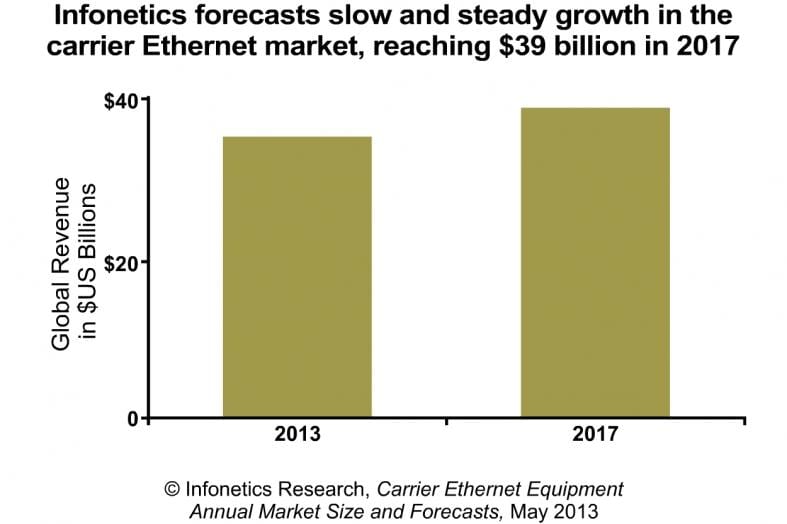

Infonetics: Carrier Ethernet market declined in 2012, but expected to be $39B by 2017

- The global carrier Ethernet equipment market declined 3% to $34 billion in 2012, following a 13% spike in 2011.

- Spending on IP edge routers totaled $9.4 billion in 2012, the most of any carrier Ethernet equipment segment.

- Asia Pacific currently accounts for the greatest portion of carrier Ethernet equipment revenue, followed by EMEA (Europe, the Middle East, and Africa); by 2017, Infonetics expects North America will have passed EMEA to become the 2nd largest carrier Ethernet market

- Infonetics projects Carrier Ethernet equipment ports will top 95 million worldwide by 2017, with 10 Gigabit Ethernet growing fast to pass 1 Gigabit Ethernet

Ethernet Access Devices (EAD) MARKET Report- released April 18, 2013

“People keep saying that copper’s dead, but it’s not—it has a limited but important role for Ethernet services, as evidenced by the continued growth of EFM (Ethernet in the first mile) bonded copper,” notes Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research. “EFM’s high capacities and reach make it a useful and effective alternative where fiber isn’t justified.”

- For the full year 2012, the global Ethernet access device (EAD) market grew 3.5%, to $860 million, with growth hesitating as a result of economic conditions and a lull in carrier spending in the 2nd half of 2012

- 10/100M copper and 1G fiber dominate EAD ports today, but 10G fiber is growing fast, forecast by Infonetics to grow at a 117% CAGR through 2017

- Though in slow decline, Ethernet over TDM (EoTDM) bonded circuits will remain a niche market, providing an inexpensive way to combine several E1s or T1s

- For the second consecutive year, the top 5 revenue share leaders in the EAD market are (in alphabetical order) Actelis, ADVA, Ciena, Overture, and RAD

EAD REPORT SYNOPSIS

Infonetics’ biannual Ethernet access devices report provides worldwide and regional market size, vendor market share, forecasts through 2017, analysis, and trends for copper and fiber EADs and ports by speed. Companies tracked: Accedian, Actelis, ADTRAN, ADVA, Canoga Perkins, Ciena, FibroLAN, IPITEK, MRV, Omnitron OMS, Overture, RAD, Tellabs, Telco Systems, Zhone, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp.