security and automation experience with its unique integration and an intuitive app to control every feature from your smartphone, tablet or PC,” said Kevin Petersen, senior vice president, AT&T Digital Life. “Combined with AT&T’s wireless network (http://www.att.com/gen/press-room?pid=2943) and unparalleled distribution channels, Digital Life will offer exciting new innovation. We can’t wait to get it into the hands of our customers.” In providing an end-to-end security solution, from hardware distribution and retail to installation and after sales support, AT&T aims to “disrupt and remake the security industry,” Peterson said.

AT&T has not revealed the value of its investment in Digital Life, the scope of the project is extensive. The firm acquired and then internally developed its own management platform for the security service, has built its own monitoring centres and dedicated support facilities and will source third party providers trained to install domestic equipment. These installers will ensure the devices’ connection to AT&T’s network and leave customers’ homes with the end users fully able to manage their new security solution through AT&T’s bespoke, multi-platform User Interface, according to Peterson.

A typical installation could require 30 or 40 devices, Peterson told Telecoms.com.

“We’ll subsidise the upfront cost of the kit and installation in exchange for two-year contracts,” he said. “We’ll be very competitively priced upfront, we’ll give lifetime warranties on the services and equipment and we’ll be very competitive on the monthly fee.” AT&T’s costs will be offset by an international licensing strategy that exploits “owners economics” Peterson added.

AT&T executives have repeatedly touted home security and automation as one of the company’s new growth opportunities for “emerging devices,” M2M, and the Internet of Things (IoT). AT&T stated it has been an innovative, proactive, early leader in machine-to machine (M2M) communications and sees exciting potential in this market. The company’s goal is to “help drive wireless capabilities into a wide variety of devices beyond traditional handsets for businesses. AT&T is driving the emergence of new categories of devices and applications that are enhanced by wireless network connectivity. This will create new categories of devices and applications, both for consumers and businesses,” according to AT&T’s website: http://www.att.com/Common/about_us/files/pdf/emerging_devices/M2M_Snapshot.pdf

Other emerging device applications that AT&T is working on (with partner companies) include the connected car, mobile healthcare/eHealth and mobile safety. In addition to a global 3G and 4G-LTE cellular network, AT&T has the nation’s largest Wi-Fi network with nearly 27,000 hotspots in the U.S. Emerging devices could connect to those networks or even wire-line networks for M2M communications.

AT&T Media kit for “emerging devices” is at: http://www.att.com/gen/press-room?pid=13434

For more information, please visit:

http://www.telecoms.com/134701/att-delays-m2m-home-security-launch/?

http://www.fiercewireless.com/story/att-remains-silent-digital-life-launch-delay/2013-04-08

http://www.business.att.com/enterprise/Family/mobility-services/machine-to-machine/

http://www.business.att.com/enterprise/Service/mobility-services/machine…

Highights of 2013 Cloud Connect Conference: April 2-5, 2013 in Santa Clara, CA

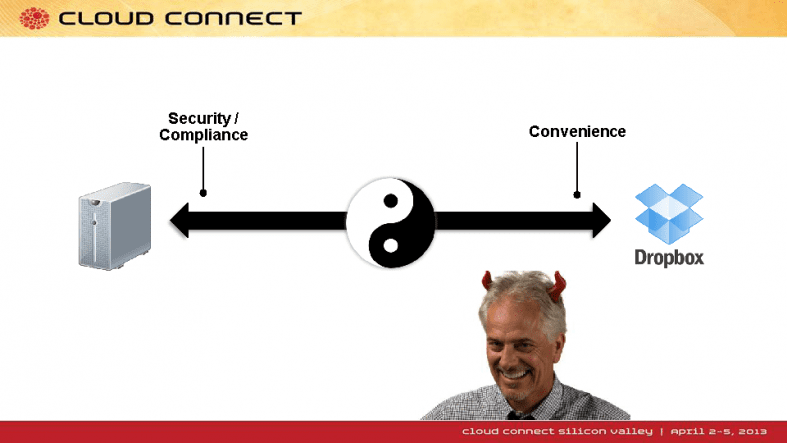

We also examine how the Mobile Cloud has and will continue to change business operations. It’s a balancing act, with compromises needed between corporate compliance/security vs worker freedom/convenience.

The Mobile Cloud:

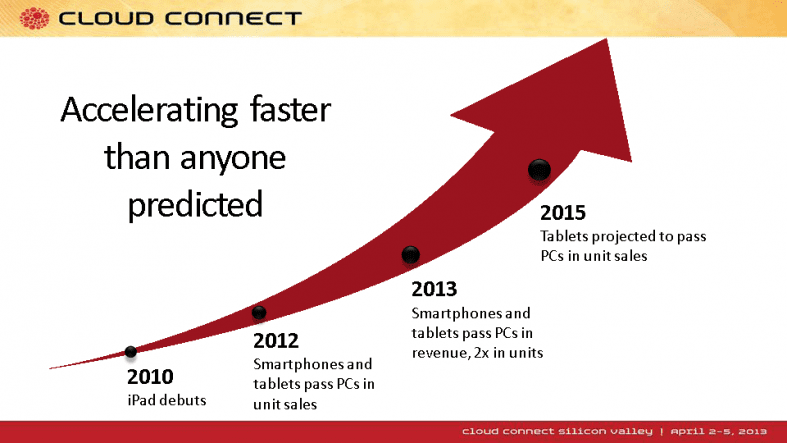

Before the end of this year there will be more smart phones than PCs, and in 2015 there will be more tablets than PCs as shown in the illustration below.

Mobile and cloud are combining to change how the underlying infrastructure of business. Mobile and cloud combine to change how applications are developed, tested and distributed. Mobile changes what features and user experience exists in applications while cloud changes where data should be located and how it will be accessed. Security and management will also change as businesses embrace mobile. Applications will be device aware, location aware and network/cloud aware. But they have to be purpose built, i.e. desktop/workstation apps won’t run on mobile computing platforms- even with 4G access. And because the demand for mobile cloud resident apps is uncertain, the mobile cloud must be very flexible in scaling up or down to accomodate the actual number of users for all the mobile apps being supported.

Going forward business processes will assume a multi-device landscape, cloud connectivity. Mobile work styles are becoming the rule rather than the exception in Enterprise IT and traditional methods of securing data behind VPNs will fall short as employees demand business tools that are as easy to use and frequently updated as the ones they use at home. Unfortunately, legal and regulatory requirements for securing data are no less stringent than they were before the mobile era. There are compliance issues with laws such as HIPAA and FINRA that apply to data sync and sharing of information/digital content.

In the future, companies will rebuild transform business applications to take advantage of a range of by using contextual data from all connected devices, including location, time of day, presence and device type. Sensors in the latest devices will also also provide contextual information such as temperature, humidity, motion, and orientation. Applications based on business critical data from connected sensors will be used by many industries, with utility, oil and gas industries leading the way. Transforming business will require businesses to use the cloud and big data processing to turn mobile data into insight in real-time.

In an excellent presentation by Jesse Lipson, Citrix VP of Data Sharing, Managing Data in the Cloud said: “VPNs are going away.They are clumsy and incovenient for mobile users.” Other reasons: there’s more IP outside of the firewall, Mobile Device Management (MDM) and simpler two factor authentication are combining to alleviate the need for VPN access. Mr Lipson also sees several new trends as a result of mobile data tsunami:

-Active Directory Integration with Single Sign On (e..g. SAML 2.0)

-2 factor authentication going away; perhaps replaced by text message authentication

-Auto Log-In from mobile devices, especially smart phones

-On premises storage alive and well due to security, compliance, convenience, and ability to access existing data stores

-“Open-in…” enable another application to open in the application being run

-Device control via MDM software deployed on all enterprise owned mobile devices

-Other mobile devices, especially laptops are getting more attention for security and control

In the end, enterprise control of mobile devices, data and apps is a balancing act between corporate compliance and security vs employee convenience and productivity (see illustration below). Each organization must decide how to chose the necessary tools, methods and procesures to ensure that both objectives are met.

2013 Cloud Connect Part II is at:

M2M Market Opportunities, Challenges, Strategies, Industry Verticals and Forecasts

Introduction:

Signals & Systems Telecom (SNS Telecom; http://www.snstelecom.com/) has just released a report on the Machine-to-Machine (M2M) communications market. The report presents an in-depth assessment of the global wireless M2M market. In addition to covering the business case, the challenges, the industry’s roadmap, value chain analysis, deployment case studies, and the vertical market ecosystem, vendor service/product strategies and strategic recommendations, the report also presents comprehensive forecasts for the wireless M2M market from 2013 till 2018, including an individual assessment of the following submarkets: Network Connectivity, Application Services, Embedded Cellular M2M Modules, Network Security, Connected Device Platforms (CDP), Application Platforms (Application Enablement Platforms, AEP and Application Development Platforms, ADP), Integration Services and Enabling Technologies, across six regions.

Also provided are network connectivity and application service revenue forecasts for the following 6 vertical market segments: Utilities & Smart Grid, Automotive & Transportation, Logistics, Public Safety, Security & Surveillance, Retail & Vending and Healthcare. Historical figures are also provided for 2011 and 2012.

Overview:

Despite its low ARPU, the wireless M2M market has become a key focus of many mobile network operators as their traditional voice and data markets become saturated. Likewise, government and regulatory initiatives such as the EU initiatives to have a smart meter penetration level of 80% by 2020 and the mandatory inclusion of automotive safety systems such as eCall in all new car models, have also helped to drive overall wireless M2M connections and revenue.

Consequently we expect the wireless M2M market to account for nearly $136 billion in revenues by the end of 2018, following a CAGR of 23% during the five year period between 2013 and 2018. Eyeing this lucrative opportunity, vendors and service providers across the highly fragmented M2M value chain have become increasing innovative in their strategies and technology offerings which have given rise to a number of submarkets such as M2M Network Security, Connected Device Platforms (CDP) and M2M Application Platforms.

Key Findings:

* The wireless M2M market will account for nearly $136 billion in annual revenues by the end of 2018, following a CAGR of 23% during the five year period between 2013 and 2018

* At present, the M2M value chain is highly fragmented with module OEMs, hardware solution providers, application platform providers, device platform providers, and mobile network operators and aggregators/MVNOs all investing across multiple segments of the value chain, whilst still maintaining a key focus on a specific portion

* Signals and Systems Telecom expects the value chain to consolidate in the future, with a smaller number of larger and profitable competitors across the M2M value chain

* The growing presence of wireless M2M solutions within the sensitive critical infrastructure industry is having a profound impact on M2M network security services, a market estimated to reach nearly $1 billion in annual spending by the end of 2018

* Driven by demands for device management, cloud based data analytics and diagnostic tools, M2M software platforms (including CDP, AEP and ADP) are expected to account for $6 billion in annual spending by the end of 2018

Key Questions Answered:

* What are the key market drivers and challenges in the wireless M2M ecosystem?

* What are the key applications of M2M across industry verticals?

* How is the M2M value chain structured, how will it evolve overtime, and what will be its impact on key vertical segments of the market?

* What opportunities does M2M technology offer to mobile network operators and other players involved in the value chain?

* What strategies should mobile network operators/MVNOs, module vendors, hardware solution providers, software platform providers and other players adopt to capitalize on the M2M opportunity?

* How big is the M2M opportunity, and how much revenue will the industry generate in 2018?

* What will be the installed base of wireless M2M connections in 2018?

* Which geographical regions and industry verticals offer the greatest growth potential for M2M services?

* What is the vendor market share embedded cellular M2M modules, how many units will ship in 2018 and how will declining ASPs impact the sales revenue?

* How will embedded cellular M2M module shipments vary by air interface technology overtime, and will LTE take a lead in 2018?

* What is the network connectivity and application service ARPU for M2M services, and how will this vary overtime for each industry vertical?

* How big is the market for M2M network security and software platforms?

For more information, including report pricing, please contact Andy Silva: [email protected]

Other SNS Telecom reports are listed at: http://www.snstelecom.com/reports-library

Another recently released M2M report was by Research & Markets:

M2M: The Next Billion Mobile Connections – Essential Analysis of the Growing Wireless M2M Industry

In that report, Parks Associates analysts examine the growing wireless M2M industry and highlight opportunities in this space for mobile service providers in the U.S. and globally. The report includes a comprehensive overview of the complex M2M ecosystem, profiles of leading M2M vendors, and analysis of carriers’ M2M strategies. The report also illuminates important trends in key verticals and provides a forecast of carrier-enabled device connections through 2016.

“Mobile service providers are facing declining revenue from traditional voice and SMS services and mobile data traffic growth that outpaces growth in data revenues,” said Jennifer Kent, research analyst, Parks Associates. “In search of new opportunities, mobile service providers are expanding their presence in the Machine-to-Machine (M2M) space. Widespread consumer and enterprise adoption of broadband Internet service, wireless routers, and devices with mobile connectivity means the ingredients are there for the M2M market to take off. Plus, mobile network operators have unique assets that position them to take advantage of the growing M2M market.”

http://www.researchandmarkets.com/research/5p8vdb/m2m_the_next