IHS: Self-Organizing Network Market Grew Nearly 50% in the Last 2 Years

By Stéphane Téral, senior research director, mobile infrastructure and carrier economics, IHS Markit

Bottom Line:

- Demand for self-organizing networks (SON) is swelling, driven by the need for automation as humans struggle to manage increasingly complex networks

- 3G Evolved High Speed Packet Access (HSPA+) has been the chief force behind SON, not Long Term Evolution (LTE)

- Nokia Networks’ acquisition of Eden Rock Communications in May 2015 has propelled the company to the head of the centralized SON (C-SON) vendor leaderboard.

IHS Analysis:

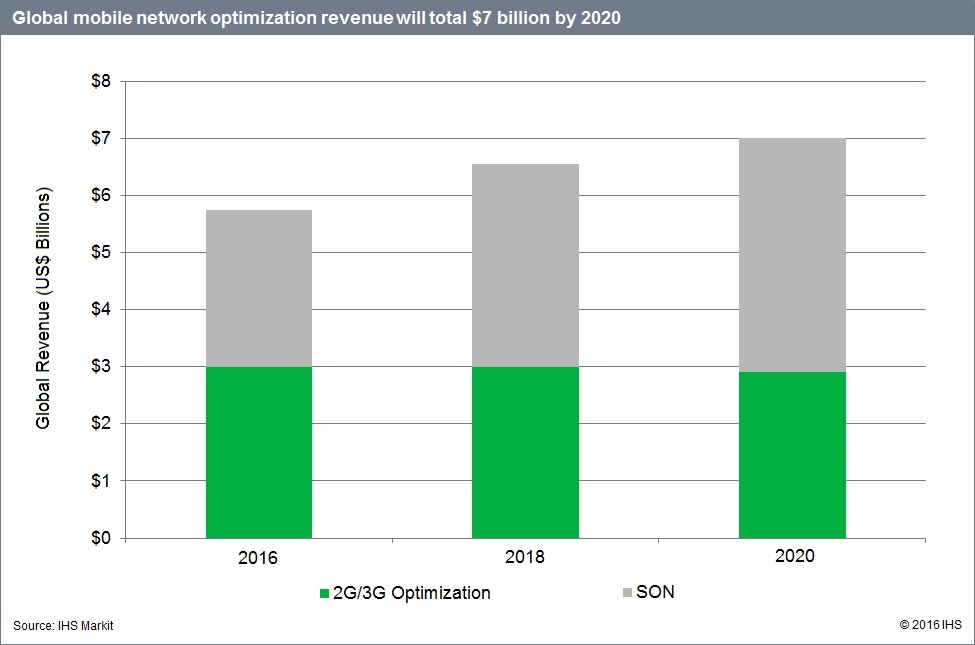

Combined, 2G/3G optimization and SON worldwide revenue grew 18% year-over-year in 2015, totaling $5.1 billion.

SON continues to explode. As a result of AT&T’s and KDDI’s 3G and 4G SON deployments, in addition to a flurry of minor ones around the world for 3G optimization, SON revenue reached $2.2 billion last year—48% more than the size of the 2014 market. At this stage, large European service providers such as BT/EE, Orange, Telefónica and Vodafone are deploying or have deployed SON across their multiple networks.

The chief driver for SON to date has been HSPA+. We found that more than 80% of mobile operators worldwide are using SON for 3G/HSPA/HSPA+ optimization.

As LTE rollouts are reaching their peak—with more than 500 commercial LTE networks worldwide—we are hearing from mobile operators that LTE is extremely reliable and fully optimized, while 3G optimization remains a chief concern and 2G is doing fine.

When it comes to the flavors of SON, C-SON still rules over distributed SON (D-SON). Moreover, the C-SON segment is no longer dominated by SON specialist vendors such as Amdocs and Cisco but rather by tier-1 mobile network vendor Nokia. Last year’s acquisition of Eden Rock Communications has really paid off for Nokia, which scored a major win at Orange in August 2016.

By 2020, the global 2G/3G optimization and SON market is forecast to hit $7 billion. As network complexity continues to rise, the need to reduce opex and remove humans—and the errors they inevitably introduce—from the equation goes on unabated.

SON Report Synopsis:

The annual IHS Markit SON and optimization software report provides worldwide and regional market size, forecasts through 2020, analysis and trends for the mobile network optimization market, including 2G and 3G optimization software and self-organizing network software by generation (3G, 4G) and by architecture (centralized, distributed). The report tracks tier-1 mobile infrastructure vendors with mobile network optimization tools, as well as specialist vendors.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

Reference: