Most Active VCs In The Internet Of Things – IIoT Rules!

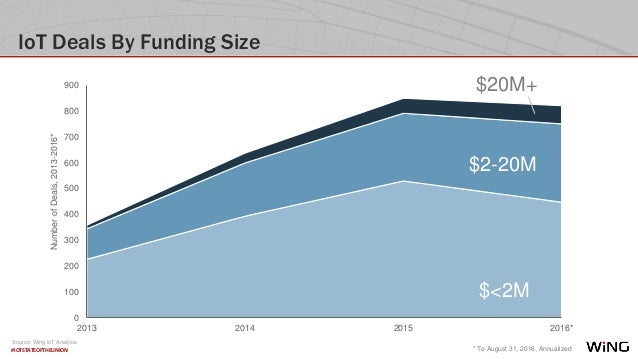

The Internet of Things (IoT) industry is on track to see nearly $3.7B in funding this year as connectivity and software are injected into sensor-laden objects and appliances. An increasing proportion of these dollars are being allocated to startups working specifically on the industrial IoT.

Five of the top 12 IoT investors are now corporate venture arms, including Intel Capital, GE Ventures, and Cisco Investments. Please refer to this chart from CBInsights:

Intel Capital still tops the list as the most active investor in IoT startups, with more than 40 unique IoT companies since 2012. GE Ventures wasn’t far behind (and is new to the ranking of top IoT investors) with recent investments in industrial-focused IoT startups like industrial analytics developer Sight Machine, fog computing platform Foghorn Systems, and commercial 3D printing startup Desktop Metal.

Following Andreessen Horowitz, the fourth-most active IoT investor is another CVC, Qualcomm Ventures. As CBInsights noted in prior investor roundups, Intel and Qualcomm are involved in designing and/or manufacturing ever-smaller chips to power mobile devices, and IoT likely offers them strategic value.

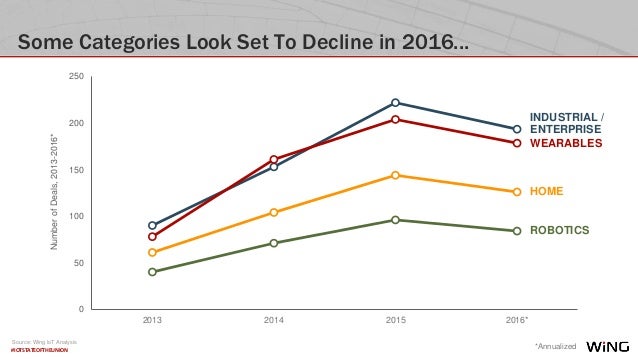

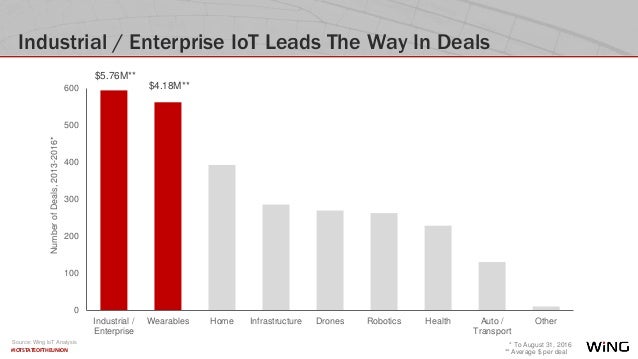

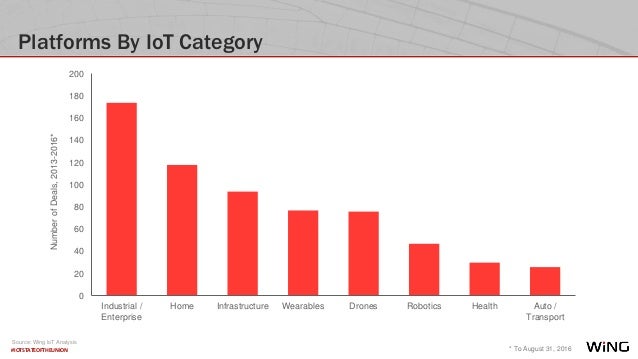

According to Wing VC (see reference& postcript below), Industrial/Enterprise IoT accounts for the largest number of funding deals over the past few years, followed by Wearables.

“When we ranked various sectors by total number of funding deals over the past three-and-a-half years, the Industrial/Enterprise category came out on top with almost 600 deals. We’re entering what’s been called the “Factory 4.0” era, in which a combination of sensors, software and backend cloud compute and storage is giving companies new insights into the performance of their physical assets. Quite a few deals in the manufacturing sub-category of Industrial/Enterprise IoT were of this nature. These startups can demonstrate swift “RoIoT”—or return on investment in IoT—to customers, who use the data and predictive analytics provided to minimize unplanned downtime and outages. On the Enterprise front, we saw a reasonable amount of activity in sub-categories such as building management services, healthcare and retailing.”

References on State of the IoT Market:

http://wing.vc/blog/iot-startup-state-of-the-union-2016

Postscript/Comment based on email from IEEE Member Discussion Group: