Infonetics: Bare Metal Switches Propel Data Center Switch Market to Grow 8% in 2014

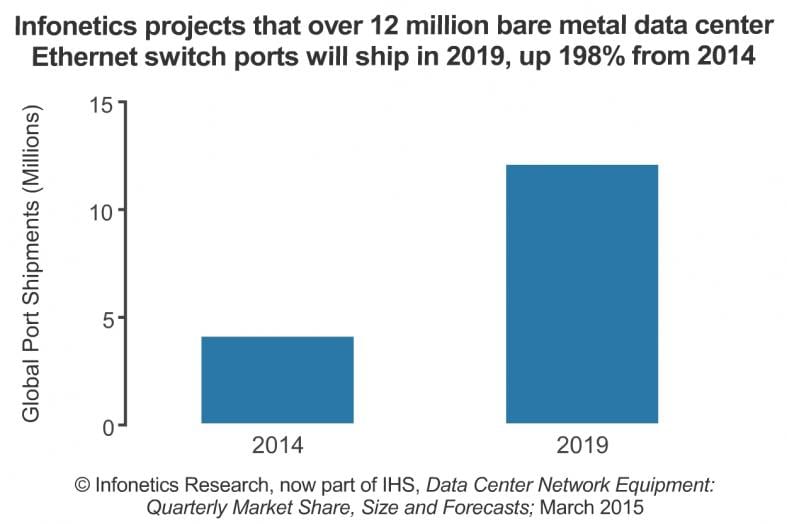

Infonetics Research, now part of IHS Inc. (NYSE: IHS), forecasts that bare metal switches (which decouple hardware from software and offer greater agility and cost savings over traditional data center switches) will make up just under a quarter of all data center ports shipped worldwide in 2019, up from 11 percent in 2014.

Infonetics’ fourth quarter 2014 (4Q14) and year-end Data Center Network Equipment vendor market share, size and forecast report tracks data center Ethernet switches, bare metal Ethernet switches, Ethernet switches sold in bundles, application delivery controllers (ADCs) and wide area network (WAN) optimization products.

DATA CENTER MARKET HIGHLIGHTS:

. Global data center network equipment revenue-including data center Ethernet switches, Application Delivery Controllers (ADCs) and WAN optimization appliances (WOAs)-grew 8 percent in 2014 from 2013, to $11.2 billion

. In the fourth quarter of 2014 (4Q14), the data center Ethernet switch market was up 5 percent sequentially, affected positively by Cloud Service Providers and financial institution spending

. The ADC segment has grown consistently on a year-over-year basis for the last 7 quarters

. Interest in optimizing the WAN via software-defined WAN (SD-WAN) is strong, but the WAN optimization segment has yet to return to long-term growth

. 25GE ports will begin shipping in 4Q15, representing a new 25/100GE architecture for data center fabrics targeted at large CSPs, a key high-end market segment

. Following double-digit increases in 2011 through 2014, long-term growth in the data center market is expected to slow down by 2019, braked by the migration to software-defined networking (SDN) and the shift to the cloud

Author’s Note: ADCs are one of many network box functions which are “virtual appliance” candidates via NFV.

“Up till now, bare metal switching has been attractive mainly to the large cloud service providers (CSPs) like Google and Amazon who provide their own switch software integrated into data center orchestration and management platforms. But with vendors such as Dell and HP jumping into the mix with branded bare metal switches, adoption of bare metal switching is going to accelerate as tier 2 CSPs and large enterprises endeavor to achieve the nimbleness demonstrated by Google,” said Cliff Grossner, Ph.D., directing analyst for data center, cloud and SDN at Infonetics Research,

DATA CENTER REPORT SYNOPSIS:

Infonetics’ quarterly data center equipment report provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis and trends for data center network equipment, including data center Ethernet switches, ADCs, WOAs and Ethernet switches sold in bundles. Vendors tracked: A10, Alcatel Lucent Enterprise, Arista, Array Networks, Aryaka, Barracuda, Blue Coat, Brocade, CloudGenix, Cisco, Citrix, Dell, Exinda, F5, HP, Huawei, IBM, Ipanema, Juniper, Kemp, NEC, Radware, Riverbed, Siaras, Silver Peak, Talari, VeloCloud, Viptela and others.

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

RELATED RESEARCH (http://www.infonetics.com/market-research-report-highlights.asp?cvg=DataCenterandStorageNetworking)

. New Era of Data Centers Coming via 25GE; Intel’s Grantley Chip Driving Growth

. Data Center SDN Market Share Up for Grabs

. Cloud-as-a-Service (CaaS) Is on Fire, Shows Infonetics Cloud Survey

Closing Comments:

We see three different types of Data Center Switches:

1. Conventional vendor specific designs with some provision for open networking, e.g. Cisco, Juniper, HP, Dell, Arista.

2. Bare metal switches using commodity hardware like Broadcom switch silicon and standard/semi-custom microprocessors from Intel.

3. A new breed of “open hardware” switches is coming from the Open Compute Project (OCP).

[IMHO, this hasn’t gotten enough publicity/press coverage]

Facebook’s Wedge, a 10-Gigabit switch to link all the servers in a rack, which the company recently proposed as a contribution to OCP. Late last year, OCP accepted its first open switch design, a 10-Gigabit Ethernet switch from Taiwan-based Accton Technology. “This is an industry first. Nowhere else can you go and just get the design package for a switch,” Facebook’s Omar Baldonado said. “Anybody can build this.”

Accton announced it plans to start selling Wedge-based switches this quarter, and other vendors plan to use the design, too. Broadcom, Mellanox and Alpha Networks have also contributed hardware designs that are being reviewed by OCP.

If the new designs become popular, it could mean huge competition for the large incumbent computer/switch makers, like Cisco, HP, and Dell, which for several years have faced inroads from open-source software. The Facebook products involve both hardware and software.

In addition, two other companies making switching software, Cumulus Networks and Big Switch Networks, are donating software to the project. Facebook is donating switch management software that it has developed.

The other Facebook donation to OCP is a new version of a low-power server that uses a semi-custom processor from Intel. Up to 192 of the chips can be fit into a single rack of servers at relatively low power consumption but high performance.

Also at the last Open Compute meeting, Hewlett-Packard announced a new server it is producing in conjunction with Foxconn, the Taiwanese manufacturer that also builds products for Apple. HP and Foxconn entered a joint venture last year, aiming to sell low-priced servers to providers of telecommunications and Internet services. The design appears to use many Open Compute features.

For more information:

http://bits.blogs.nytimes.com/2015/03/10/facebooks-status-update-for-com…