Month: August 2015

Surge in Carrier SDN Spending Forecast by IHS-Infonetics Lead Analyst

MARKET FOR CARRIER SDN FORECAST TO GROW EXPONENTIALLY:

As service providers seek service agility and operational efficiency in their networks to stay competitive, the global market for carrier software-defined networking (SDN) software, hardware and services is expected to grow from $103 million in 2014 to $5.7 billion in 2019, according to IHS.

“We’re still early in the long-term, 10- to 15-year transformation of service provider networks to SDN. Momentum is strong, but we won’t see widespread commercial deployments where bigger parts of — let alone whole — networks are controlled by SDN until 2016 through 2020,” said Michael Howard, senior research director for carrier networks at IHS.

ADDITIONAL CARRIER SDN MARKET HIGHLIGHTS:

- SDN software — including network apps, such as traffic analytics, and orchestration and controller software — is the critical piece that will convert a network into a software-defined network

- IHS predicts service providers around the world will increase their spending on SDN software by 15 times from 2015 to 2019

- Due to the newness of SDN technology and the fundamental changes it brings to networks, there is an incredible demand for expertise to design, deploy and operate SDN-based services, and carriers are looking to vendors for this expertise

- IHS expects outsourced services for SDN projects to grow at a 2014–2019 CAGR of 199%

SDN SURVEY SYNOPSIS:

The 2015 IHS Infonetics Carrier SDN Hardware, Software, and Services market size and forecast report, led by analyst Michael Howard, examines the markets and trends related to building service provider software-defined networks. Specifically, the report tracks software that provides orchestration, controller and application functions; outsourced services for SDN projects; and hardware in use for SDN networks, including routers, switches, WDM and video content delivery network (CDN) equipment, and other telecom equipment controlled by SDN orchestration and controllers, such as CPE.

To purchase the report, please visit www.infonetics.com/contact.asp

Editor’s Note: SDN is not necessarly an open network!

Contrary to popular belief, SDN does not always imply an “open network.” That’s because most of the SDN implementations are, in fact, proprietary extensions of network equipment vendor boxes (e.g. Cisco, Juniper, Arista Networks, etc). There is no mutli-vender interoperability other than when using accepted tunneling protocols like VxLAN for the network virtualization/overlay model. Is that SDN? Purists and the ONF say NO! Vendors that implement it (many) say YES!

The latest poll from the Open Network User Group (ONUG) found that 71% of respondents characterized their network(s) as “A Little Open or Not at All.” See reerence below or click here for ONUG’s Market Perspective of Open Cloud Infrastructure.

Recent SDN References:

https://techblog.comsoc.org/2015/07/26/my-perspective-on-ons-2015-sdn-open-networking

https://techblog.comsoc.org/2015/06/24/highlights-of-2015-open-network-summit-ons-key-take-aways

IHS-Infonetics: Optical Network Equipment Spending Trends + Huge Growth for 100G Optical Ports

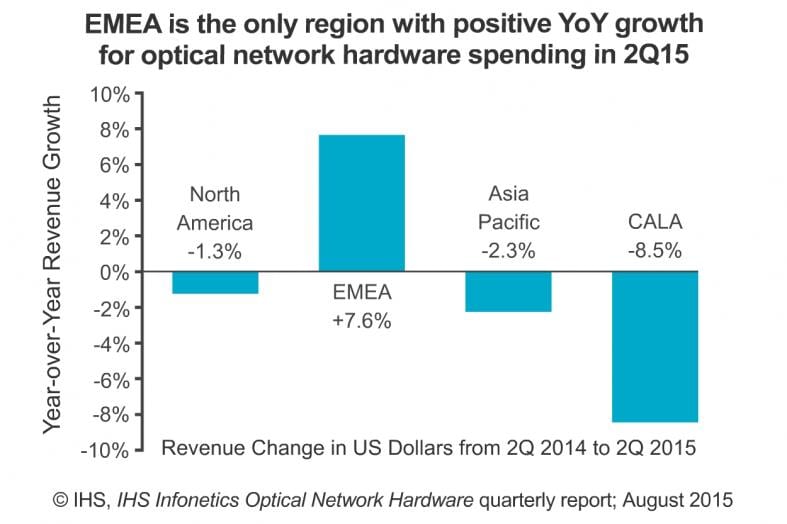

IHS-Infonetics just released vendor market share and preliminary analysis from its 2nd quarter 2015 (2Q15) IHS Infonetics Optical Network Hardware report (Full report published by August 24th). According to the report, global optical network hardware revenue (WDM and SONET/SDH) grew 22% sequentially in 2Q15, but was flat on a year-over-year basis. Europe is the only major world region that posted positive year-over-year growth in 2Q15, up 8%.

OPTICAL MARKET HIGHLIGHTS:

- On a rolling 4-quarter basis, WDM equipment spending further extended 3 years of consecutive growth

- Spending on WDM equipment grew 23 % in 2Q15 from 1Q15, and was up 6 % from 2Q14

- WDM gear comprised 86 % of total worldwide optical hardware revenue in Q2

- Spending on optical network hardware in Asia Pacific surged 36% in 2Q15 from the previous quarter, but is down 2% from one year ago

- Alcatel-Lucent announced an intention to merge with Nokia, an action IHS does not expect to have any transformative effects on ALU’s optical business or the competitive landscape

Analyst Quote:

“With three consecutive quarters of good results under its belt, Europe is signaling a reversal of the terrible optical spending that we’ve seen in the region over the last five years,” said Andrew Schmitt, research director for carrier transport networking at IHS. “This strength is concentrated in Alcatel-Lucent, Ciena and Infinera.”

“When taking into account currency effects, the results are even stronger – adjusted for exchange rate, optical spending in Europe saw a 30 % year-over-year growth rate in the second quarter when measured in euros,” Schmitt said.

OPTICAL REPORT SYNOPSIS:

The quarterly IHS Infonetics Optical Network Hardware market size, share and forecast report, led by analystAndrew Schmitt, examines the vendors, markets and trends related to metro and long haul WDM and SONET/SDH equipment used to build optical networks. The report also tracks Ethernet optical, SONET/SDH/POS and WDM ports. Vendors tracked include Adtran, Adva, Alcatel-Lucent, Ciena, Cisco, Coriant, Cyan, ECI, Fujitsu, Huawei, Infinera, NEC, Padtec, Transmode, TE Connectivity, Tyco Telecom, ZTE, others.

To purchase the report, please visit www.infonetics.com/contact.asp

RELATED RESEARCH

- Huge Growth for 100 Gigabit Optical Ports as Operators Increase Network Capacity

- Ciena, Cisco and Infinera Lead 2015 Optical Network Hardware Scorecard

- Packet-Optical Transport Deployments Slower Than Anticipated

- Europe Exiting Optical Spending Slump, Data Centers Bullish on 100G

- In Data Center Optics Market, 40G Transceivers Ubiquitous, 100G Accelerating

- In Telecom Optics Market, 100G Transceiver Growth Suppressed Until 2016

- OTN Switch Spending Up 40 Percent from a Year Ago

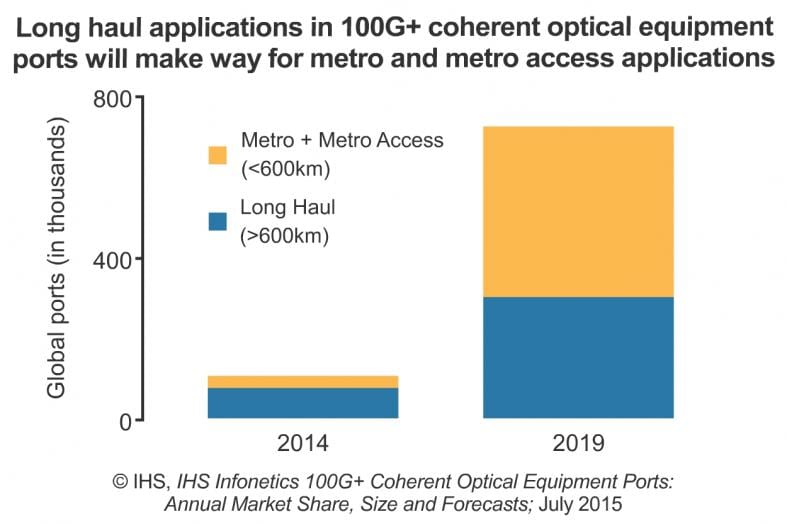

Separately, IHS-Infonetics reports that Coherent 100G port shipments for metro regional optical networks grew 145 % in 2014 from the prior year, and are anticipated to grow another 118 % in 2015.

“Adoption of 100G coherent technology has surged, first in long haul networks and now becoming a material part of metro networks. The expansion of 100G into new markets was the catalyst for our 100G+ coherent optical ports report, which provides an accurate, in-depth picture of how 100G technology is being used today and how it’ll be used in the future as the landscape grows increasingly complex,” said Andrew Schmitt, research director for carrier transport networking at IHS.

“100G is poised to explode in 2016 as new equipment built specifically for the metro reaches the market, allowing 100G technology to economically reach new portions of the network such as metro edge and metro regional,”Schmitt said.

100G+ COHERENT OPTICAL PORT MARKET HIGHLIGHTS:

- 2014 was a banner year for 100G port shipments, led by massive purchases in China from China Mobile

- Most of 100G coherent technology deployed in 2014 was for long haul applications, but metro regional (<600km) and metro access (<80km) applications will start ramping in 2016

- 100G market share is concentrated in a small circle of players: Alcatel-Lucent, Ciena, Huawei, Infineraand ZTE; the only potential catalyst for shifts will come from deployment in shorter reach metro and datacenter applications—the next growth vector for 100G

- Sometime in 2017–2018, 100G coherent will make another quantum jump, displacing 10G in the 80km or less metro-access market

100G OPTICAL REPORT SYNOPSIS:

The 20-page IHS Infonetics 100G+ Coherent Optical Equipment Ports market size, vendor market share and forecast report provides detailed granularity for 100G+ coherent and non-coherent port shipments on optical transport equipment, tracking the evolution of 100G as operators increase the flexibility and capacity of their networks. The report tracks 100G by application, including metro regional, metro access and long haul, as well as specific technology derivatives such as flex-coherent and direct-detect 100G.

To purchase the report, please visitwww.infonetics.com/contact.asp

Competing market research firm Dell’Oro Group says the optical transport network equipment market will grow at a 10% compounded annual growth rate (CAGR). Demand for metro WDM capacity will drive up the overall optical transport revenues to $15 billion by 2019 according to this Dell’Oro report.

Exposed url:

During this four-year period, service providers will continue to deploy a mix of 100G and 200G wavelengths in their networks. The research firm forecast that over 75 percent of WDM capacity will be from 100G wavelengths, while 200G will contribute nearly 25 percent of WDM metro equipment revenue by 2019.

Jimmy Yu, VP of optical transport market research at Dell’Oro Group, said in a release that the majority of metro equipment sales will come from traditional service providers, but content providers and financial trading companies will contribute to overall growth as they install their own 100G networks.

“The majority of metro equipment purchases will still be made by telecom service providers, expanding their metro network capacity for higher speed services, but we also see a strong trend towards enterprises such as Internet content providers and financial institutions procuring and installing their own high speed 100 Gbps links. This trend is being powered by the increasing importance of data centers to a company’s core business,” Yu said.

“The network still needs a lot of raw bandwidth and WDM is the best equipment to deliver that. While high demand for long haul equipment will continue, the biggest growth that we are projecting is in metro applications. The majority of metro equipment purchases will still be made by telecom service providers, expanding their metro network capacity for higher speed services, but we also see a strong trend towards enterprises such as Internet content providers and financial institutions procuring and installing their own high speed 100 Gbps links. This trend is being powered by the increasing importance of data centers to a company’s core business,” added Mr. Yu.

