IHS: Welcome to 4G Land: LTE-Advanced Goes Mainstream

By Stéphane Téral, senior research director, mobile infrastructure and carrier economics, IHS Markit

Key Points:

- The migration from basic Long Term Evolution (LTE) to true 4G is well underway:

84 percent of IHS Markit’s service provider respondents are already running LTE‑Advanced (LTE-A) networks - Barriers to deploying 4G are nonexistent at this point, and the main driver for 4G is the lower cost per megabyte of data

- Easy upgradability and standards compliance are the top two LTE features among those surveyed

- Respondent carriers view Ericsson as the top LTE vendor, followed by Nokia and Huawei

IHS Markit Analysis:

IHS Markit asked service providers participating in its 4G survey whether they had deployed LTE-Advanced and found that a vast majority (84 percent) are already running a 4G network. This is significantly higher than a year ago, when around half of survey respondents were running LTE-Advanced—a clear indication of a quick migration from initial LTE rollouts to 4G through the implementation of carrier aggregation.

Case in point: according to recent Global Mobile Suppliers Association (GSA) data, 521 operators have now commercially launched LTE, LTE-Advanced or LTE-Advanced Pro networks in 170 countries. 147 of these operators have deployed LTE-Advanced, and 9 have commercially launched LTE-Advanced Pro. LTE-Advanced has now moved into mainstream deployments, and the GSA has raised its forecast to 560 LTE network deployments by the end of 2016.

The most deployed LTE-Advanced feature among operator respondents is inter-band carrier aggregation, followed by enhanced inter-cell interference coordination and LTE‑Advanced coordinated multipoint. Three- and four-component carrier aggregation is rising fast, and five component is coming soon.

Voice over LTE (VoLTE) is exploding: three-quarters of those surveyed are offering VoLTE, up from just a quarter last year. This will not necessarily lead to imminent 2G or 3G shutdown, but 2G is rising on the agenda.

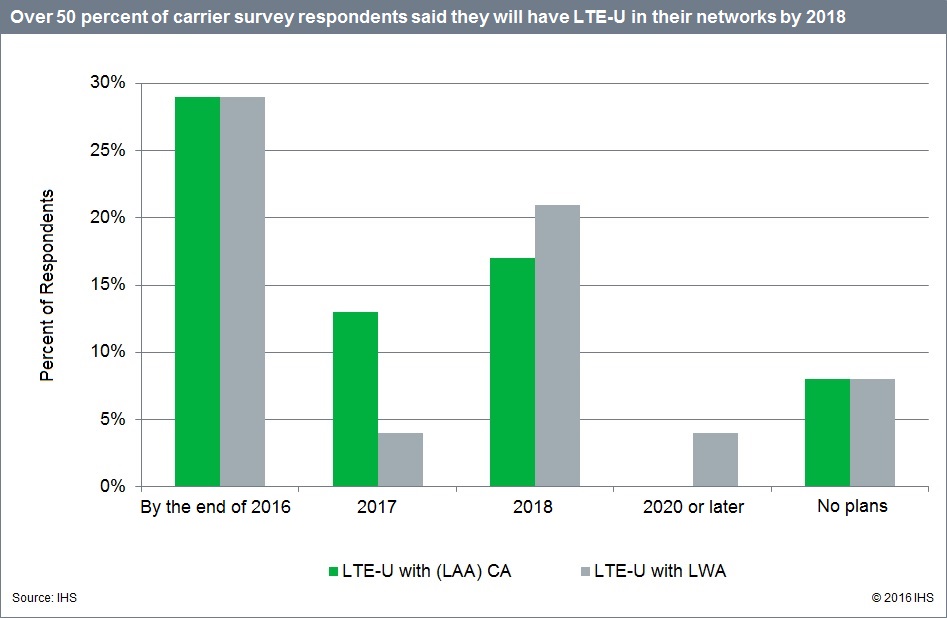

And when it comes to LTE in unlicensed spectrum (LTE-U), over 50 percent of respondents plan to deploy LTE-U by 2018. These respondents are operating in very competitive markets that push them to use as many spectrum ammunitions as possible to stay ahead of the capacity crunch curve to keep their subscribers happy and, of course, on their networks.

4G Survey Synopsis

For the 24-page 4G survey, IHS Markit interviewed purchase-decision makers at 24 global service providers that have deployed or trialed LTE or will do so by the end of 2017. The study covers LTE features and upgrade drivers and barriers; LTE-Advanced timing and features; LTE-U; VoLTE service timing and data/voice roaming; and operator ratings of LTE manufacturers (Ericsson, Huawei, Nokia, Samsung and ZTE). The operators participating in the study represent about half of the world’s telecom capex and revenue.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or[email protected].

Verizon LTE Advanced covers more than 450 cities from coast to coast.

https://www.verizonwireless.com/featured/lte-advanced/?cmp=SOC-C-HQ-NON-S-AW-NONE-lTEATWFirstView-2S0OO0-CO-P-TWT-RE-PP-083016LTE

Complete Deep Research Report on 4G LTE Wireless Broadbandmarket spread across 103 pages, profiling 09 companies and supported with 101 tables and figures is at

http://www.deepresearchreports.com/contacts/inquiry.php?name=225815

The report provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. The 4G LTE Wireless Broadband industry analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development status.

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, cost, price, revenue and gross margins.

Key Manufacturers Analysis of 4G LTE Wireless Broadband Industry: Gemalto NV, Huawei Technologies Co. Ltd., Sierra Wireless Inc., Telit Communications SpA, Novatel Wireless, Option, Quectel Wireless Solutions, u-blox and ZTE.