IHS-Infonetics: MSOs Plan Massive DOCSIS Deployments; Shift to Remote/Distributed Access & HFC Optical Nodes

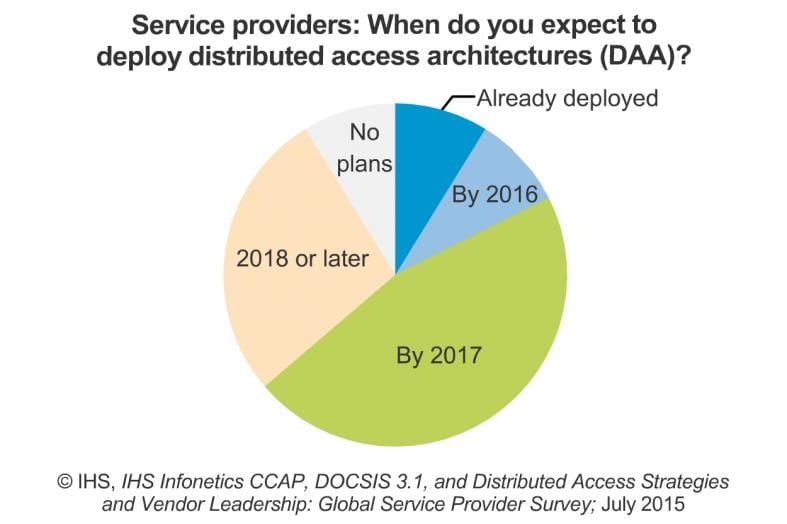

1. IHS-Infonetics conducted in-depth interviews with cable operators (MSOs) across the globe that collectively control 87 percent of the world’s cable capex and found that 42 percent of them plan to deploy a distributed access architecture (DAA) by 2017.

In the study, CCAP, DOCSIS 3.1, and Distributed Access Strategies and Vendor Leadership: Global Cable Operator Survey, respondent operators say their primary choices for distributed access are R-PHY, R-MACPHY and R-CCAP.

CABLE SURVEY HIGHLIGHTS:

- The operational benefits cable operators are reaping from moving from CMTS (cable modem termination system) to CCAP (converged cable access platform) are just the first step in a long-term transition to distributing data processing capabilities throughout the network

- Survey respondents, on average, say that about 1/3 of their residential subscribers will be passed by DOCSIS 3.1 (CableLabs spec) enabled headends by April 2017

- By 2017, nearly half of respondents will have return path (upstream) frequencies of 86–100MHz, while a quarter will have 101–200MHz of return path spectrum

“Cable operators are clearly committed to both DOCSIS 3.1 and distributed access architectures to increase bandwidth in their access networks. Though there is no consensus yet on which distributed access technology most will use, there’s no question they will distribute some portion of the DOCSIS layer to their optical nodes,” said Jeff Heynen, research director for broadband access and pay TV at IHS.

Definitions:

● Remote PHY (R-PHY): in this scenario, the entire DOCSIS PHY modulation is moved into the node while the MAC layer remains in the headend.

● R-CMTS: in this scenario, the DOCSIS MAC and PHY are removed from the headend and placed in the node

● R-CCAP: in this scenario, the DOCSIS MAC and PHY and video QAM capabilities are removed from the headend and placed in the node.

ABOUT THE REPORT:

The 29-page IHS Infonetics study, led by IHS analyst Jeff Heynen, focuses on DOCSIS 3.1, converged cable access platforms (CCAPs) and distributed access architectures, and how and when cable operators will deploy these technologies and architectures to improve their broadband and IP service offerings over the next 2 years.

The study includes operator ratings of CCAP and distributed access equipment suppliers (Arris, Casa Systems, Cisco, Gainspeed, Harmonic, Huawei and Pace/Aurora) on 9 criteria. Note from Jeff Heynen: “These are really the primary suppliers of node-based products. There are a number of Chinese ODMs. But they are really only present in China proper.”

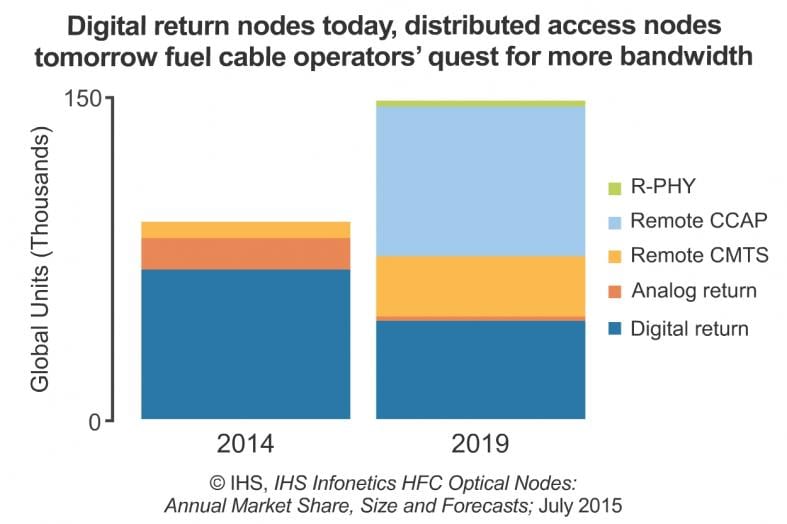

2. In a related report, IHS-Infonetics forecasts global hybrid fiber-coaxial (HFC) optical node shipments to more than double in the 5 years from 2014 to 2019, jumping from 92,000 to 200,000. Driving the boost are cable operators upgrading their networks with optical fiber cable, taking advantage of its high-bandwidth, low-noise, low-interference characteristics to deliver broadband video, data and voice services to homes and businesses.

“Optical nodes have rapidly become important platforms for cable operators to grow their broadband capabilities. By way of increased node splitting today for increased bandwidth and a transition to distributed access in the coming years, optical nodes will see significant unit growth and innovation,” said Jeff Heynen, research director for broadband access and pay TV at IHS.

OPTICAL NODE MARKET HIGHLIGHTS:

- Globally, HFC optical node revenue reached $356 million in 2014, up 14 percent from 2013

- In 2014, 80 percent of worldwide optical node revenue came from digital return nodes, and 15 percent from analog return nodes

- By 2019, IHS expects 35 percent of new physical nodes to be remote CCAP devices, 27 percent to be R-PHY units, and 23 percent to be traditional digital return nodes

- Arris led optical node global revenue and physical node unit shipments for the full-year 2014

ABOUT THE HFC OPTICAL NODE REPORT:

The 23-page IHS Infonetics HFC Optical Nodes market share and forecast report provides worldwide and regional market size, vendor market share, forecasts through 2019 and in-depth analysis for hybrid fiber-coaxial optical nodes. The annual market research service tracks physical node units, logical node segments and revenue for optical node types including analog and digital return, and remote PHY, converged cable access platform (CCAP) and cable modem termination system (CMTS).

RELATED RESEARCH:

- Biggest Trend among Cable Operators: Massive DOCSIS Deployments and a Shift to Remote/Distributed Access

- Broadband CPE Market Up 3 Percent from a Year Ago in 1Q15

- Reliable WiFi for Multiscreen TV Is Powering Growth in WiFi Extender Market

- Cable Broadband Equipment Market Off to Mixed Start in 2015

- 14 Percent Increase for Broadband Equipment Market from a Year Ago

- Pay TV Providers Embrace OTT Video, ‘Skinny’ Bundles to Stave Off Cord-Cutting

To buy Infonetics reports, visit: http://www.infonetics.com/contact.asp