Verizon conducts field trial of 10 Gb/sec Nex Gen PON2 service; ITU-T rec’s for NG PON2

Verizon has completed a field trial of NG-PON2 fiber-to-the-premises technology that could provide the infrastructure for download speeds up to 10 Gbps for residential and business customers. The huge telco’s current top download speed for its residential FiOS service is 500 Mbps. The new technology could “open the door” to speeds as high as 80 Gbps, according to Verizon.

The field trial took place on a network link between the company’s central office in Framingham, MA and a home three miles away served by Verizon FiOS. The test required installation of a new optical line terminal (OLT) at the central office supporting four wavelengths, each capable of delivering speeds up to 10 Gbits/s downstream and 2.5 Gbits/s upstream. Verizon also said it was able to demonstrate the simultaneous use of standard GPON and NG-PON2 on a single fiber, and a successful fail-over scenario where its new ONT autonomously restored 10G service by tuning to a new wavelength after a simulated fault was introduced.

Vendor partners in the trial included Cisco Systems Inc. and PT Inovação (part of the Portugal Telecom Group) which provided the NG-PON2 equipment system.

For Verizon’s upcoming NG-PON2 RFP, there are vendors like Alcatel-Lucent, Adtran Inc. Calix Networks Inc, Huawei Technologies Co. Ltd. and of course Cisco.

“The advantage of our FiOS network,” said Lee Hicks, vice president of network technology at Verizon, “is that it can be upgraded easily by adding electronics onto the fiber network that is already in place. Deploying this exciting new technology sets a new standard for the broadband industry and further validates our strategic choice of fiber-to-the-premises.”

ITU-T recommendations for NG PON2 specify up to 40G b/sec speed:

Recommendation ITU-T G.989.1 series describes 40 Gigabit-capable passive optical network (NG-PON2) systems to an optical access network for residential, business, mobile backhaul, and other applications.

Recommendation ITU-T G.ngpon2.1 addresses the general requirements of 40 Gigabit-capable passive optical network (NG-PON2) systems, in order to guide and motivate the physical layer and the transmission convergence layer specifications. This Recommendation includes principal deployment configurations, migration scenarios from legacy PON systems, and system requirements that are requested by network operators. This Recommendation also includes the service and operational requirements to provide a robust and flexible optical access network supporting all access applications.

The physical layer specifications for the NG-PON2 physical media dependent (PMD) layer is described in Recommendation ITU-T G.989.2 (ex G.ngpon2.2, draft). The transmission convergence (TC) layer is described in ITU-T Rec. G.987.3, with unique modifications for NG-PON2 captured in Recommendation ITU-T G.989.3 (ex G.ngpon2.3, draft). The ONU management and control interface (OMCI) specifications are described in ITU-T Rec. G.988 for NG-PON2 extensions.

http://www.itu.int/rec/T-REC-G.989.1-201303-I

References:

http://www.multichannel.com/news/technology/verizon-tests-10-gig/392933

http://www.lightreading.com/gigabit/fttx/verizon-revs-up-wireline-race-with-ng-pon2/d/d-id/717555

http://www.telecompaper.com/news/verizon-tests-ng-pon2-to-seek-proposals-later-this-year–1096954

https://www.ntt-review.jp/archive/ntttechnical.php?contents=ntr201503gls.html

IHS-Infonetics Survey: Network Operators Reveal SDN Plans,Timing & Challenges/Alan's Take

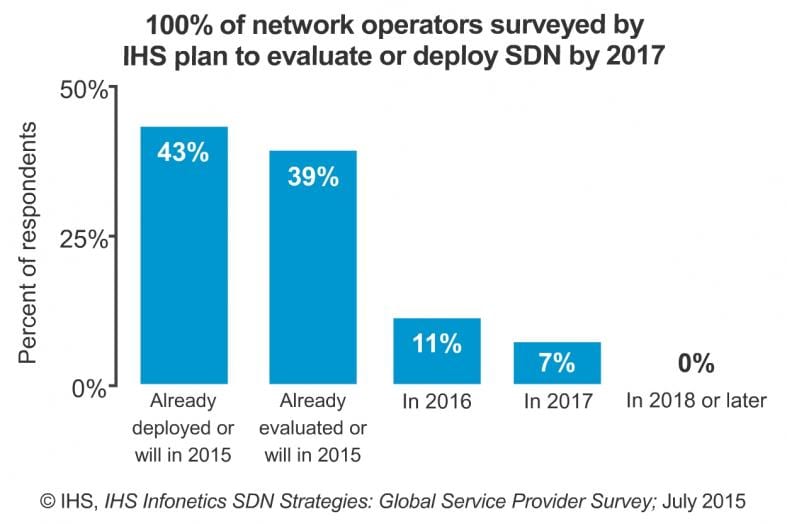

IHS-Infonetcs latest report: “SDN Strategies: Global Service Provider Survey” of worldwide carriers says that global network operators are moving toward software-defined networking (SDN). The carriers surveyed represent 49% of the world’s telecom capex and 46% of global telecom revenue.

–>The study found that 82 % of service provider respondents have either already deployed SDN, are now deploying SDN, or plan to evaluate it in 2015.

SDN STRATEGIES SURVEY HIGHLIGHTS:

- The #1 reason service providers are investing in SDN is to simplify and automate service provisioning, which they believe will lead to service agility and quick time to revenue.

- Various barriers are becoming more prominent as operators get closer to commercial deployment; respondents to this year’s survey cited integrating SDN into existing networks and immature technologies and products as the top 2 barriers.

- Operators want SDN in most parts of their networks, with the top domains for deployment consisting of cloud services offered to customers, within and between data centers, and access for businesses.

Lead Analyst Quotes:

“The successful field trials and a few commercial deployments of SDN in the last year keep moving toward more commercial deployments in 2015, still mostly on a limited basis as operators put one or two use cases to the test under real-world conditions in their live networks,” said Michael Howard, senior research director for carrier networks at IHS & co-founder of Infonetics.

“Carriers are starting small with their SDN deployments and focusing on only parts of their network to ensure they can get the technology to work as intended. We see in the results of our SDN survey that though momentum is strong, it will be many years before we see bigger parts or a whole network that is controlled by SDN,” Howard said.

SDN SURVEY SYNOPSIS:

- The 25-page 2015 IHS Infonetics SDN Strategies: Global Service Provider Survey is based on interviews with purchase-decision makers at 28 incumbent, competitive and mobile service providers from EMEA, Asia Pacific and North America that have evaluated or deployed SDNs in their networks or plan to do so. IHS asked operators about their strategies and timing for SDN, including deployment drivers and barriers, target domains, use cases and more.

To purchase the report, please visit www.infonetics.com/contact.asp

Author’s Rebuttal:

We firmly believe that the overwhelming majority of network operators, with the exception of NTT, will not be deploying classical/pure SDN-OpenFlow as standardized by the Open Network Foundation (ONF). Many are evaluating network virtualization (an overlay model where a logical network is mapped onto a physical network) as per the VMware schema.

However, the vast majority of carriers (and cloud service providers like Amazon, Google, and Microsoft) have invented their own version of SDN and instructed their equipment suppliers to implement that. In some cases, they use a specific vendor product with some user programmablity, e.g. Cisco Metro Ethernet switches used for AT&Ts Network on Demand service (a switched Ethernet WAN service).

The bottom line is that such carrier or network equipment vendor specific solutions are generally not inter-operable with any other SDN carrier or cloud service provider offering. Hence volumes will be limited and network equipment vendors will need different software for different carriers. As a result, we will likely see pockets of SDN in carrier WANs, but no mass deployment of ONF standardized SDN-OpenFlow anytime soon!

RELATED RESEARCH:

NFV Market to Grow More than 5-Fold through 2019:

https://www.infonetics.com/pr/2015/NFV-Market-Highlights.asp

Virtualizing Network Security with NFV and SDN – Whitepaper and Webinar:

https://www.infonetics.com/pr/2015/IHS-SDN-NFV-Security-Webinar-and-Whitepaper.asp

35 Percent of Operators Surveyed Will Deploy NFV This Year:

https://www.infonetics.com/pr/2015/NFV-Strategies-Survey-Highlights.asp

Virtual Routers on Track to Grow 125 Percent in the Next Year:

http://www.infonetics.com/pr/2015/1Q15-Carrier-Router-Switch-Market.asp

Data Center and Enterprise SDN Market to Grow More than 15-fold by 2019:

https://www.infonetics.com/pr/2015/2H14-Data-Center-SDN-Market-Highlights.asp

Network Operators Rate Router and Switch Vendors; Cisco #1 for 3rd Straight Year:

http://www.infonetics.com/pr/2015/Router-Switch-Leadership-Survey.asp

Mixed-Bag Carrier Ethernet Equipment Market Set to Top $29 Billion in 2019:

http://www.infonetics.com/pr/2015/Carrier-Ethernet-Market-Highlights.asp

RECENT AND UPCOMING RESEARCH:

Download the IHS Infonetics 2015 service brochure or log in: www.infonetics.com/login.

– Analyst Note: ONUG Spring 2015: Preparing for Open Networking (June)

– NFV Hardware, Software, and Services Forecast (July)

– Carrier SDN Hardware, Software, and Services Forecast (Aug.)

– Routing, NFV, and Packet-Optical Strategies: Service Provider Survey (Aug.)

– Data Center SDN Strategies: Global Service Provider Survey (Aug.)

– NFV Vendor Leadership Analysis (2015)

SDN AND NFV WEBINARS (https://www.infonetics.com/infonetics-events)

– SDN & NFV: Lessons Learned (Sept. 24: Learn more)

– SDN & NFV: Accelerating PoCs to Live Commercial Deployment (Watch now)

– White Box Switching: Is It Time to Jump In? (Watch now)

– Service Provider Experiences with NFV: The Good, the Bad & the Ugly (Watch now)

– Evolving Network Architectures: Cloud, SDN, NFV & Packet-Optical (Watch now)

– Router Bypass: Using NFV to Deliver Enterprise Services (Sponsor)

TO PURCHASE RESEARCH, CONTACT:

IHS Sales: +1 844-301-7334

https://www.ihs.com/about/contact-us.html

New Mobile Virtual Network Operator Service Agreement & Other Wireless Telco News

Wireless communications service providers are licensing their network infrastructure to mobile virtual network operators. Telco Cuba, Inc. (OTC: QBAN), a U.S. based mobile telecom and data connectivity service provider, announced today that it has immediately begun offering mobile voice and data services to consumers and corporations as a result of a Mobile Virtual Network Operator (MVNO) agreement with Next Mobility.

TelcoCuba now provides high-quality voice and data services to consumers and enterprises utilizing LTE, 4G, and 3G networks. Telco Cuba mobile services will be available in other countries via roaming agreements and services with other mobile service providers. Telco Cuba and its wholly owned subsidiary Amgentech, Inc. are already well established in the local market for Voice over IP (VOIP) services and communications technology. Amgentech, Inc. has provided services to multiple network operators, constructed its own highly reliable network to enable communications worldwide, and has built highly reliant networks for its client base. Going forward, it will now offer extra-flexible solutions that combine mobile voice and data communication services with existing services for blended communication solutions that include mobile voice and data, mobile VoIP, VoIP, International Dialing, top-off prepaid phone service, international roaming, and much more.

The MVNO agreement signed with Next Mobility is a major first milestone for Telco Cuba. It affords Telco Cuba the ability to enter the cell phone service provider market with a drastically reduced startup cost, allowing Telco Cuba to use its budget where it matters – customer acquisition and marketing. Speed to market is the single most important factor in the digital age. Next Mobility is a well-established entity in the space and our contracted services will afford Telco Cuba a time to market of just under 60 days.

—>Apple is reportedly in talks with telecom companies in the U.S. and Europe to let customers pay the Cupertino-based tech giant for wireless service directly, rather than going through wireless firms like AT&T or Verizon. The company is conducting private trials of the service in the U.S. and has engaged in discussions with European companies to offer a similar service there, Business Insider reports. Also see related RCR Wireless article.

MVNO – Mobile Virtual Network Operator is a term coined to describe a company that setups a platform for the resell of mobile phone services from one of the big three cell phone providers in the United States of America or elsewhere in the world. AT&T, T-Mobile & Sprint are the biggest of the Mobile Virtual Network Enablers.

In other wireless and telecommunications news and developments:

- Verizon recently announced Grid Wide Utility Solutions, a new Internet of Things (IoT) platform service offering utility companies an easy on-ramp to grid modernization. Now available in the U.S., Grid Wide offers electric utility companies an integrated solution for smart metering, demand response, meter data management and distribution monitoring and control. With 147 million electric meters in the U.S. today, Verizon’s Grid Wide aims to transform the delivery and consumption of energy nationwide for investor-owned, cooperative and municipal utilities and their customers. Designed to maximize the benefits of smart meters, the solution comes equipped with a wide range of cloud-based applications intended to help utility companies drive incremental revenue, reduce operating costs, increase efficiency and improve customer experience.

- AT&T is promoting a $200 monthly cellphone and TV Everywhere bundle that it plans to offer throughout the U.S. — marking the first fruits of its merger with DIRECTV. Starting Aug. 10, the carrier will provide four phone lines with unlimited voice and texting, along with 10 gigabytes of sharable data. On the video side, AT&T will hook up four TVs with HD and DVR features and the ability to watch on any mobile device. The New York Times (free-article access for SmartBrief readers) (8/3), CNET (8/2)

- Vonage Holdings Corp, a leading provider of cloud communications services for consumers and businesses, today announced results for the second quarter ended June 30, 2015. Second Quarter Consolidated Financial Results – “We continue to drive market-leading growth at Vonage Business, while increasing profitability in Consumer Services,” said Alan Masarek, Chief Executive Officer of Vonage. “At Vonage Business, we delivered 118% revenue growth fueled by the successful execution of our acquisition strategy coupled with strong organic growth. We also made significant investments in our sales infrastructure, brand and leadership team to enhance our position in the rapidly growing Unified Communications-as-a-Service (UCaaS) market.”

- T-Mobile US Inc last week reported second quarter 2015 results reflecting continued strong momentum, industry-leading growth, and continued low churn. The Company again outperformed the competition in both customer and financial growth metrics. T-Mobile generated 2.1 million total net customer additions, marking the ninth consecutive quarter that T-Mobile has delivered over one million total net customer additions. Additionally, the Company delivered 14% total revenue growth and 25% growth in adjusted EBITDA compared to the second quarter of 2014.

“While the carriers continue to use gimmicks to confuse consumers, T-Mobile continues to listen to customers and respond with moves that blow them away,” said John Legere, President and CEO of T-Mobile. “On top of adding 2.1 million new customers in the second quarter, we delivered 14% year-over-year revenue growth and 25% year-over-year Adjusted EBITDA growth. Overall, I think our results speak for themselves.”

- U.S. Cellular to launch LTE roaming in next 60-90 days: CEO Ken Meyers said U.S. Cellular has completed its first LTE roaming agreement, though he declined to reveal the carrier partner. He said the companies are in the implementation phase of the deal and the respective engineering teams of the companies are working together. U.S. Cellular customers will be able to start benefiting from expanded LTE roaming in the next 60 to 90s days, he said. The partner is likely a Tier 1 carrier, so U.S. Cellular customers will get access to a more robust and nationwide LTE network. Meyers said he expects U.S. Cellular customers to see benefits more than he expects U.S. Cellular to reap inbound roaming revenue. Meyers said that the agreement is the first of multiple LTE roaming deals the company is working on.